Income Tax Form Templates

Documents:

2505

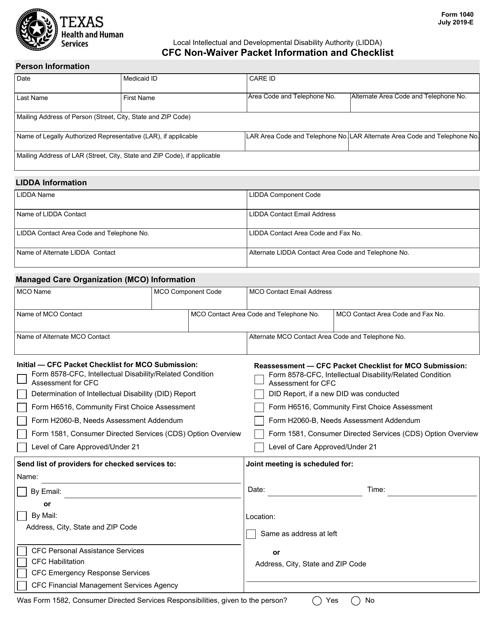

This Form is used for providing information and checklist for filing Form 1040 CFC Non-waiver Packet in Texas.

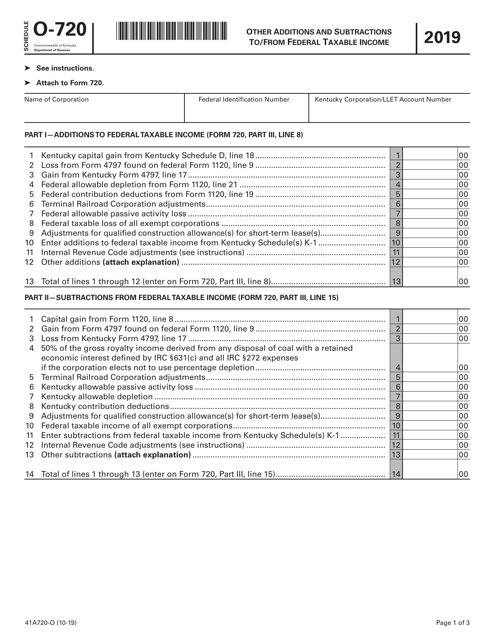

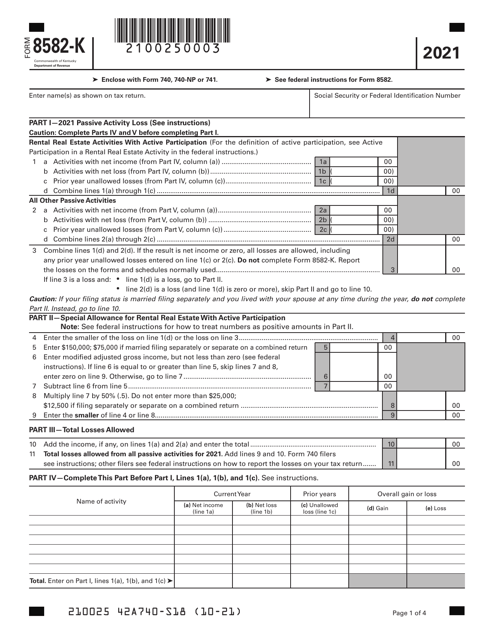

This form is used for reporting other additions and subtractions to or from federal taxable income for residents of Kentucky on their state tax return.

