Tax Exempt Form Templates

Documents:

1303

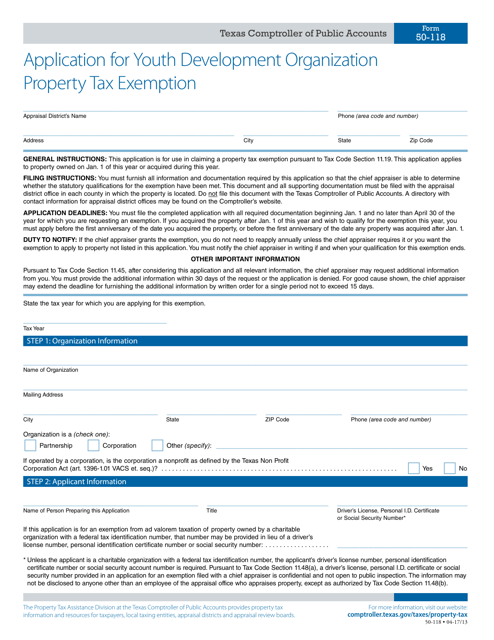

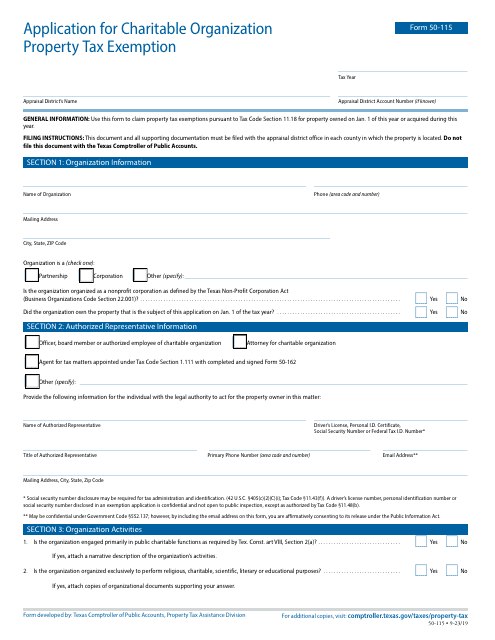

This form is used for applying for a property tax exemption for a youth development organization in Texas.

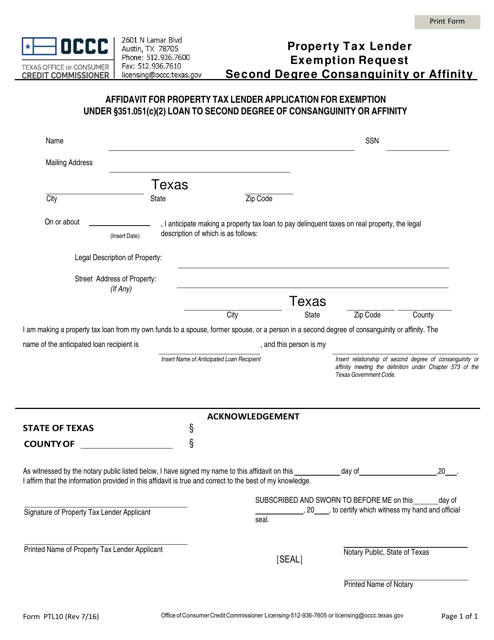

This form is used for requesting an exemption from property tax for property held by a lender who is related to the property owner by second-degree consanguinity or affinity in Texas.

