Fill and Sign United States Legal Forms

Documents:

235709

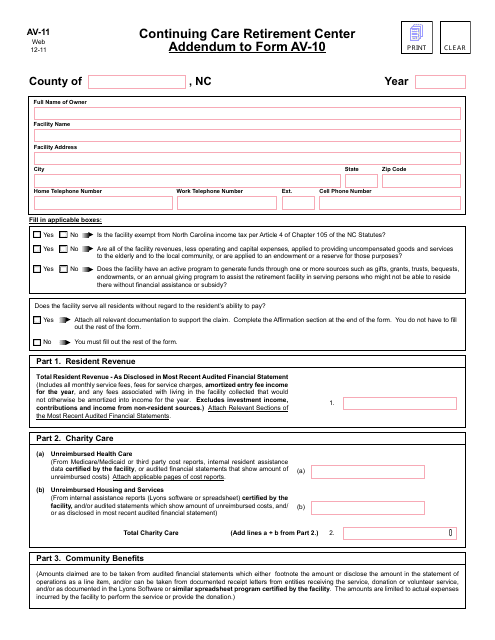

This form is used as an addendum to Form AV-10 for Continuing Care Retirement Centers in North Carolina.

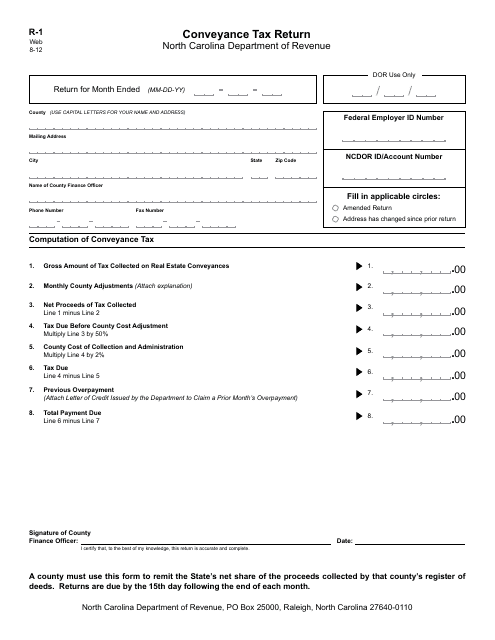

This Form is used for filing a Conveyance Tax Return in North Carolina.

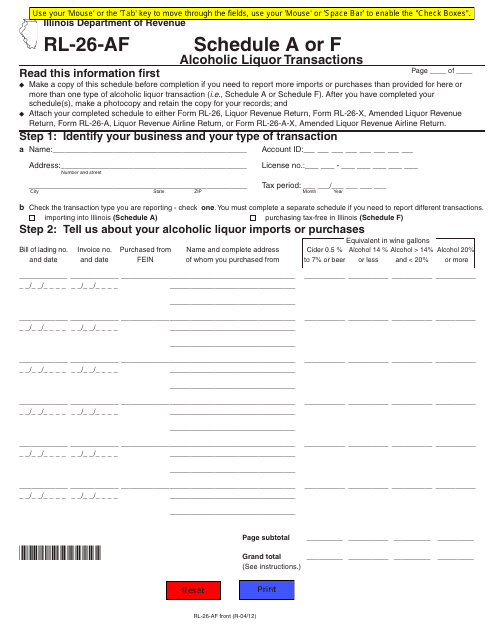

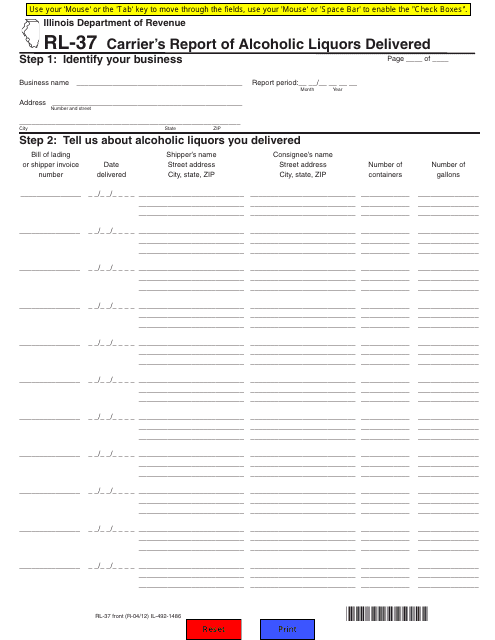

This form is used for reporting alcoholic liquor transactions in Illinois.

This form is used for Illinois carriers to report the delivery of alcoholic liquors. It is a required document for compliance purposes.

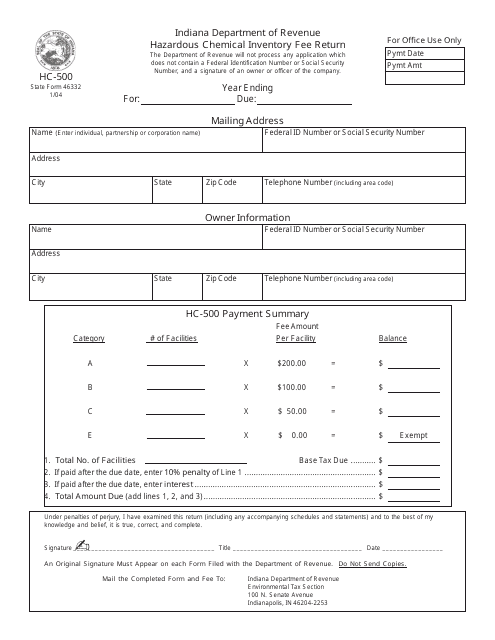

This Form is used for reporting and paying hazardous chemical inventory fees in the state of Indiana.

