Income Tax Form Templates

Documents:

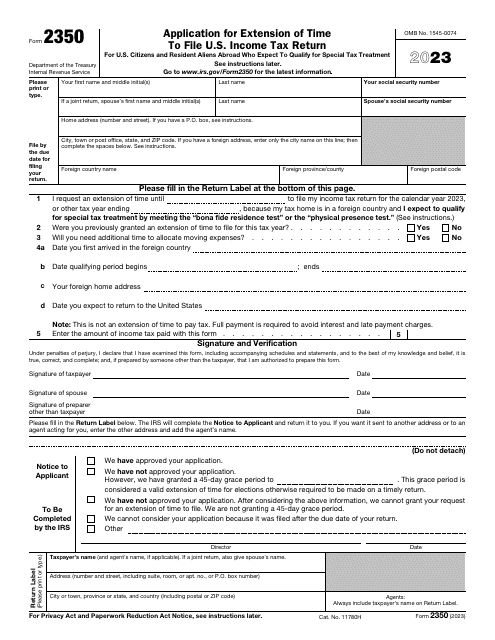

2505

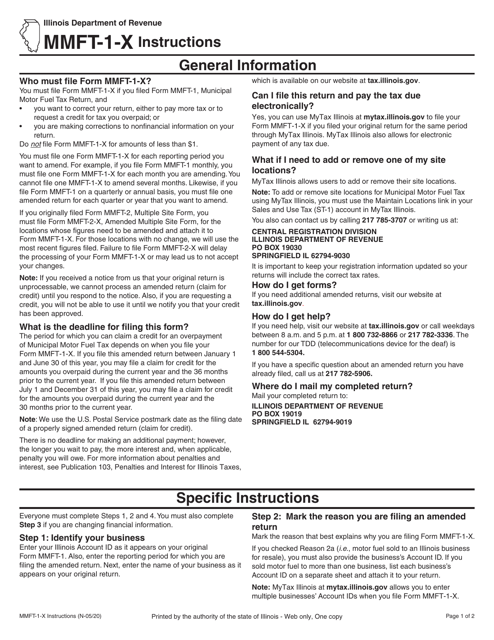

This Form is used for filing an amended Municipal Motor Fuel Tax Return in the state of Illinois.

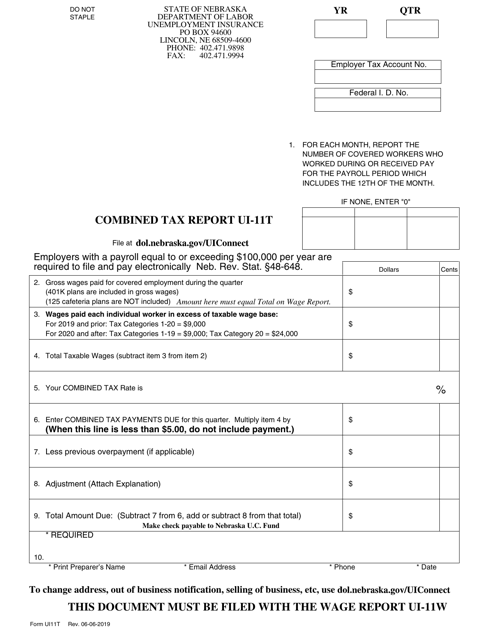

This document is used for filing a combined tax report in Nebraska. It is known as Form UI-11T.

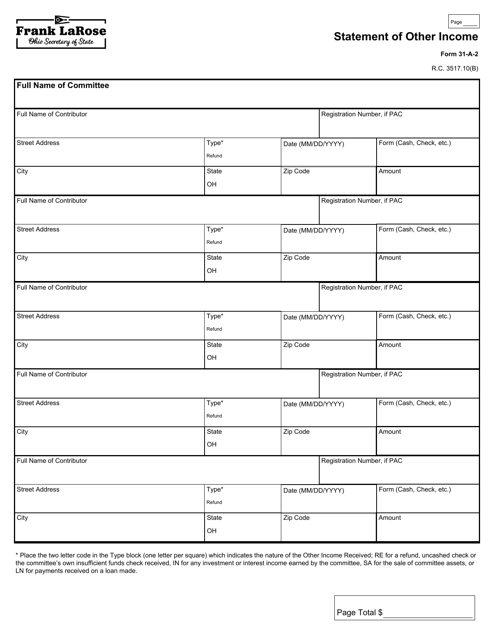

This form is used for reporting other sources of income in the state of Ohio.