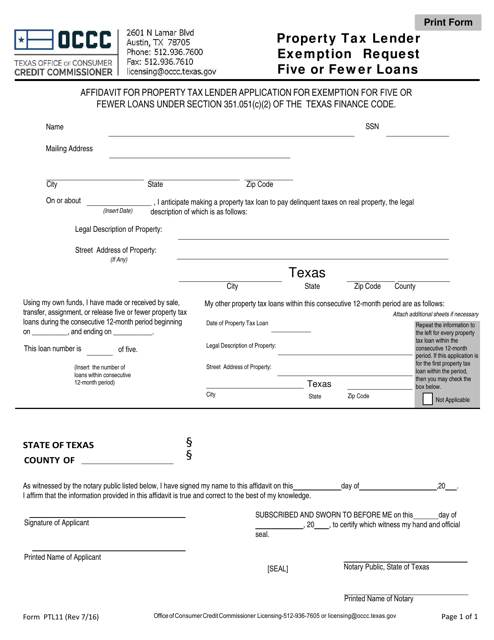

This form is used for requesting an exemption for property tax lenders in Texas who have issued five or fewer loans.

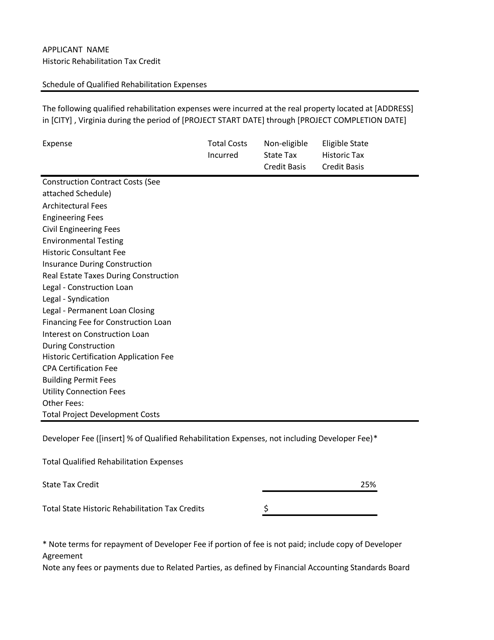

This document provides information about the schedule of qualified rehabilitation expenses in the state of Virginia. It outlines the expenses that qualify for rehabilitation tax credits in the state.

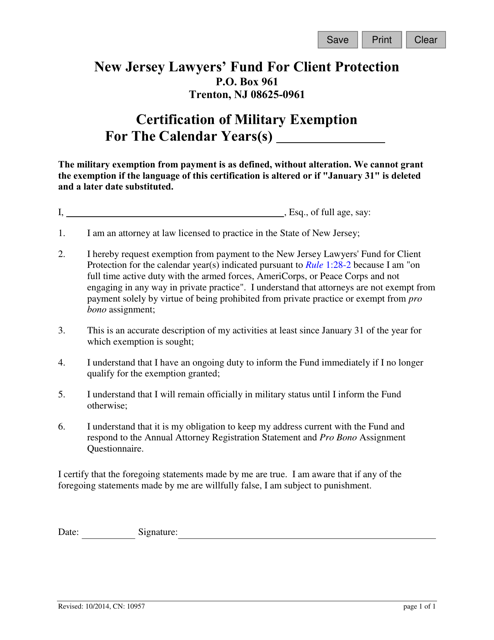

This form is used for certifying military exemption in the state of New Jersey. It is used by individuals serving in the military to exempt them from certain taxes or fees.

