Income Tax Form Templates

Documents:

2505

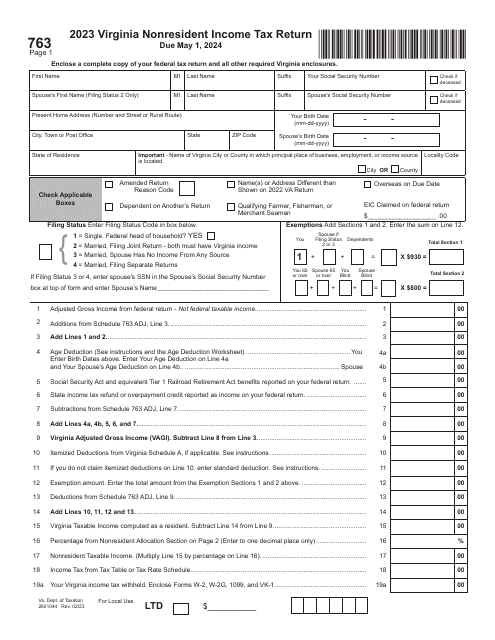

This form is used for reporting income in the state of Virginia. It is specifically for individuals who are nonresidents of Virginia, but have income from Virginia sources.

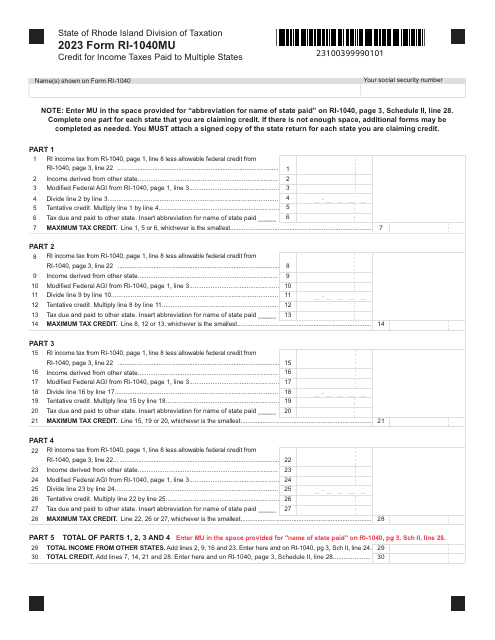

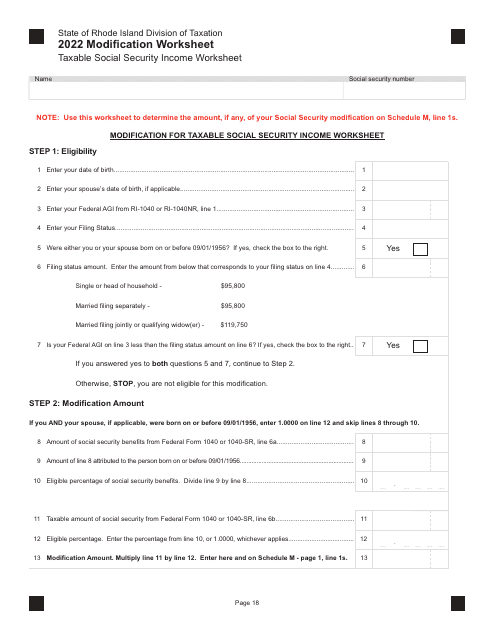

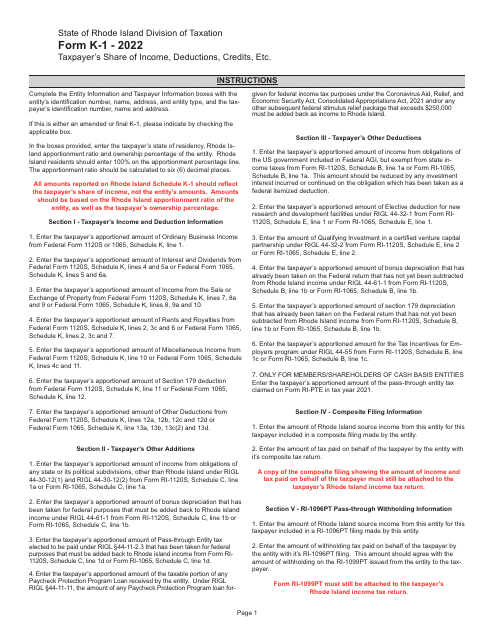

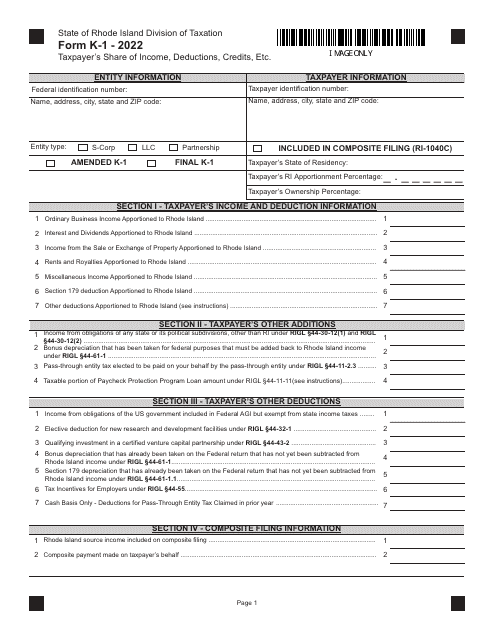