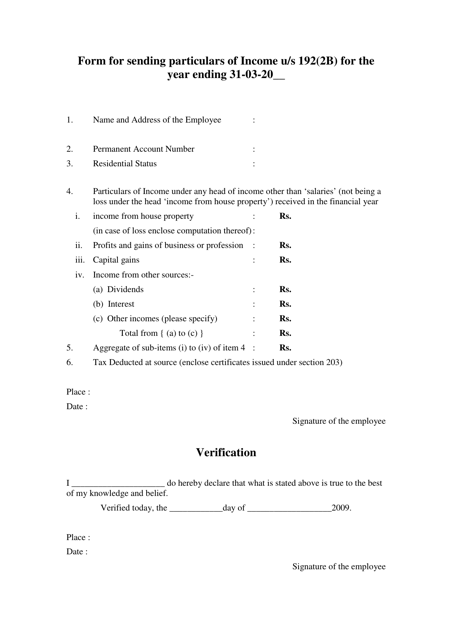

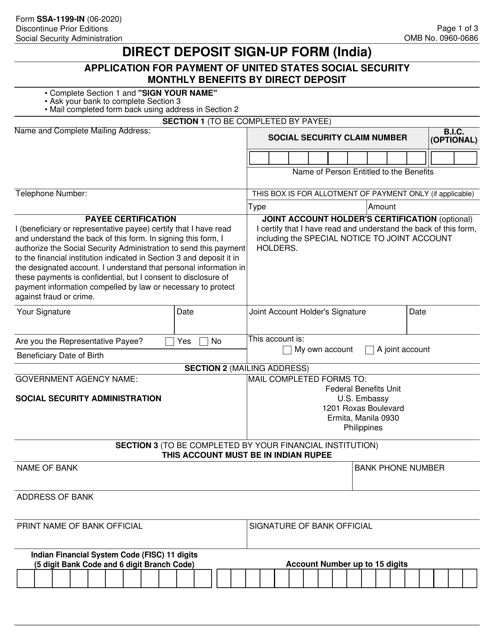

This form is used for sending specific income details under section 192(2b) of the Indian Income Tax Act.

Use this basic form if you are an American taxpayer and wish to submit an annual income tax return. This form is also known as the Individual Income Tax Return Form.

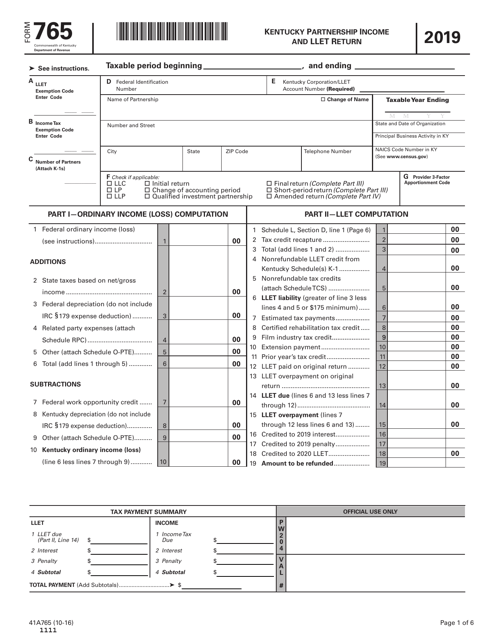

This form is used for reporting partnership income and filing tax returns in the state of Kentucky.

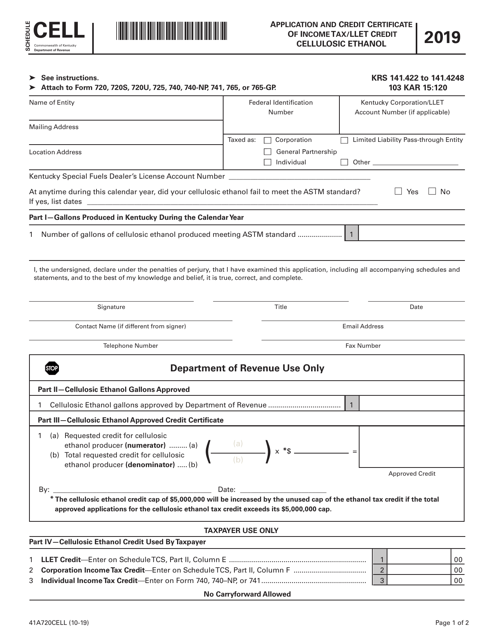

This document is used for applying for a credit certificate of income tax and/or fuel tax credit for producing cellulosic ethanol in the state of Kentucky.

