Fill and Sign United States Legal Forms

Documents:

235709

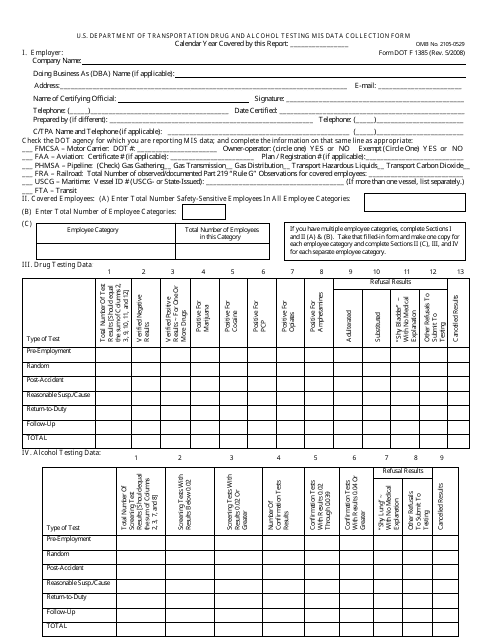

This form is used for collecting data on drug and alcohol testing misuse.

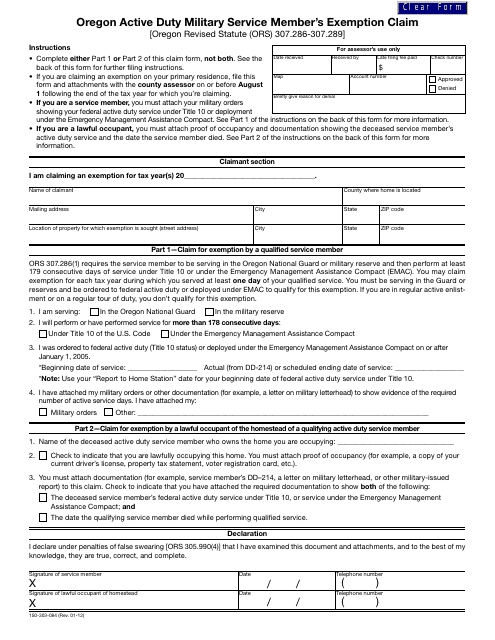

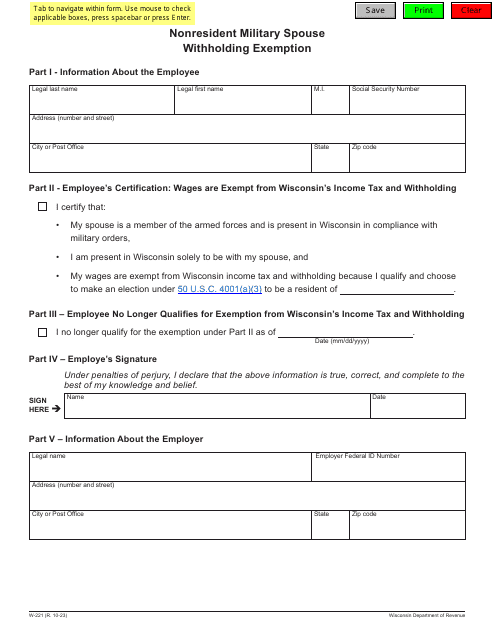

This form is used for Oregon residents who are active duty military service members to claim an exemption on their taxes.

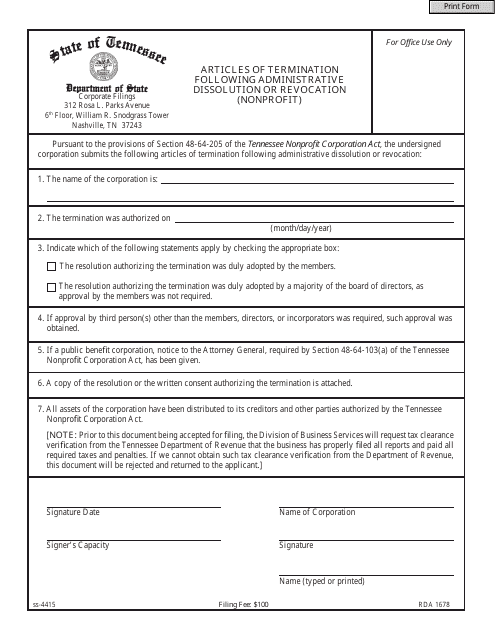

This form is used for filing the Articles of Termination following the administrative dissolution or revocation of a nonprofit organization in the state of Tennessee.

