Tax Exempt Form Templates

Documents:

1303

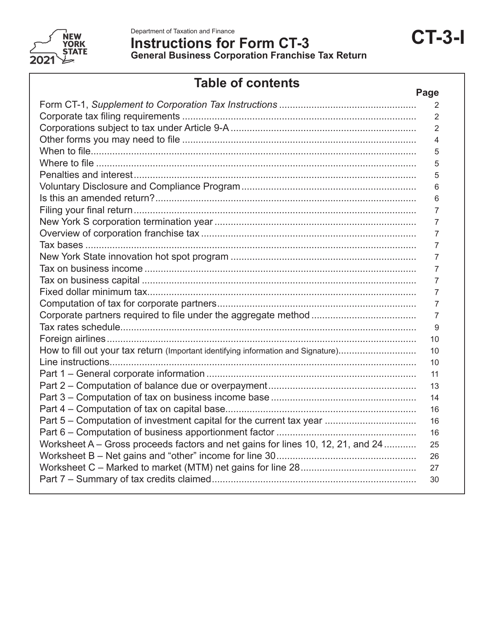

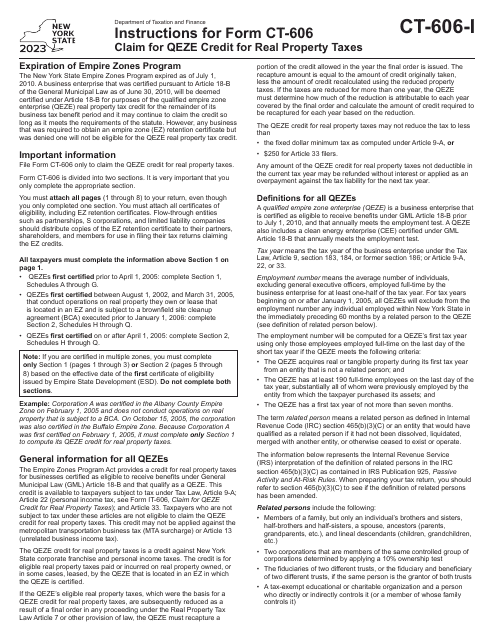

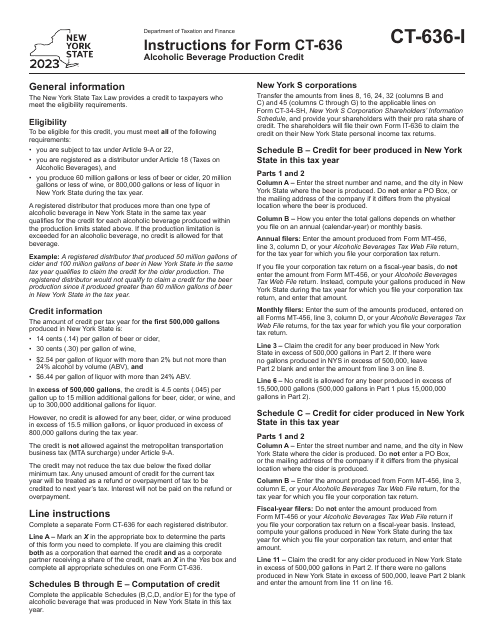

This form is used for filing the General Business Corporation Franchise Tax Return in the state of New York. It provides instructions on how to correctly complete and submit the form.

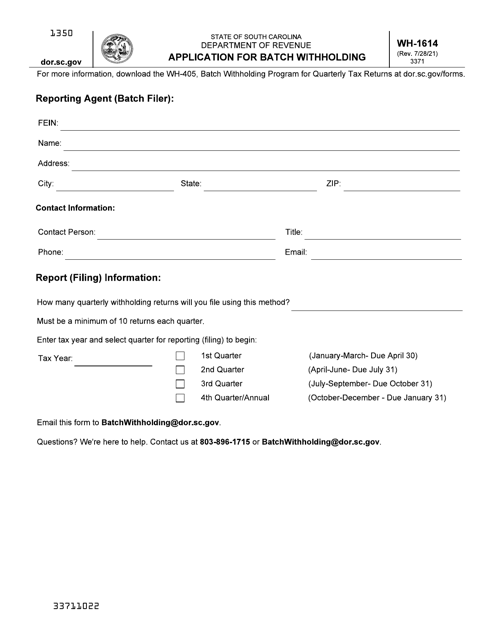

This form is used to apply for batch withholding in the state of South Carolina.

