Income Tax Form Templates

Documents:

2505

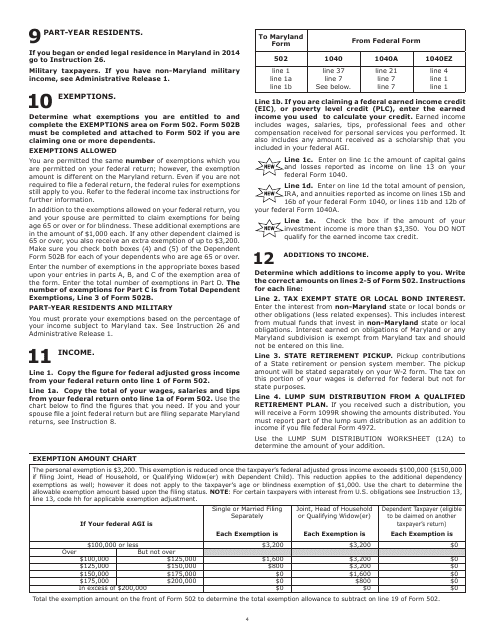

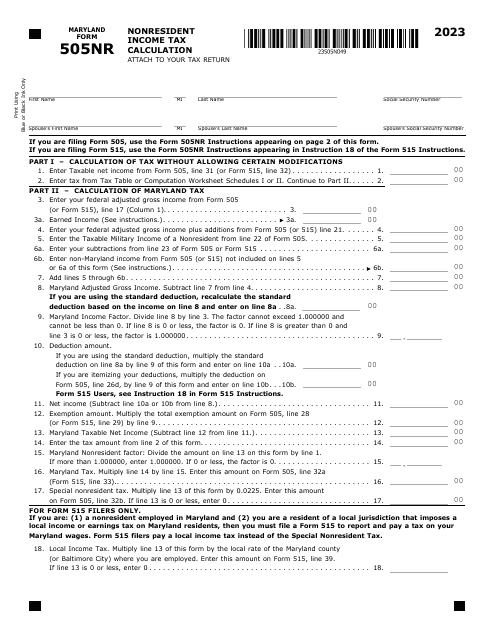

This document provides an exemption amount chart specifically for the state of Maryland. It details the specific amounts that individuals or businesses may be exempt from certain taxes or fees in Maryland.

This form is used for electing pass-through entity income tax return in the state of Ohio.

