Tax Compliance Form Templates

Documents:

727

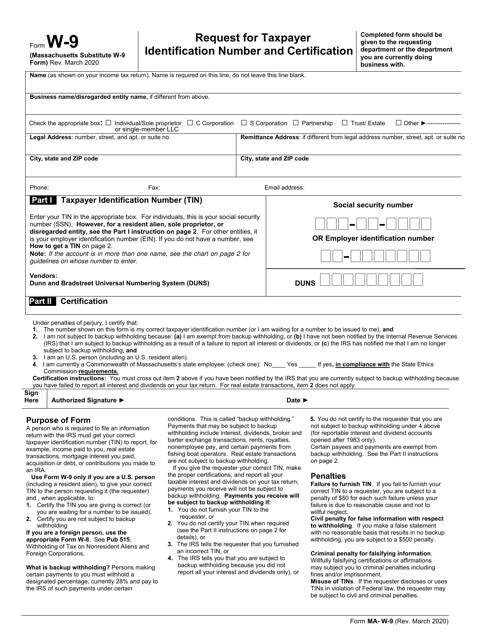

This form is used for requesting taxpayer identification number and certification in Massachusetts.

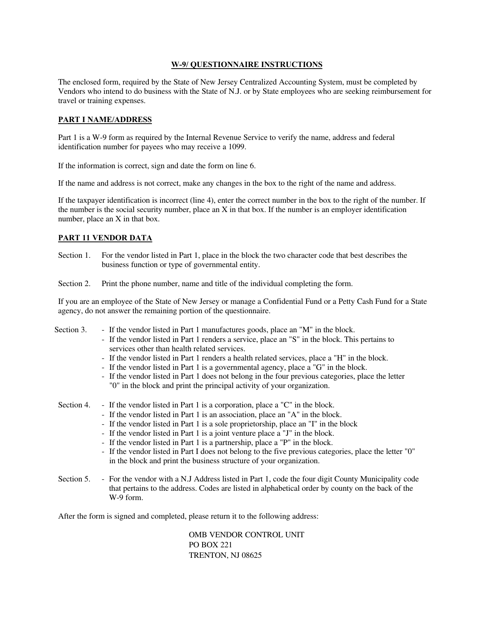

This document is a W-9 questionnaire specific to the state of New Jersey. It is used to collect taxpayer identification information for reporting purposes.

Complete this template to describe the work to be performed, the terms and conditions of performing that work, any limitations, and payment terms to the client.

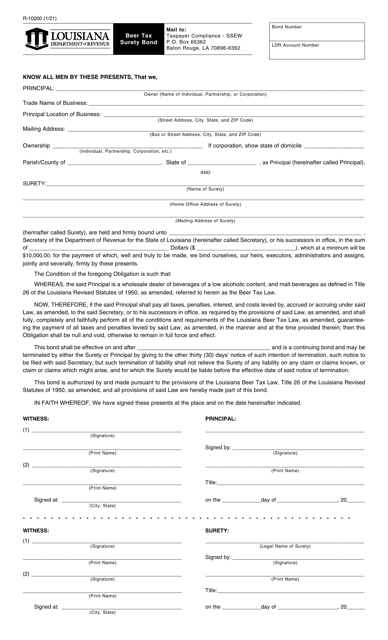

This form is used for obtaining a beer tax surety bond in the state of Louisiana. A surety bond is a guarantee that the beer taxes owed to the state will be paid by the bondholder.

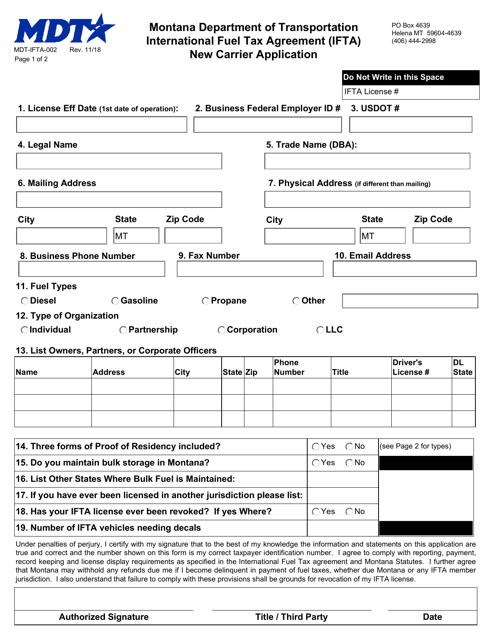

This form is used for new carriers in Montana to apply for the International Fuel Tax Agreement (IFTA), which allows them to report and pay fuel taxes in multiple states or provinces.

