Income Tax Form Templates

Documents:

2505

This form is used for reporting the Foreign Tax Credit for individuals in West Virginia.

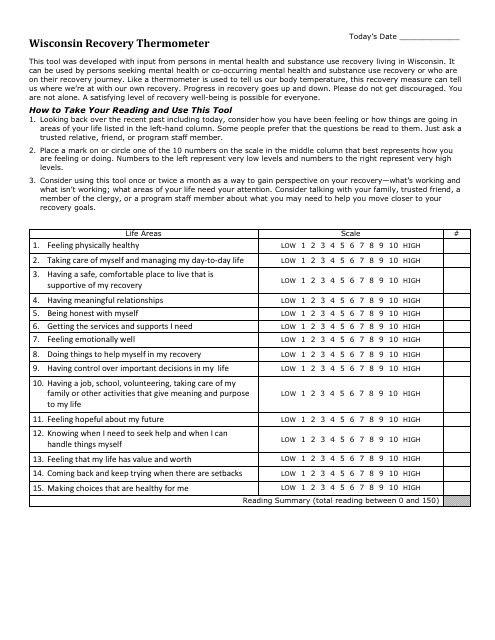

This form is used for tracking and monitoring the recovery progress in the state of Wisconsin.

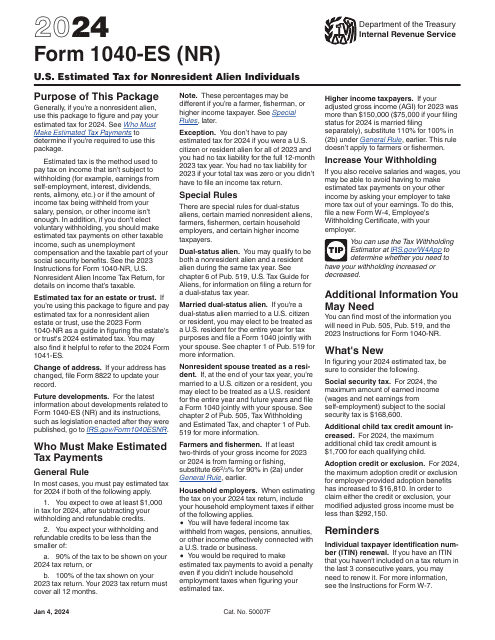

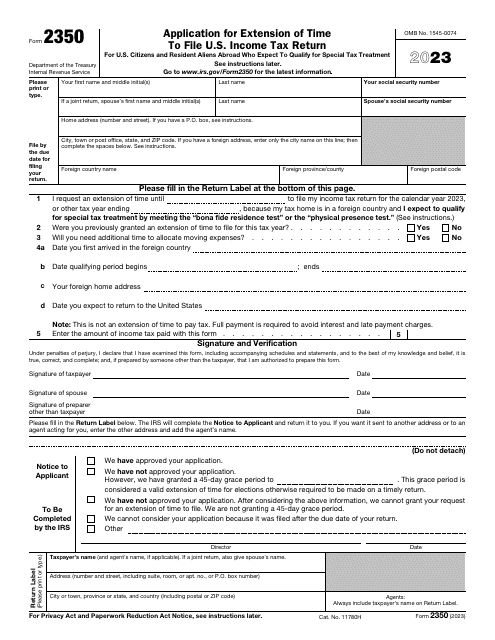

This is a form used to calculate and pay estimated tax on income by nonresident aliens that isn't subject to IRS withholding.