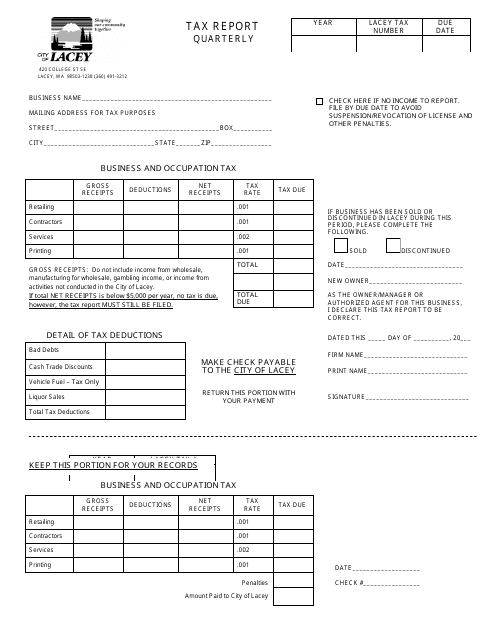

This document is a tax report for the City of Lacey, Washington on a quarterly basis. It is used to report and pay taxes owed to the city.

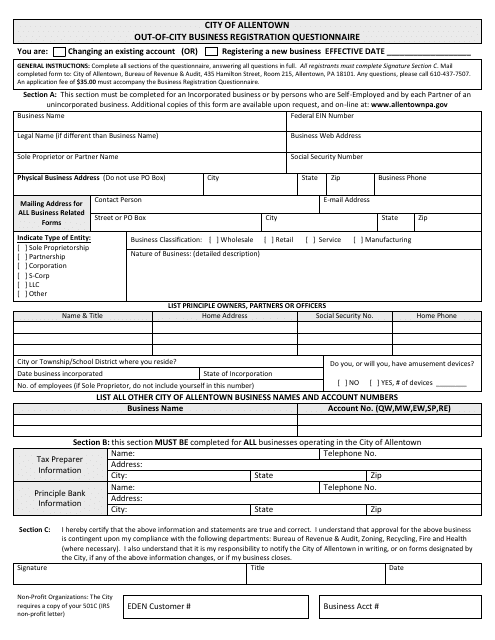

This document is a questionnaire that needs to be filled out by businesses located outside of Allentown, Pennsylvania that want to register with the city.

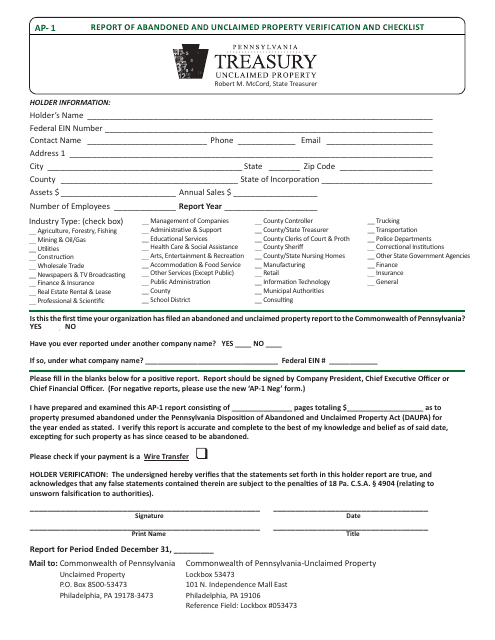

This document is for verifying and checking abandoned and unclaimed property in Pennsylvania. It is used to report and track properties that have been abandoned or left unclaimed.