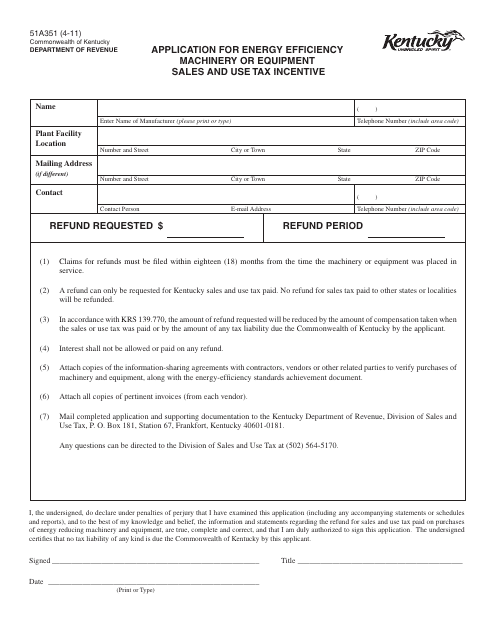

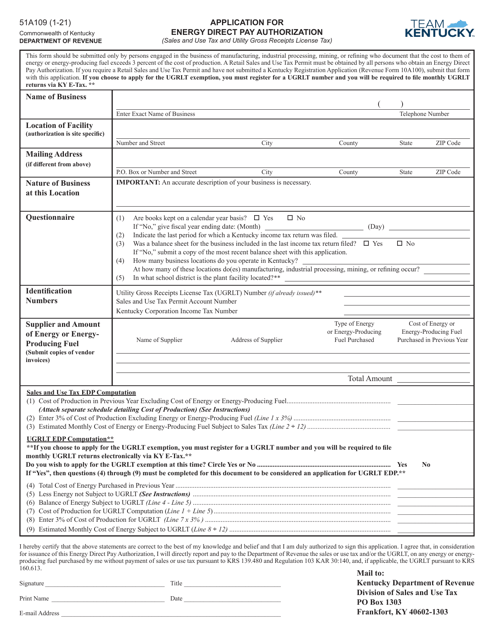

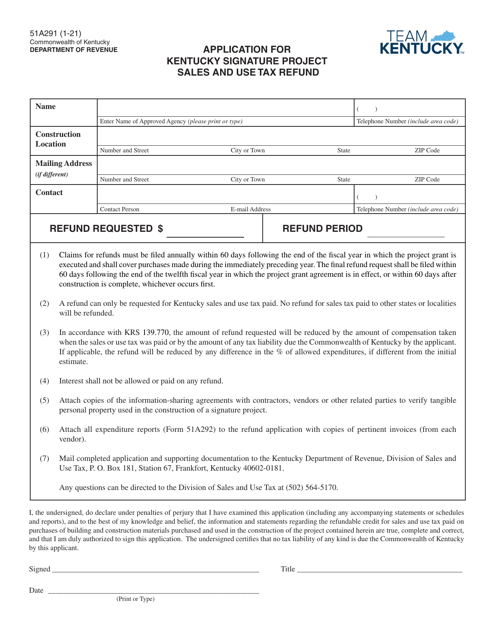

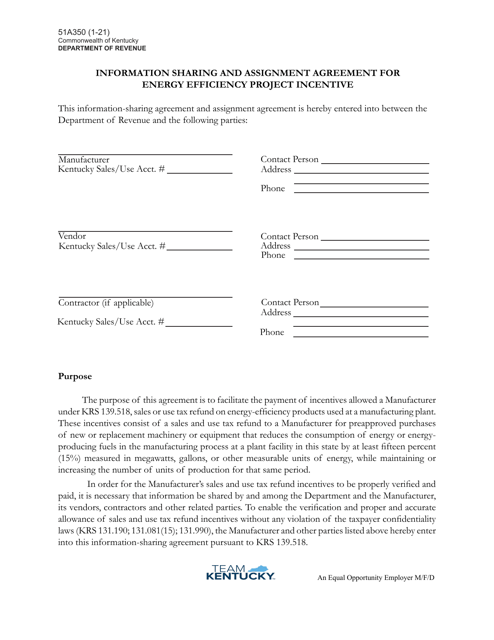

This form is used for applying for the Energy Efficiency Machinery or Equipment Sales and Use Tax Incentive in the state of Kentucky.

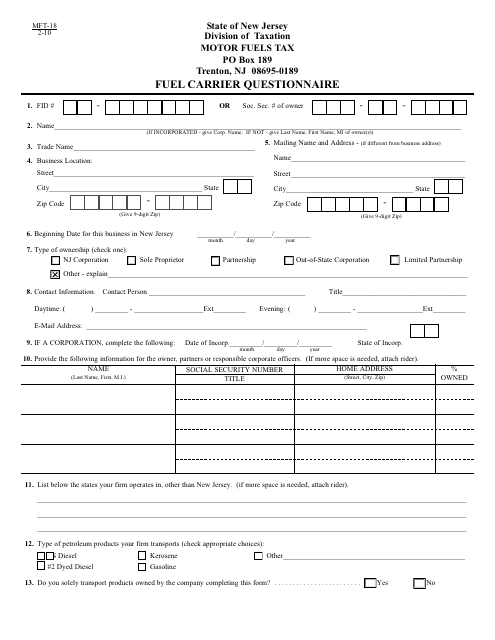

This form is used for fuel carriers in New Jersey to answer several questions regarding their operations and compliance with regulations.

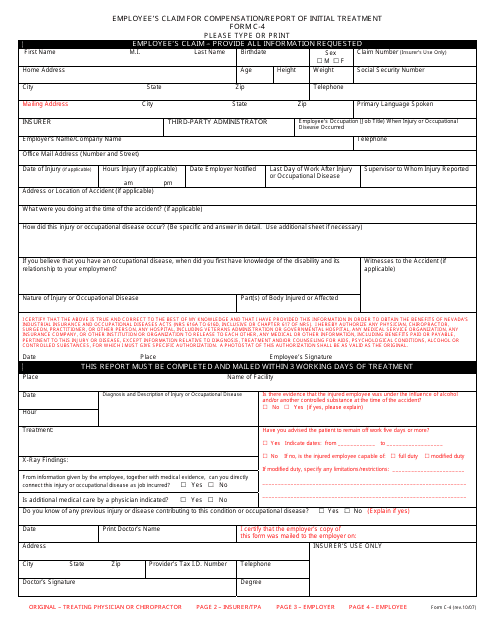

This document is used by employees in Nevada to file a claim for compensation and report the initial treatment received for a work-related injury or illness.

