Tax Exempt Form Templates

Documents:

1303

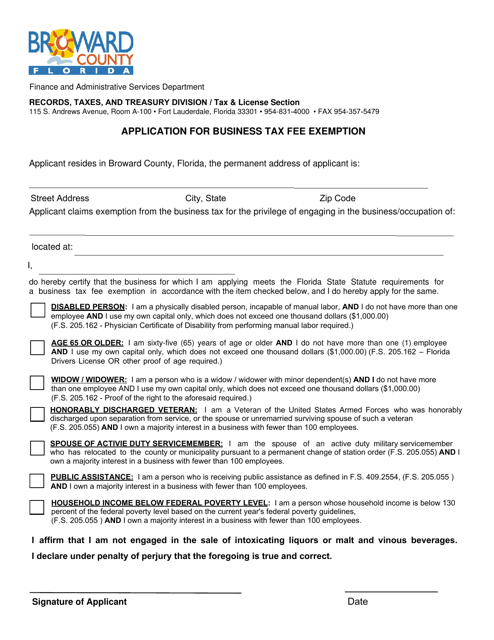

This document is an application for a business tax fee exemption in Broward County, Florida. It is used by businesses to request exemption from certain taxes.

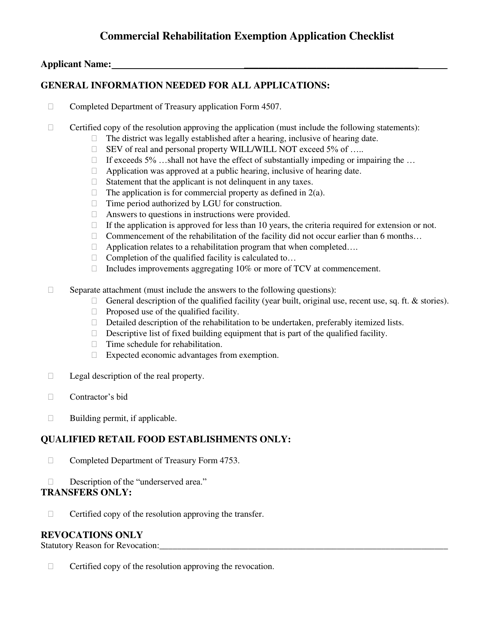

This document is a checklist for applying for a commercial rehabilitation exemption in Michigan. It provides a list of the necessary documents and steps required for the application process.

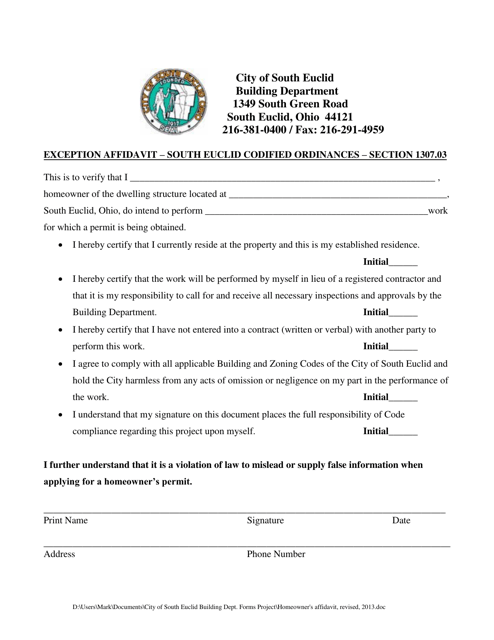

This document is used by homeowners in the City of South Euclid, Ohio to request an exception from certain property regulations or requirements.

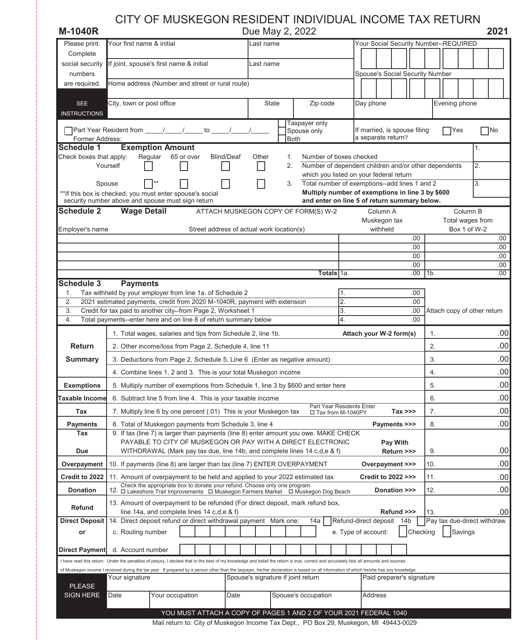

This form is used for reporting and filing resident individual income taxes for residents of Muskegon, Michigan.

