Fill and Sign United States Legal Forms

Documents:

235709

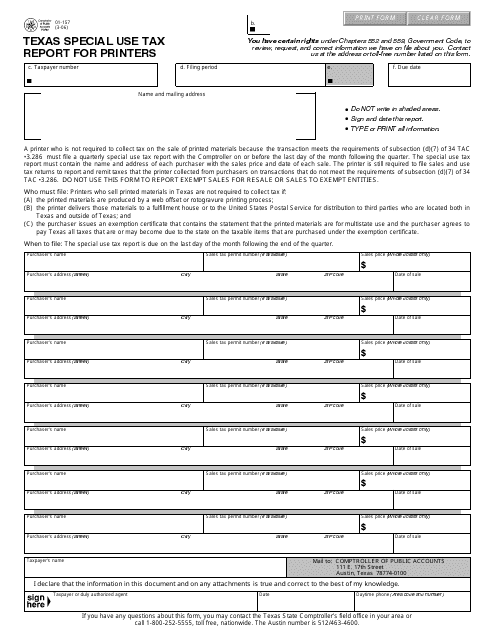

This form is used for reporting special use tax for printers in Texas.

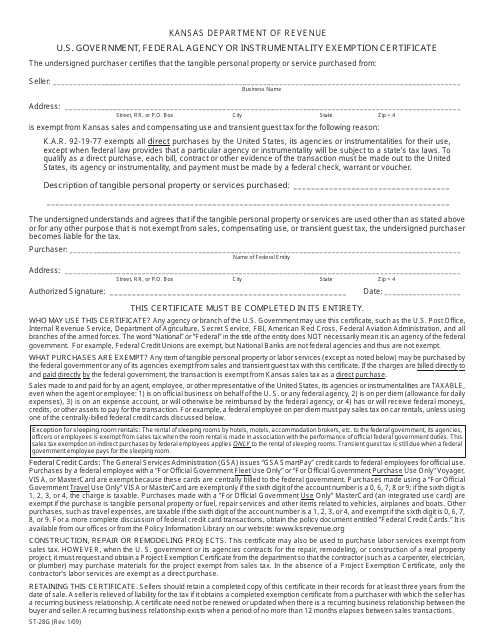

This Form is used for claiming exemption from sales tax for U.S. Government, Federal Agencies or Instrumentalities in the state of Kansas.

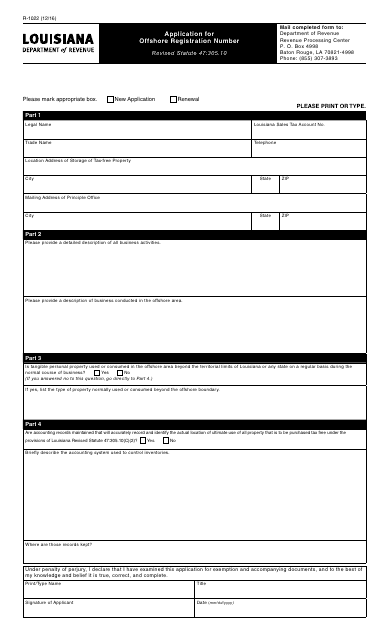

This form is used for applying for an offshore registration number in the state of Louisiana.

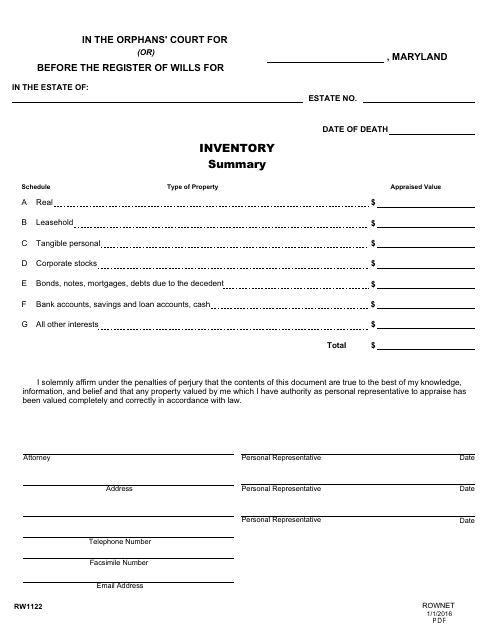

This Form is used for submitting an inventory summary and supporting schedule in the state of Maryland. It is used to provide a detailed breakdown of an organization's inventory holdings.