Instructions for Form K-1 Taxpayer's Share of Income, Deductions, Credits, Etc. - Rhode Island, 2022

This form is used for reporting estimated income tax for a taxed S Corporation in North Carolina.

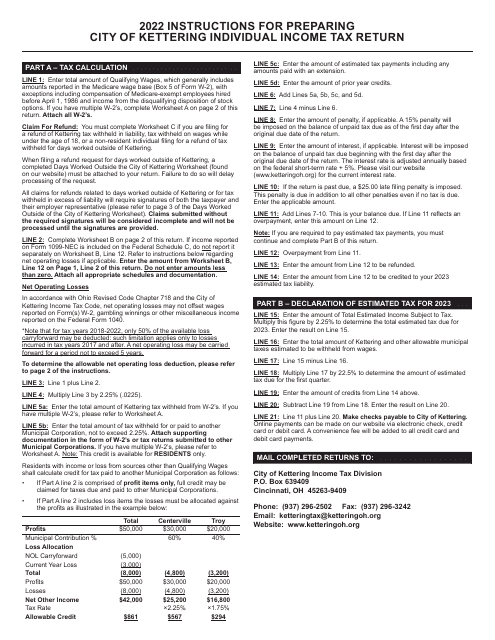

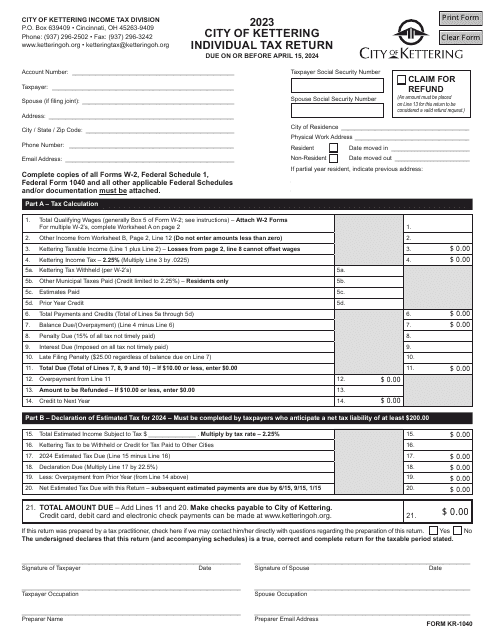

This document is used for filing the individual income tax return in the City of Kettering, Ohio. It provides instructions on how to accurately file your taxes and comply with the city's tax regulations.

