Income Tax Form Templates

Documents:

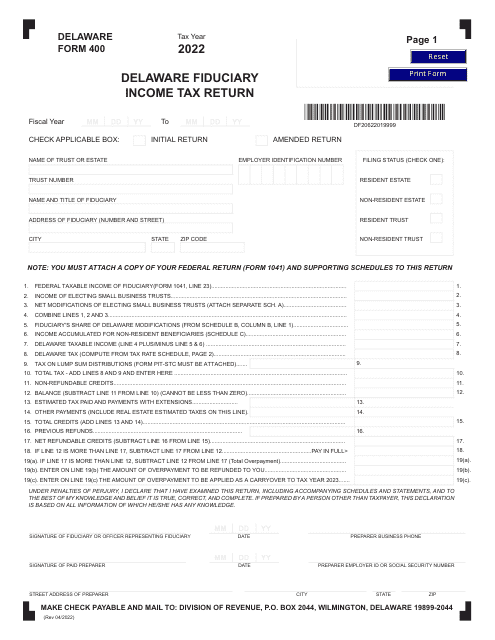

2505

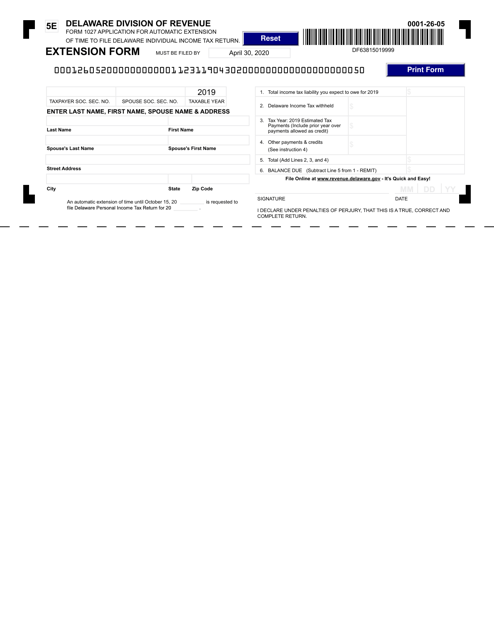

This form is used for individuals in Delaware to request an automatic extension of time to file their estimated income tax return.