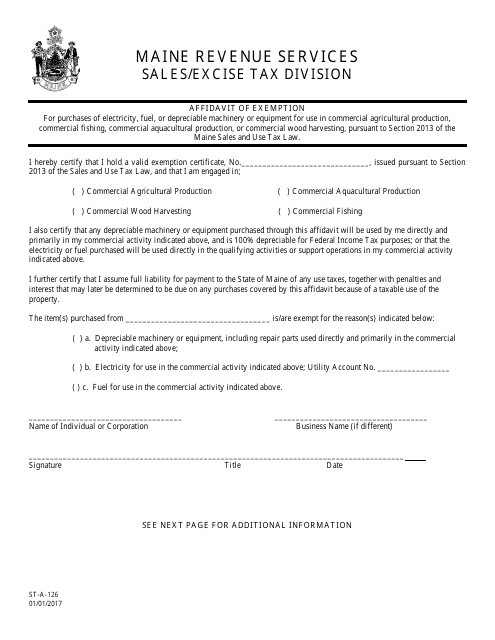

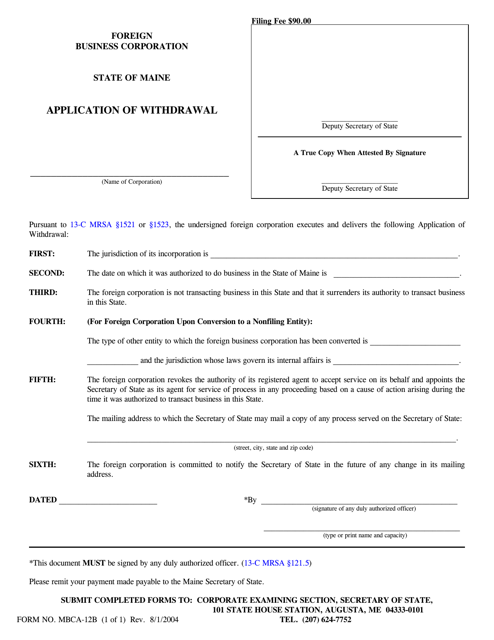

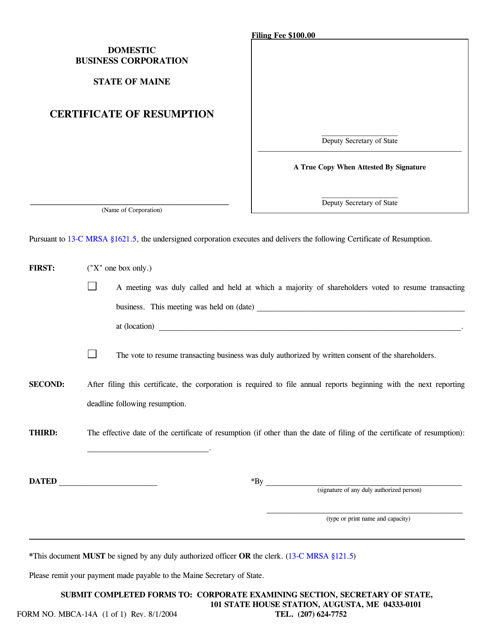

This form is used for claiming an exemption from certain requirements in the state of Maine.

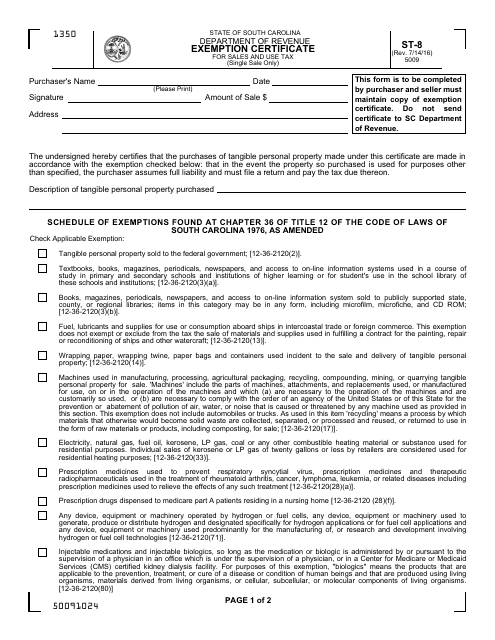

This form is used for requesting an exemption from sales and use tax in South Carolina. It is for individuals or businesses who qualify for certain exemptions.

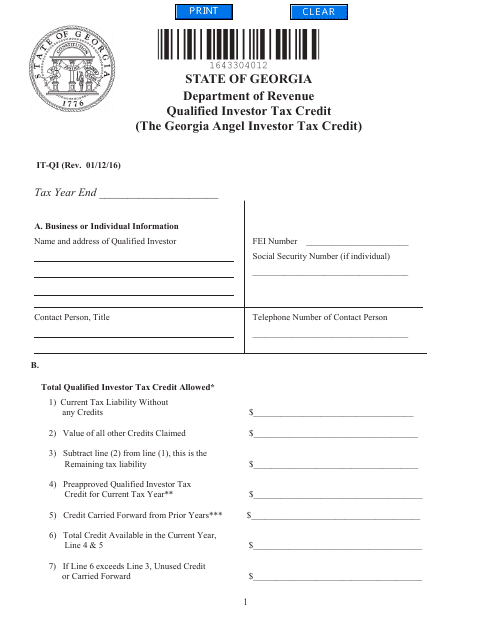

This form is used for claiming the Qualified Investor Tax Credit in the state of Georgia. Residents who meet the qualifying criteria can use this form to claim a tax credit for investing in certain businesses or projects.