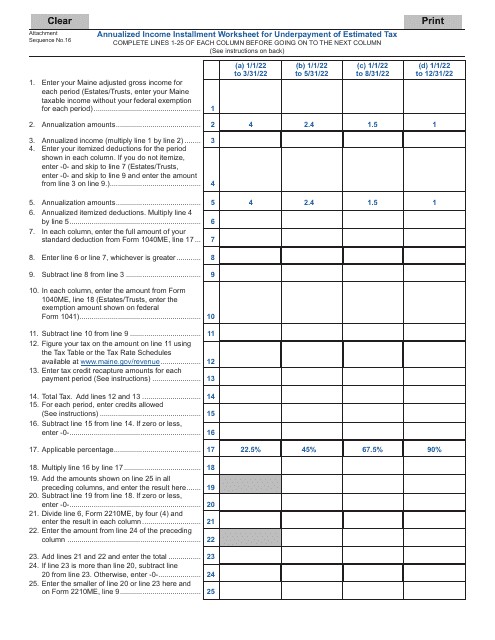

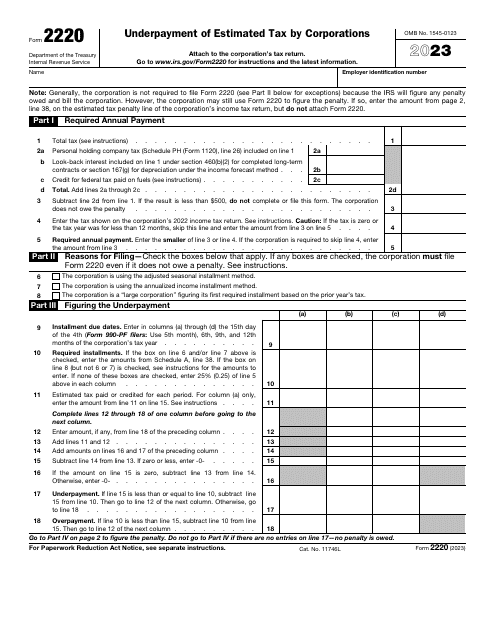

This Form is used for calculating annualized income installment and assessing underpayment of estimated tax in Maine.

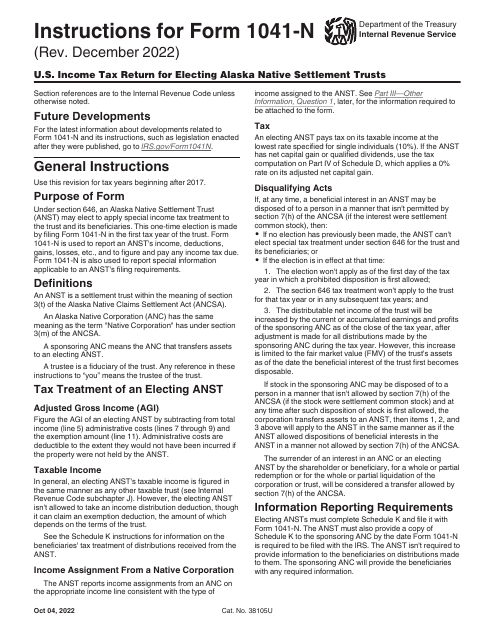

Instructions for IRS Form 1041-N U.S. Income Tax Return for Electing Alaska Native Settlement Trusts

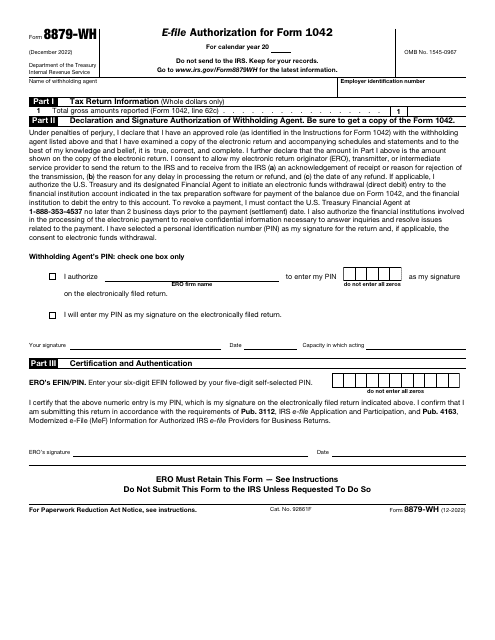

This form is used for authorizing electronic filing for Form 1042 to the IRS.

