Tax Exempt Form Templates

Documents:

1303

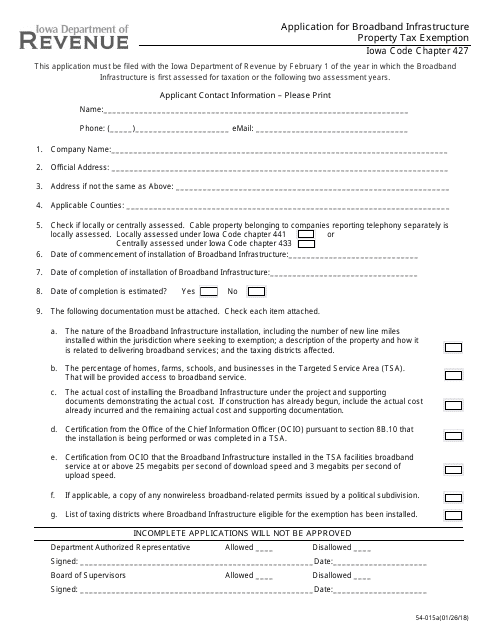

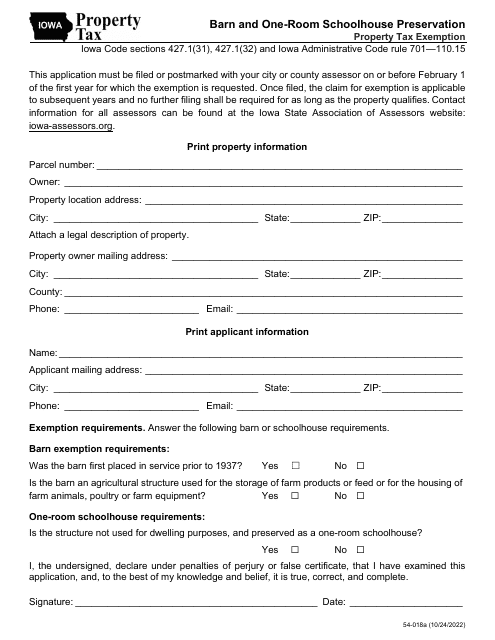

This Form is used for applying for a property tax exemption for broadband infrastructure in Iowa.

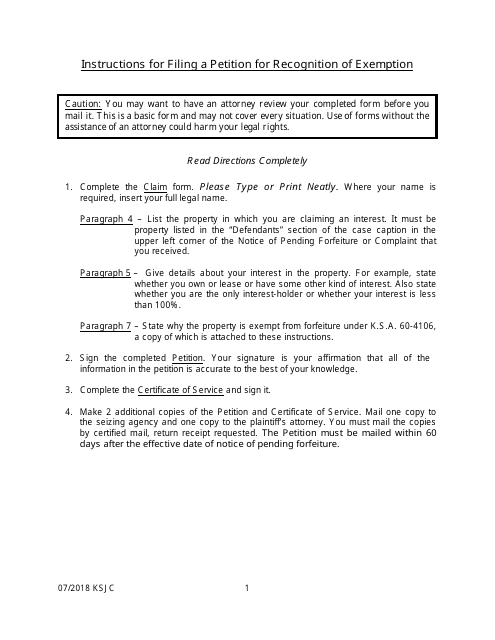

This form is used for petitioning the state of Kansas to recognize an organization's tax exempt status

