Fill and Sign United States Legal Forms

Documents:

235709

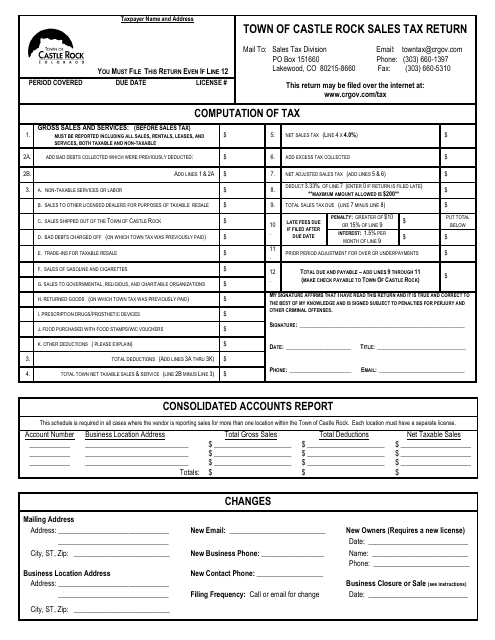

This document is used for reporting and remitting sales tax in the Town of Castle Rock, Colorado. Businesses must submit this form to the town's tax department on a regular basis to comply with local tax regulations.

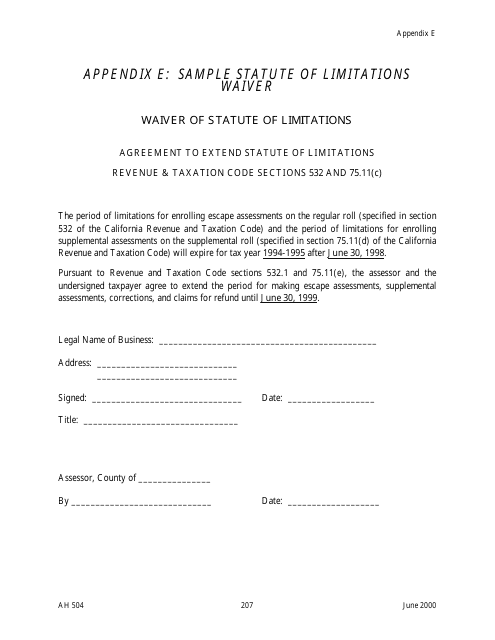

This document is a sample statute of limitations waiver form for use in California. It is used to waive the time limit within which a legal claim or lawsuit can be brought.

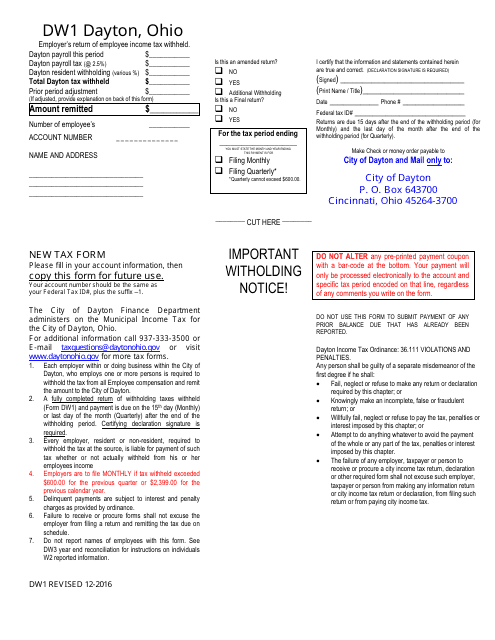

This form is used for employers in the City of Dayton, Ohio to report the income tax withheld from their employees' paychecks.

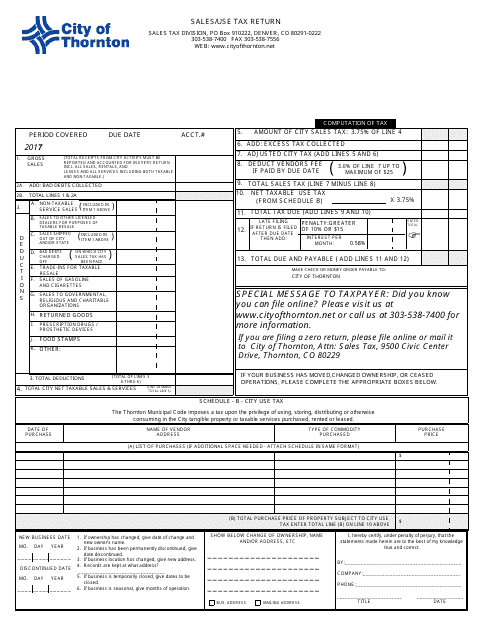

This form is used for reporting and remitting sales or use tax to the City of Thornton, Colorado.

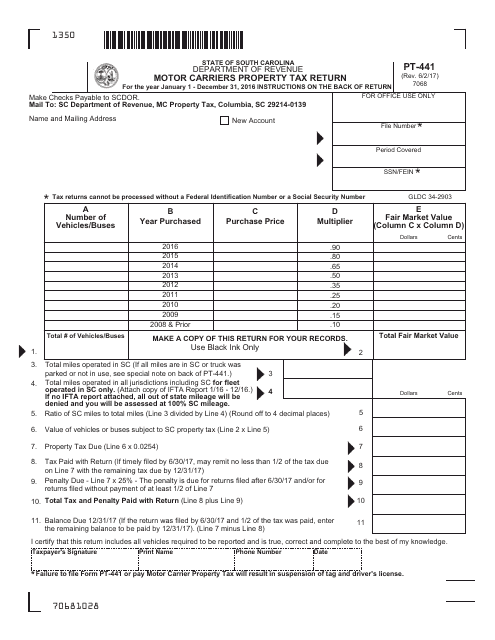

This form is used for South Carolina motor carriers to report and pay property taxes related to their operations.

