Tax Exempt Form Templates

Documents:

1303

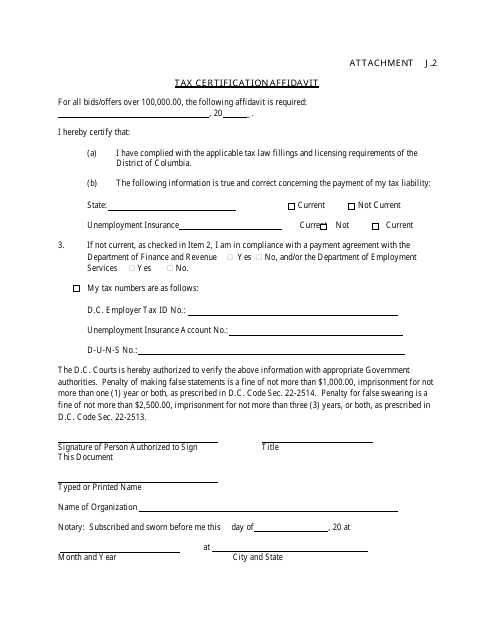

This document is for certifying tax information in Washington, D.C. It is used to confirm details related to tax obligations.

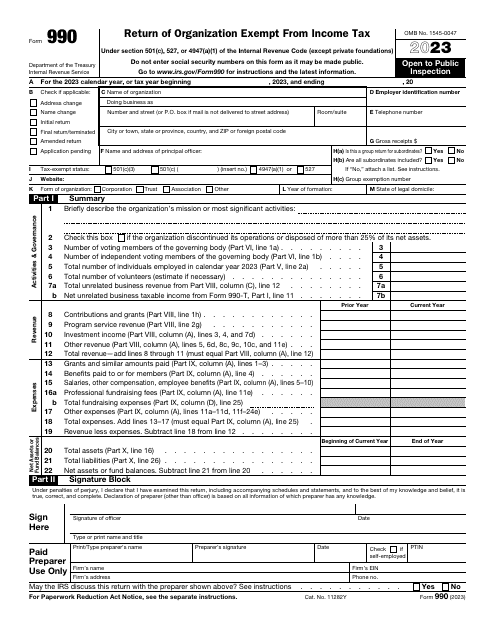

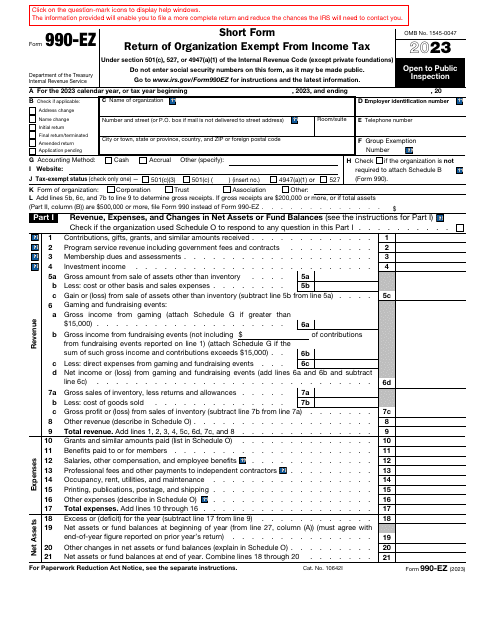

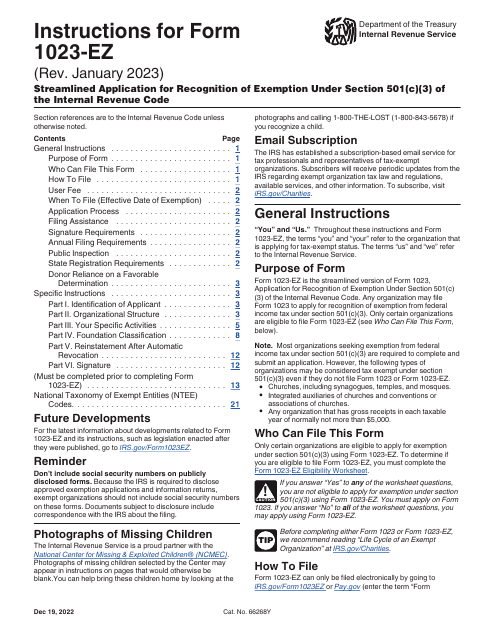

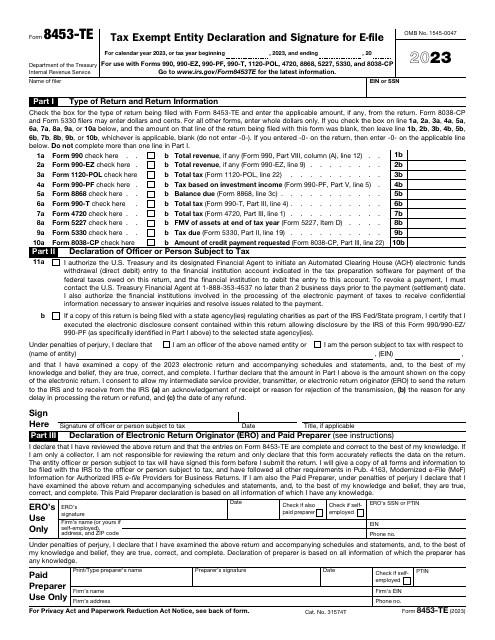

This form is used to supply the Internal Revenue Service (IRS) with information regarding receipts, gross income, disbursements, and other data used by tax-exempt organizations to summarize their work during the tax year.

