Tax Exempt Form Templates

Documents:

1303

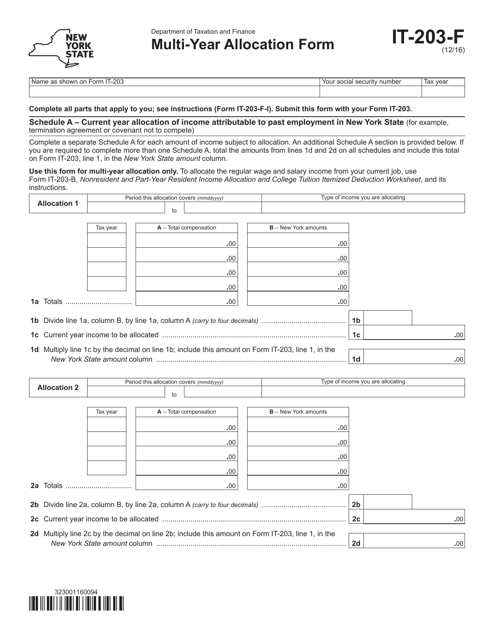

This Form is used for allocating income and deductions for multiple years in New York.

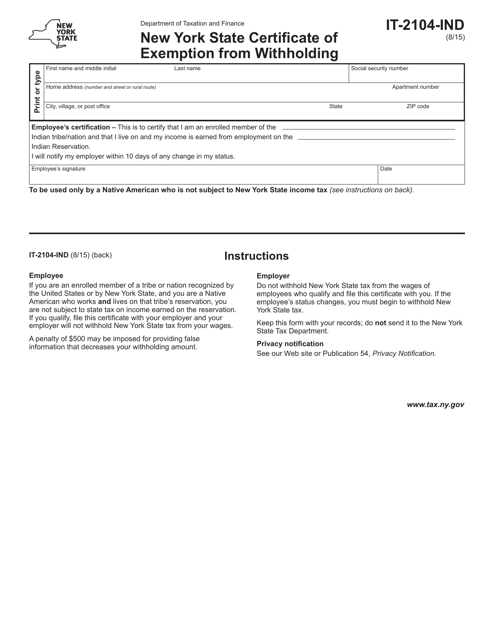

This Form is used for exempting individuals in New York State from income tax withholding. Individuals can use this form to claim an exemption from having taxes withheld from their wages.

