Fill and Sign United States Legal Forms

Documents:

235709

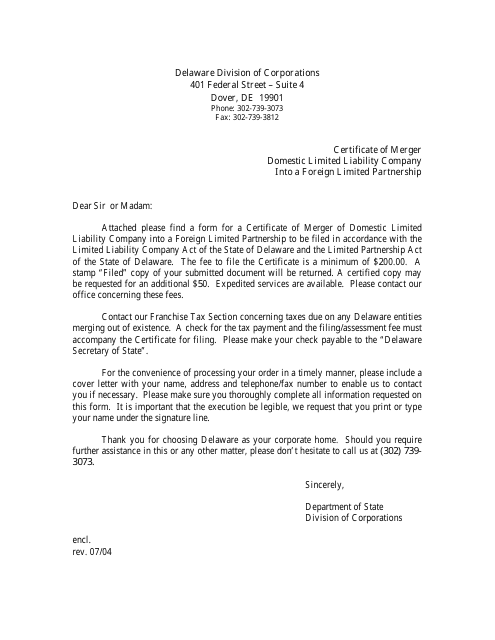

This document is used for certifying the merger of a domestic limited liability company based in Delaware into a foreign limited partnership. It signifies the legal consolidation of two entities into one.

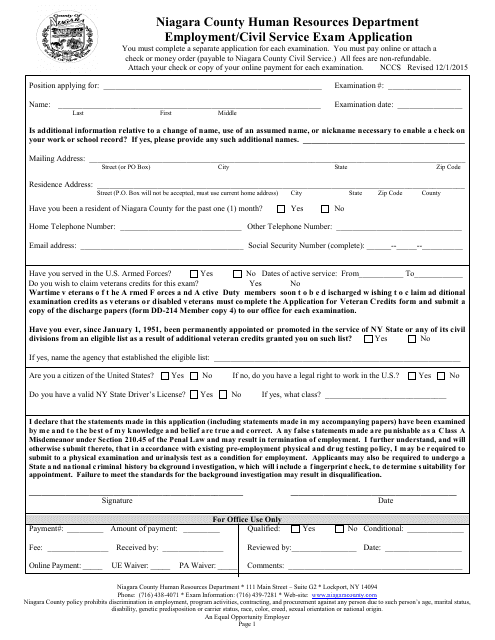

This form is used for applying for employment or civil service exams in Niagara County, New York.

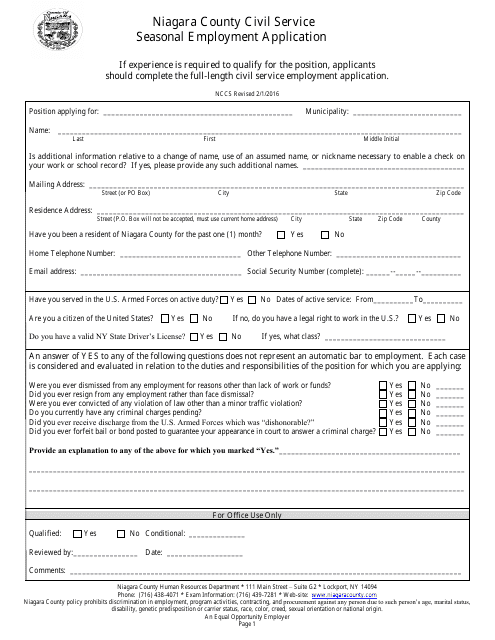

This Form is used for applying for seasonal employment in Niagara County, New York.

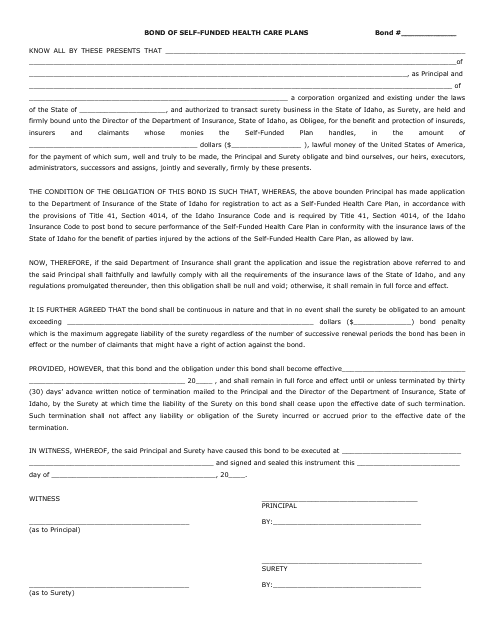

This form is used for self-funded health care plans in Idaho. It serves as a bond to ensure financial responsibility for the plan.

