Income Tax Form Templates

Documents:

2505

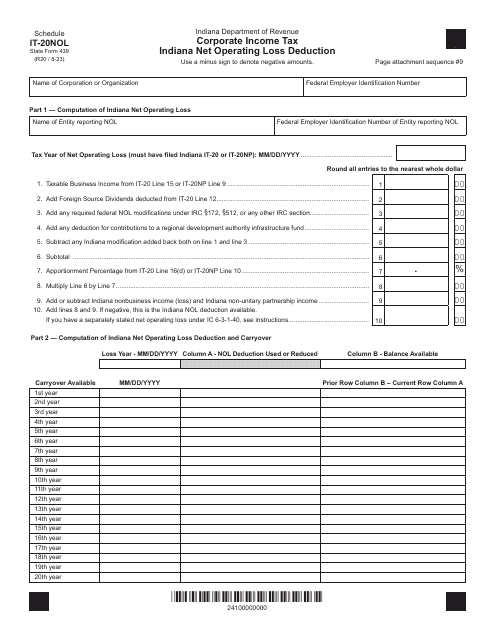

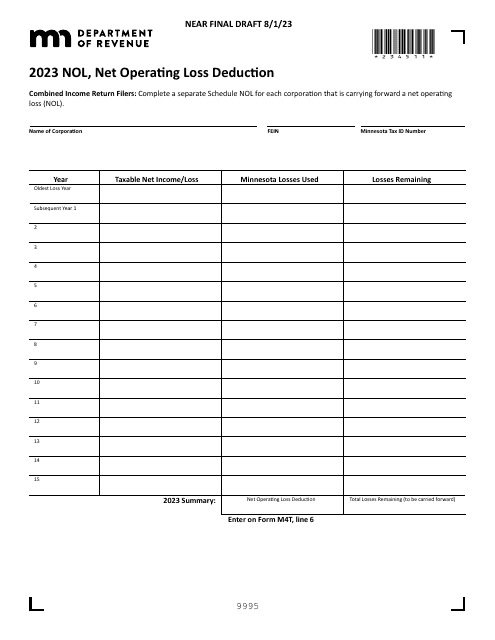

State Form 439 Schedule IT-20NOL Corporate Income Tax Indiana Net Operating Loss Deduction - Indiana

