Tax Exempt Form Templates

Documents:

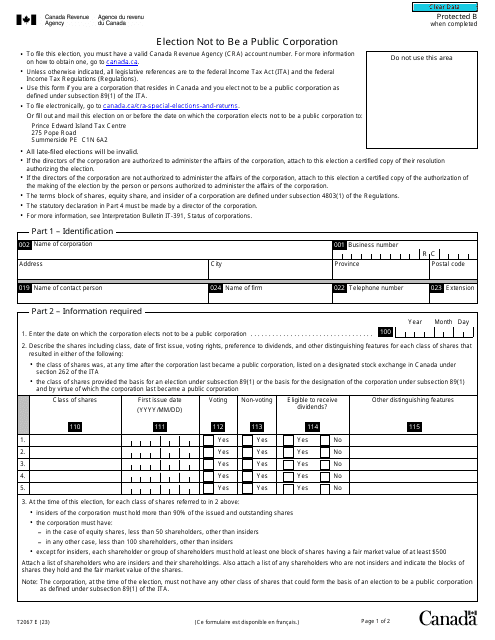

1303

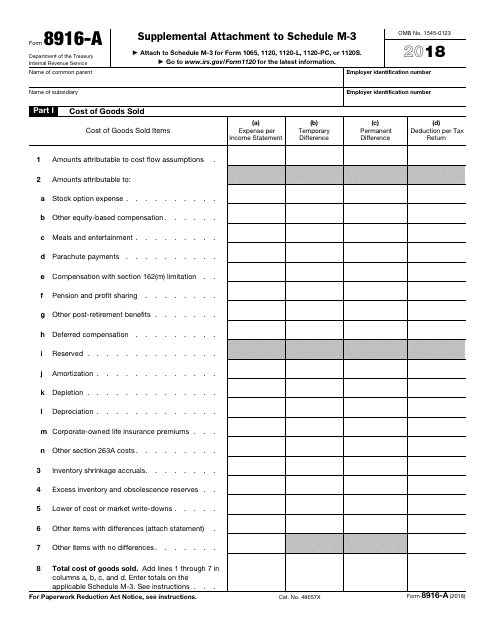

This form is used for providing additional information and attachments to the Schedule M-3 when filing taxes with the IRS.

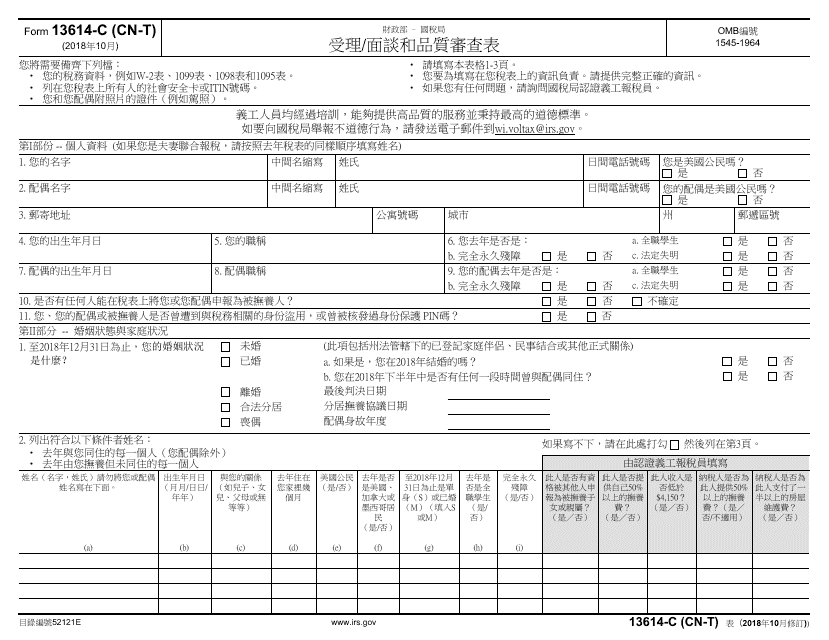

This form is used for the intake, interview, and quality review process conducted by the IRS. It is specifically designed for Chinese individuals or those who prefer to use Chinese language.