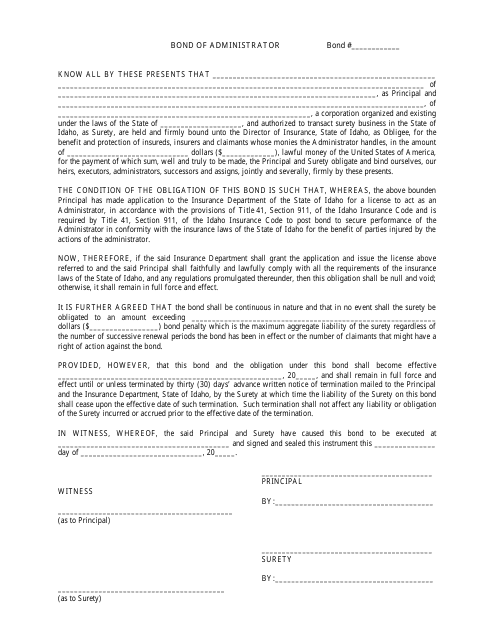

This document is a legal bond for an administrator in the state of Idaho. It guarantees the administrator's faithful performance of their duties.

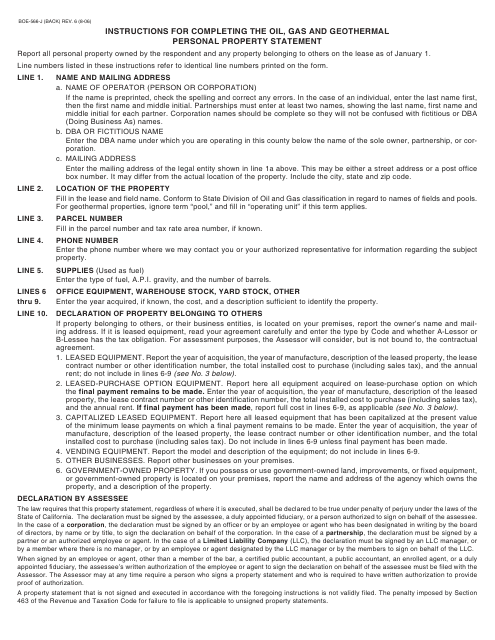

This Form is used for reporting oil, gas, and geothermal personal property in California. It provides instructions on how to fill out and submit the Form BOE-566-J.

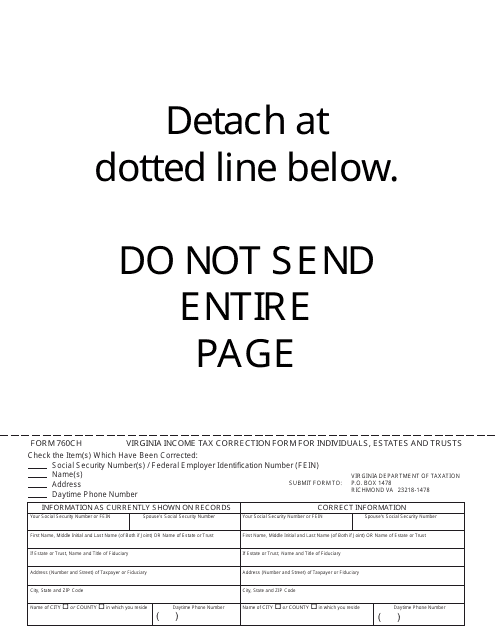

This form is used for correcting Virginia income tax filings for individuals, estates, and trusts in the state of Virginia. It is used to amend any errors or omissions made on previous tax returns.

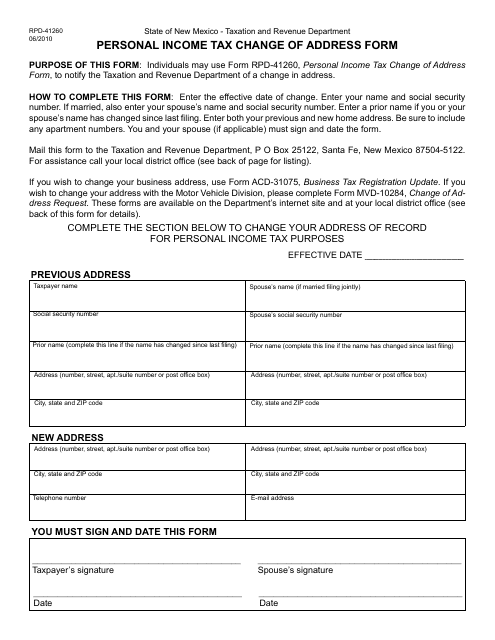

This Form is used for changing your address for personal income tax purposes in the state of New Mexico.

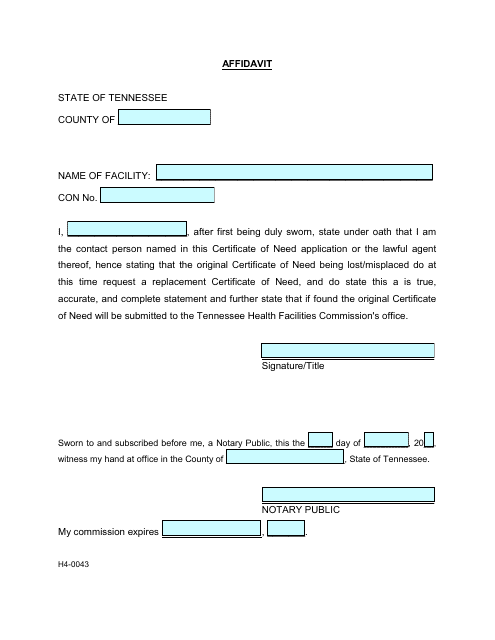

This form is used for filing an affidavit for a lost driver's license in the state of Tennessee.

