Tax Exempt Form Templates

Documents:

1303

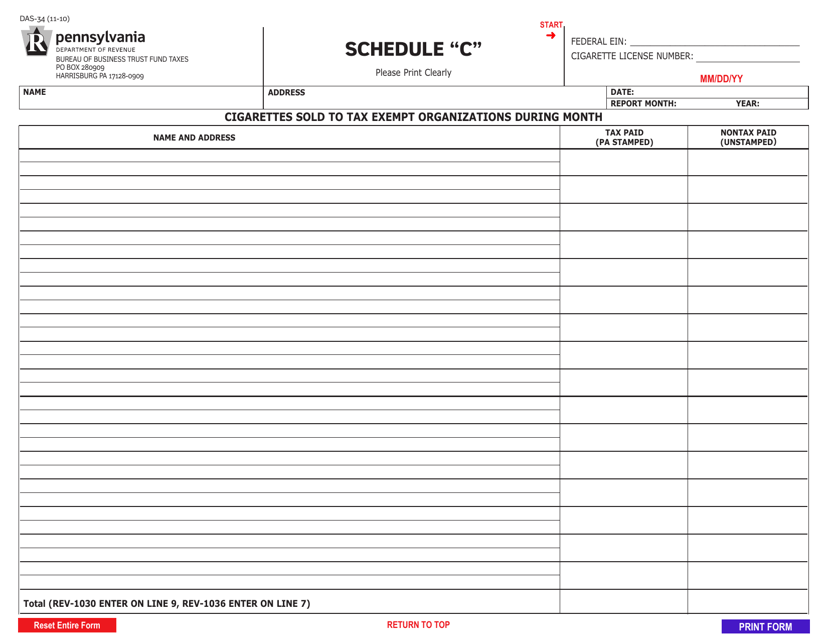

This form is used for reporting the sale of cigarettes to tax-exempt organizations in Pennsylvania during a specific month.

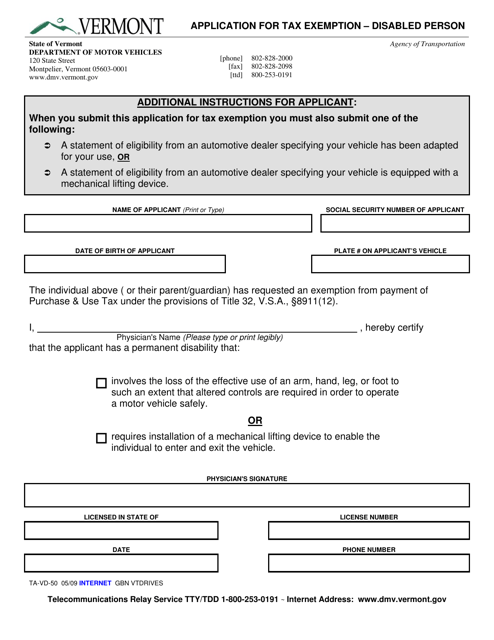

This form is used for disabled persons in Vermont to apply for tax exemption.

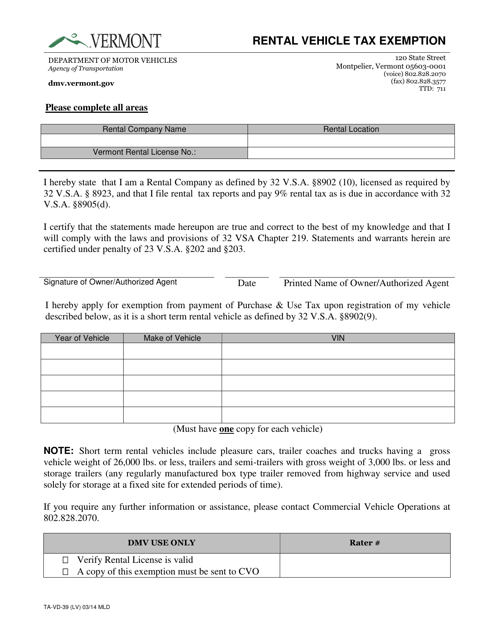

This form is used for claiming tax exemption on rental vehicles in the state of Vermont.