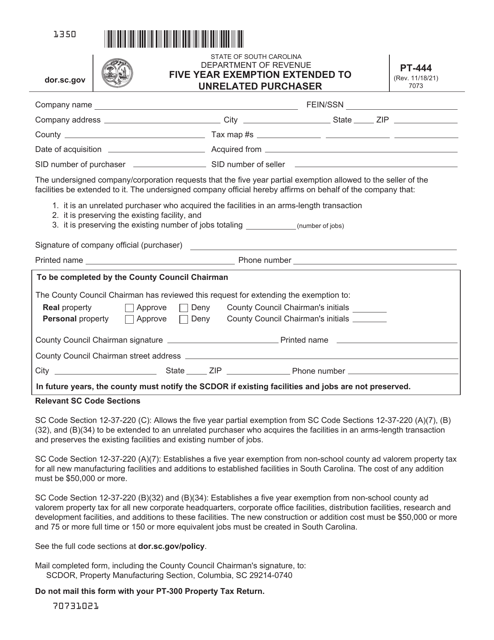

This form is used for extending the five-year exemption to an unrelated purchaser in South Carolina.

This Form is used for applying for a tax abatement on real property in Washington, D.C.

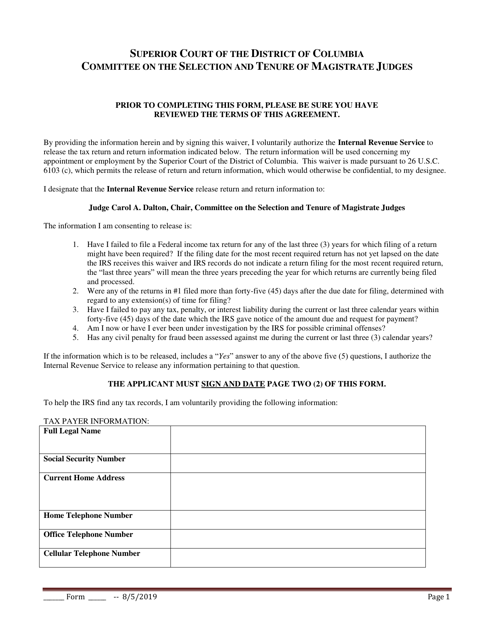

This document is used for requesting a waiver of taxes in Washington, D.C.

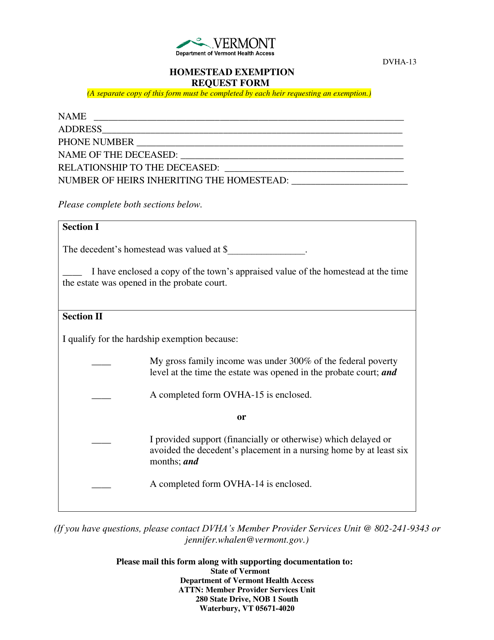

This form is used for requesting a homestead exemption in the state of Vermont.