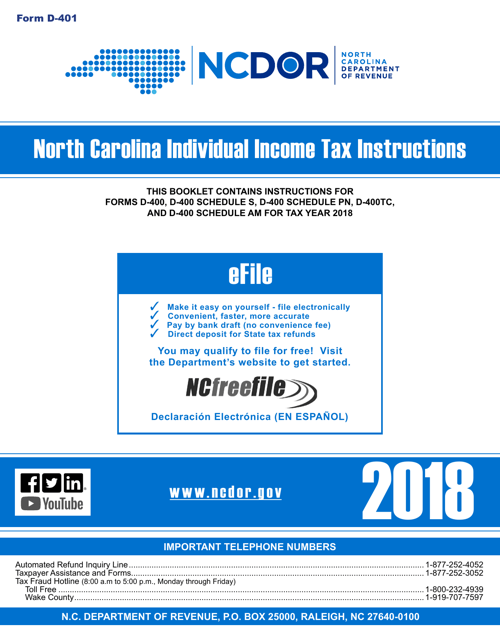

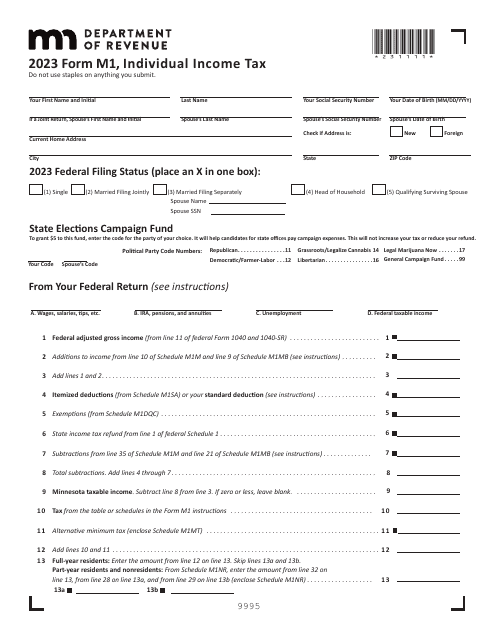

This Form is used for filing individual income taxes in the state of North Carolina. It provides instructions on how to accurately complete and submit the D-400 tax return form.

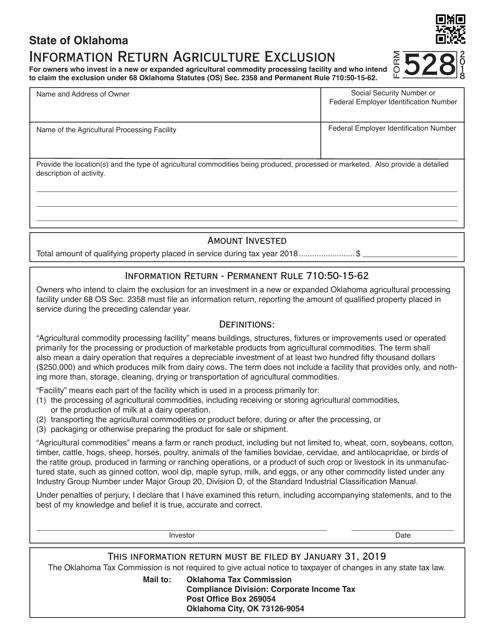

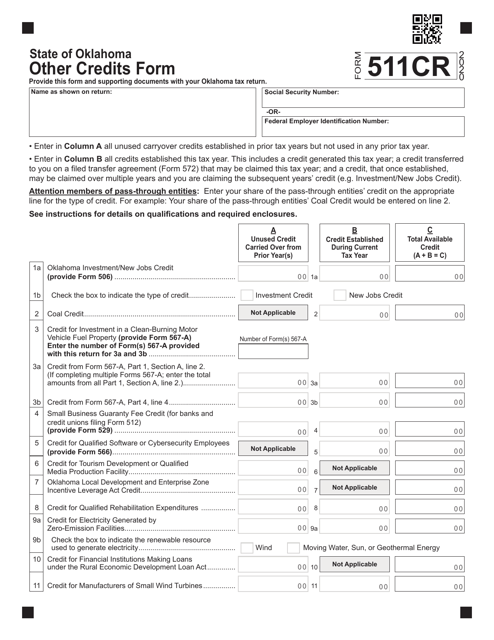

This form is used for reporting information related to the agriculture exclusion in the state of Oklahoma. It helps to determine which agriculture activities are exempt from certain taxes.

