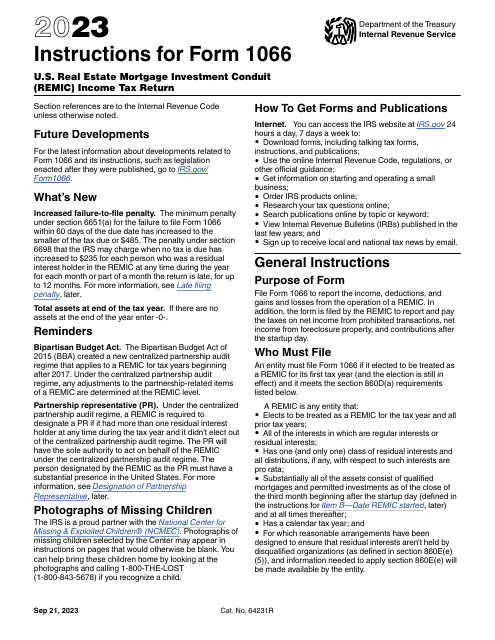

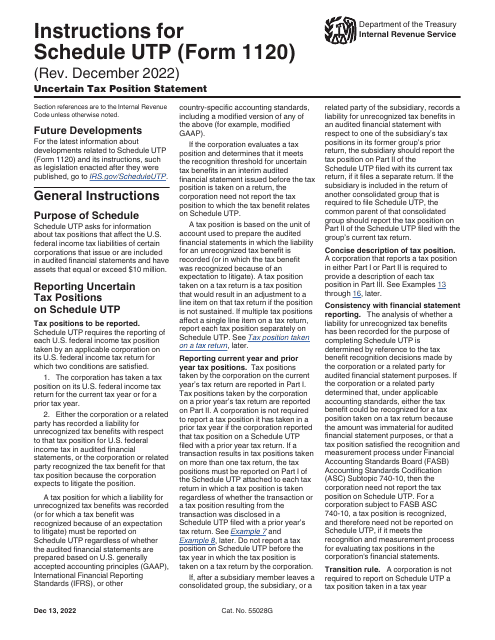

Income Tax Form Templates

Documents:

2505

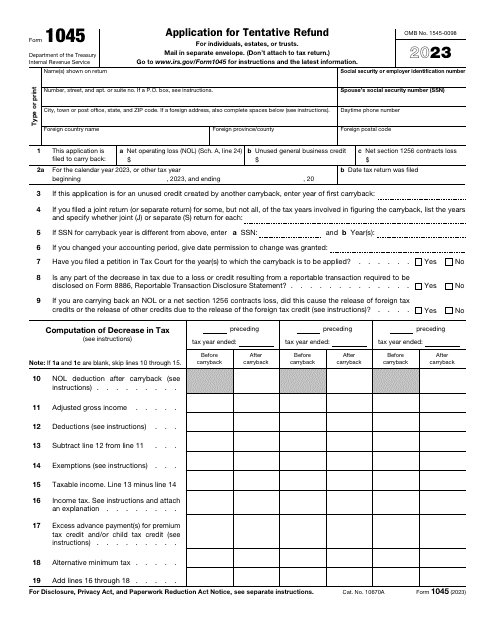

Use this basic form if you are an American taxpayer and wish to submit an annual income tax return. This form is also known as the Individual Income Tax Return Form.