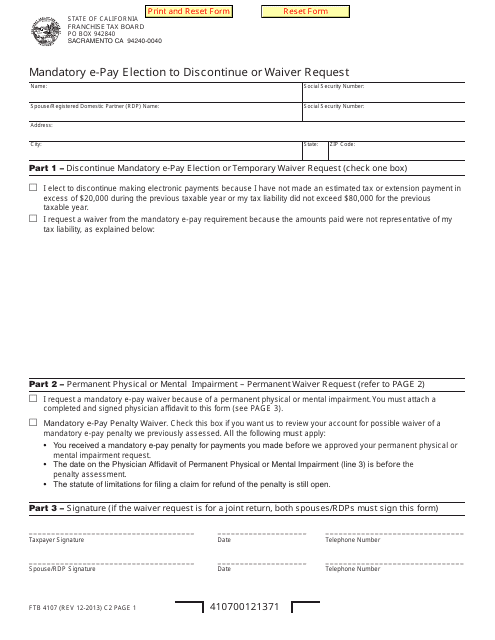

This form is used for making a mandatory electronic payment election and requesting to discontinue or waive the requirement in California.

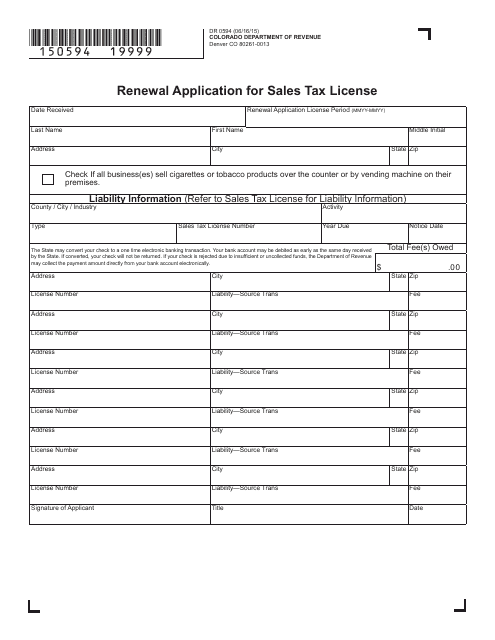

This form is used for renewing a sales tax license in Colorado.

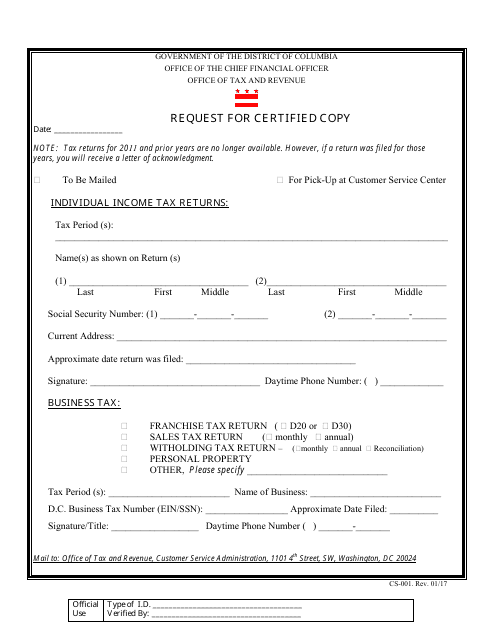

This Form is used for requesting a certified copy of a document in Washington, D.C.

