Income Tax Form Templates

Documents:

2505

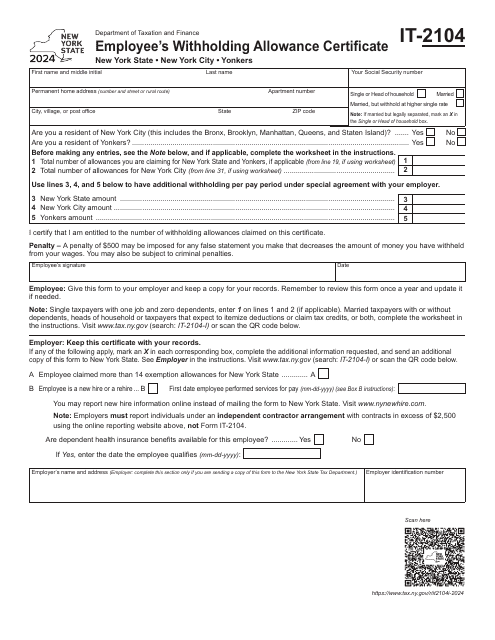

Use this application to specify how much tax needs to be withheld from an employee's pay. It is supposed to be filled out by an individual who works in New York State (New York City and Yonkers) and given to their employer.

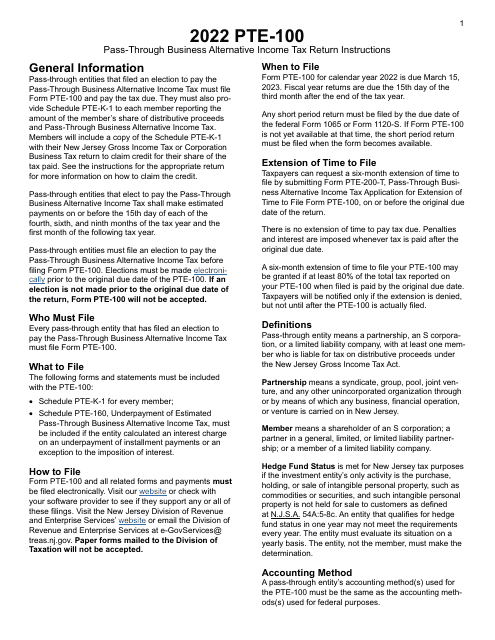

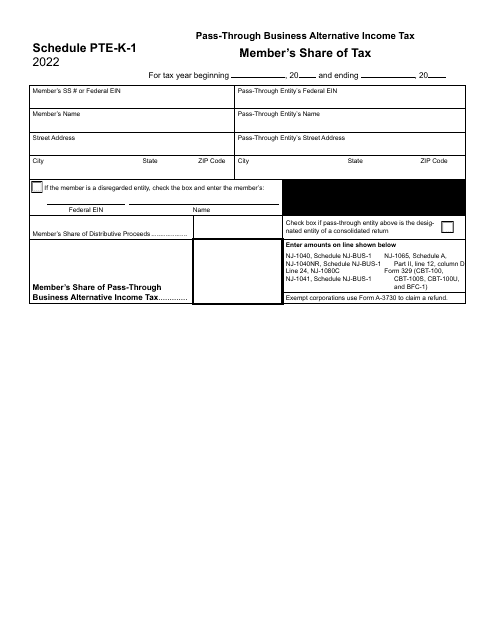

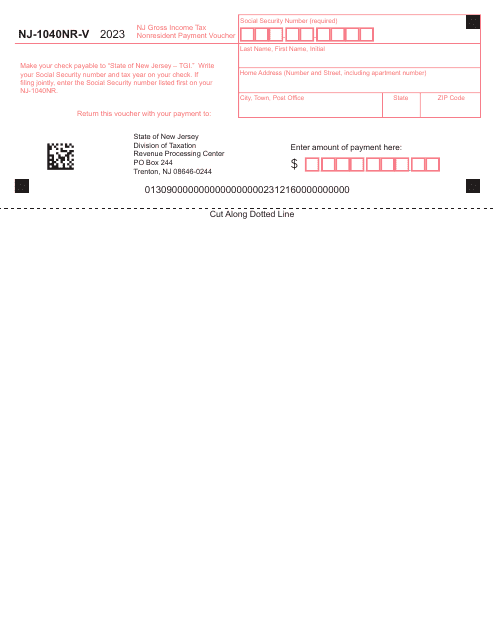

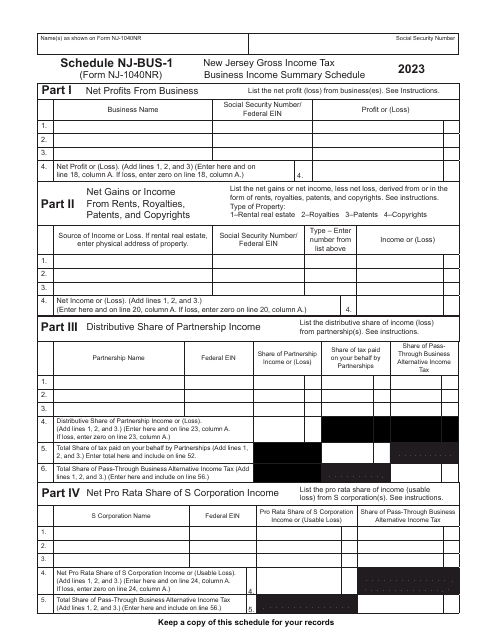

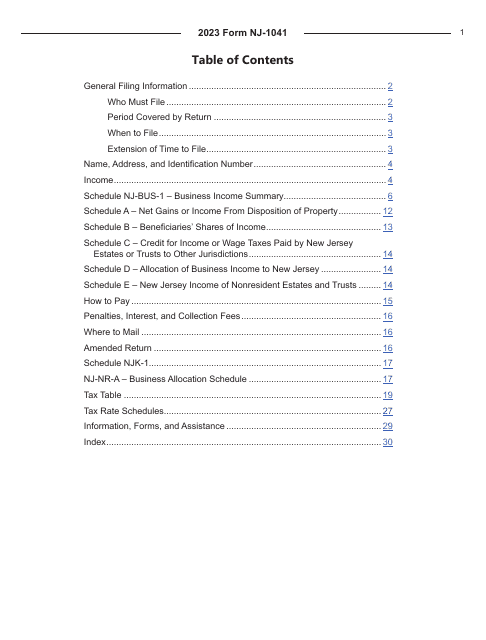

This Form is used for filing the Pass-Through Business Alternative Income Tax Return in the state of New Jersey. It is specifically for businesses classified as pass-through entities.

Instructions for Form PTE-100 Pass-Through Business Alternative Income Tax Return - New Jersey, 2022