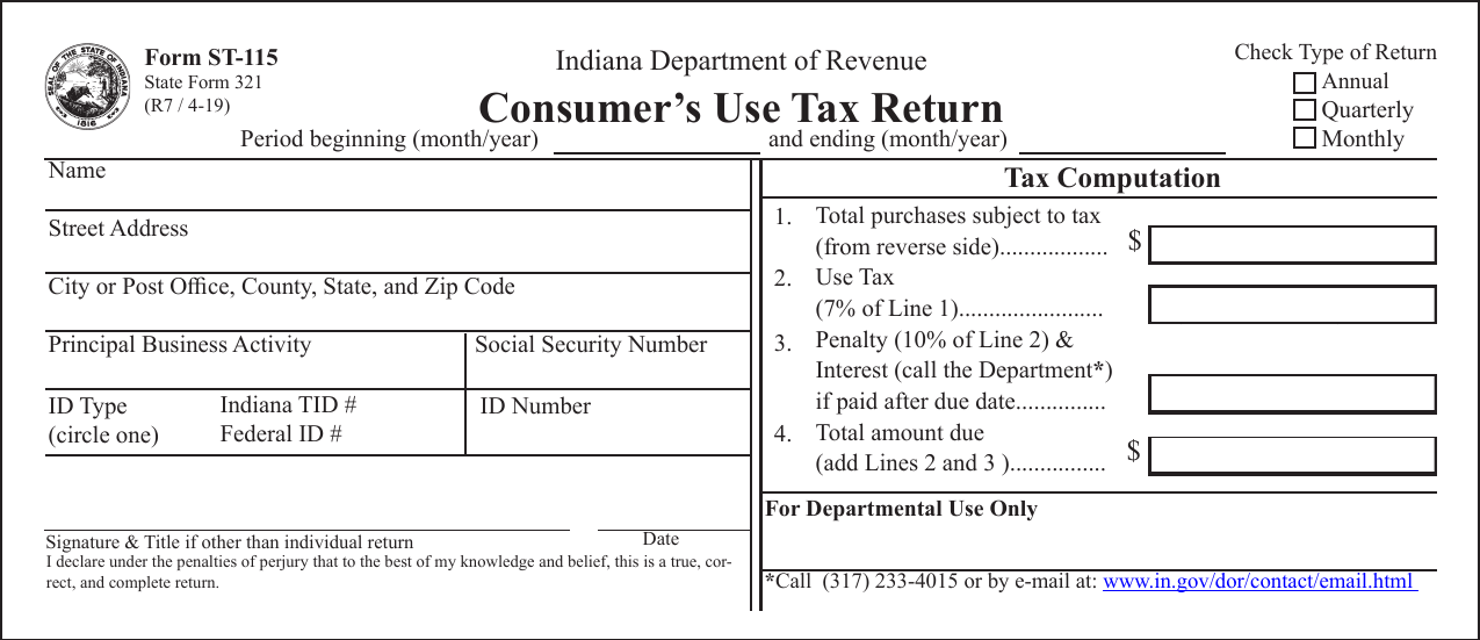

This Form is used for reporting consumer's use tax owed by individuals and businesses in the state of Indiana. It is used to report tax on purchases made from out-of-state retailers where sales tax was not collected.

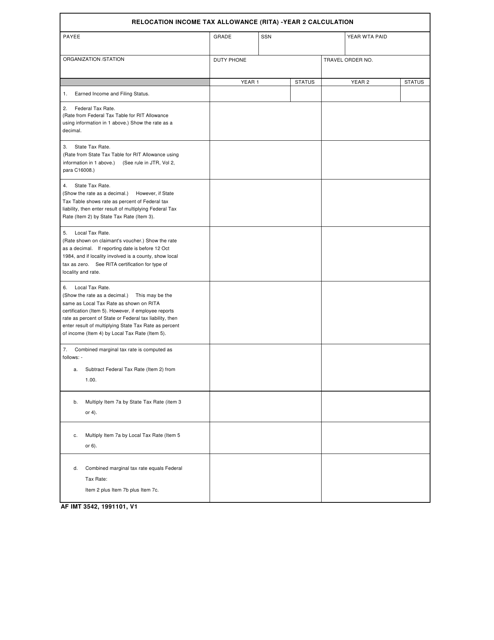

This form is used for calculating the Relocation Income Tax Allowance for the second year of a move.

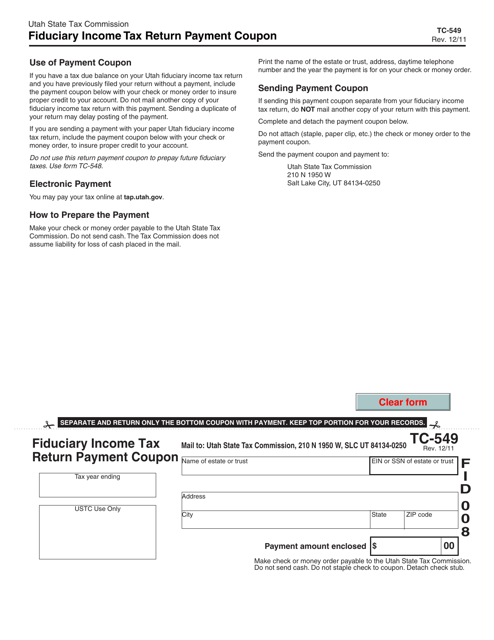

This document is used for making payments for the Utah Fiduciary Income Tax Return.

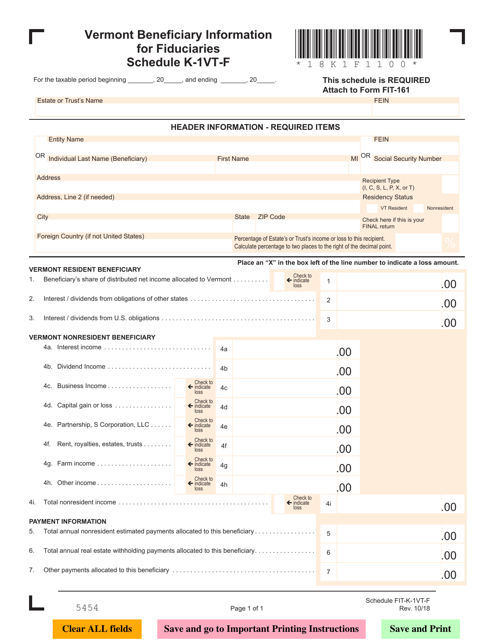

This document provides beneficiary information for fiduciaries in Vermont. It is used for reporting income from trusts or estates to individual beneficiaries.