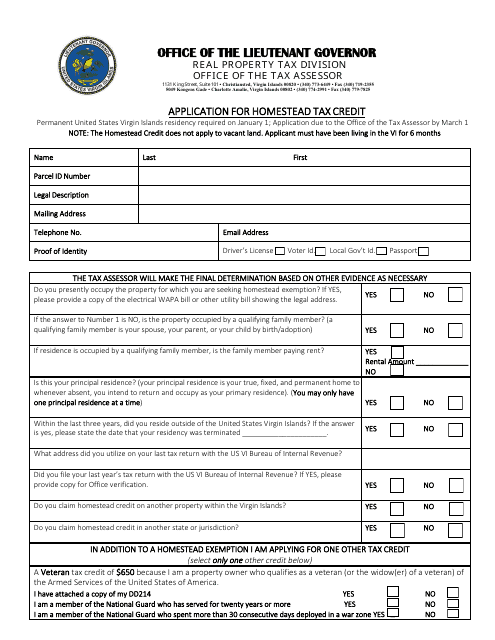

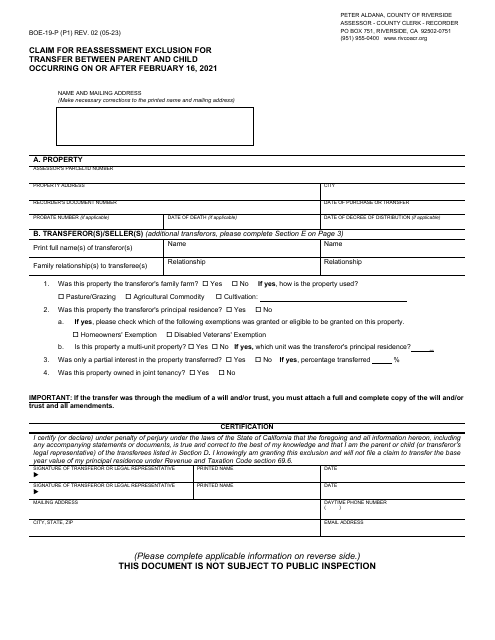

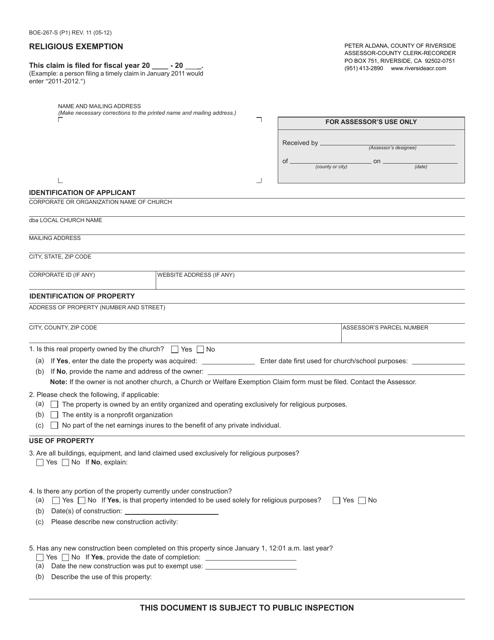

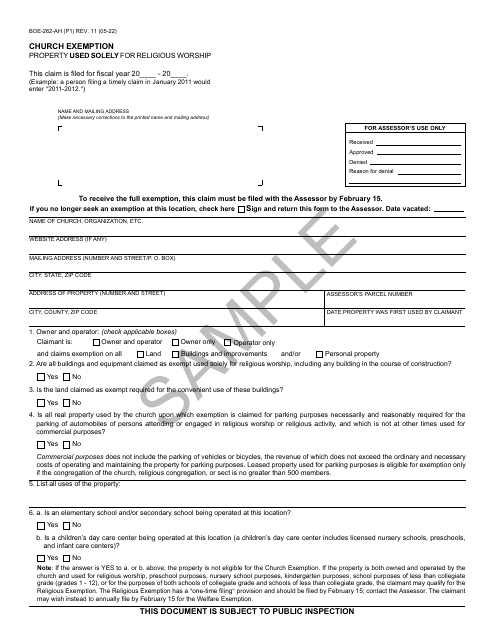

This form is used for applying for a religious exemption in the County of Riverside, California.

