Tax Exempt Form Templates

Documents:

1303

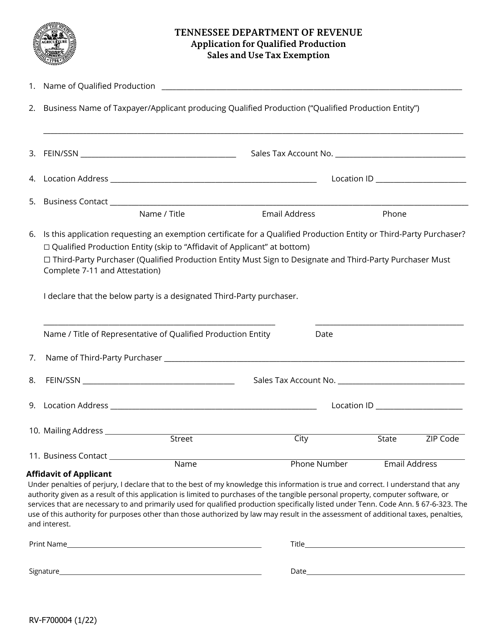

This form is used for applying for a qualified production sales and use tax exemption in Tennessee. It helps businesses in the production industry to claim exemptions on the sales and use tax for certain goods and services.

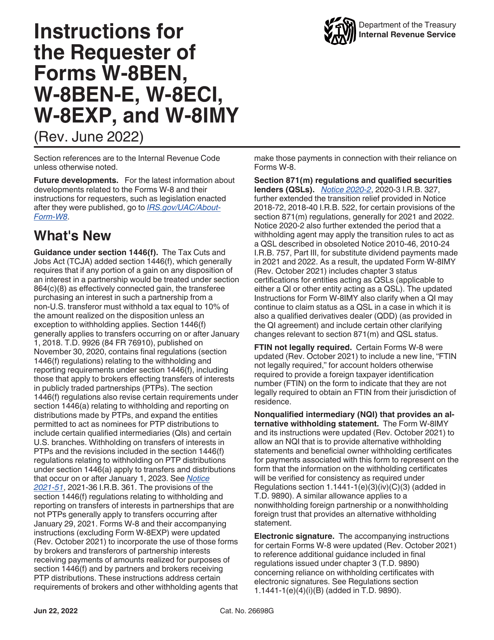

This document provides instructions for individuals or entities requesting Forms W-8BEN, W-8BEN-E, W-8ECI, W-8EXP, and W-8IMY. It explains how to complete these forms necessary for tax purposes.

This form is also known as the IRS itemized deductions form. It belongs to the IRS 1040 series. This document is used in order to calculate the amount of your itemized deductions.

This is a formal statement prepared by an employee after figuring out how much tax an employer has to deduct from their paycheck.

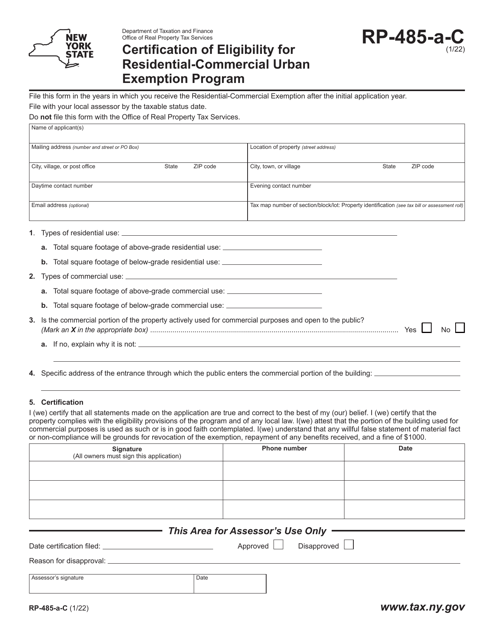

This form is used for certifying eligibility for the Residential-Commercial Urban Exemption Program in New York.