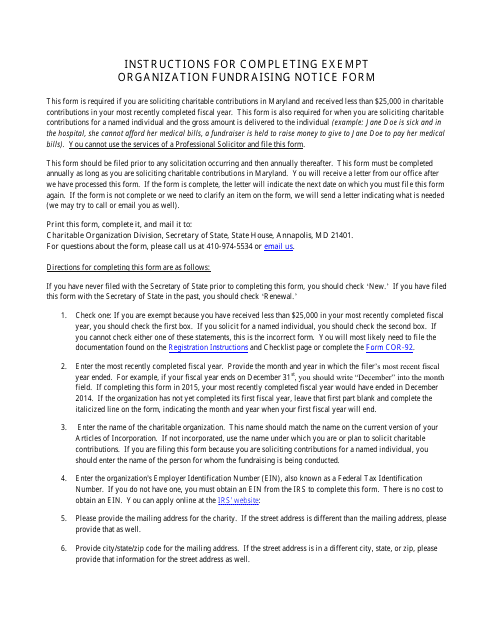

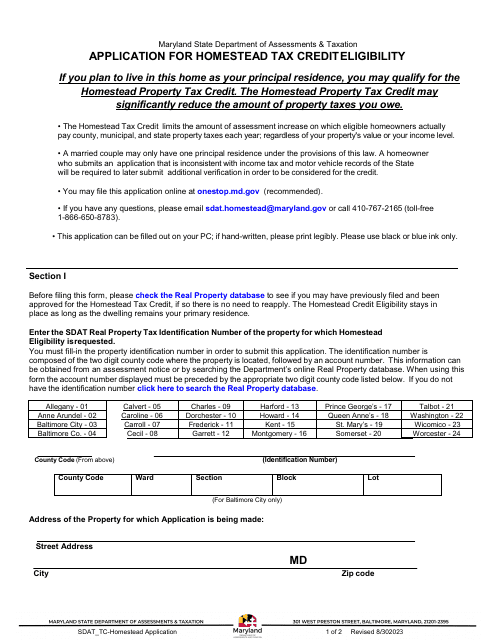

This Form is used for nonprofit organizations in Maryland to provide information about their fundraising activities.

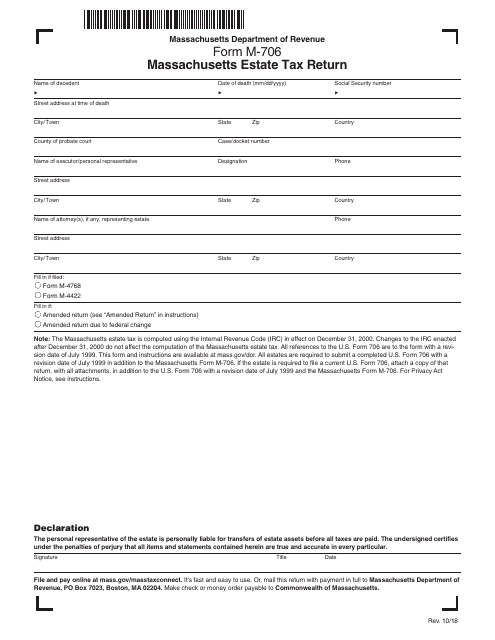

This form is used for filing an estate tax return in the state of Massachusetts.

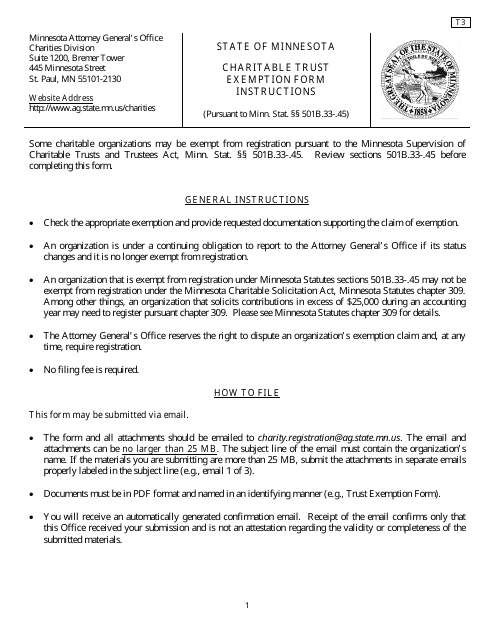

This form is used for applying for charitable trust exemption in the state of Minnesota.

