Income Tax Form Templates

Documents:

2505

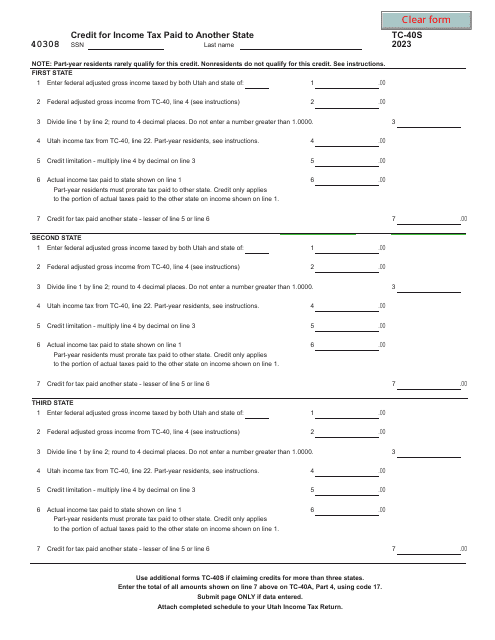

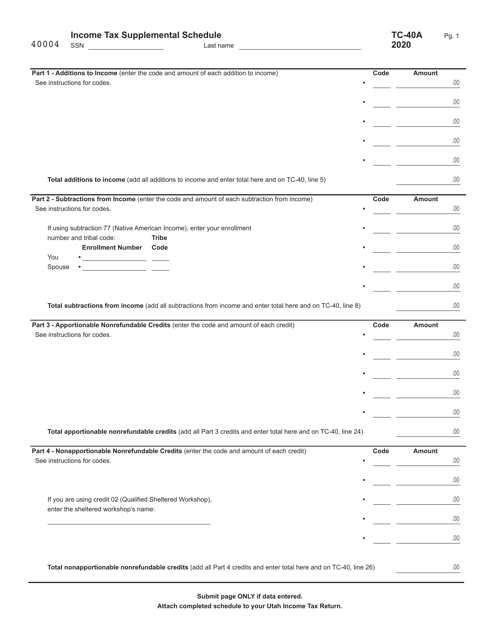

This form is used for reporting supplemental income tax information on the TC-40 Income Tax Return in the state of Utah.