This document provides instructions for filing the Corporation Income Tax Return specifically for businesses located in the City of Grand Rapids, Michigan. It explains how to report and calculate corporate income tax owed to the city.

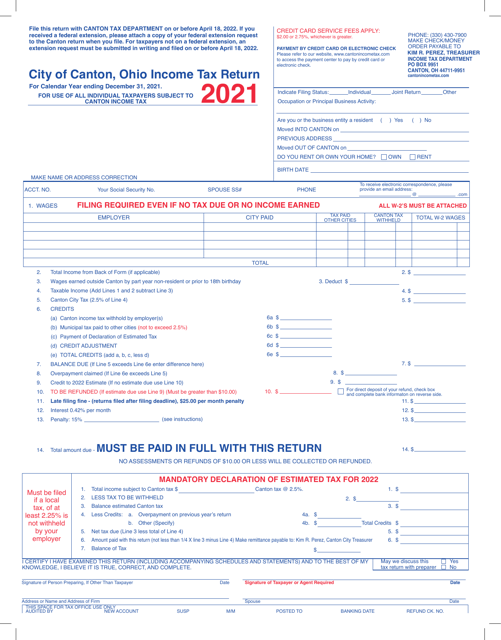

This form is used for filing the individual income tax return for residents of the city of Canton, Ohio.

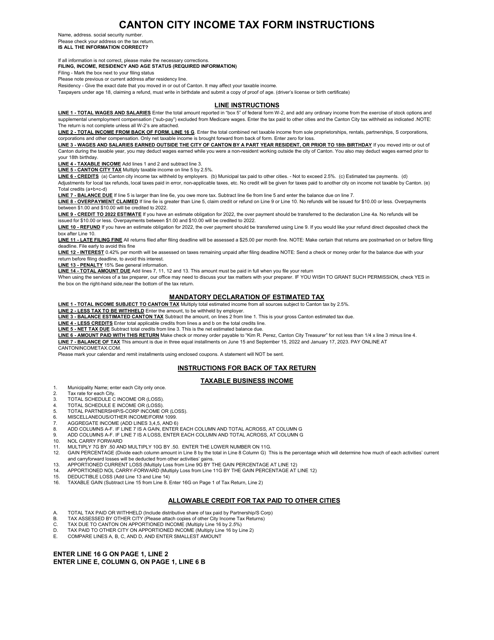

This Form is used for filing your Individual Income Tax Return with the City of Canton, Ohio. It provides step-by-step instructions for completing your tax return and ensures that you accurately report your income and claim any applicable deductions and credits.

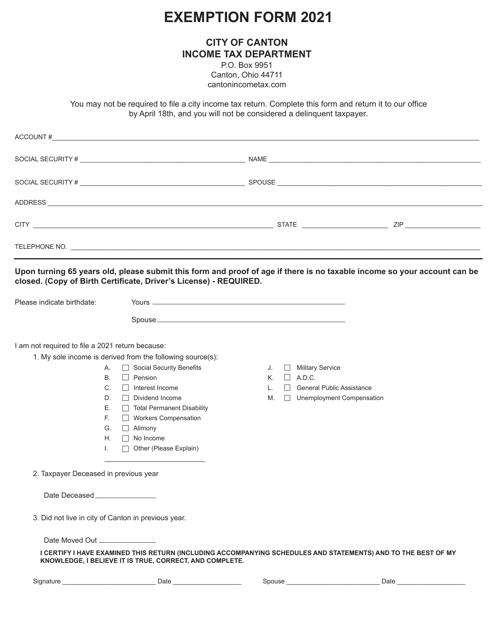

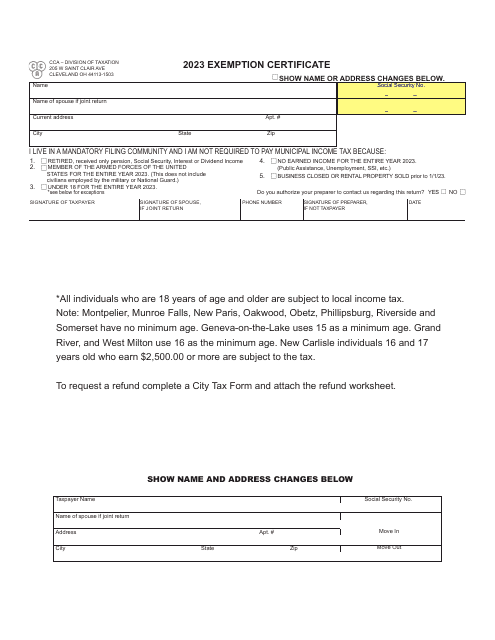

This form is used for applying for exemptions from certain City of Canton, Ohio requirements or regulations.

