Income Tax Form Templates

Documents:

2505

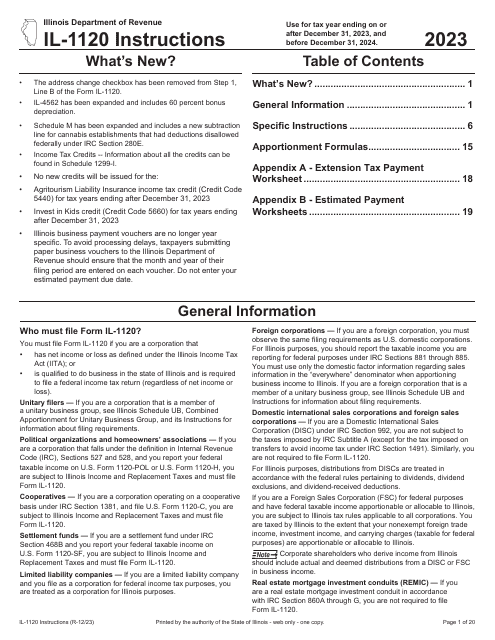

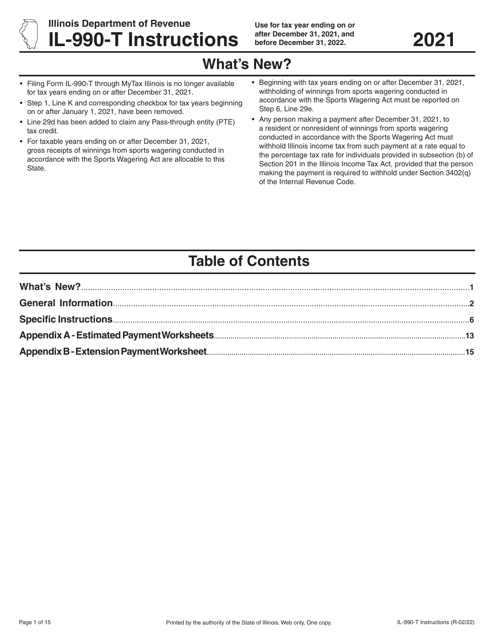

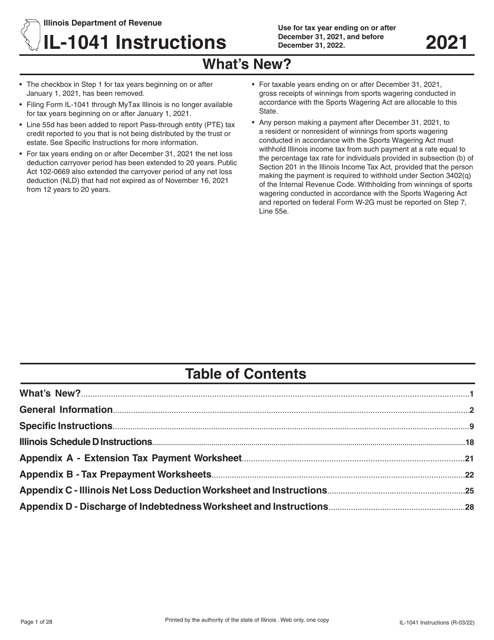

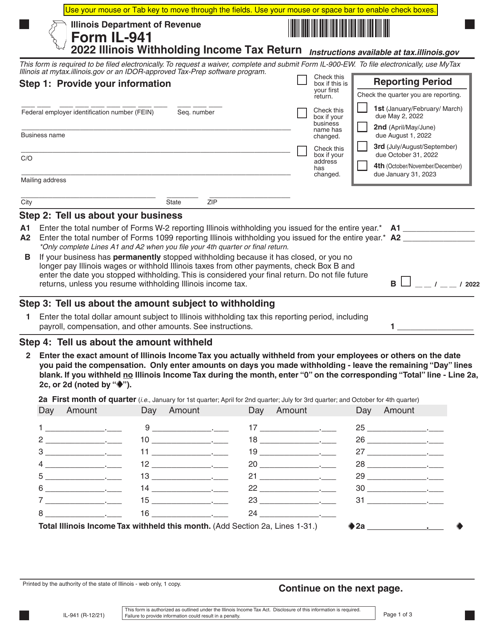

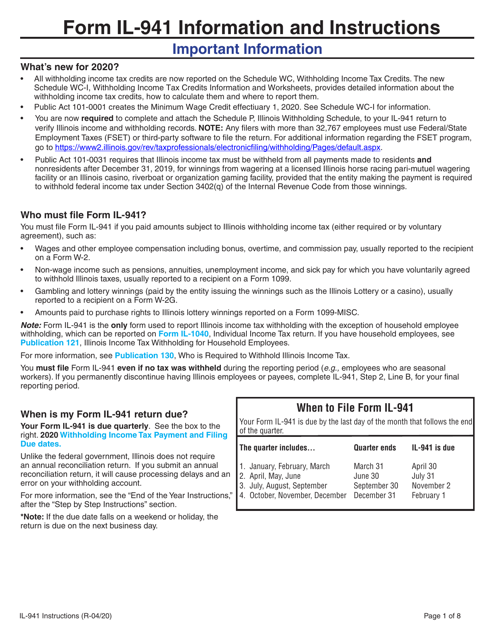

This document is used for filing the Illinois Withholding Income Tax Return in the state of Illinois. It provides instructions on how to accurately report and pay your withholding taxes to the Illinois Department of Revenue.