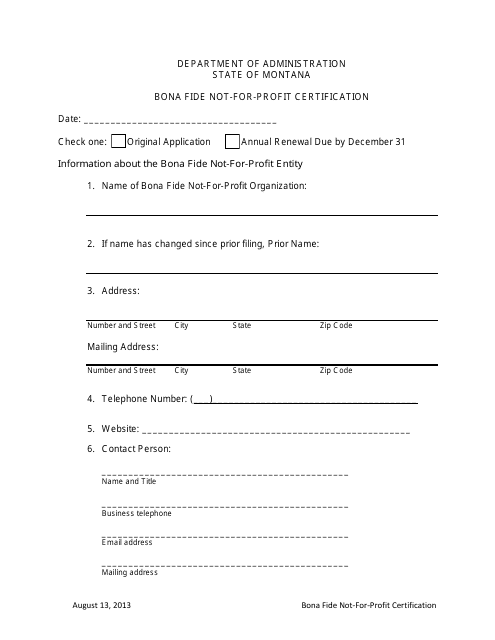

This document is for obtaining a certification as a bona fide not-for-profit organization in the state of Montana. It is used to establish and prove the organization's non-profit status.

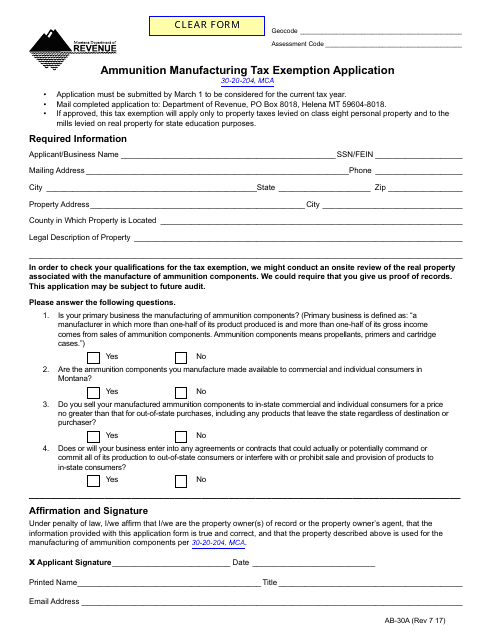

This form is used for applying for a tax exemption on ammunition manufacturing in Montana.

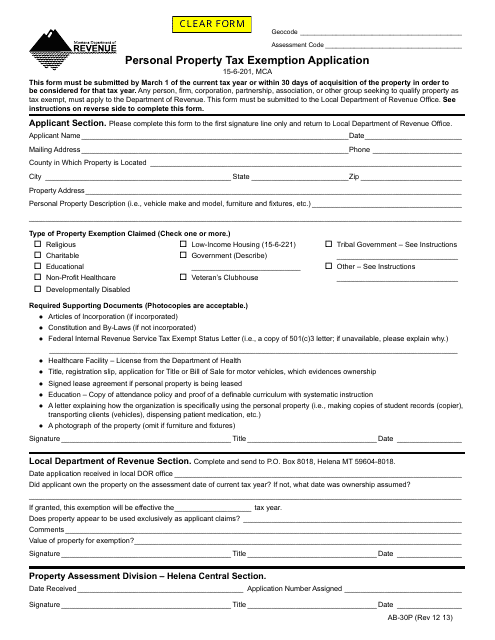

This form is used for applying for a personal property tax exemption in Montana. It allows individuals to request an exemption from paying taxes on certain personal property.

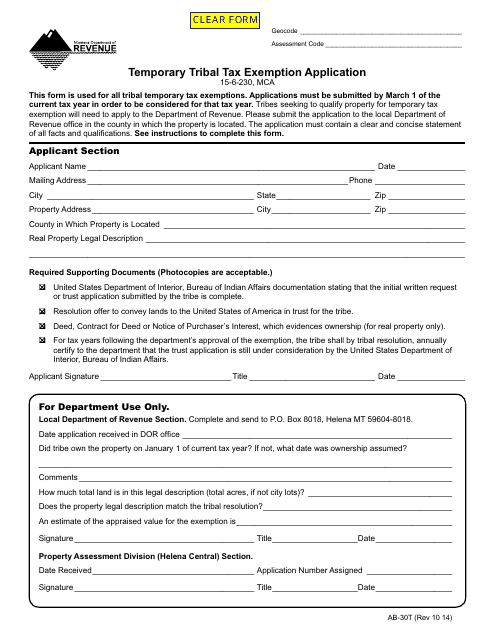

This form is used for applying for a temporary tax exemption for tribal members in Montana.

