Income Tax Form Templates

Documents:

2505

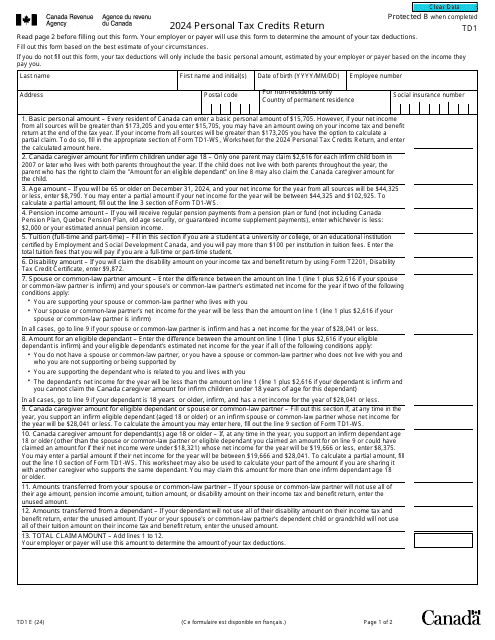

The purpose of this document is to provide a taxpayer's employer with all of the necessary information so that they will be able to determine the number of tax deductions for the Canadian taxpayer.

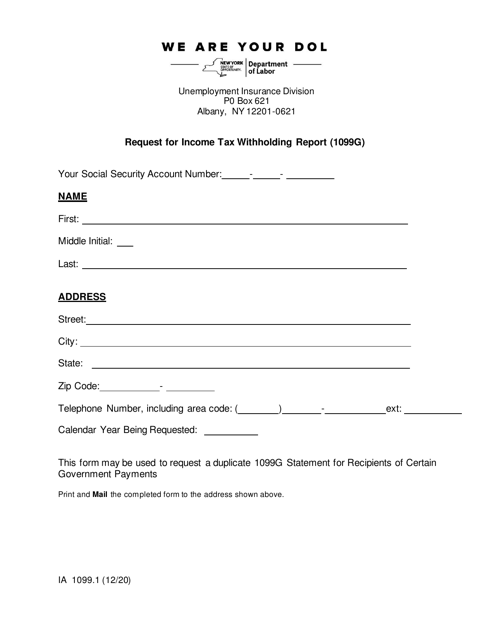

This form is used for requesting an Income Tax Withholding Report (1099g) in New York.

