Tax Exempt Form Templates

Documents:

1303

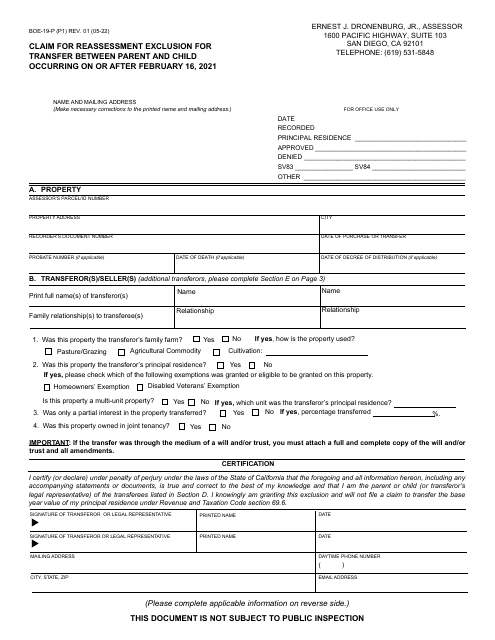

This form is used for claiming reassessment exclusion for property transfers between a parent and child in San Diego County, California that occurred on or after February 16, 2021.

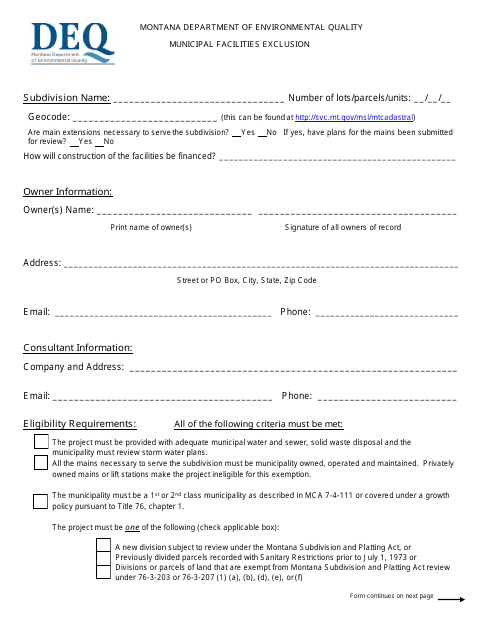

This document provides information about the Municipal Facilities Exclusion in Montana.

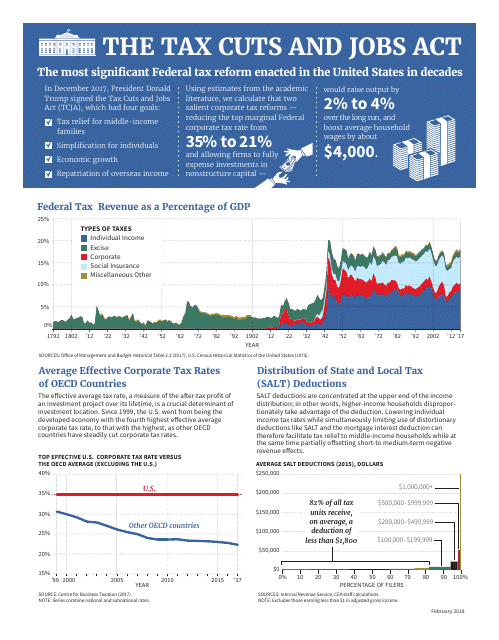

This document explains the Tax Cuts and Jobs Act, a law in the United States that made changes to the tax code with the goal of promoting economic growth and job creation.

