Tax Exempt Form Templates

Documents:

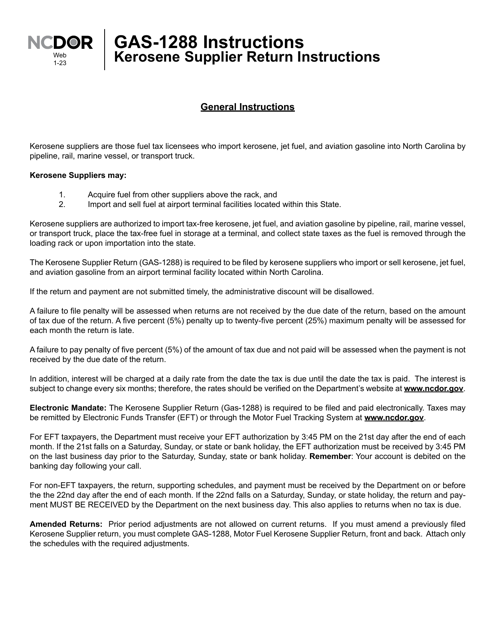

1303

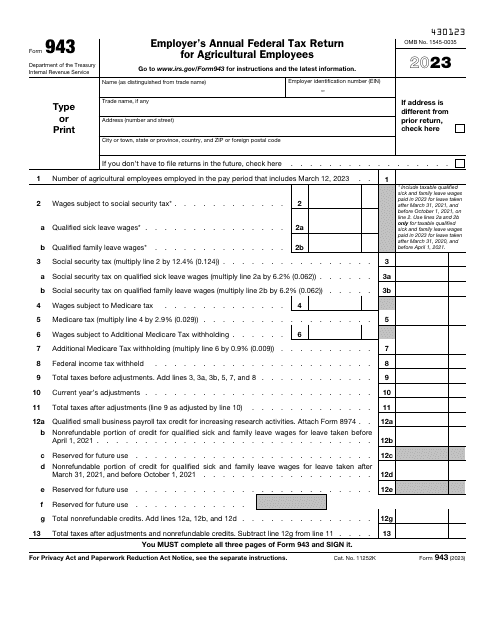

If you paid wages in the reported tax year to one or more farm workers, file this form for your annual federal tax return in case the wages you paid to your farmworkers were subject to the federal income, Medicare, or social security tax withholdings.

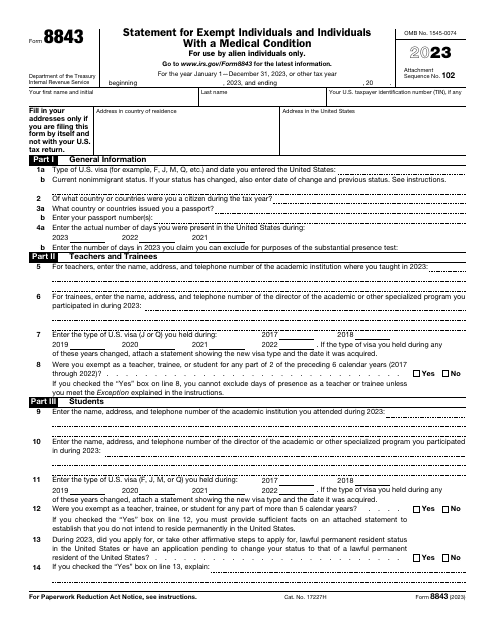

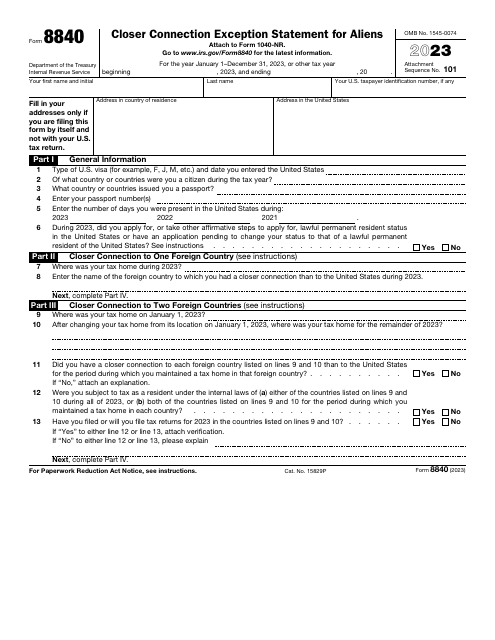

This is an application issued by the Internal Revenue Service (IRS) especially for alien individuals who use it to claim the closer connection to a foreign country exception to the substantial presence test.