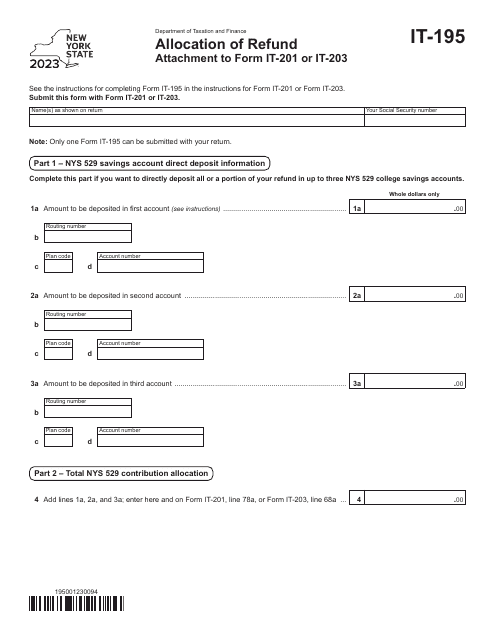

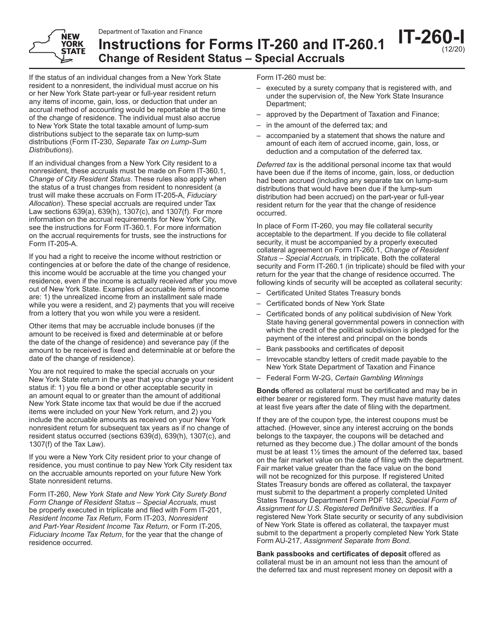

This Form is used for reporting a change in resident status and special accruals in the state of New York. It provides instructions on how to accurately complete the form.

