Income Tax Form Templates

Documents:

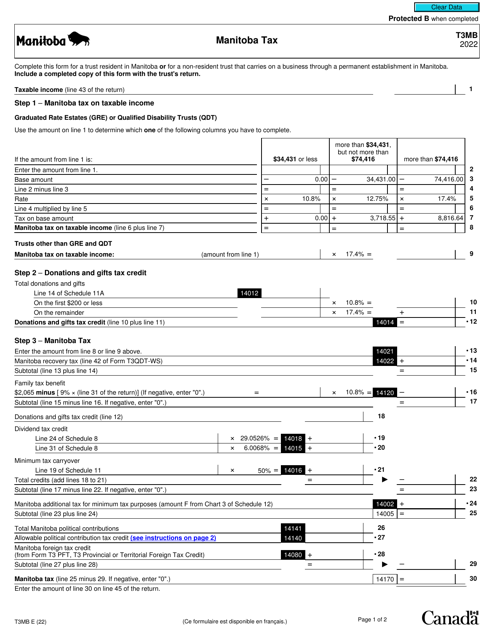

2505

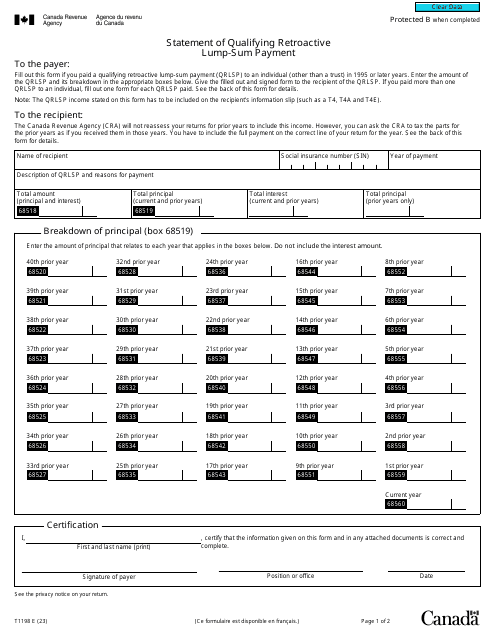

Individuals and companies residing in Canada can fill out this document if they have paid a lump-sum payment in the last twenty-five years to ask the tax authorities to compute taxes differently for the beneficiary and spare them from the necessity to pay all taxes at once.

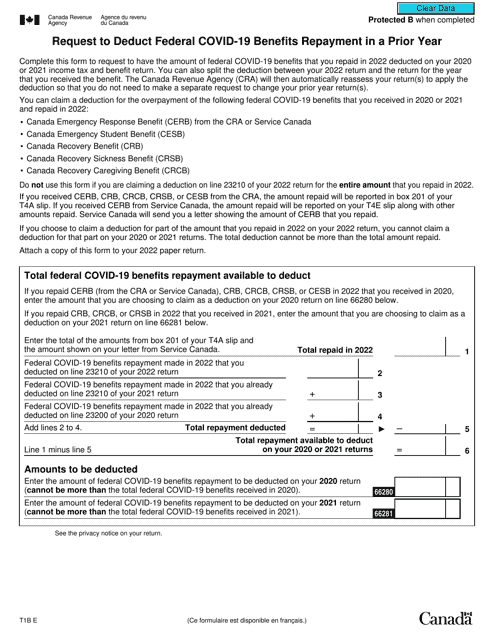

This Form is used for requesting to deduct federal Covid-19 benefits repayment from a prior year in Canada.