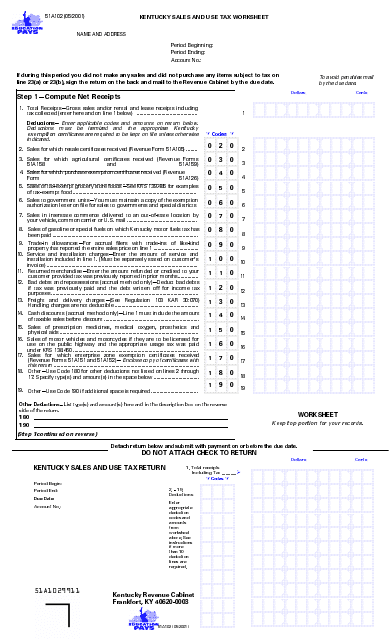

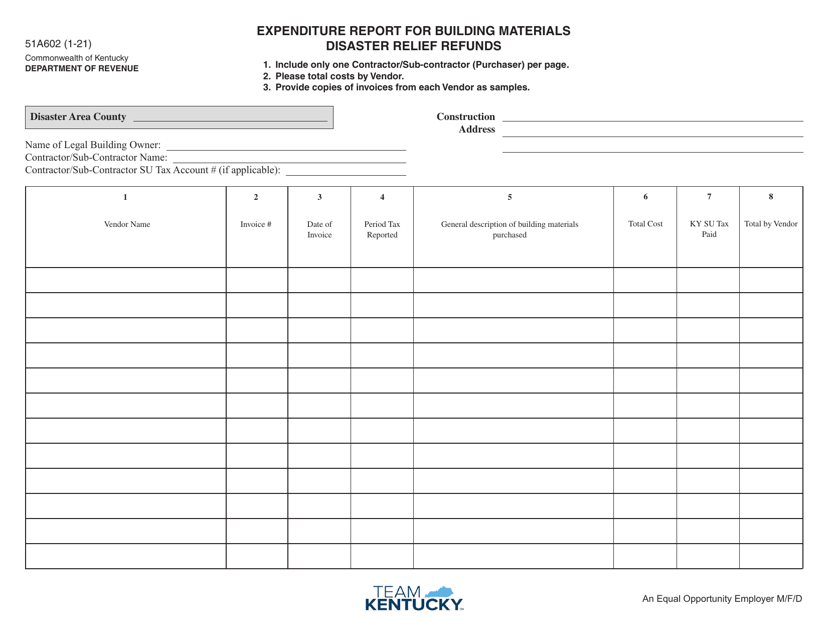

This Form is used for calculating sales and use tax in the state of Kentucky. It helps individuals and businesses determine the amount of tax owed based on their sales and use of taxable items.

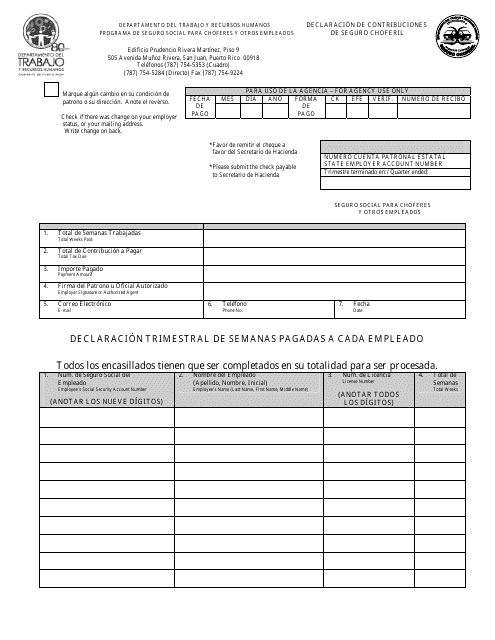

This document is for declaring driver's insurance contributions in Puerto Rico.

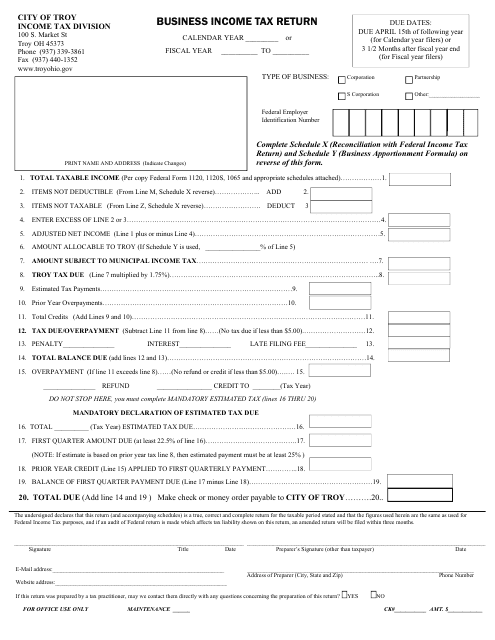

This document is used for filing your business income tax return specifically for the City of Troy, Ohio. It is required for businesses operating within the city to report their income and pay the appropriate taxes.

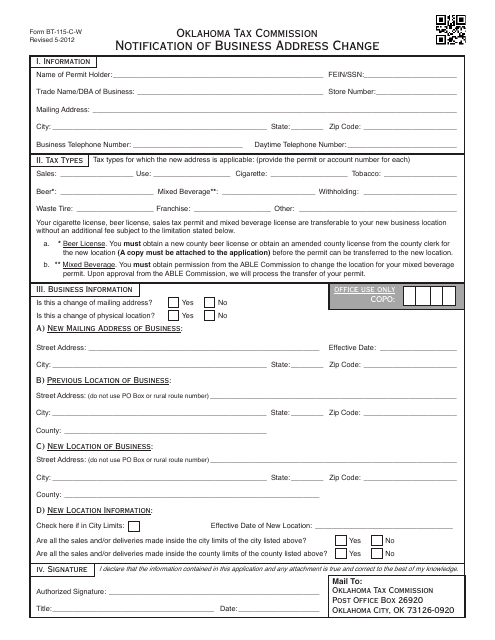

This form is used for notifying the Oklahoma Tax Commission of a change in business address.

