Income Tax Form Templates

Documents:

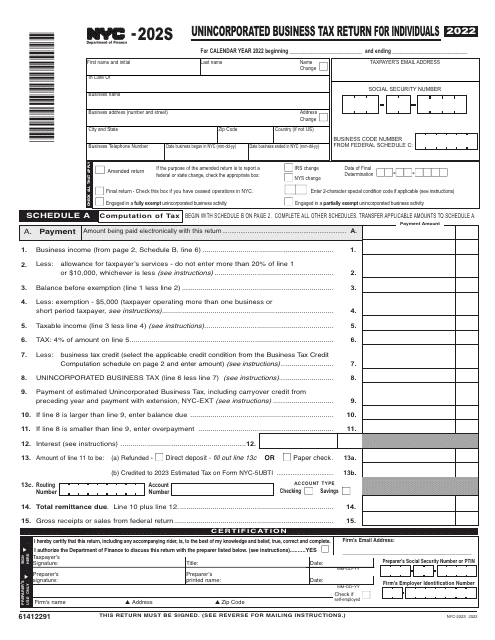

2505

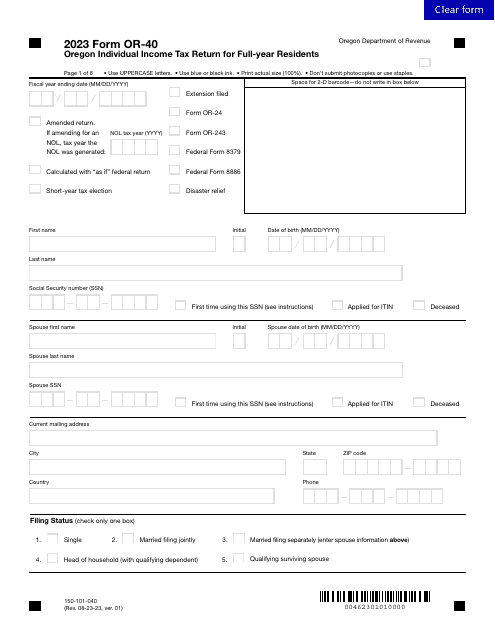

Use this basic form if you are an American taxpayer and wish to submit an annual income tax return. This form is also known as the Individual Income Tax Return Form.

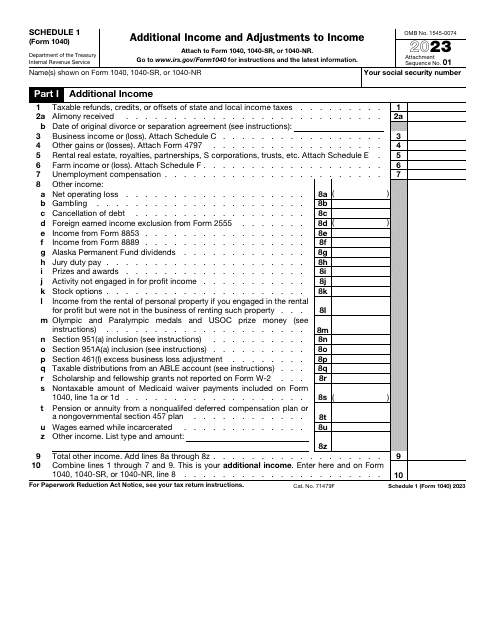

This is a supplementary form used by taxpayers to list income they did not include on the main income statement they file.

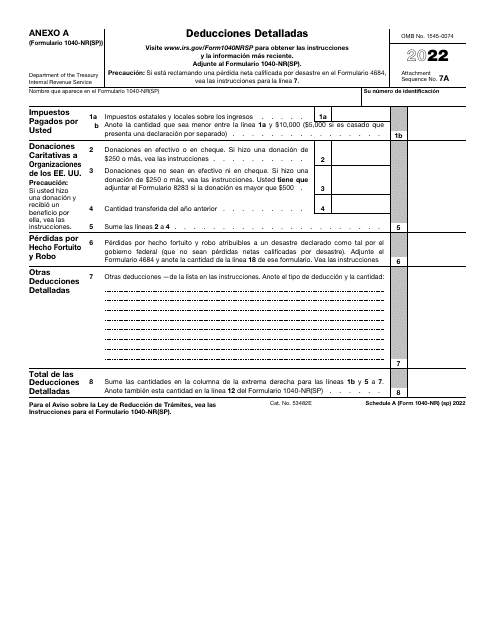

This form is also known as the IRS itemized deductions form. It belongs to the IRS 1040 series. This document is used in order to calculate the amount of your itemized deductions.

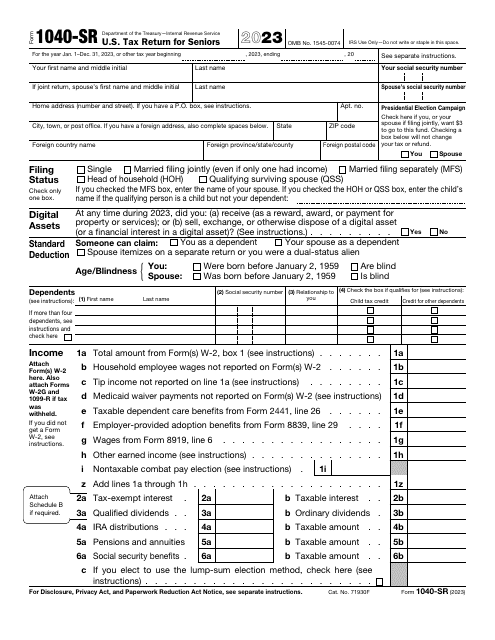

The purpose of this IRS application is to make the process of filing a federal income tax return easier for seniors - the document features larger print, but contains the standard deduction charts.