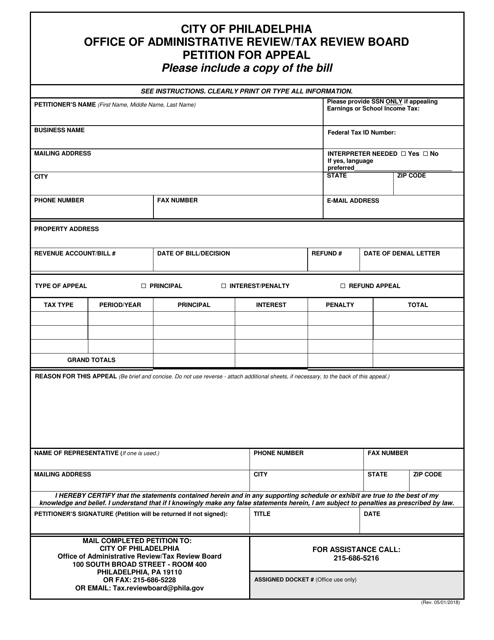

This Form is used for submitting a petition for appeal to the Tax Review Board in the City of Philadelphia, Pennsylvania.

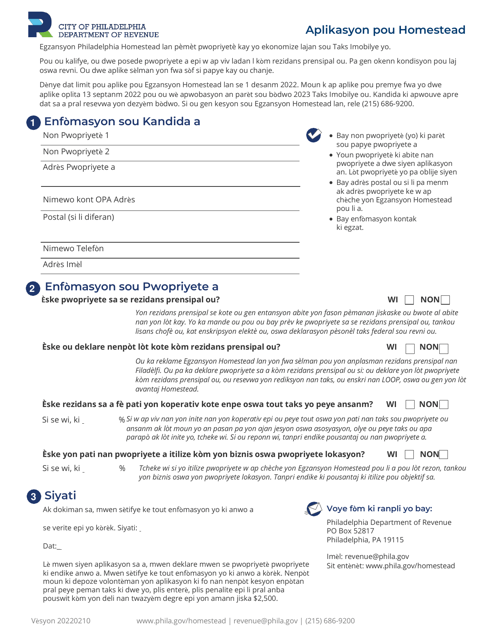

This document is an application for the Homestead Exemption in the City of Philadelphia, Pennsylvania. It is available in Haitian Creole language. The Homestead Exemption provides property tax relief for homeowners in Philadelphia.

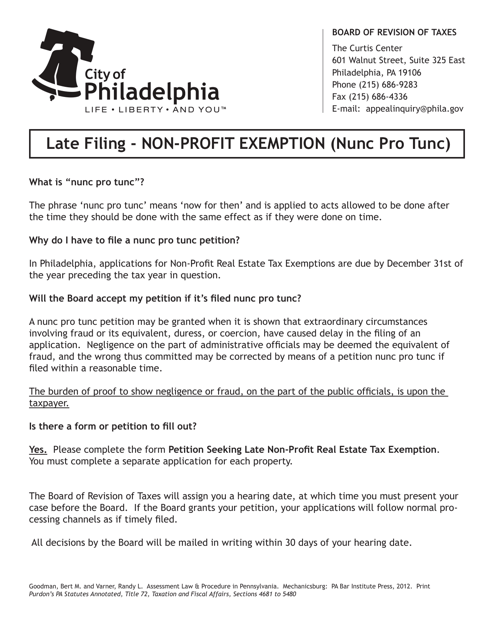

This document is a petition for a late non-profit real estate tax exemption in the City of Philadelphia, Pennsylvania. It is used to request a retroactive exemption for real estate taxes for a non-profit organization.

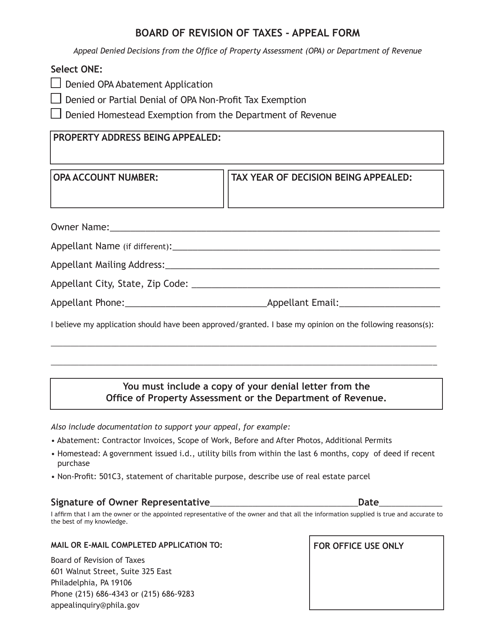

This Form is used for appealing a denied abatement or exemption in the City of Philadelphia, Pennsylvania.