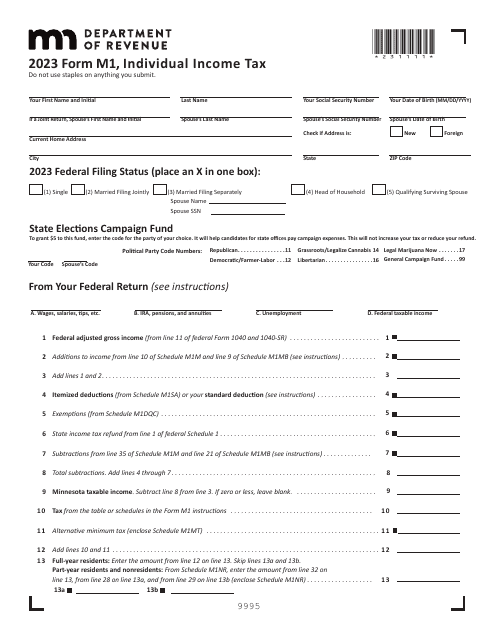

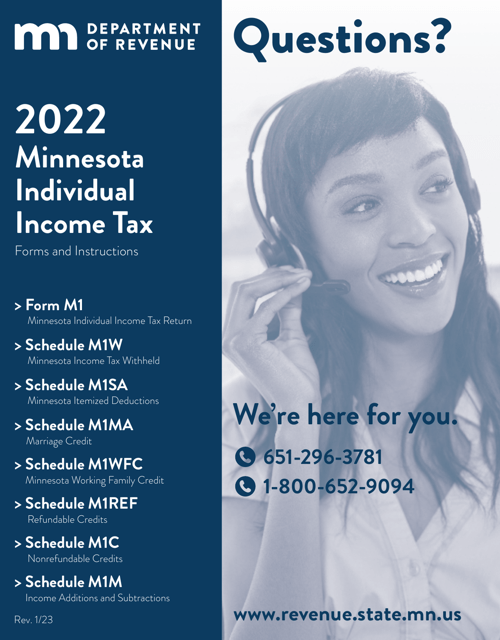

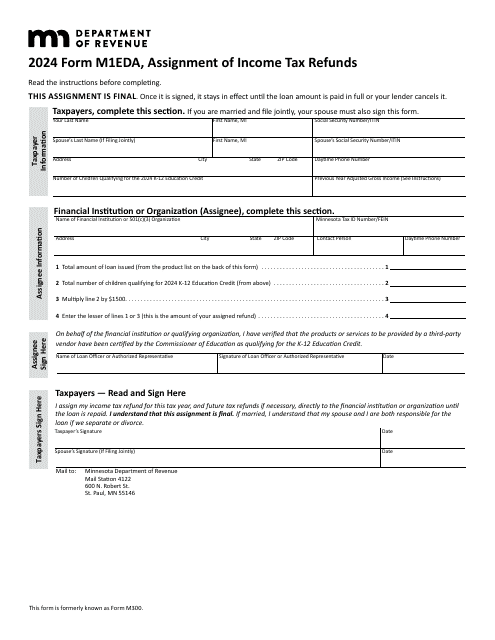

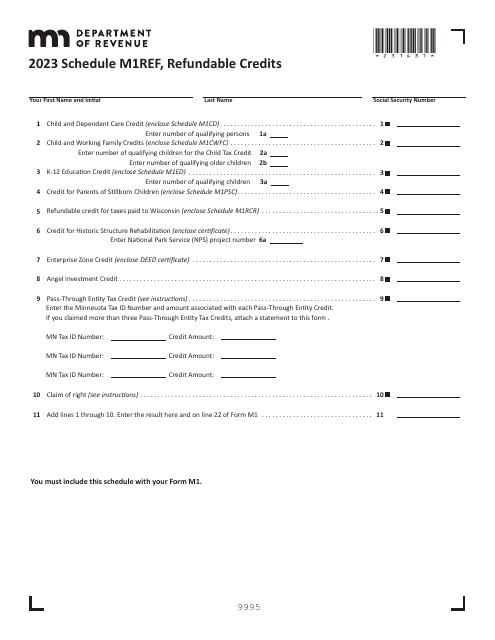

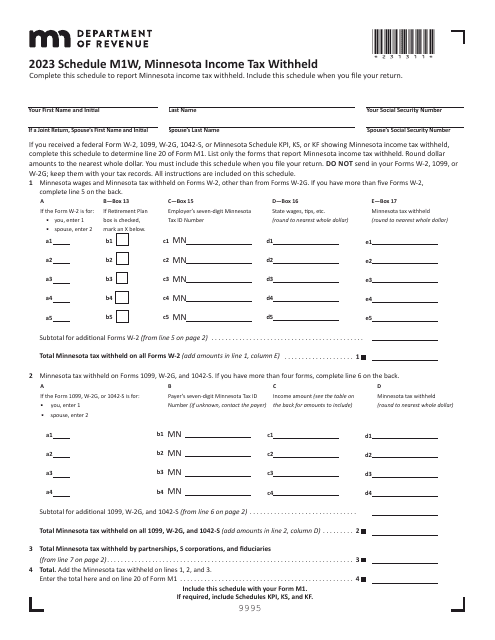

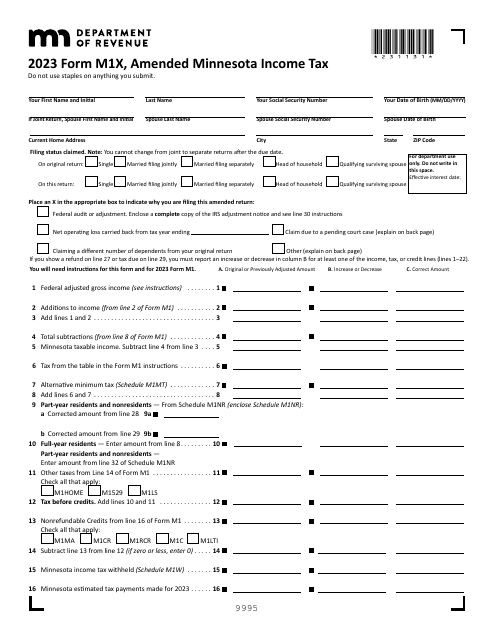

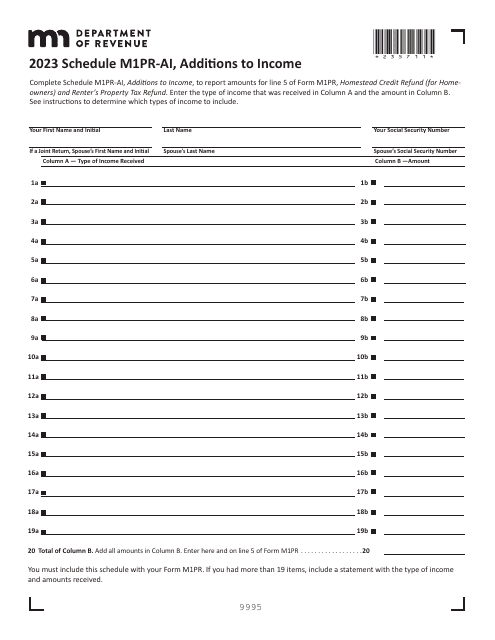

