Income Tax Form Templates

Documents:

2505

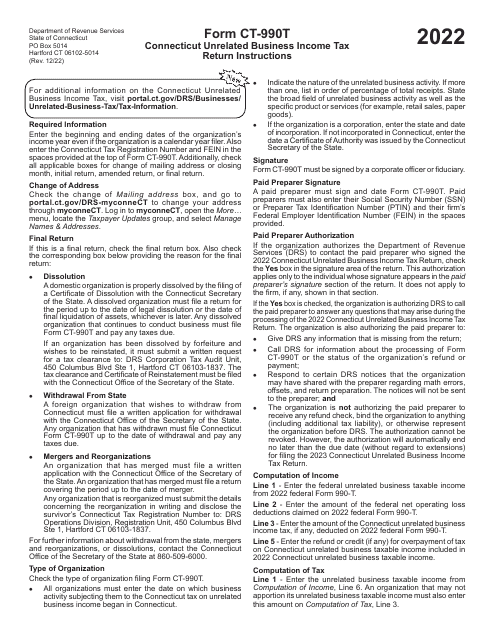

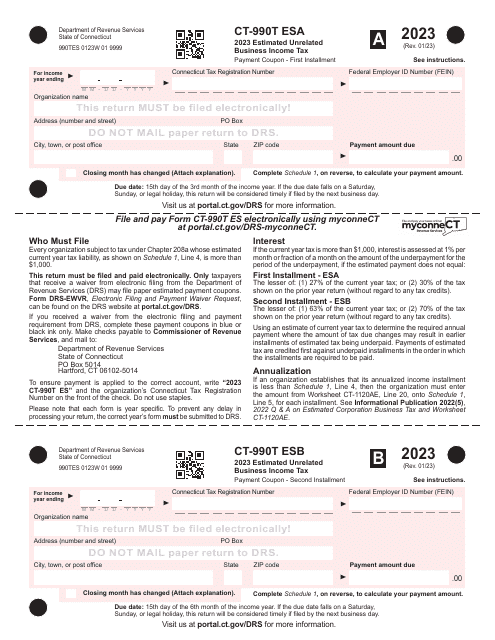

This form is used for making estimated tax payments for unrelated business income tax in Connecticut.

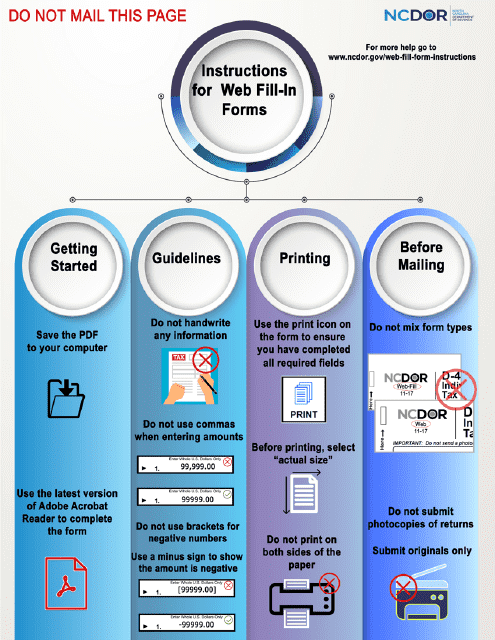

This Form is used for residents of North Carolina to file their state income tax return and claim deductions, credits, and exemptions. The D-400TC Schedule A, AM, PN, PN-1, S are additional schedules that may be necessary depending on your specific tax situation.