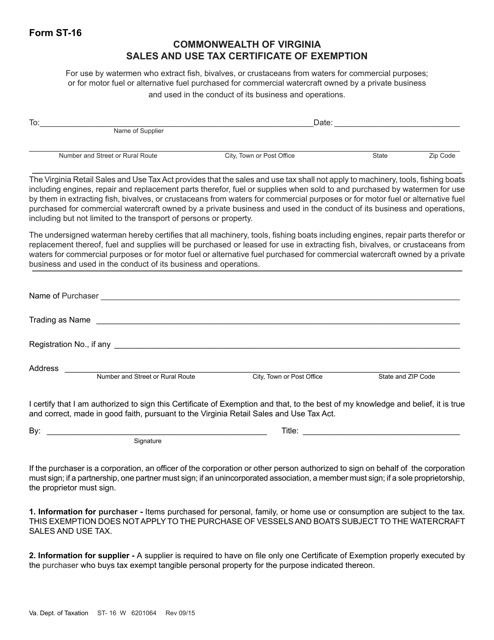

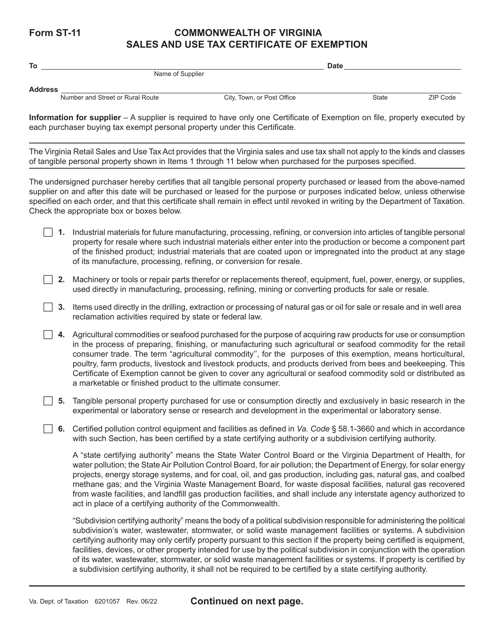

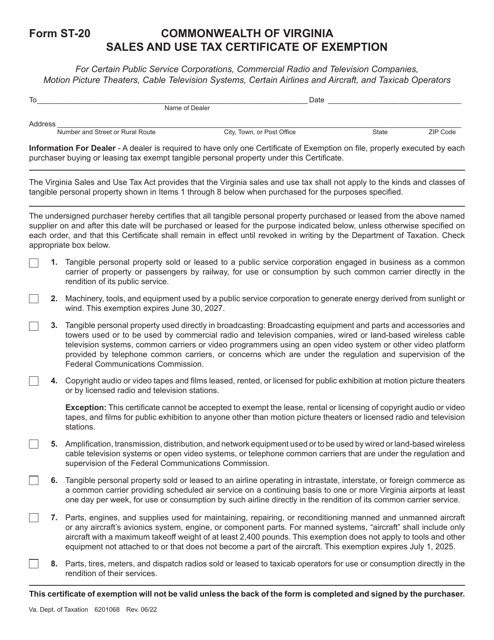

This form is used for the Sales and Use Tax Certificate of Exemption in Virginia.

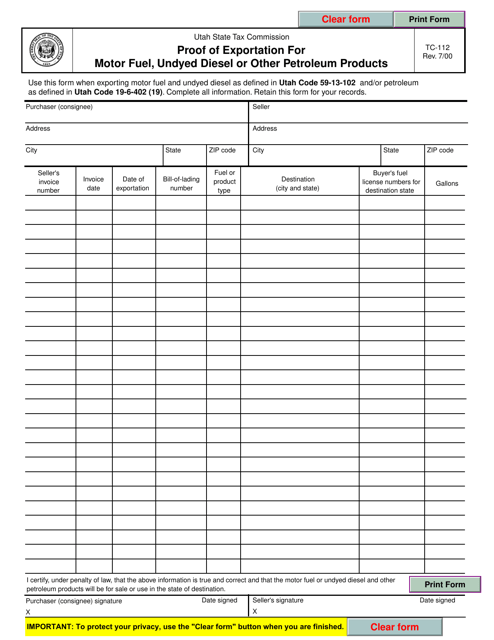

This form is used for providing proof of exportation for motor fuel, undyed diesel, or other petroleum products in the state of Utah. It is required to demonstrate that these products have been exported out of the state.

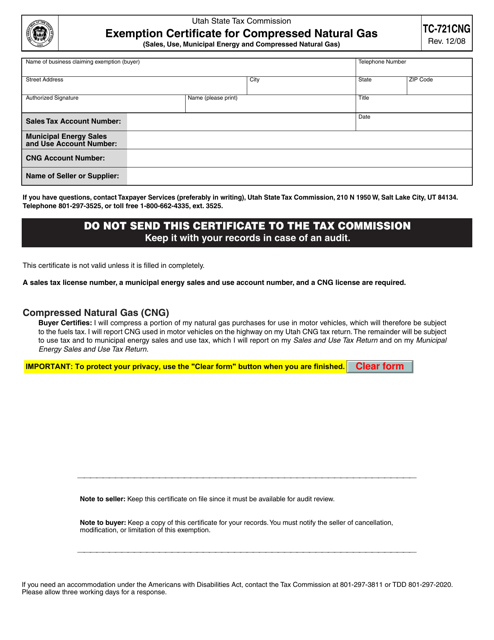

This form is used for obtaining an exemption certificate for using compressed natural gas in Utah.

