Tax Exempt Form Templates

Documents:

1303

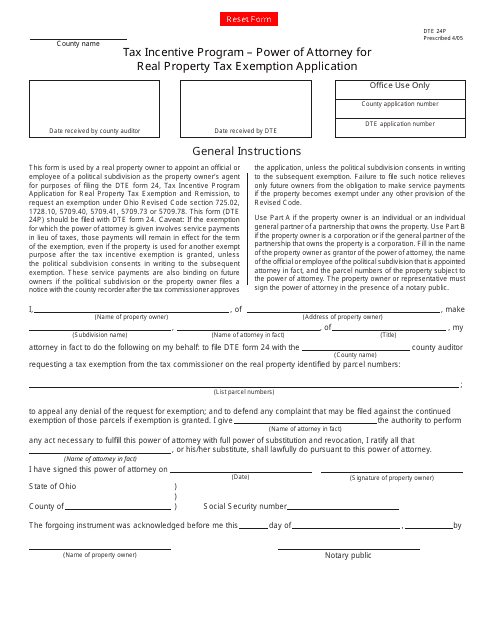

This form is used for applying for a power of attorney for real property tax exemption in Ohio's tax incentive program. It allows someone to act on your behalf in the application process.

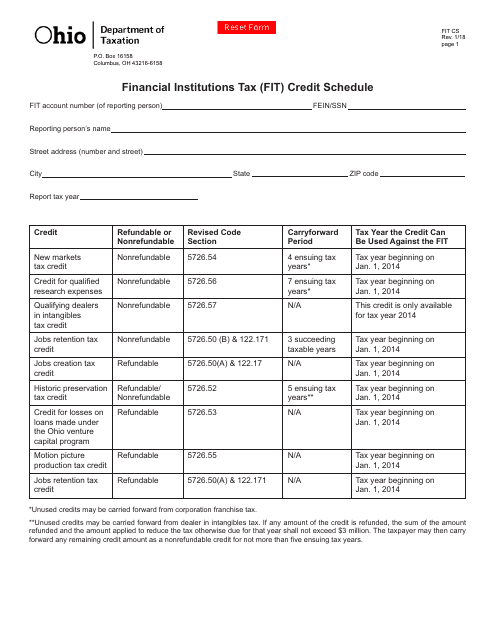

This Form is used for reporting and claiming the Financial Institutions Tax (FIT) Credit in Ohio.

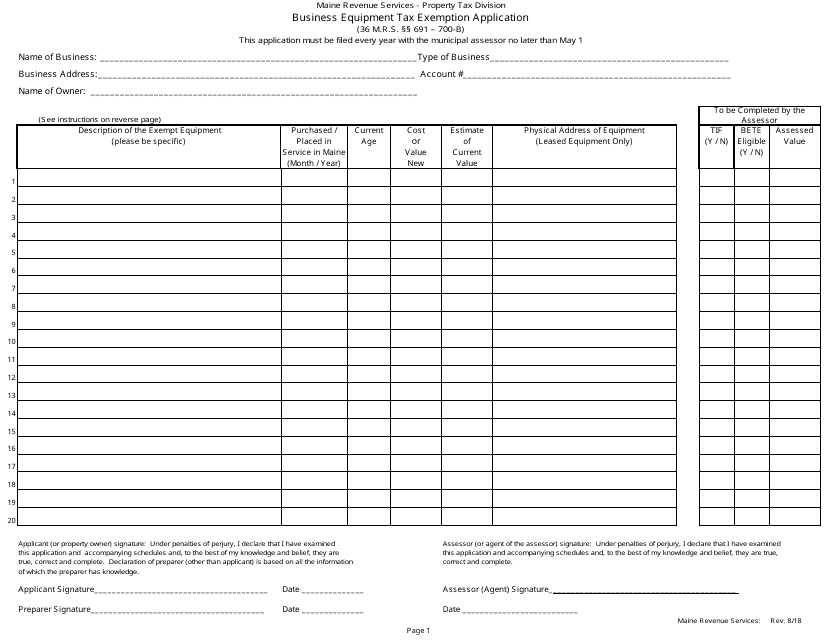

This Form is used for applying for a tax exemption on business equipment in the state of Maine.