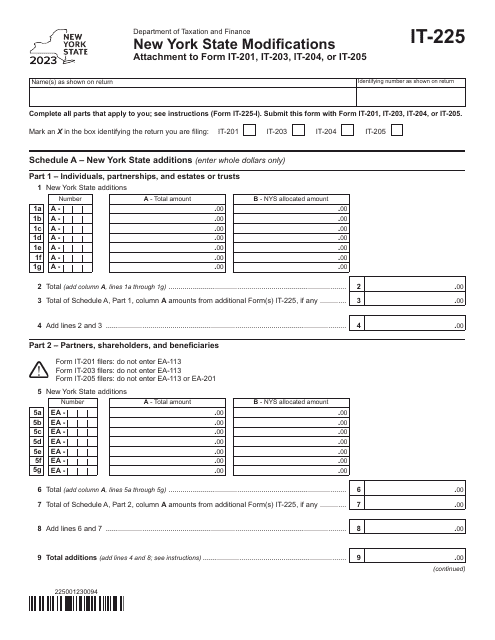

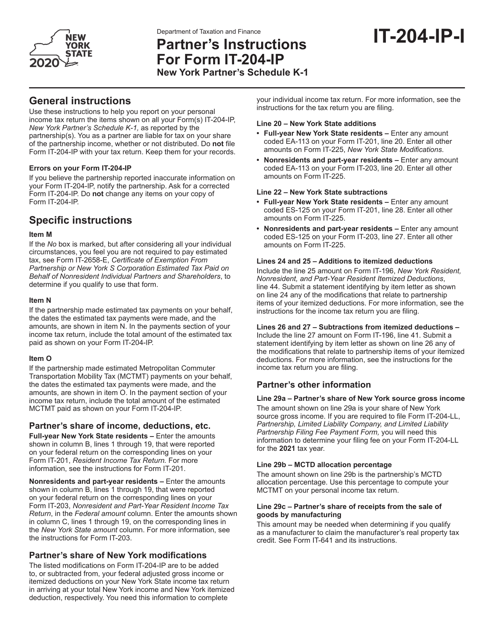

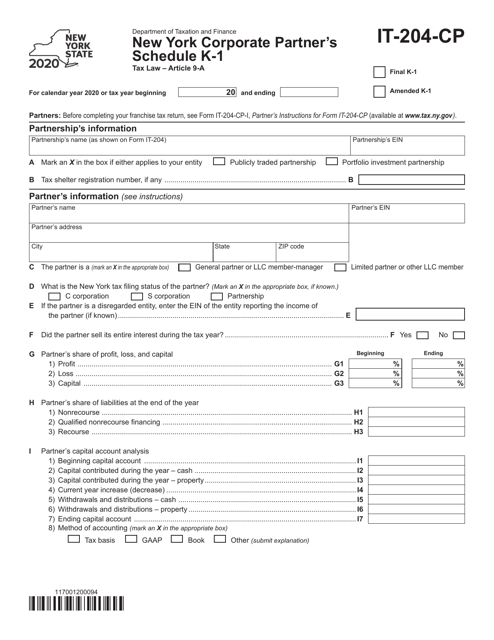

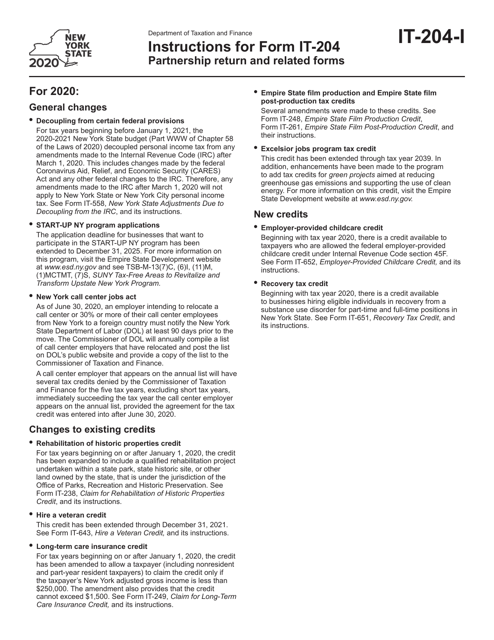

This form is used for reporting a New York corporate partner's share of income, deductions, and credits on Schedule K-1.

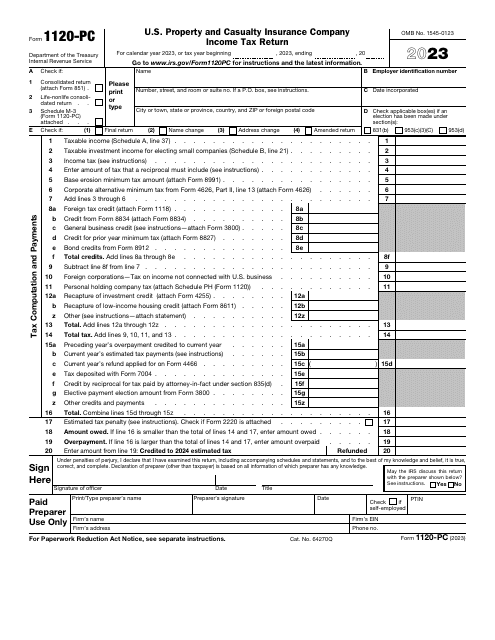

This form is filed by non-life insurance companies wishing to inform the Internal Revenue Service (IRS) of their income, deductions, and credits, as well as to figure their income tax liability.

This is an IRS form used by taxpayers to calculate the amount of alternative minimum tax they owe to the government.

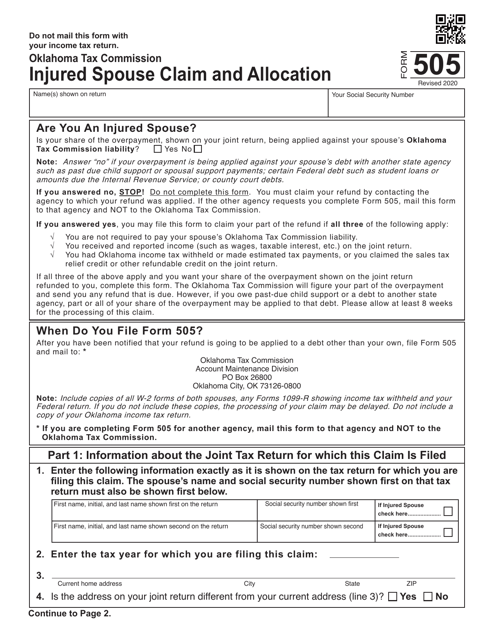

This Form is used for Oklahoma residents who are filing an injured spouse claim and allocation.