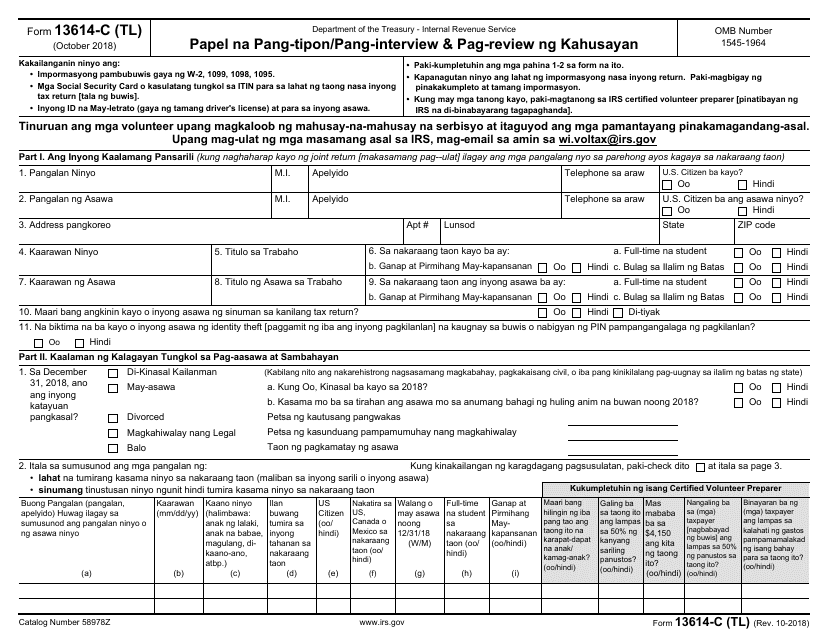

This document is for individuals who speak Tagalog and need assistance with their tax intake process. It is used to gather information about the taxpayer's financial situation for the IRS.

This document is for nonresident aliens with no dependents who need to file their U.S. income tax return. It provides instructions on how to complete IRS Form 1040NR-EZ.

This document is used for reporting contributions of motor vehicles, boats, and airplanes to qualifying organizations.

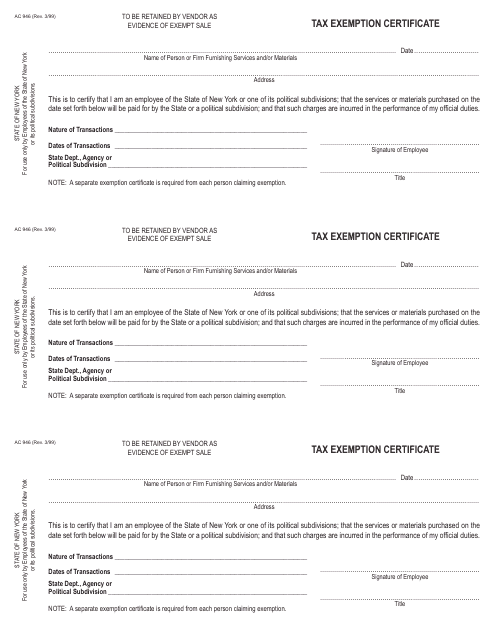

This type of document is used for obtaining tax exemption in New York.