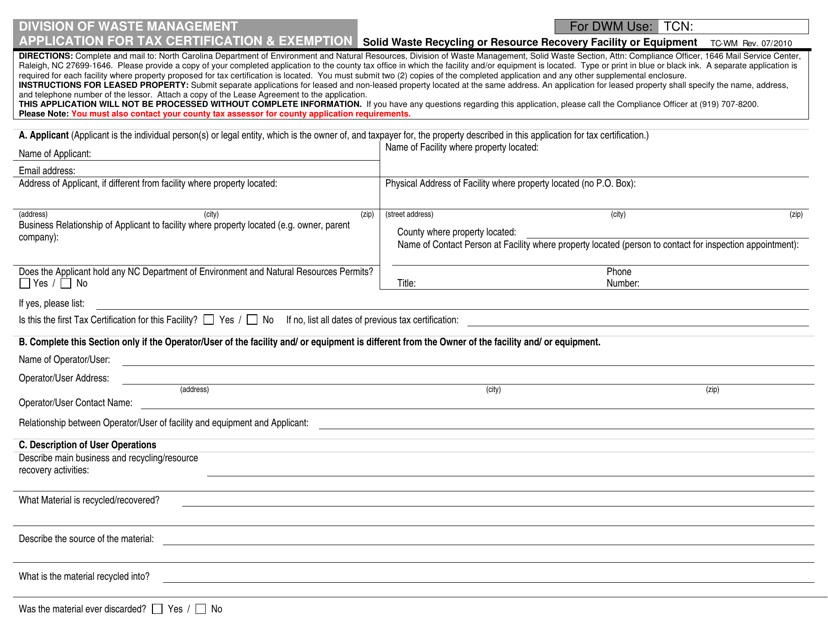

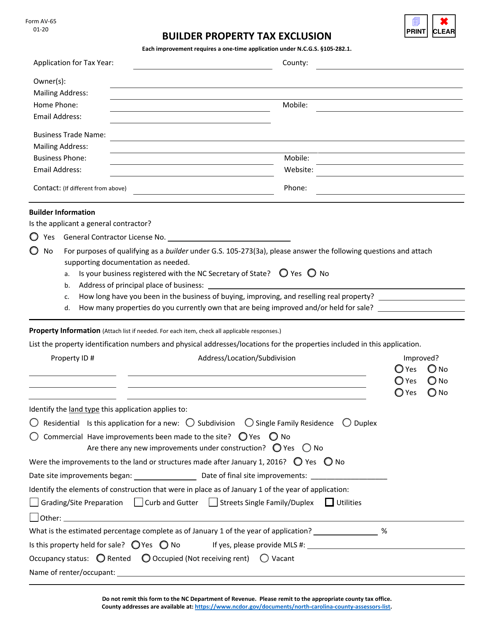

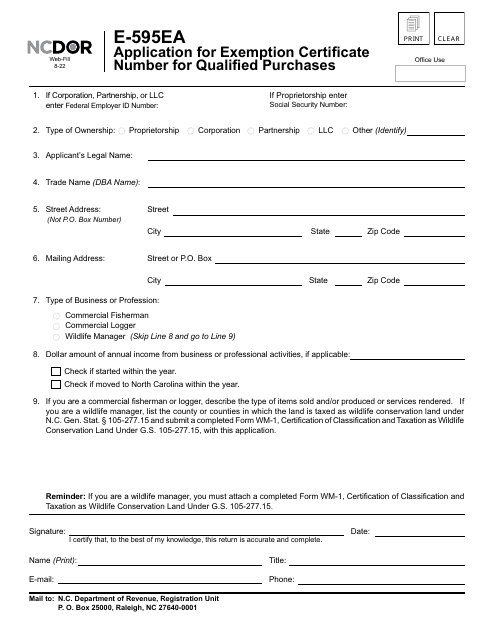

This form is used for applying for tax certification and exemption in North Carolina.