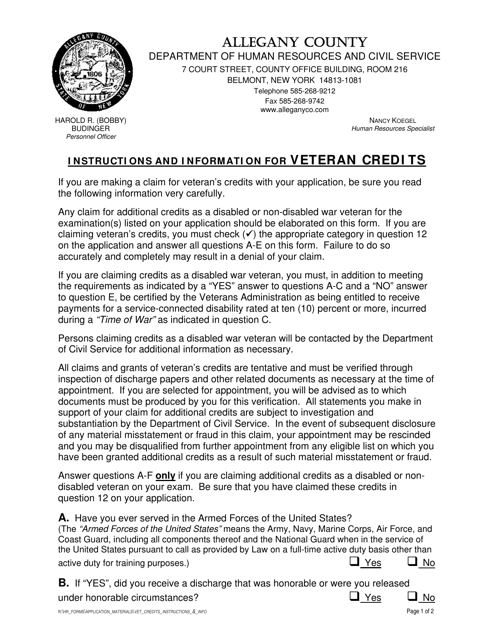

This type of document provides information about veteran credits available in Allegany County, New York. It describes the credits and eligibility requirements for veterans in the county.

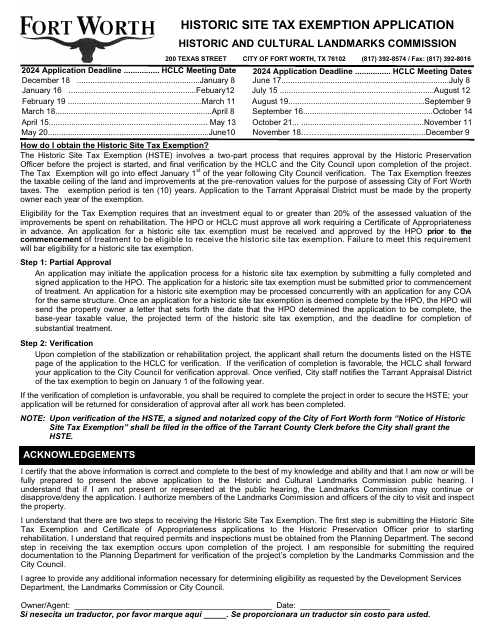

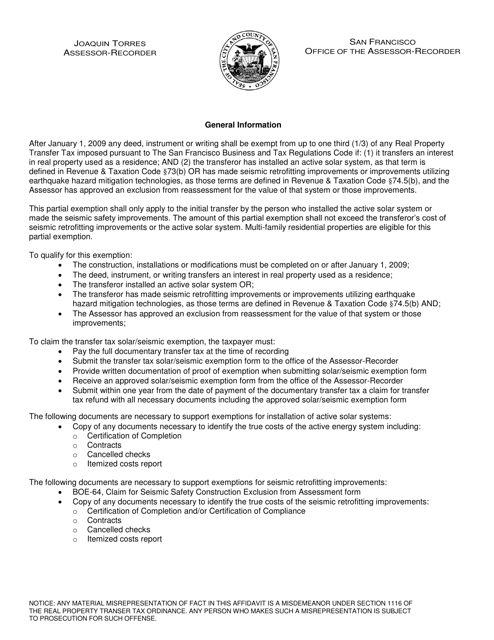

Seismic/Solar Documentary Transfer Tax Exemption Form - City and County of San Francisco, California

This form is used for obtaining a transfer tax exemption for documentary transfers related to seismic or solar projects in the City and County of San Francisco, California.

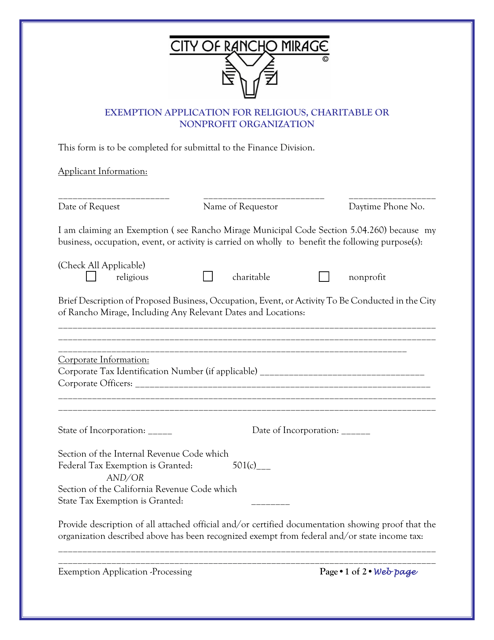

This Form is used for applying for an exemption for religious, charitable, or nonprofit organizations in the City of Rancho Mirage, California.