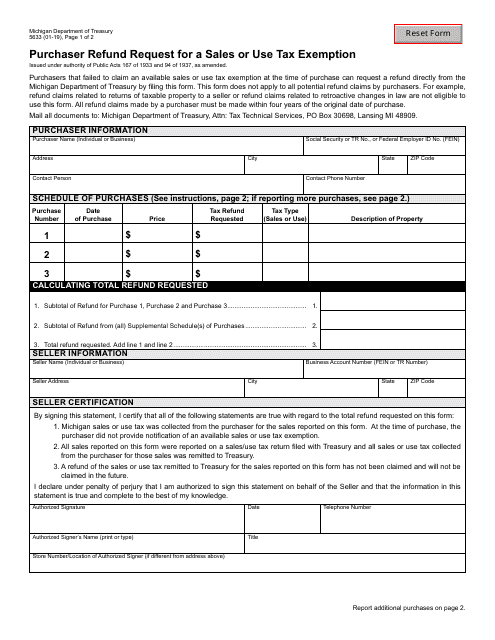

This form is used for requesting a refund for sales or use tax exemption in Michigan.

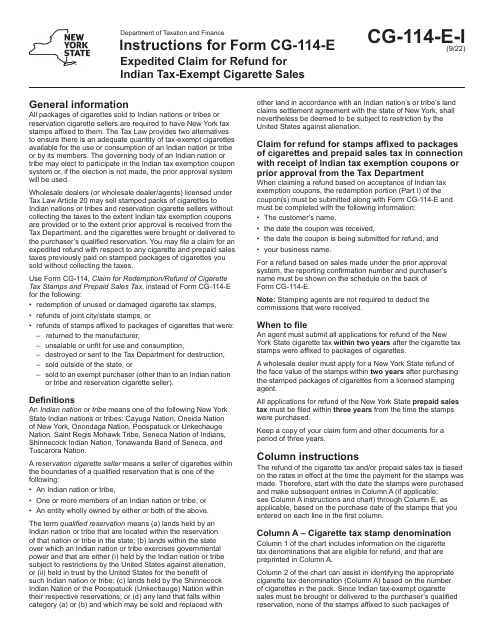

This form is used for filing an expedited claim for refund for Indian tax-exempt cigarette sales in New York. It provides instructions on how to complete the form and submit the claim.

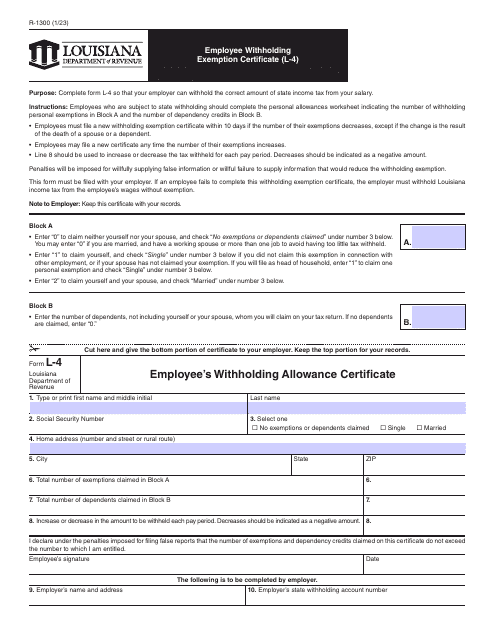

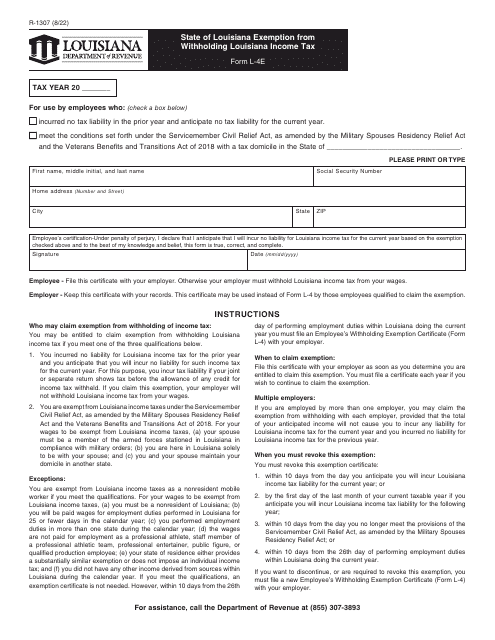

This Form is used for claiming exemption from withholding Louisiana income tax in the state of Louisiana.