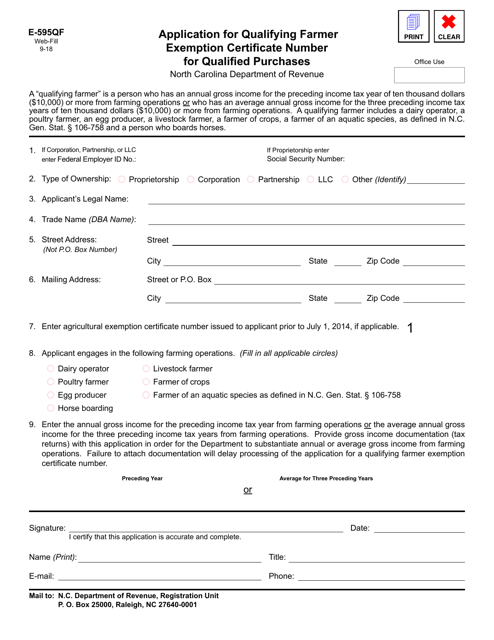

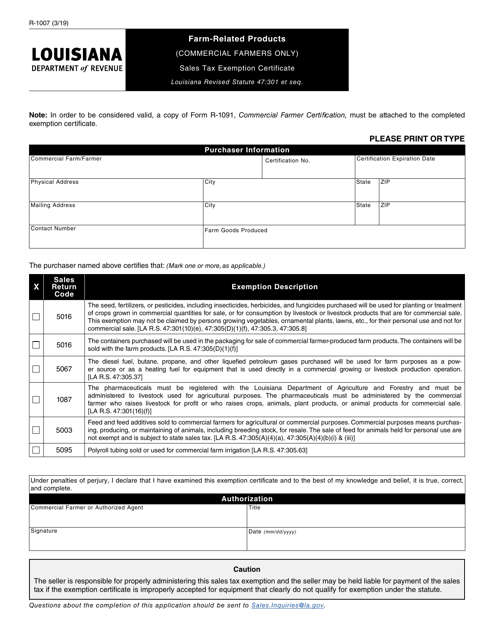

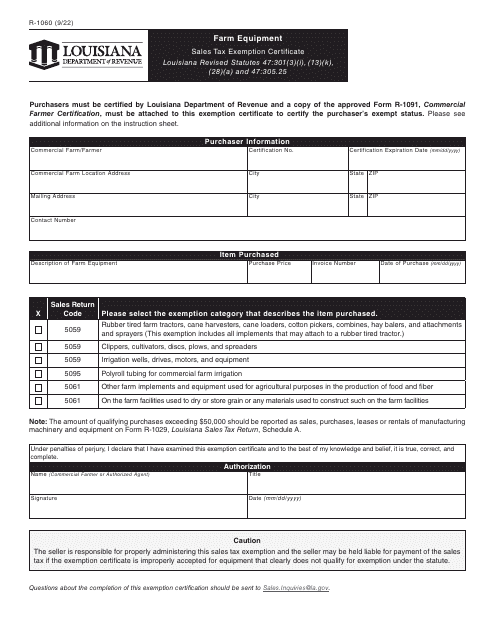

This form is used for applying for a Qualifying Farmer Exemption Certificate Number in order to receive exemptions for qualified purchases in North Carolina.

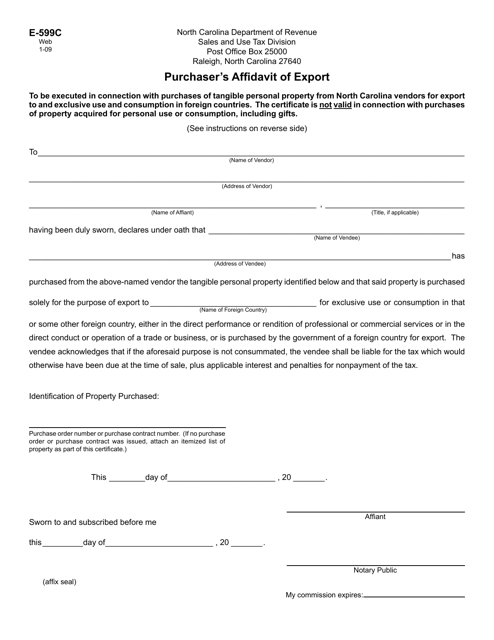

This Form is used for purchasers in North Carolina to declare that they are exporting the purchased items.

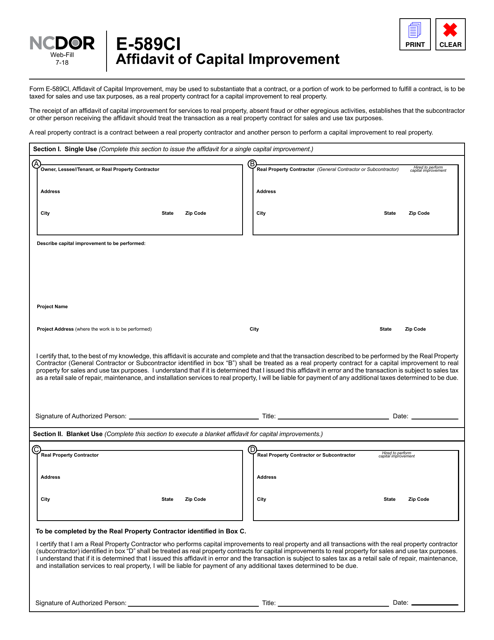

This form is used for filing an Affidavit of Capital Improvement in North Carolina. It is used to certify that certain construction or improvements have been made to a property in order to claim an exclusion or deferment from property taxes.

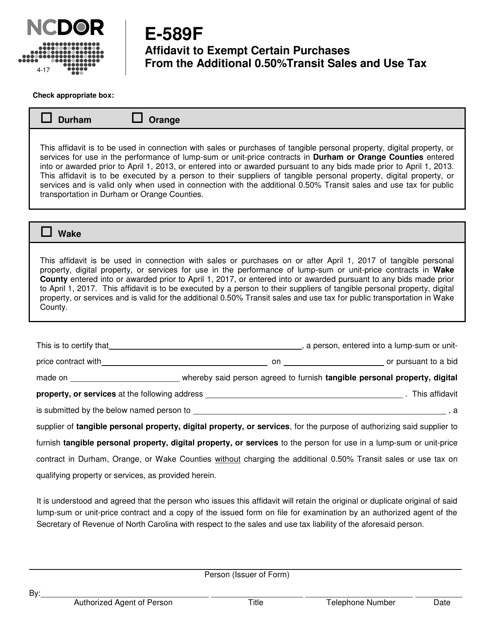

This form is used for requesting an exemption from the additional 0.50% transit sales and use tax on certain purchases in North Carolina.