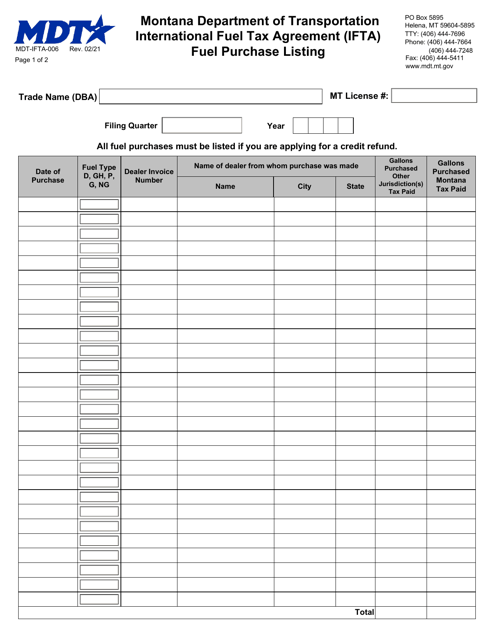

This Form is used for reporting fuel purchases made under the International Fuel Tax Agreement (IFTA) in the state of Montana.

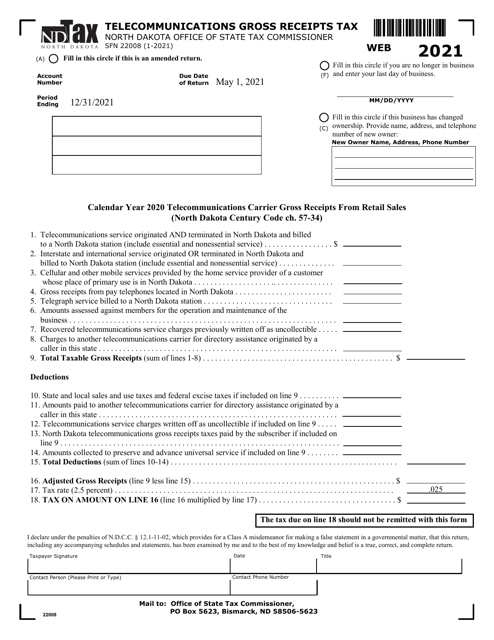

This form is used for calculating and reporting the telecommunications gross receipts tax in North Dakota.

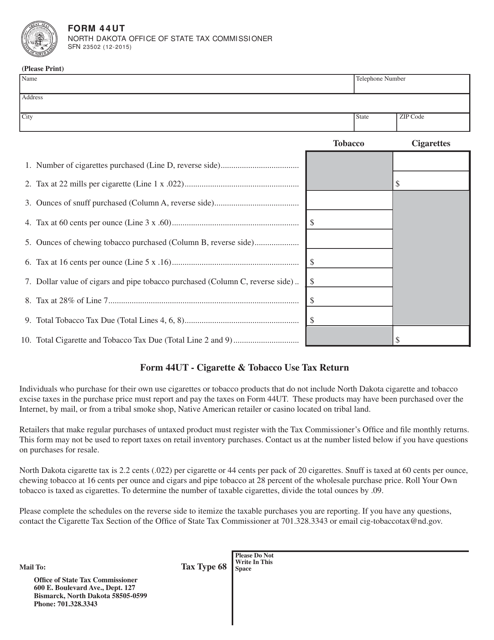

This document is used for filing the Cigarette & Tobacco Use Tax Return in North Dakota.