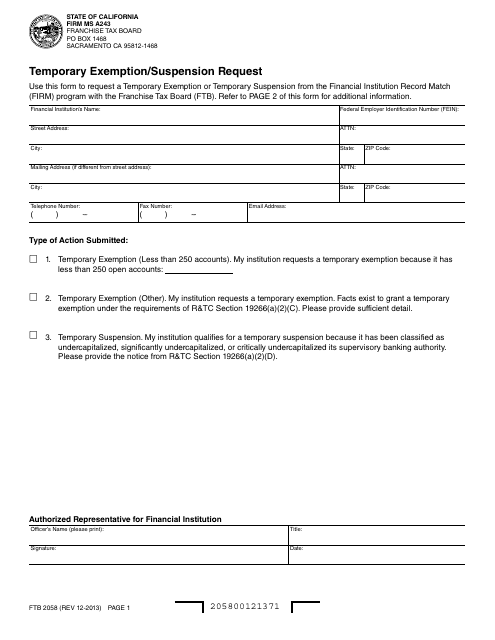

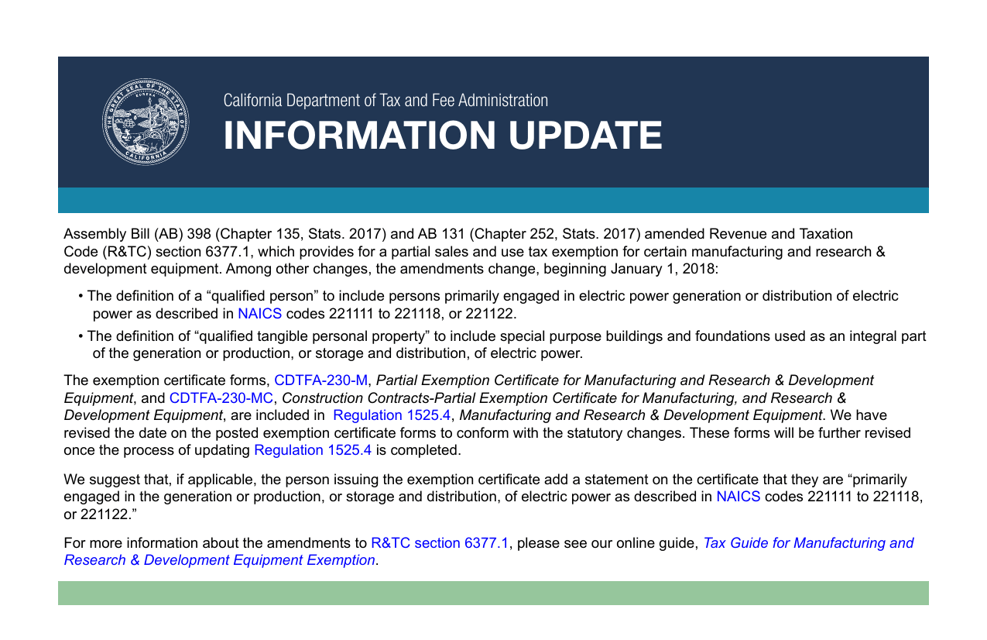

This form is used for requesting temporary exemption or suspension in California.