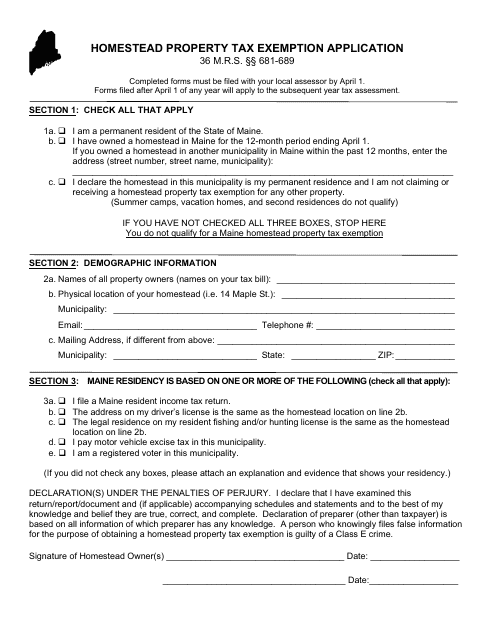

This form is used for applying for a property tax exemption in the state of Maine for qualifying homestead properties.

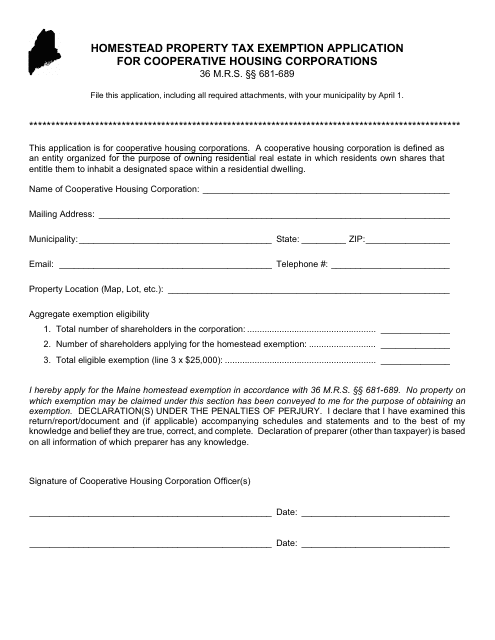

This type of document is used for applying for a property tax exemption for cooperative housing corporations in the state of Maine.

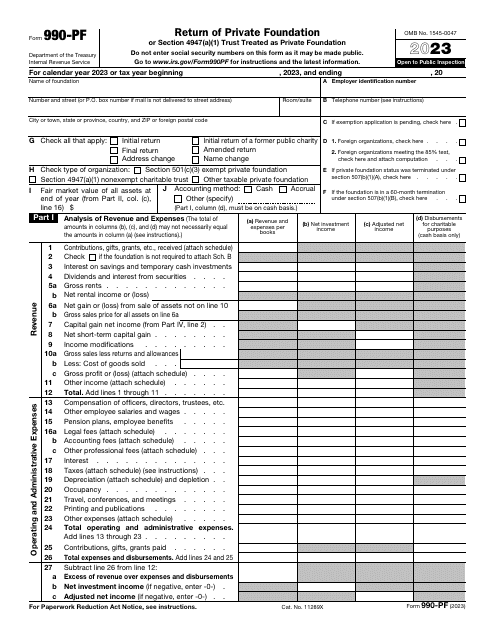

This form, also known as the private foundation tax return, can also substitute Form 1041, if a trust has no taxable income. Use this form to calculate the tax on the income from an investment and to report charitable activities and distributions.

Use this basic form if you are an American taxpayer and wish to submit an annual income tax return. This form is also known as the Individual Income Tax Return Form.