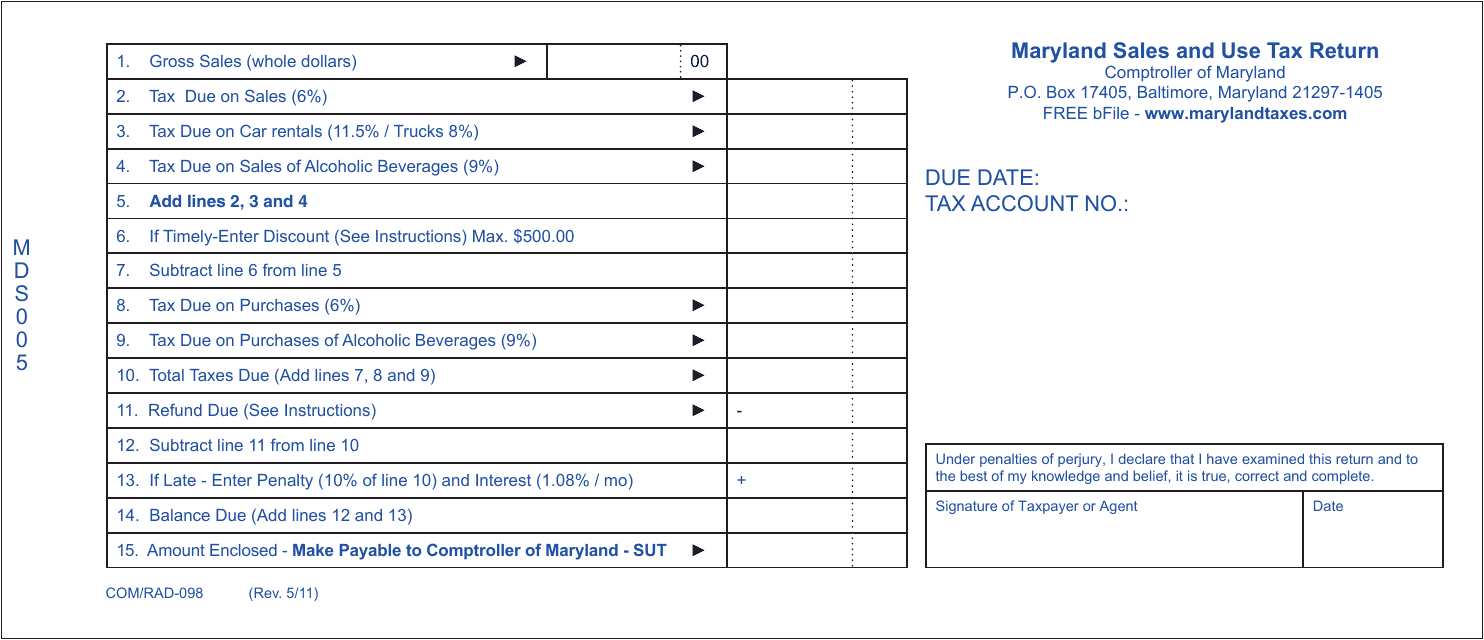

This form is used for reporting sales and use tax in the state of Maryland. It is used by businesses to calculate and pay their tax obligations related to sales of goods and services.

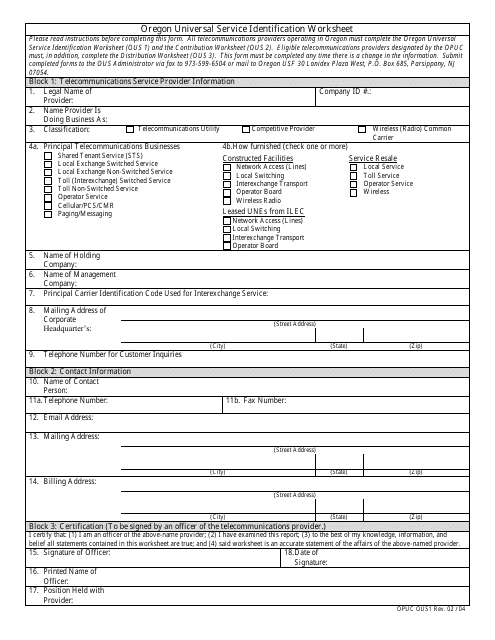

This Form is used for identifying universal service in Oregon.

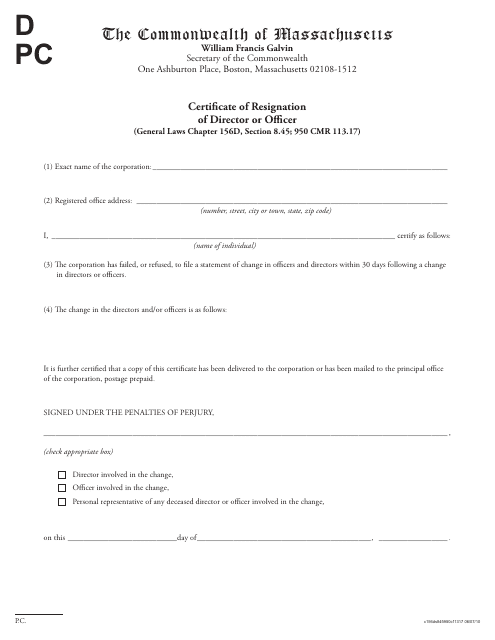

This document is used for officially resigning a director or officer position in Massachusetts. It certifies that an individual has stepped down from their role in a company or organization.