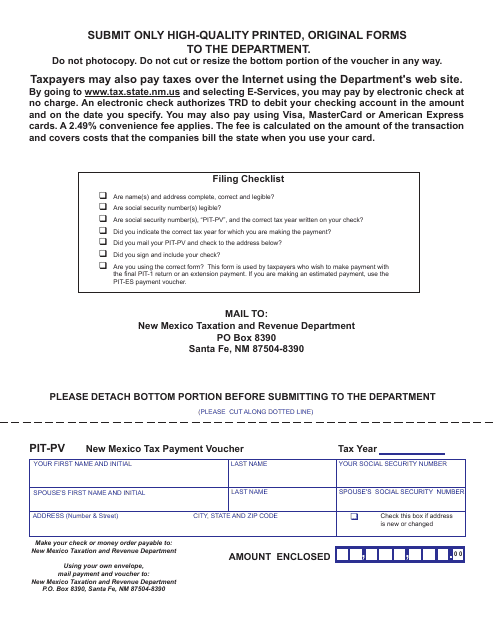

This form is used for making tax payment in New Mexico. It is called the PIT-PV (Personal Income Tax Payment Voucher) and is used to submit tax payments to the state.

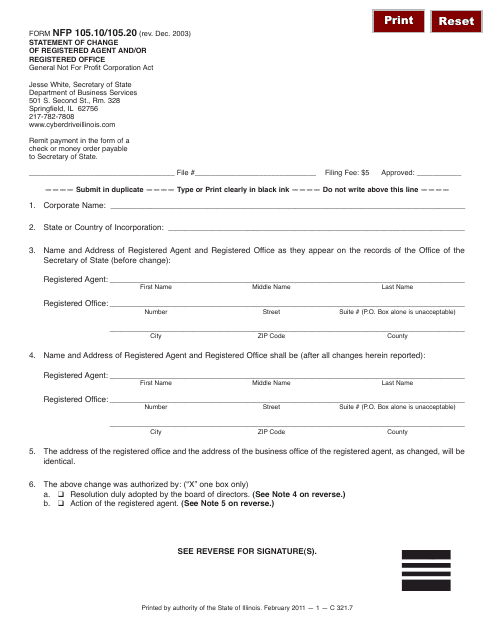

This Form is used for making changes to the registered agent and/or registered office in the state of Illinois.

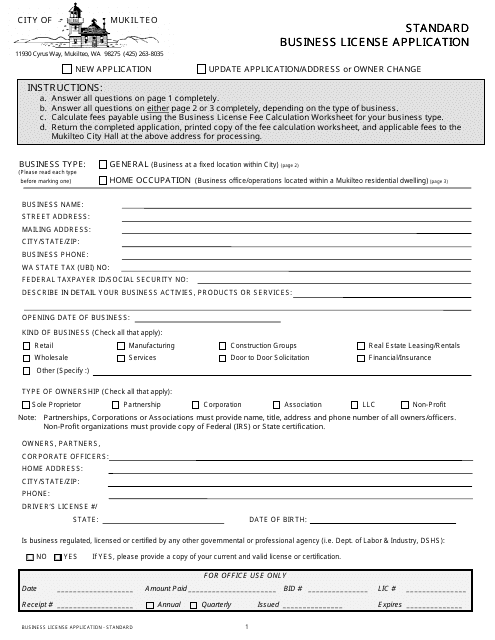

This form is used for applying for a standard business license in the City of Mukilteo, Washington. It is necessary for anyone who wants to start a business in this city.

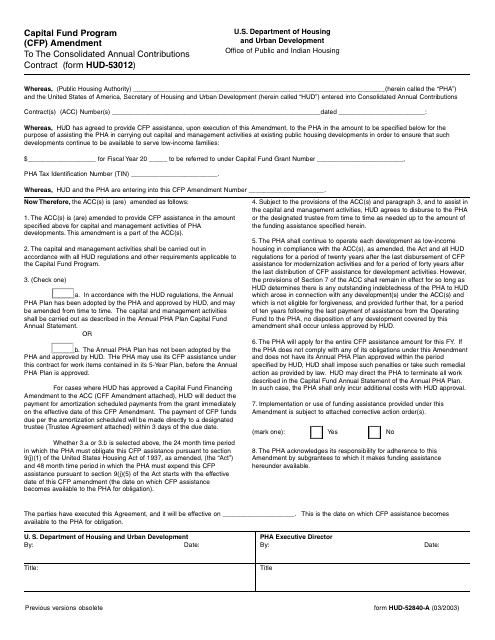

This Form is used for making amendments to the Consolidated Annual Contributions Contract for the Capital Fund Program.