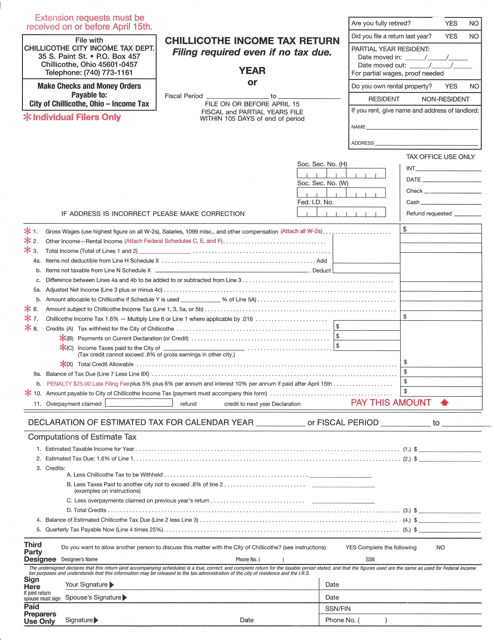

This document is used for filing your income tax return with the City of Chillicothe, Ohio.

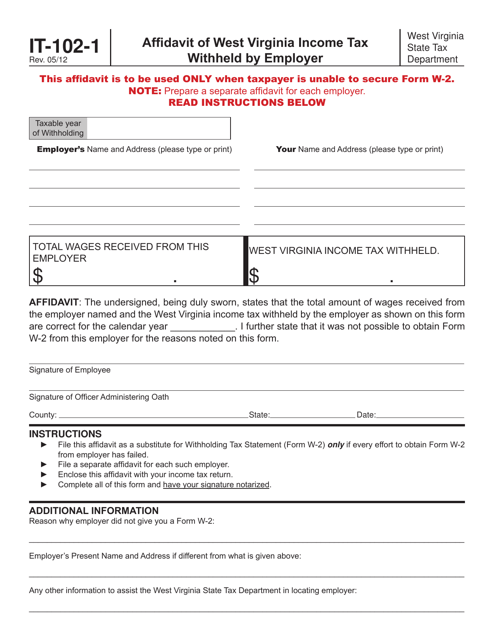

This form is used for reporting West Virginia income tax withheld by an employer in West Virginia.

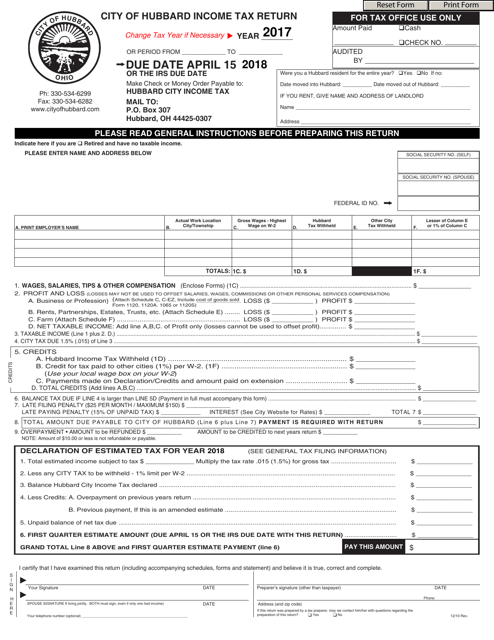

This document is used for filing income tax returns in the City of Hubbard, Ohio.

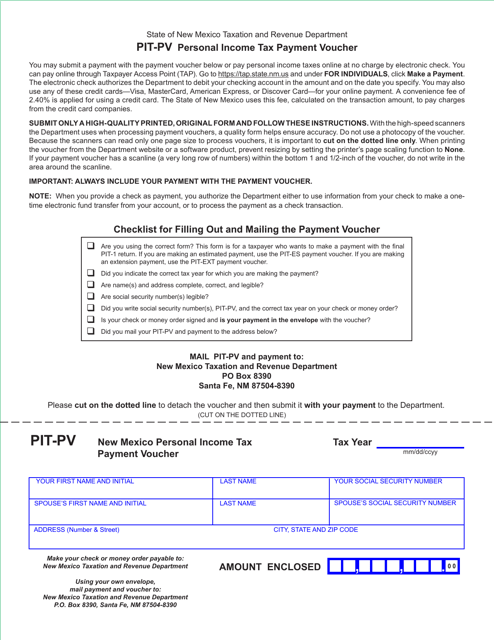

This Form is used for making personal income tax payments in the state of New Mexico. It serves as a payment voucher for individuals to submit their tax payments.