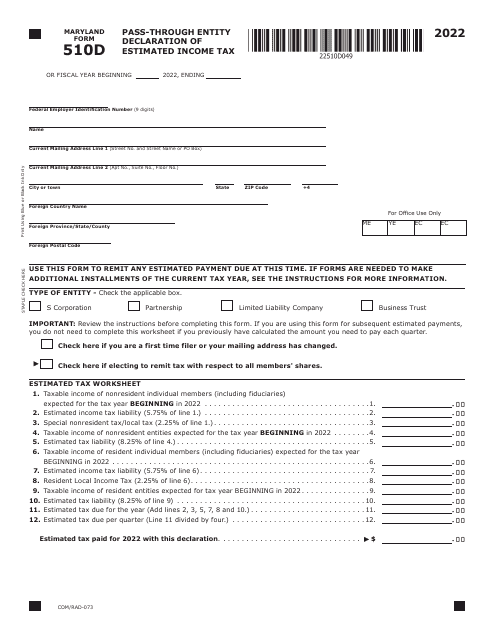

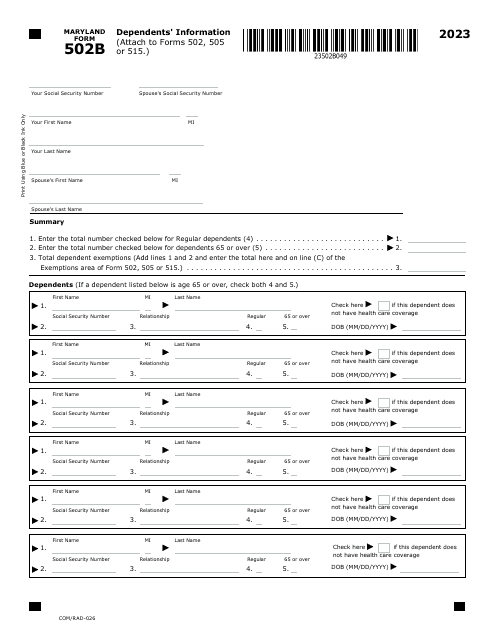

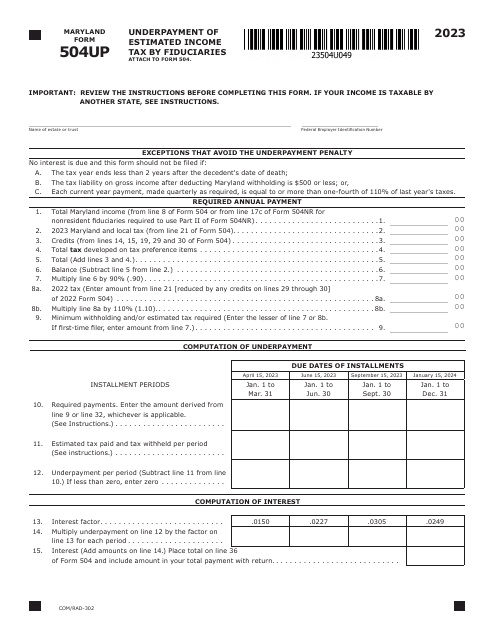

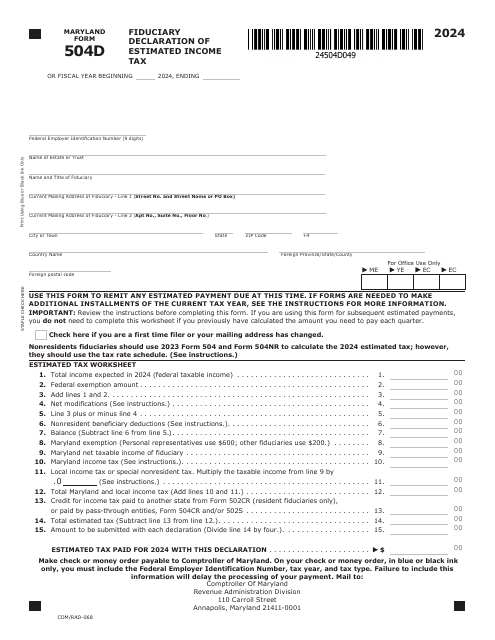

This Form is used for pass-through entities in Maryland to declare estimated income tax.

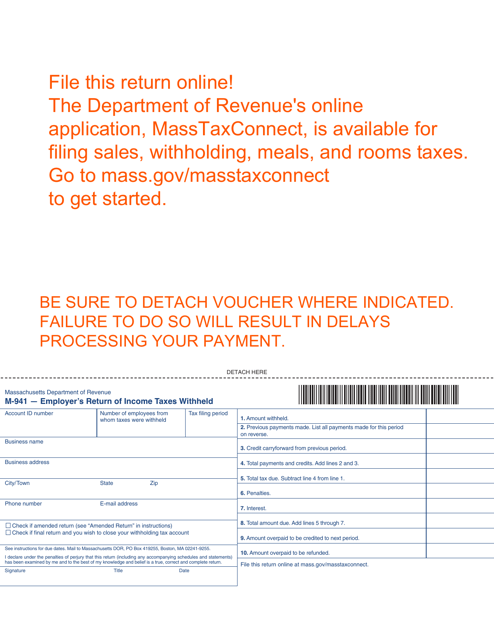

This Form is used for filing the Employer's Return of Income Taxes Withheld in the state of Massachusetts.

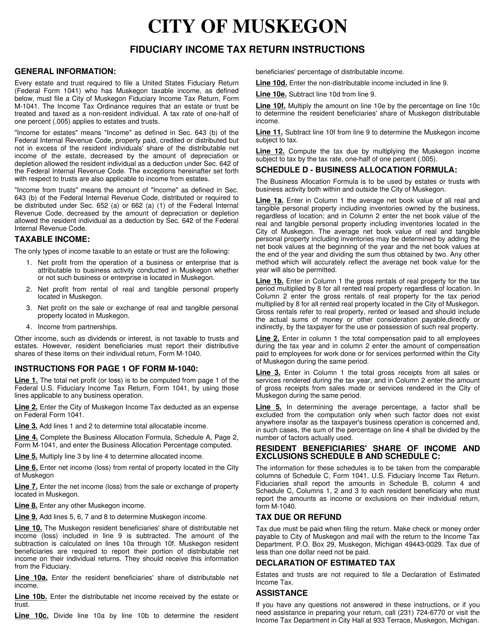

This form is used for filing the fiduciary income tax return for the City of Muskegon, Michigan.