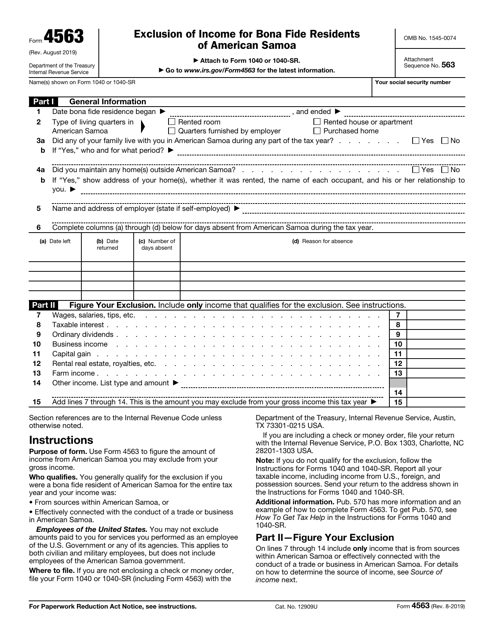

This is a tax form people permanently residing in American Samoa can use to exclude certain income from their gross income.

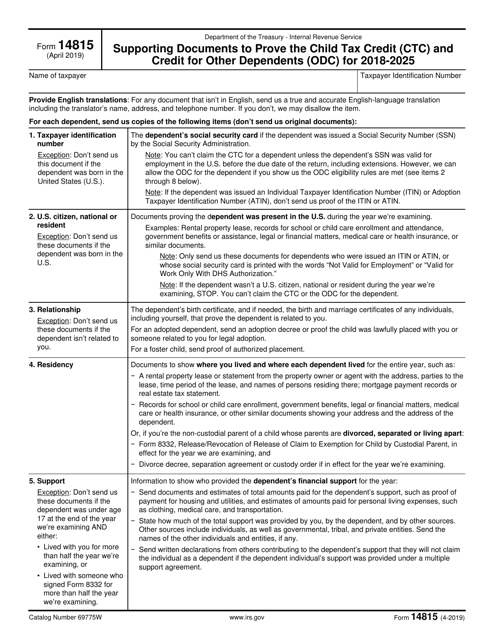

This Form is used for submitting supporting documents to prove eligibility for the Child Tax Credit (CTC) and Credit for Other Dependents (ODC) to the IRS.

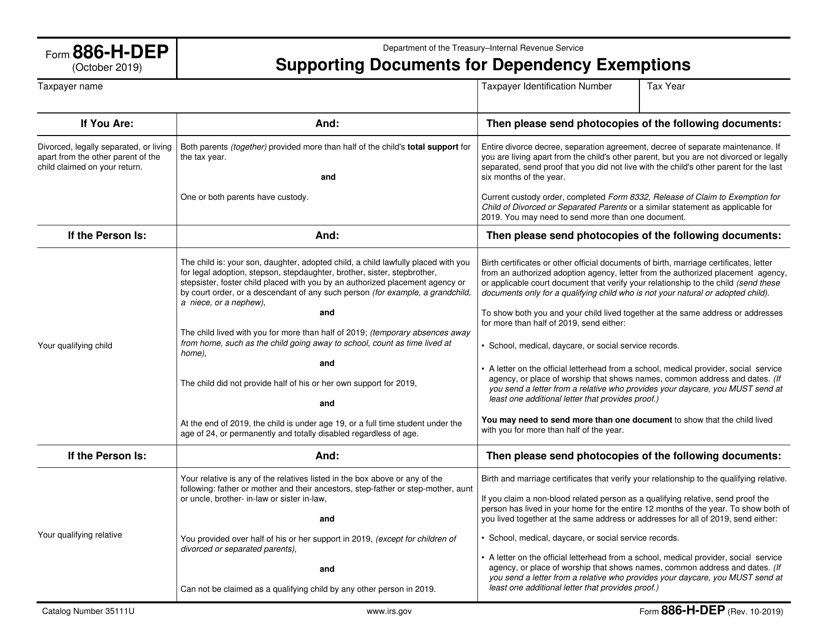

This type of document is used to provide supporting documents for dependency exemptions on Form 886-H-DEP.