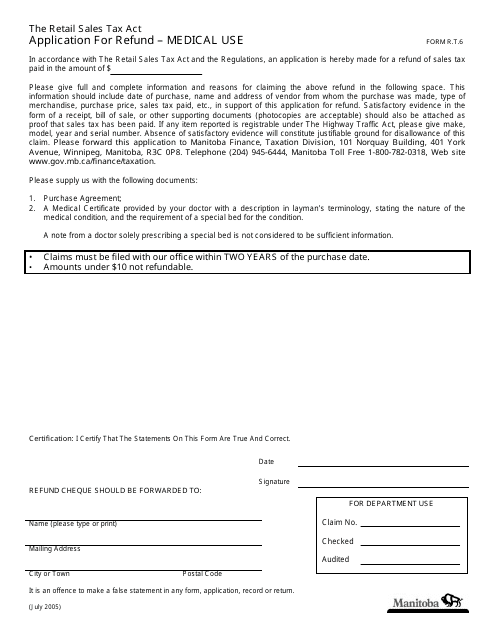

This form is used for applying for a refund for medical expenses in Manitoba, Canada. It is specifically for individuals who have purchased medical supplies or equipment for their medical use and are seeking reimbursement from the government.

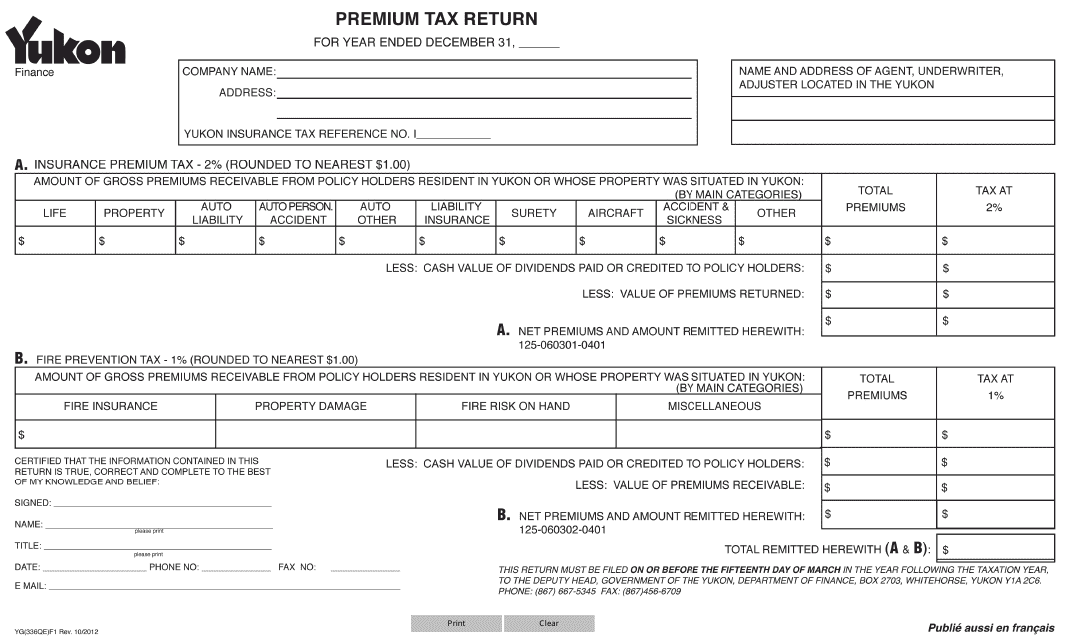

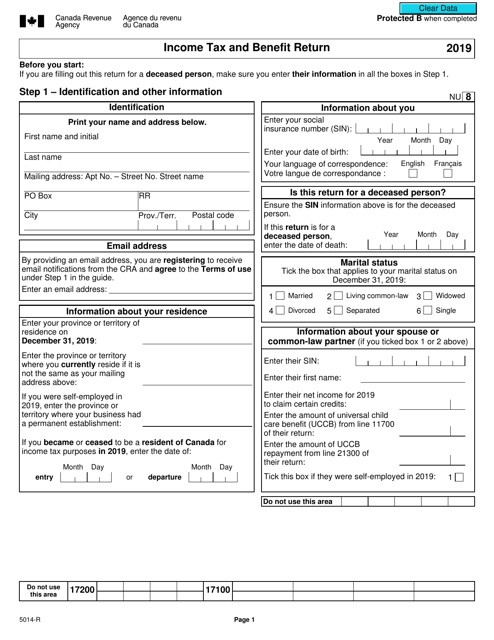

This form is used for filing premium tax returns in Yukon, Canada.