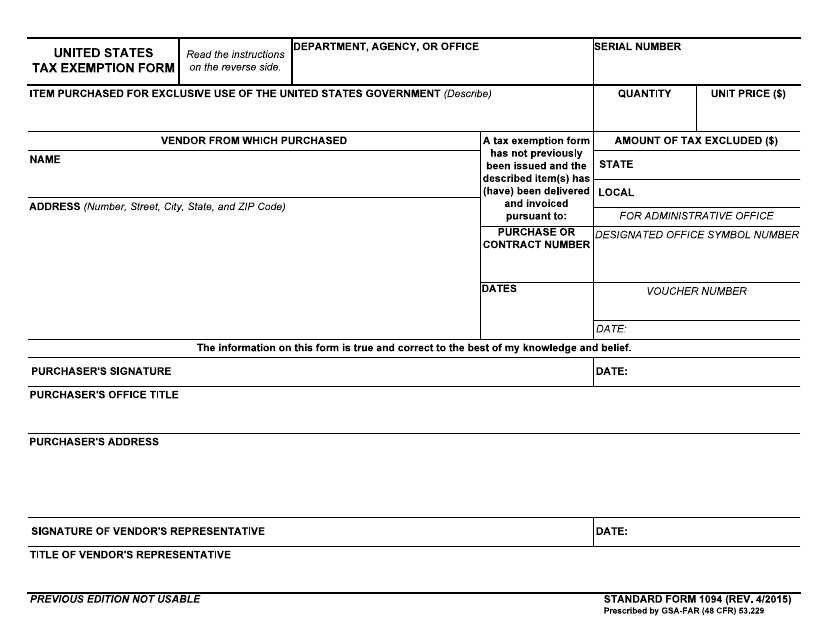

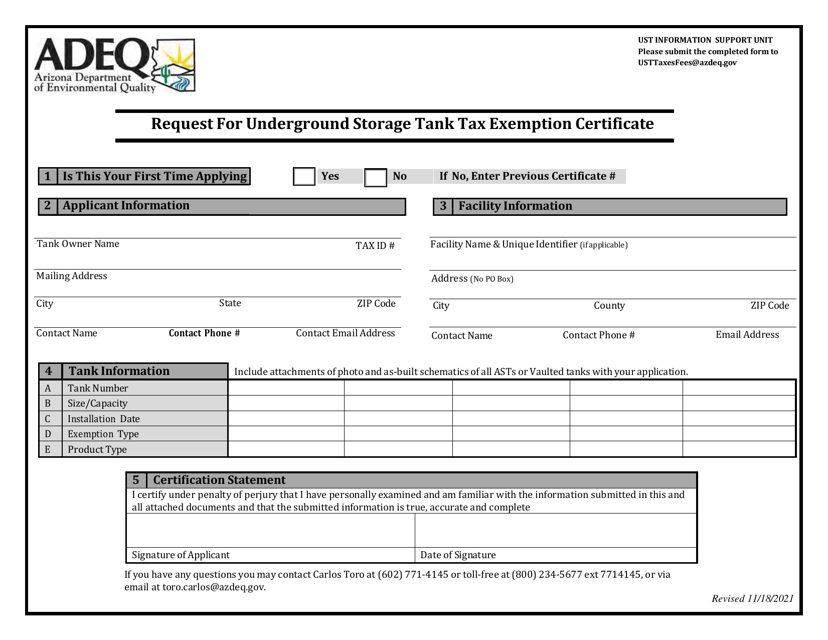

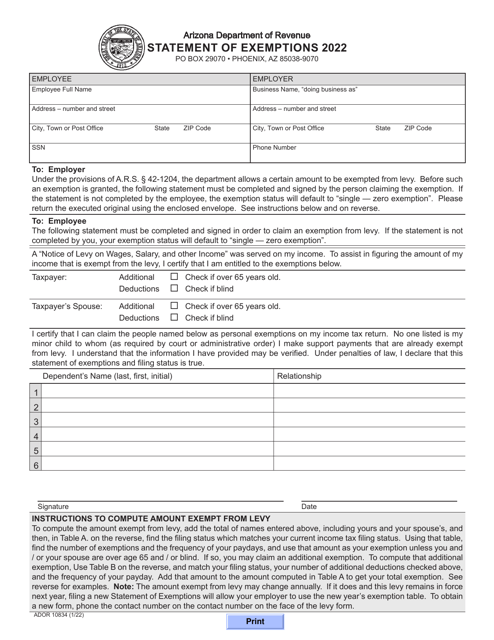

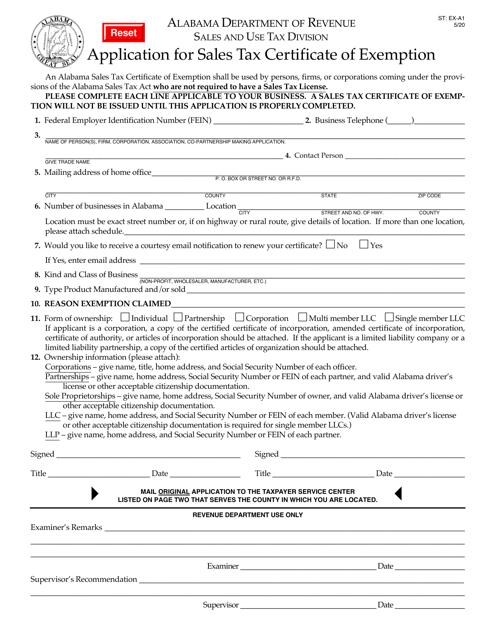

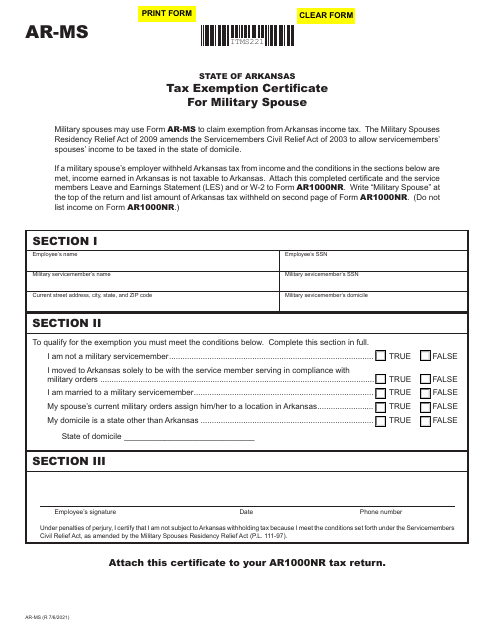

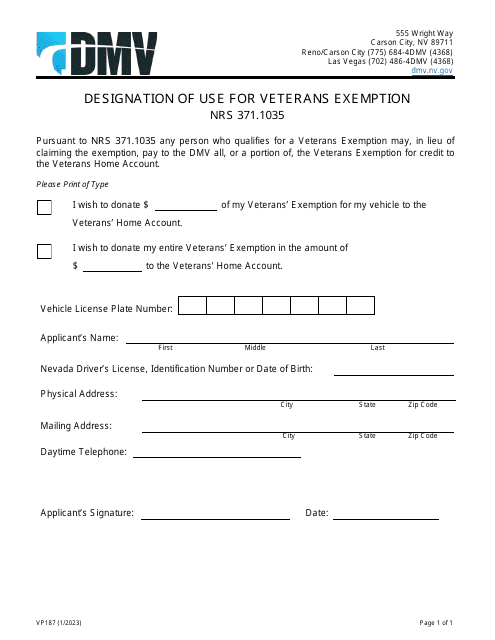

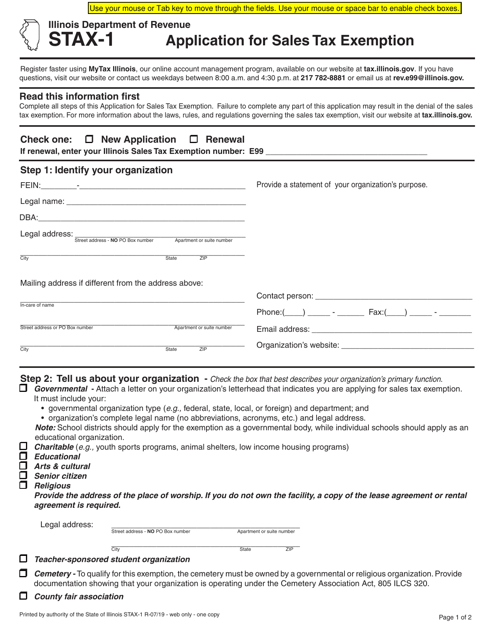

This form is used for applying for tax exemption in the United States.