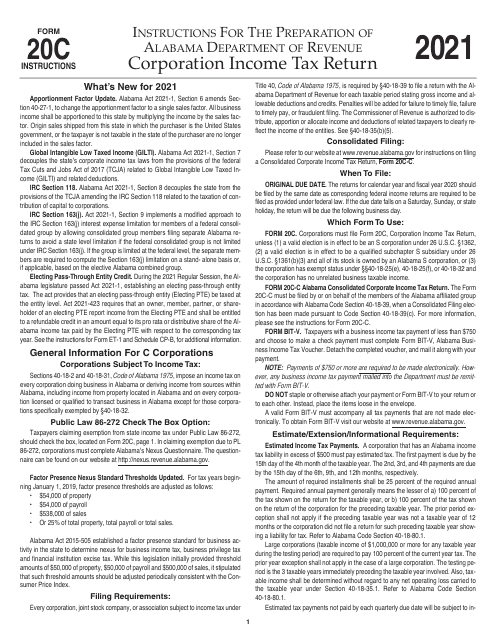

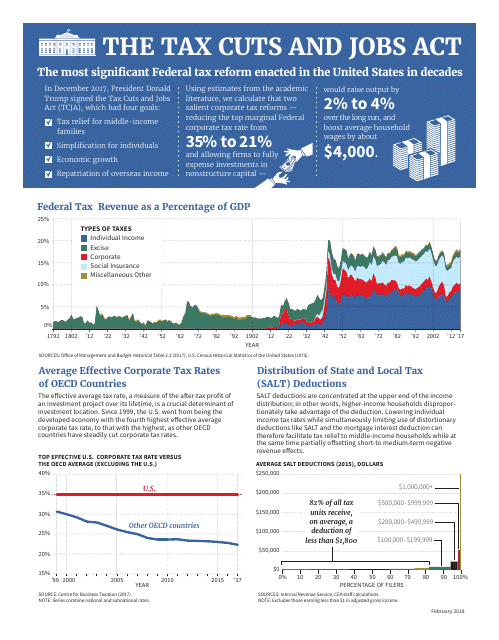

This document explains the Tax Cuts and Jobs Act, a law in the United States that made changes to the tax code with the goal of promoting economic growth and job creation.