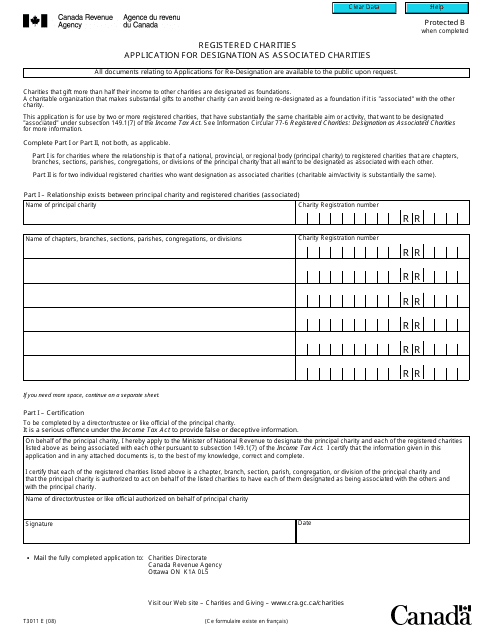

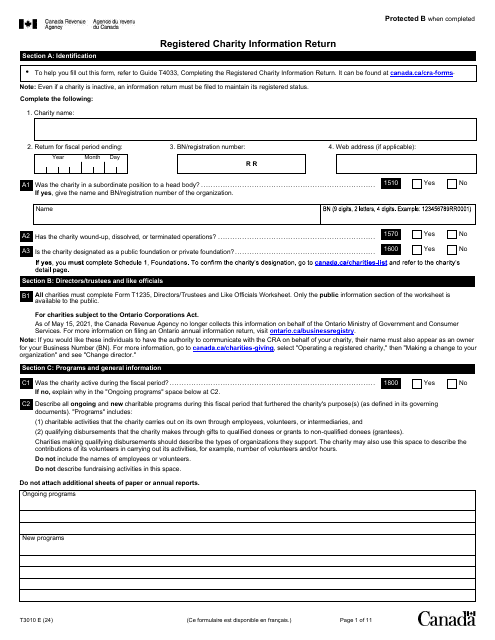

This form is used for applying for designation as associated charities in Canada.

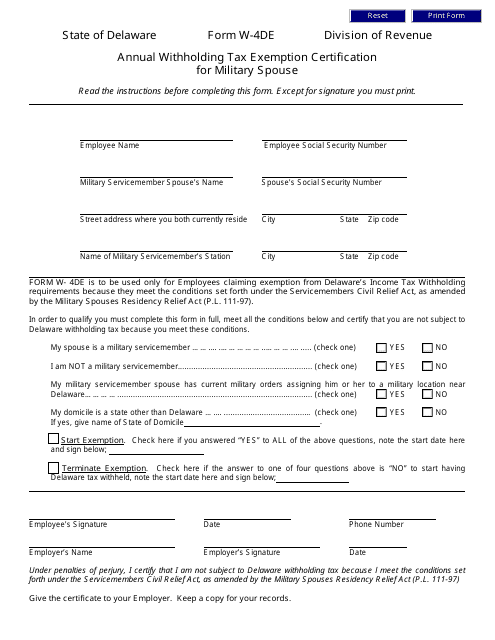

This document is used to certify tax exemption for military spouses in Delaware. It helps determine the amount of federal income tax to be withheld from their paychecks.