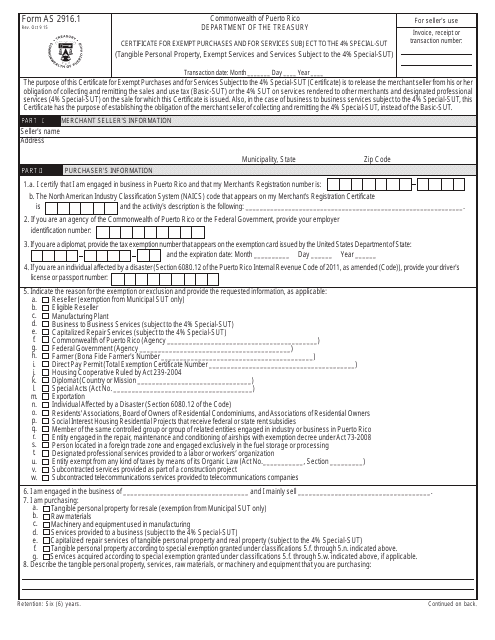

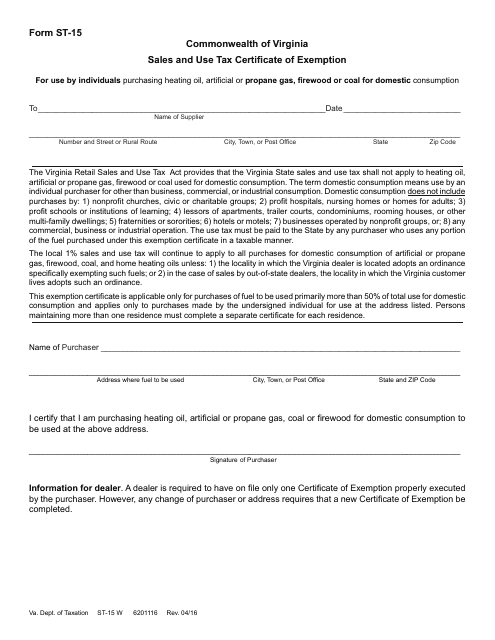

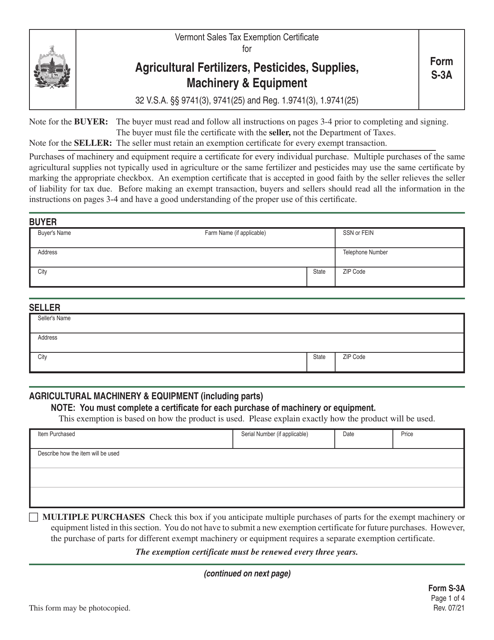

This form is used for claiming sales and use tax exemption in the state of Virginia.

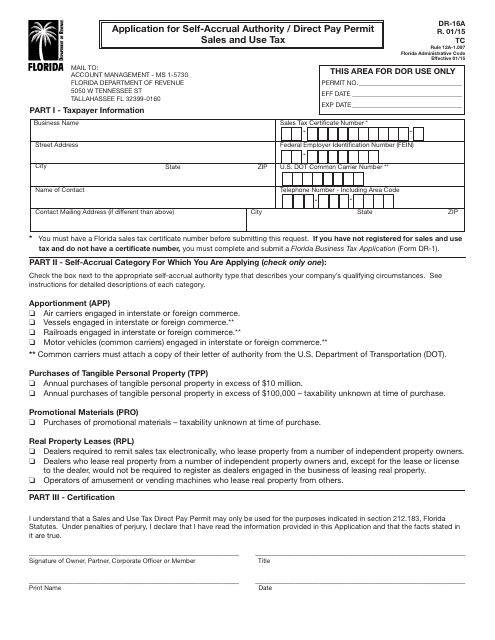

This Form is used for applying for self-accrual authority or a direct pay permit for sales and use tax in Florida.

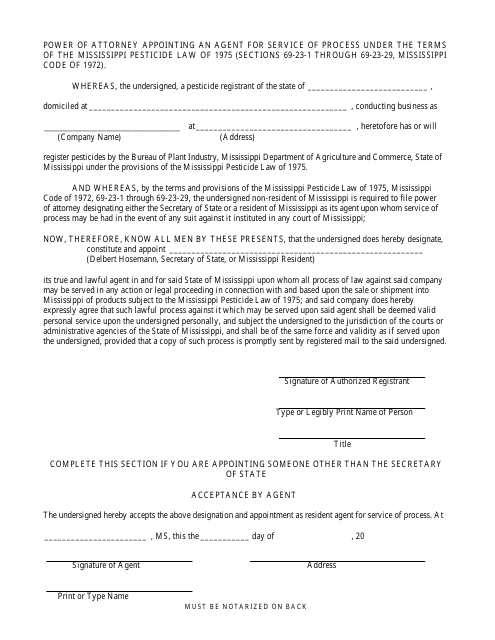

This document is used to grant someone the legal authority to register pesticides in Mississippi on behalf of another person or organization.

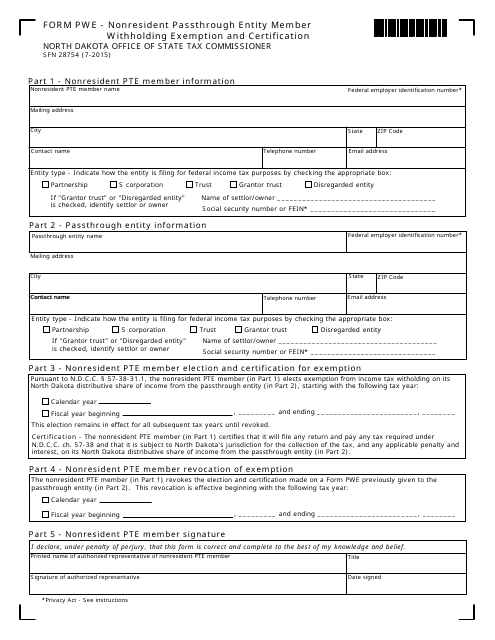

This form is used for nonresident members of a passthrough entity to claim withholding exemption in North Dakota.

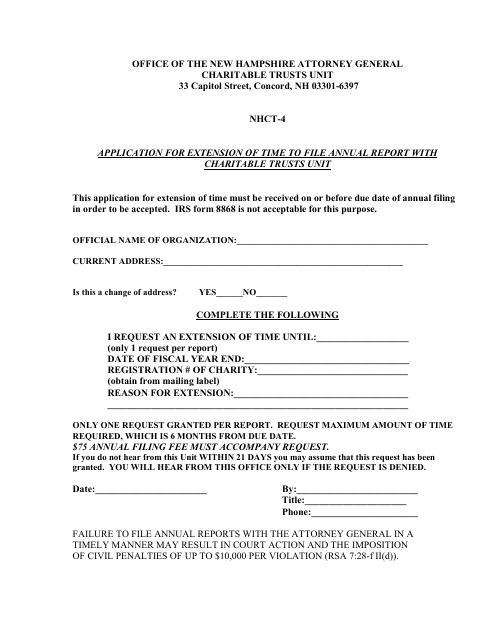

This form is used for requesting an extension of time to submit the annual report with the Charitable Trusts Unit in New Hampshire.