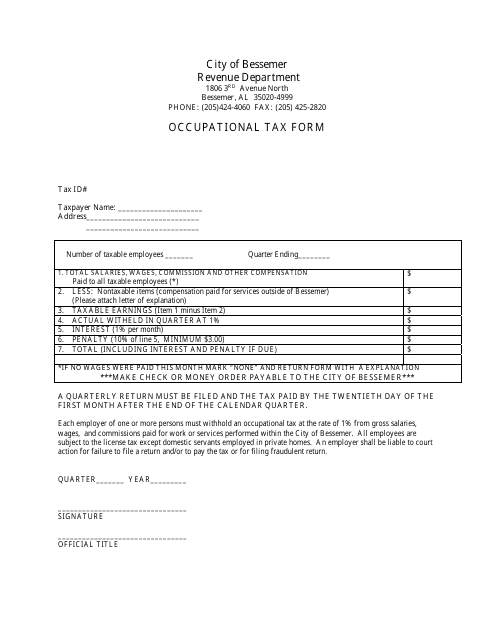

This Form is used for paying occupational taxes to the City of Bessemer, Alabama.

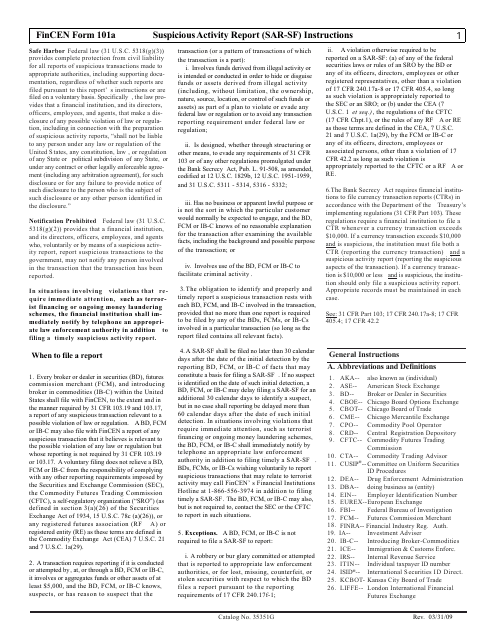

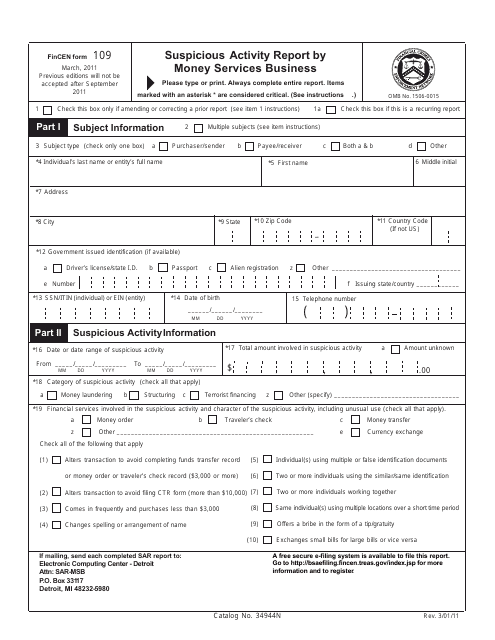

This document provides instructions for completing the FinCEN Form 101A, also known as the Suspicious Activity Report (SAR-SF). It outlines the steps and information required to report any suspicious financial transactions or activities to the Financial Crimes Enforcement Network (FinCEN).

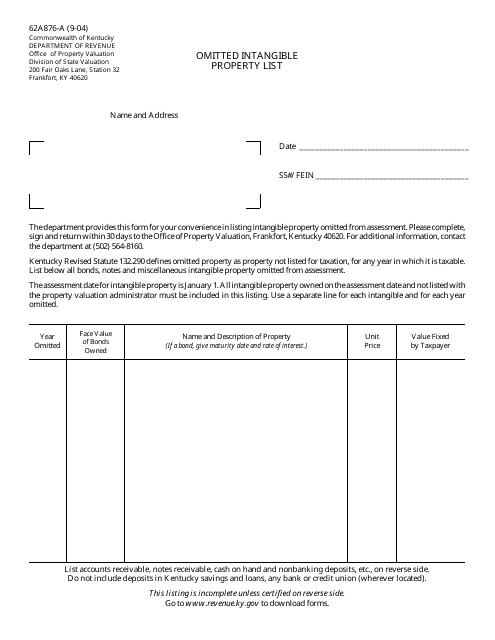

This Form is used for reporting omitted intangible property in the state of Kentucky.

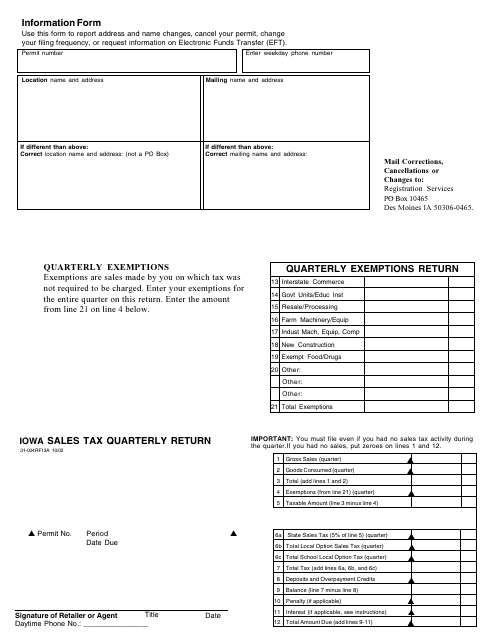

This Form is used for submitting Iowa sales tax quarterly return.

