Income Tax Form Templates

Documents:

2505

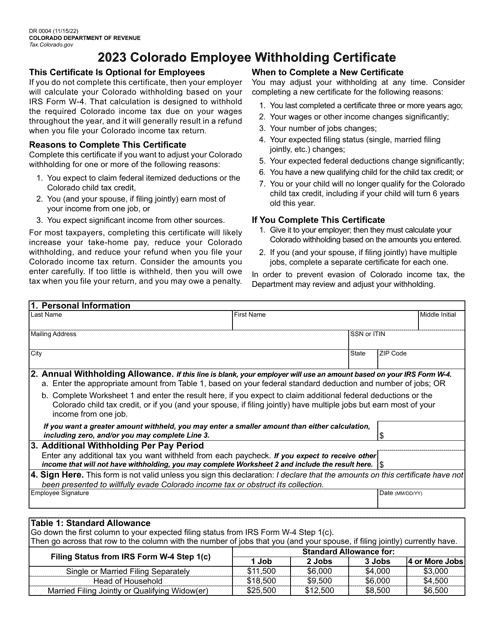

This Form is used for Colorado employees to declare their withholding preferences for state taxes. It helps employers determine how much to withhold from an employee's wages for state income tax purposes.

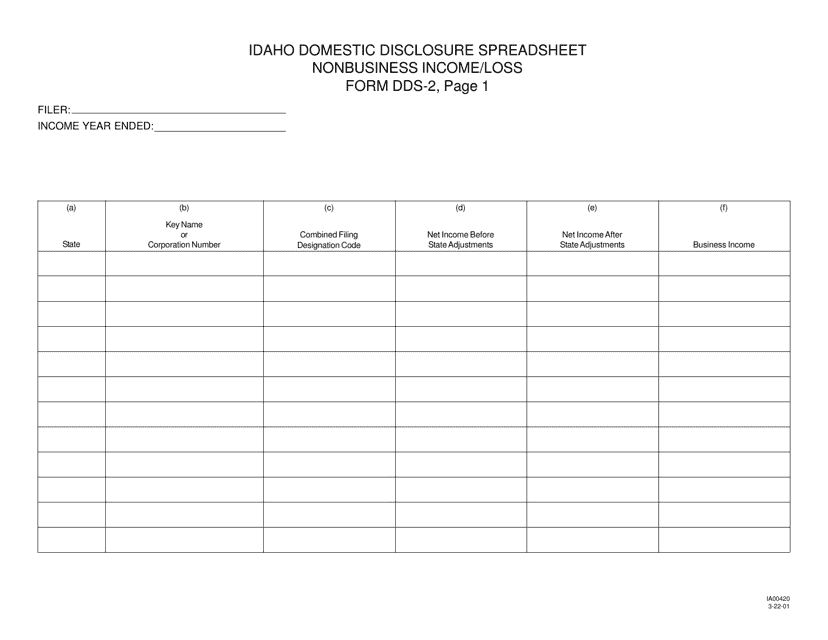

This form is used for reporting nonbusiness income or loss in the state of Idaho.

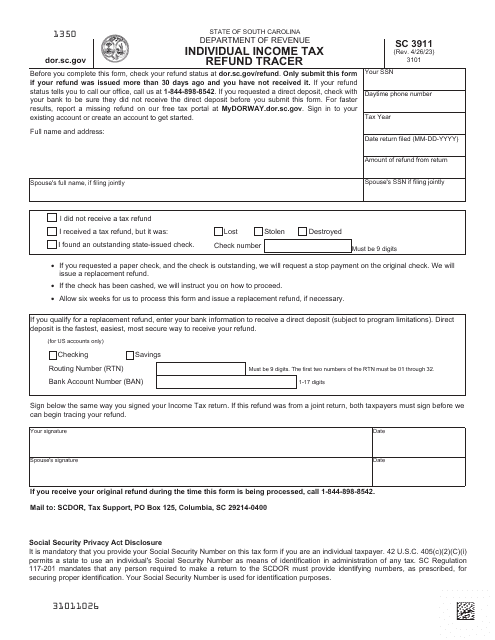

This form is used for tracking the status of individual income tax refunds in North Carolina.