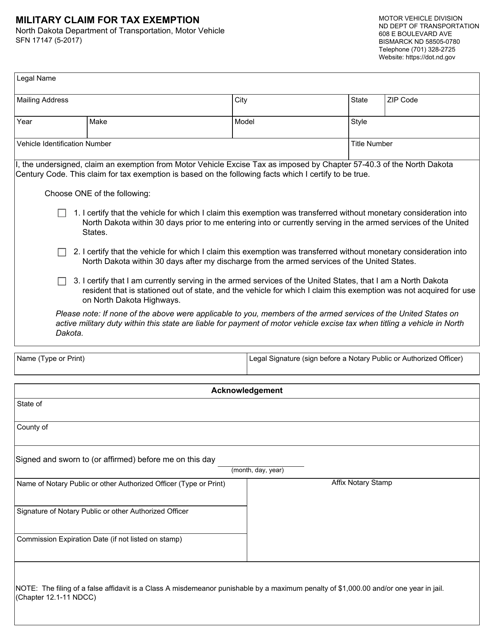

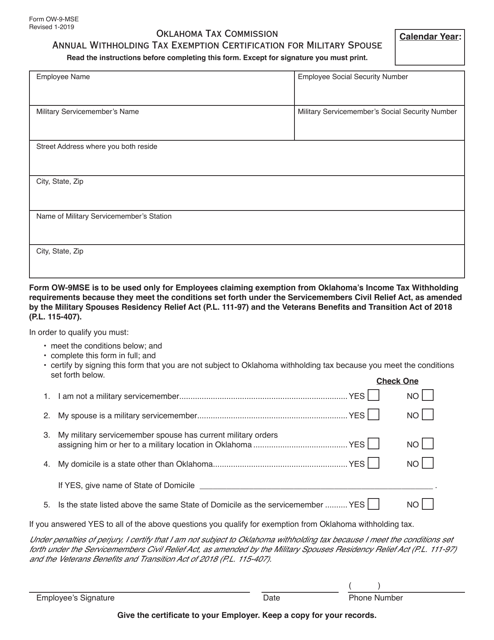

This form is used for military personnel in North Dakota to claim tax exemption.

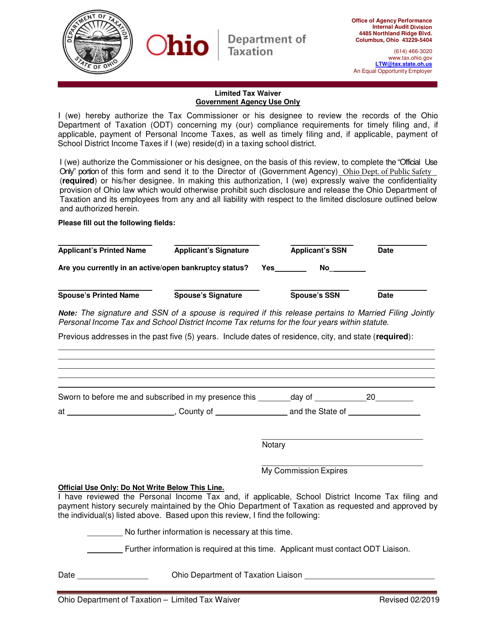

This Form is used for applying for a limited tax waiver in the state of Ohio. It allows individuals to request an exemption or reduction in their taxes for a specific period or situation.