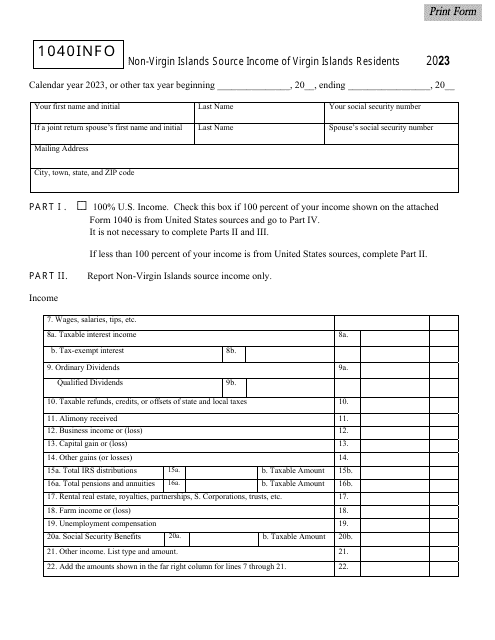

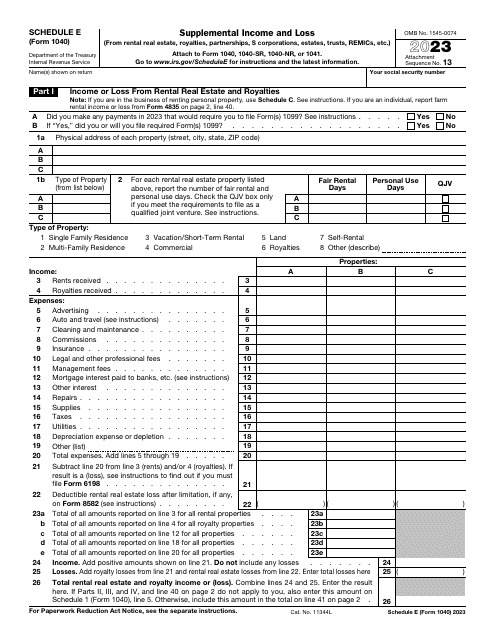

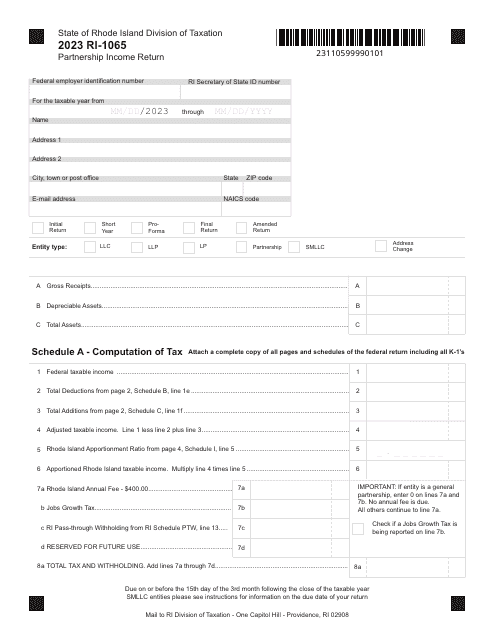

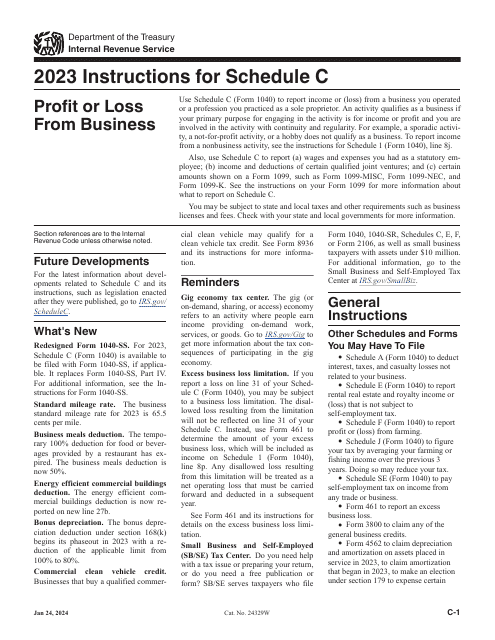

This form is part of the IRS 1040 series, which is used to calculate and submit different types of federal individual income tax returns. File this form to inform the Internal Revenue Service (IRS) about your income and loss from royalties, rental real estate, trusts, and S corporations among others.

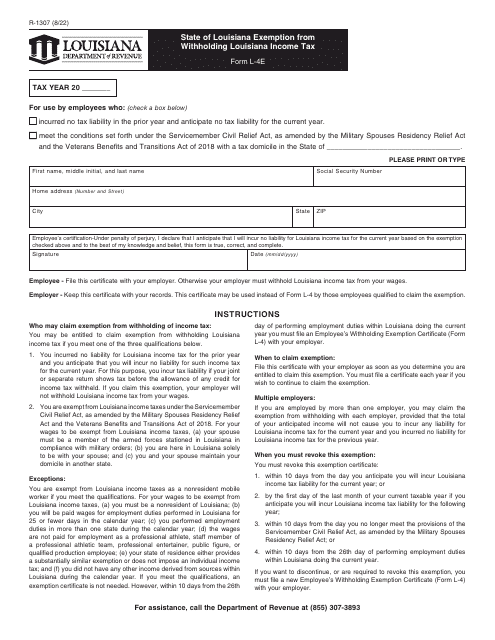

This Form is used for claiming exemption from withholding Louisiana income tax in the state of Louisiana.

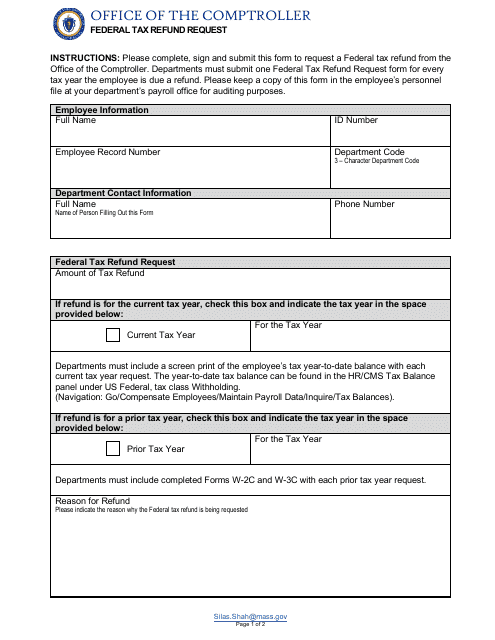

This document is used to request a federal tax refund in the state of Massachusetts.