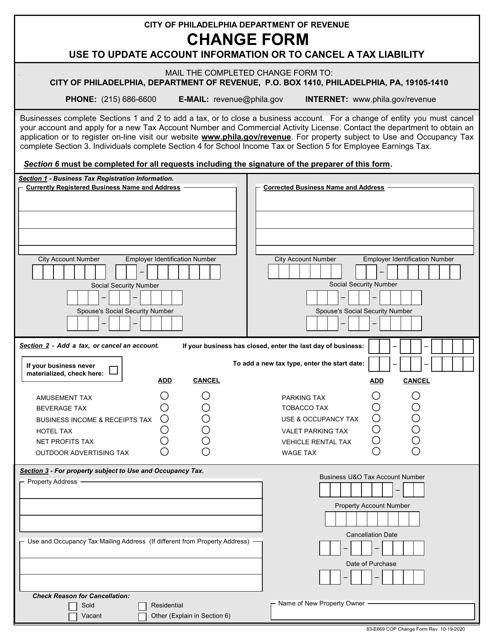

This form is used for changing your tax account information with the City of Philadelphia, Pennsylvania.

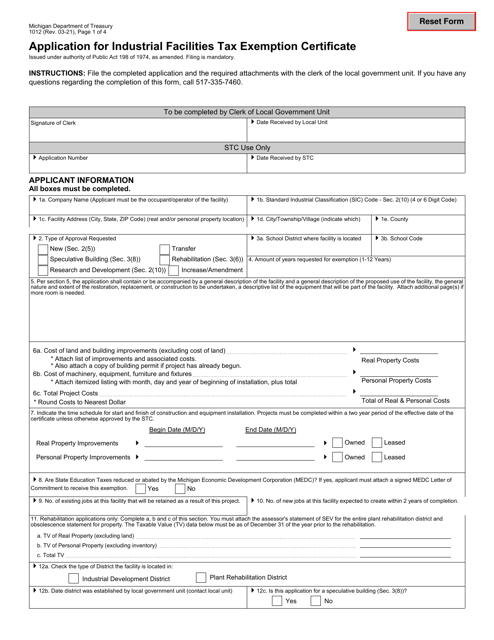

This Form is used for applying for an Industrial Facilities Tax Exemption Certificate in Michigan.

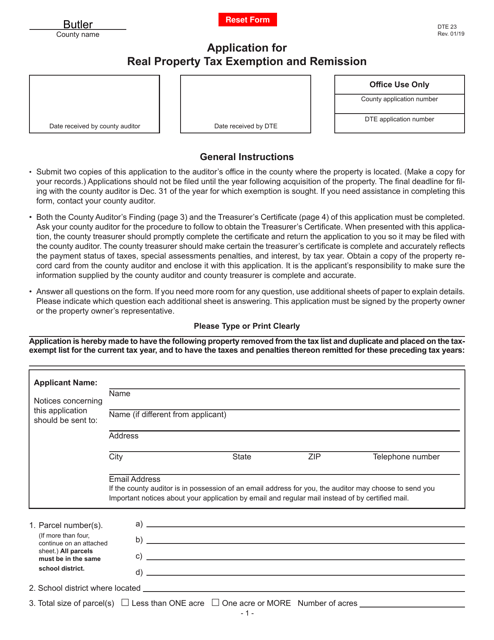

This form is used for applying for real property tax exemption and remission in Butler County, Ohio.

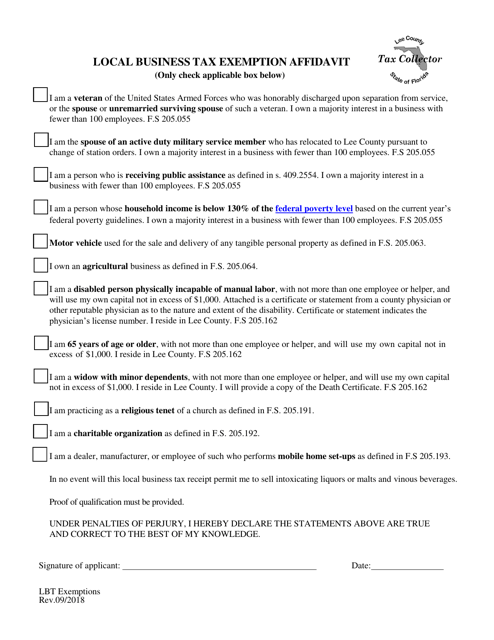

This document is for local businesses in Lee County, Florida to apply for tax exemption.