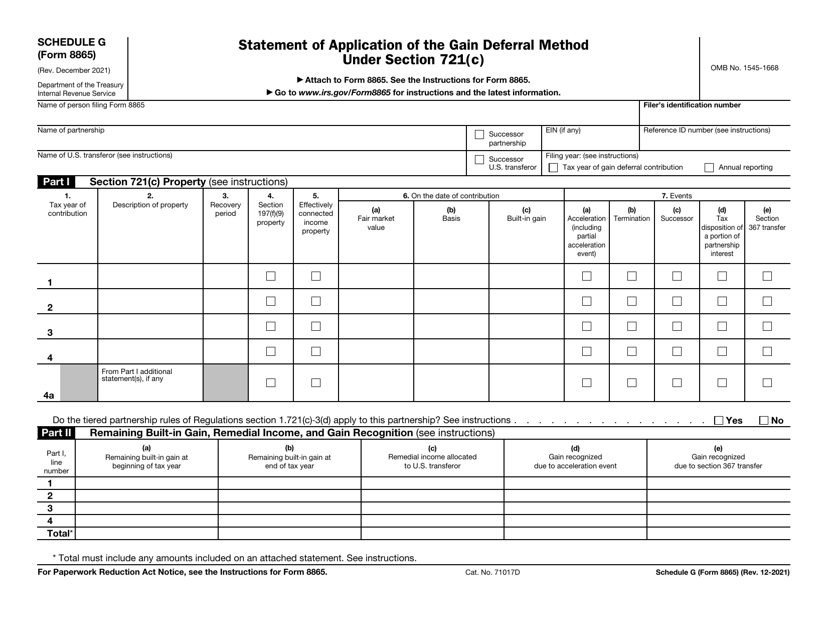

This form is used for reporting the application of the gain deferral method under Section 721(c) for certain contributions of property to a partnership.

This is a formal statement prepared by an employee after figuring out how much tax an employer has to deduct from their paycheck.

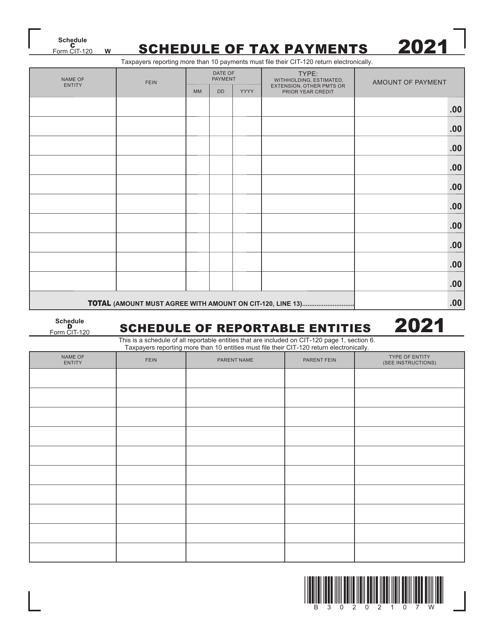

This form is used for reporting tax payments made in West Virginia. It is specifically used for Schedule C in the CIT-120 form.

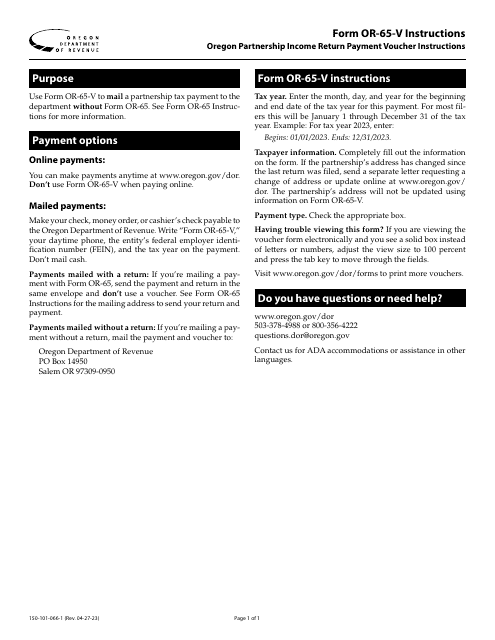

Instructions for Form OR-65-V, 150-101-066 Oregon Partnership Income Return Payment Voucher - Oregon

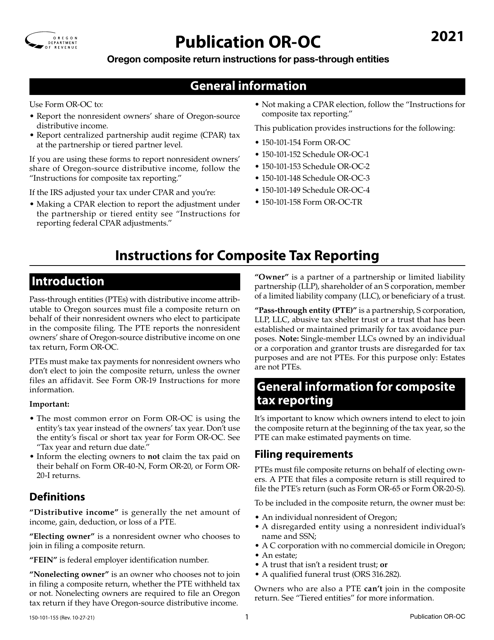

This document provides instructions for completing Form OR-OC, which is used by pass-through entities in Oregon to file their composite return.