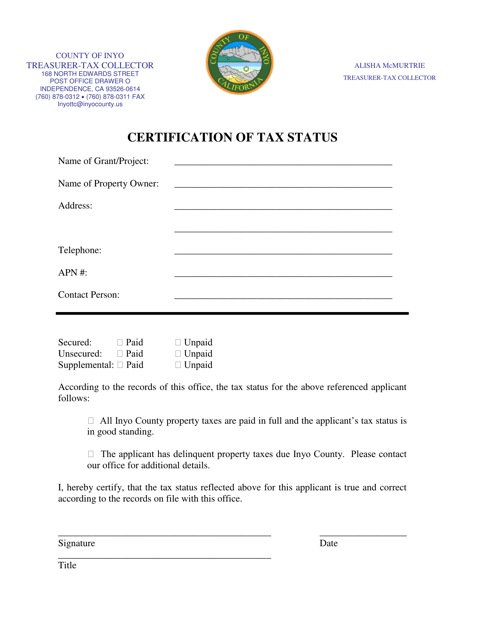

This document is used for certifying the tax status of individuals or entities in Inyo County, California. It verifies whether a person or organization is up to date with their tax obligations in the county.

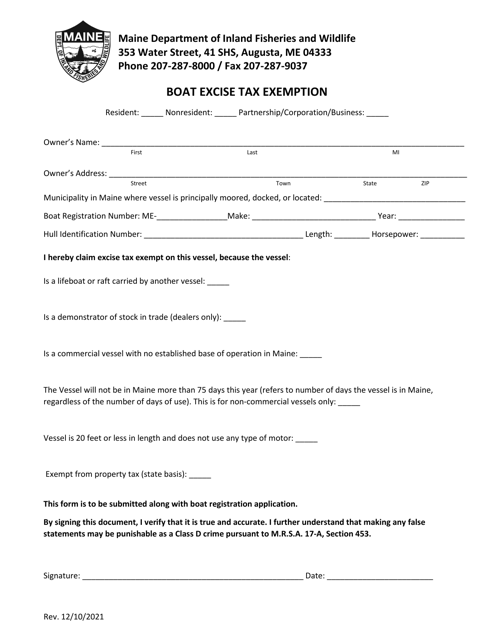

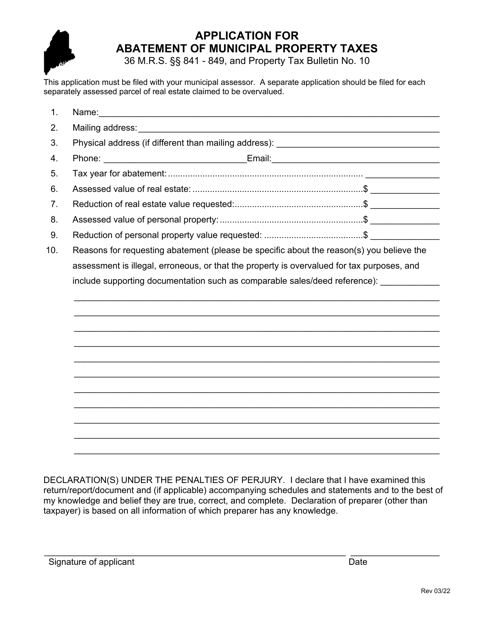

This form is used for requesting a reduction or elimination of municipal property taxes in the state of Maine. It allows property owners to seek relief from excessive tax payments.

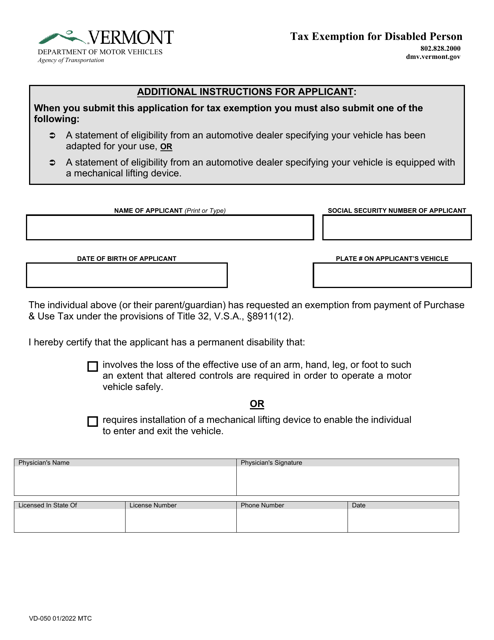

This Form is used for applying for tax exemption for disabled persons in Vermont.