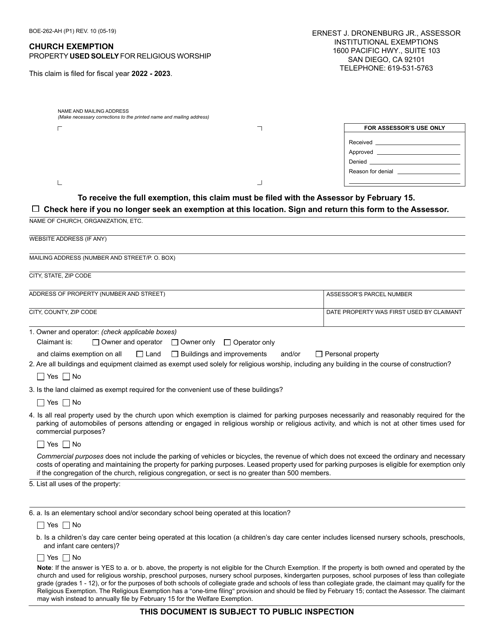

This form is used for applying for a church exemption in the County of San Diego, California.

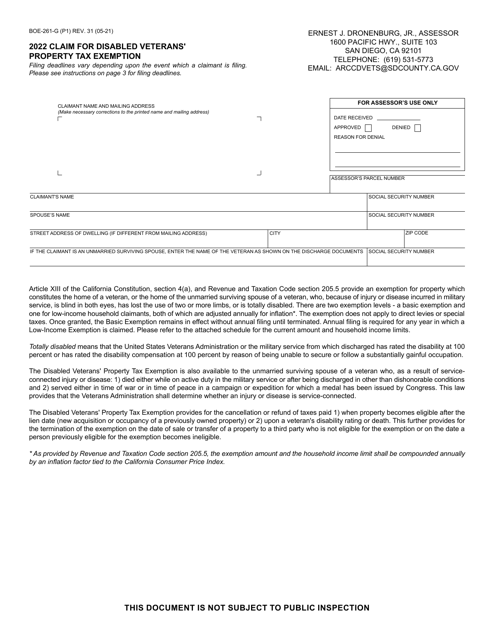

This form is used for claiming a property tax exemption for disabled veterans in San Diego County, California.

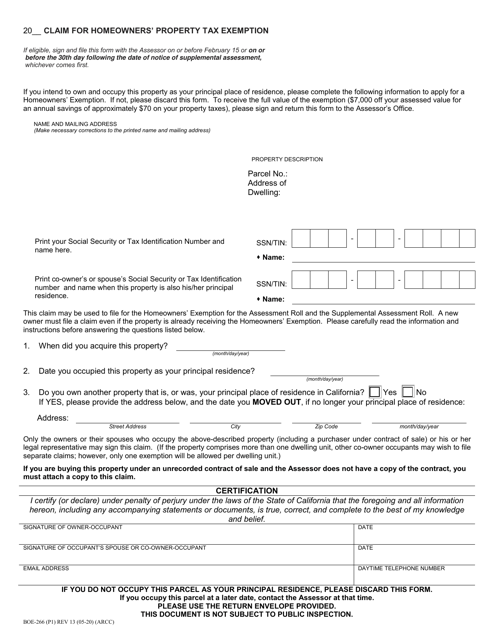

This form is used for homeowners in San Diego, California to claim a property tax exemption.

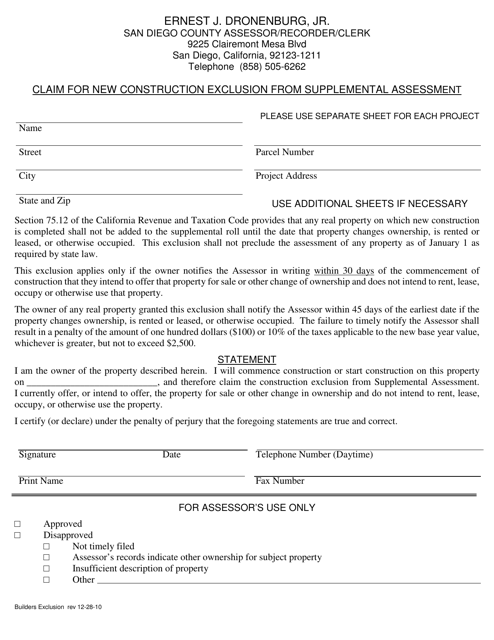

This form is used for claiming the exclusion from supplemental assessment for new construction in San Diego County, California. It allows property owners to request a reassessment of their property value due to new construction, which may result in a lower tax assessment.