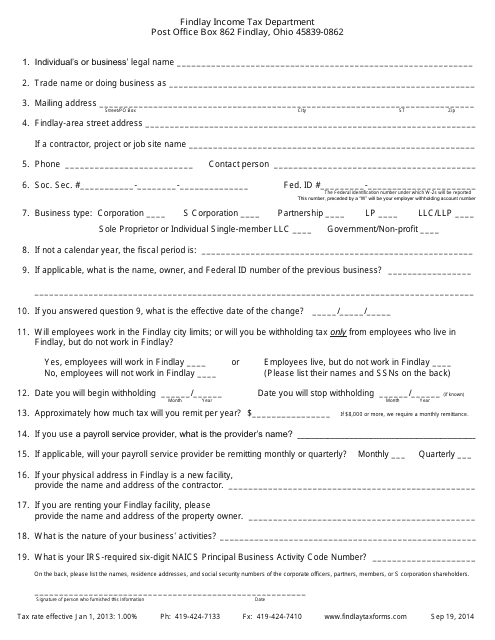

This type of document is a Business Questionnaire Form used by the City of Findlay, Ohio. It is used to collect information from businesses in the city for various purposes such as licensing, tax assessment, and community development.

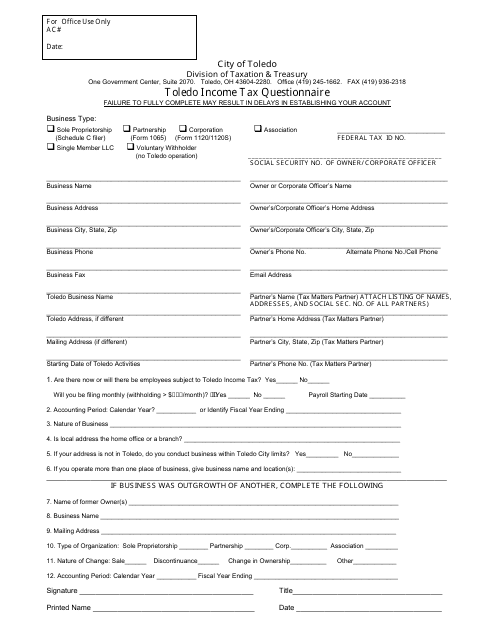

This Form is used for completing the Toledo Income Tax Questionnaire for residents of Toledo, Ohio.

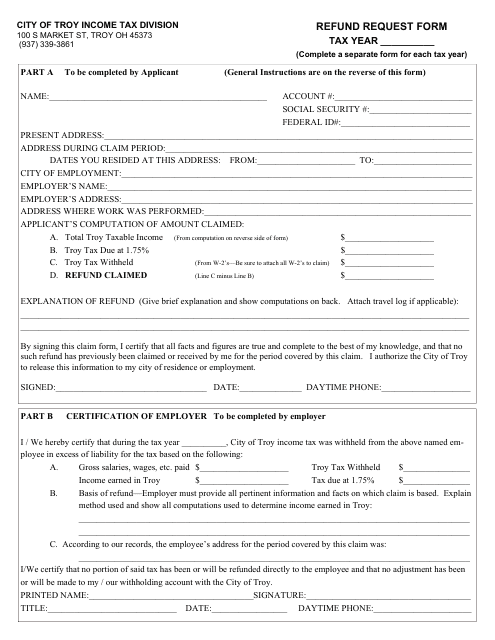

This Form is used for requesting a refund from the City of Troy, Ohio.

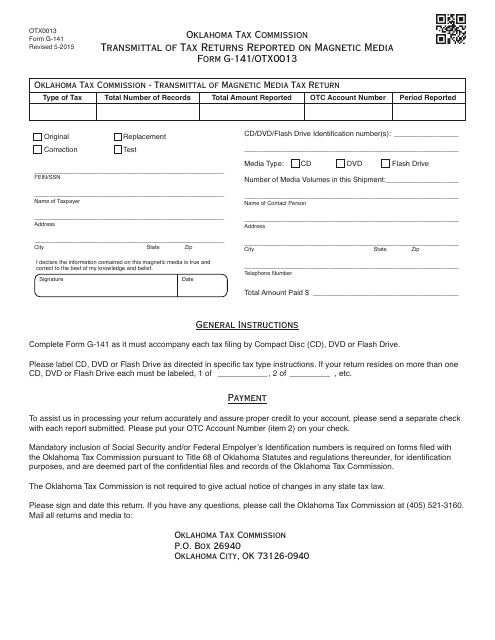

This document is used for transmitting tax returns reported on magnetic media to the Oklahoma Tax Commission (OTC).

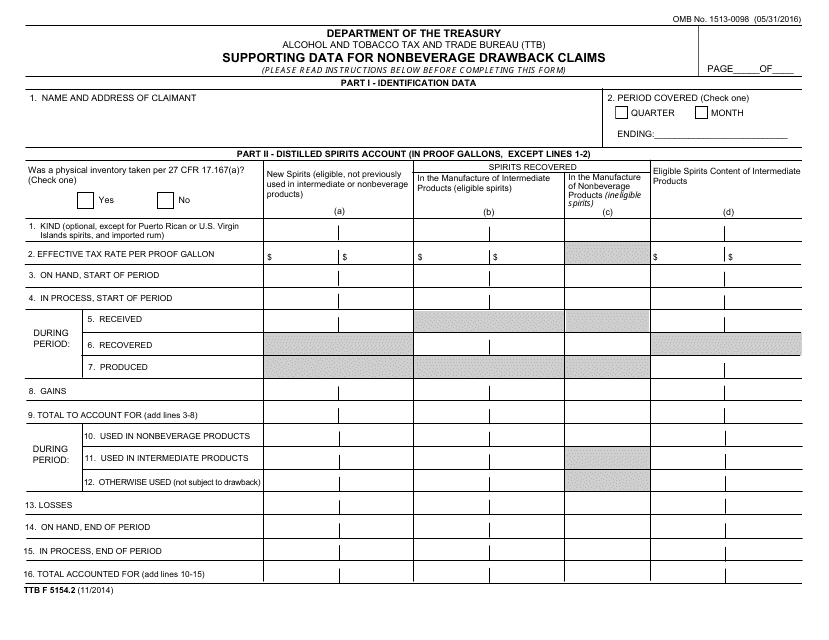

This Form is used for submitting supporting data for nonbeverage drawback claims to the Alcohol and Tobacco Tax and Trade Bureau (TTB).