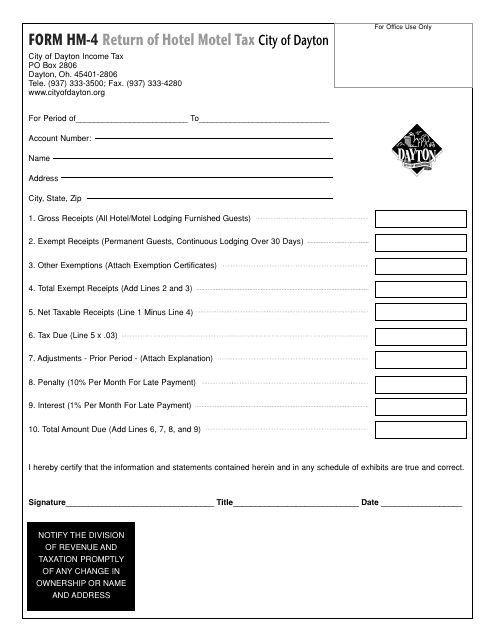

This form is used for the return of hotel motel tax in the City of Dayton, Ohio.

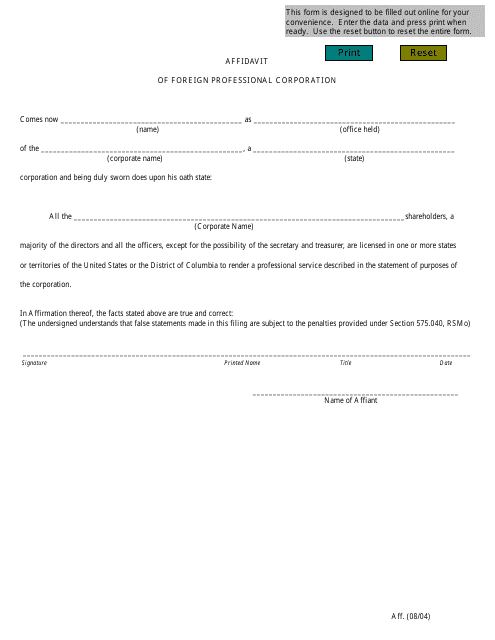

This document is used when a foreign professional corporation wishes to conduct business in the state of Missouri. It serves as a declaration of the corporation's intent to comply with all relevant laws and regulations.

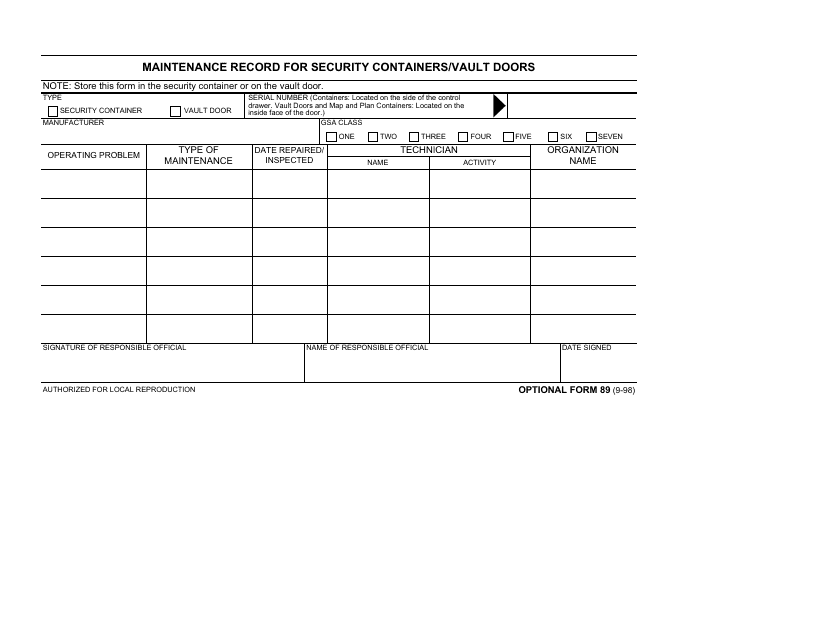

This Form is used for keeping track of maintenance records for security containers and vault doors.

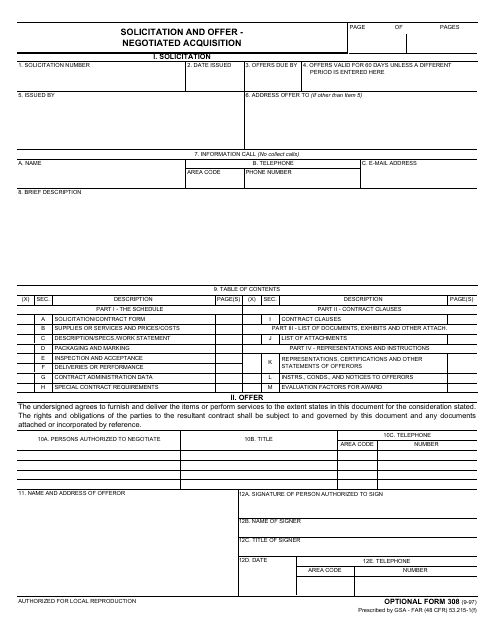

This form is used for the solicitation and offer of a negotiated acquisition. It provides a standardized format for the procurement process and aids in the negotiation and awarding of contracts.