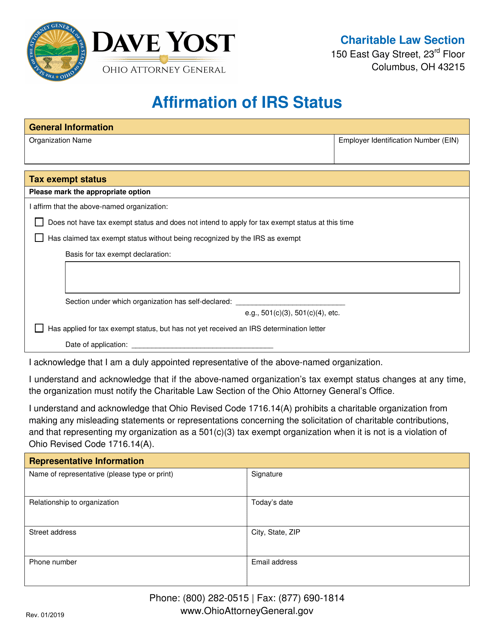

This form is used by organizations in Ohio to affirm their IRS tax-exempt status.

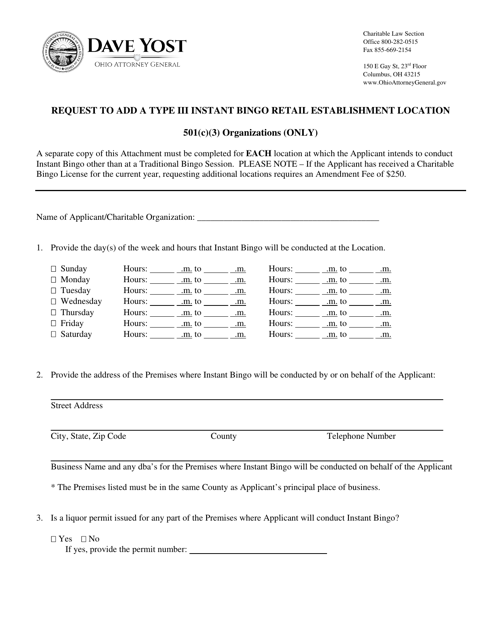

This document is a request form to add a Type III Instant Bingo retail establishment location for 501(c)(3) organizations in the state of Ohio. It is used to facilitate the process of adding a bingo location for eligible nonprofit organizations.

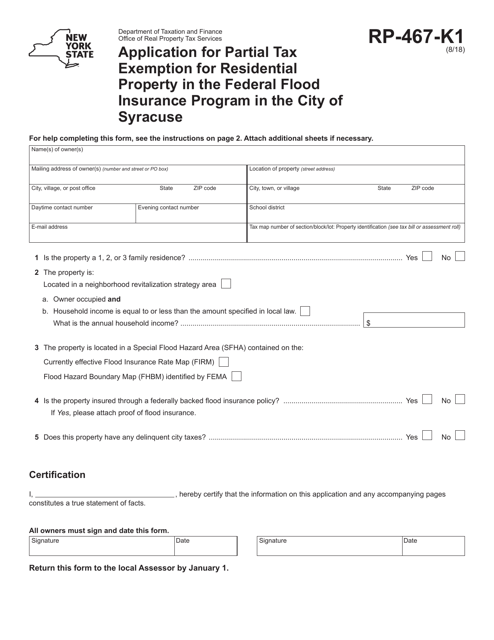

This form is used for applying for a partial tax exemption for residential property located in the City of Syracuse, New York, that is participating in the Federal Flood Insurance Program.

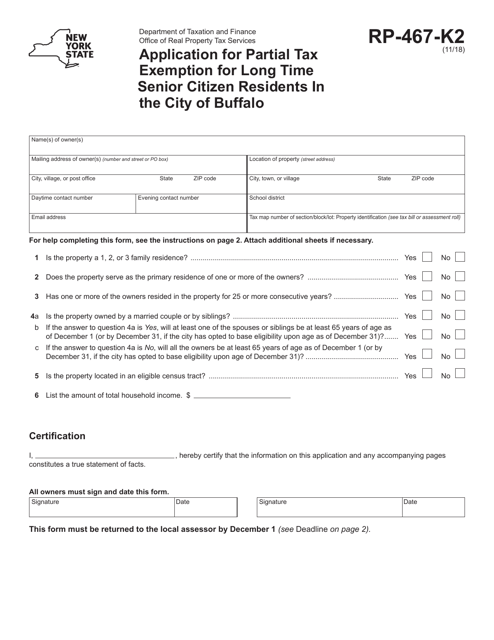

This form is used for applying for a partial tax exemption for long-time senior citizen residents in the city of Buffalo, New York.