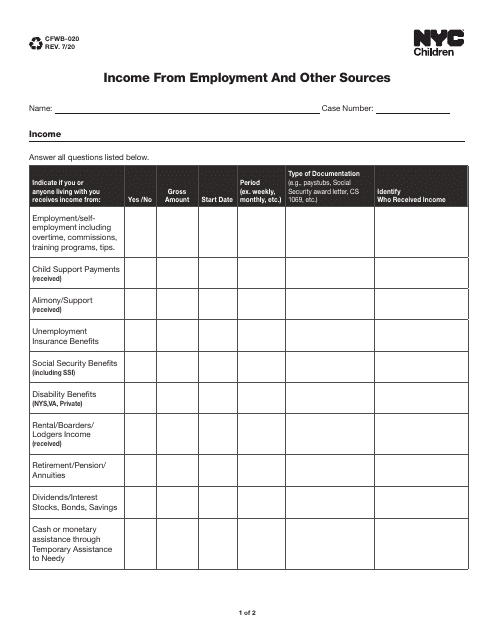

This form is used for reporting income from employment and other sources in New York City.

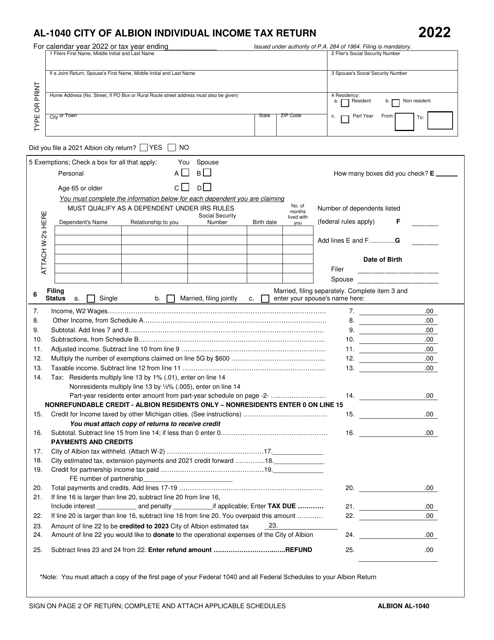

This form is used for filing an individual income tax return specifically for residents of the City of Albion, Michigan.

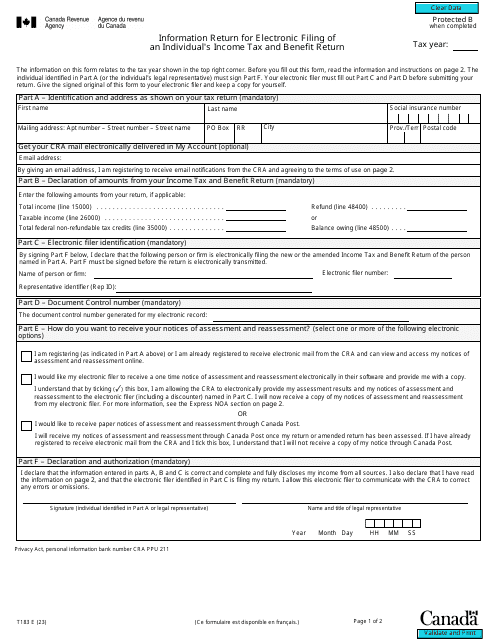

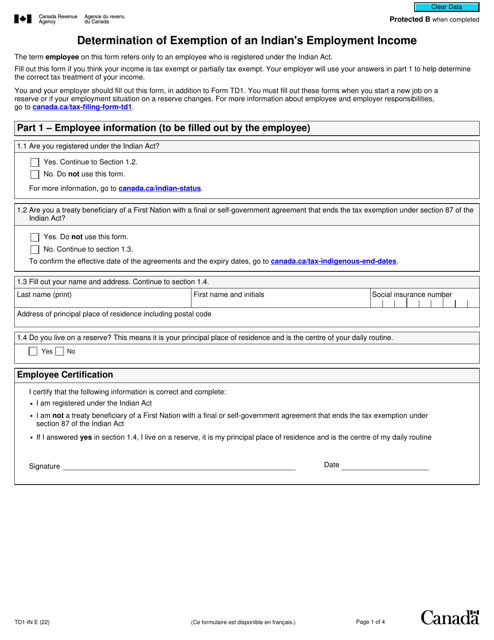

Employees who are defined as Indians under the Canadian Indian Act are supposed to use this form when they want to figure out whether their income from employment is exempt from income tax.