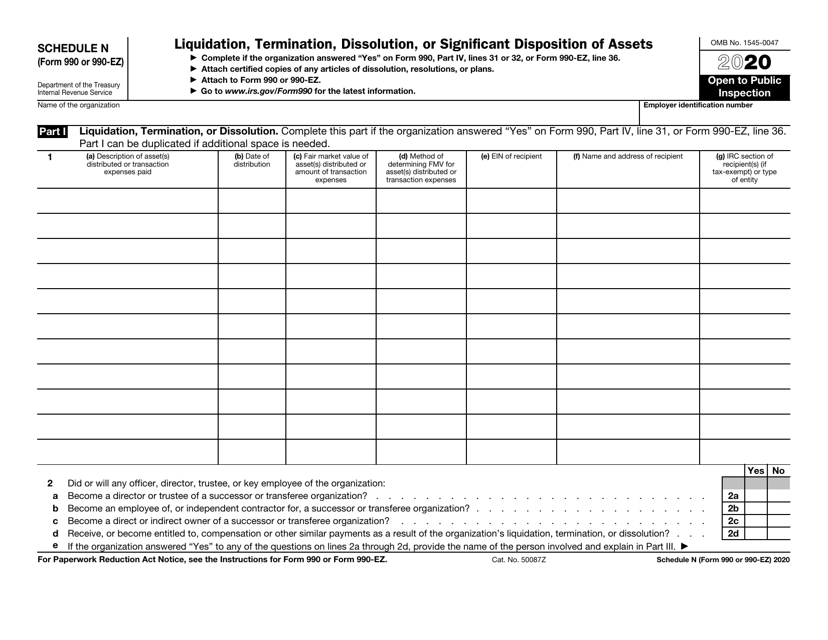

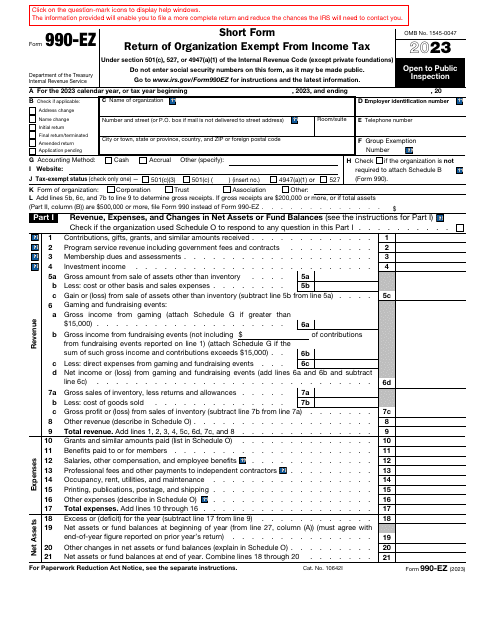

This is a fiscal form used by tax-exempt organizations required to inform tax organizations about their earnings, expenses, and achievements over the course of the year.

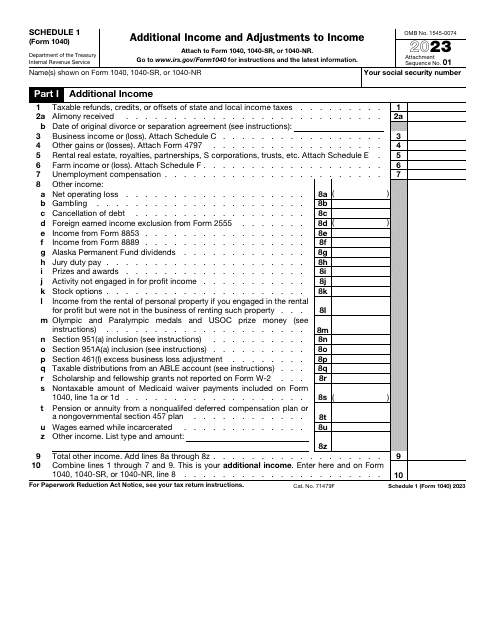

This is a supplementary form used by taxpayers to list income they did not include on the main income statement they file.

This form is used for applying for a determination from the IRS for an employee benefit plan.

This is a formal statement prepared by an employee after figuring out how much tax an employer has to deduct from their paycheck.