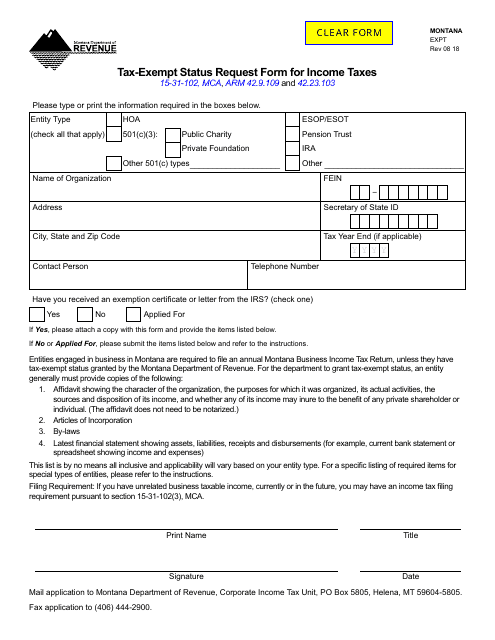

This form is used to request tax-exempt status for income taxes in Montana.

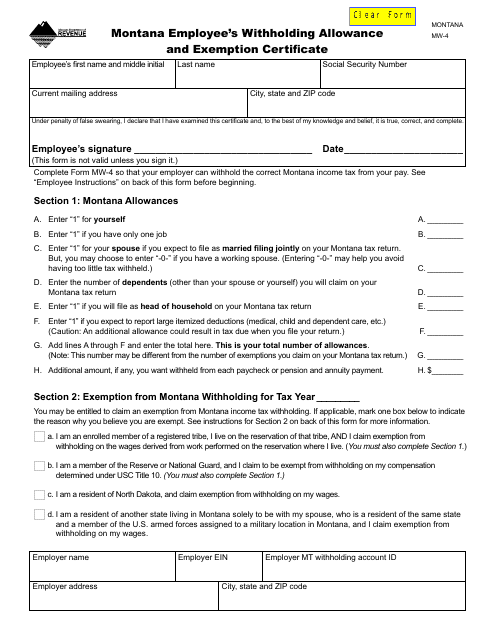

This form is used for reporting employee allowances and exemptions for state income tax withholding in Montana.

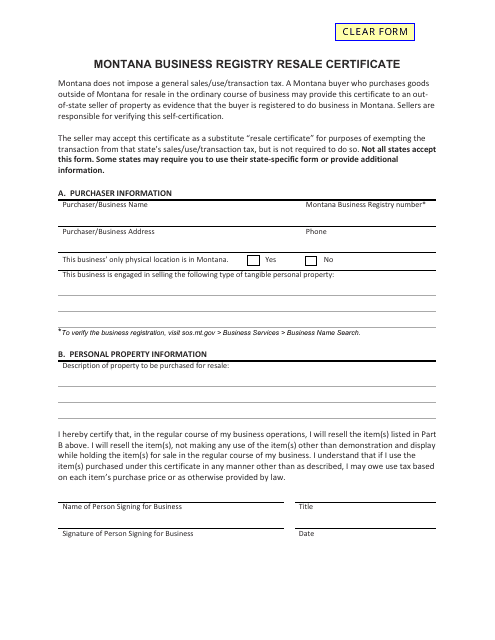

This Form is used for obtaining a Resale Certificate in Montana to conduct business activities and make purchases without paying sales tax on items that will be resold.