This document provides instructions for various schedules/forms used in Minnesota state tax filing. It includes M1 Schedule M1M, M1MA, M1REF, M1SA, M1W, and M1WFC.

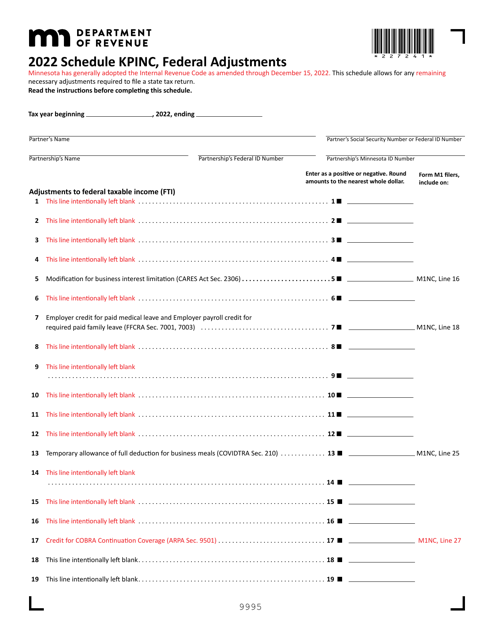

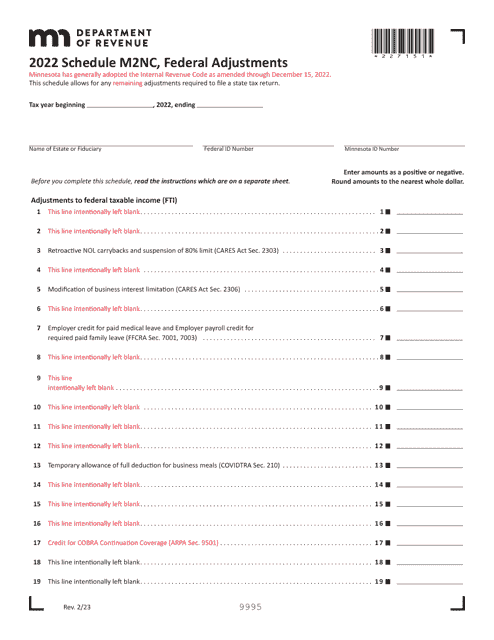

This document is used to schedule federal adjustments for the state of Minnesota as part of the KPINC tax filing process.

