Tax Exempt Form Templates

Documents:

1303

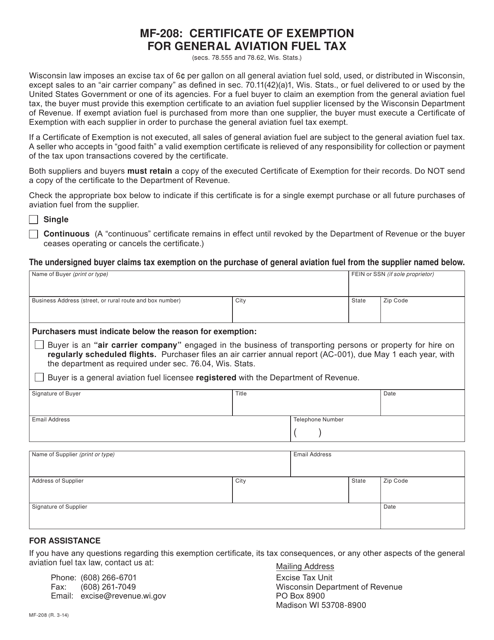

This Form is used for applying for a certificate of exemption from the general aviation fuel tax in Wisconsin. It is used by individuals or organizations involved in general aviation operations to claim a tax exemption on fuel purchases.