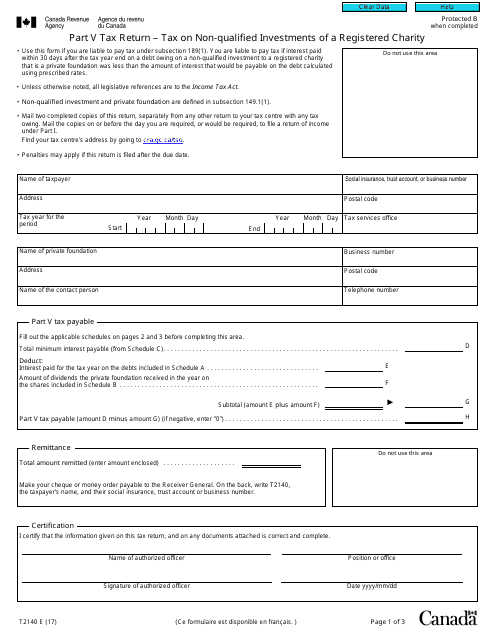

This form is used for reporting and paying taxes on non-qualified investments made by a registered charity in Canada.

This form is used for calculating the tax on payments made to the Canadian government by a tax-exempt individual or organization.

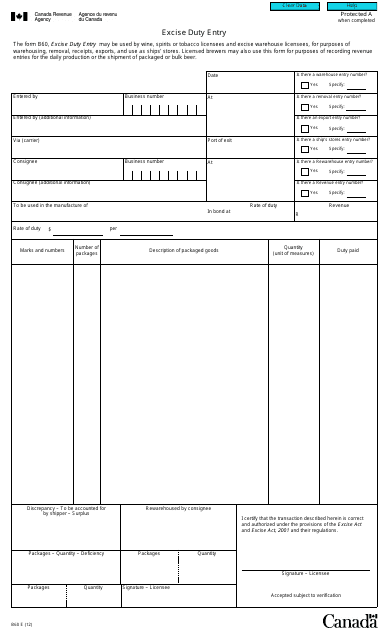

This Form is used for reporting and paying excise duty in Canada. Excise duty is a tax imposed on certain goods, such as tobacco, alcohol, and gasoline, produced or imported into the country. The B60 form is used to provide details of the goods subject to excise duty and calculate the amount owed.

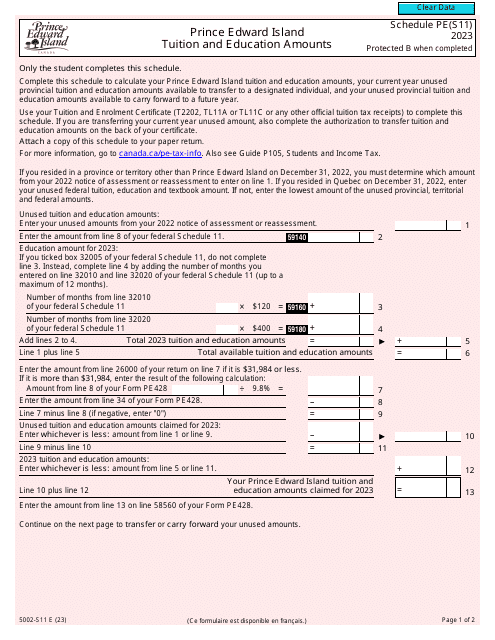

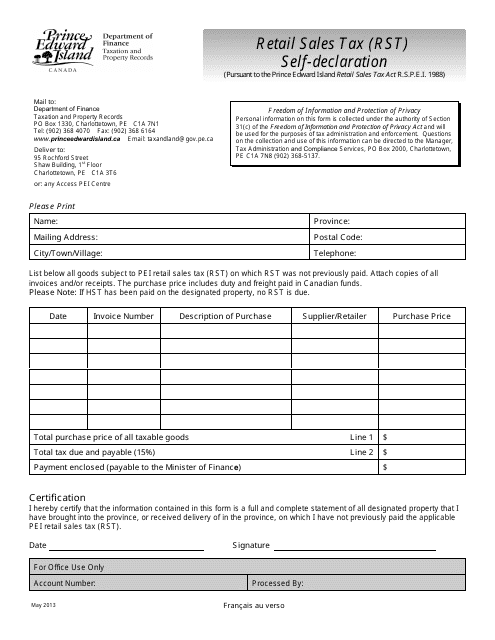

This document is used for self-declaration of Retail Sales Tax (RST) in Prince Edward Island, Canada. It pertains to businesses reporting and paying their retail sales tax obligations to the provincial government.