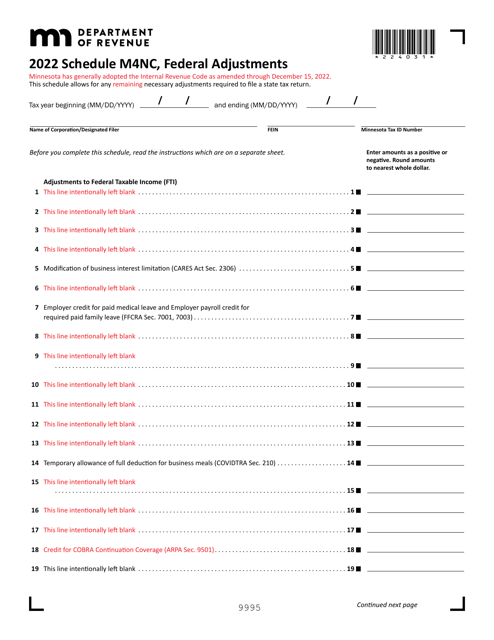

This document is used for making federal adjustments to your Minnesota state income tax return. It helps calculate any differences between your federal and state tax obligations in Minnesota.

This document is used for reporting federal adjustments on your Minnesota state tax return. It helps ensure that you are accurately reporting your income and deductions for state tax purposes.

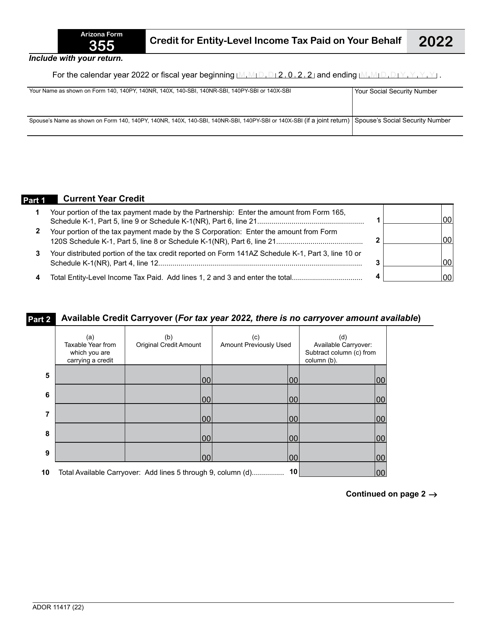

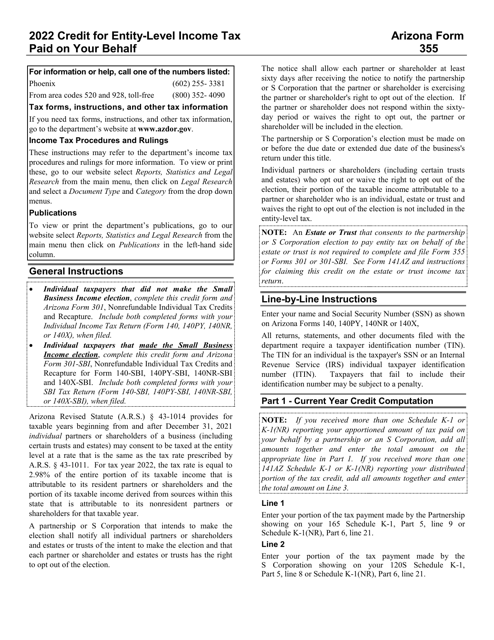

This Form is used for claiming a credit for entity-level income tax paid on your behalf in Arizona.

This Form is used for claiming the credit for entity-level income tax paid on your behalf in the state of Arizona. Follow the instructions provided to correctly complete and submit Form 355 to the Arizona Department of Revenue (ADOR).