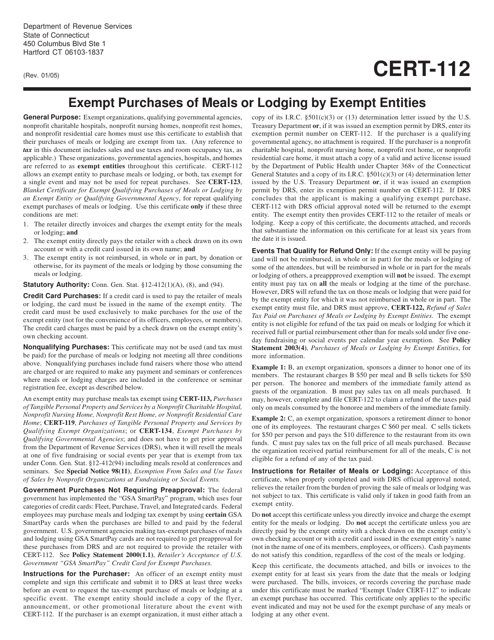

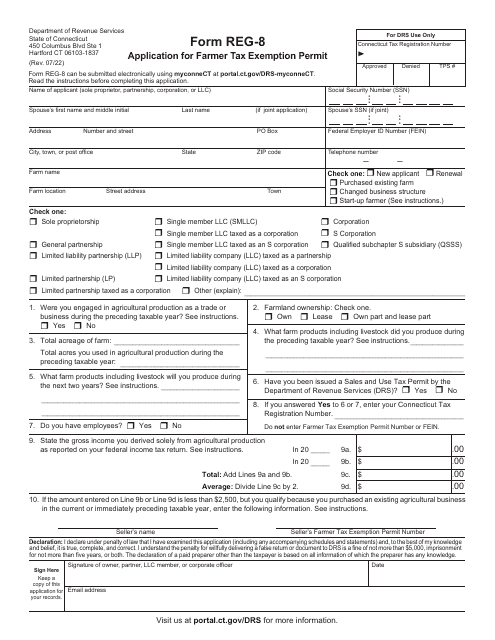

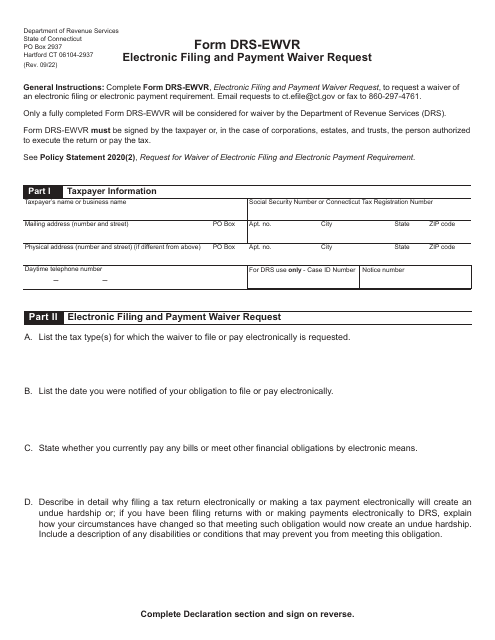

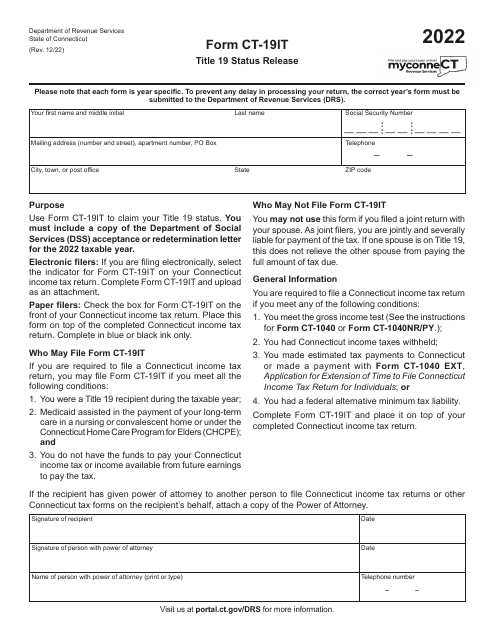

This form is used for exempt entities in Connecticut to certify their purchases of meals or lodging as exempt from taxes.

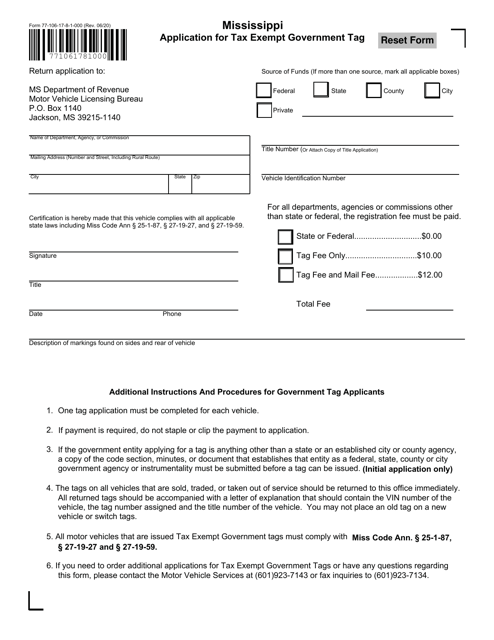

This form is used for applying for a tax-exempt government tag in Mississippi.

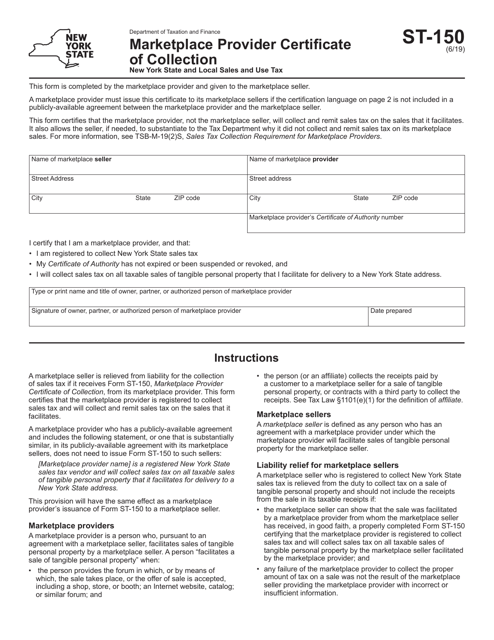

This form is used for marketplace providers in New York to certify their sales tax collection activities.