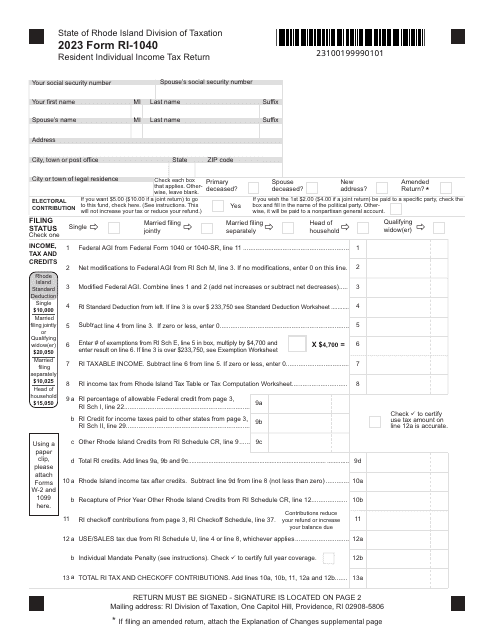

Use this basic form if you are an American taxpayer and wish to submit an annual income tax return. This form is also known as the Individual Income Tax Return Form.

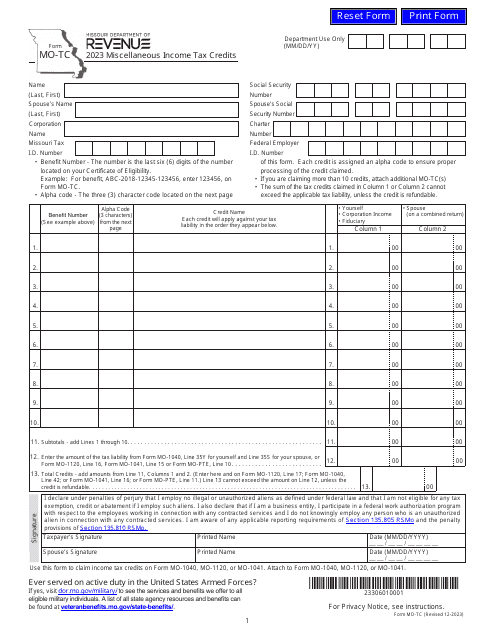

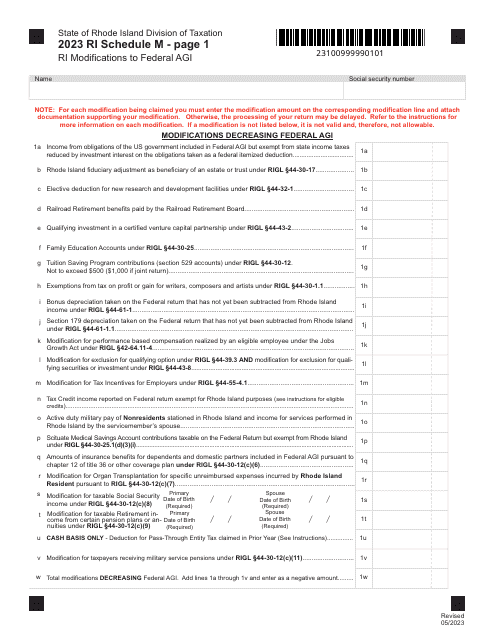

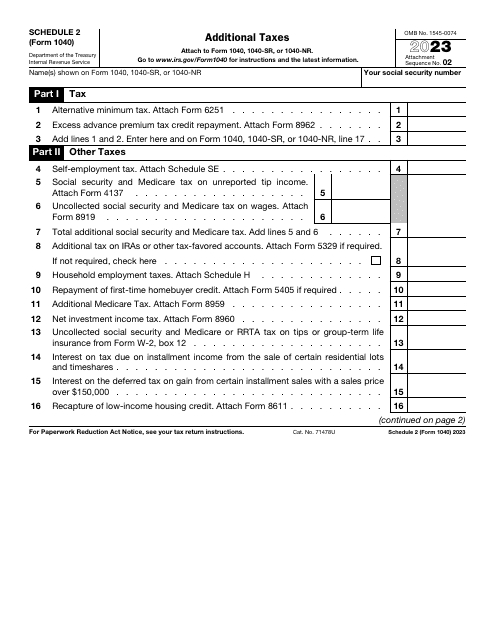

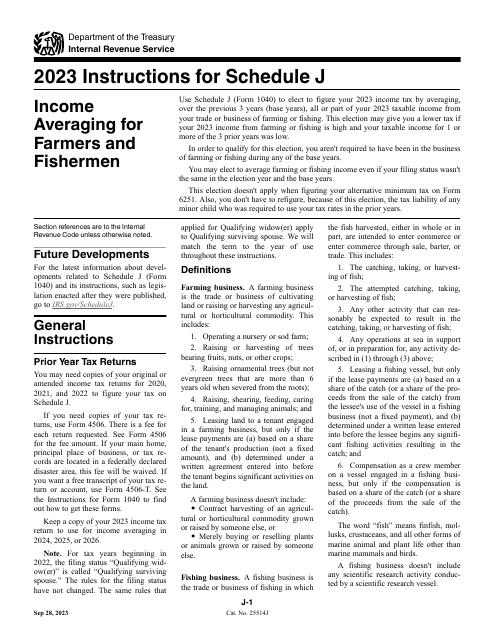