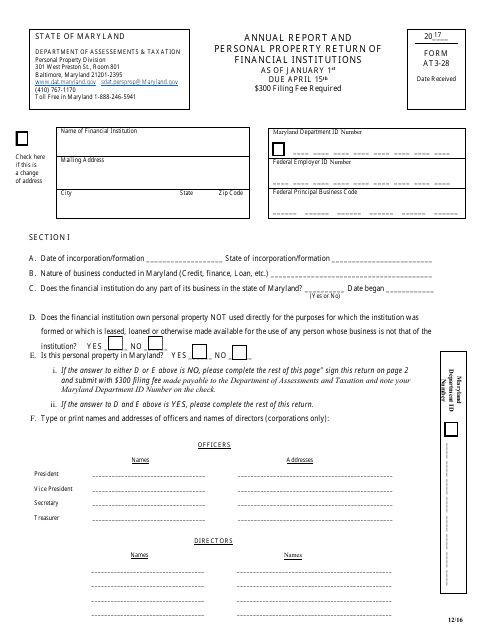

This Form is used for financial institutions in Maryland to file their annual report and personal property return.

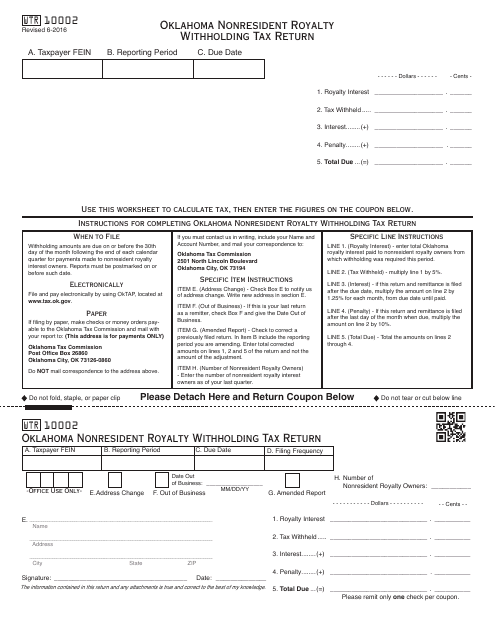

This form is used for reporting and paying nonresident royalty withholding taxes in Oklahoma. It applies to individuals or entities who receive royalty income from sources in Oklahoma but are not residents of the state.

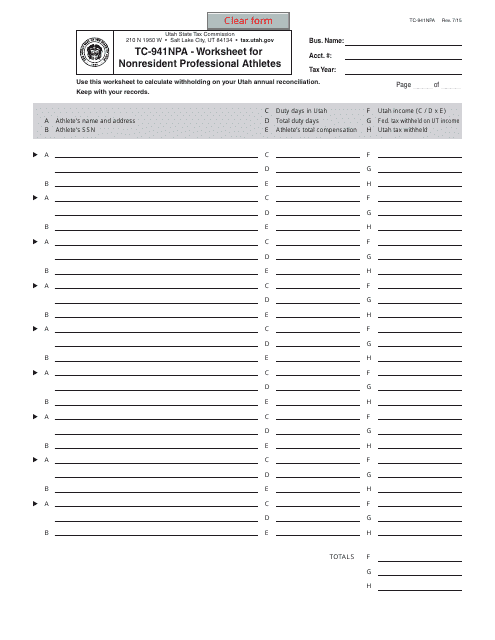

This form is used for nonresident professional athletes in Utah to calculate taxes owed.