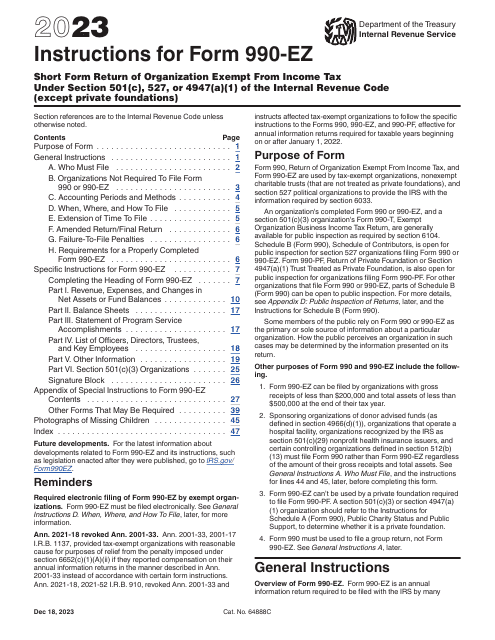

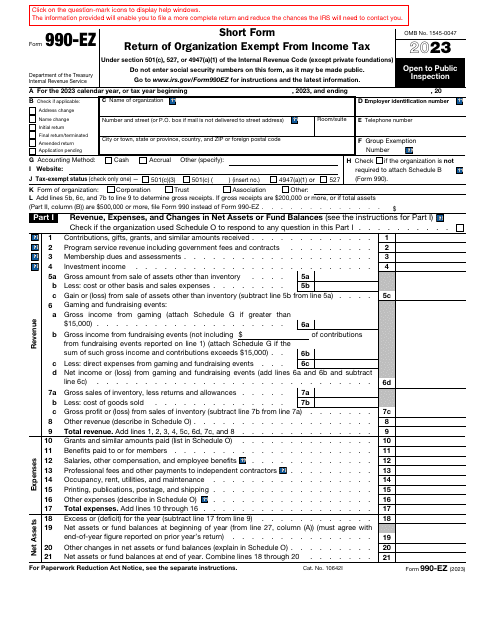

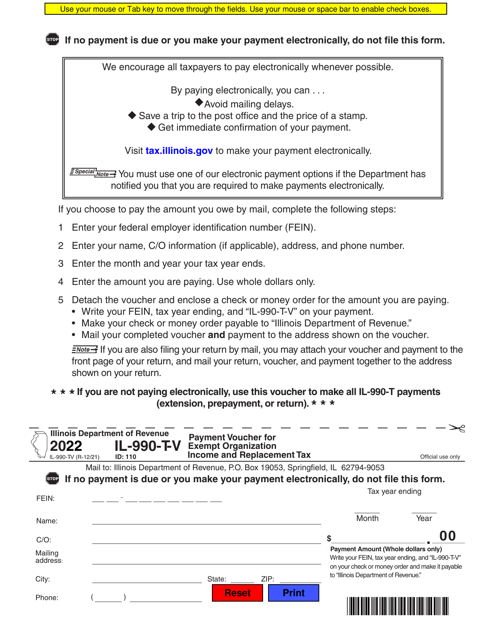

This is a fiscal form used by tax-exempt organizations required to inform tax organizations about their earnings, expenses, and achievements over the course of the year.

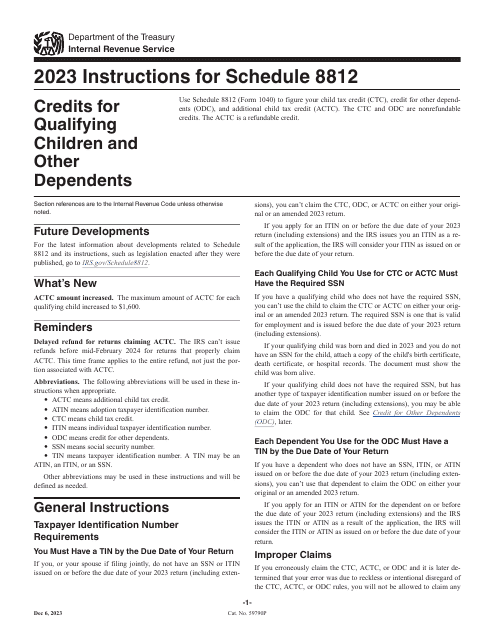

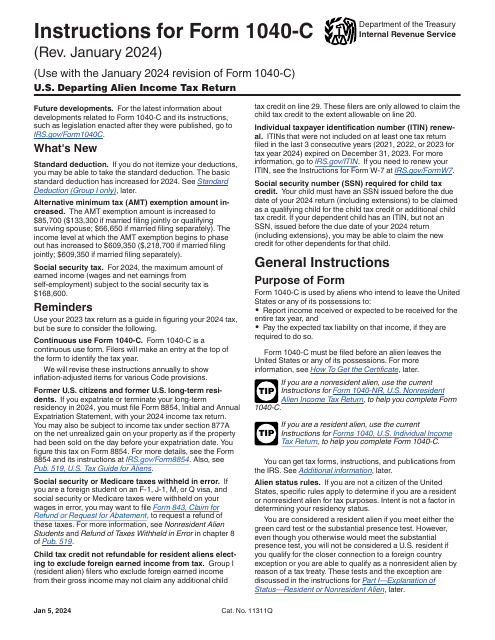

This is a formal instrument used by taxpayers to clarify how much investment income they have received and to figure out the amount of supplementary tax they have to pay.