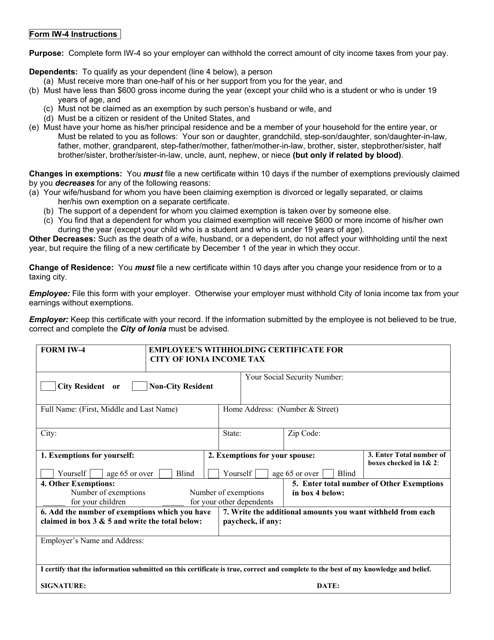

This form is used for employees in City of Ionia, Michigan to declare their withholding preferences for city income tax.

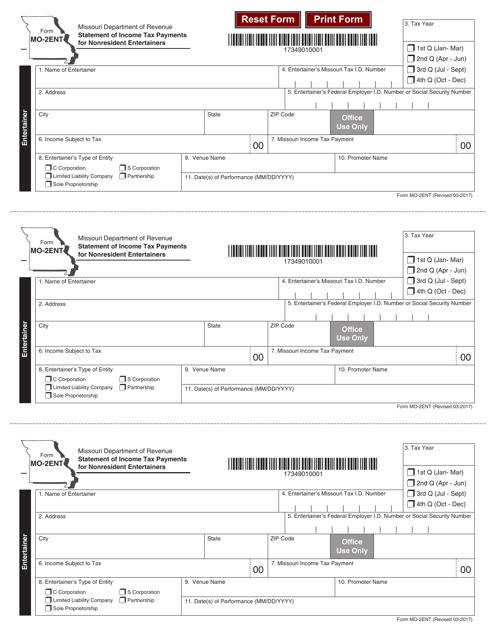

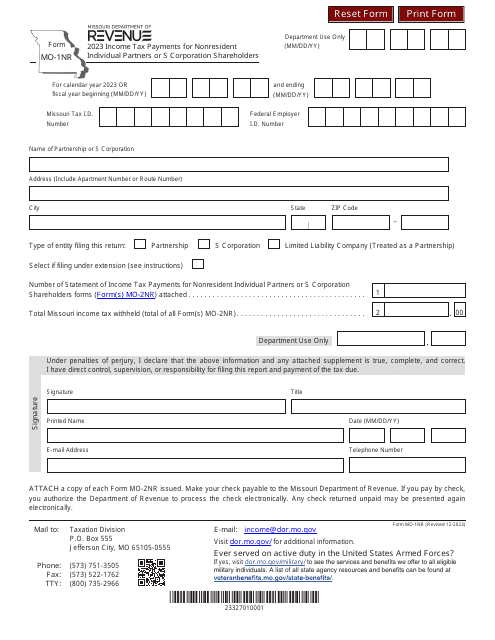

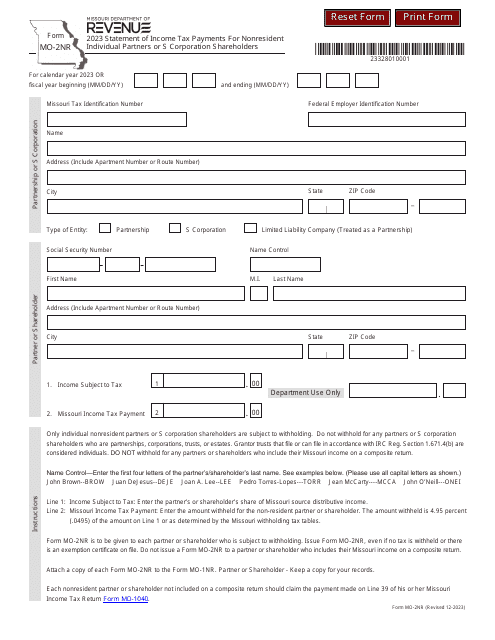

This form is used for nonresident entertainers in Missouri to report their income tax payments.