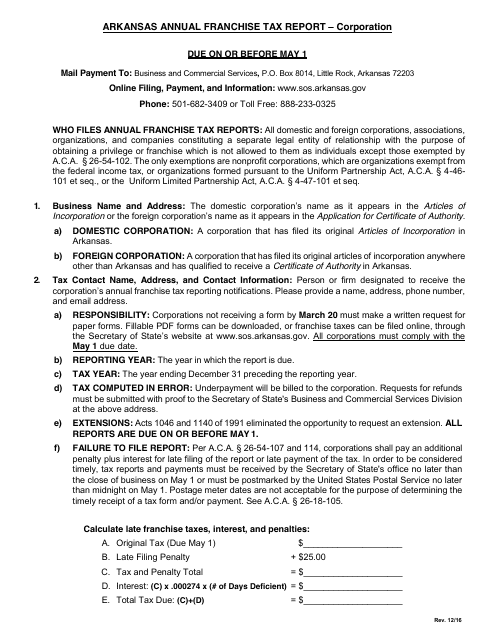

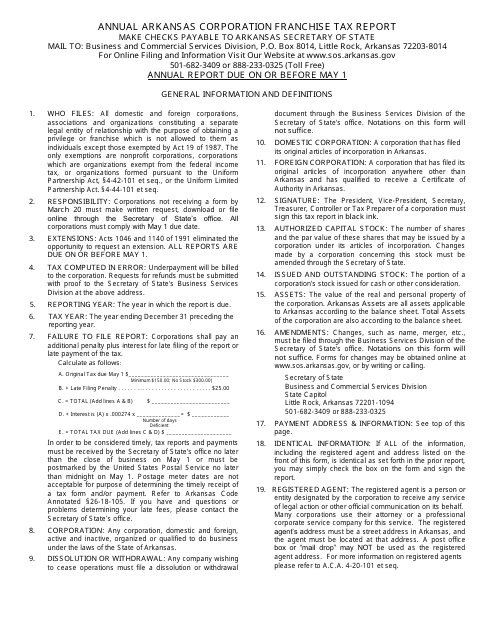

This document provides instructions for filling out the Annual Corporation Franchise Tax Report in Arkansas. It guides corporations on how to accurately report their taxes and includes step-by-step instructions for each section of the form.

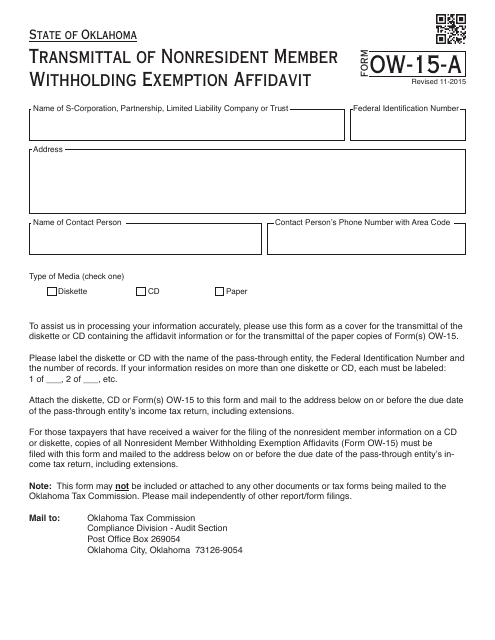

This document is used for transmitting the Nonresident Member Withholding Exemption Affidavit in Oklahoma.

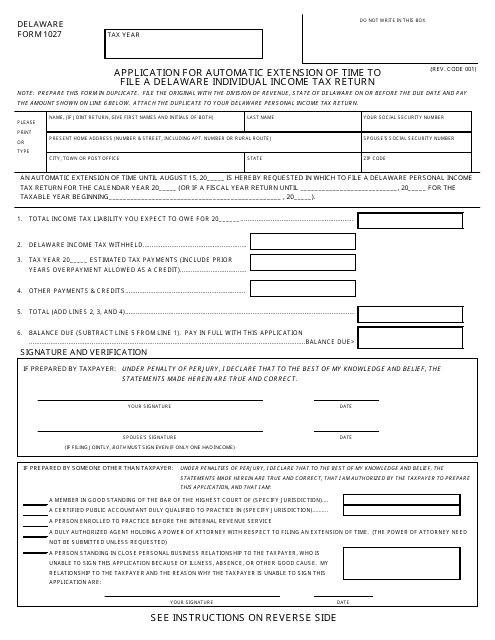

This Form is used for requesting an automatic extension of time to file a Delaware individual income tax return.

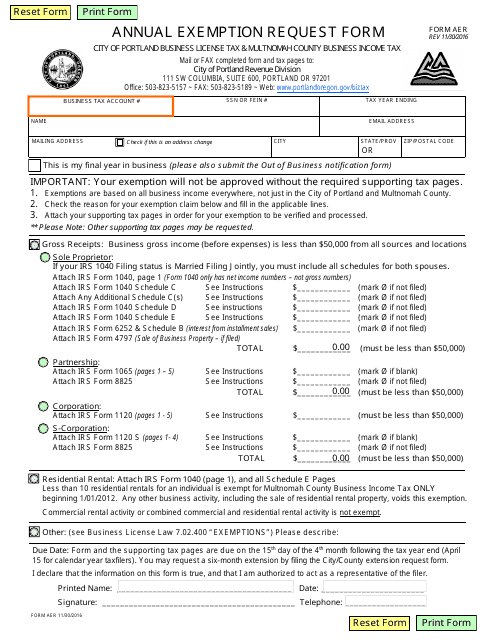

This Form is used for requesting an annual exemption from certain requirements in the City of Portland, Oregon.