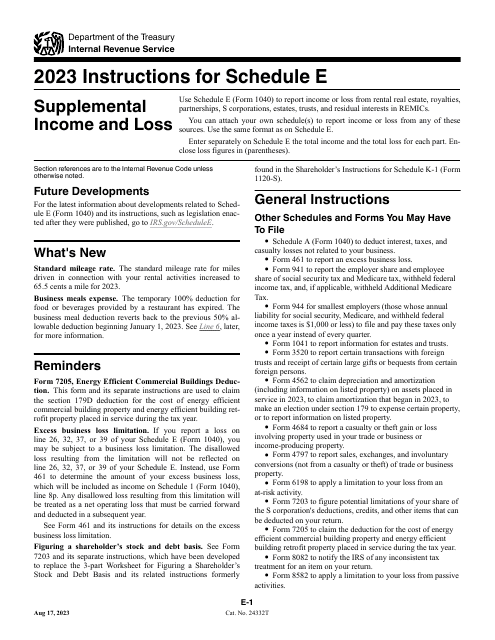

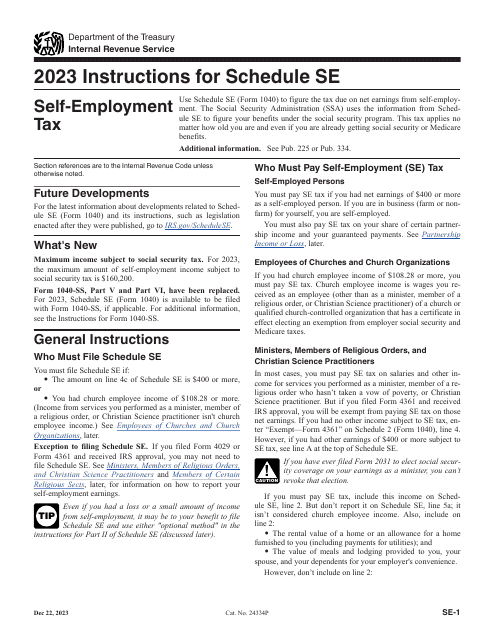

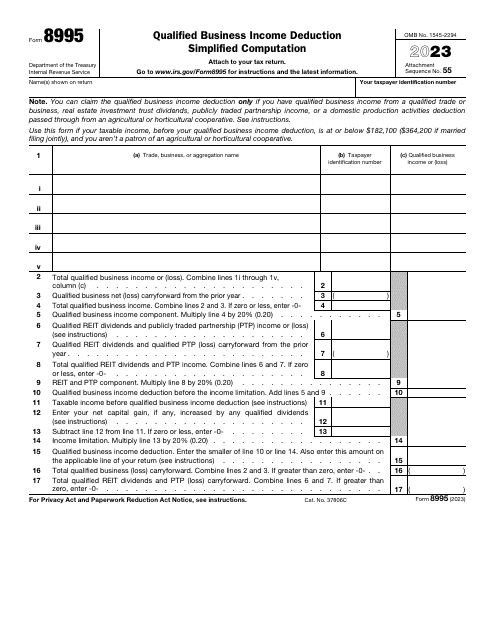

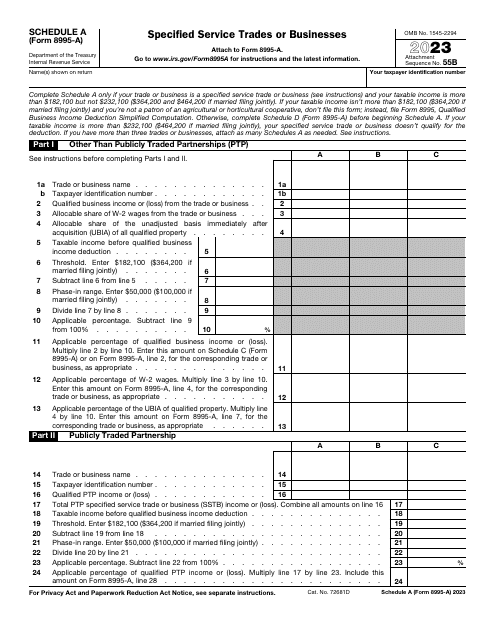

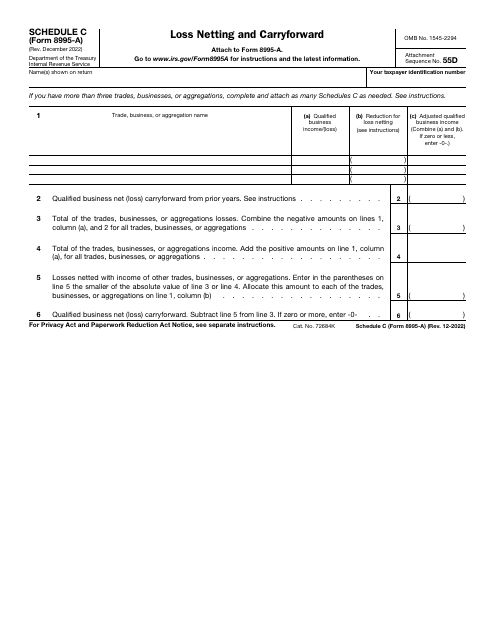

This is a supplementary IRS form used by taxpayers in order to claim a business deduction after reporting your business income.