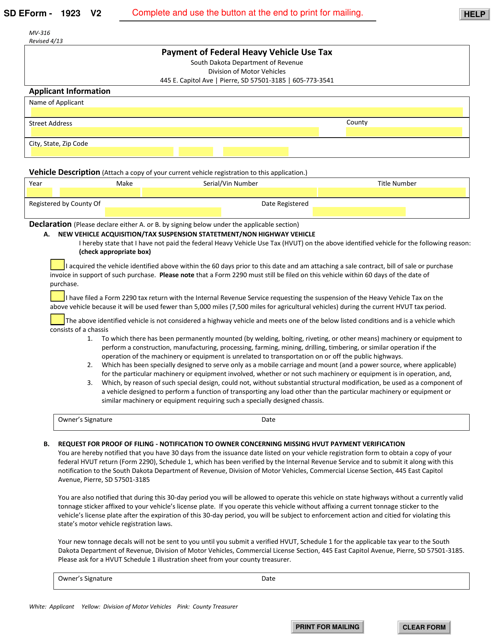

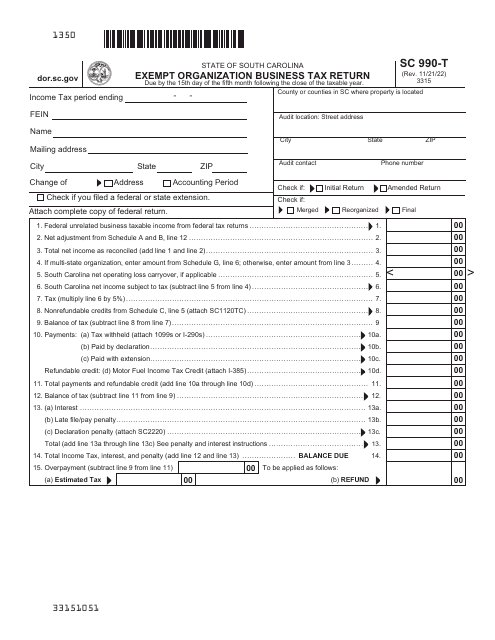

This form is used for paying the federal heavy vehicle use tax in South Dakota.

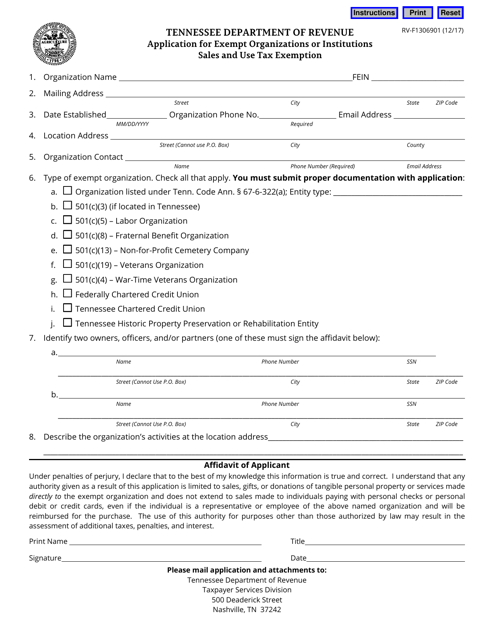

This form is used for applying for sales and use tax exemption for exempt organizations or institutions in Tennessee.

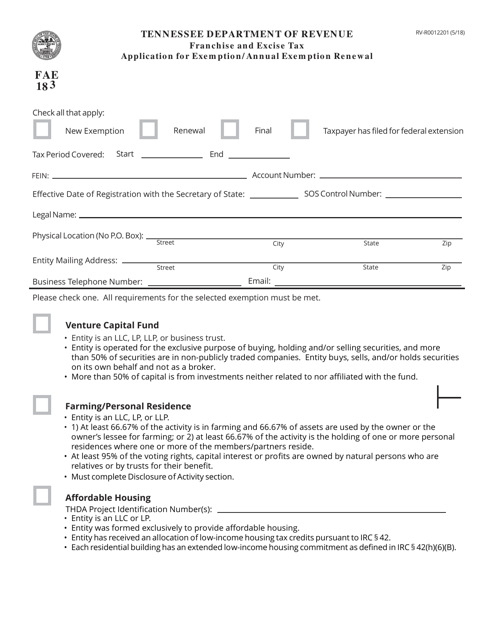

This form is used for applying for exemption or renewing an annual exemption in Tennessee.

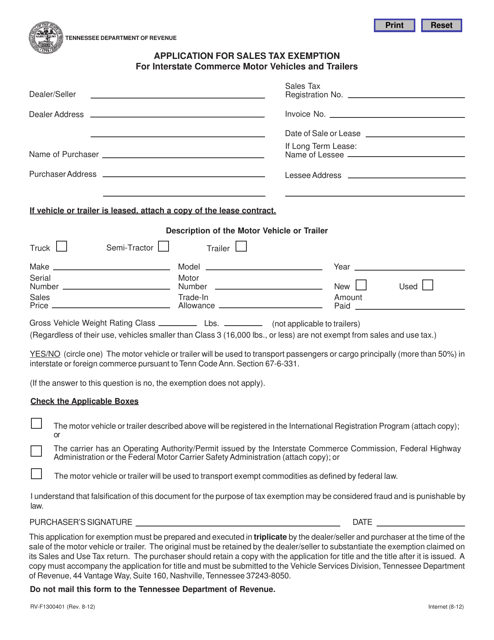

This form is used for applying for a sales tax exemption in Tennessee for motor vehicles and trailers used in interstate commerce.