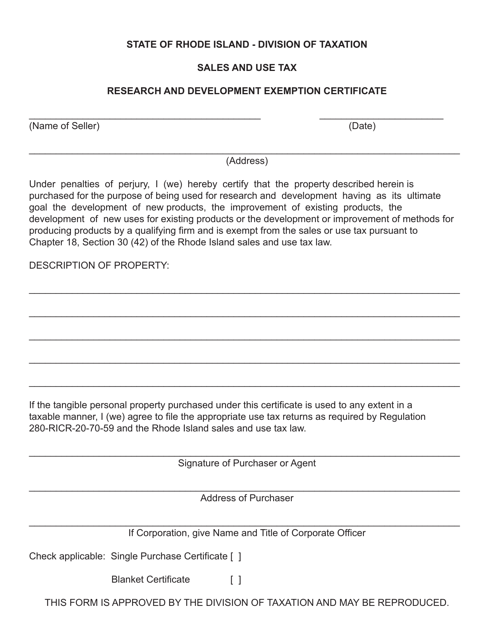

This document is for businesses in Rhode Island to obtain an exemption certificate for research and development activities.

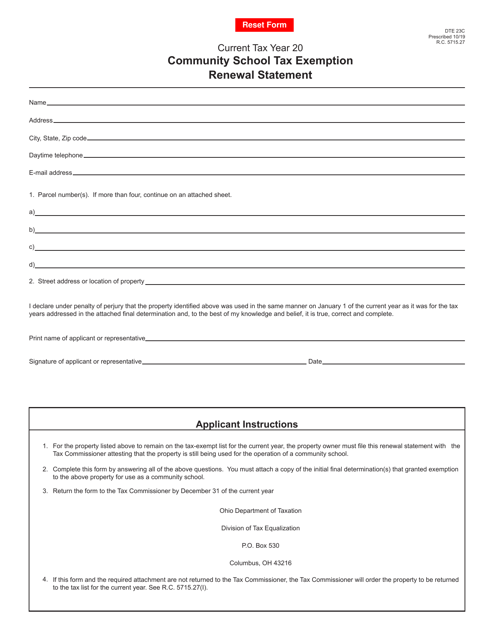

This Form is used for renewing the tax exemption status for community schools in Ohio.

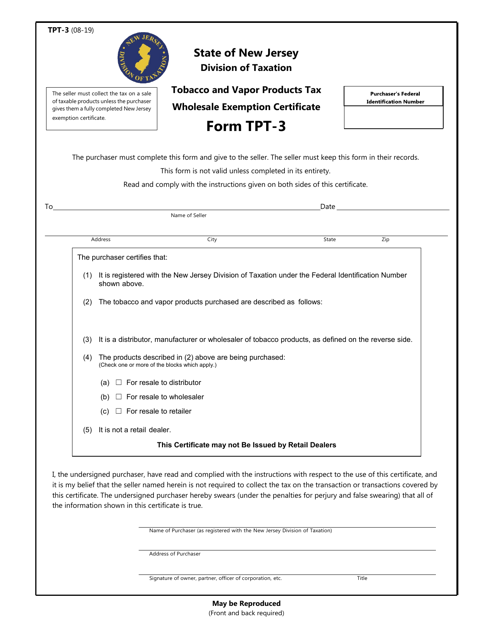

This form is used for applying for a tax exemption on wholesale purchases of tobacco and vapor products in the state of New Hampshire.