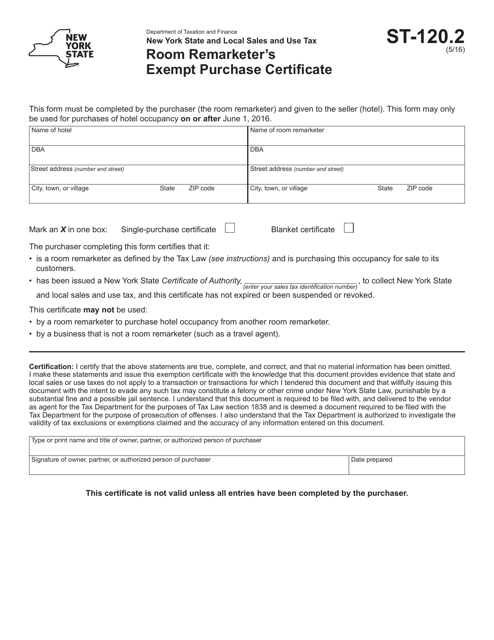

This document is used for exempt purchases made by room remarketers in New York.

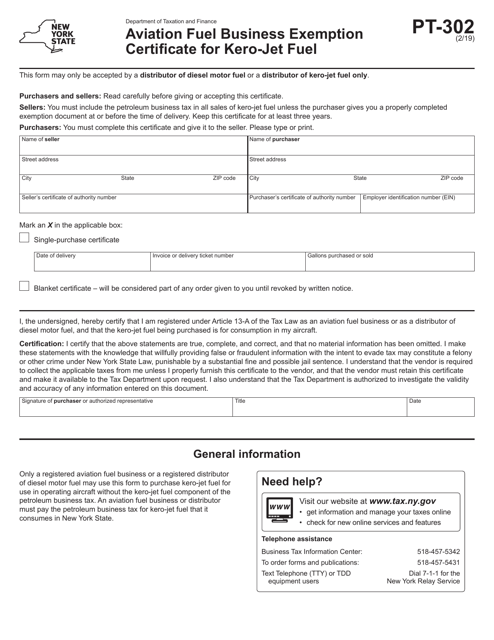

This form is used for obtaining an Aviation Fuel Business Exemption Certificate for Kero-Jet Fuel in New York.

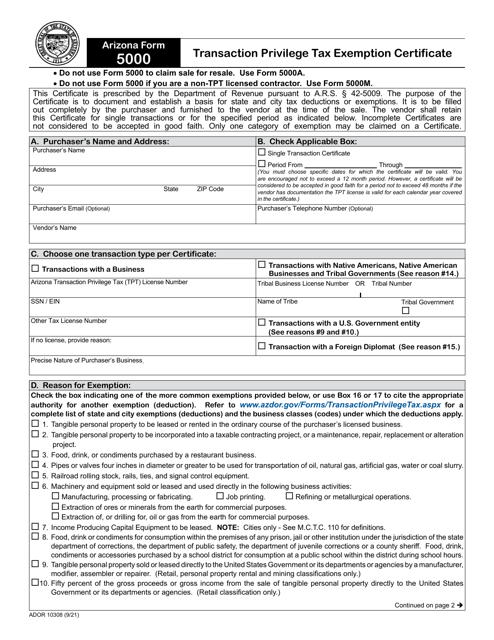

Transaction privilege tax (TPT) is a sales tax levied by the state of Arizona on vendors for the ability to conduct business in the state and this is a document that establishes the basis for state exceptions.

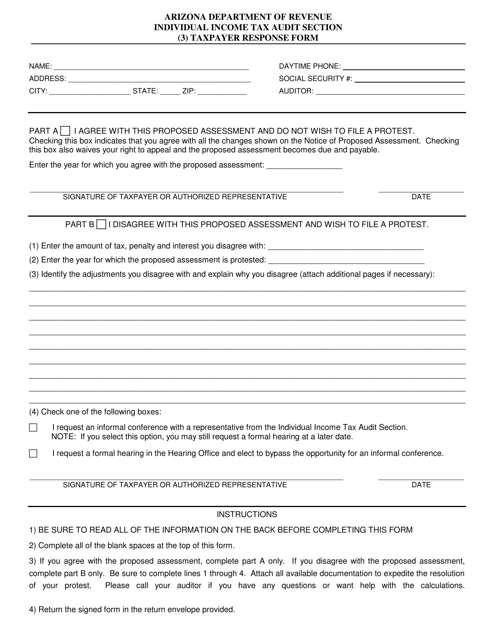

This Form is used for taxpayers in Arizona to respond to correspondence from the tax authorities.