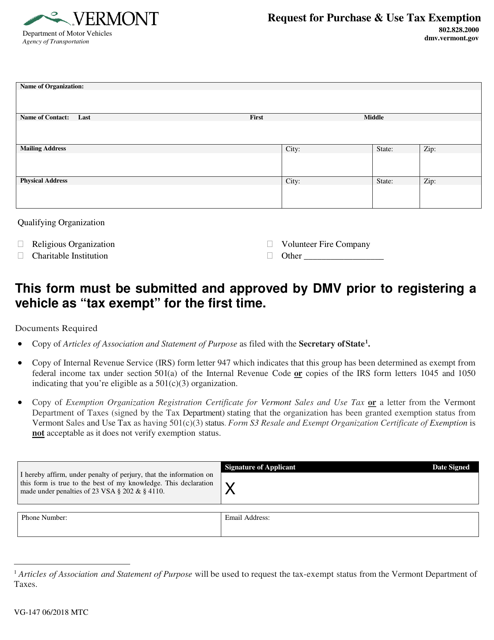

This form is used for requesting a purchase and use tax exemption in the state of Vermont.

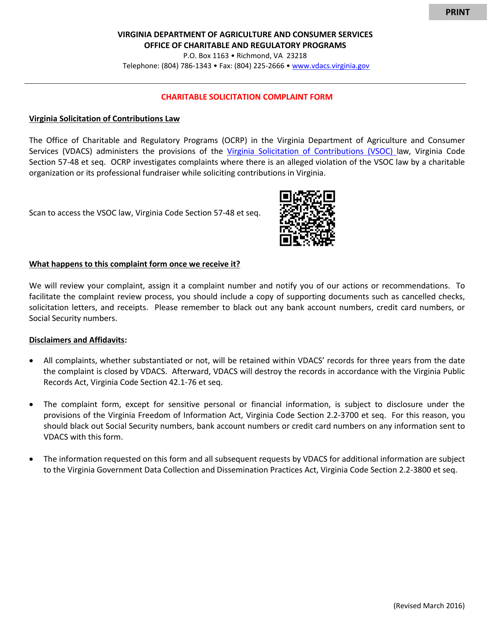

This Form is used for reporting charitable solicitation compliance in the state of Virginia. It ensures that organizations are following the necessary rules and regulations for soliciting donations.

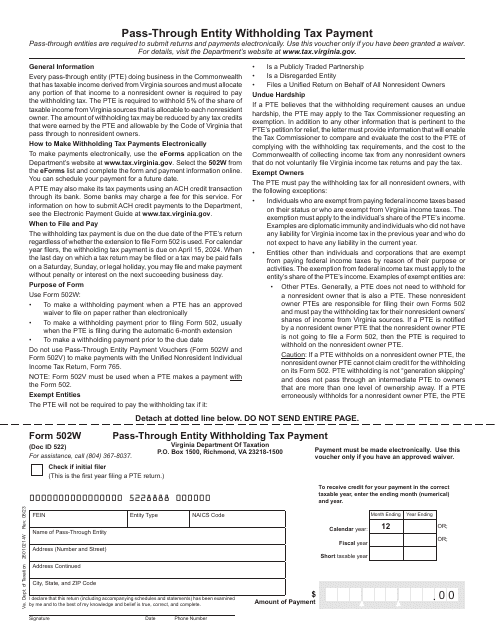

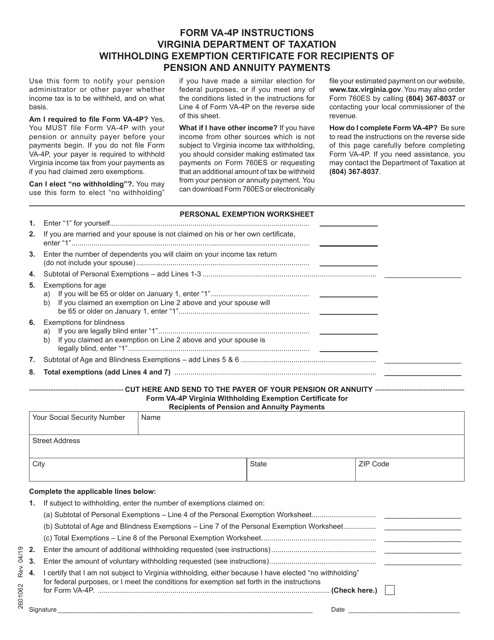

This Form is used for declaring withholding exemptions for pension and annuity recipients in the state of Virginia.