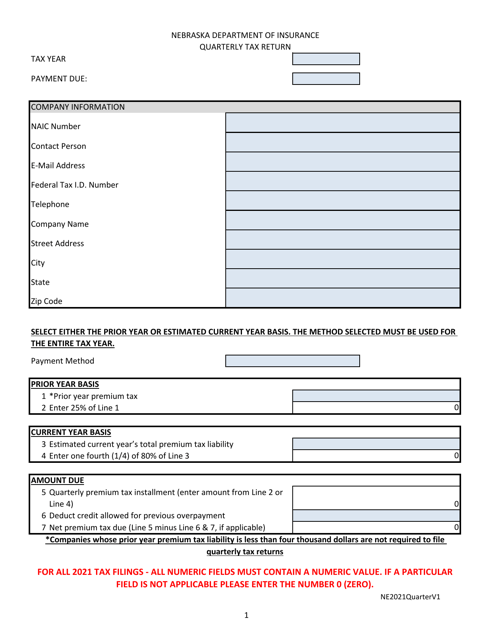

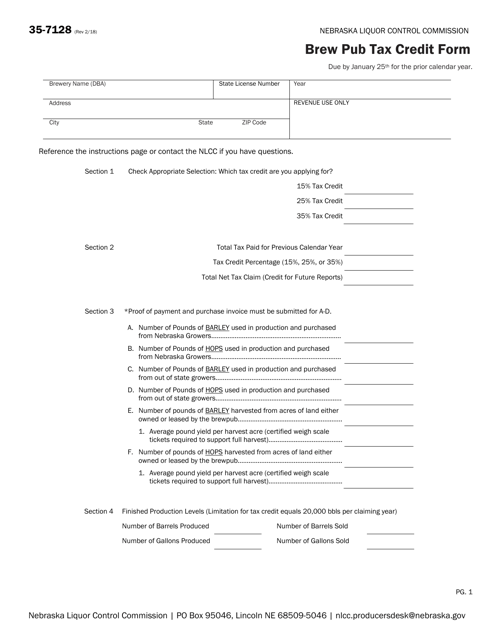

This Form is used for claiming the Brew Pub Tax Credit in the state of Nebraska.

This is a formal IRS document that outlines the financial health of a business entity that owes a tax debt to the government.

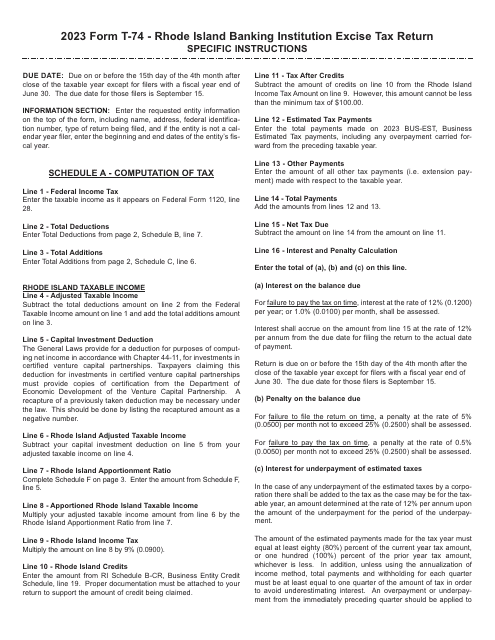

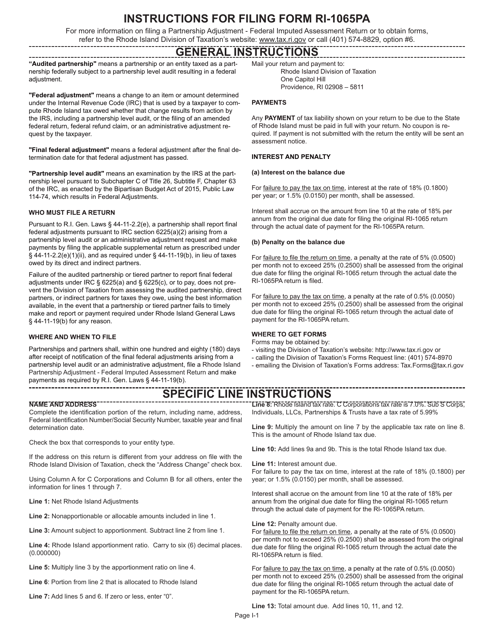

This document provides instructions for completing Form RI-1065PA Partnership Adjustment for Federal Imputed Assessment in Rhode Island.