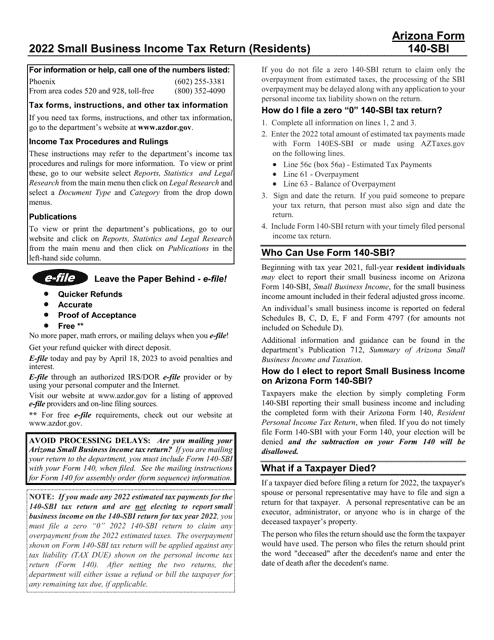

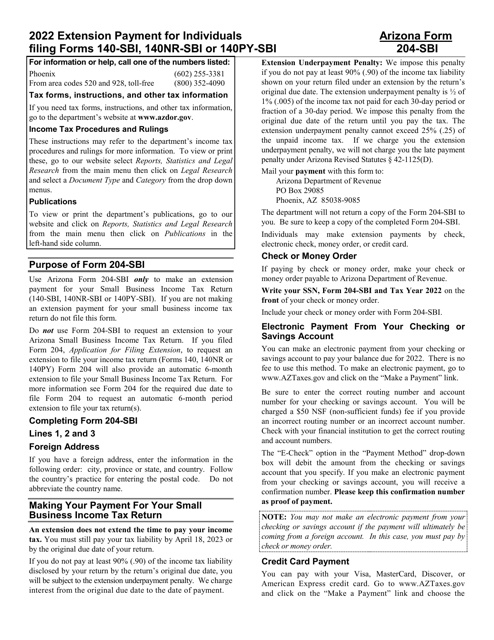

This form is used for making extension payments for small business income tax returns in Arizona. It provides instructions on how to properly complete and submit Form 204-SBI, ADOR11402.

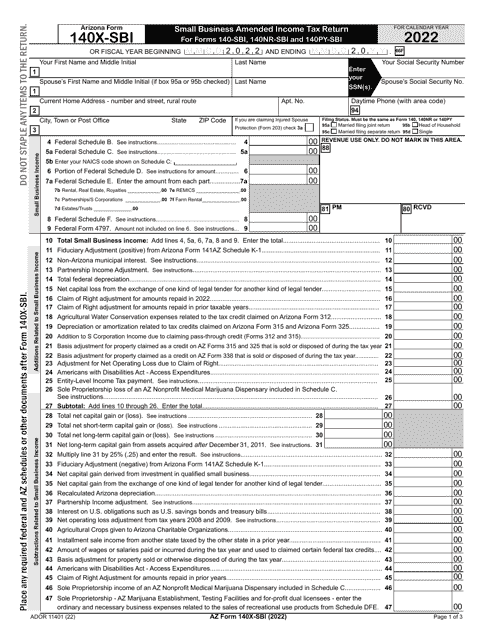

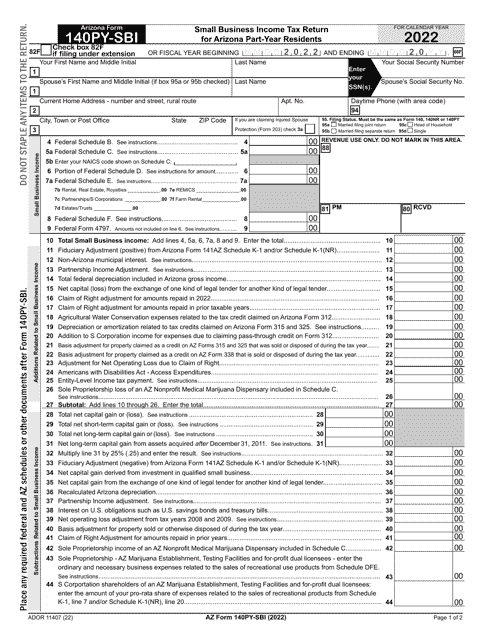

This Form is used for filing the small business income tax return in Arizona for part-year residents.