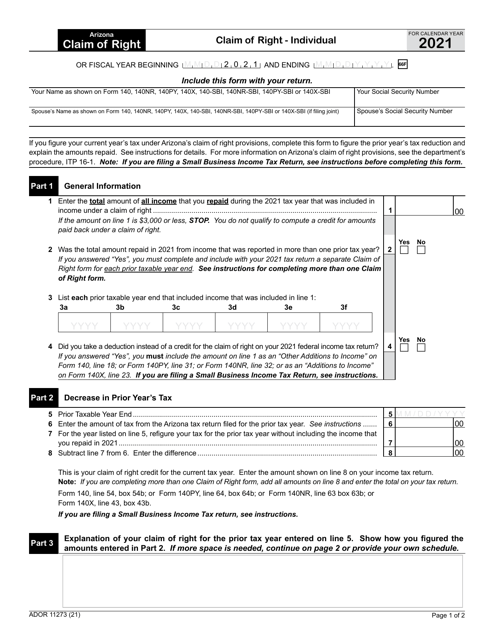

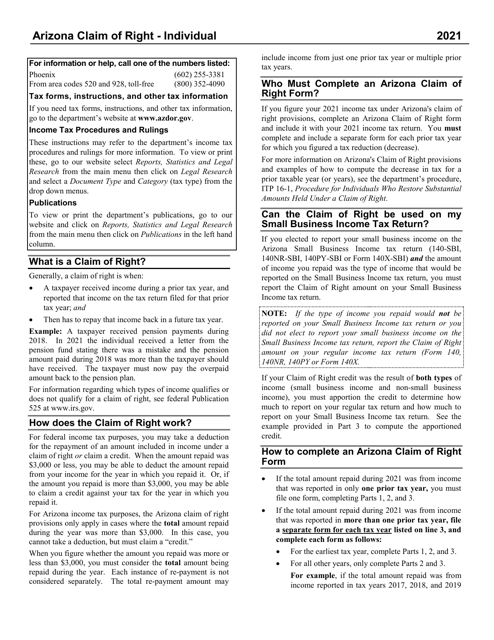

This form is used for individuals in Arizona to make a Claim of Right. It provides a way for individuals to express their claim to certain funds or property.

This Form is used for claiming the right to a refund on individual taxes paid in Arizona. It provides instructions for completing and filing Form ADOR11273.

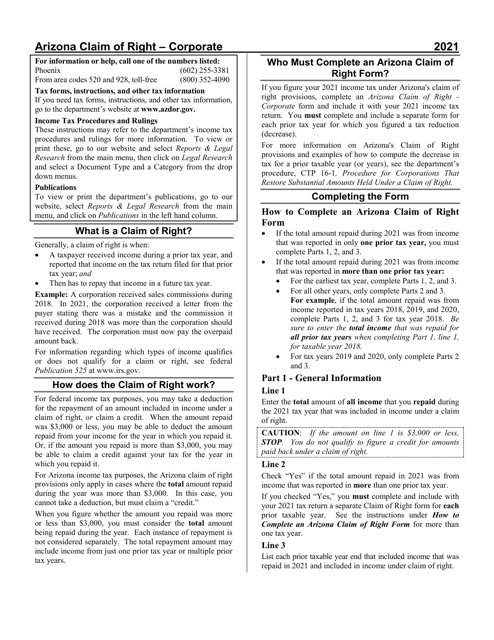

This document is used for filing a request to restore a substantial amount held under a claim of right for a corporate entity in the state of Arizona. It provides instructions on how to complete the form ADOR11289.