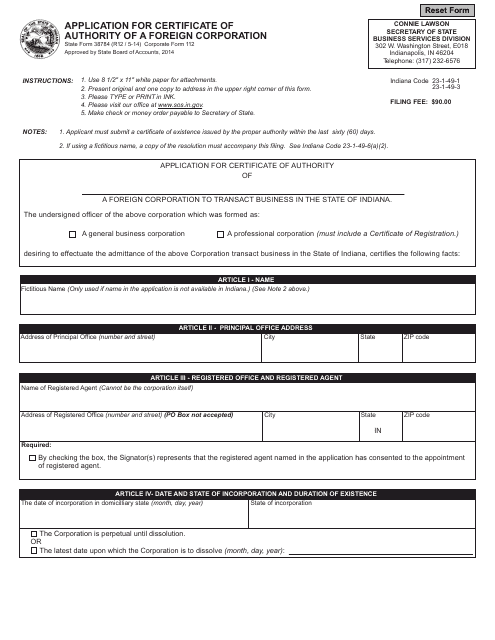

This form is used for foreign corporations to apply for a certificate of authority in the state of Indiana. It is also known as Corporate Form 112.

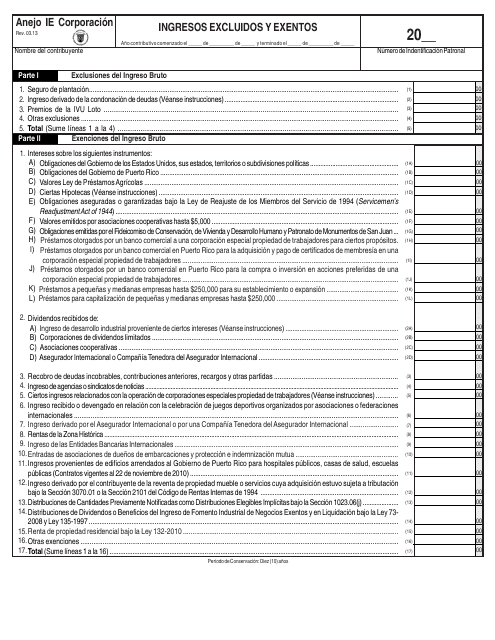

This document is for the inclusion and exemption of excluded and exempted income for corporations in Puerto Rico.

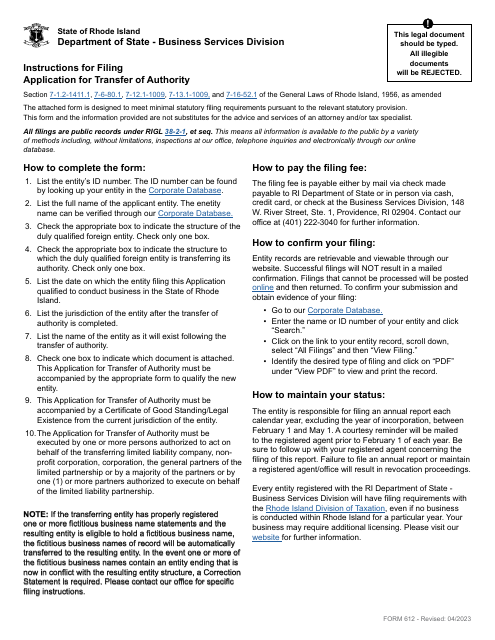

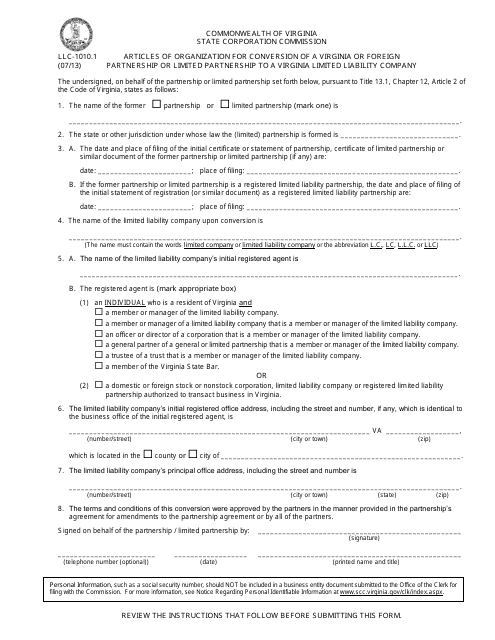

This Form is used for converting a partnership or limited partnership to a Virginia Limited Liability Company (LLC) in Virginia.

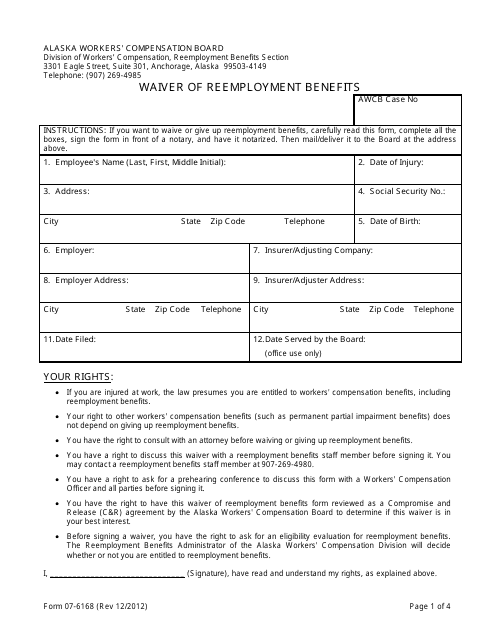

This form is used for waiving reemployment benefits in Alaska.