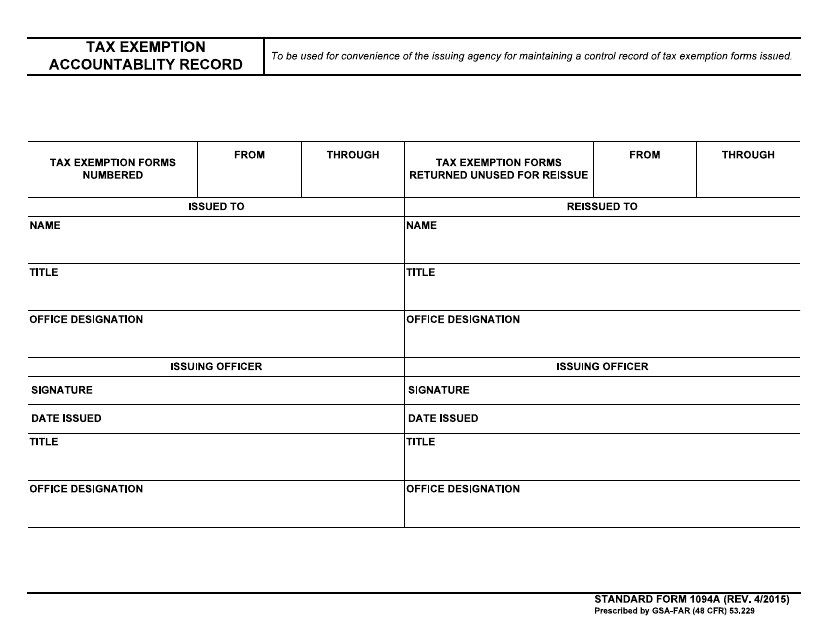

This form is used for recording tax exemption accountability.

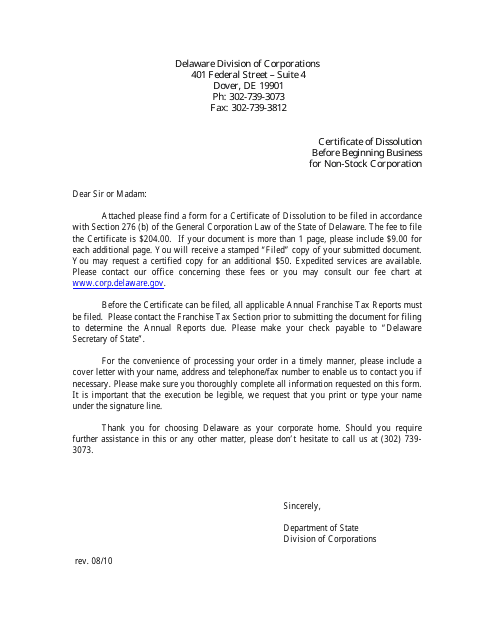

This document is used for non-stock corporations in Delaware to dissolve the corporation before it begins any business activities.

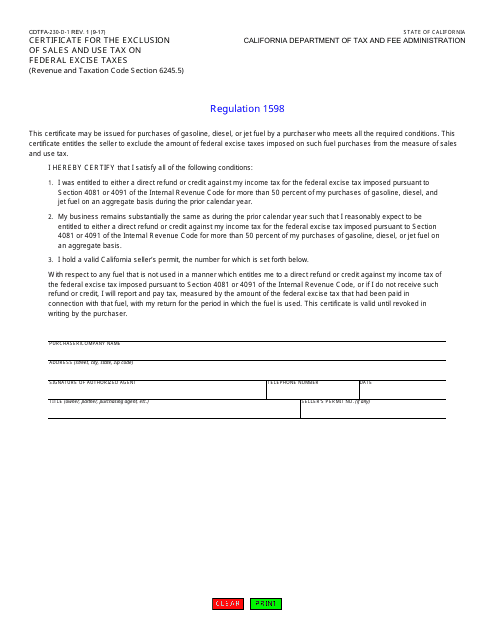

This form is used for requesting an exclusion of sales and use tax on federal excise taxes in the state of California.

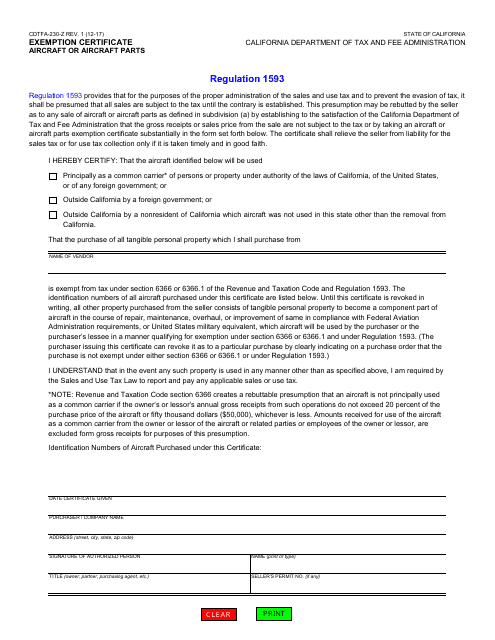

This Form is used for claiming exemption from California sales and use tax for aircraft or aircraft parts. It is issued by the California Department of Tax and Fee Administration (CDTFA).

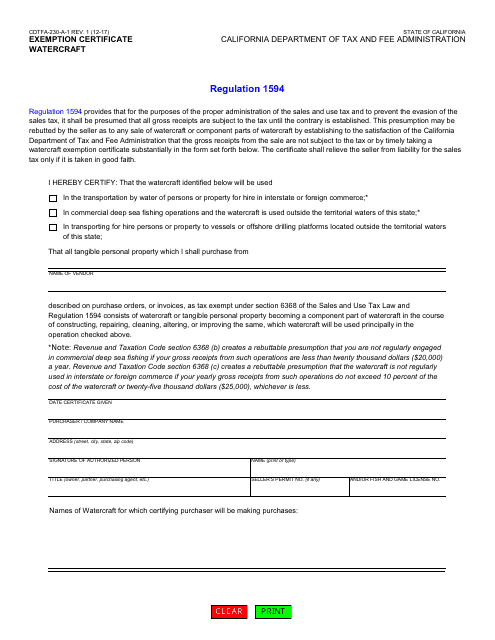

This Form is used for applying for an exemption from paying certain taxes for watercraft in California.