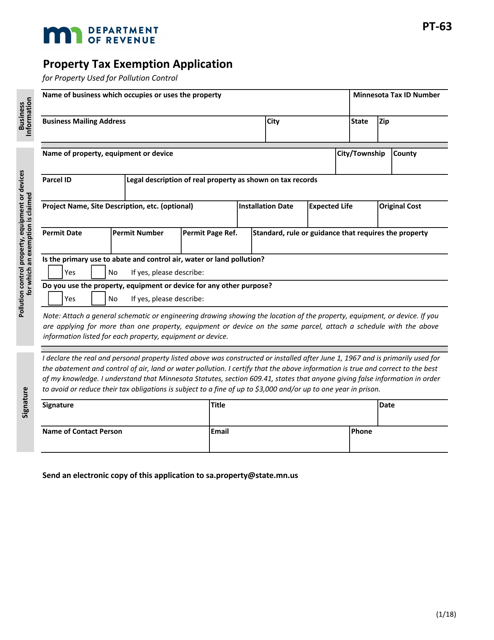

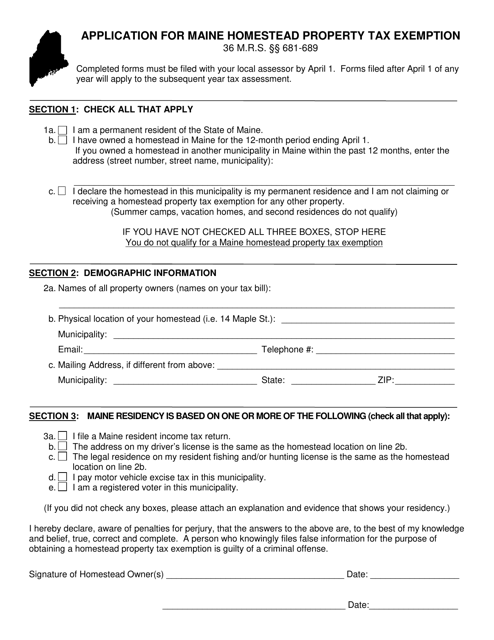

This document is used for applying for a property tax exemption in Minnesota.

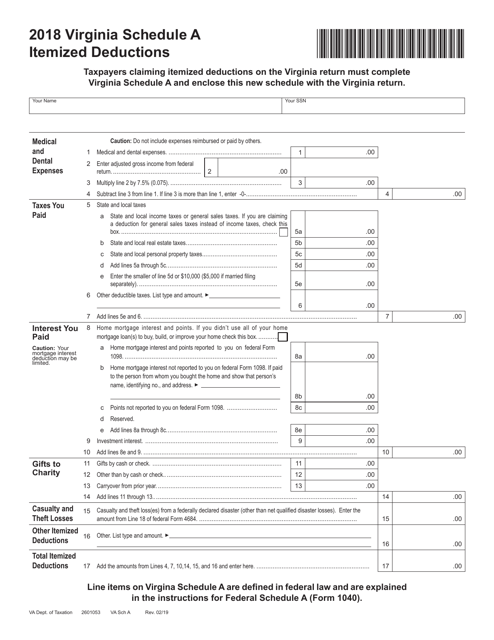

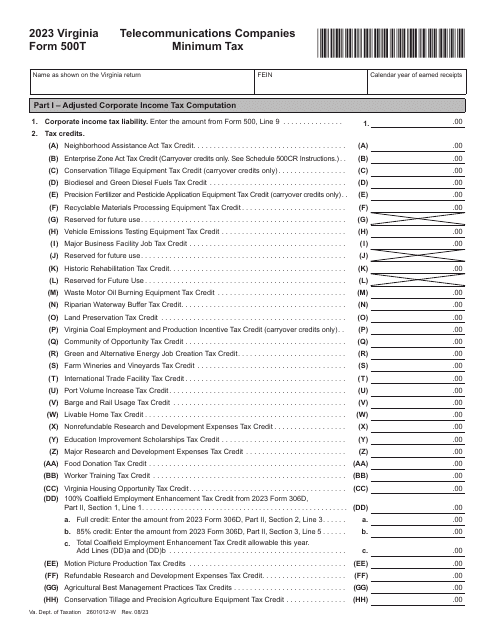

This form is used for reporting itemized deductions on your Virginia state tax return. It allows you to claim deductions such as medical expenses, mortgage interest, and charitable contributions to potentially reduce your taxable income.