This form is filed to report American Samoa wages and withheld taxes. It is not used for reporting income taxes in the United States. IRS Form W-2, Wage and Tax Statement is used in these cases.

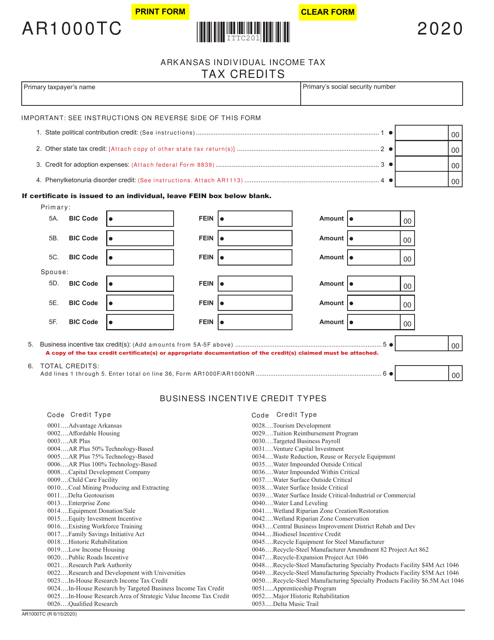

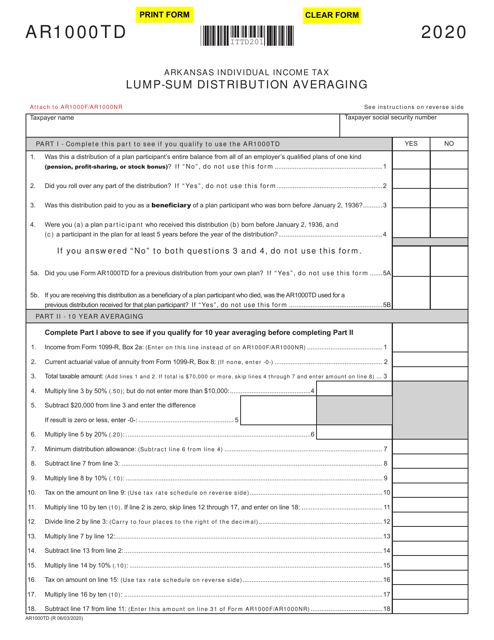

This Form is used for claiming tax credits on your Arkansas state taxes. It allows you to reduce the amount of tax you owe or increase your tax refund.