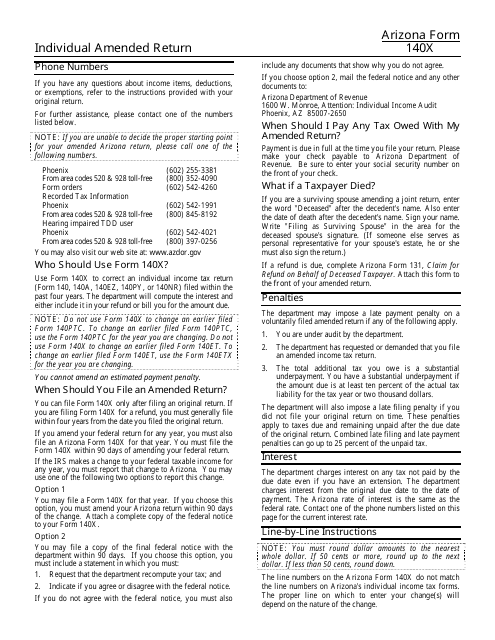

This Form is used for filing an amended individual tax return in the state of Arizona. It allows taxpayers to make corrections or updates to their previously filed Form 140.

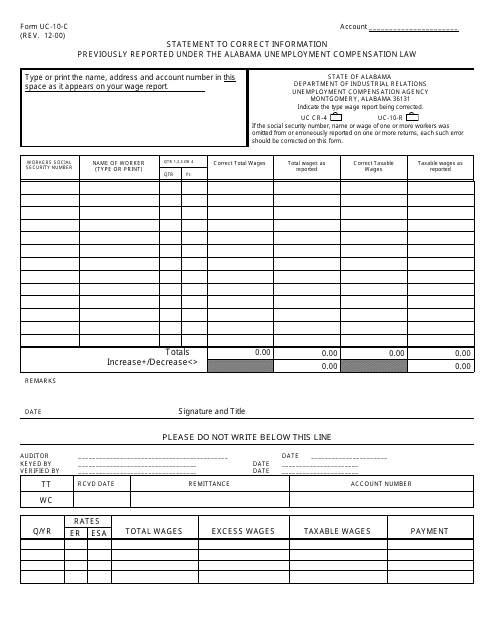

This Form is used for correcting information that was previously reported under the Alabama Unemployment Compensation Law in Alabama.

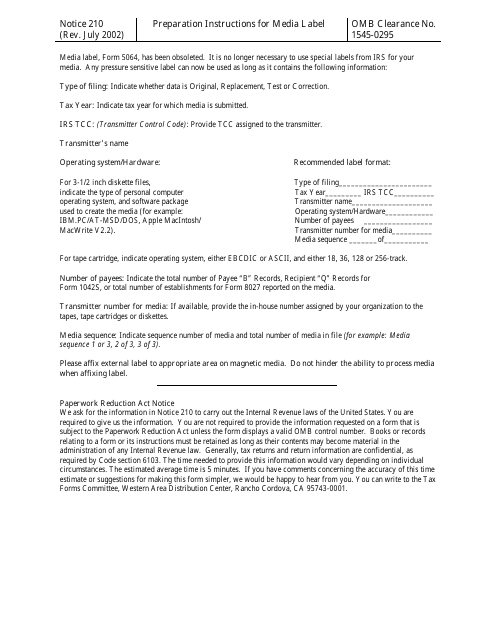

This document provides instructions for preparing media labels as required by the IRS for tax-related purposes.

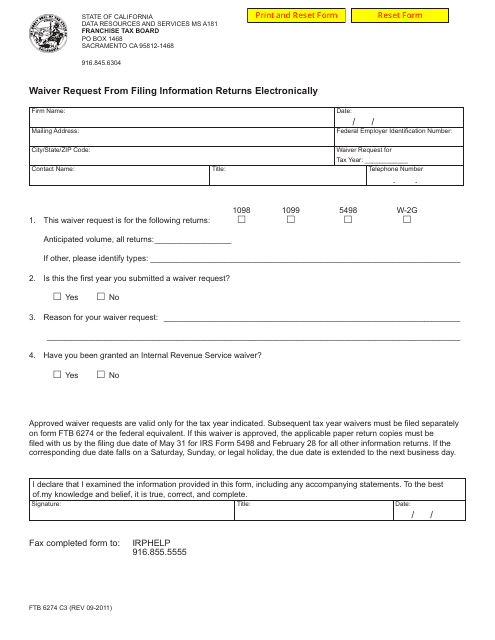

This form is used for requesting a waiver from filing information returns electronically in California.

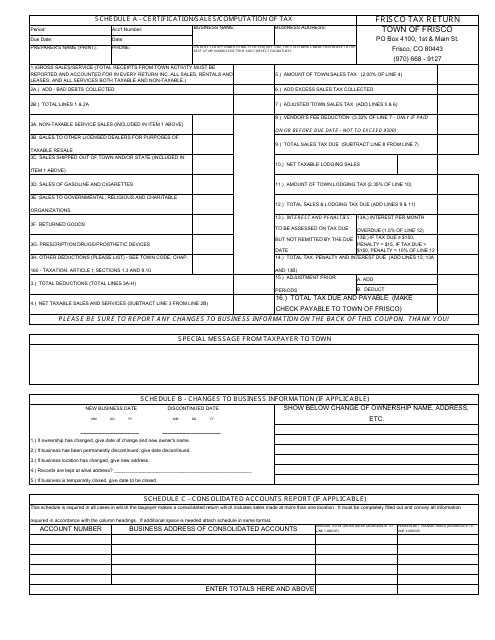

This document is used for certifying sales and computing tax for the Frisco Tax Return in the town of Frisco, Colorado.