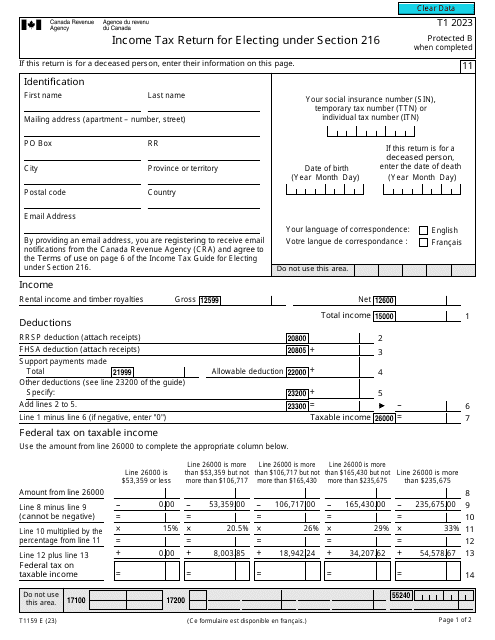

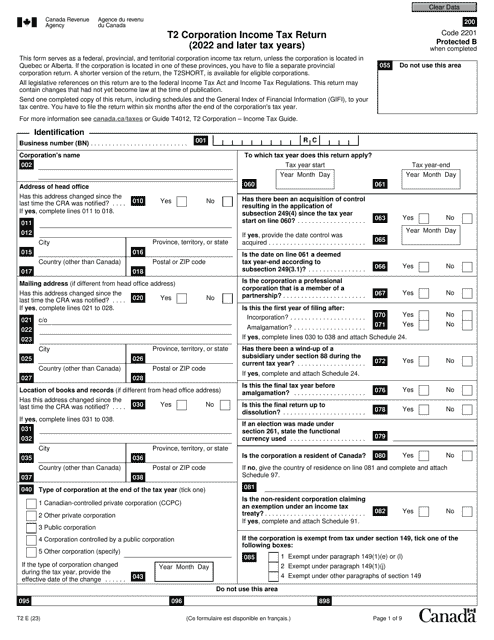

Canadian corporations must complete this main statement every year to report their income even if they eventually do not pay any tax.

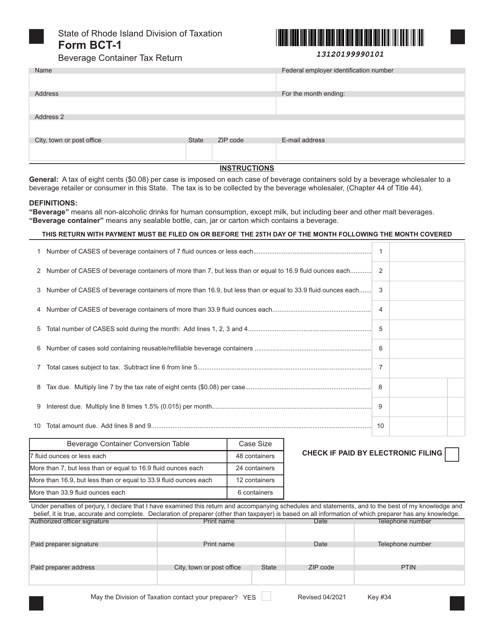

This Form is used for reporting and paying the beverage container tax in Rhode Island.

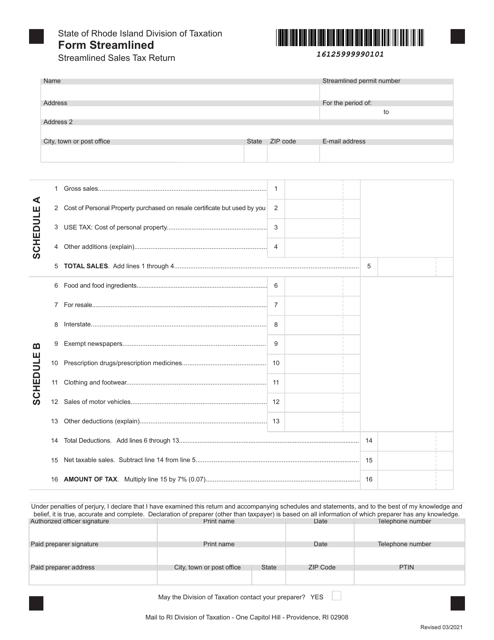

This document is for filing the Streamlined Sales Tax return in the state of Rhode Island. It is used by businesses to report their sales tax collections and remit the taxes owed to the state.