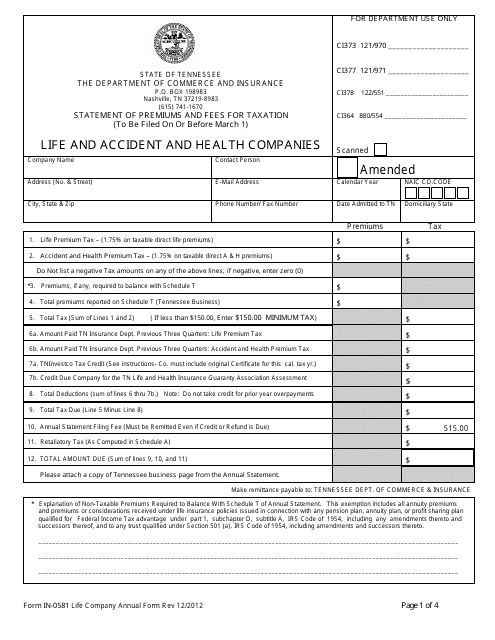

This form is used for reporting premiums and fees for taxation purposes by life and accident and health insurance companies in Tennessee.

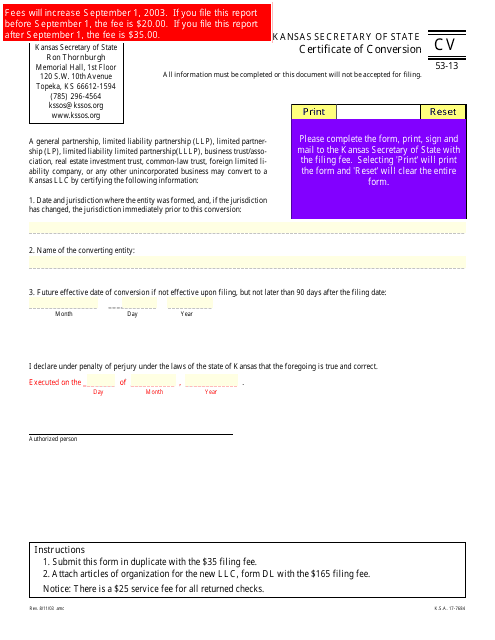

This form is used for converting a business entity into a different type of entity in the state of Kansas. It is known as the Certificate of Conversion.

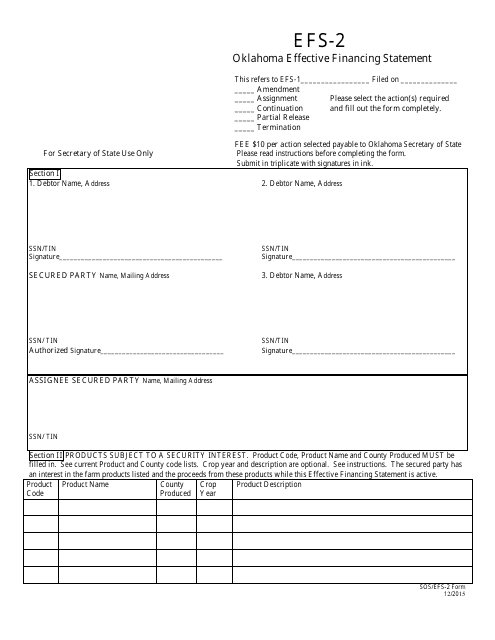

This form is used for filing an Effective Financing Statement (EFS) in the state of Oklahoma. It serves as a legal document to provide notice of a security interest in personal property.

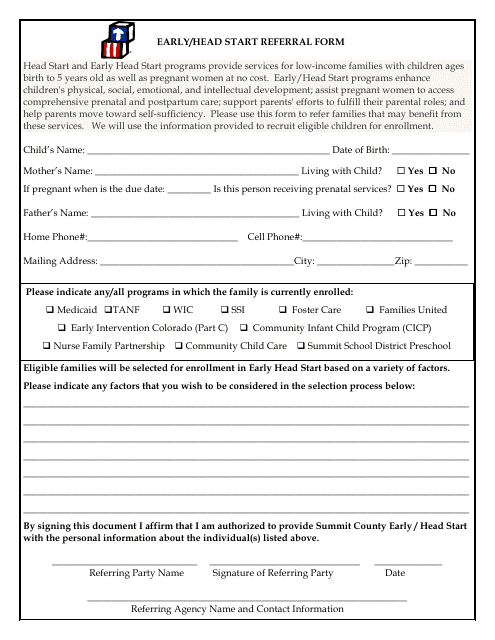

This Form is used for referring children to the Early/Head Start program for early childhood education and development opportunities.

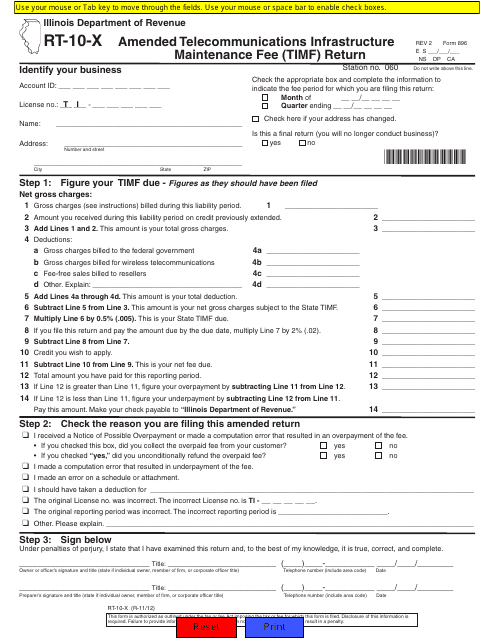

This Form is used for filing an amended return for the Telecommunications Infrastructure Maintenance Fee (TIMF) in Illinois. It is designated as Form RT-10-X (896).