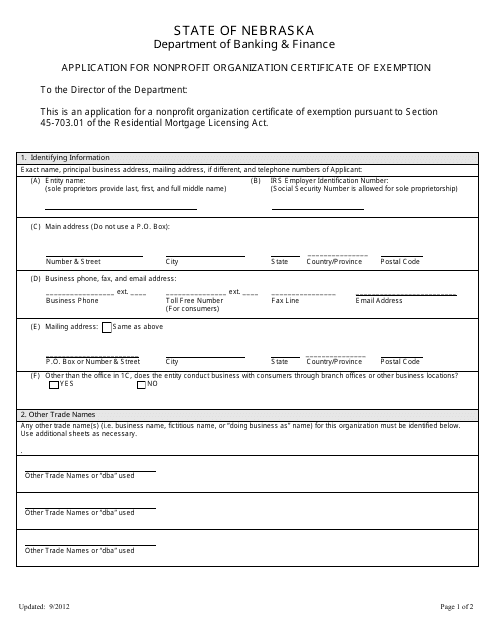

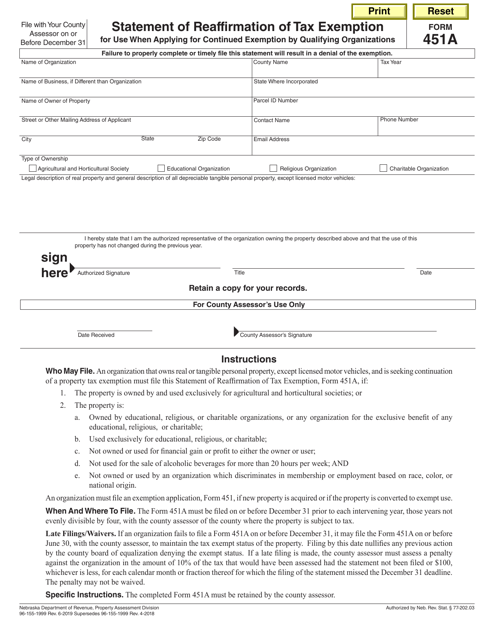

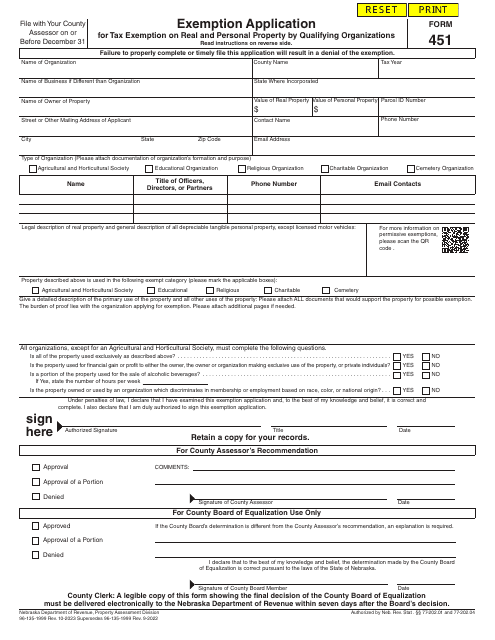

This document is used for applying for a certificate of exemption for nonprofit organizations in the state of Nebraska.