This Form is used for reporting suspicious activity by a Money Services Business to the Financial Crimes Enforcement Network (FinCEN).

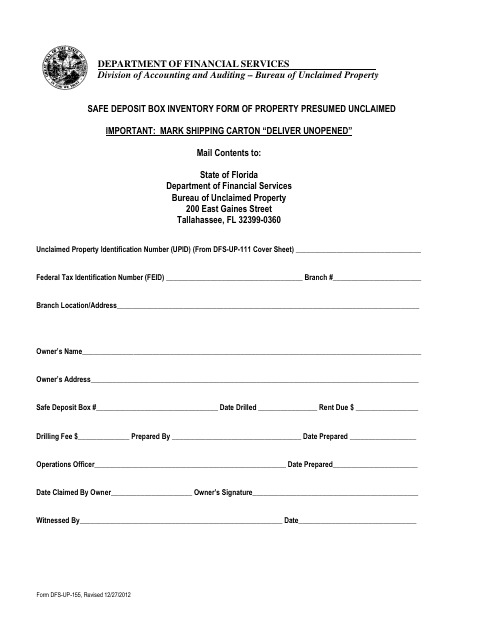

This Form is used for creating an inventory of property stored in a safe deposit box that is presumed to be unclaimed in the state of Florida.

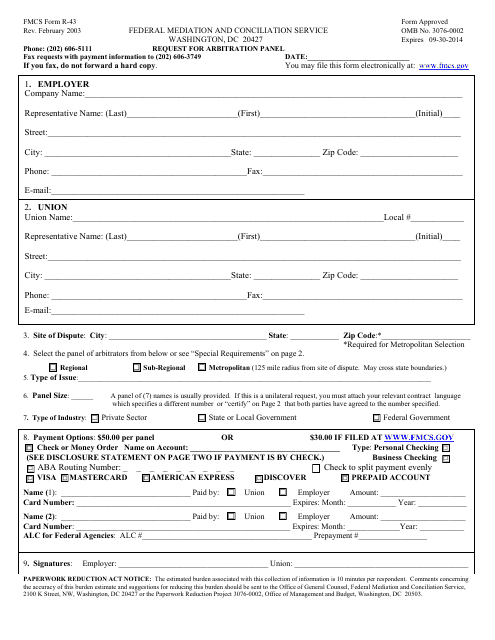

This Form is used for requesting an arbitration panel through the Federal Mediation and Conciliation Service (FMCS).

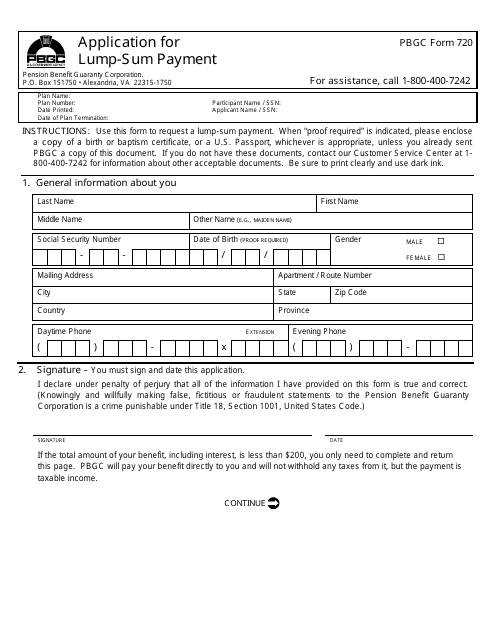

This Form is used for applying for a lump-sum payment from the Pension Benefit Guaranty Corporation (PBGC).

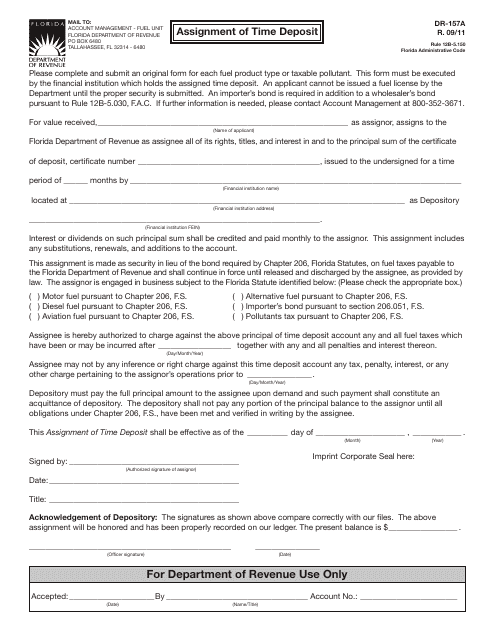

This form is used for assigning a time deposit in the state of Florida.

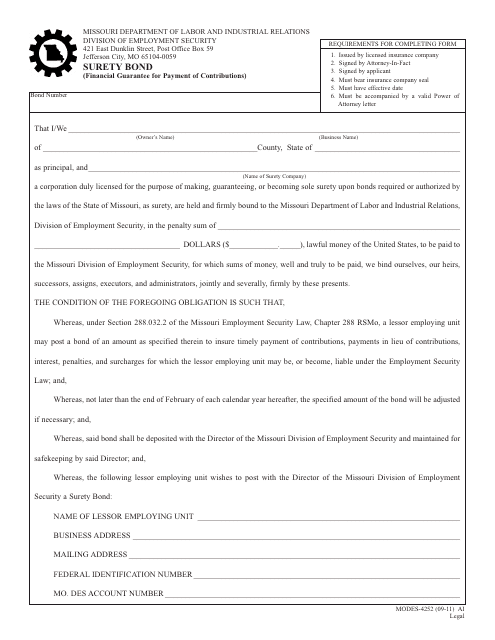

This form is used for obtaining a surety bond in Missouri to guarantee the payment of contributions.