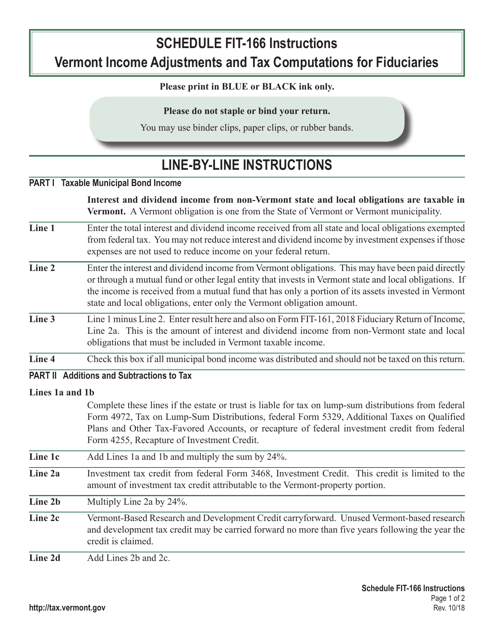

This Form is used for reporting income adjustments and tax computations for fiduciaries in Vermont. It provides instructions on how to accurately complete the VT Form FIT-166.

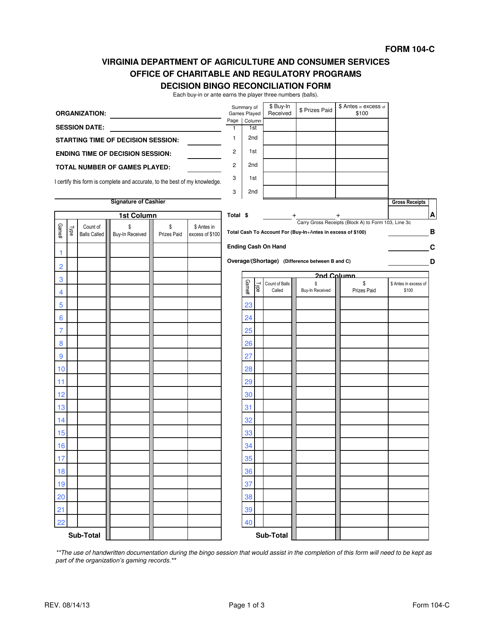

This Form is used for reconciling decisions made during a game of bingo in the state of Virginia.

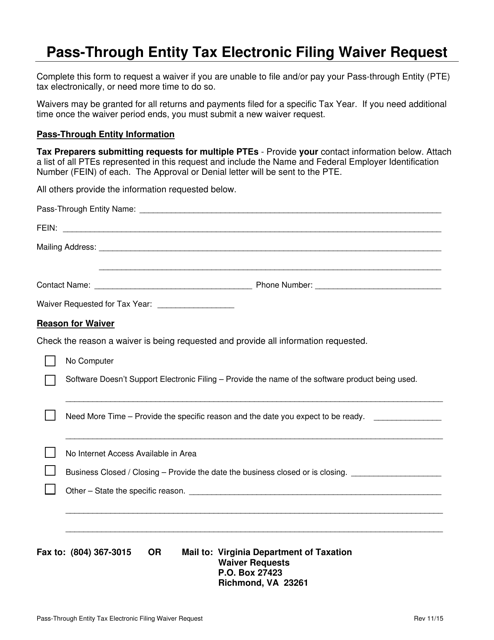

This Form is used for requesting a waiver to electronically file pass-through entity tax returns in the state of Virginia.