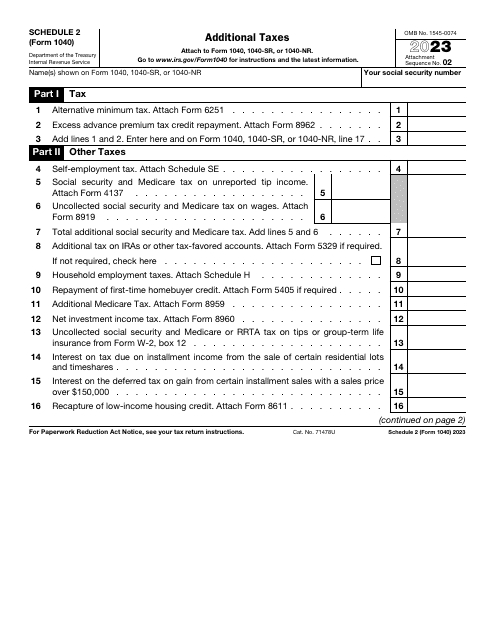

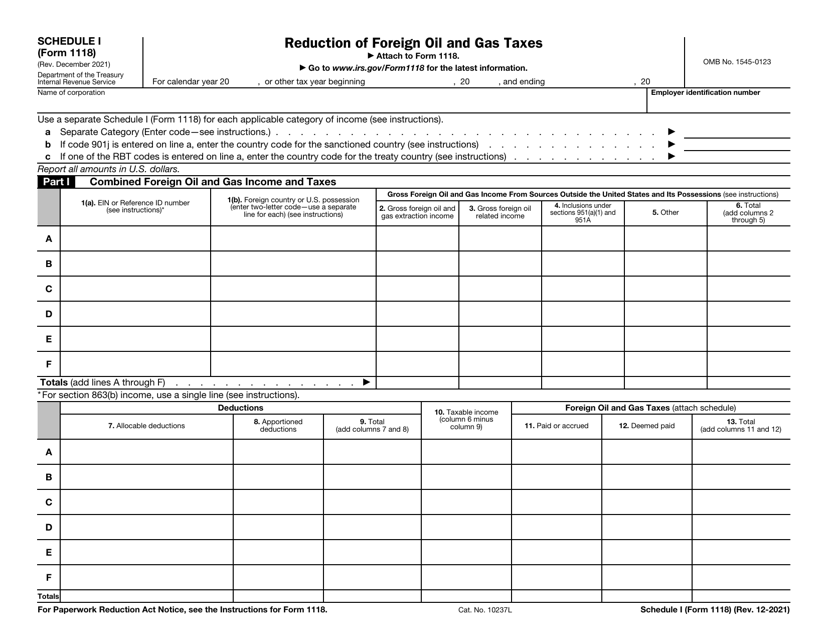

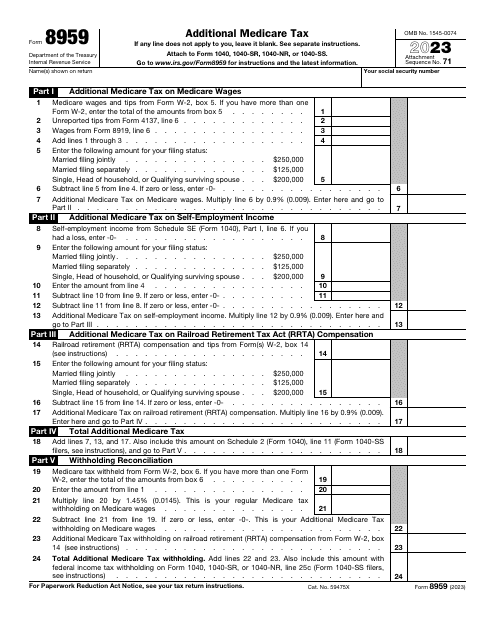

This is a supplementary document designed to allow taxpayers to list taxes they do not outline on the main income statement they are supposed to file annually.

This form is also known as the IRS itemized deductions form. It belongs to the IRS 1040 series. This document is used in order to calculate the amount of your itemized deductions.