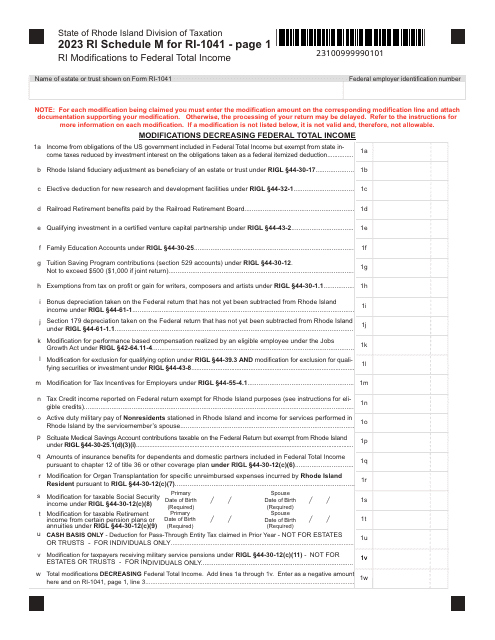

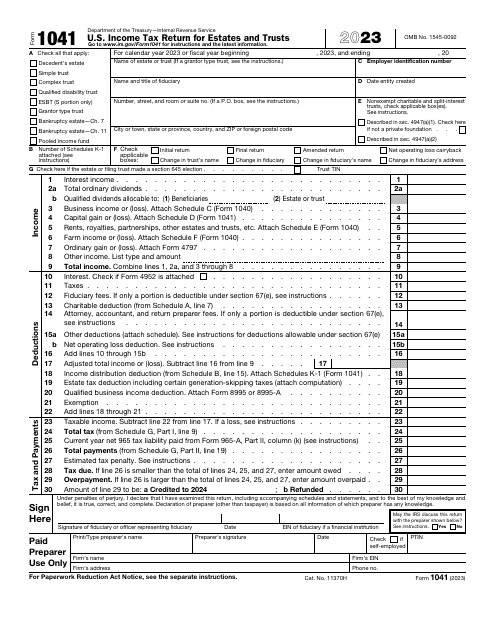

File this document, also known as the Estates and Trusts Tax Return, as an income tax return to the Internal Revenue Service (IRS) if you are a fiduciary of a bankruptcy estate, domestic decedent's estate, or a trust.

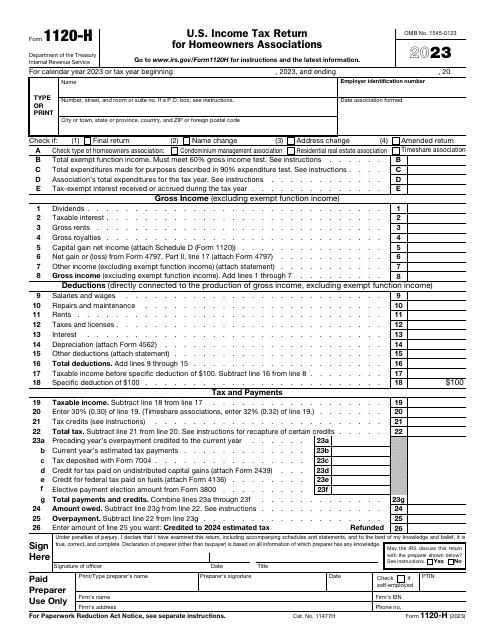

Fill out this form if you represent a homeowner's association in order to make use of certain tax benefits. That means, that the association can exclude the Exempt Function Income from its gross income.