This is a supplementary document designed to allow taxpayers to list taxes they do not outline on the main income statement they are supposed to file annually.

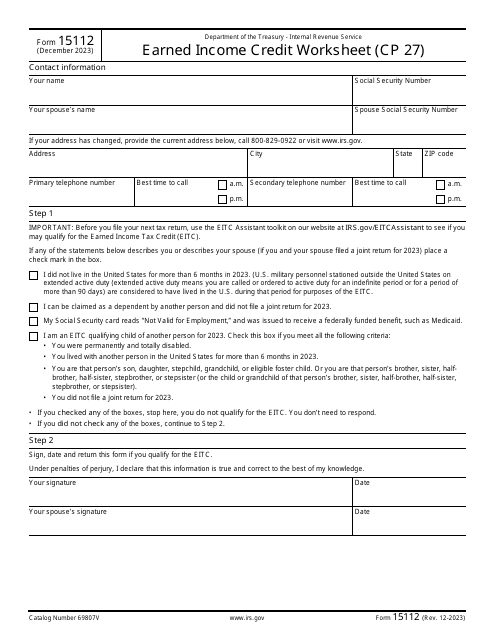

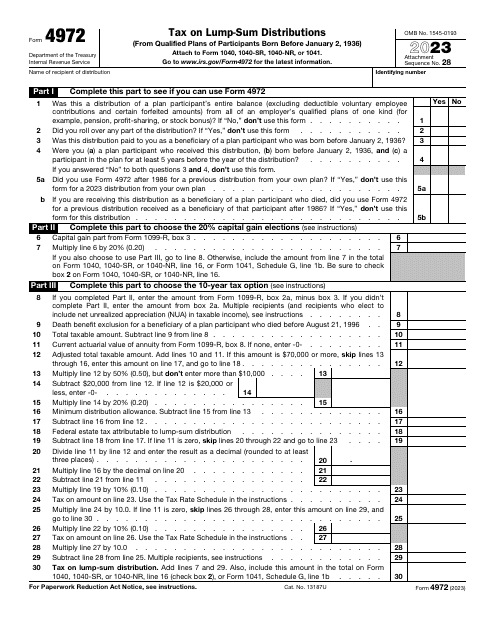

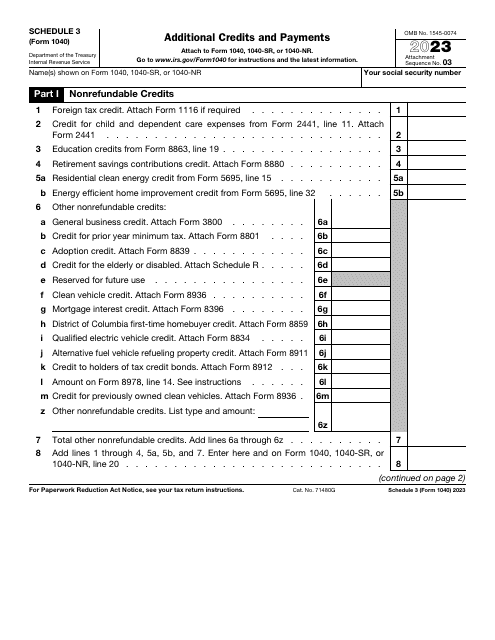

This is a fiscal form that elaborates on payments and credits that may let an individual lower the taxes they would otherwise have to pay in full or add to the amount of tax refund they are claiming.