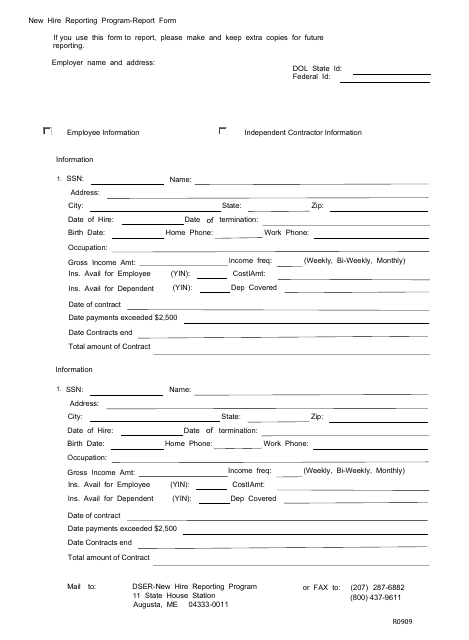

This form is used for reporting new hires in the state of Maine. Employers are required to use this form to provide information about newly hired employees to the state's employment agency.

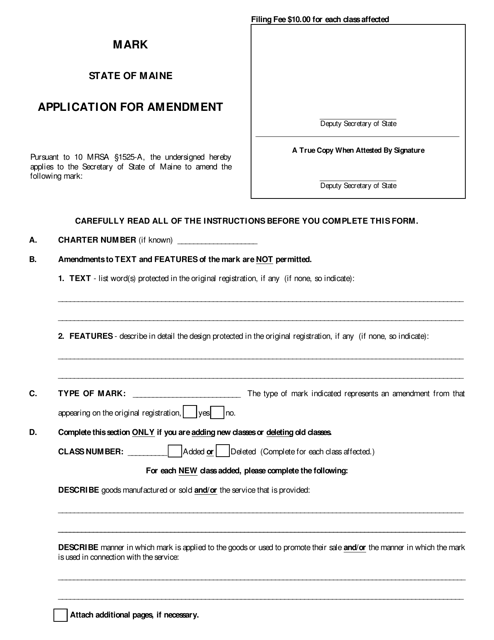

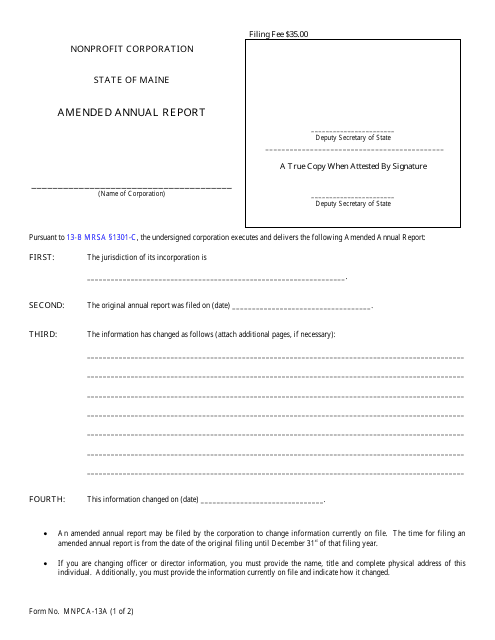

This form is used for filing an amended annual report for a nonprofit corporation in the state of Maine.

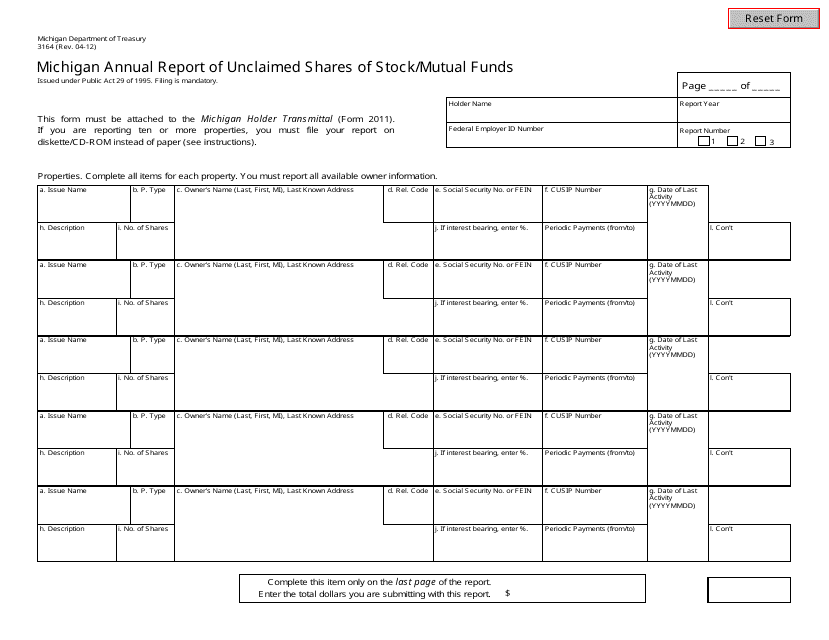

This document is used for reporting unclaimed shares of stock or mutual funds in the state of Michigan on an annual basis.