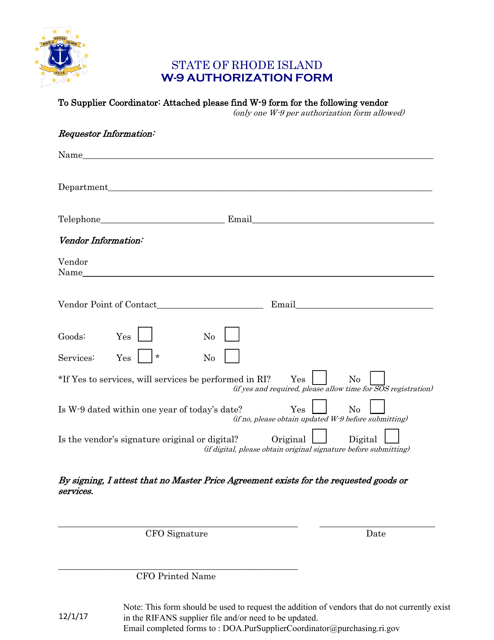

This document authorizes the withholding of taxes in Rhode Island.

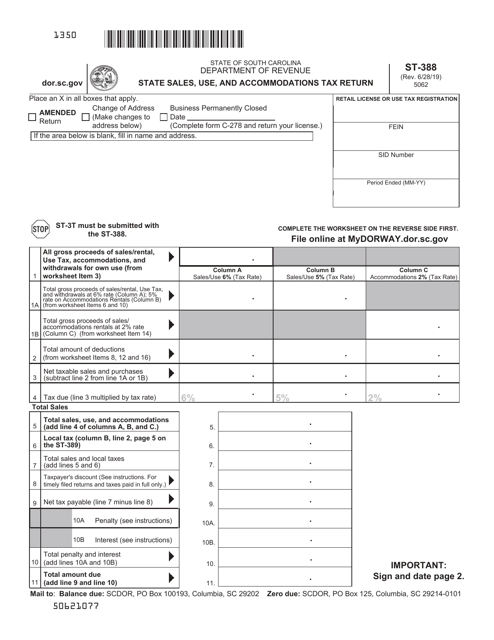

This form is used for reporting State Sales and Use and Accommodations Tax in South Carolina.

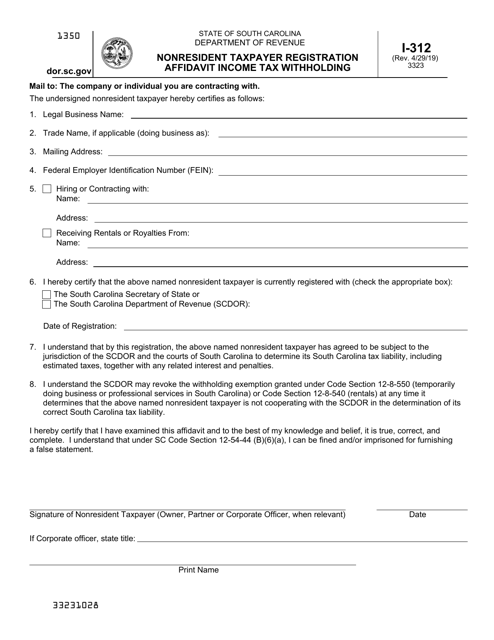

This form is used for nonresident taxpayers in South Carolina to register and declare their income tax withholding status.

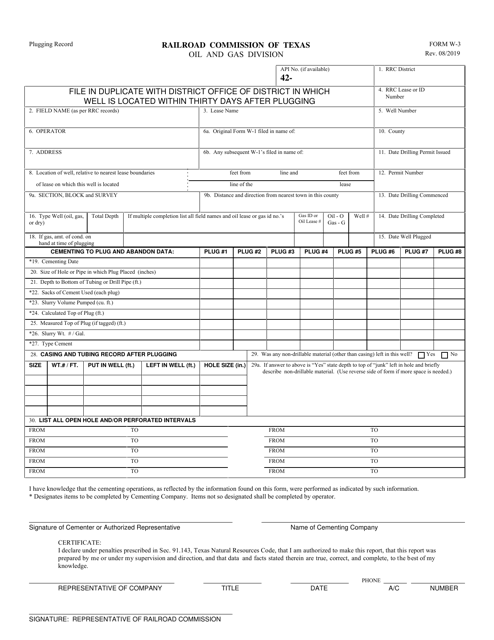

This form is used for record keeping purposes in the state of Texas. It is specifically used for plugging records related to oil and gas wells.