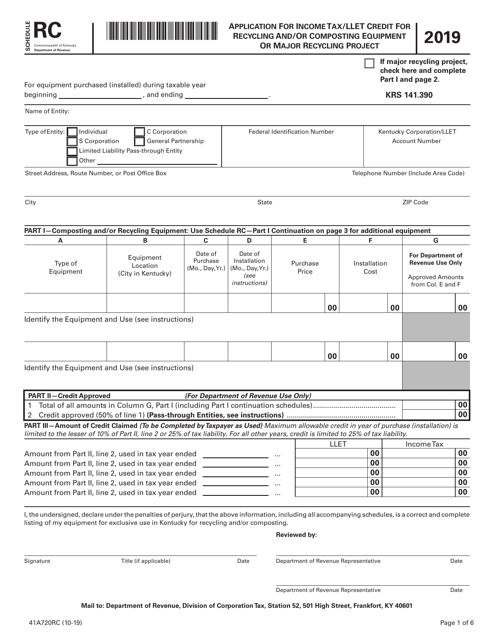

This form is used for applying for income tax or letter credit in Kentucky for recycling and/or composting equipment or a major recycling project.

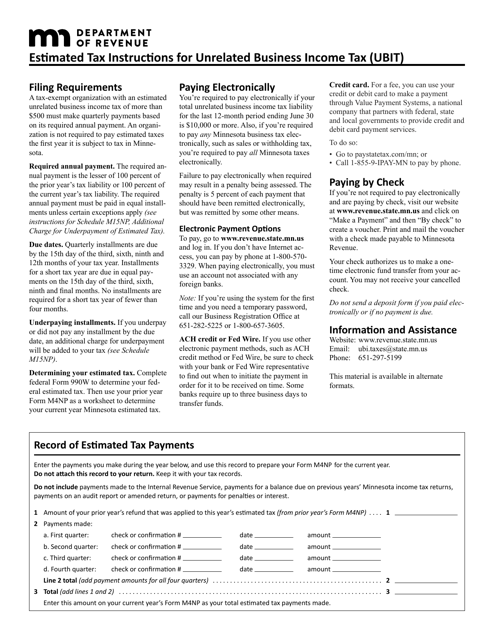

This document provides instructions for estimating and paying unrelated business income tax (UBIT) in the state of Minnesota. It is a guide for organizations that engage in activities unrelated to their exempt purpose and need to report and pay taxes on that income.

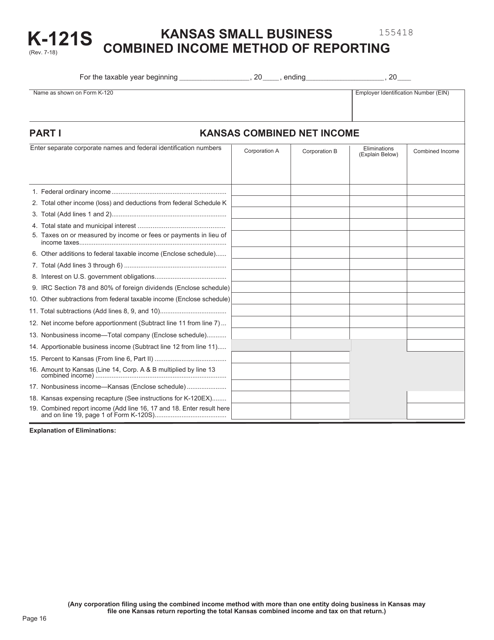

This document is used for reporting the combined income of small businesses in the state of Kansas using the Kansas Small Business Combined Income Method of Reporting.

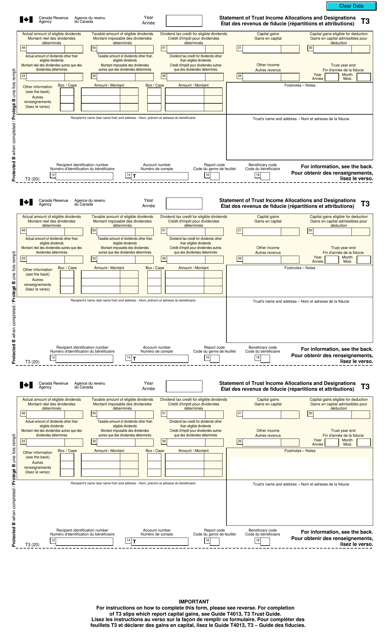

Canadian taxpayers may use this form when they would like to report the investment income they have received during the year.