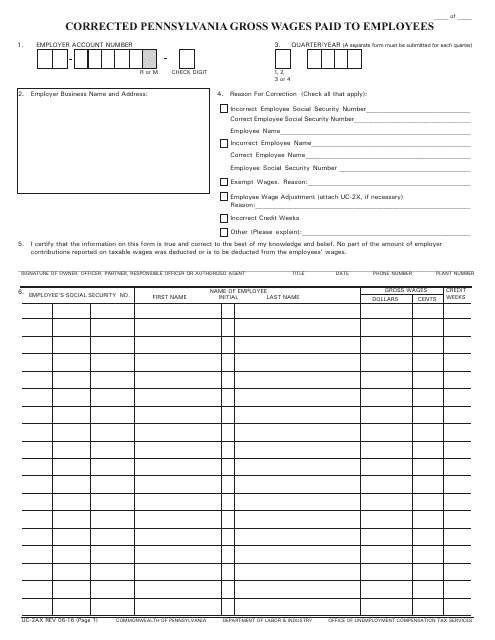

This form is used for reporting corrected gross wages paid to employees in Pennsylvania. It helps to ensure accurate reporting for tax purposes.

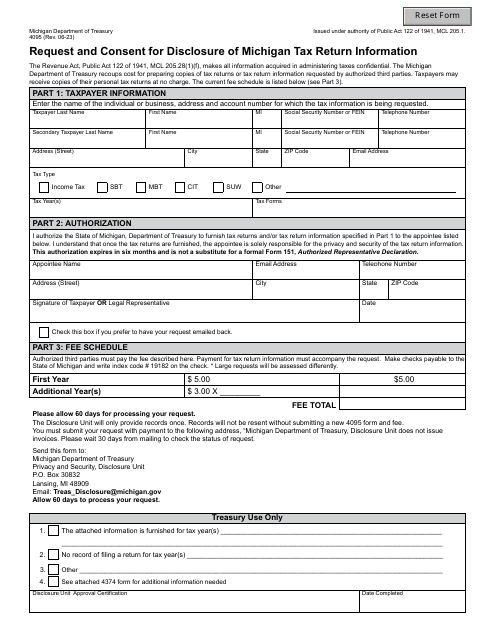

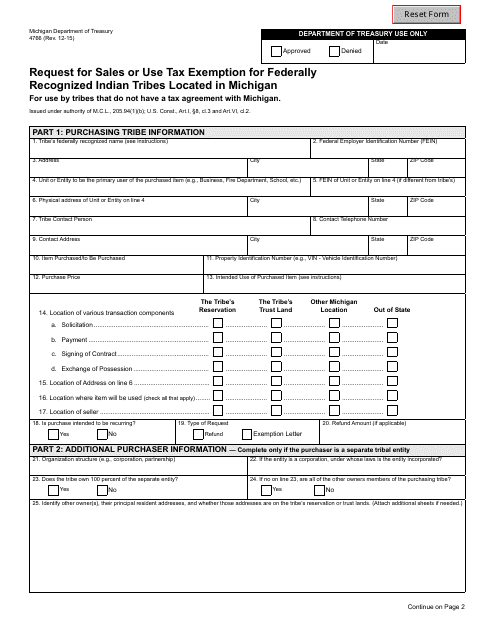

This form is used for requesting sales or use tax exemption for federally recognized Indian tribes located in Michigan.

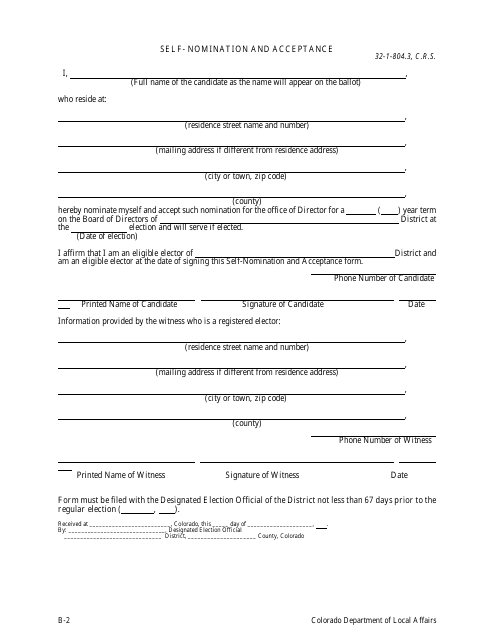

This Form is used for self-nomination and acceptance in the state of Colorado.