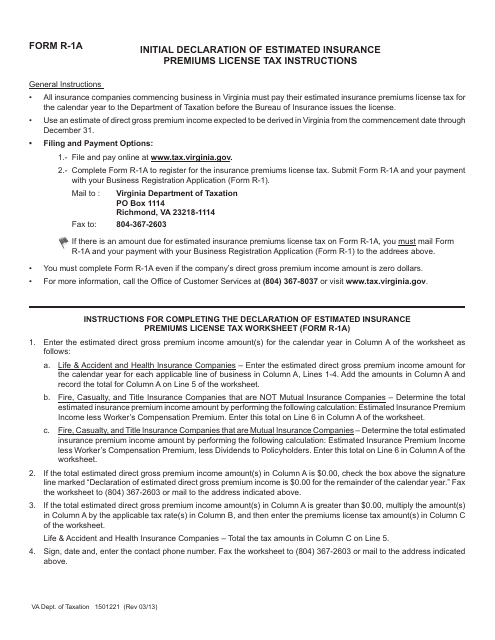

This form is used for the initial declaration of estimated insurance premiums license tax in the state of Virginia.

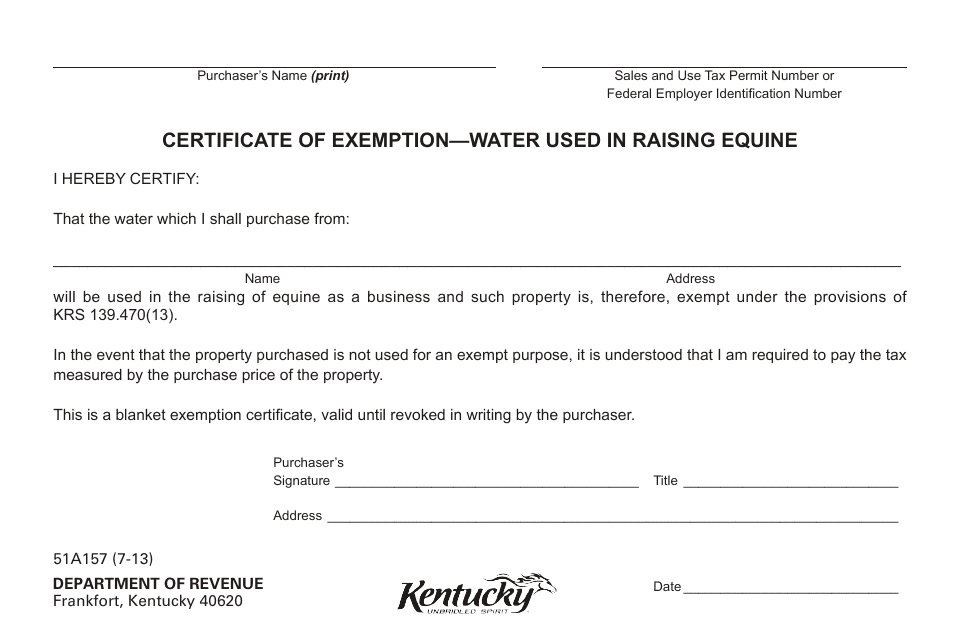

This form is used for applying for a Certificate of Exemption to exempt the water used in raising equine from the water withdrawal reporting requirements in Kentucky.

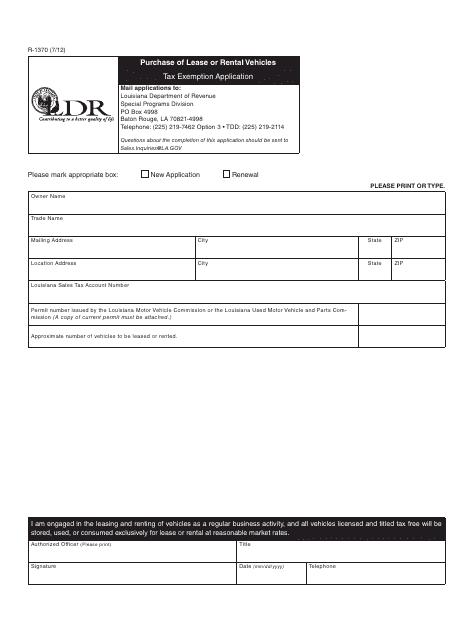

This form is used for applying for a tax exemption on the purchase of lease or rental vehicles in the state of Louisiana.