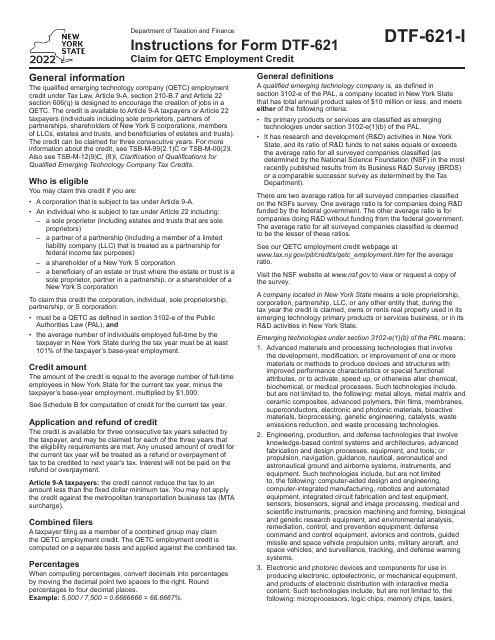

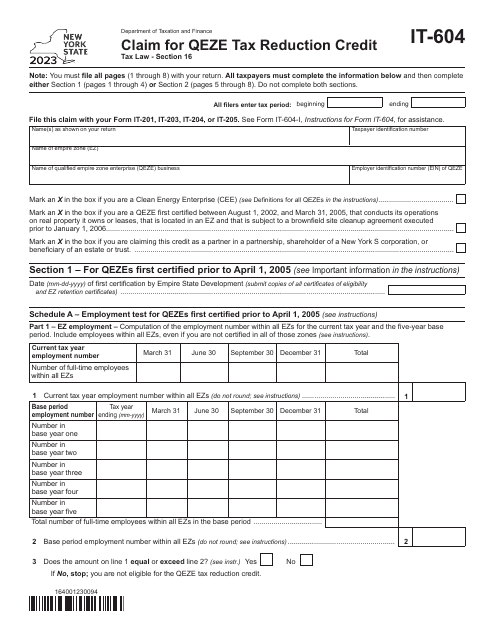

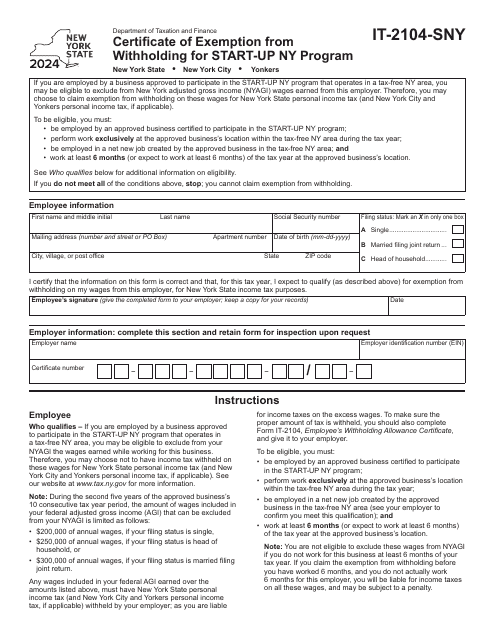

This Form is used for claiming the QETC Employment Credit in the state of New York. It provides instructions on how to fill out and submit the form to receive the credit.

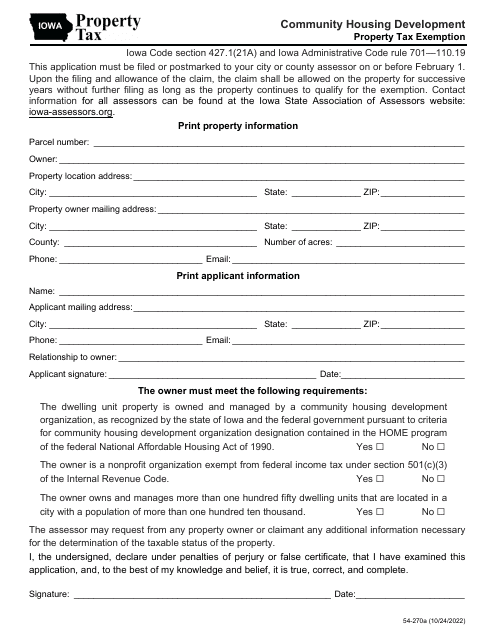

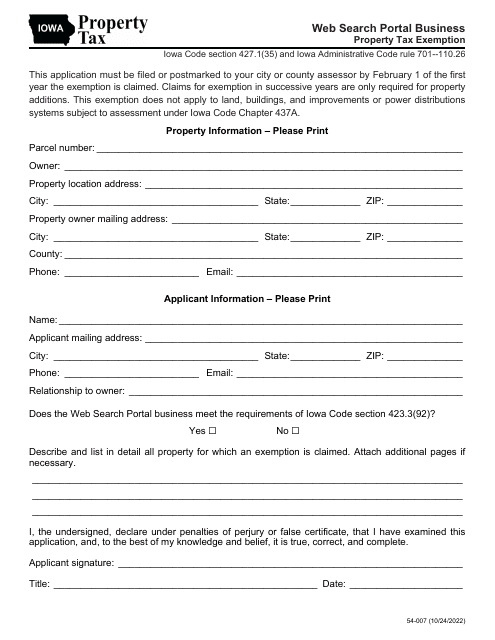