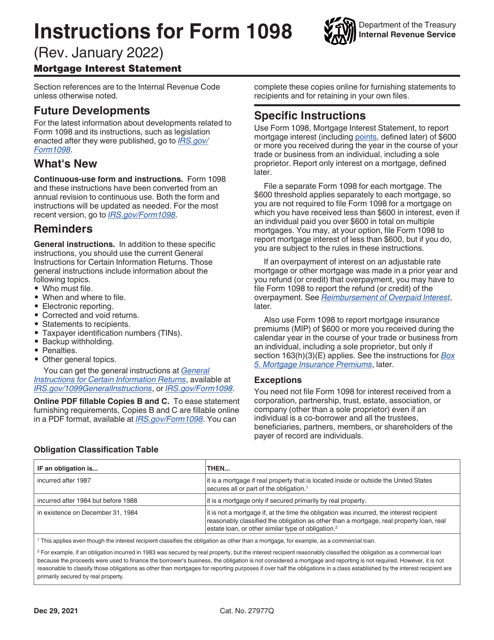

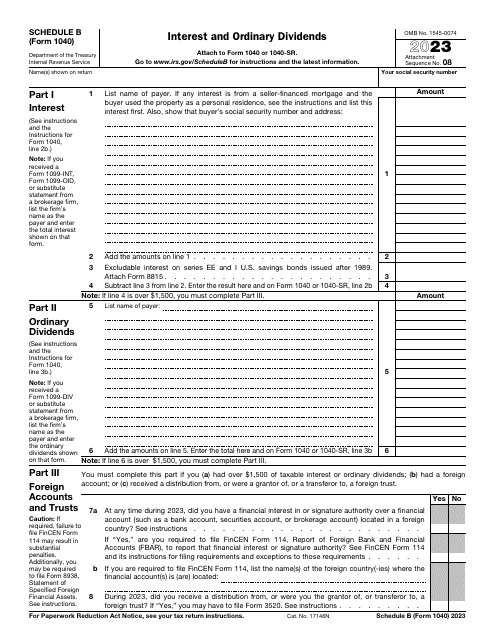

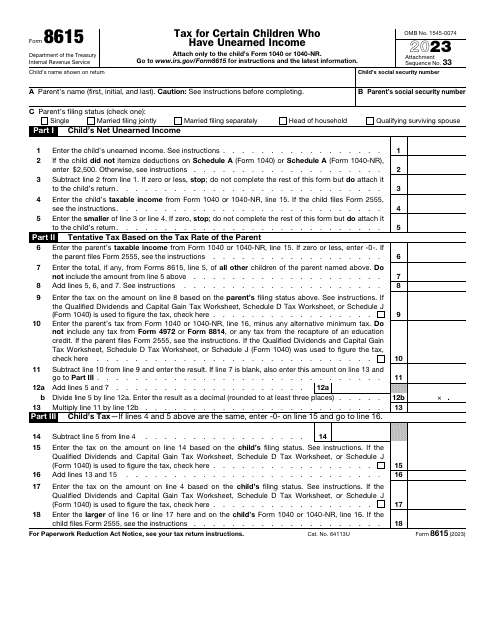

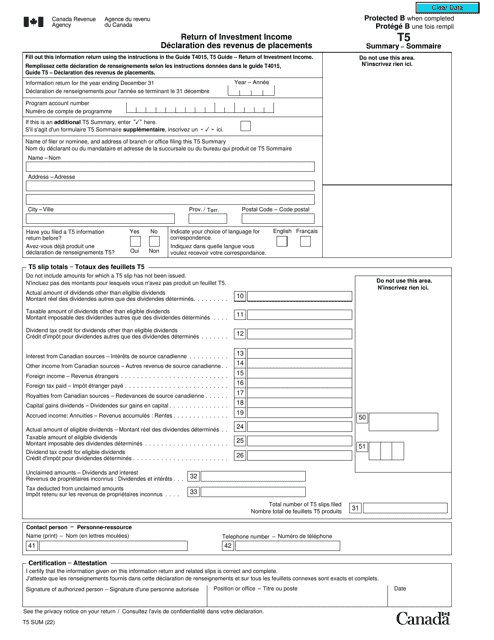

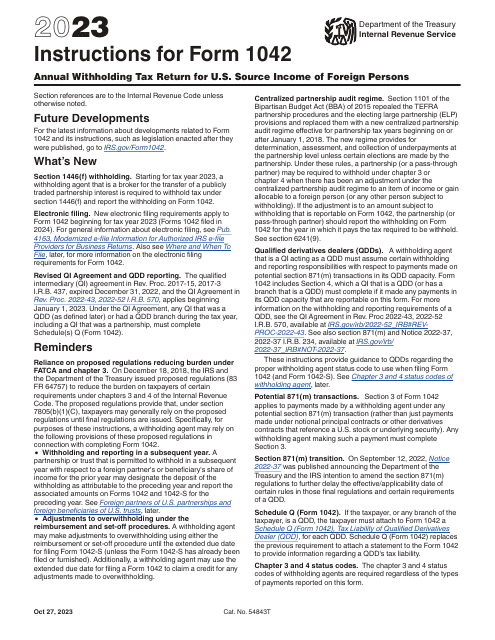

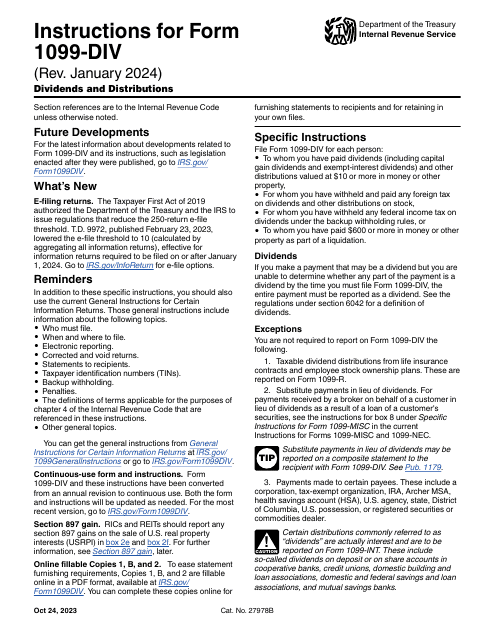

This is a supplementary form individuals are supposed to use to calculate income tax they owe after receiving interest from bonds and earning dividends.

This form is a fiscal instrument used by creditors to inform their debtors about the debts they canceled over the course of the calendar year.