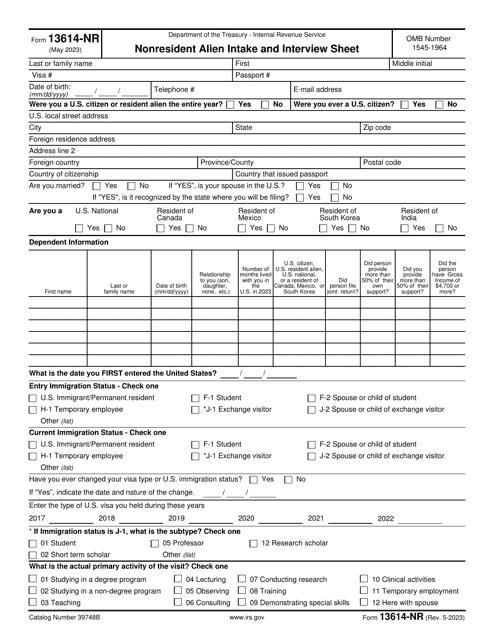

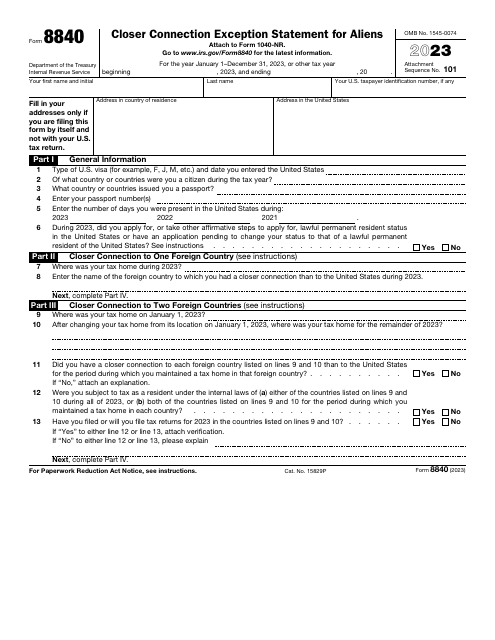

This is an application issued by the Internal Revenue Service (IRS) especially for alien individuals who use it to claim the closer connection to a foreign country exception to the substantial presence test.

This document is for obtaining a homestead permit in the City of Fort Worth, Texas. It serves as an affidavit to verify residency and eligibility for the homestead exemption.

This document is a Request for Exoneration From Per Capita Tax specific to the Central Columbia School District in Pennsylvania. It is used by residents in the school district to request an exemption from paying the per capita tax.

This form is used for requesting the exoneration of per capita tax in the Cranberry Area School District in Pennsylvania.

This document is a request to be exempted from paying the per capita tax in the Neshaminy School District in Pennsylvania.

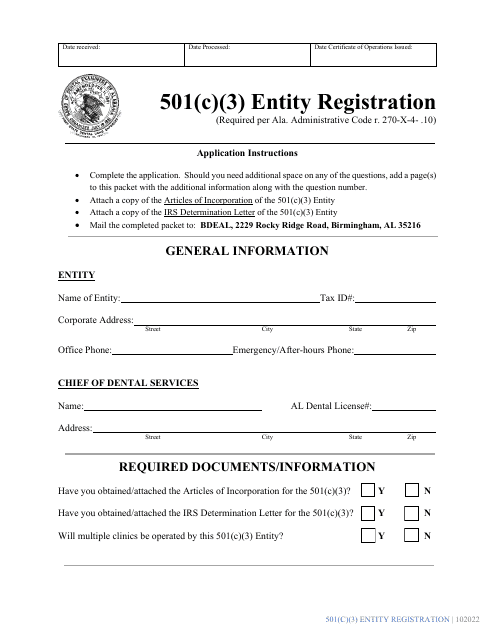

This document is used for the registration of a 501(c)(3) entity in the state of Alabama.

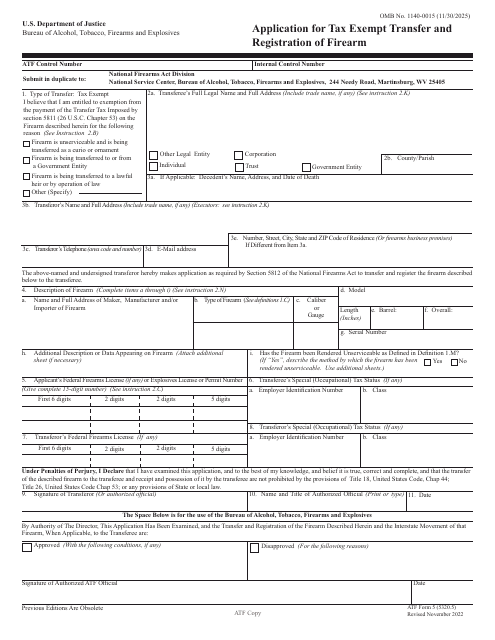

This form is used for applying for tax exempt transfer and registration of a firearm with the ATF (Bureau of Alcohol, Tobacco, Firearms and Explosives).