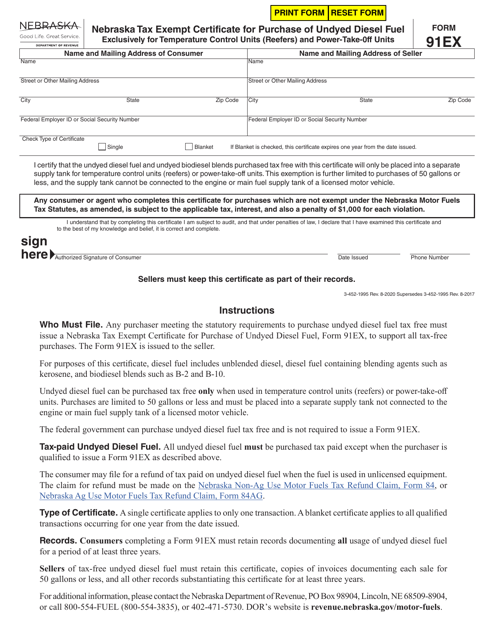

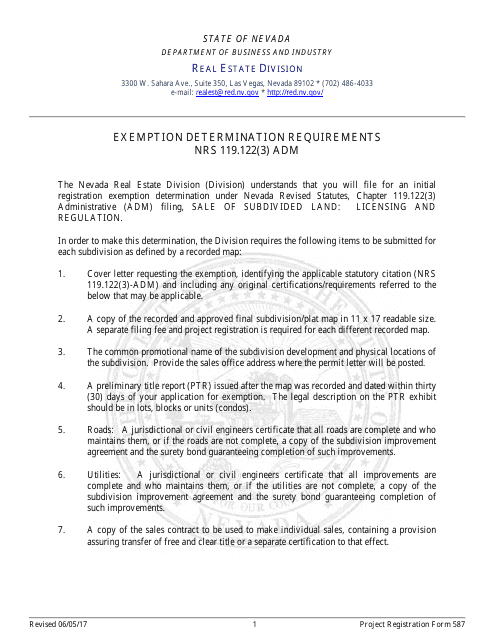

This form is used for determining the exemption requirements of NRS 119.122(3) in Nevada.

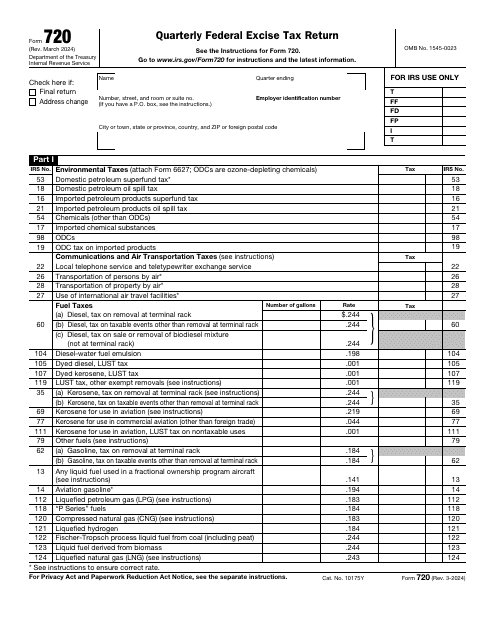

This is a fiscal document used by taxpayers to outline the excise taxes charged on certain services and goods.

