Tax Exempt Form Templates

Documents:

1303

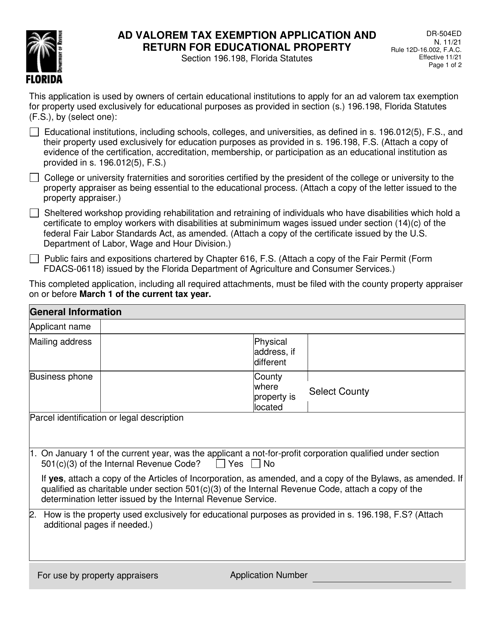

This form is used for applying for a tax exemption on educational property in Florida.

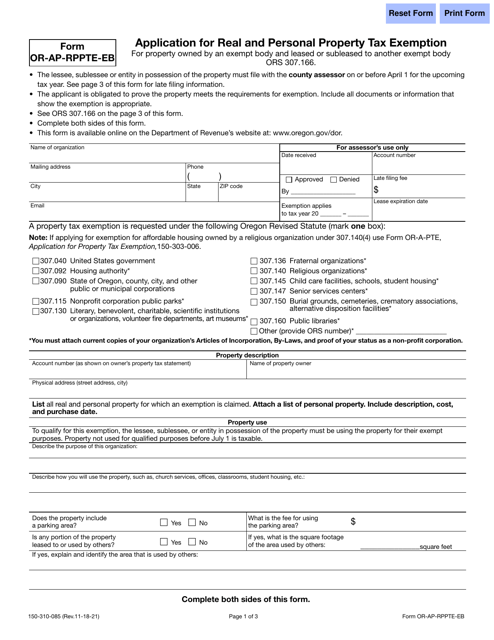

This form is used for applying for a tax exemption on real and personal property in Oregon when the property is owned by an exempt organization and leased or subleased to another exempt organization.

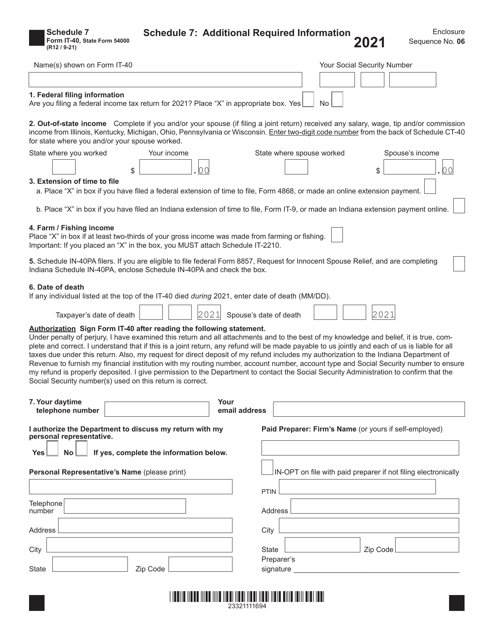

This form is used for providing additional required information for Form IT-40 in the state of Indiana.

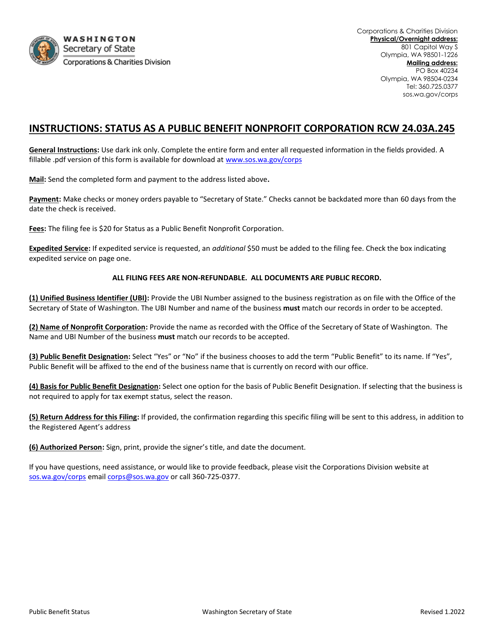

This document is used for applying for status as a public benefit nonprofit corporation in the state of Washington. It is necessary for organizations seeking to operate as a nonprofit and provide public benefits.

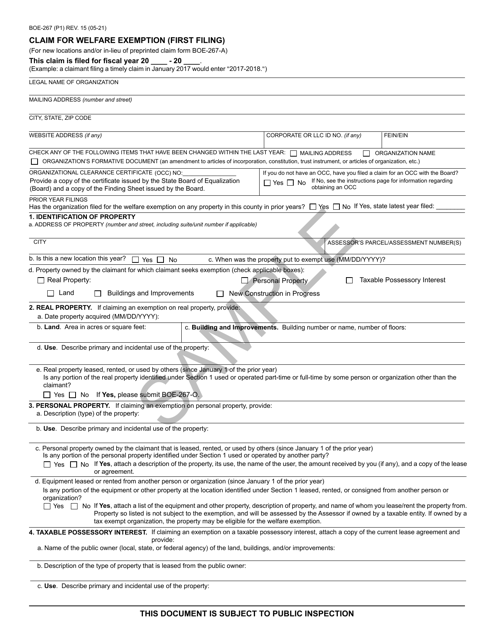

This form is used for claiming a welfare exemption for the first time in California. It is a sample form for reference purposes.