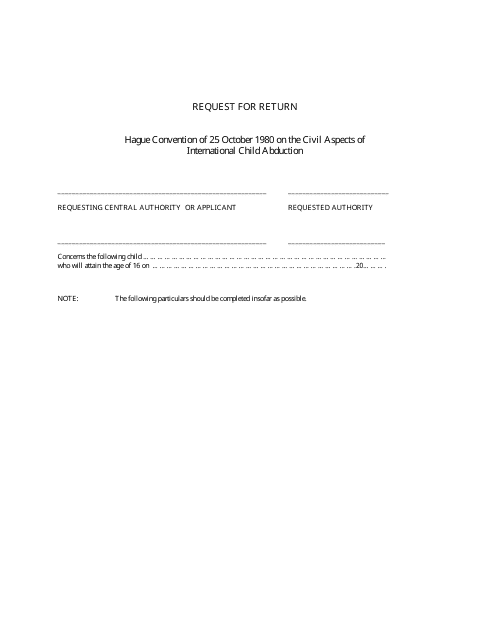

This document is used to request a return in the province of Saskatchewan, Canada.

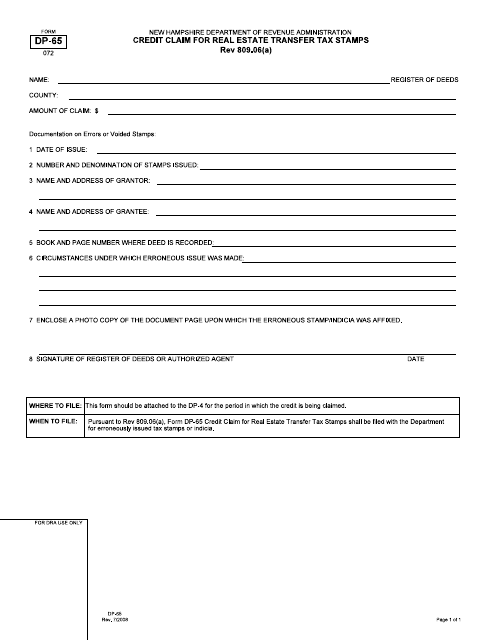

This form is used for claiming credit for real estate transfer tax stamps in New Hampshire.

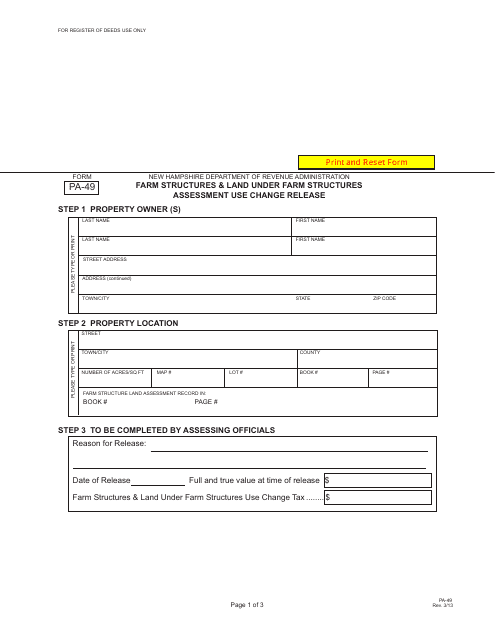

This form is used for releasing the use change of farm structures and land under farm structures assessment in the state of New Hampshire.