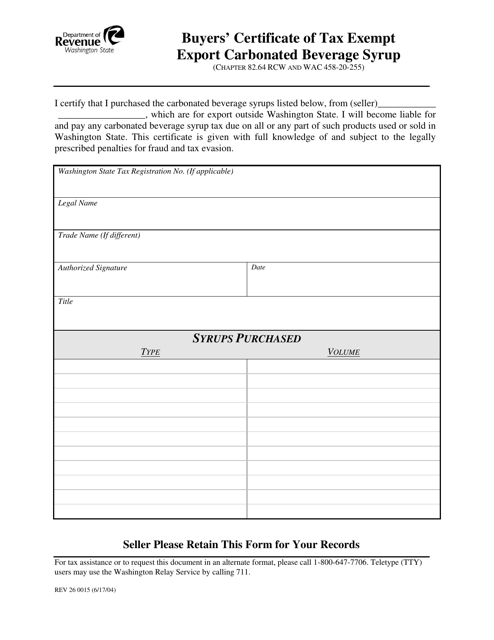

This Form is used for buyers in Washington to certify their tax-exempt export of carbonated beverage syrup.

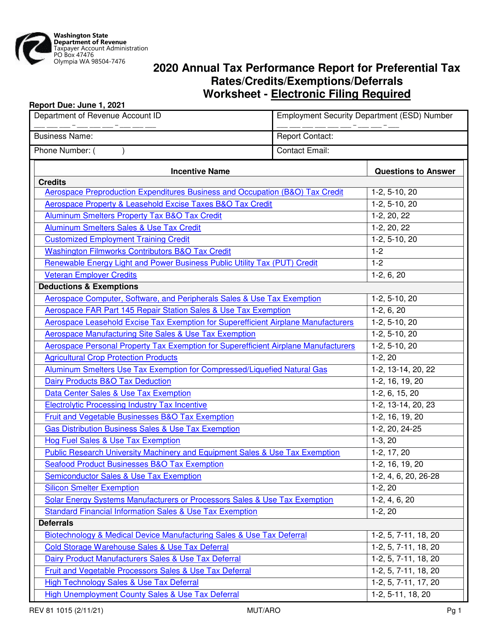

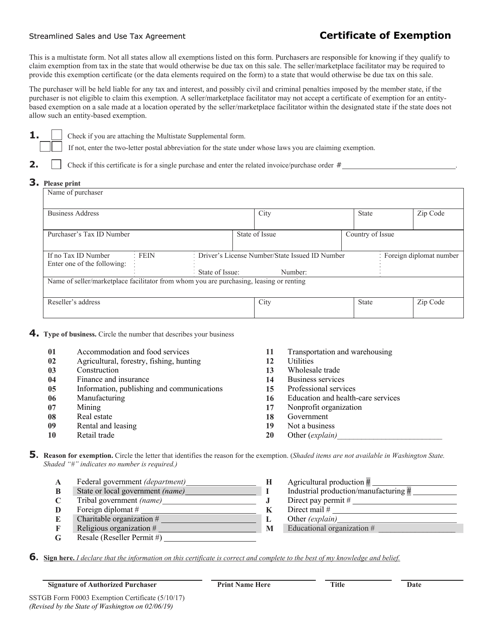

This Form is used for claiming exemption from sales and use tax in the state of Washington.

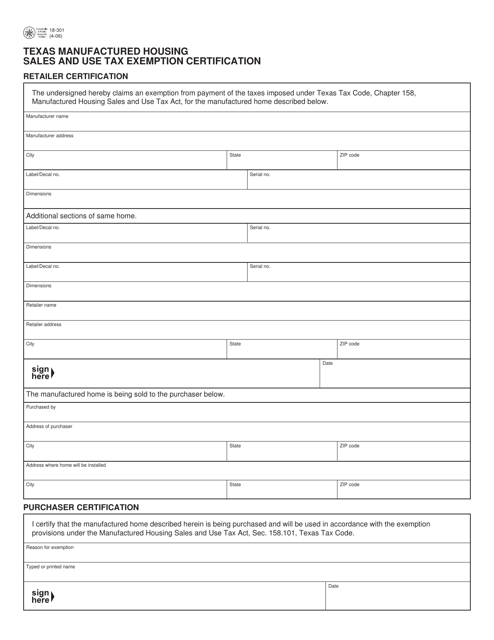

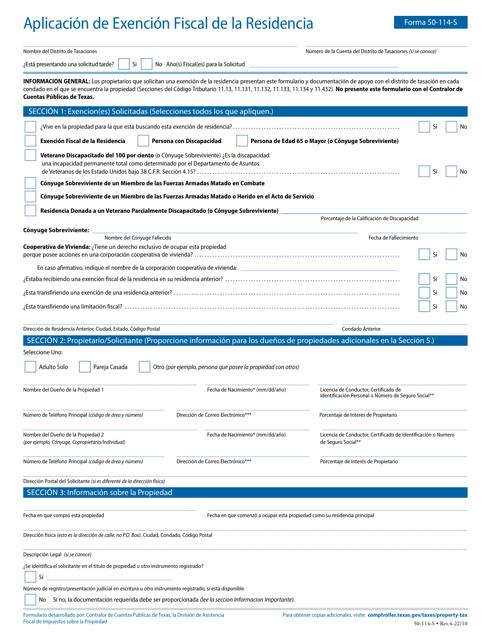

This form is used for obtaining a sales and use tax exemption for the purchase of manufactured housing in the state of Texas.