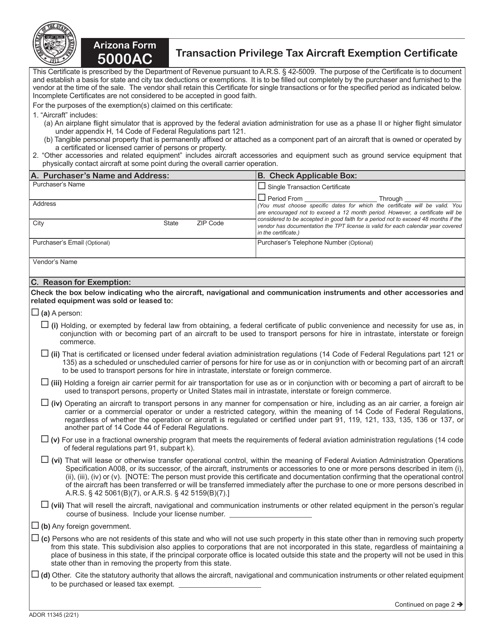

This document is used for applying for an aircraft exemption certificate for transaction privilege tax in Arizona.

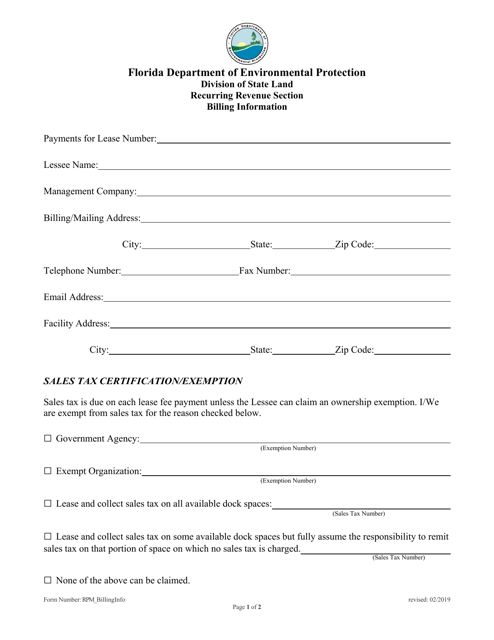

This form is used for requesting sales tax exemption in the state of Florida. It is required for individuals or businesses seeking tax exemption on certain purchases.

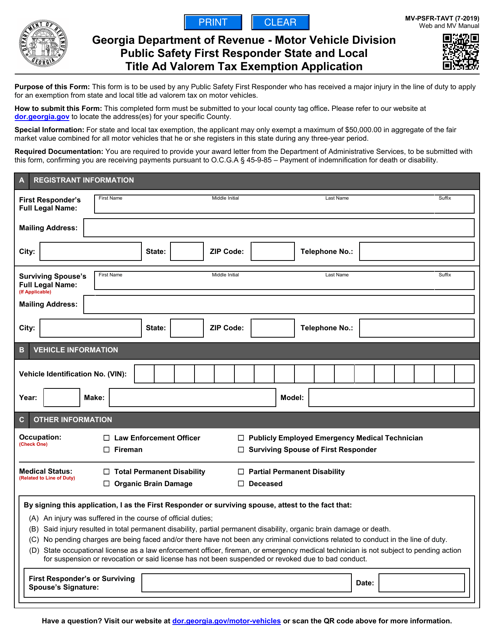

This Form is used for applying for the Public Safety First Responder State and Local Title Ad Valorem Tax (TAVT) Exemption in the state of Georgia.