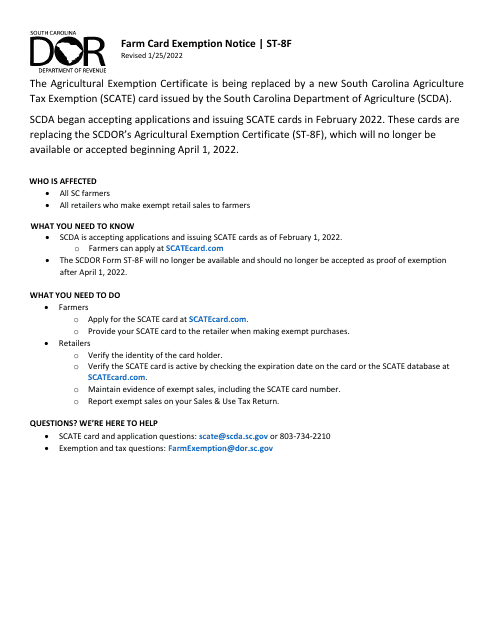

This form is used for claiming an exemption from sales and use tax on agricultural products in South Carolina. It is specifically for farmers and agricultural businesses.

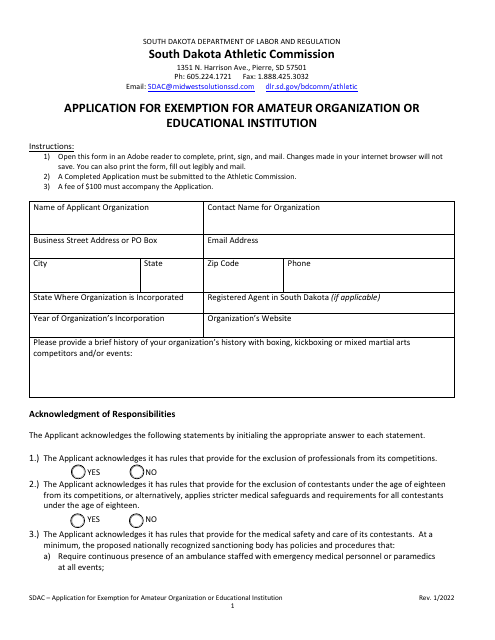

This form is used for amateur organizations or educational institutions in South Dakota to apply for exemption.

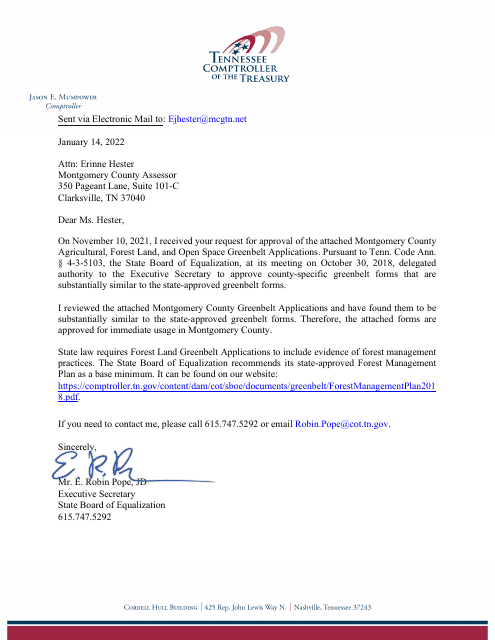

This Form is used for applying for a Greenbelt Assessment in the state of Tennessee. Greenbelt Assessment allows eligible agricultural, forest, or open land to be appraised at its current use value rather than its market value for property tax purposes.

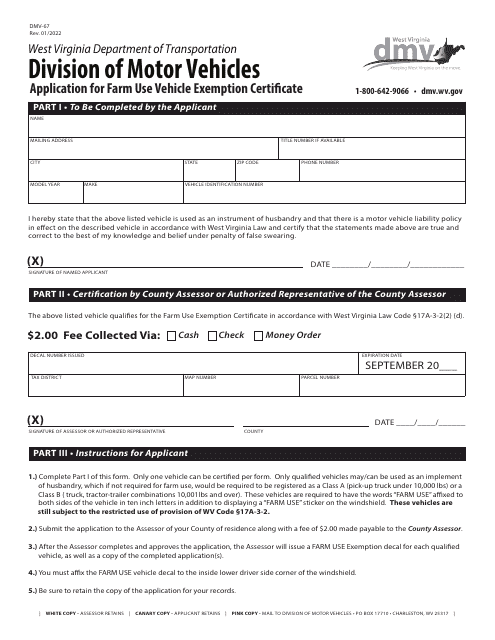

This form is used for applying for a Farm Use Vehicle Exemption Certificate in West Virginia for agricultural vehicles.