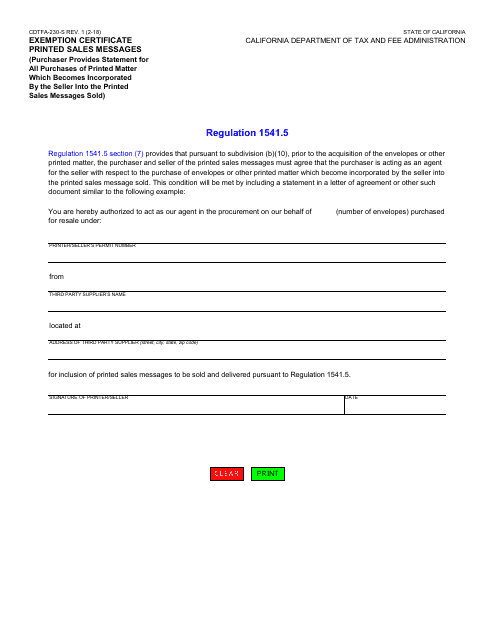

This form is used for claiming exemption from sales tax for printed sales messages in California.

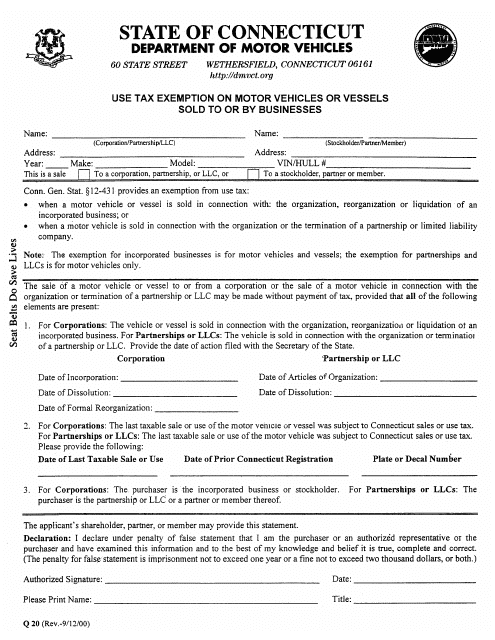

This form is used for claiming a tax exemption on motor vehicles or vessels sold to or by businesses in Connecticut.

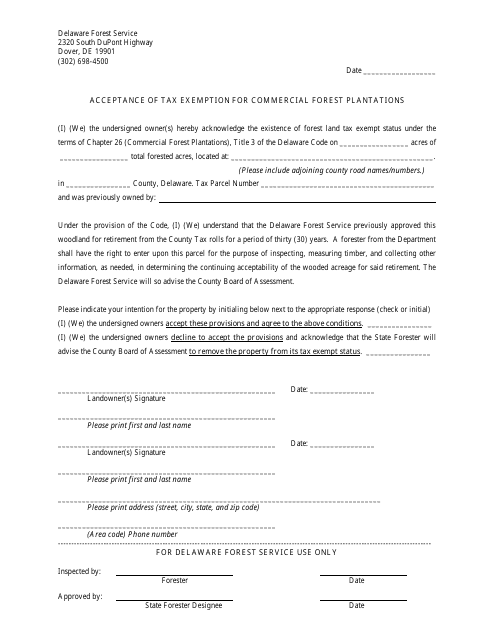

This document is for the acceptance of tax exemption for commercial forest plantations in the state of Delaware. It allows commercial forest owners to claim tax exemptions based on their plantation activities.

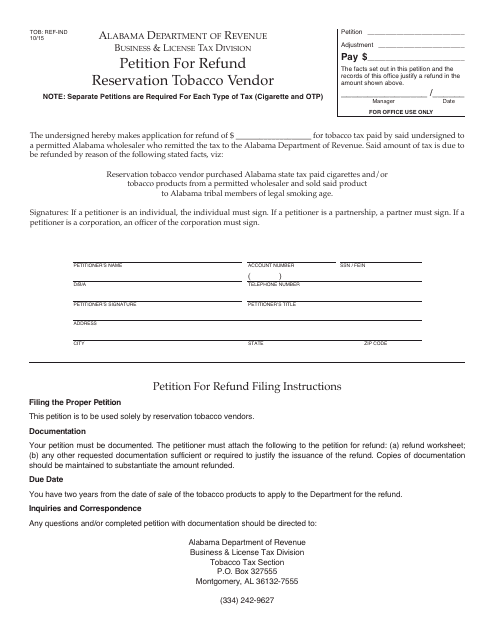

This form is used for Alabama tobacco vendors to petition for a refund reservation for tobacco sales.