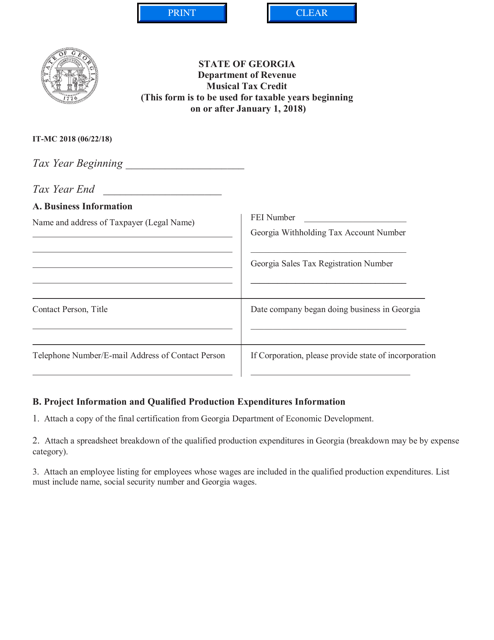

This document is a form used in Georgia (United States) for claiming the Musical Tax Credit.

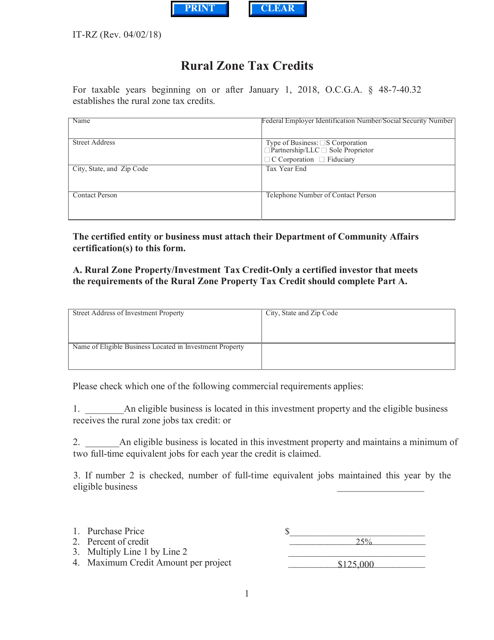

This form is used for claiming rural zone tax credits in the state of Georgia. It allows eligible individuals or businesses to receive tax credits for certain expenses incurred within designated rural zones.