This Form is used for applying for a property tax exemption for community housing development in Iowa.

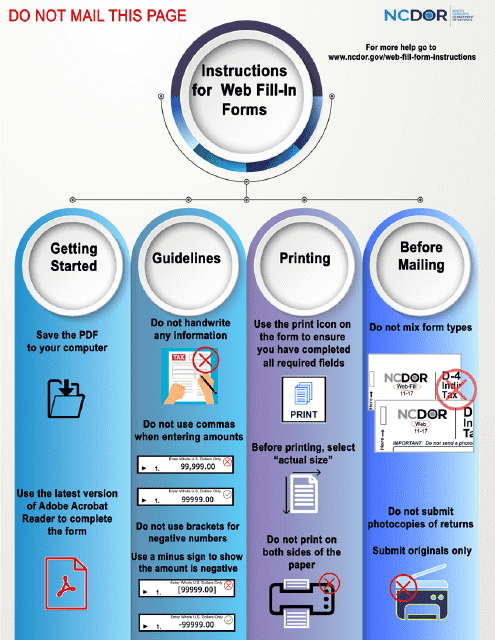

This Form is used for residents of North Carolina to file their state income tax return and claim deductions, credits, and exemptions. The D-400TC Schedule A, AM, PN, PN-1, S are additional schedules that may be necessary depending on your specific tax situation.