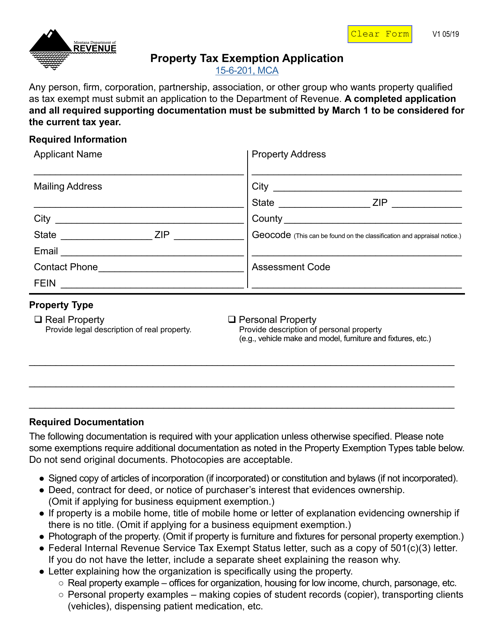

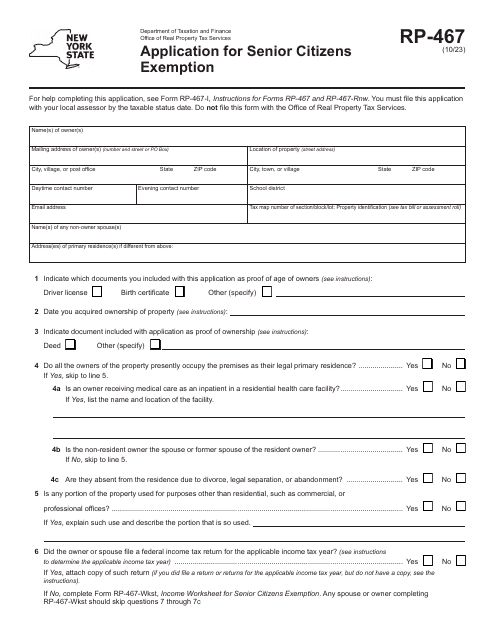

This document is used for applying for a property tax exemption in Montana. It helps eligible individuals or organizations apply for a reduction or exemption from their property taxes.

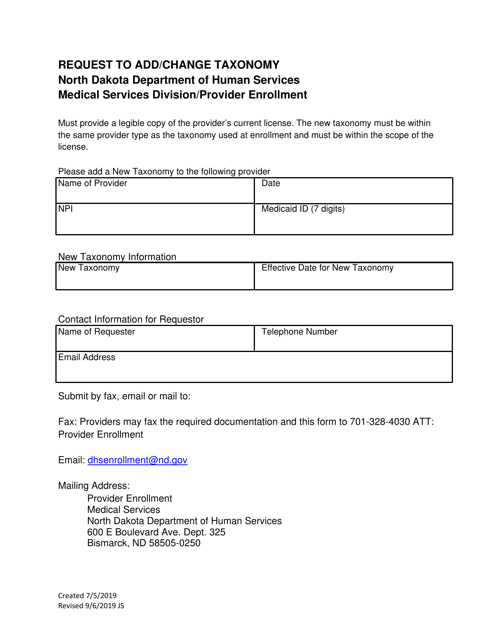

This document is a request form used in North Dakota to add or change a taxonomy.

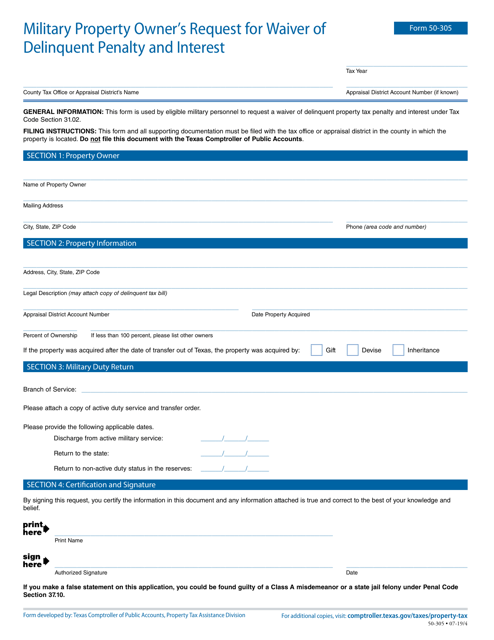

This form is used for military property owners in Texas to request a waiver of delinquent penalty and interest for their property taxes.