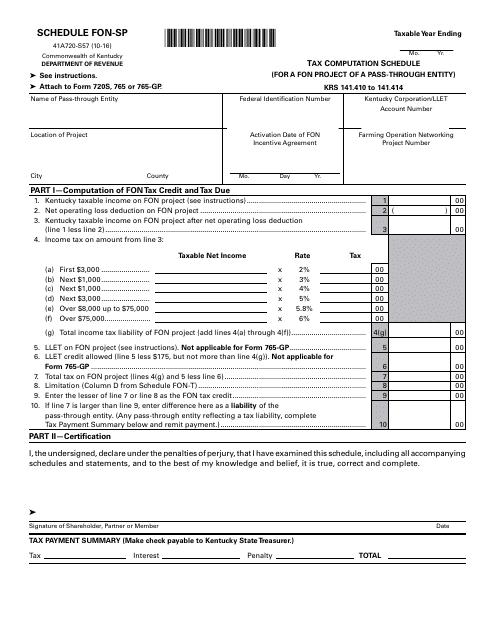

This Form is used for calculating tax for a Fon project of a pass-through entity in Kentucky.

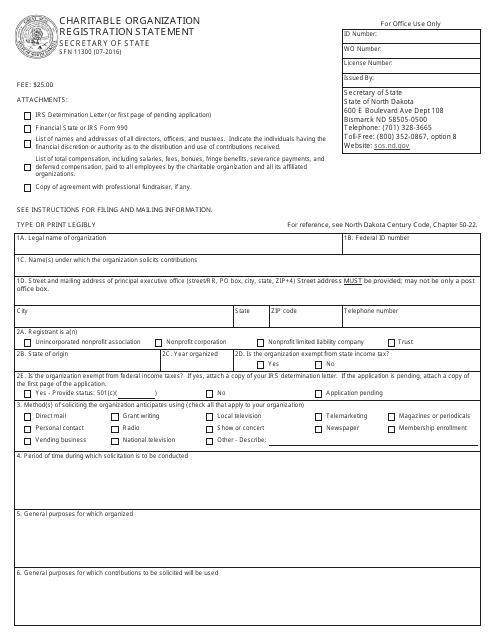

This form is used for registering a charitable organization in North Dakota.

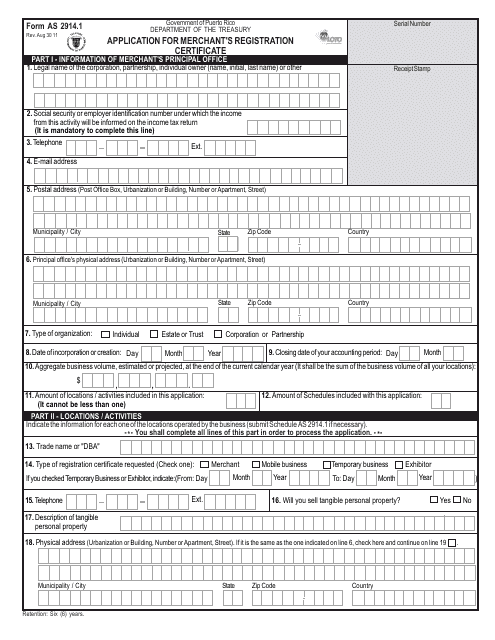

This form is used for applying for a Merchant's Registration Certificate in Puerto Rico. It is required for individuals or businesses engaging in commercial activities on the island.

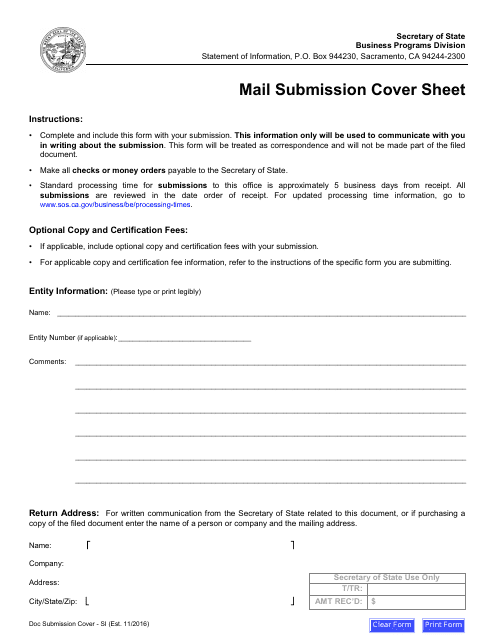

This document is used for submitting mail in California and includes a cover sheet for easy identification and organization.

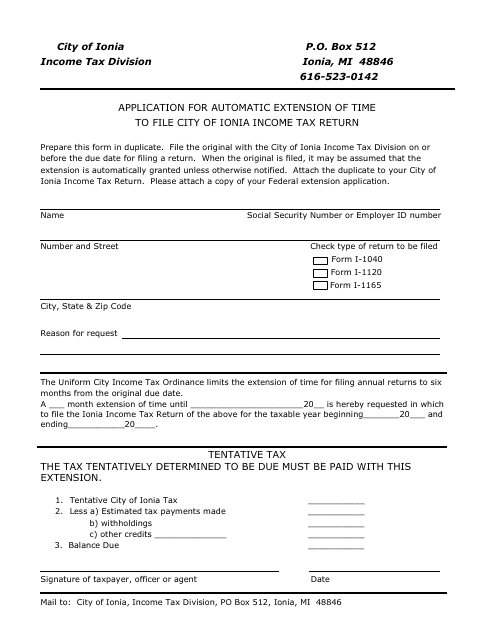

This Form is used for requesting an automatic extension of time to file your City of Ionia income tax return in Michigan.