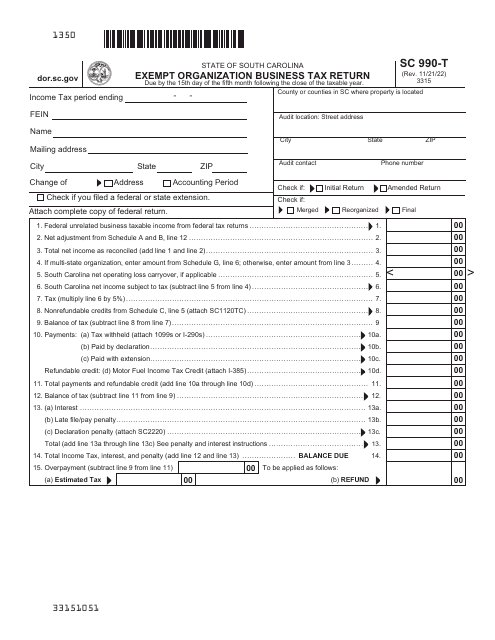

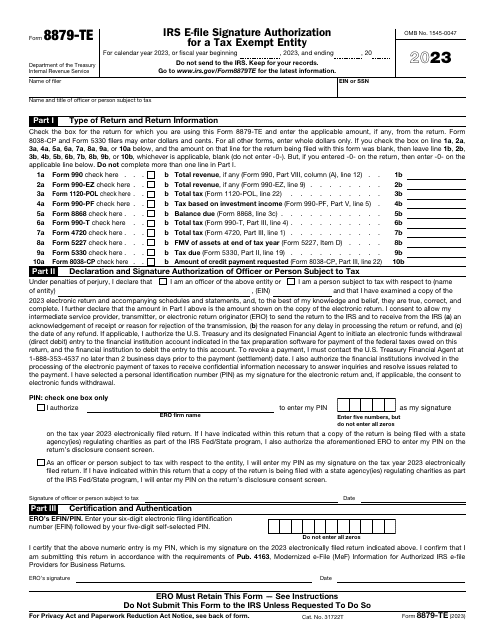

This is a fiscal form used by tax-exempt organizations required to inform tax organizations about their earnings, expenses, and achievements over the course of the year.

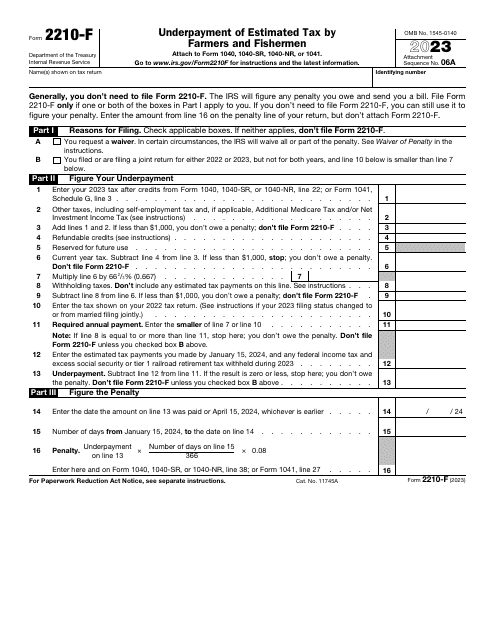

This is an IRS form completed by individuals, trusts, and estates to figure out whether they owe tax authorities a penalty after making an error in estimated tax calculations.