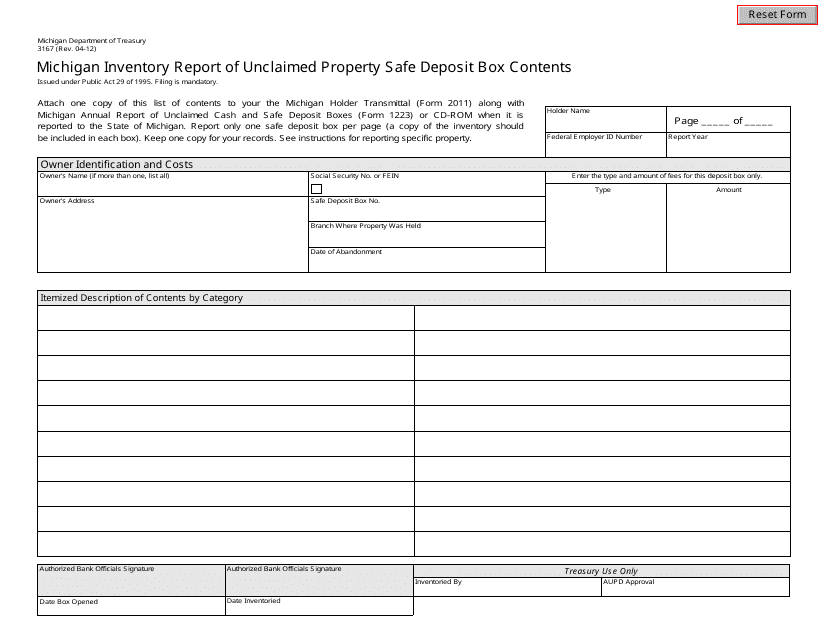

This Form is used for reporting and documenting the inventory of unclaimed property stored in safe deposit boxes in the state of Michigan.

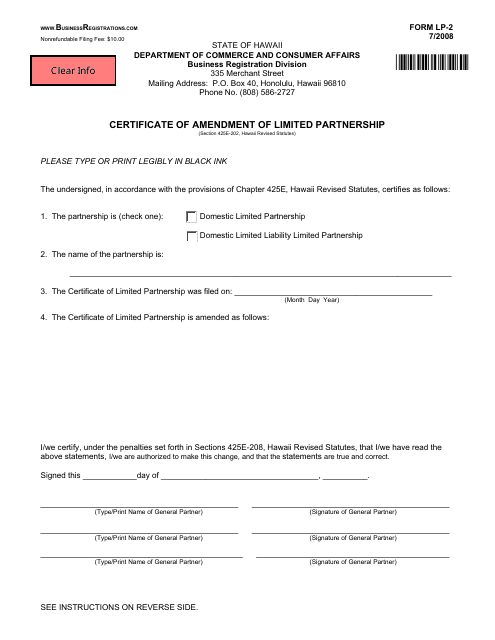

This form is used for amending the certificate of a limited partnership in the state of Hawaii. It is required to update any changes made to the partnership's information, such as the addition or removal of partners, changes to the partnership's name, or any other modifications to its structure.

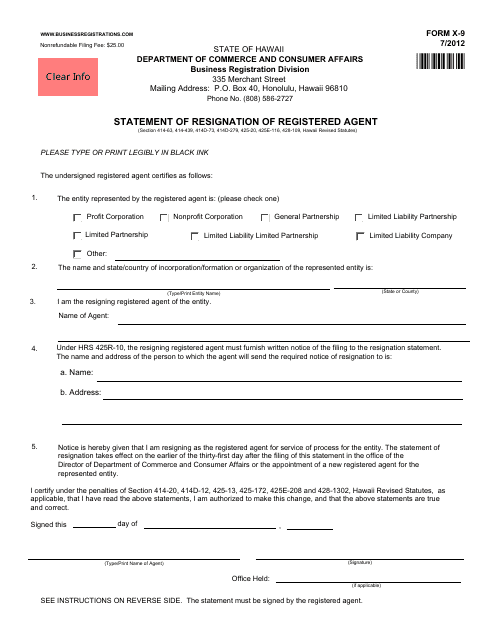

This form is used for filing a statement of resignation of a registered agent in the state of Hawaii.

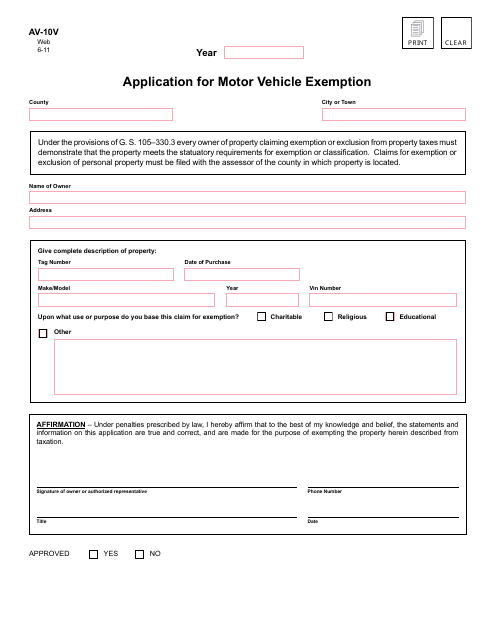

This Form is used for applying for motor vehicle exemption in North Carolina.