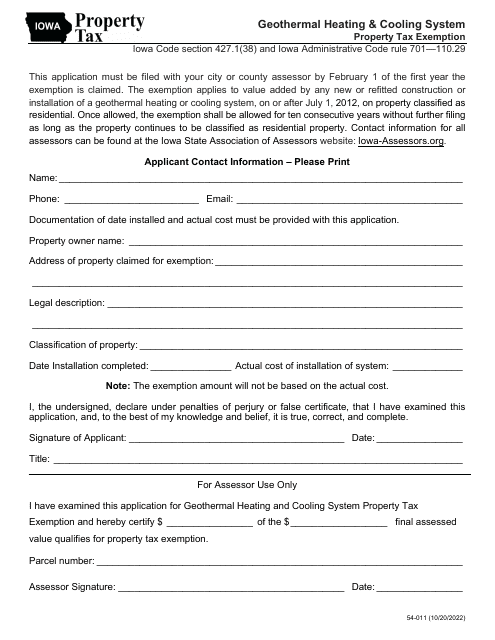

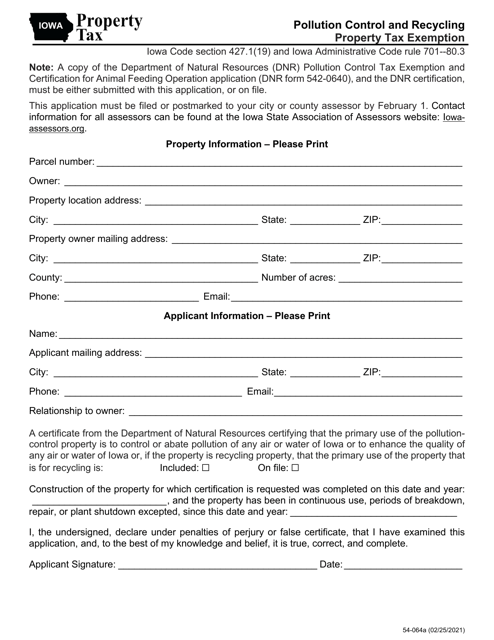

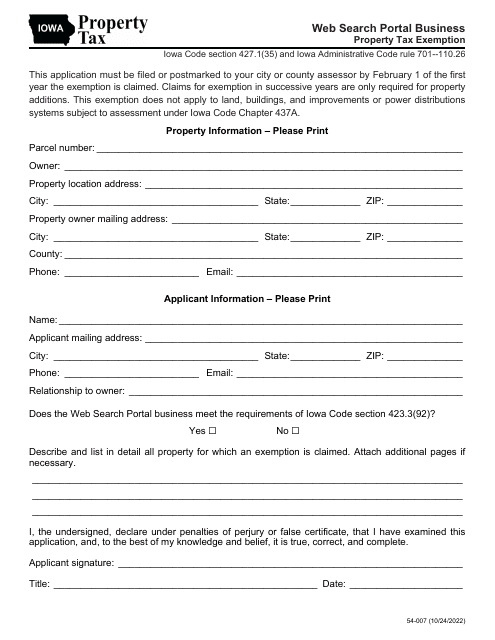

This form is used for applying for a property tax exemption for pollution control and recycling properties in the state of Iowa.

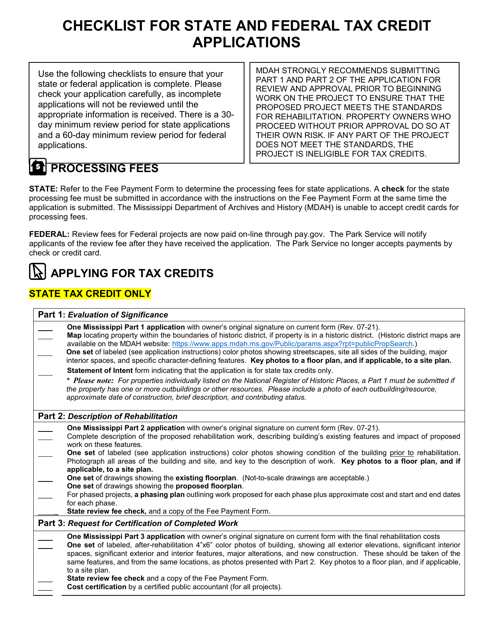

This document is a checklist for individuals in Mississippi who are applying for state and federal tax credits. It helps ensure that all necessary information and documentation are included in the application to receive tax credits.

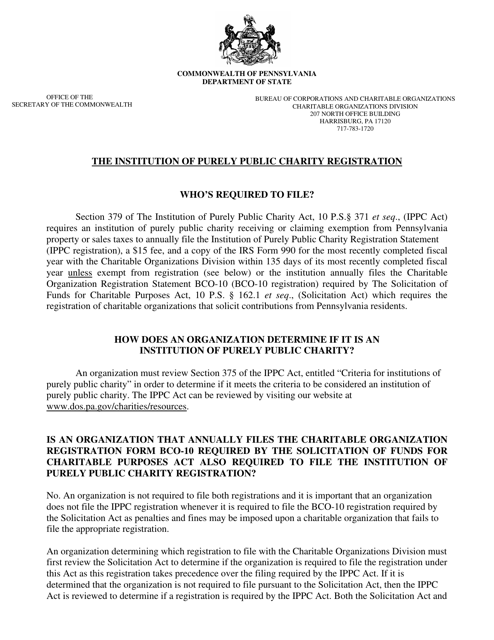

This Form is used for registering an institution as a purely public charity in the state of Pennsylvania.

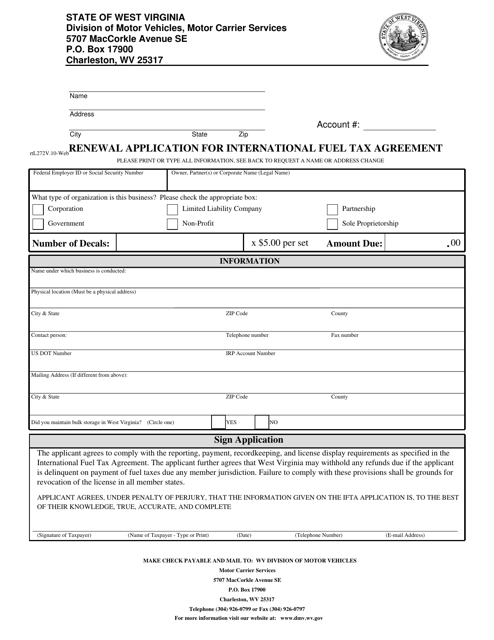

This form is used for renewing the International Fuel Tax Agreement in the state of West Virginia.