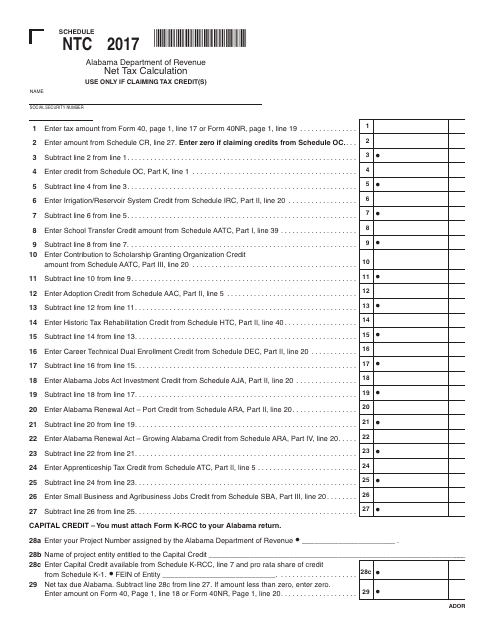

This document is used for calculating the net tax in Alabama using Schedule NTC.

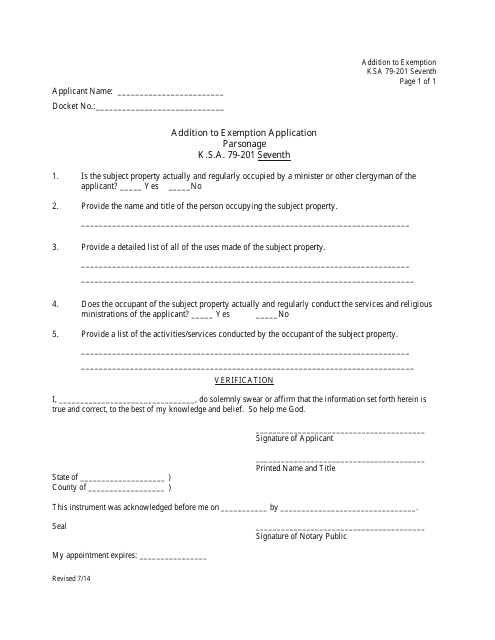

This document is an addition to the exemption application for parsonage in the state of Kansas. It is used to provide additional information or updates to an existing application.

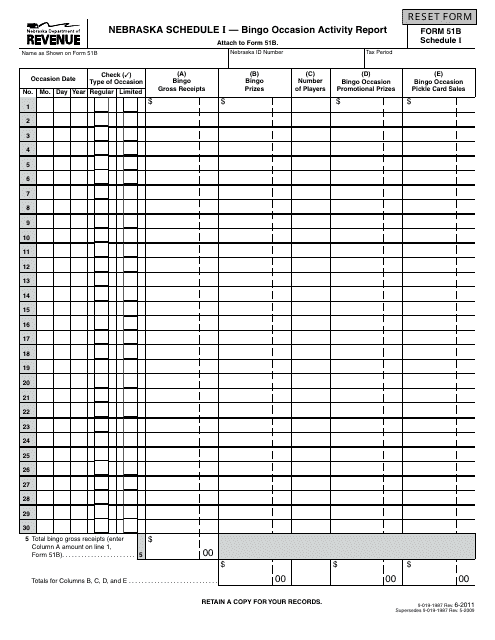

This document is used for reporting bingo occasion activities in Nebraska.

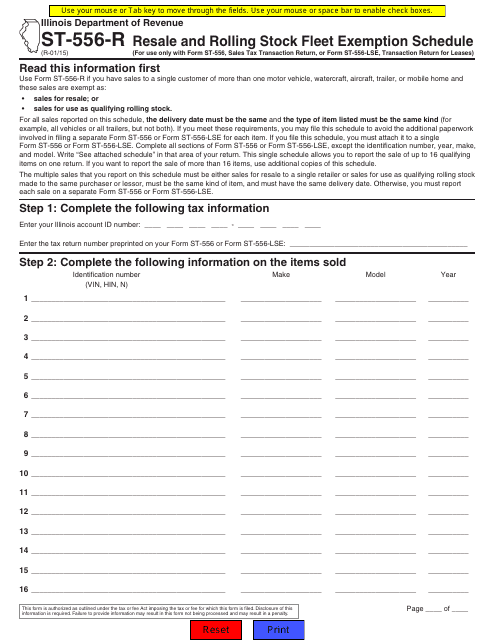

This form is used for reporting the resale and exemption schedule for rolling stock fleets in the state of Illinois.

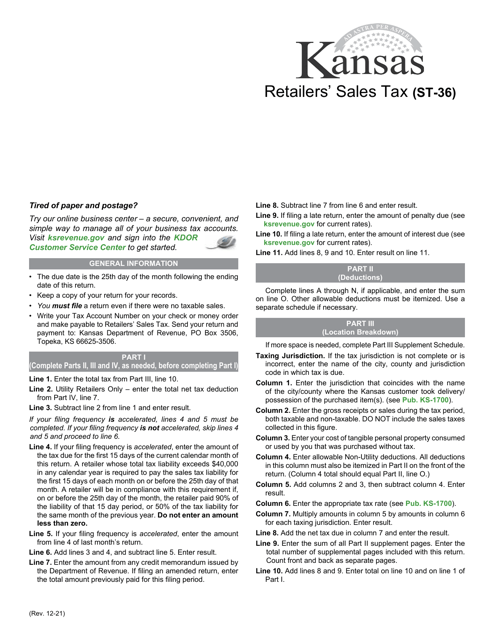

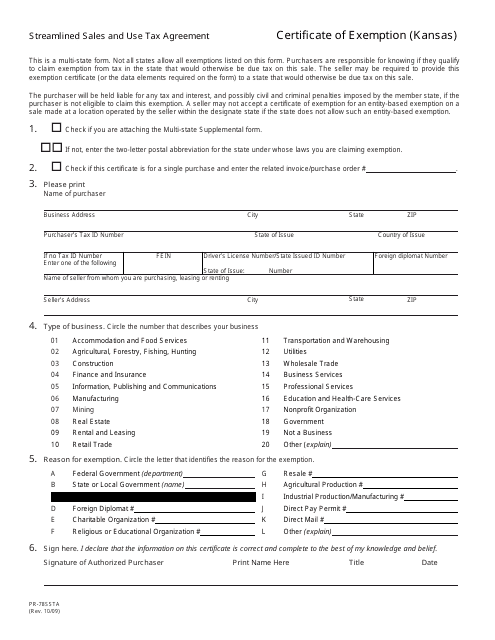

This form is used for obtaining a certificate of exemption from sales and use taxes in Kansas under the Streamlined Sales and Use Tax Agreement.