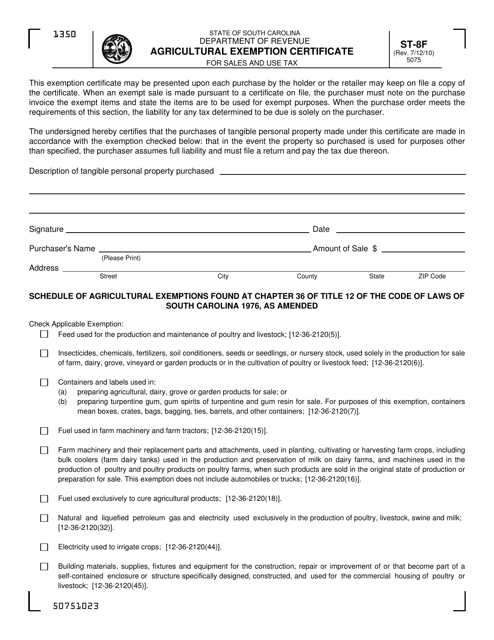

This form is used for claiming an exemption from sales and use tax on agricultural products in South Carolina. It provides instructions on how to properly fill out and submit the Form ST-8F Agricultural Exemption Certificate.

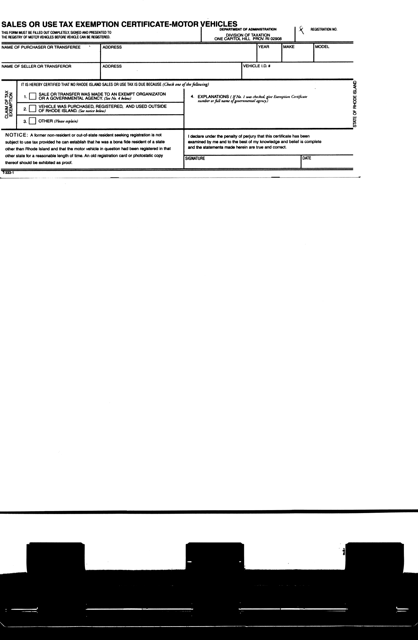

This form is used for claiming exemption from sales or use tax in the state of Rhode Island.

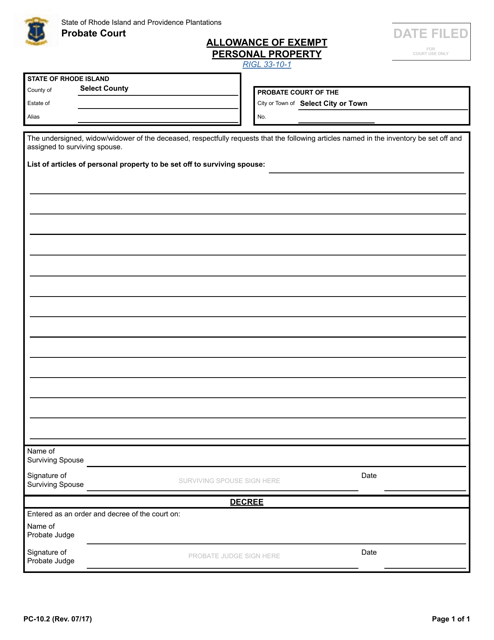

This Form is used for the allowance of exempt personal property in Rhode Island.