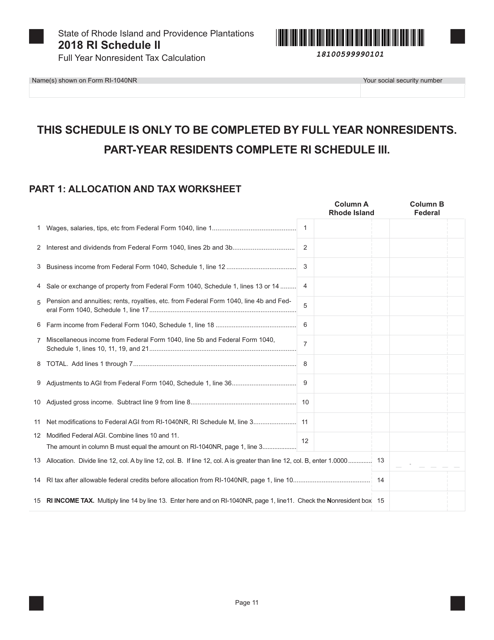

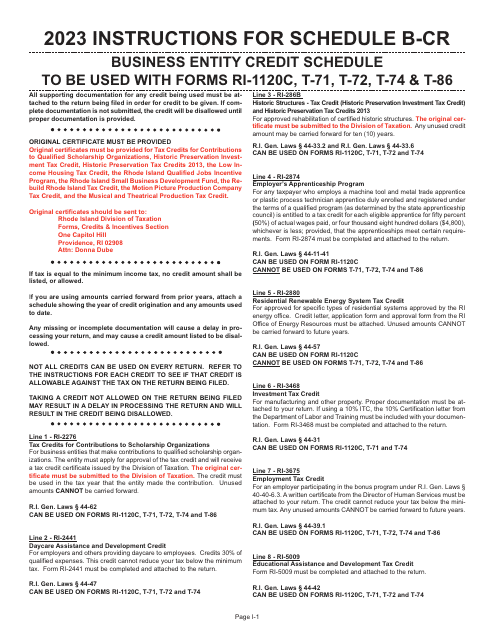

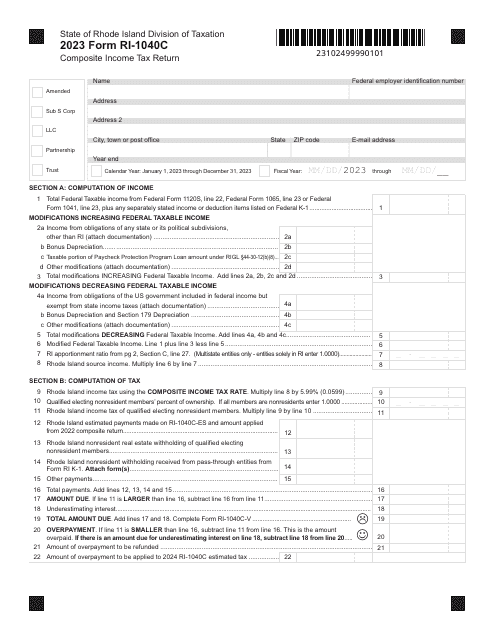

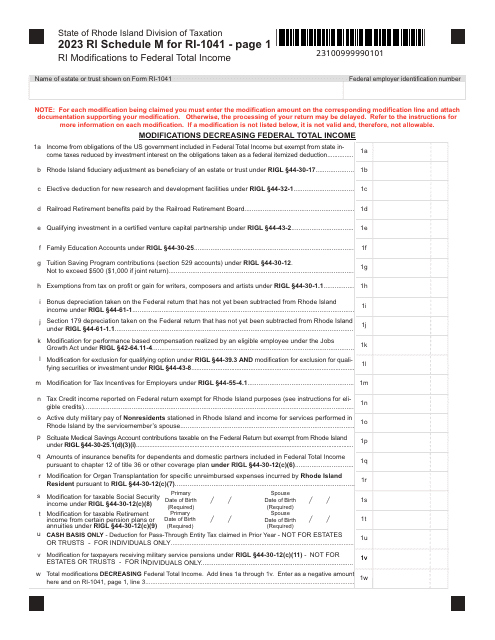

This document is used for calculating the full-year nonresident tax for Schedule II in Rhode Island.