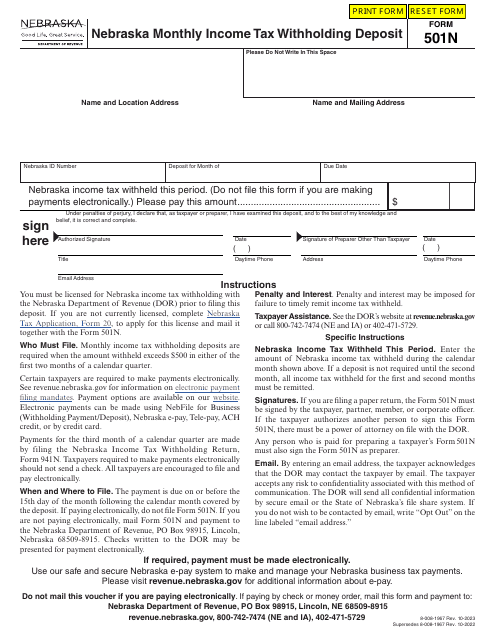

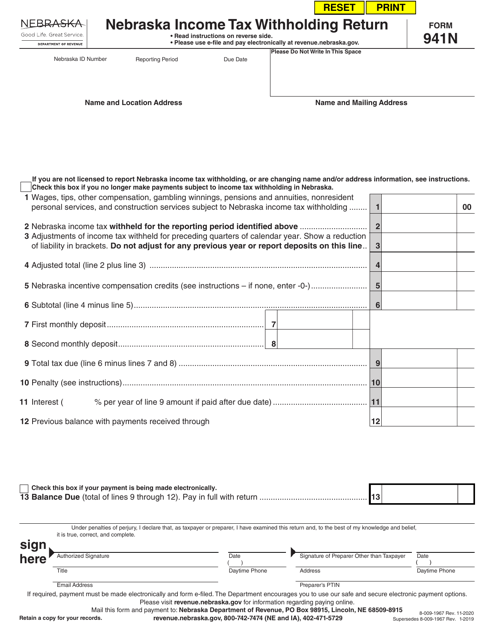

This Form is used for reporting Nebraska income tax withholding for businesses in the state.

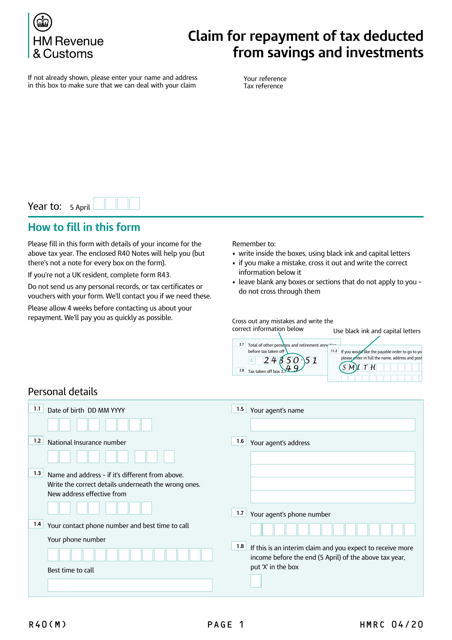

This is a document that may be used when an individual wants to claim a repayment of tax on their savings interest.

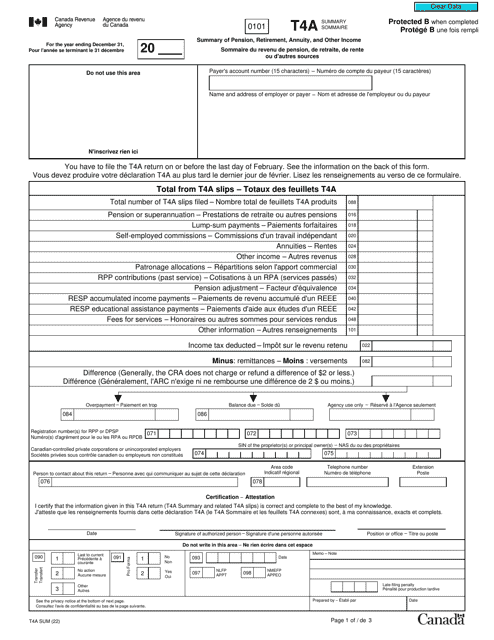

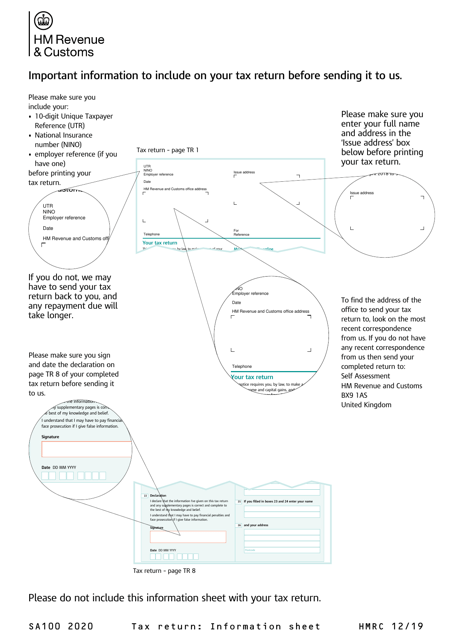

This form is used for reporting income, loan repayments, pensions, annuities, charitable contributions, and tax allowances.