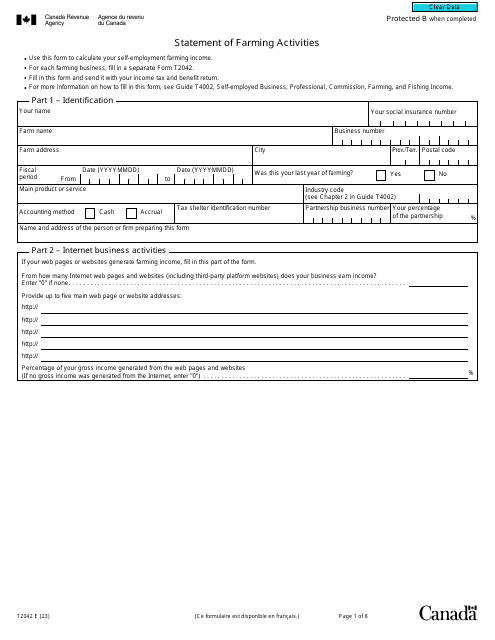

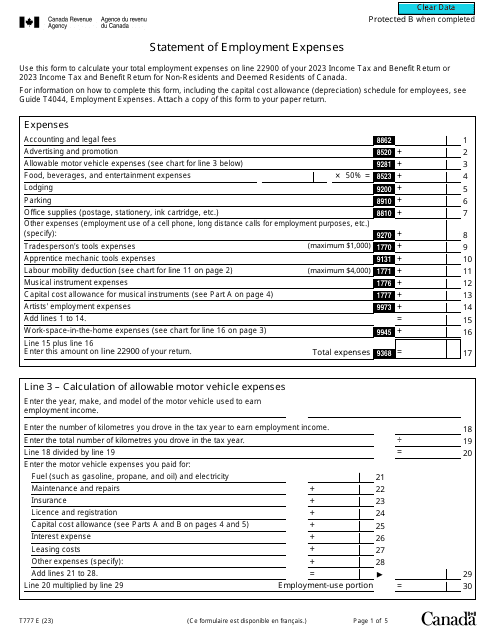

Canadian employees may use this form when they often need to supply themselves with materials necessary to complete their work, but are not reimbursed through their place of work for these expenses.

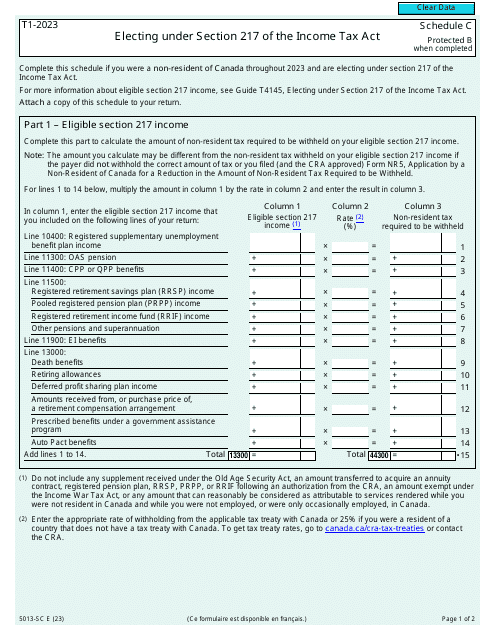

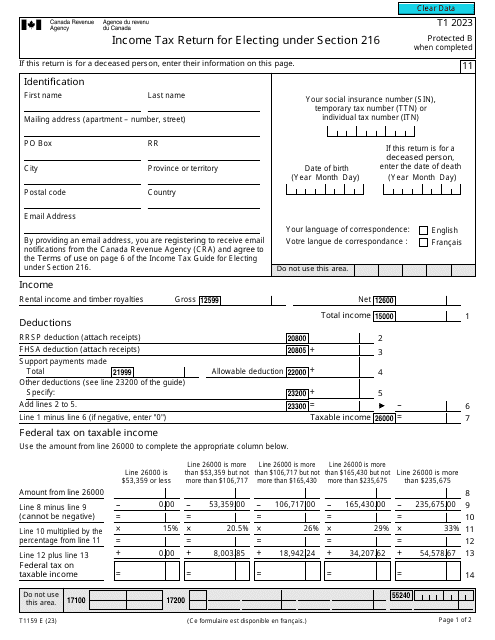

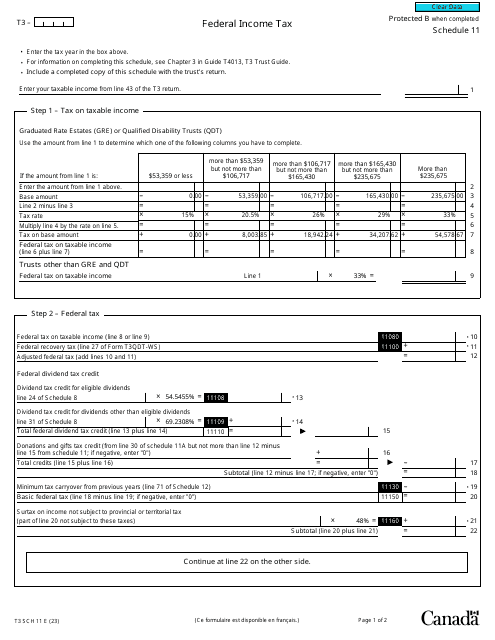

This form is used for reporting the net income or loss for income tax purposes in Canada.