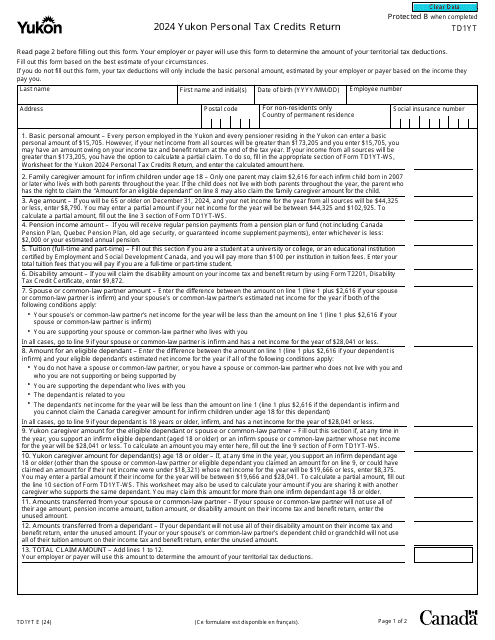

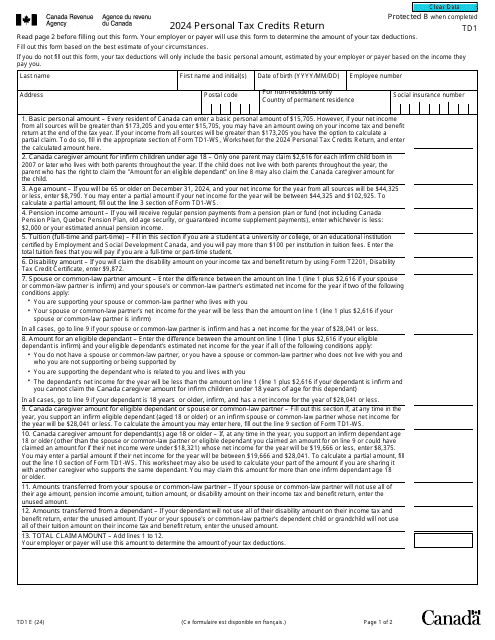

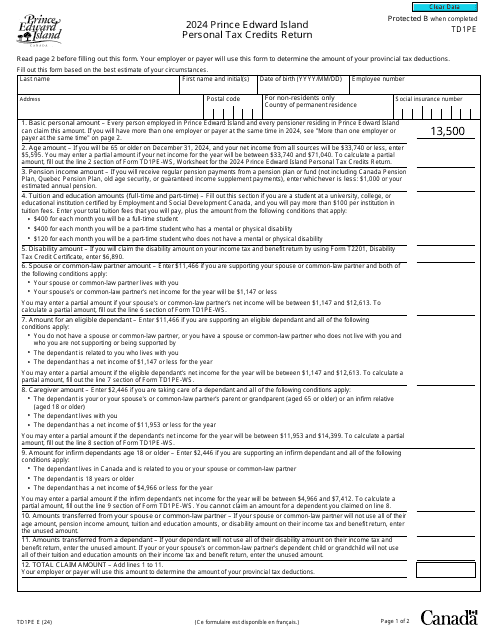

The purpose of this document is to provide a taxpayer's employer with all of the necessary information so that they will be able to determine the number of tax deductions for the Canadian taxpayer.

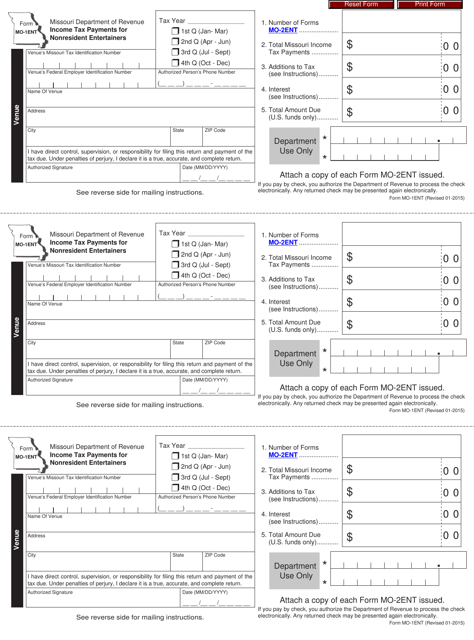

This form is used for reporting income tax payments made by nonresident entertainers in the state of Missouri.

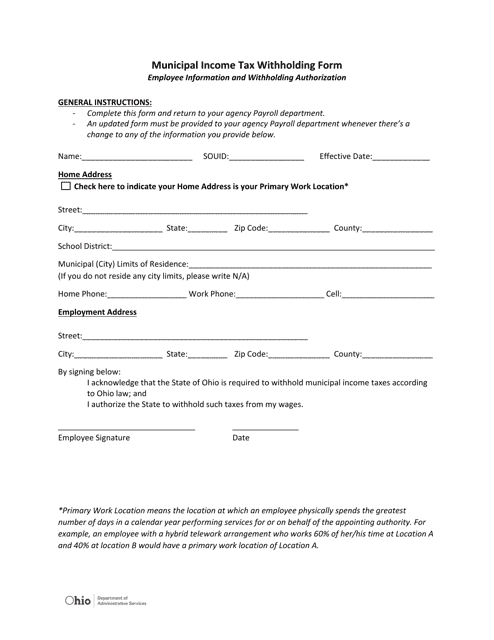

This document is for Ohio residents who need to report and withhold municipal income taxes. It helps employers determine the correct amount of taxes to withhold from their employees' paychecks.