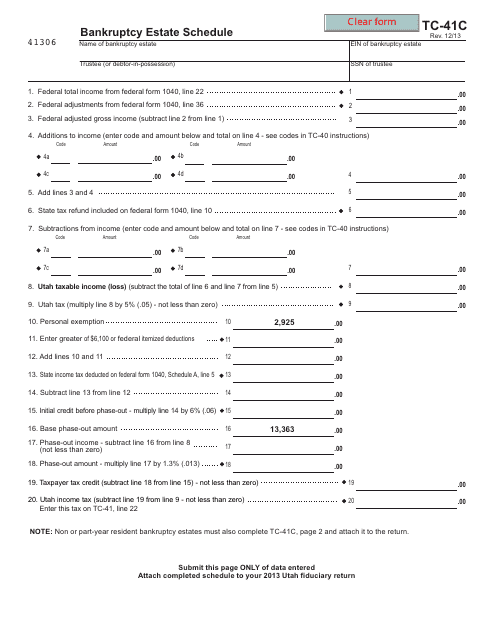

This form is used for filing bankruptcy estate schedule specifically for the state of Utah.

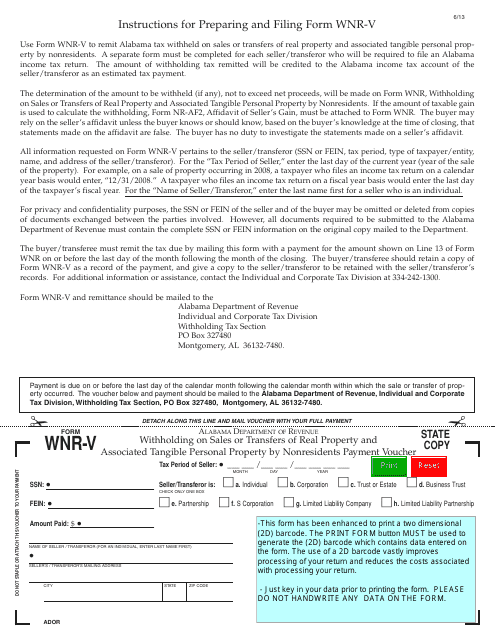

This form is used for making payment vouchers for nonresidents who are withholding on sales or transfers of real property and associated tangible personal property in Alabama.

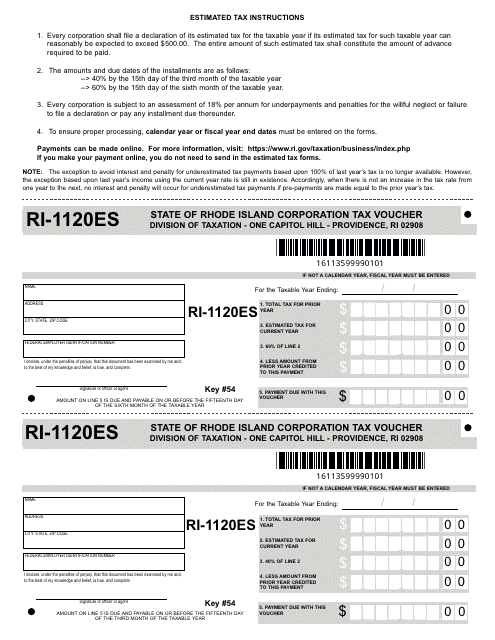

This form is used for submitting corporation tax payments to the State of Rhode Island.

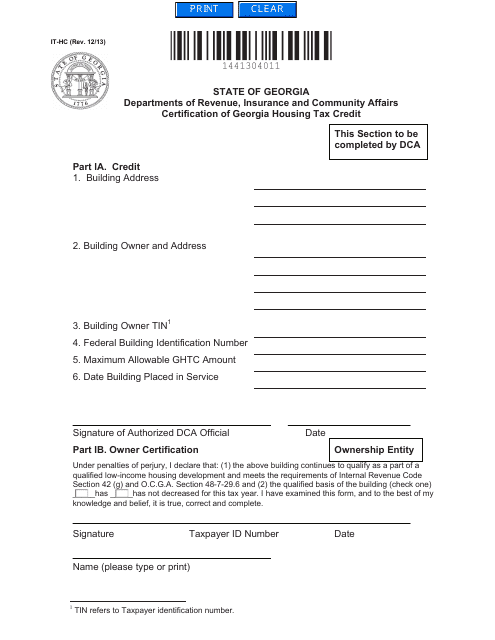

This Form is used for certification of Georgia Housing Tax Credit for properties located in Georgia (United States).