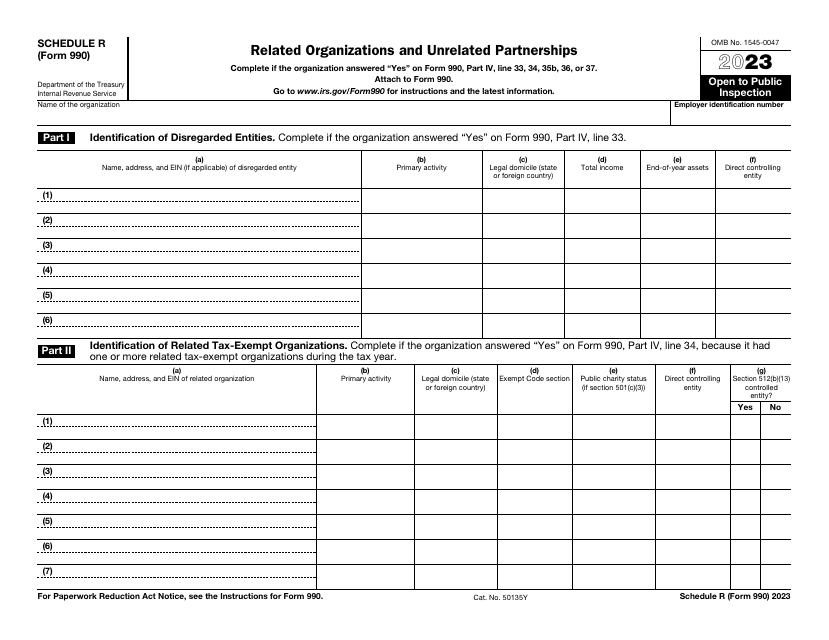

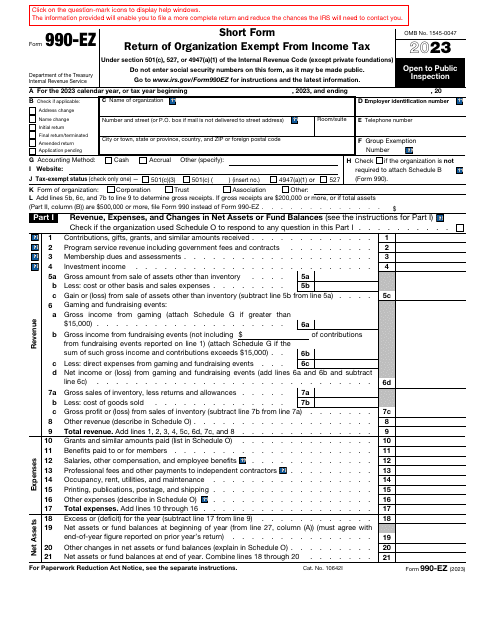

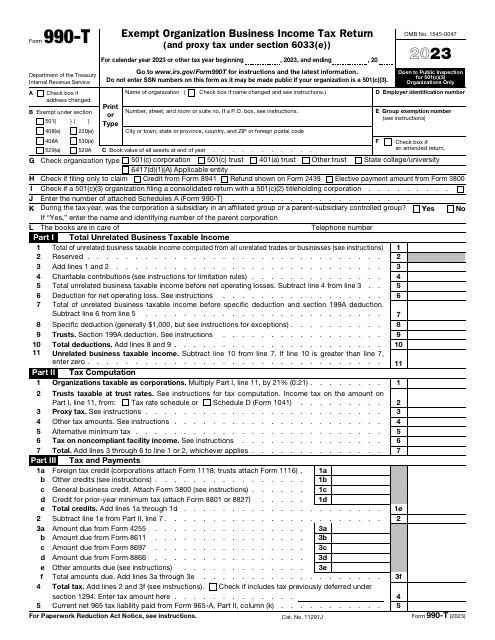

This is a fiscal form used by tax-exempt organizations required to inform tax organizations about their earnings, expenses, and achievements over the course of the year.

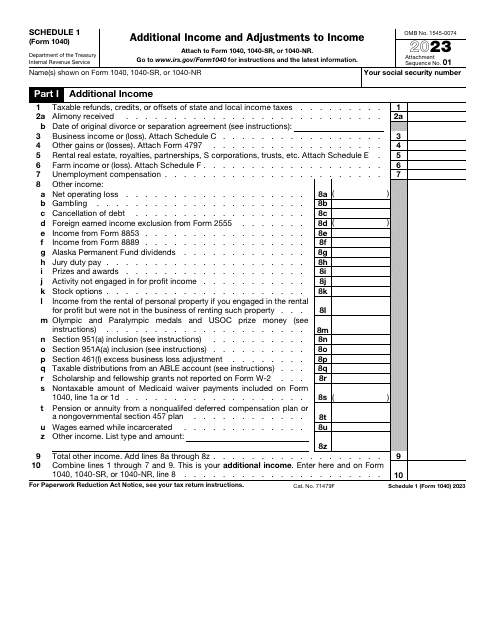

This is a supplementary form used by taxpayers to list income they did not include on the main income statement they file.

This is a formal statement filled out by the organization that manages certain retirement accounts to inform the recipient of the distribution about the income they generated and report the details to tax organizations.

This is a formal document filed with the IRS by a domestic corporation to inform the government about their taxable income and taxes they compute annually.

This form was developed for taxpayers who have paid someone to care for their child or another qualifying person so they could work or look for work.