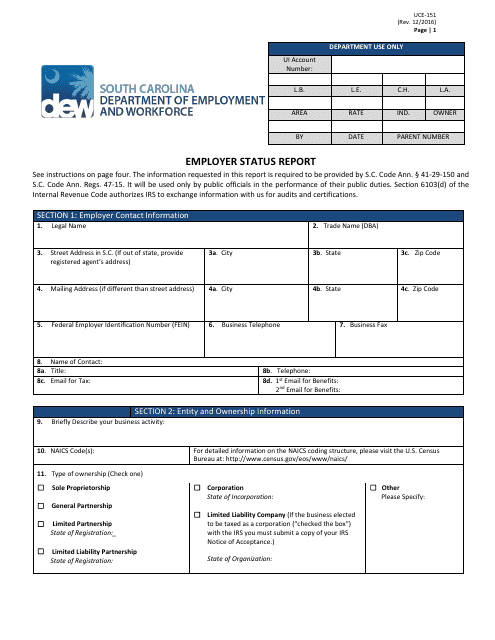

This form is used for employers in South Carolina to report their status.

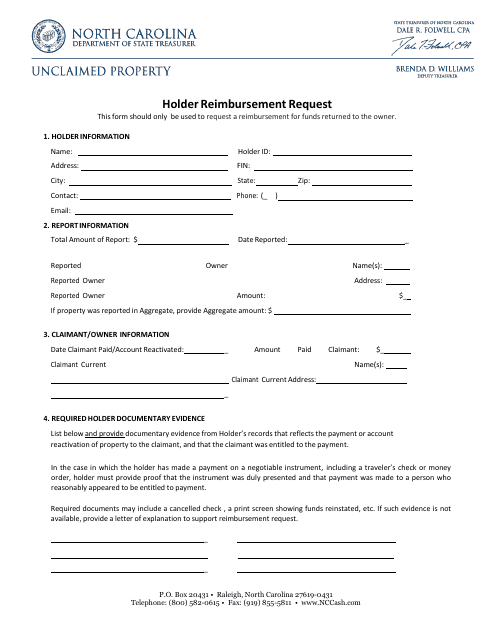

This form is used to request reimbursement for expenses incurred by the holder of a specific program in North Carolina.

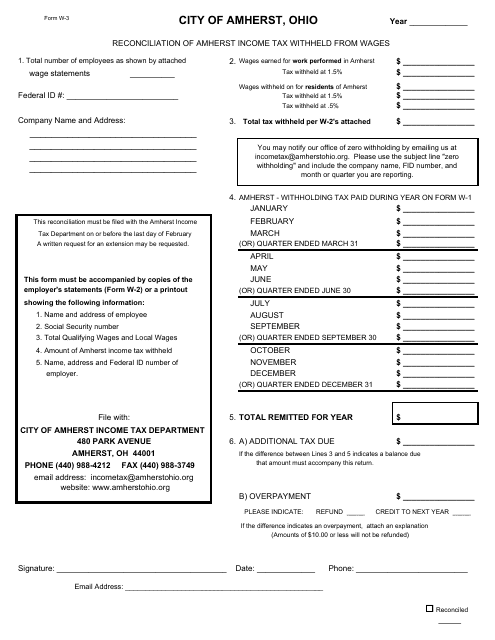

This type of document is used for reconciling the income tax withheld from wages in the city of Amherst, Ohio.

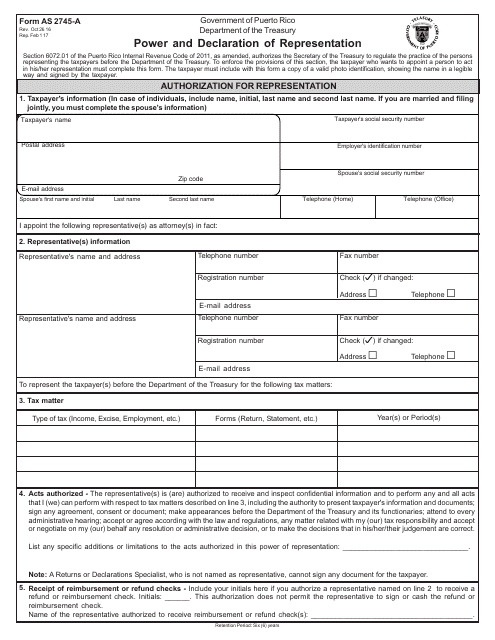

This Form is used for power and declaration of representation in Puerto Rico.

This type of document provides instructions on how to fill out the Annual Arkansas Corporation Franchise Tax Report for corporations in Arkansas. It explains the necessary steps and information required for completing the tax report accurately.