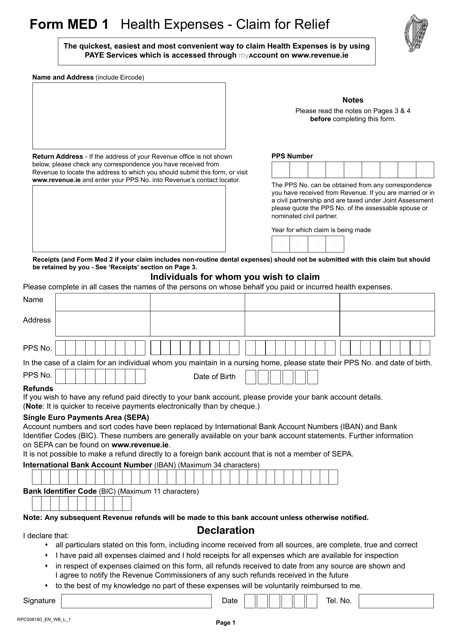

This Form is used for claiming relief on health expenses in Ireland.

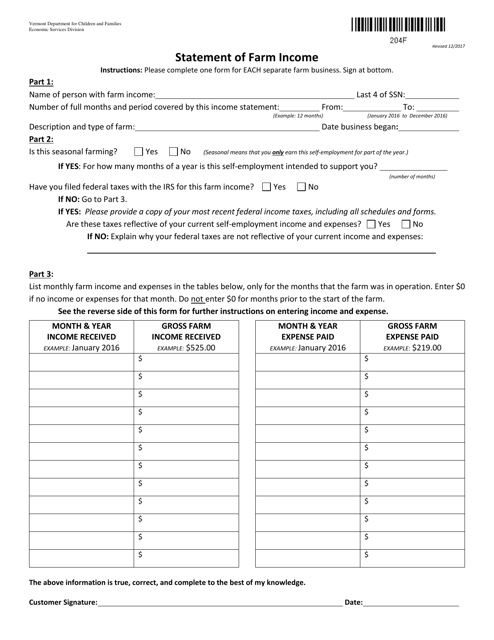

This form is used for reporting farm income in the state of Vermont. It is used by farmers to accurately report their income from agricultural activities.

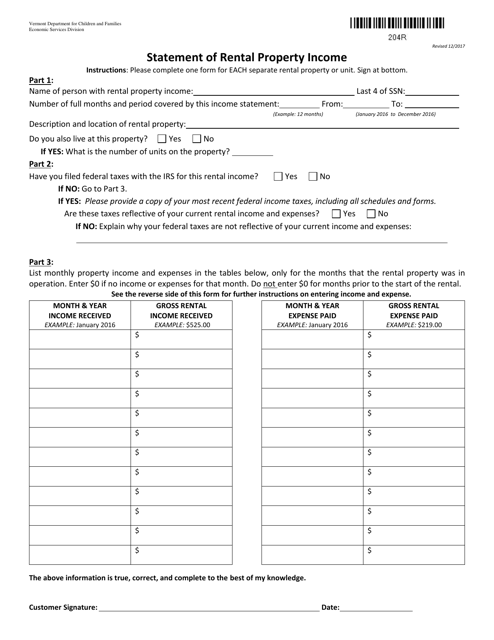

This form is used for reporting rental property income in the state of Vermont.

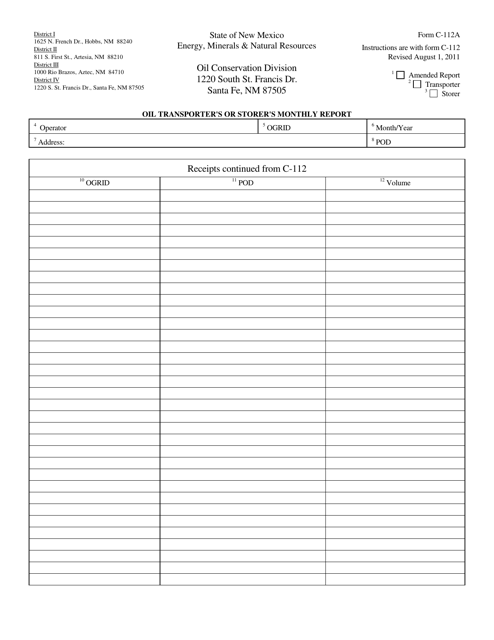

This form is used for providing a continuation of receipts information in the state of New Mexico.