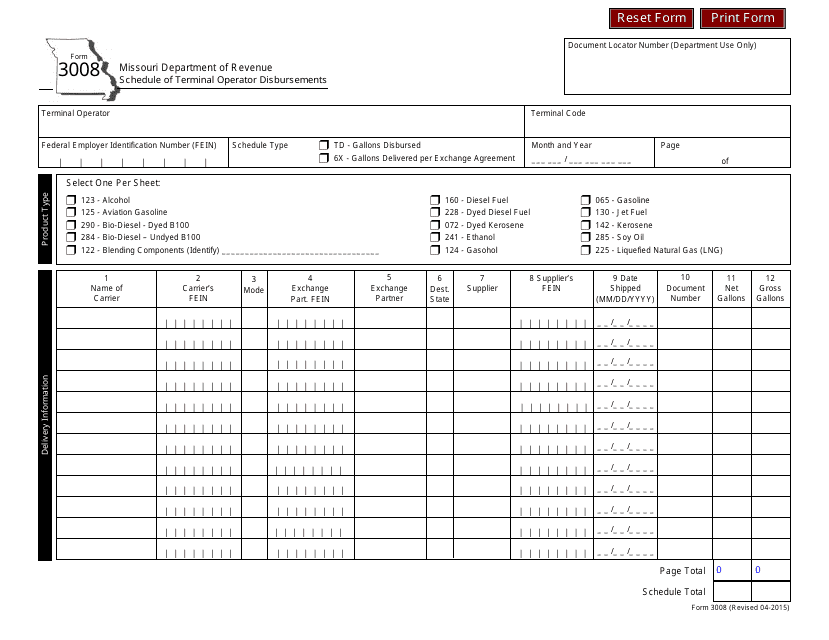

This form is used for detailing the disbursements made by terminal operators in Missouri.

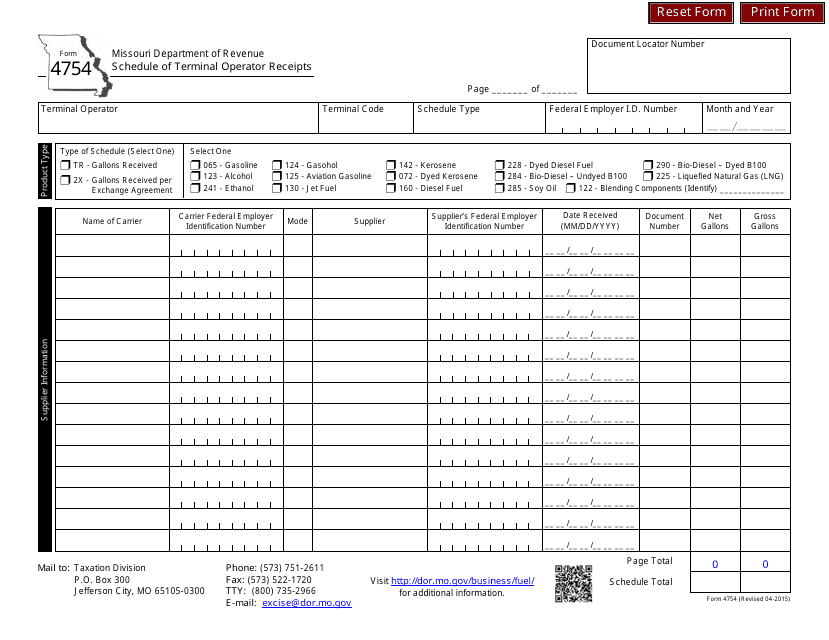

This form is used for reporting the receipts of terminal operators in Missouri. It helps to track and calculate the revenue generated by terminal operators in the state.

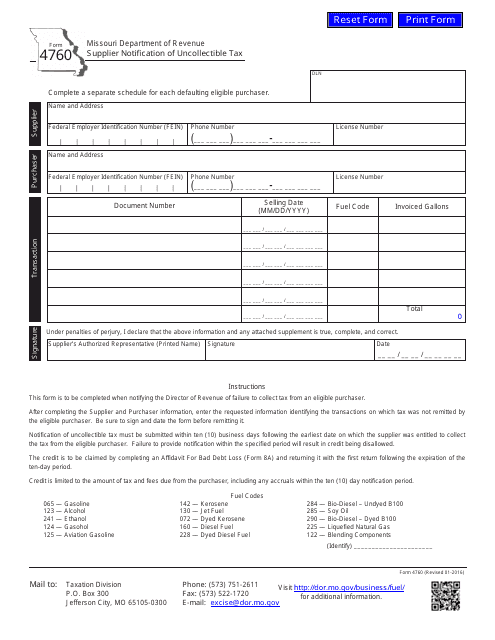

This form is used for suppliers in Missouri to notify the state about uncollectible tax.

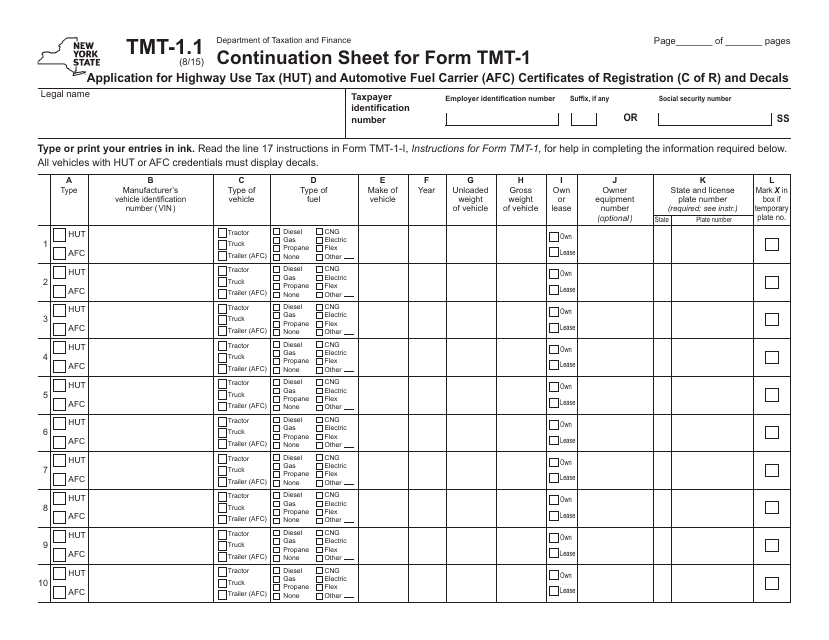

This form is used as a continuation sheet for Form TMT-1, which is an application for Highway Use Tax (HUT) and Automotive Fuel Carrier (AFC) certificates of registration and decals in the state of New York. It provides additional space to provide more information and details related to the application.