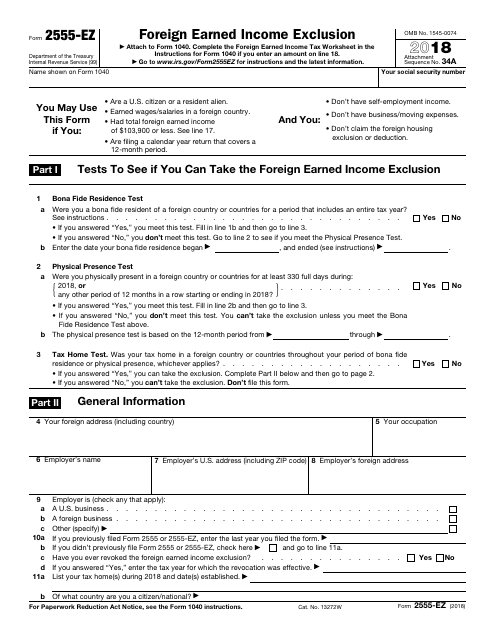

This document is used for claiming the Foreign Earned Income Exclusion on your taxes.

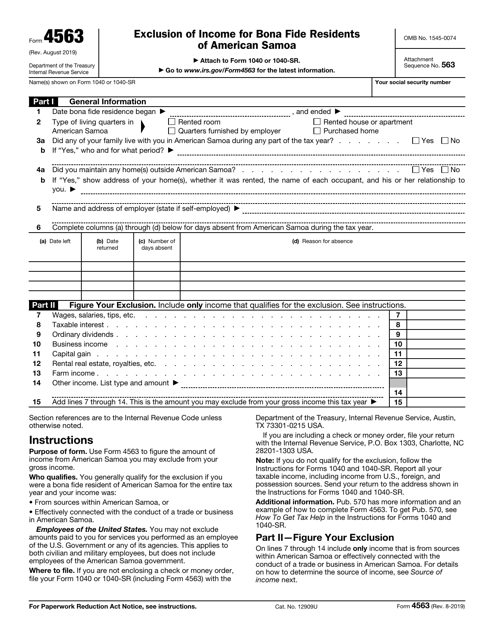

This is a tax form people permanently residing in American Samoa can use to exclude certain income from their gross income.

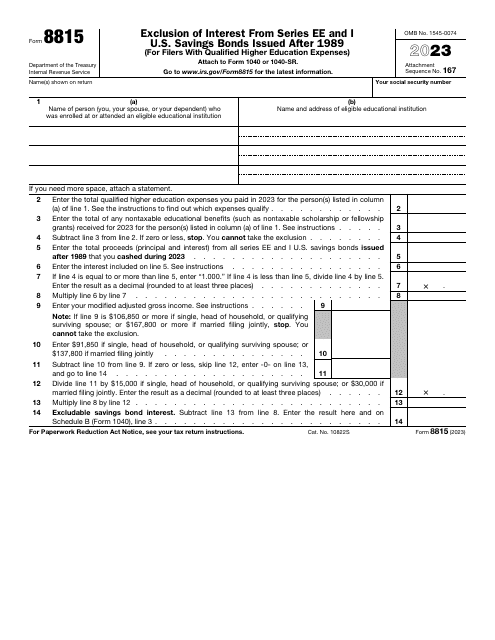

This is a fiscal document used by individual taxpayers to exclude the specific bond interest from their income.

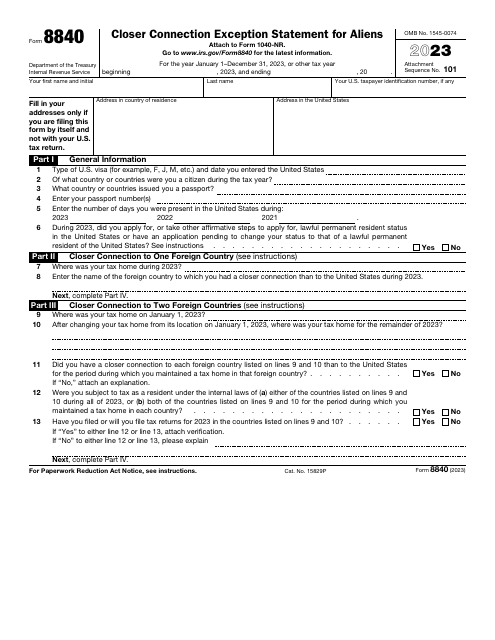

This is an application issued by the Internal Revenue Service (IRS) especially for alien individuals who use it to claim the closer connection to a foreign country exception to the substantial presence test.