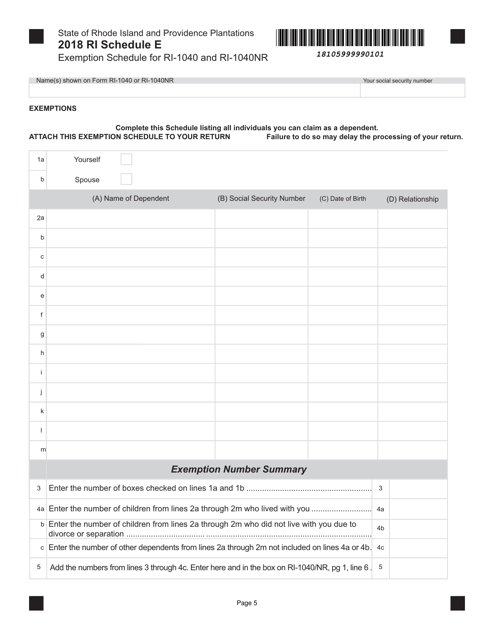

This document is used for claiming exemptions on the Schedule E of the Ri-1040 and Ri-1040nr tax forms in Rhode Island.

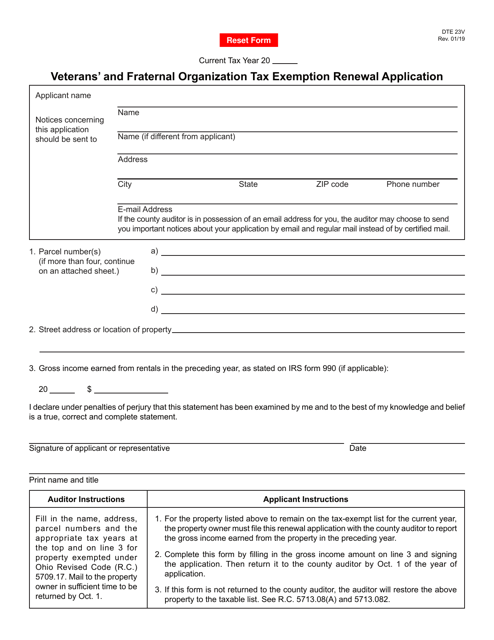

This form is used for veterans' and fraternal organizations in Ohio to renew their tax exemption status.

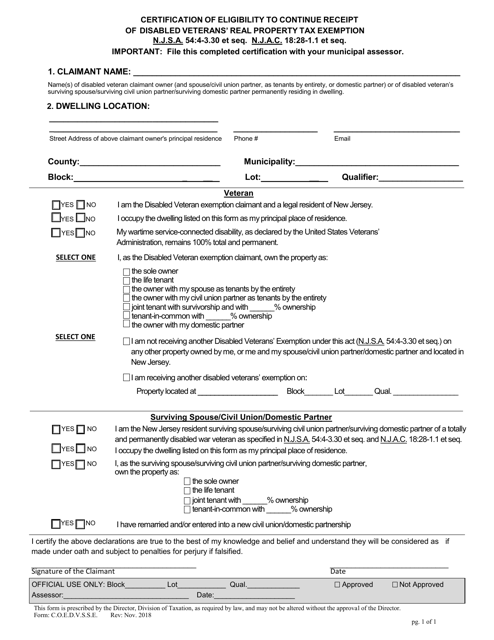

This form is used for obtaining certification of eligibility to continue receiving the Disabled Veterans' Real Property Tax Exemption in New Jersey. It confirms that the individual is still eligible for the tax exemption due to their disabled veteran status.