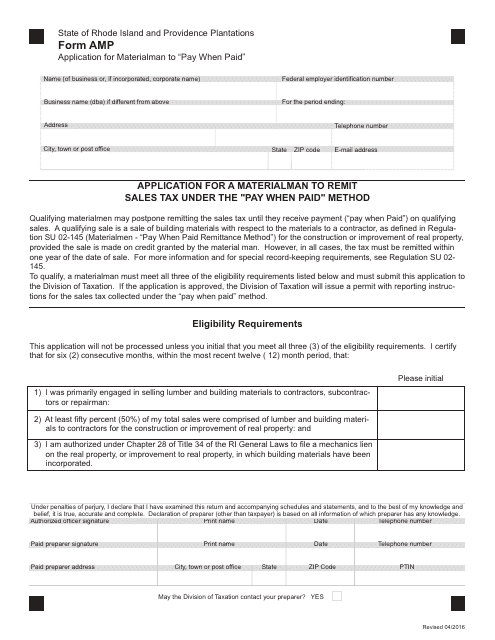

This form is used for materialmen in Rhode Island to remit sales tax under the "pay when paid" method. It allows them to report and pay the appropriate sales tax on their transactions.

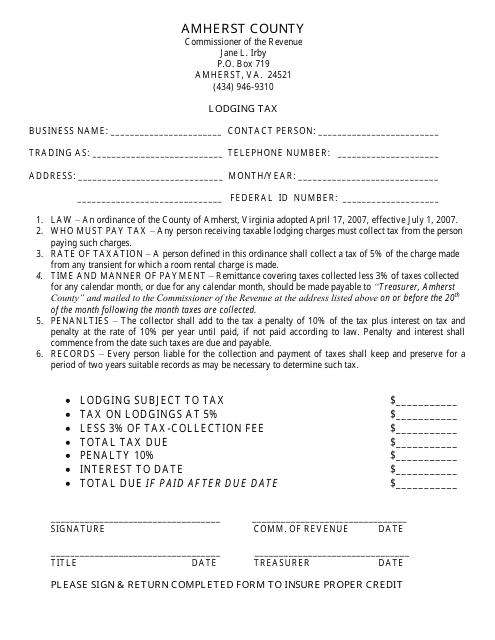

This form is used for paying lodging tax in Amherst County, Virginia.

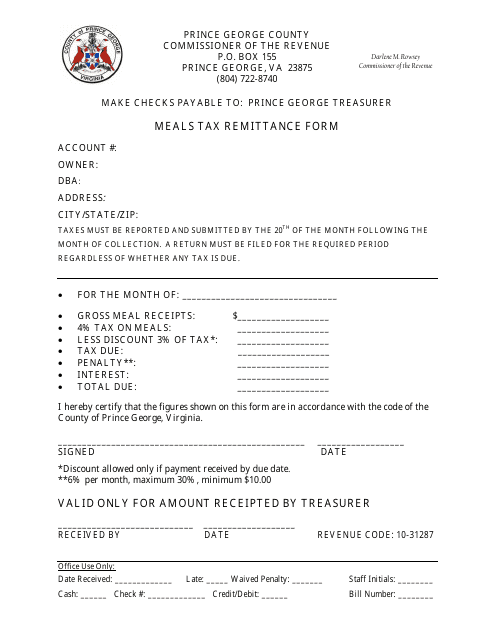

This form is used for remitting the meals tax in Prince George County, Virginia.

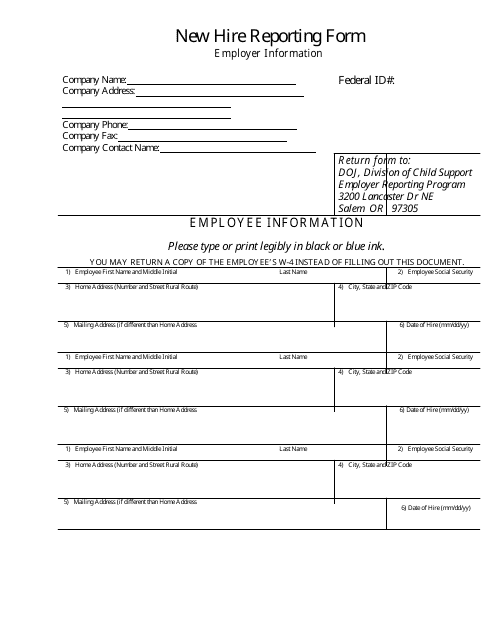

This form is used for reporting the hiring of new employees in the state of Oregon. Employers are required to submit this form to the appropriate state agency for the purpose of documenting new hires.

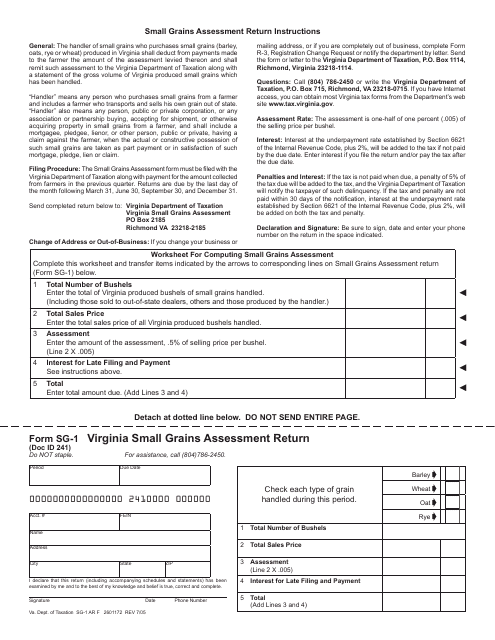

This form is used for submitting small grain assessment returns in the state of Virginia. Farmers use this form to report their small grain production and pay the required assessments.