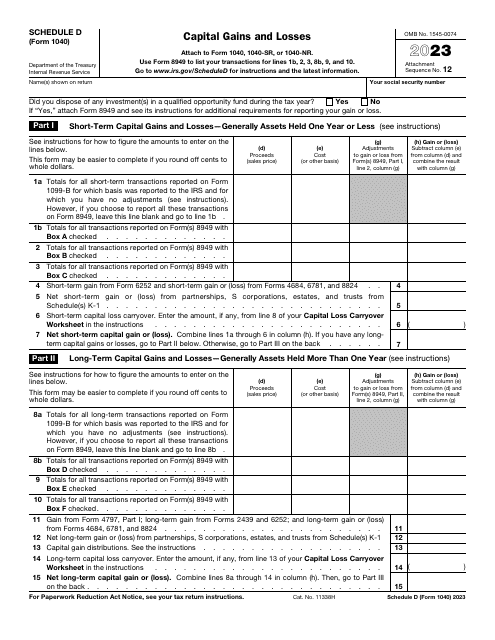

This is a supplementary document taxpayers have to attach to their tax return to outline capital gains and losses that were the result of property sales.

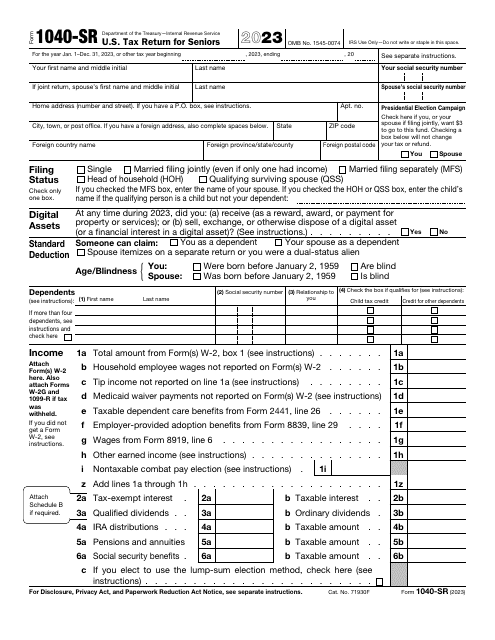

The purpose of this IRS application is to make the process of filing a federal income tax return easier for seniors - the document features larger print, but contains the standard deduction charts.

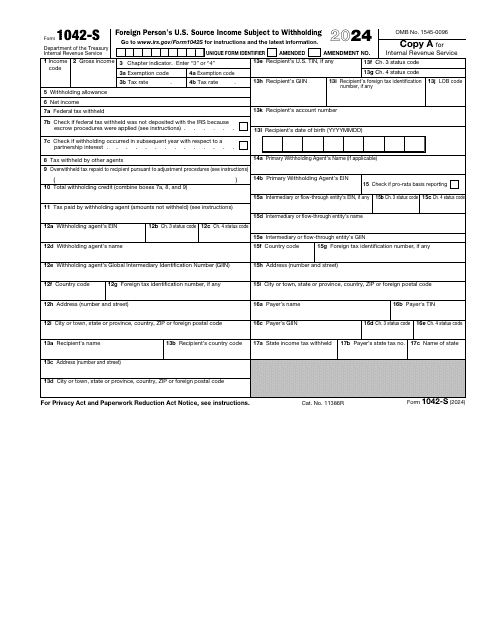

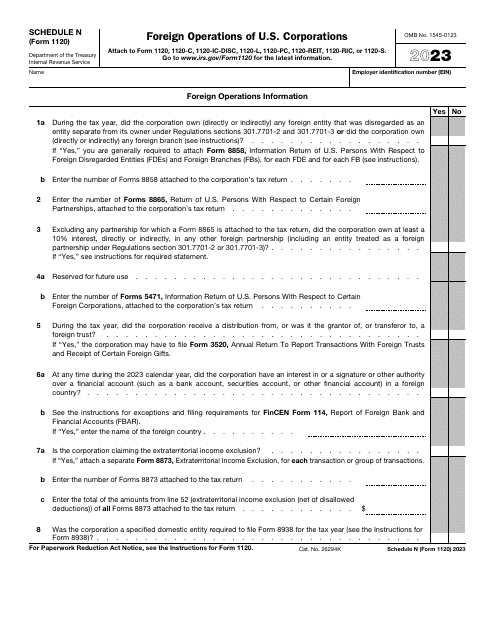

This is a fiscal IRS document designed to outline the tax deducted from the income of various foreign persons.