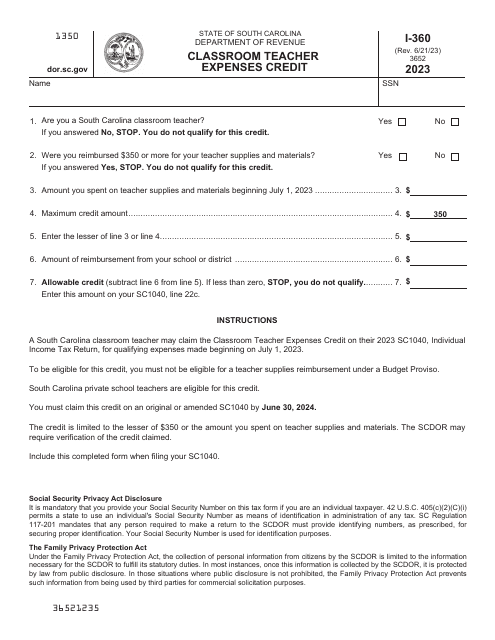

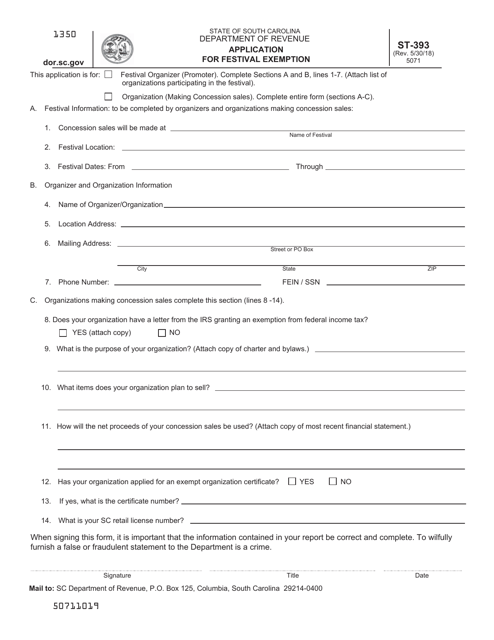

This form is used for applying for a festival exemption in South Carolina.

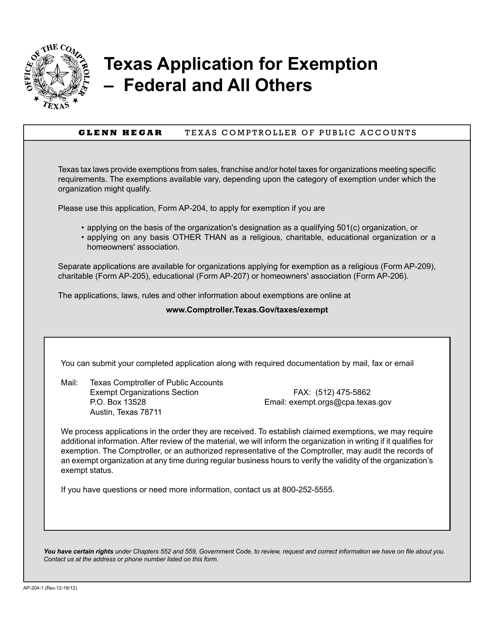

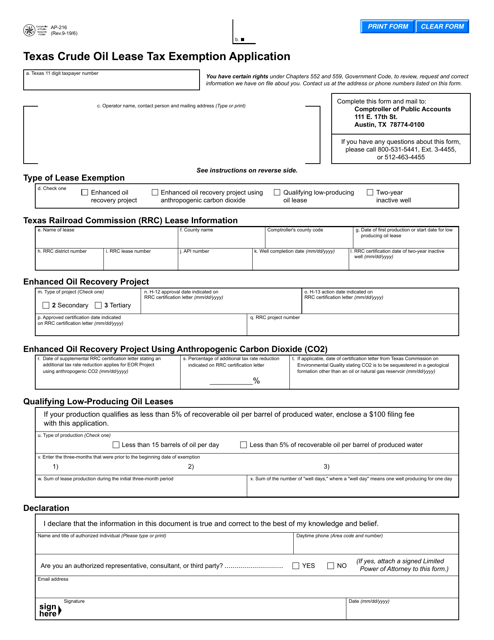

This form is used for applying for an exemption from federal and all other taxes in the state of Texas.

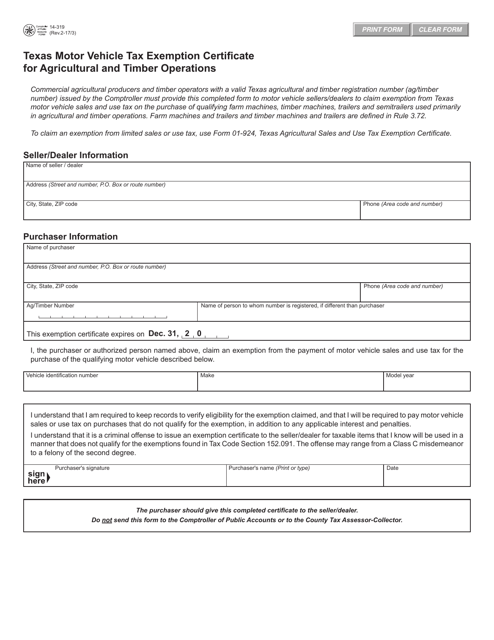

This form is used for obtaining a tax exemption certificate for agricultural and timber operations in Texas. It allows eligible individuals or businesses to claim an exemption from paying motor vehicle taxes for vehicles used in these operations.

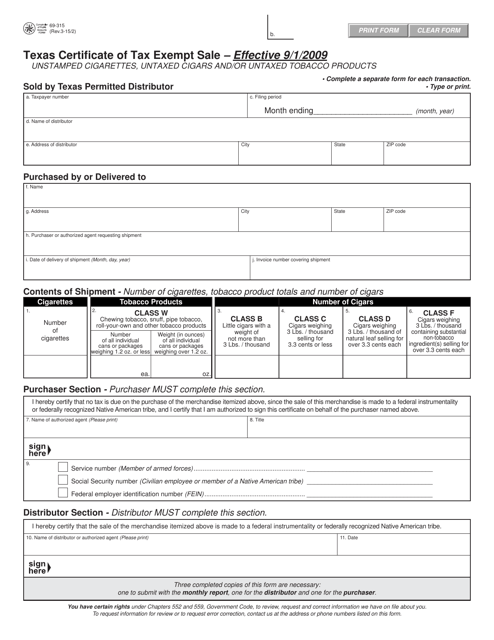

This form is used for reporting and certifying tax exempt sales in the state of Texas. It is necessary for businesses and organizations that are exempt from paying sales tax to provide this form to the seller during a qualifying transaction.