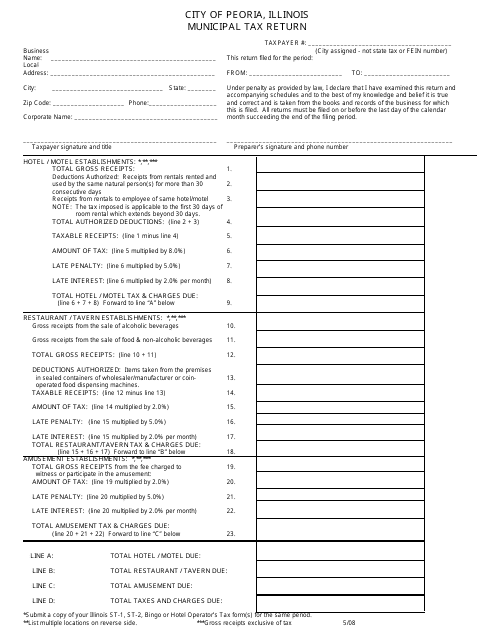

This type of document is used for reporting and filing municipal taxes for residents of Peoria, Illinois.

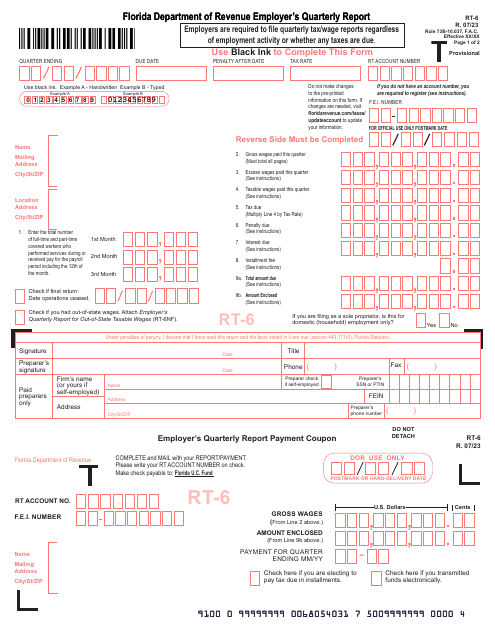

This is a legal document used to inform the Florida Department of Revenue (DOR) about the total number of all employees who performed services or received pay, their gross, excess, and taxable wages.

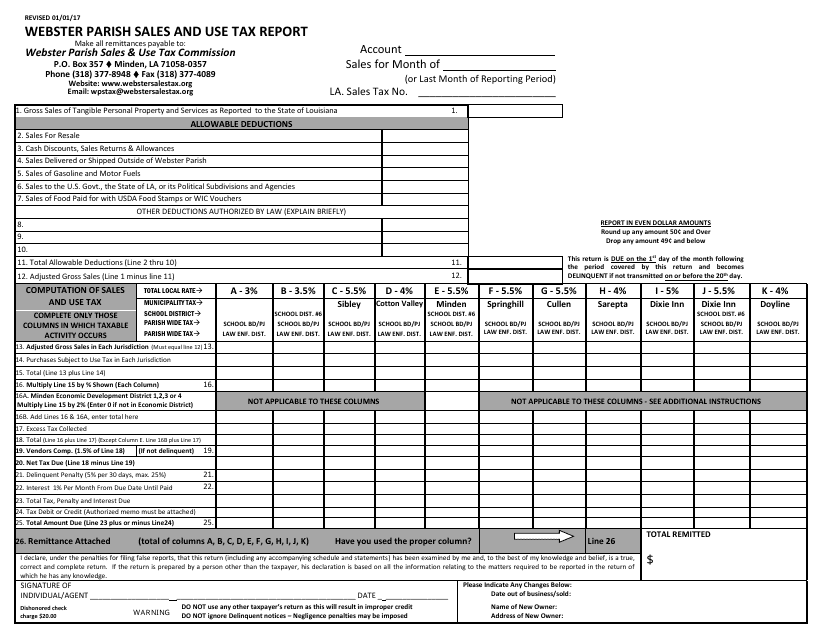

This document is used for reporting sales and use tax in Webster Parish, Louisiana.

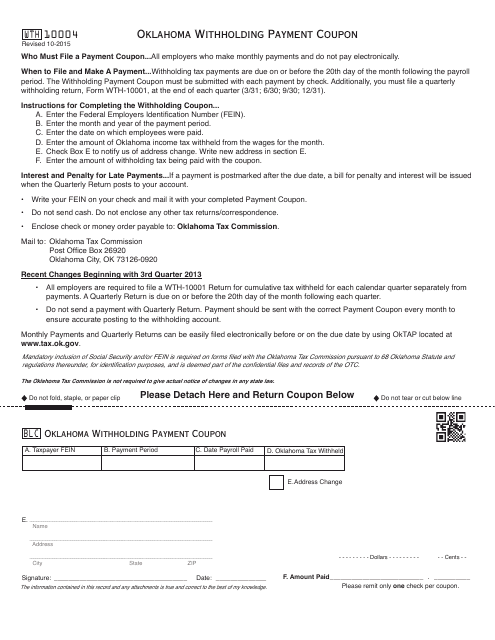

This document is a payment coupon specifically used for Oklahoma state withholding taxes. It is used to make payments for withholding taxes to the state of Oklahoma.