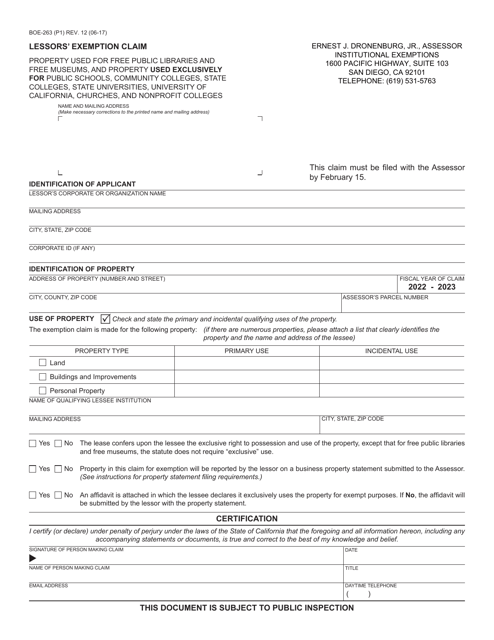

This form is used for claiming a lessors' exemption in San Diego County, California.

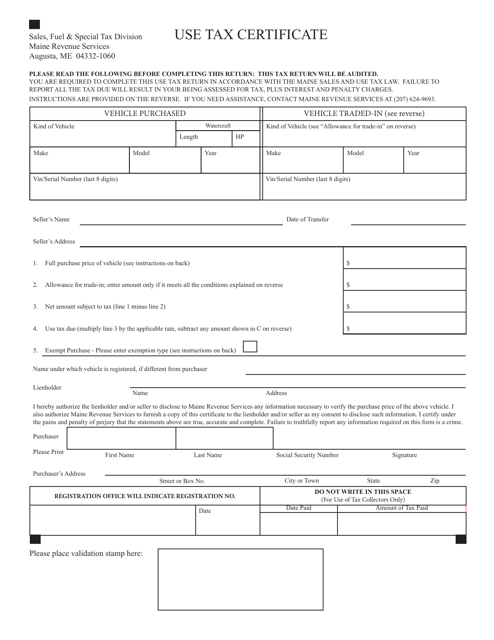

This document is used for reporting and paying use tax in the state of Maine.

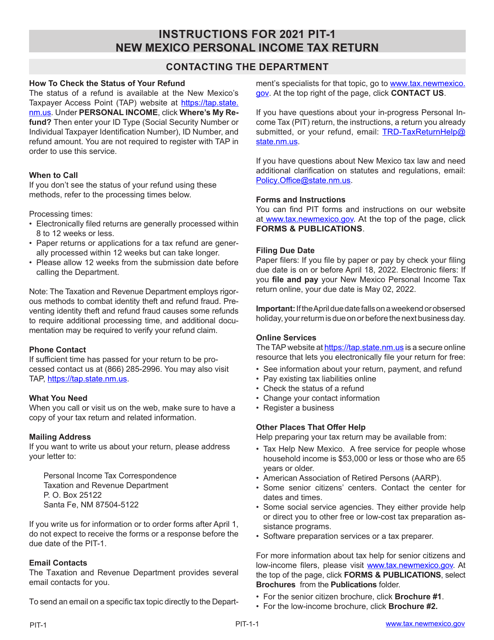

This Form is used for filing the New Mexico Personal Income Tax Return in the state of New Mexico. It provides instructions on how to accurately complete and submit the PIT-1 form for income taxes.

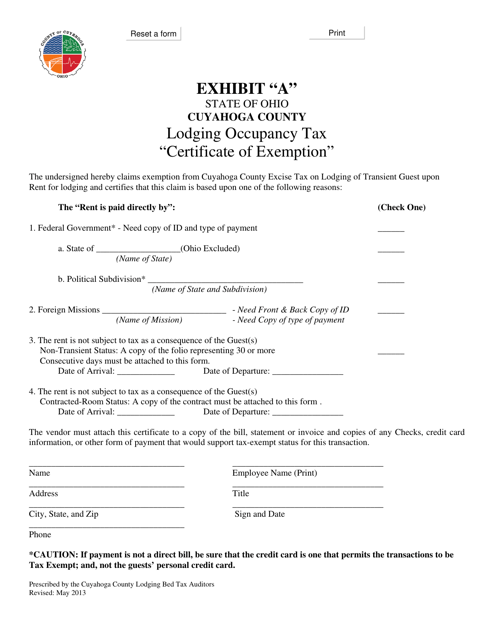

This document is a Lodging Occupancy Tax Certificate of Exemption specific to Cuyahoga County, Ohio. It is used for exempting certain types of lodging establishments from paying occupancy taxes in the county.