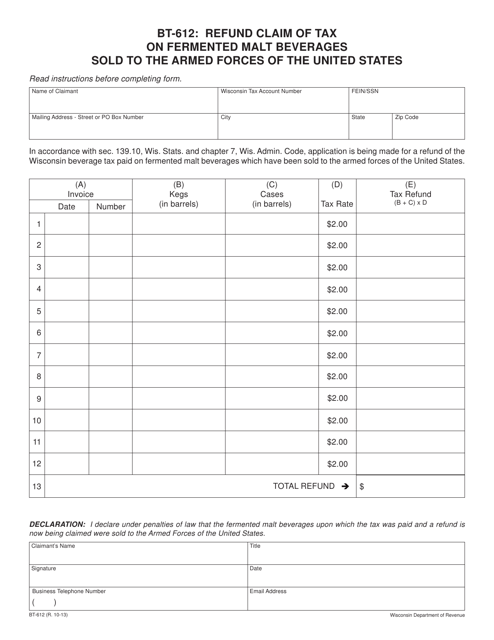

This Form is used for claiming a refund of tax on fermented malt beverages sold to the Armed Forces of the United States in Wisconsin.

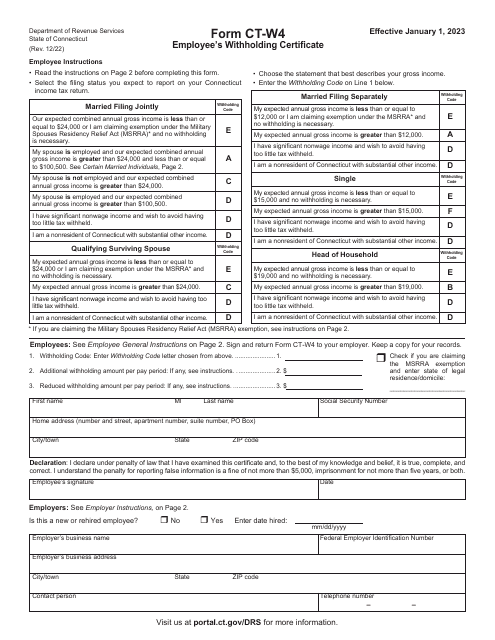

Use this form to withhold the proper amount of taxes when being employed in the state of Connecticut.

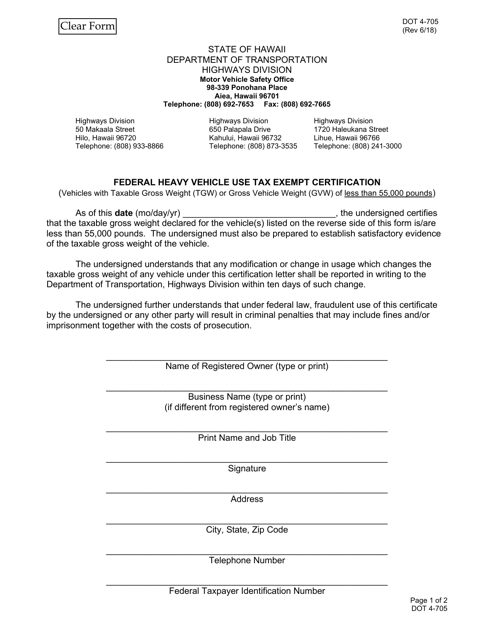

This form is used to certify that a heavy vehicle is exempt from federal heavy vehicle use tax in the state of Hawaii.