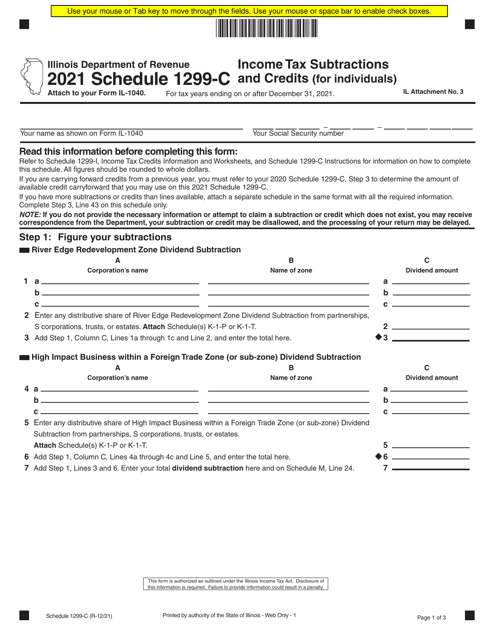

This Form is used for reporting other additions and subtractions on your Illinois Individual Income Tax Return (Form IL-1040). It helps calculate your total income or deductions for tax purposes in Illinois.

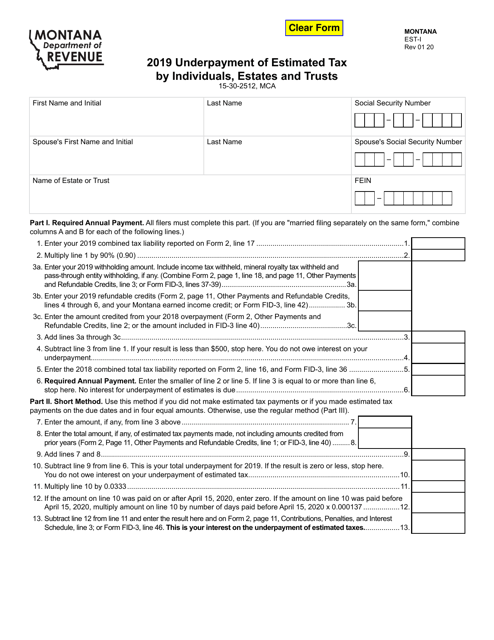

This Form is used for reporting underpayment of estimated tax by individuals, estates, and trusts in the state of Montana.