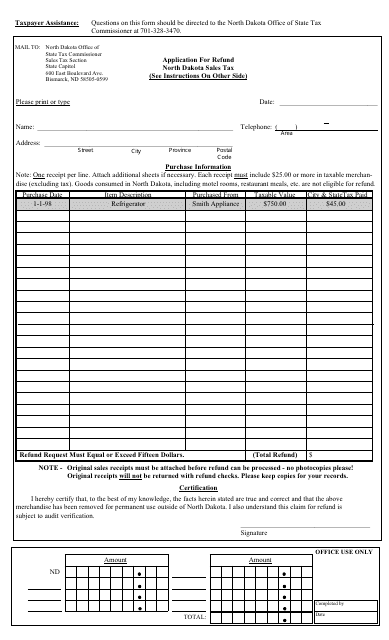

This Form is used for requesting a refund in the state of North Dakota.

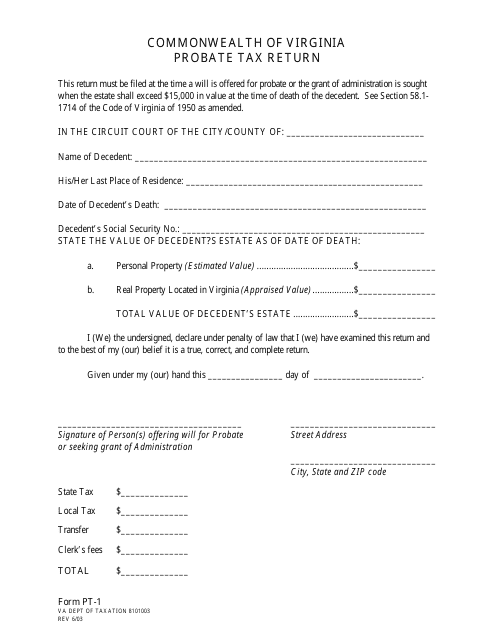

This form is used for filing the probate tax return in the state of Virginia. It is required when dealing with the estate and assets of a deceased individual.

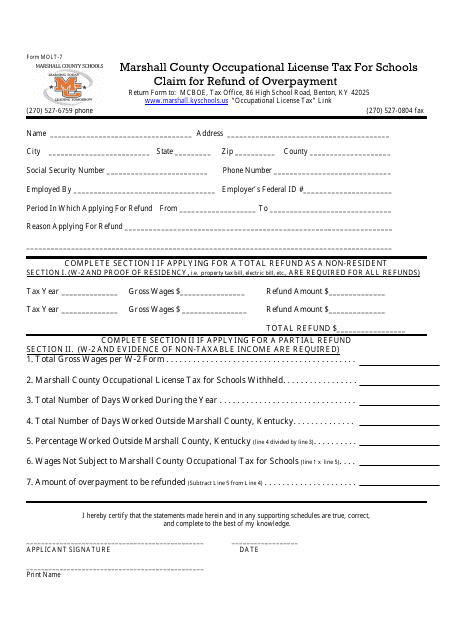

This form is used for residents of Marshall County, Kentucky to claim a refund of overpaid occupational license tax for schools.

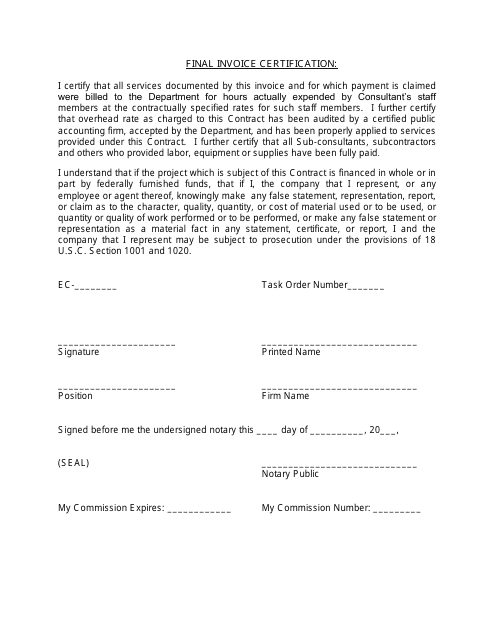

This form is used for certifying the final invoice in Oklahoma. It ensures that all the necessary information and documentation is provided to validate the completion of a business transaction.

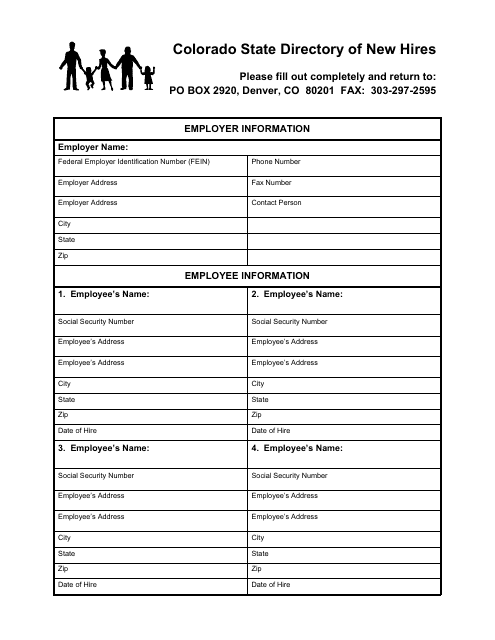

This form is used for collecting information about the employer in Colorado, including company name, address, and contact details.