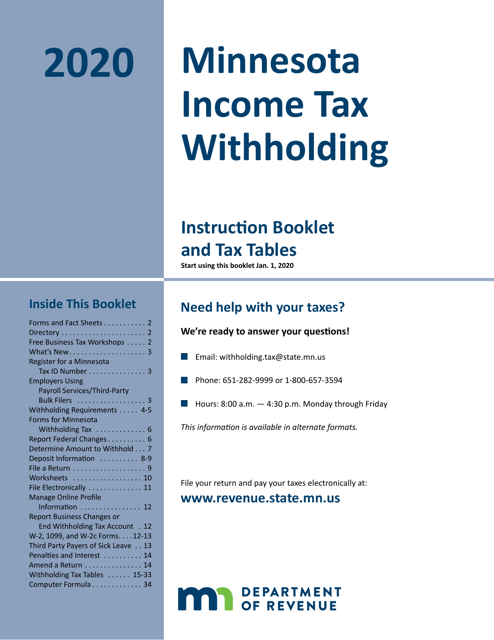

This type of document is the Minnesota Income Tax Withholding form, which is used to determine the amount of state income tax that employers should withhold from employees' paychecks in Minnesota.

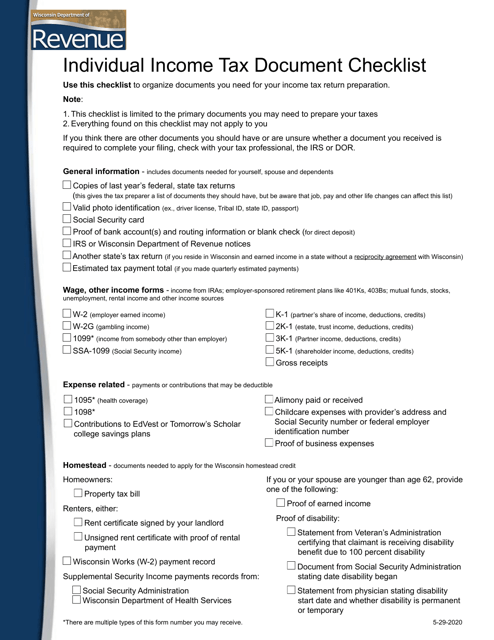

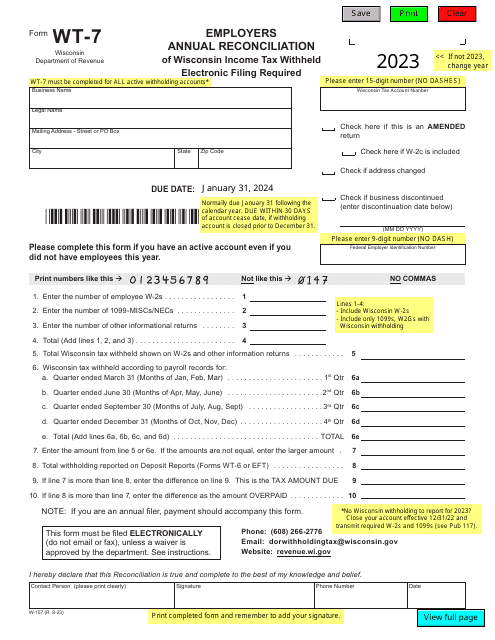

This document is a checklist for individuals filing their income tax in Wisconsin. It helps ensure that all necessary documents and information are gathered for accurate tax reporting.