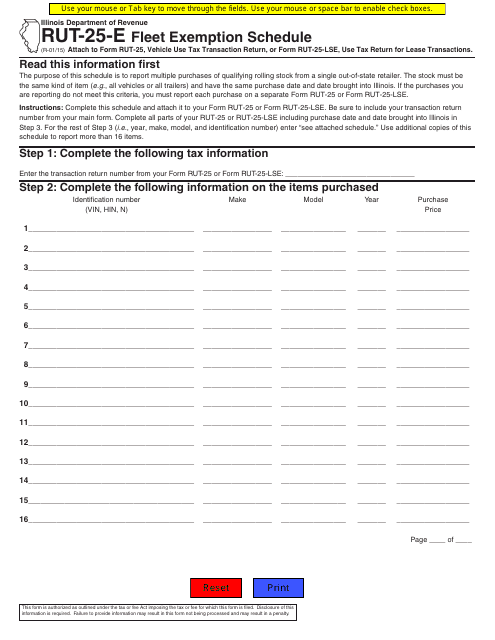

This form is used for fleet exemption schedule in Illinois. It is specifically for Form RUT-25-E.

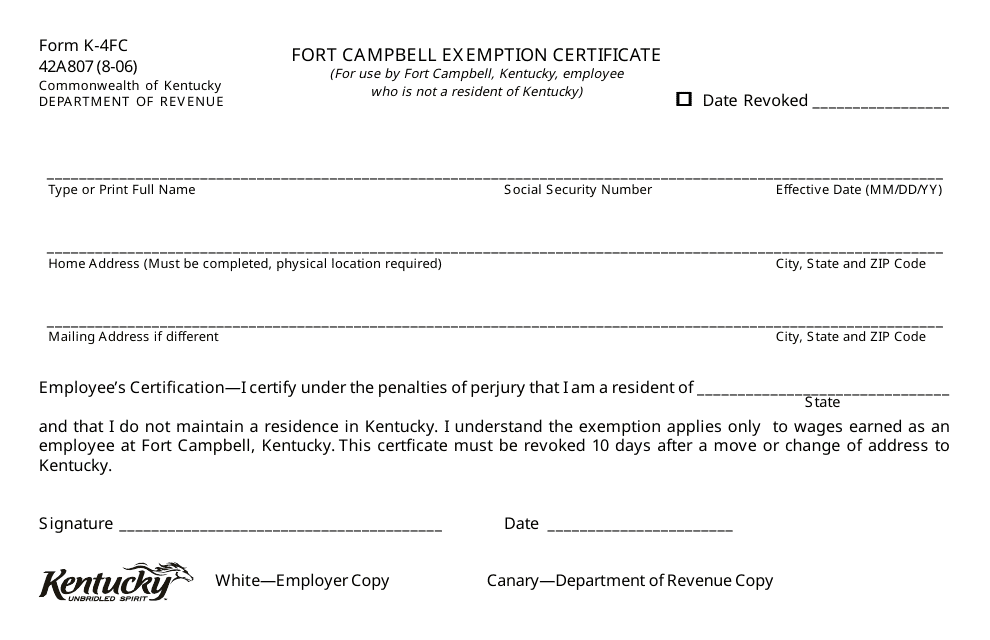

This form is used for applying for a Fort Campbell exemption certificate in Kentucky. It is specifically for those who are eligible for the K-4FC exemption.

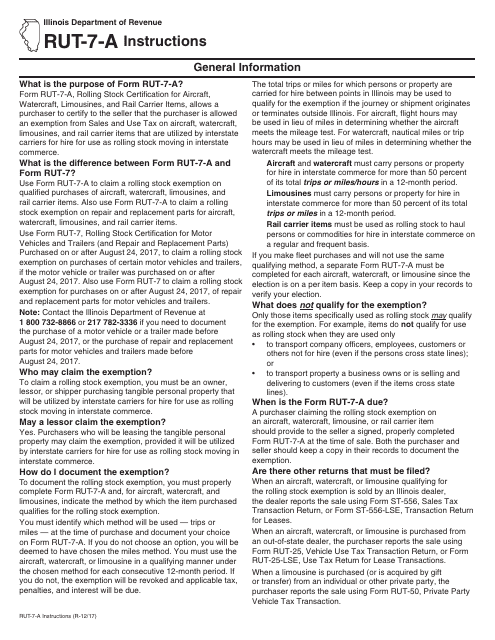

This Form is used for certifying rolling stock items such as aircraft, watercraft, limousines, and rail carrier items in the state of Illinois. It provides instructions for filling out Form RUT-7-A.