This is a fiscal IRS form filled out by the cooperative that paid patronage dividends during the tax year.

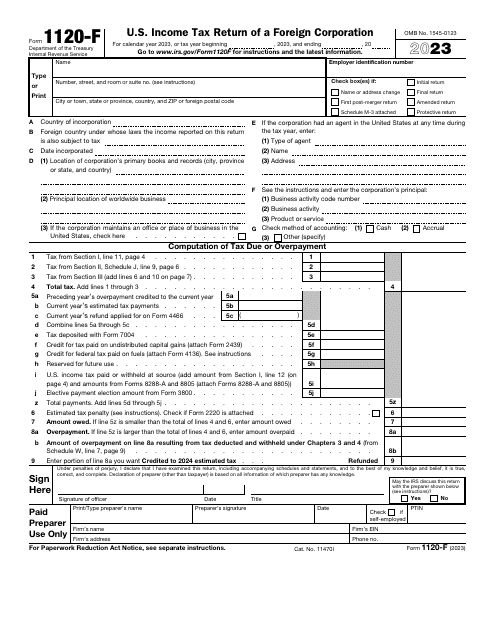

File this form if you are a foreign corporation and maintain an office within the United States in order to report your income, deductions, and credits to the Internal Revenue Service (IRS), as well as to figure your U.S. income tax liability.

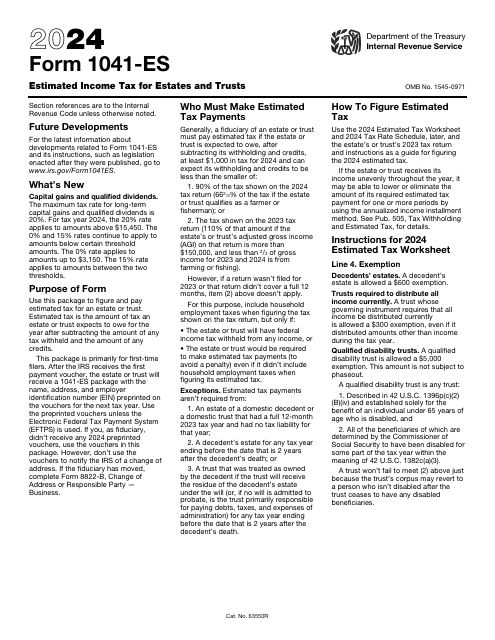

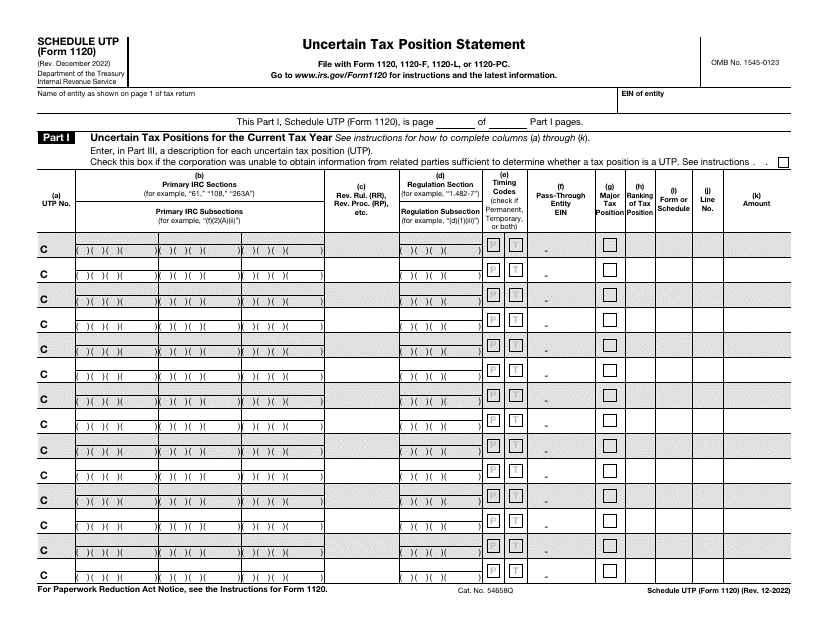

This is a supplementary form corporations were expected to fill out to compute the amount of estimated tax they owe to fiscal authorities.