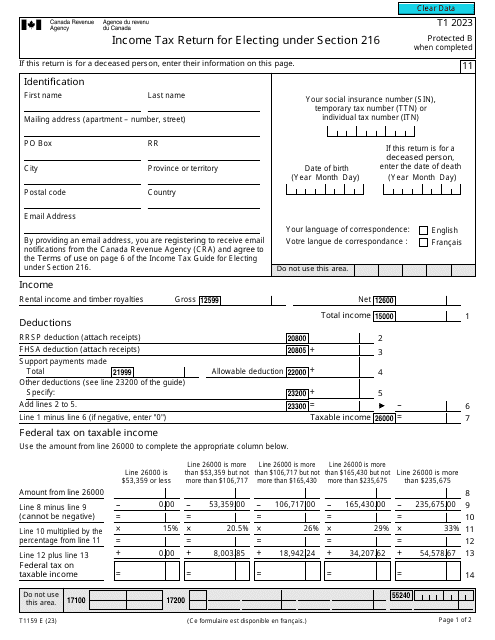

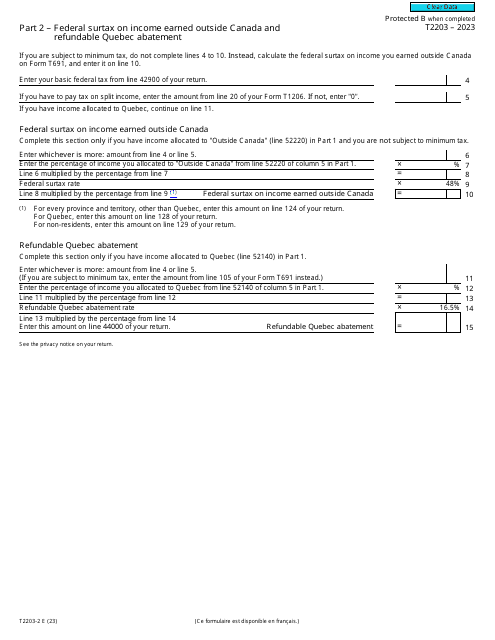

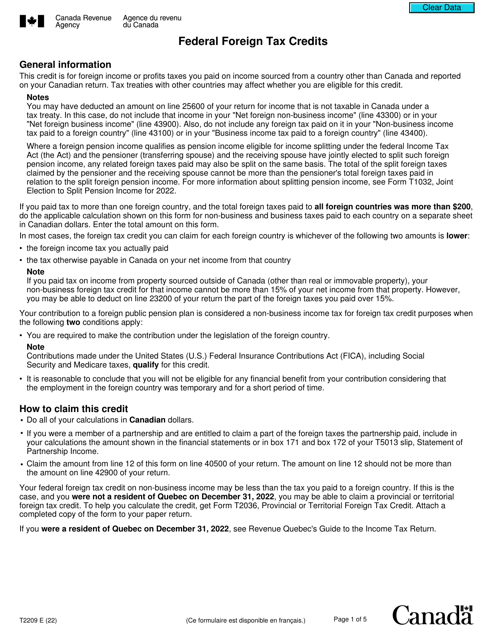

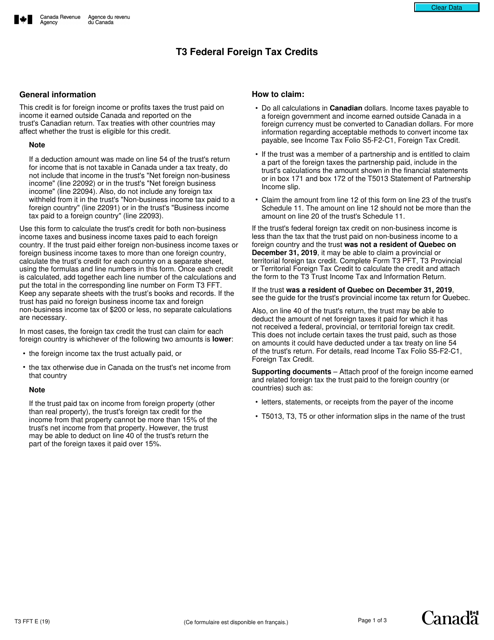

This form is used for claiming foreign tax credits on your Canadian federal tax return.