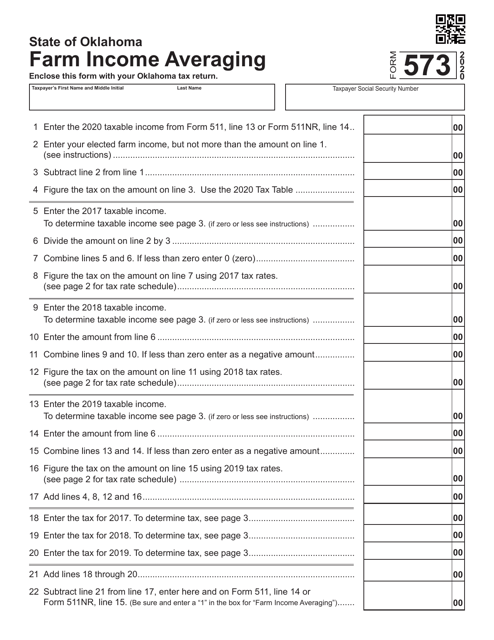

This form is used for farm income averaging in Oklahoma. It helps farmers in calculating their average income over a period of time to reduce tax liability.

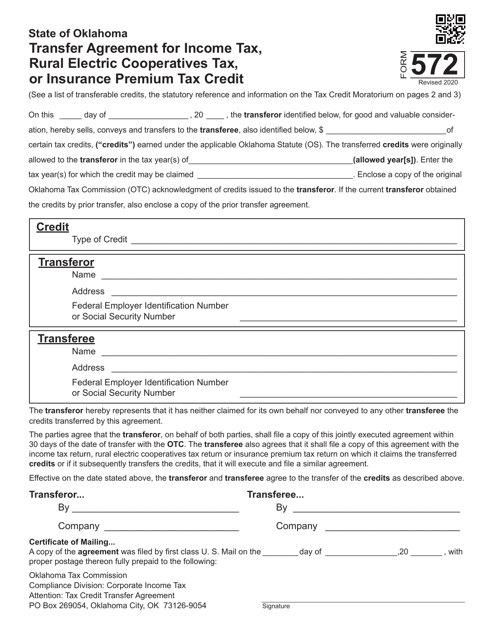

This Form is used for transferring agreements related to income tax, rural electric cooperatives tax, or insurance premium tax credit in the state of Oklahoma.

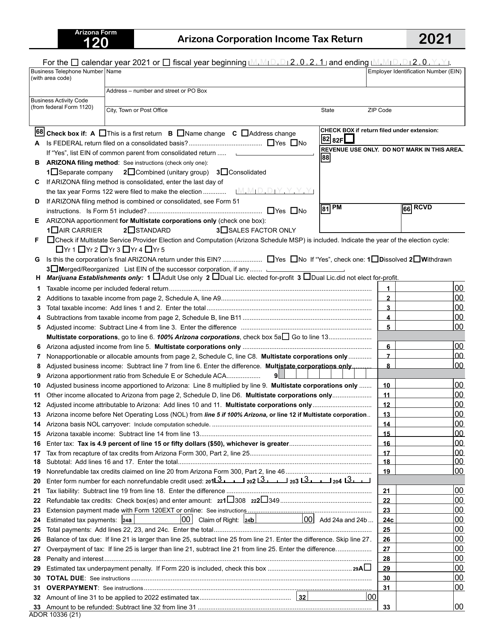

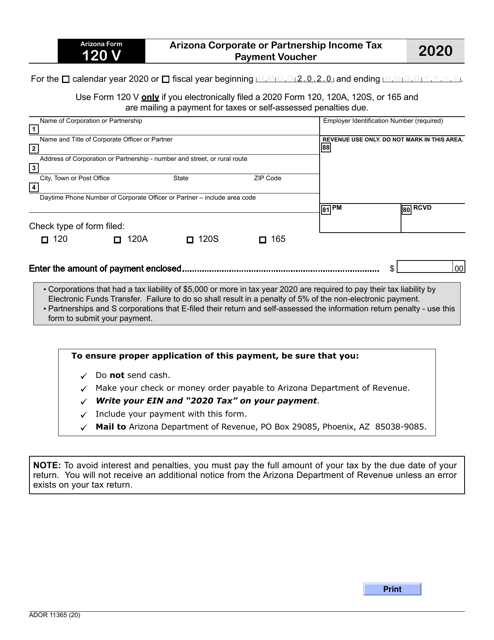

This form is used for making tax payments for corporate or partnership income tax in Arizona.