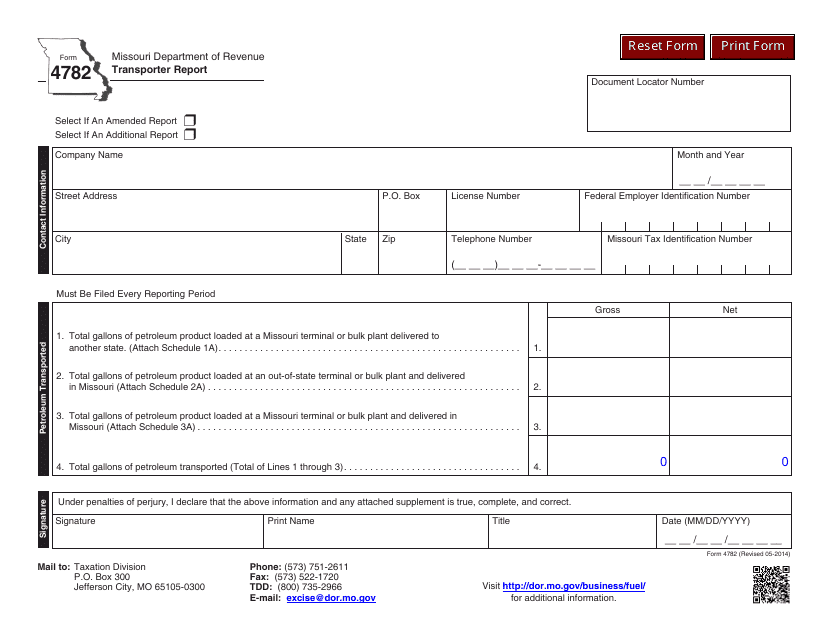

This form is used for reporting transportation details in the state of Missouri.

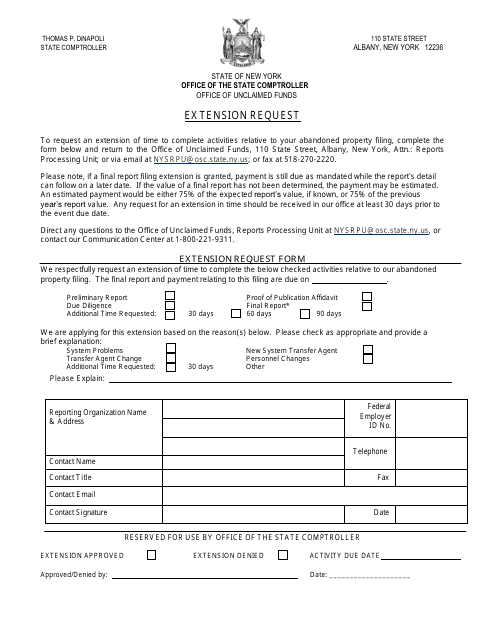

This form is used for requesting an extension on an obligation or deadline in the state of New York.

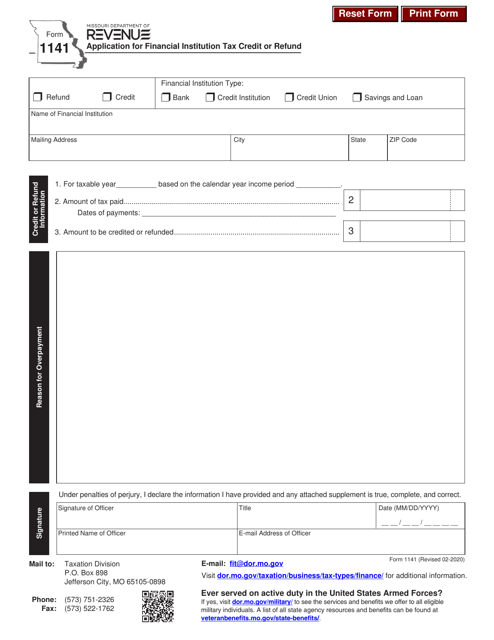

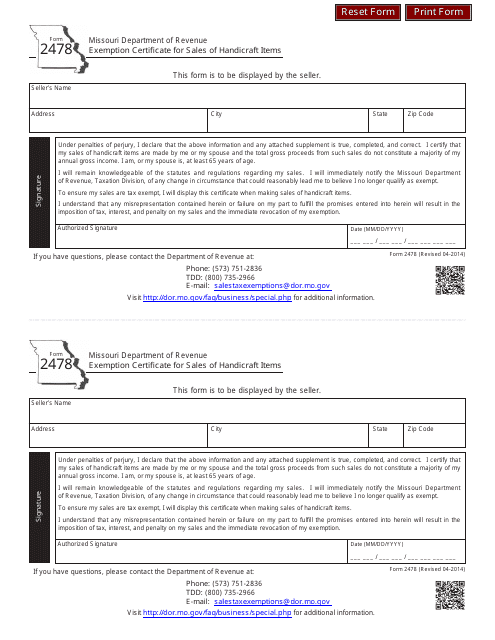

This document is used for obtaining an exemption certificate in Missouri for sales of handicraft items.