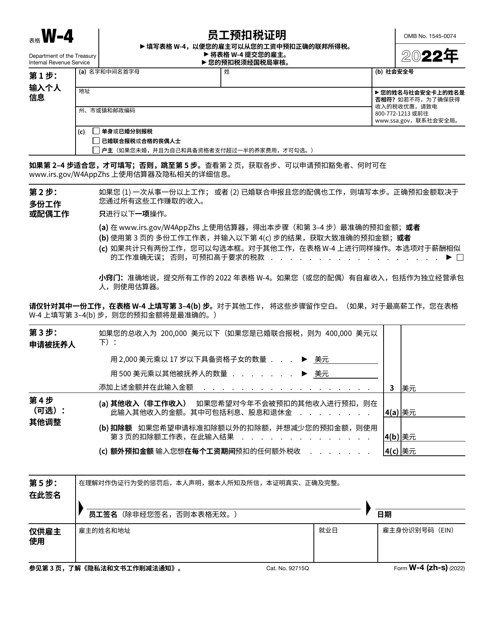

This Form is used for Chinese Simplified version of the IRS Form W-4 Employee's Withholding Certificate. It is used by employees to indicate their tax withholding preferences for income earned in the United States.

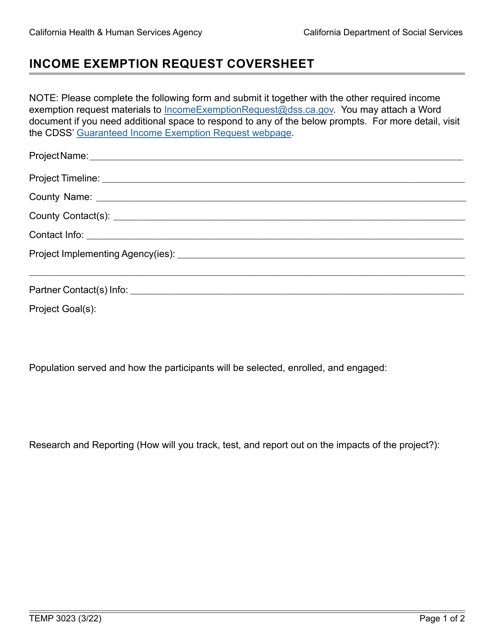

This form is used for requesting an exemption from income requirements in California.

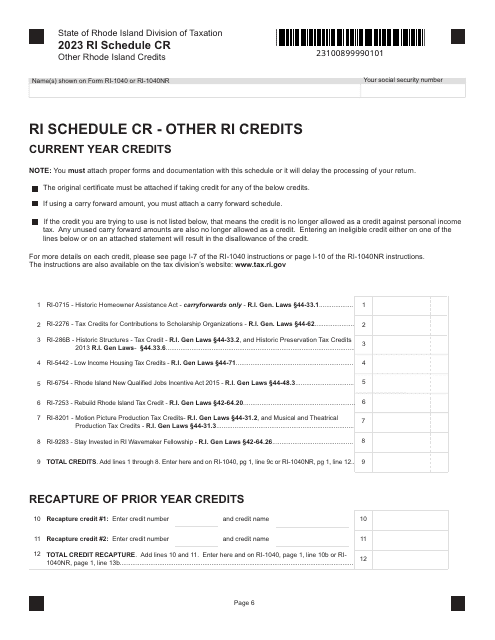

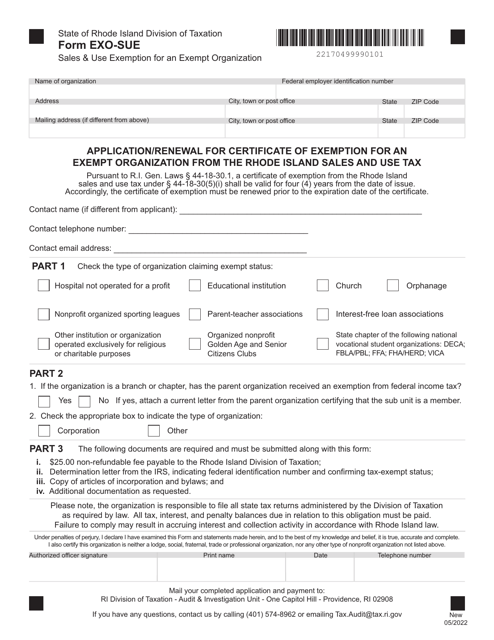

This form is used for applying or renewing a certificate of exemption for an exempt organization from the Rhode Island sales and use tax.