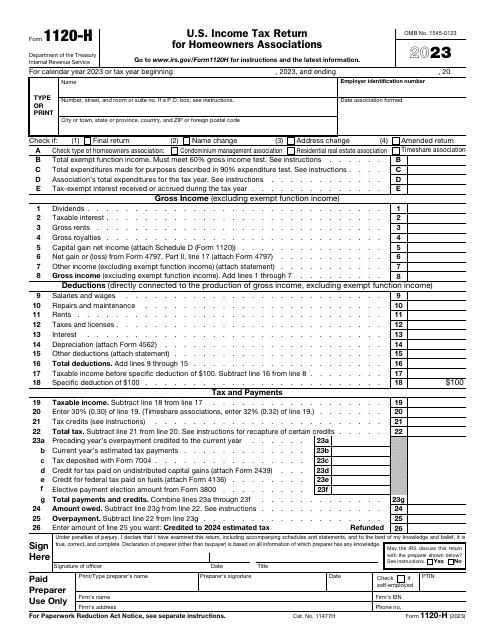

Fill out this form if you represent a homeowner's association in order to make use of certain tax benefits. That means, that the association can exclude the Exempt Function Income from its gross income.

This is an IRS form that includes the details of an installment sale.

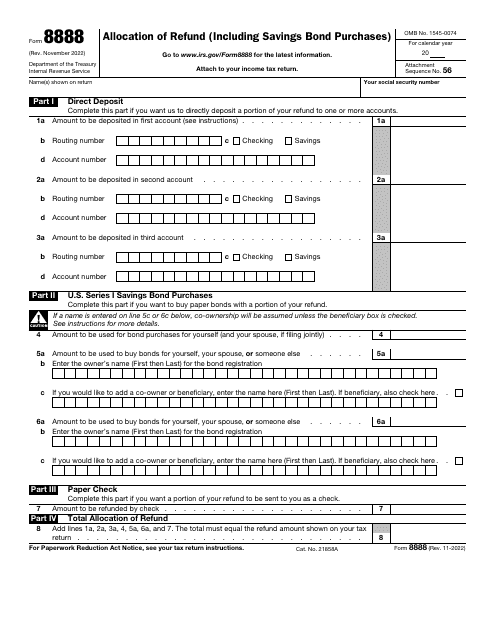

This is an IRS form filled out and submitted by a taxpayer that chooses to spread their tax refund across several accounts.

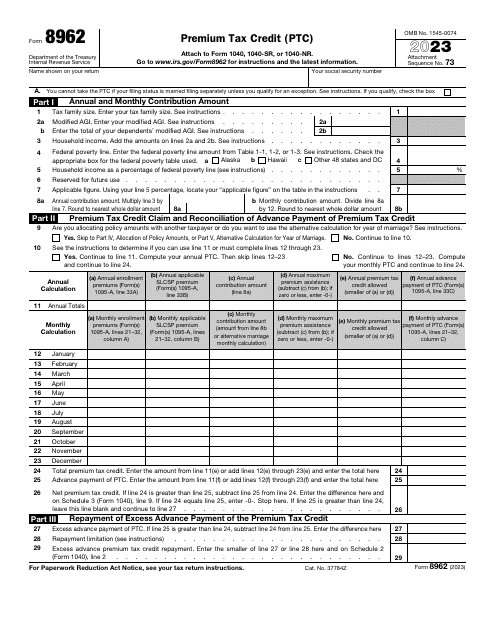

This is an IRS legal document completed by individuals who need to figure out the amount of their Premium Tax Credit and reconcile it with the Advanced Premium Tax Credit (APTC) payments made throughout the reporting year.