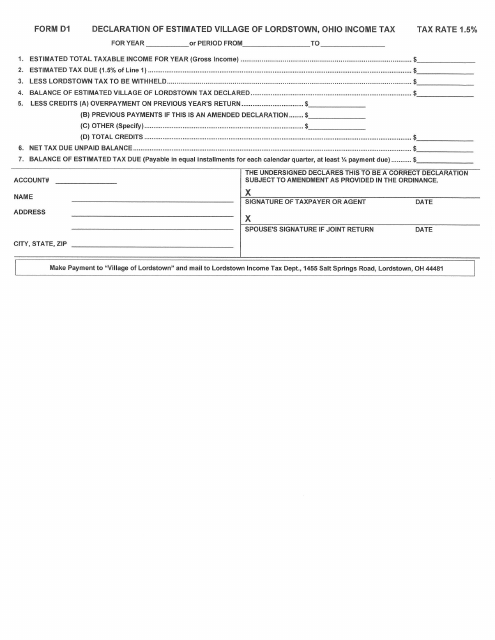

This document is used for declaring estimates of income tax for residents of Lordstown, Ohio, to the Village of Lordstown, Ohio.

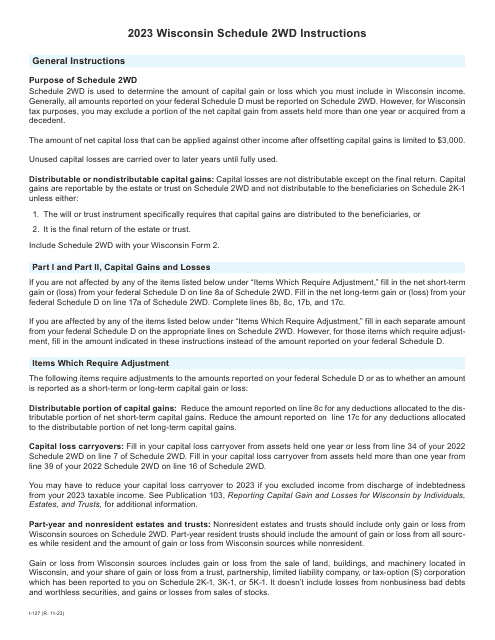

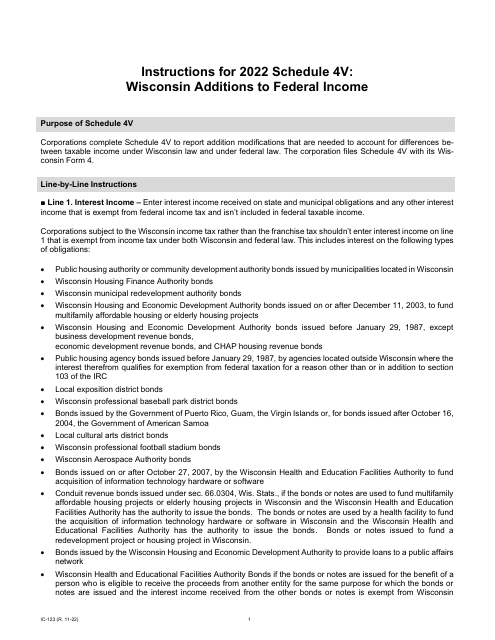

This form is used for reporting additions to your federal income for tax purposes in the state of Wisconsin. It is specifically for residents of Wisconsin who need to report these additions on their state tax return.

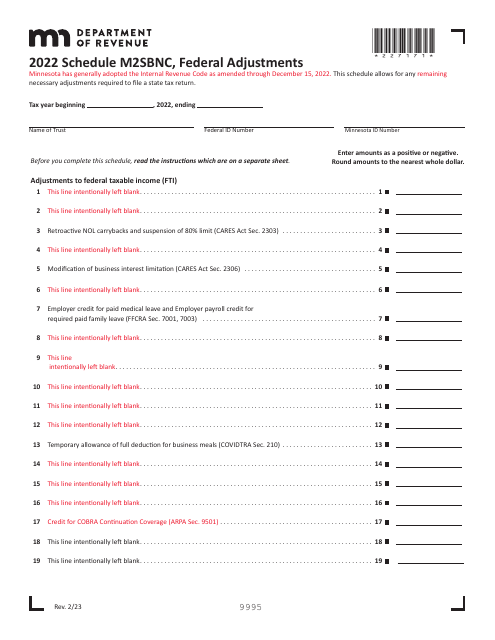

This document is used for reporting federal adjustments made on the Minnesota state tax return. It is specifically for businesses (M2SBNC) in Minnesota.