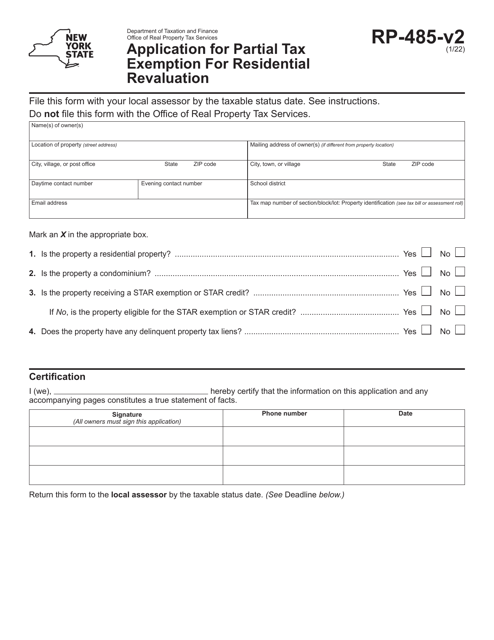

This form is used to apply for a partial tax exemption for residential revaluation in New York. It allows homeowners to potentially reduce their property taxes based on the changes in market value of their residential property.

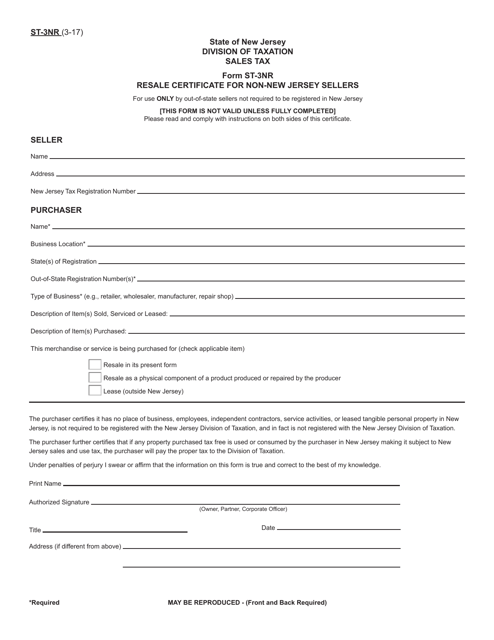

This form is used for non-New Jersey sellers to obtain a resale certificate for sales in New Jersey. It is required for sellers who are not based in New Jersey but make taxable sales in the state.

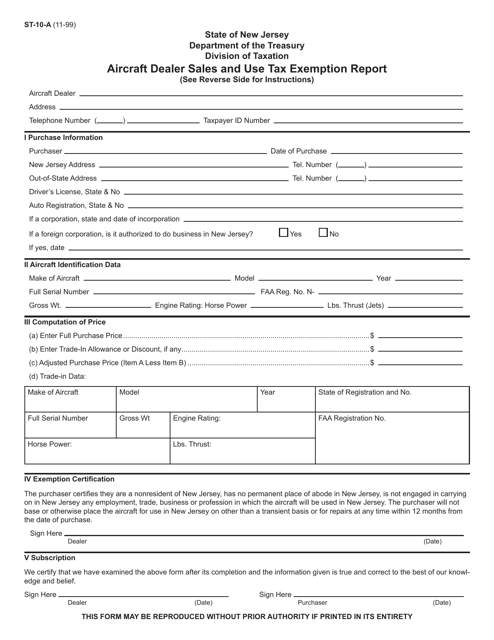

This form is used for reporting sales and use tax exemptions for aircraft dealers in New Jersey.

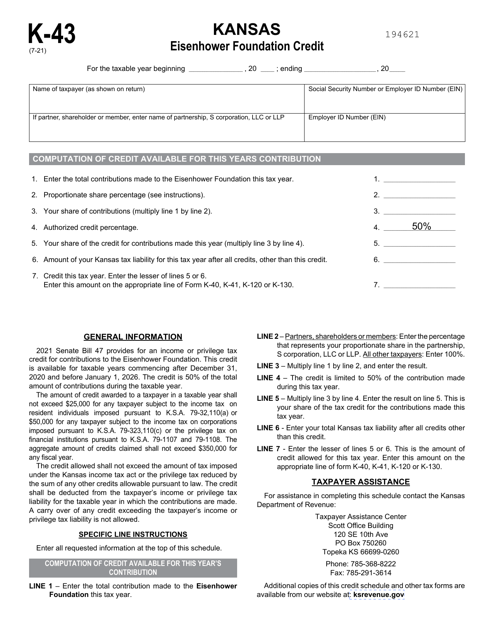

This form is used for claiming the Kansas Eisenhower Foundation Credit in the state of Kansas. Taxpayers can use this credit to offset their state income tax liability.