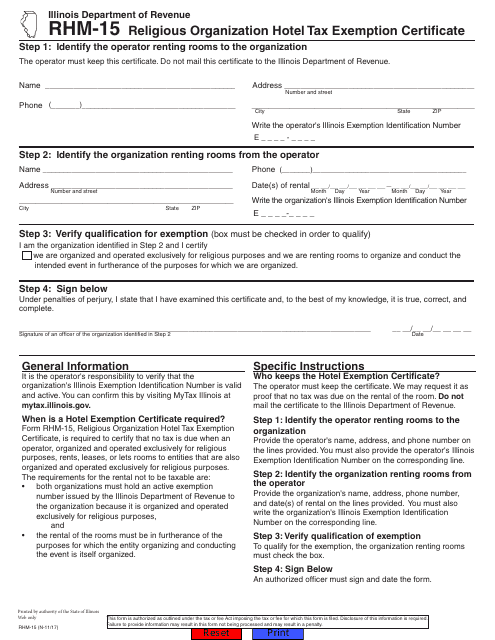

This form is used for religious organizations in Illinois to apply for hotel tax exemption.

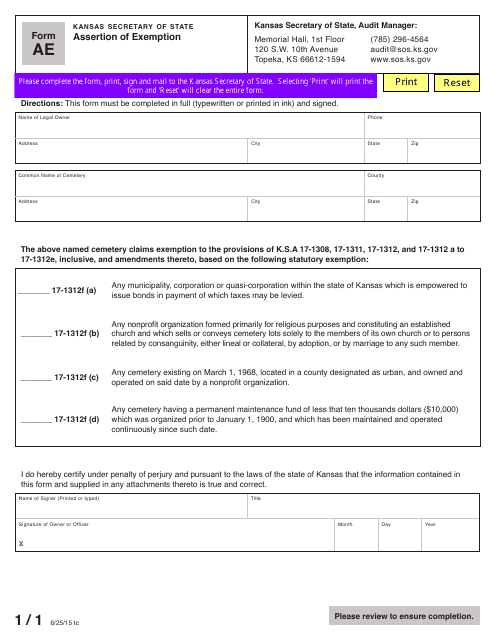

This form is used for asserting an exemption in the state of Kansas.

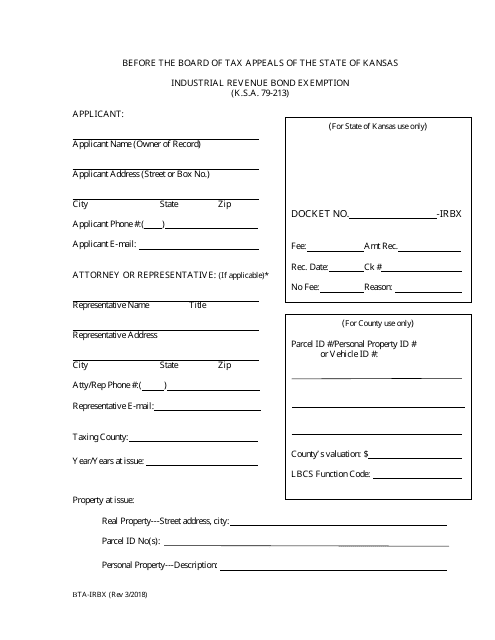

This form is used for applying for an exemption from industrial revenue bond taxes in the state of Kansas.

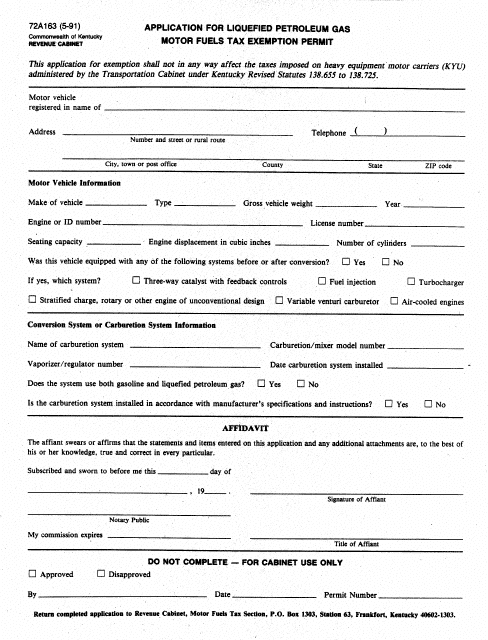

This form is used for applying for an exemption permit for the motor fuels tax on liquefied petroleum gas in the state of Kentucky.

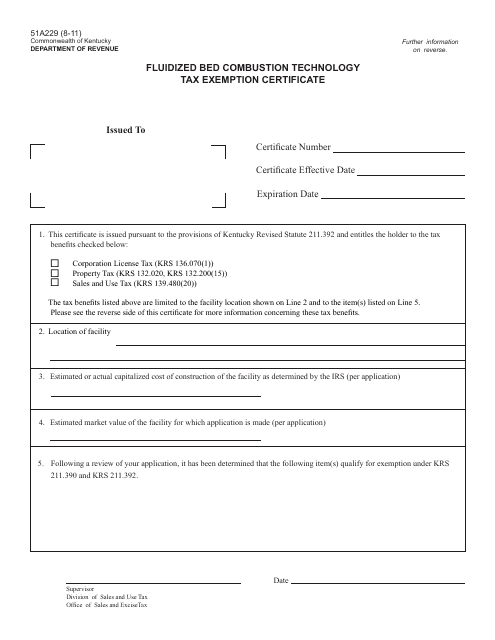

This document is used for applying for tax exemption for companies using fluidized bed combustion technology in the state of Kentucky.