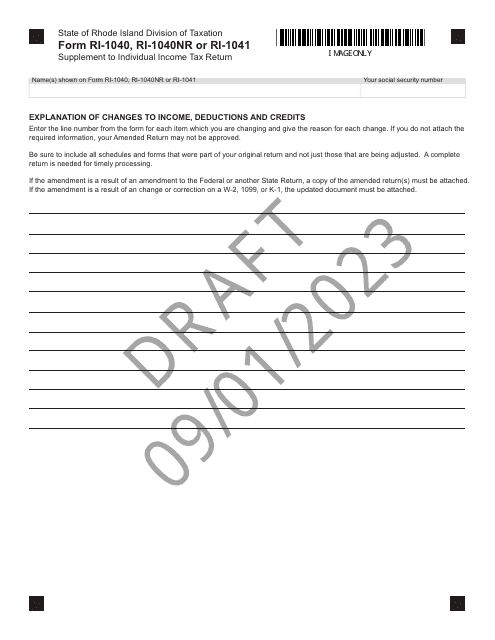

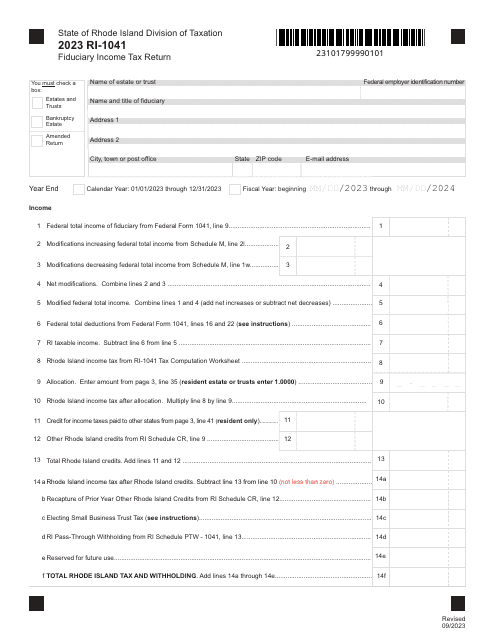

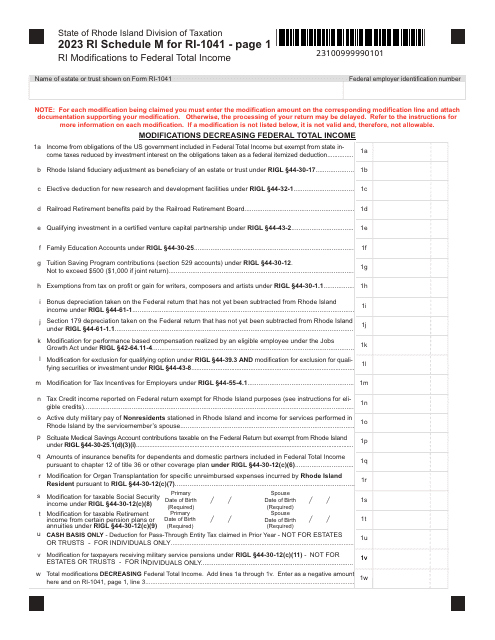

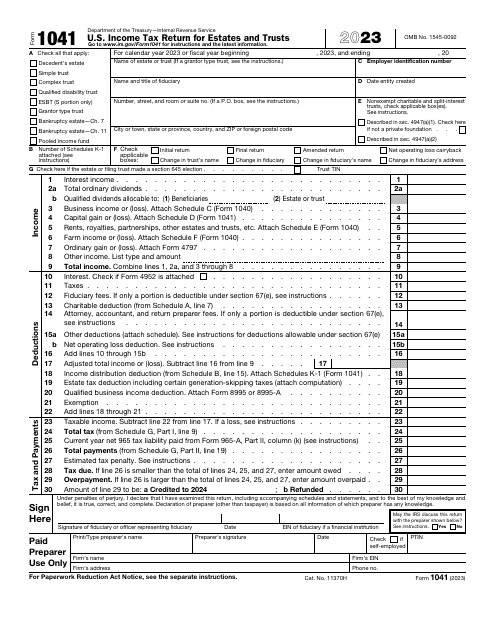

File this document, also known as the Estates and Trusts Tax Return, as an income tax return to the Internal Revenue Service (IRS) if you are a fiduciary of a bankruptcy estate, domestic decedent's estate, or a trust.