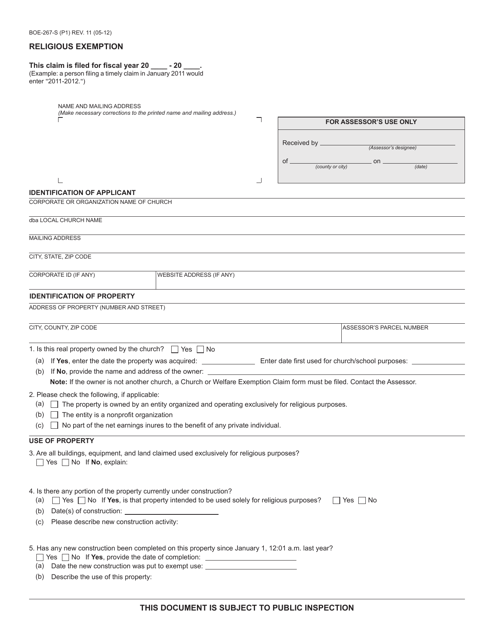

This form is used for claiming a religious exemption from certain taxes in the state of California.

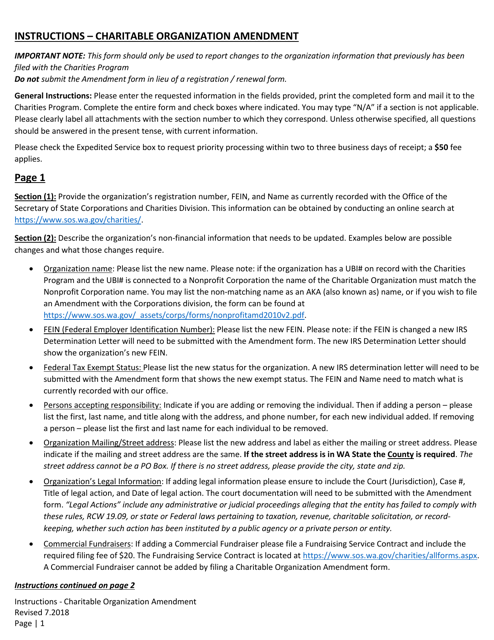

This document is used for amending the registration of a charitable organization in the state of Washington.

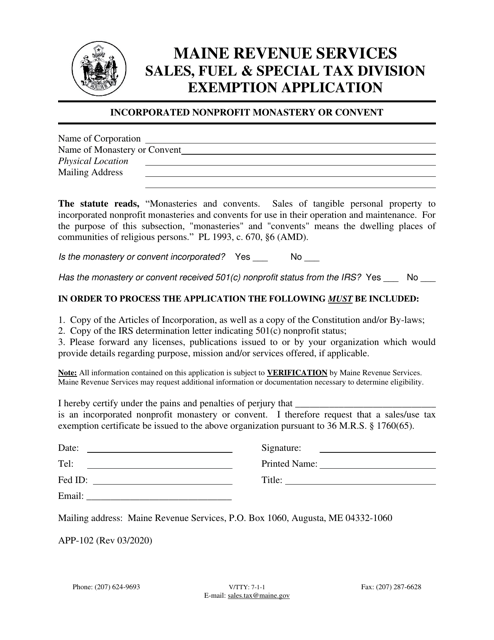

This form is used for applying for an exemption for an incorporated nonprofit monastery or convent in the state of Maine.

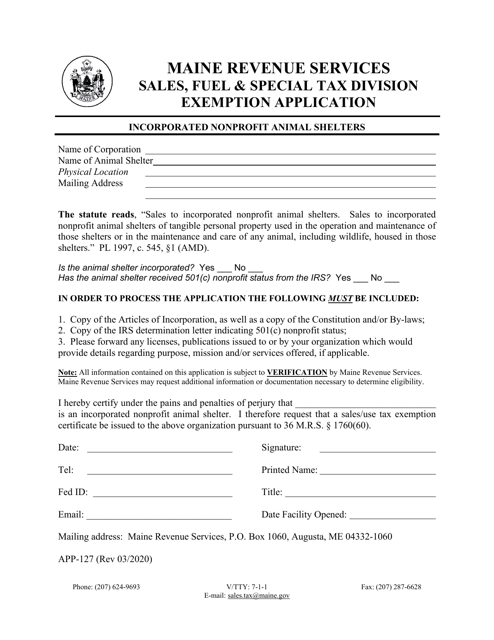

This form is used for applying for exemption as an incorporated nonprofit animal shelter in Maine.