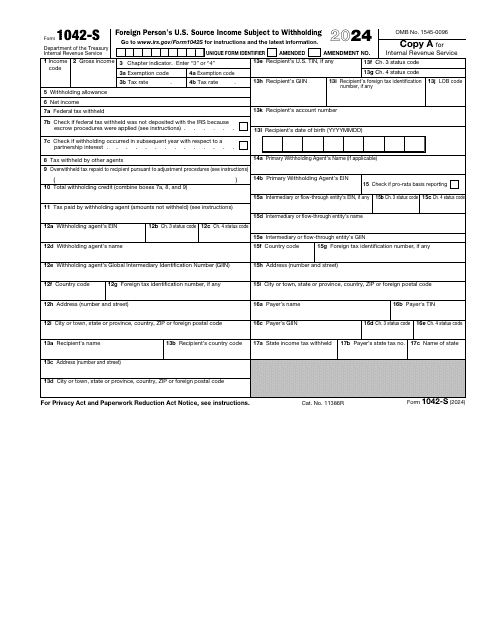

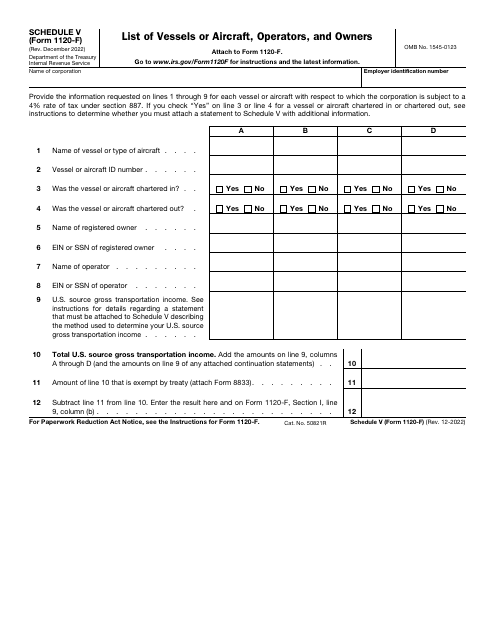

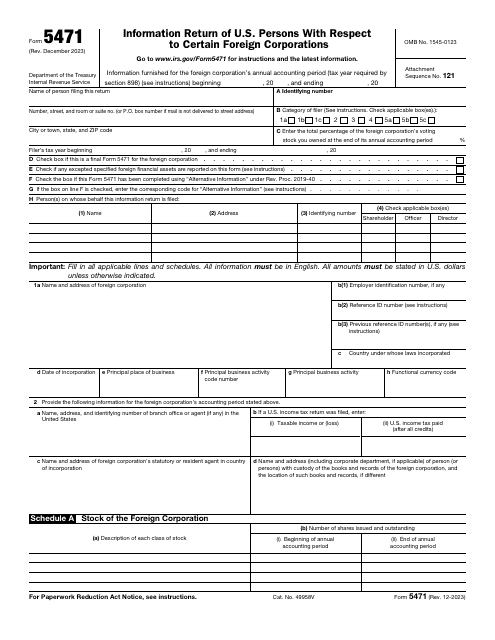

This is a fiscal IRS document designed to outline the tax deducted from the income of various foreign persons.

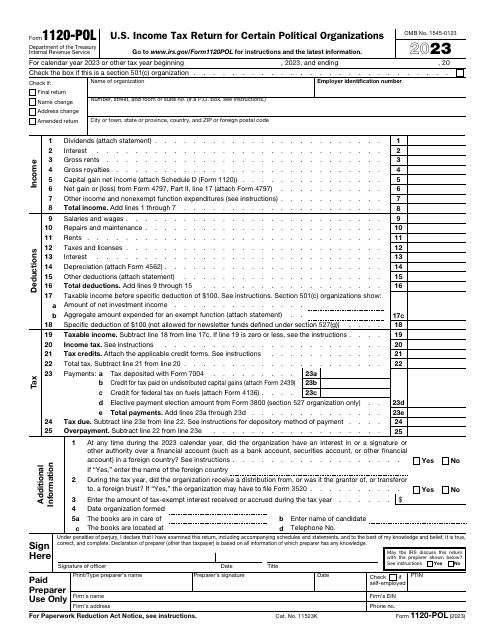

Use this form to inform the Internal Revenue Service (IRS) about the taxable income of your political organization, as well as about your tax liability according to Section 527.

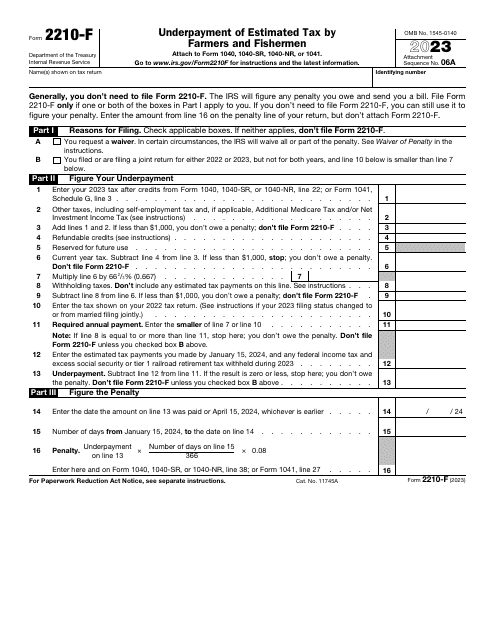

This is an IRS form completed by individuals, trusts, and estates to figure out whether they owe tax authorities a penalty after making an error in estimated tax calculations.

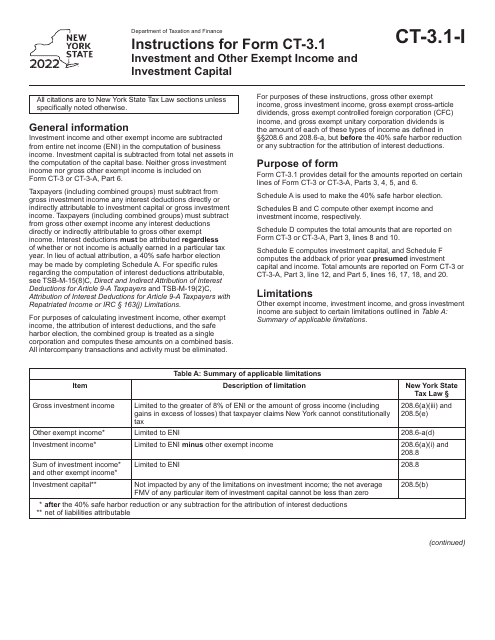

This form is used for reporting investment income and investment capital that are exempt from tax in the state of New York.