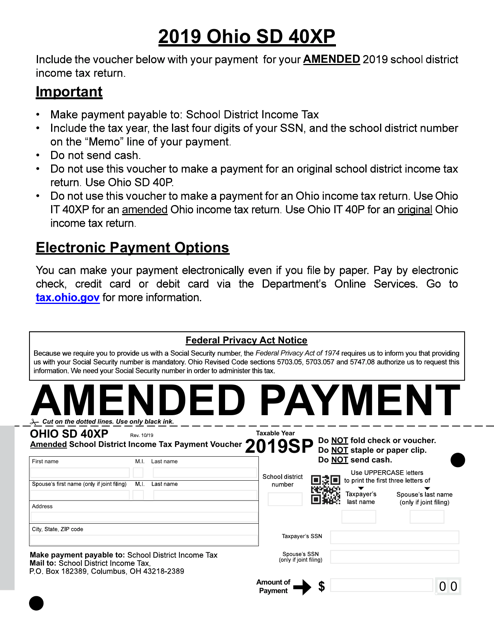

This form is used for making amended school district income tax payments in Ohio.

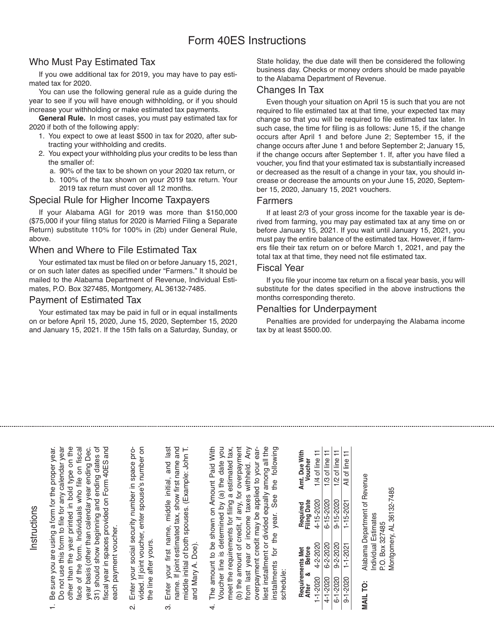

This form is used for making estimated income tax payments in Alabama. It provides instructions for filling out and submitting the Form 40ES voucher.

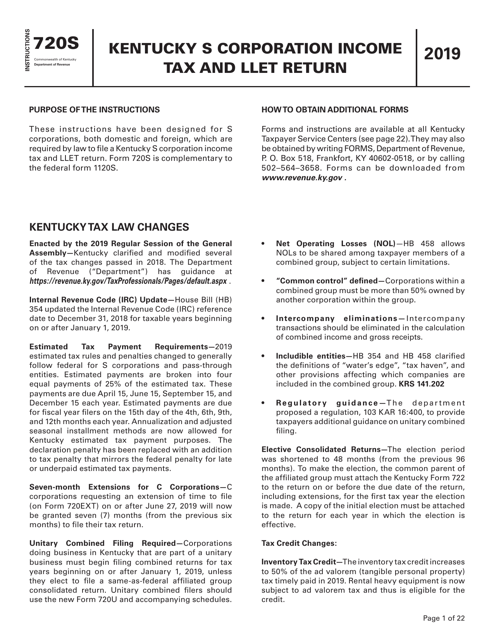

This Form is used for filing the Kentucky S Corporation Income Tax and Llet Return for Kentucky residents. It provides instructions on how to accurately report income and deductions for S Corporations operating in Kentucky.

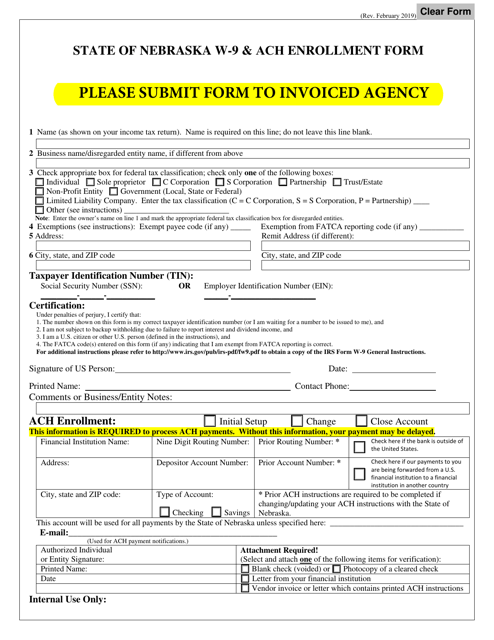

This form is used for the state of Nebraska to receive W-9 information and enroll in ACH (Automated Clearing House) payment.