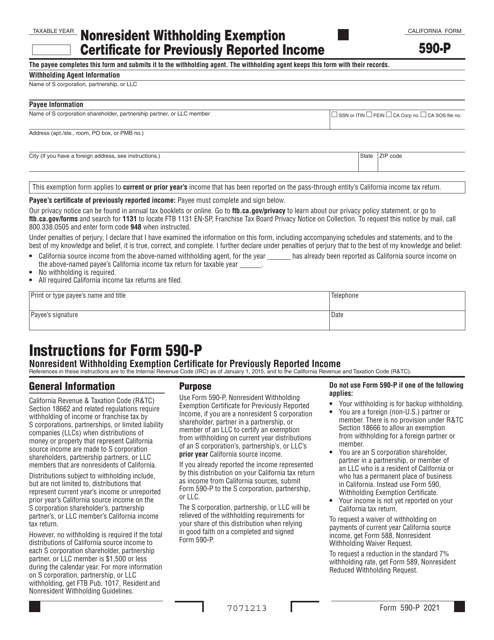

Form 590-P Nonresident Withholding Exemption Certificate for Previously Reported Income - California

This Form is used for claiming an exemption from nonresident withholding for previously reported income in California.

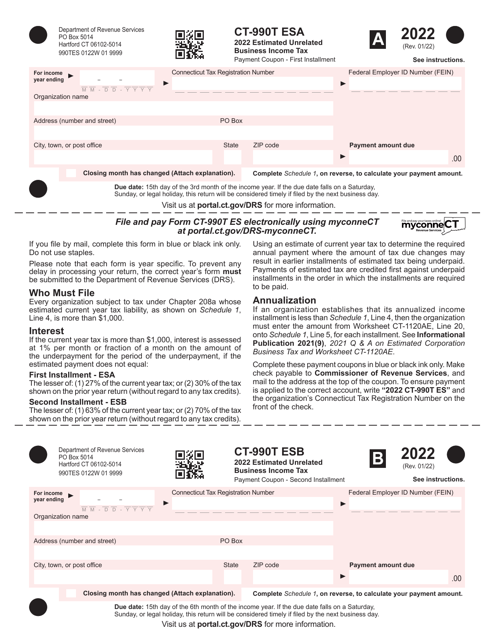

This form is used for estimating the unrelated business income tax for entities operating in Connecticut.

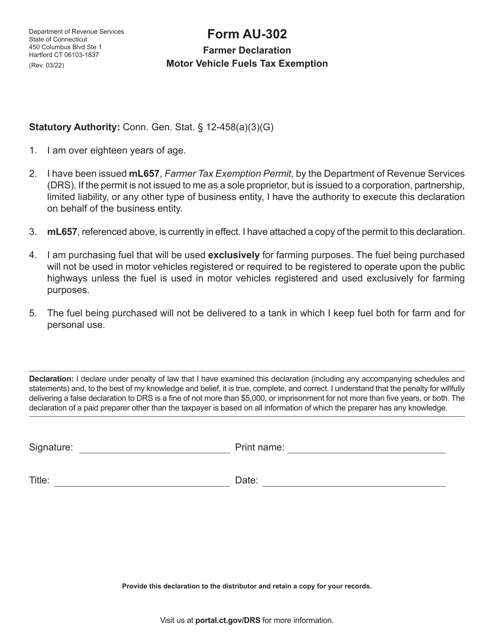

This form is used for farmers in Connecticut to declare their eligibility for a motor vehicle fuels tax exemption. Farmers can use this form to claim a tax exemption on fuels used for agricultural purposes.

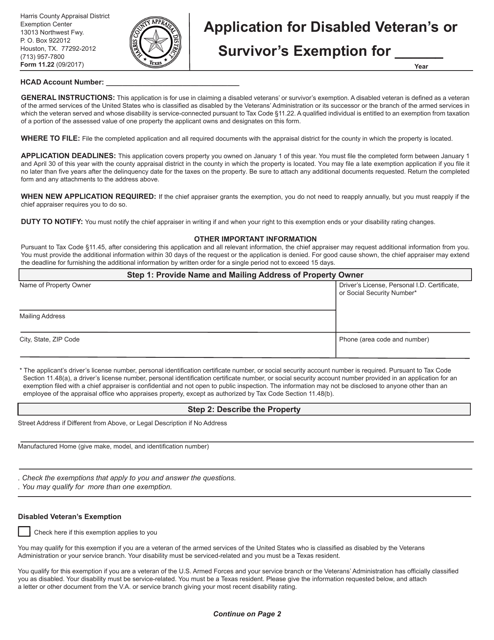

This type of document is used for applying for the Disabled Veteran's or Survivor's Exemption in Harris County, Texas.