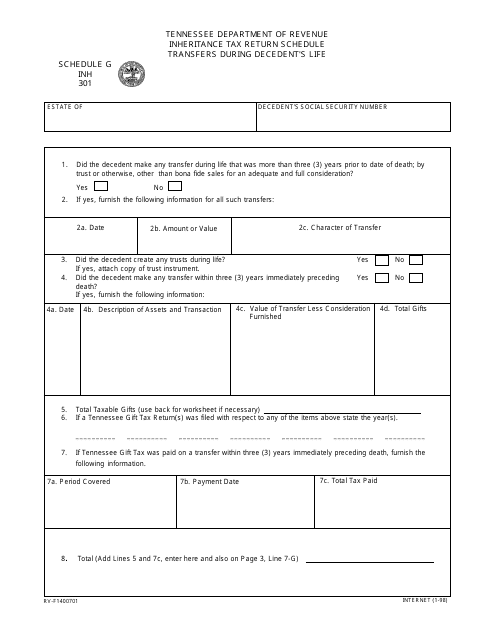

This form is used for reporting transfers made by the deceased person during their lifetime for the purpose of calculating inheritance tax in Tennessee.

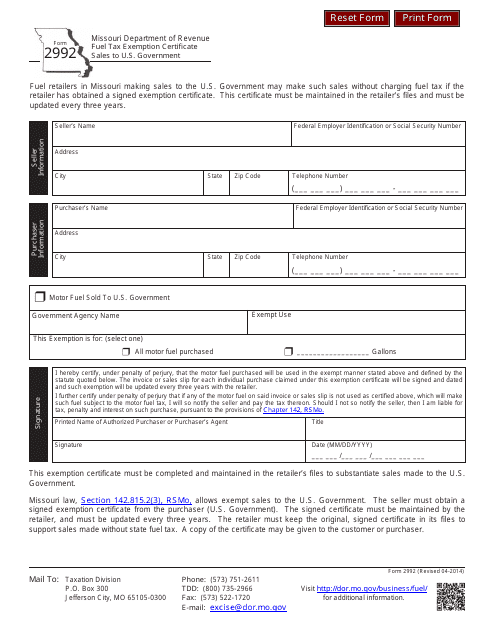

This form is used for claiming a fuel tax exemption on sales made to the U.S. Government in the state of Missouri.

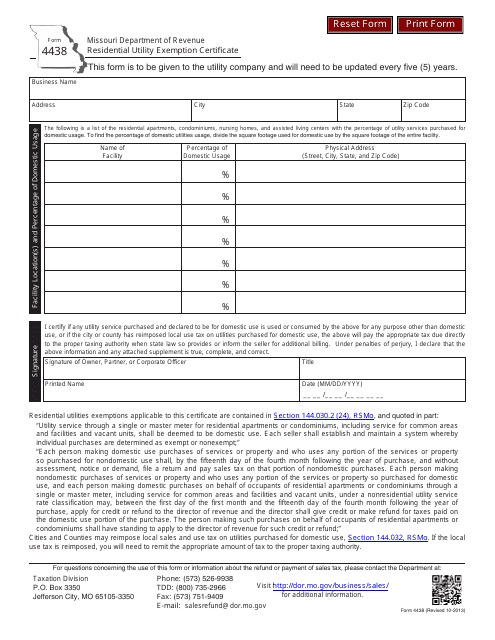

This form is used for requesting a residential utility exemption certificate in the state of Missouri.

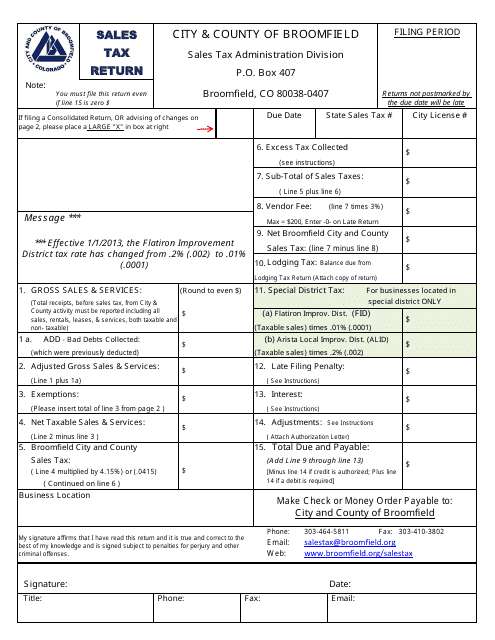

This form is used for filing sales tax returns for the City and County of Broomfield, Colorado.

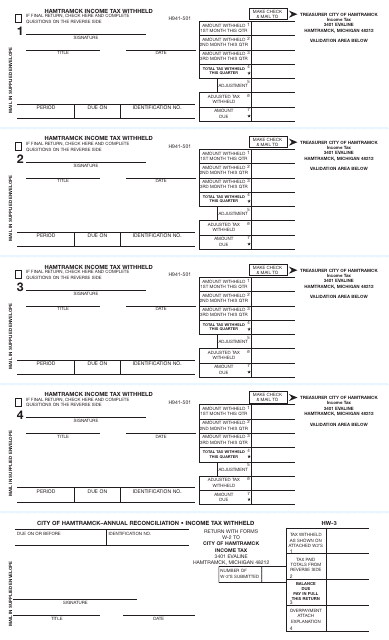

This Form is used for reporting income tax that has been withheld from wages in Hamtramck, Michigan.