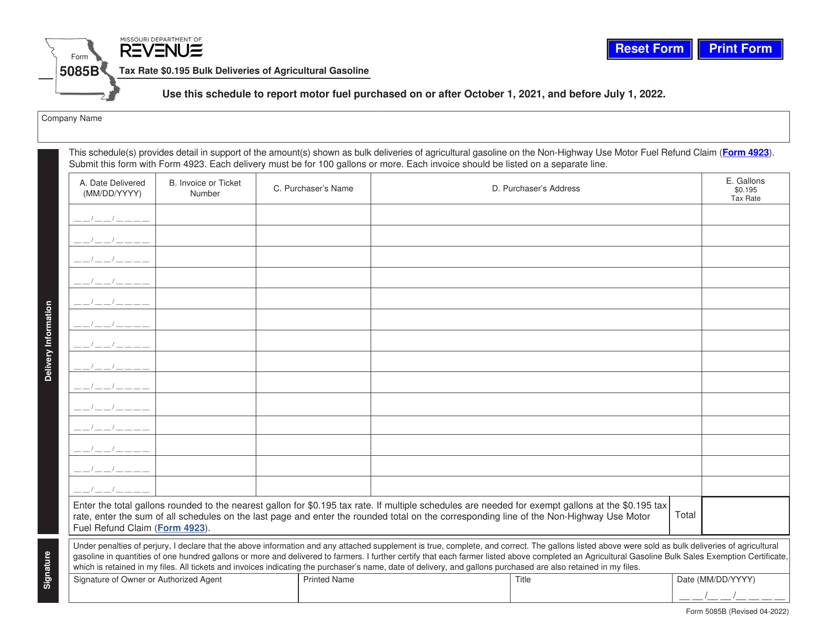

This form is used for reporting and paying a tax rate of $0.195 on bulk deliveries of agricultural gasoline in the state of Missouri.

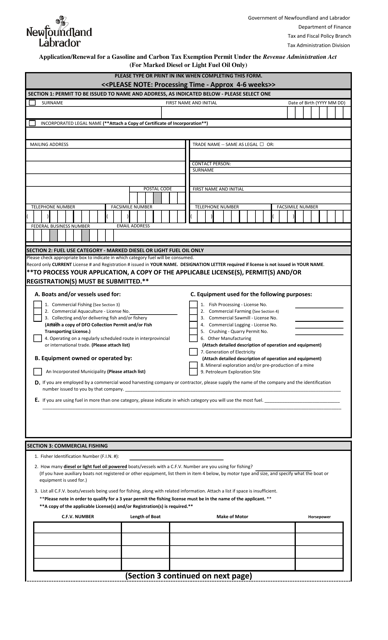

This document is used for applying or renewing a gasoline and carbon tax exemption permit in Newfoundland and Labrador, Canada, under the Revenue Administration Act.

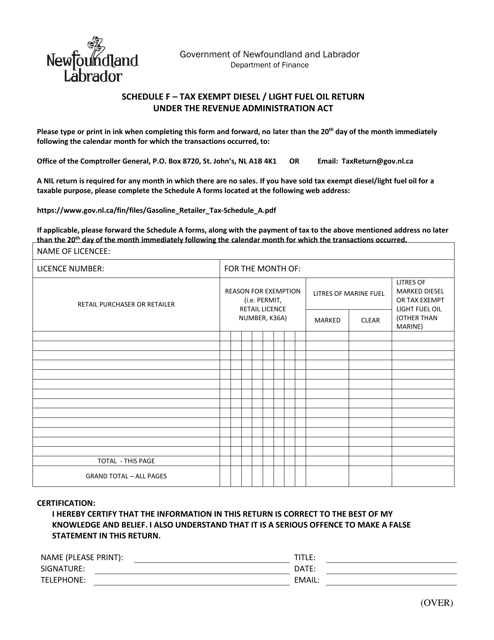

This document is used for filing tax returns for diesel or light fuel oil in Newfoundland and Labrador, Canada. It is specifically for tax-exempt entities.