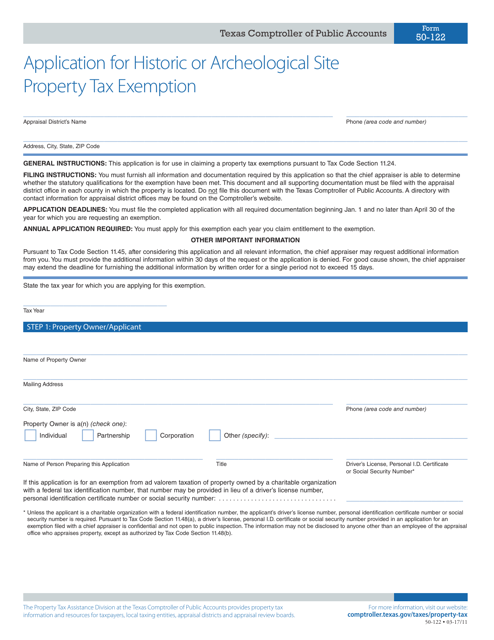

This Form is used for applying for a property tax exemption for historic or archaeological sites in Texas.

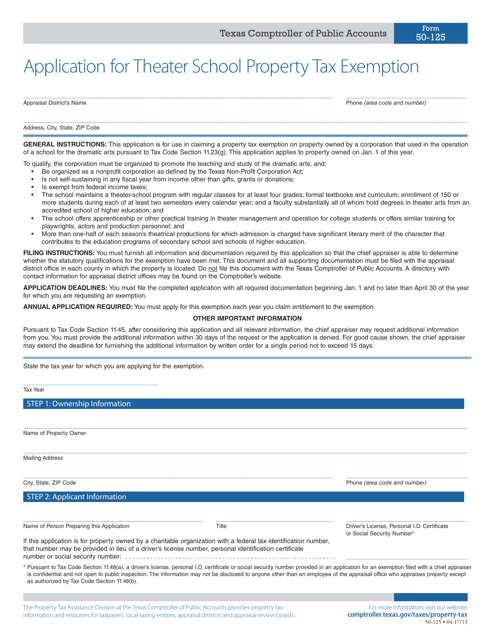

This document is used for applying for a property tax exemption for theater schools in Texas.

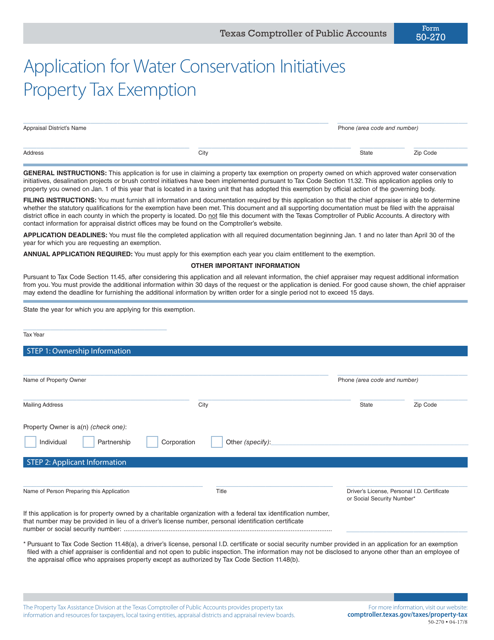

This form is used for applying for a property tax exemption in Texas for water conservation initiatives.

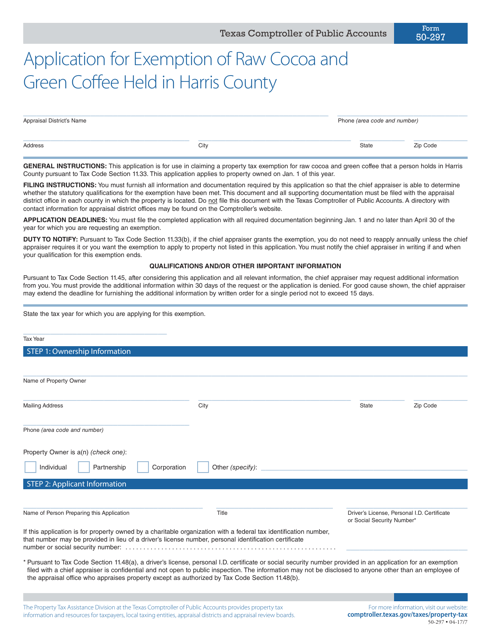

This form is used for applying for an exemption for raw cocoa and green coffee held in Harris County, Texas from certain taxes or regulations.