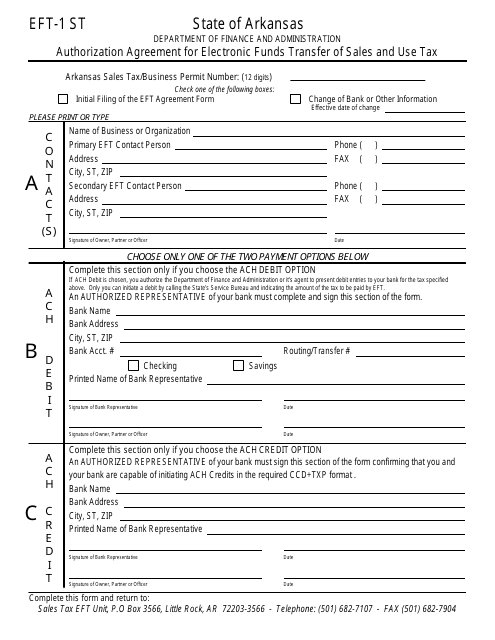

This form is used for authorizing the electronic funds transfer of sales and use tax in the state of Arkansas.

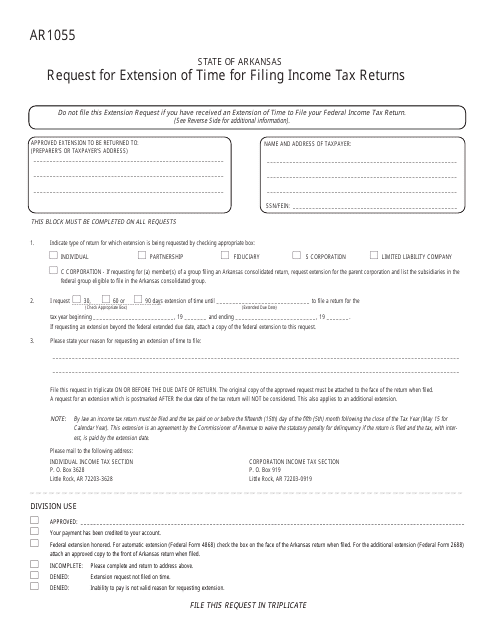

This form is used for requesting an extension of time to file income tax returns in Arkansas.

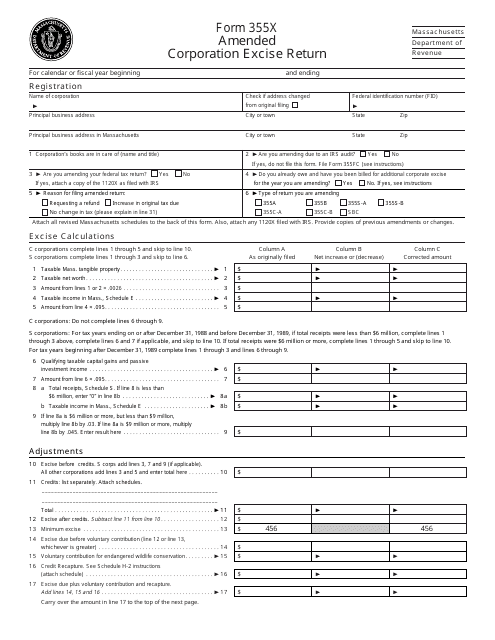

This form is used for filing an amended corporation excise return in the state of Massachusetts.

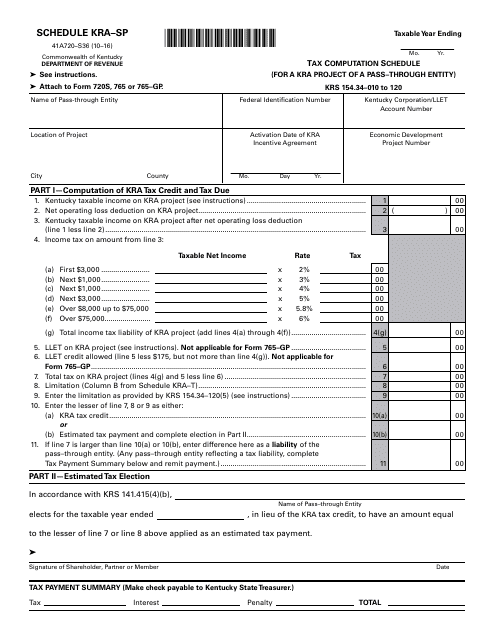

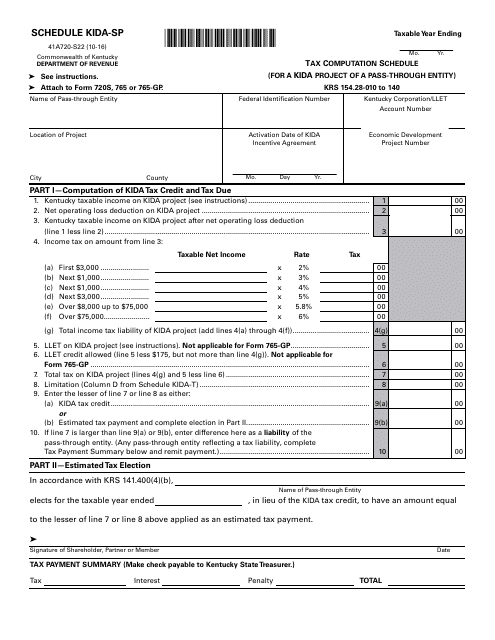

This Form is used for tax computation for a Kra project of a pass-through entity in Kentucky.