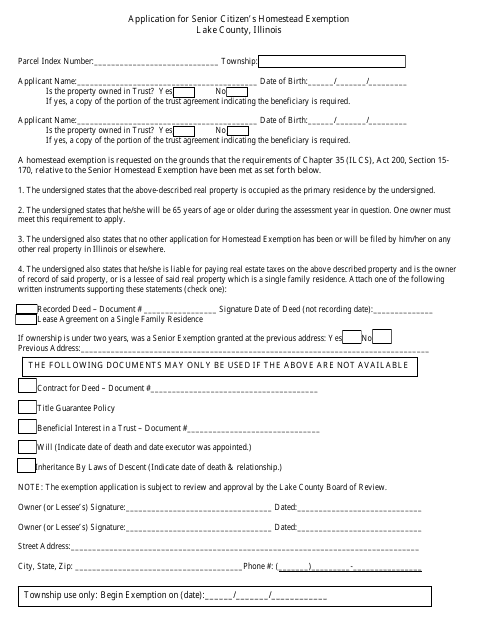

This document is an application for the Senior Citizen's Homestead Exemption in Lake County, Illinois. The exemption offers a reduction in property taxes for qualifying senior citizens. Complete this application to apply for the exemption.

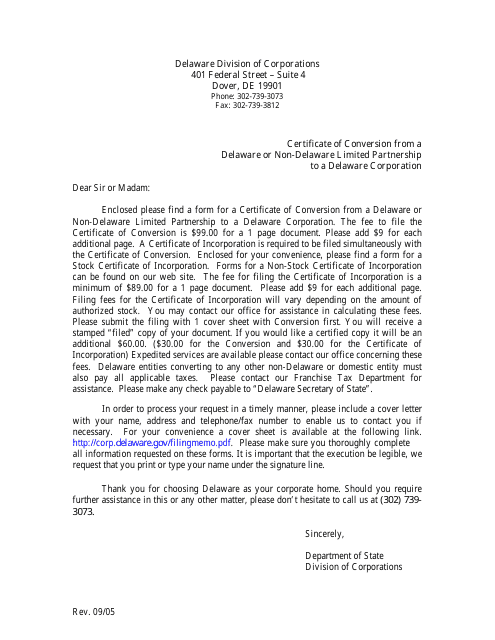

This document is used for converting a Delaware or non-Delaware limited partnership into a Delaware corporation.

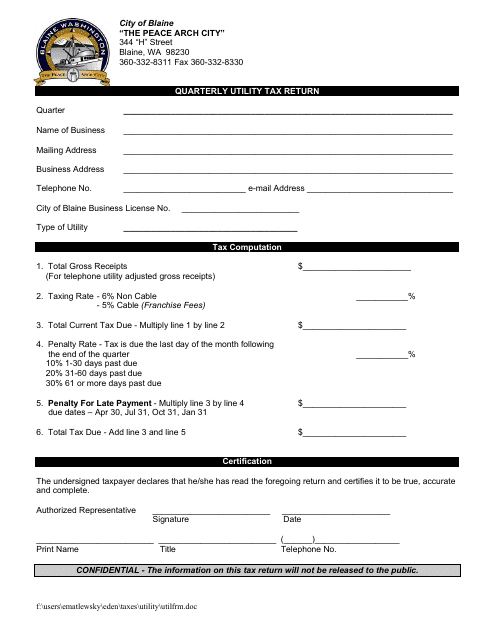

This Form is used for reporting and paying the utility tax owed to the City of Blaine, Washington on a quarterly basis.

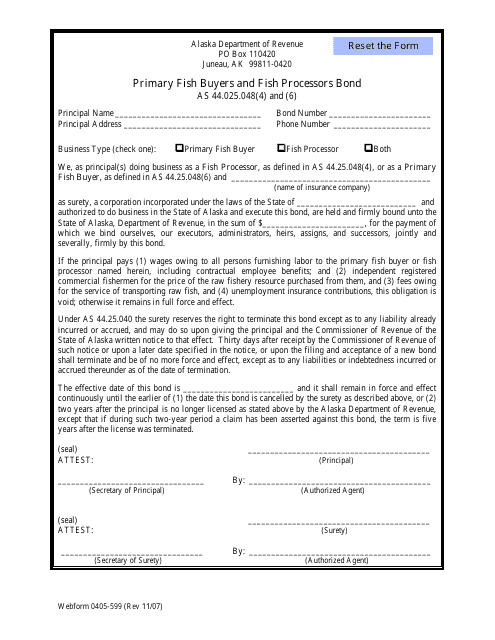

This form is used for obtaining a bond for primary fish buyers and fish processors in Alaska. It is a requirement for those involved in the fishing industry to ensure compliance with regulations and protect the interests of stakeholders.