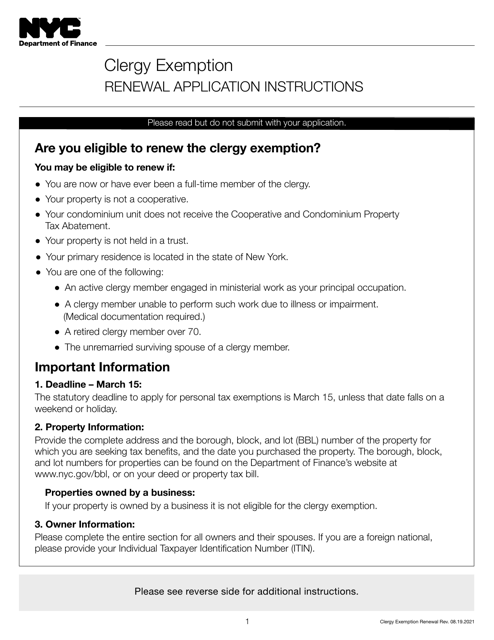

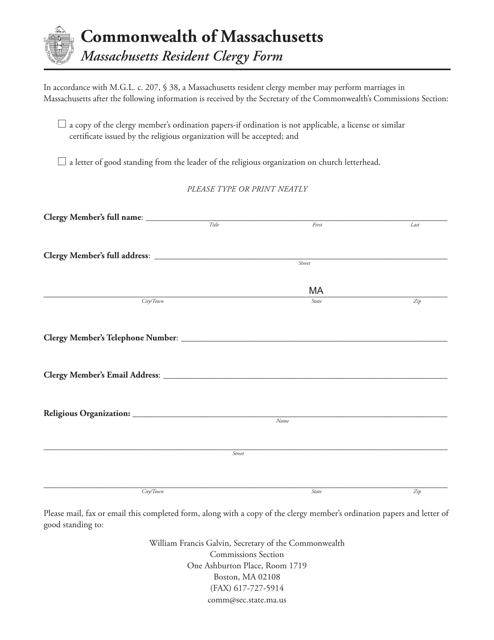

This Form is used for residents of Massachusetts who are clergy members. It is a document that clergy members in Massachusetts need to complete and submit for tax purposes or certain legal requirements.

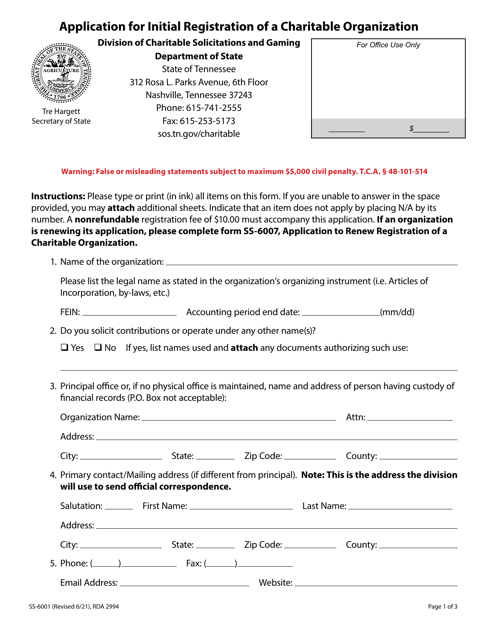

This form is used for the initial registration of a charitable organization in the state of Tennessee. It is required for organizations that wish to solicit charitable contributions in the state.

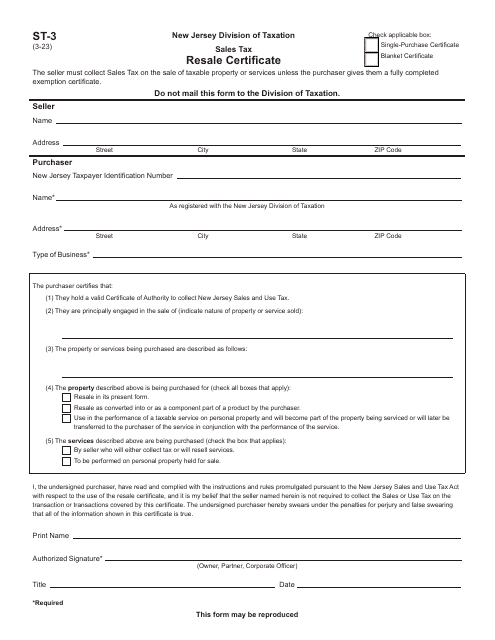

This is a legal document which is needed to be filled out to gain tax exemption for goods you plan to resell in the State of New Jersey.