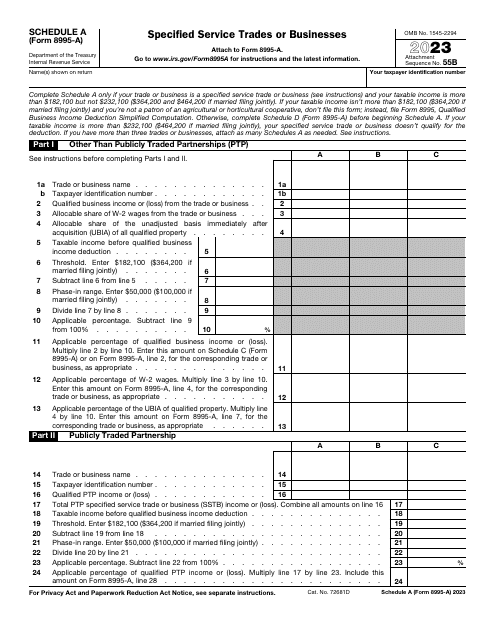

This is a supplementary IRS form used by taxpayers in order to claim a business deduction after reporting your business income.

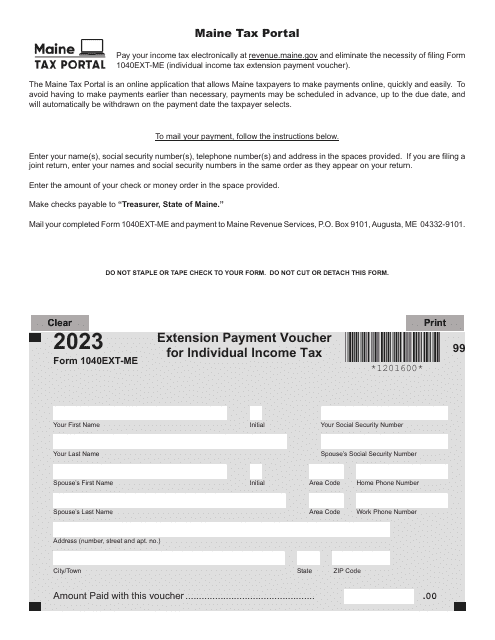

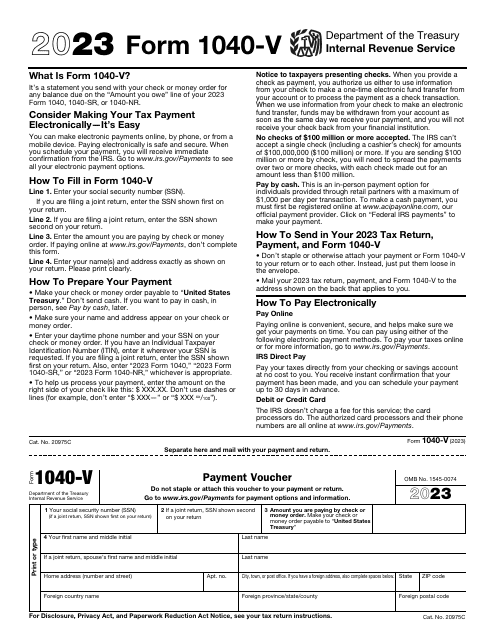

This is a supplementary document completed by taxpayers that chose to fulfill their financial obligations to fiscal organizations with the help of a check or money order.

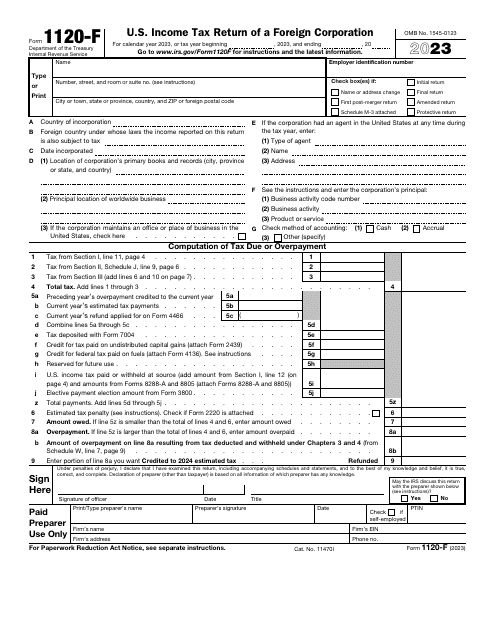

File this form if you are a foreign corporation and maintain an office within the United States in order to report your income, deductions, and credits to the Internal Revenue Service (IRS), as well as to figure your U.S. income tax liability.