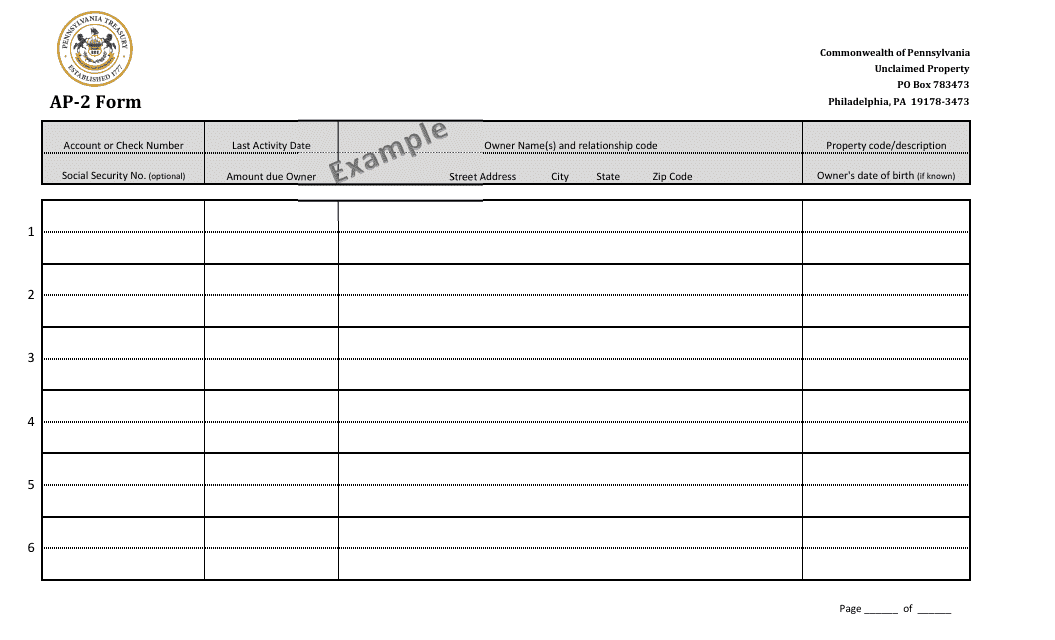

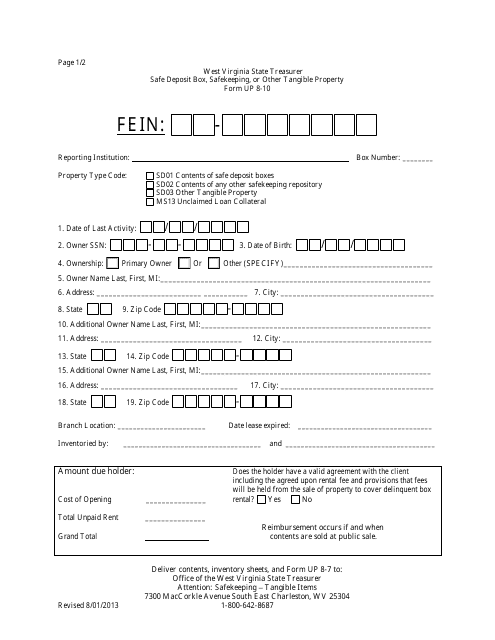

This form is used for reporting safe deposit boxes, safekeeping, or other tangible property in West Virginia.

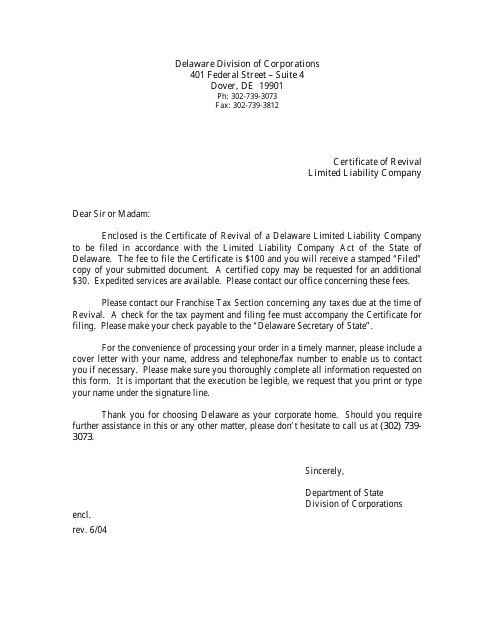

This document is used for reviving a Delaware Limited Liability Company that has been inactive or administratively dissolved. It confirms the restoration of the company's legal status.