This Form is used for calculating the tax for a specific type of project in Kentucky that is owned by a pass-through entity.

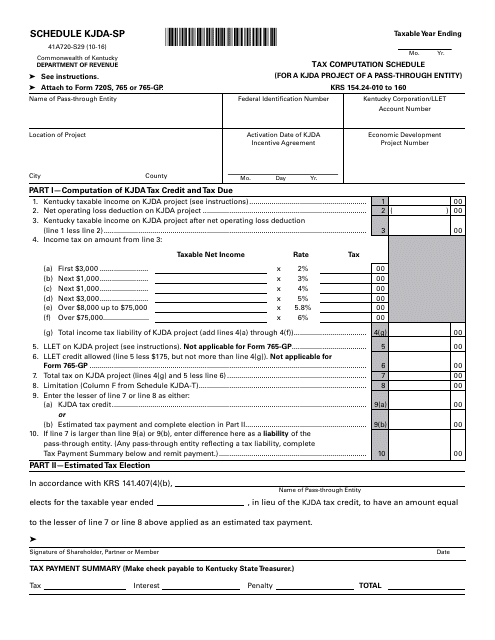

This document is used for tracking schedules for a Kjda Project in Kentucky.

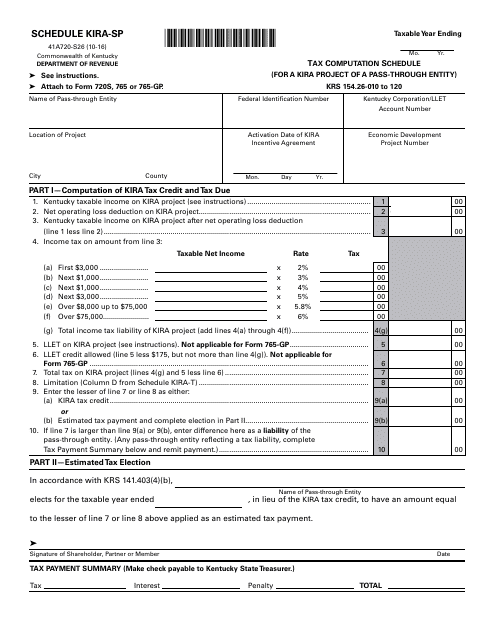

This form is used for calculating and reporting taxes for a Kira Project of a pass-through entity in Kentucky.

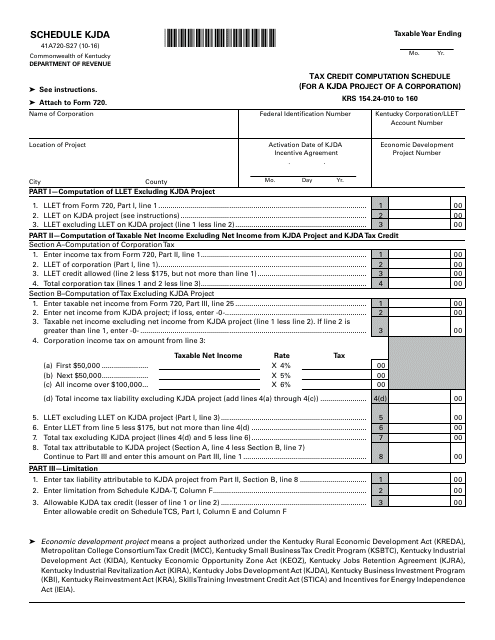

This form is used for calculating tax credits for a KJDA project of a corporation in Kentucky.

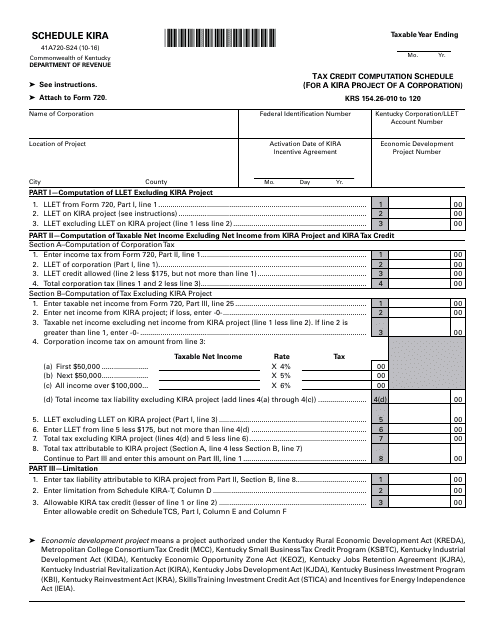

This form is used for tracking schedules related to a Kira project in the state of Kentucky.

This form is used for calculating tax credits for a Kira project of a corporation in Kentucky.

This Form is used for calculating tax for a Kida project of a pass-through entity in Kentucky.