Tax Compliance Form Templates

Documents:

727

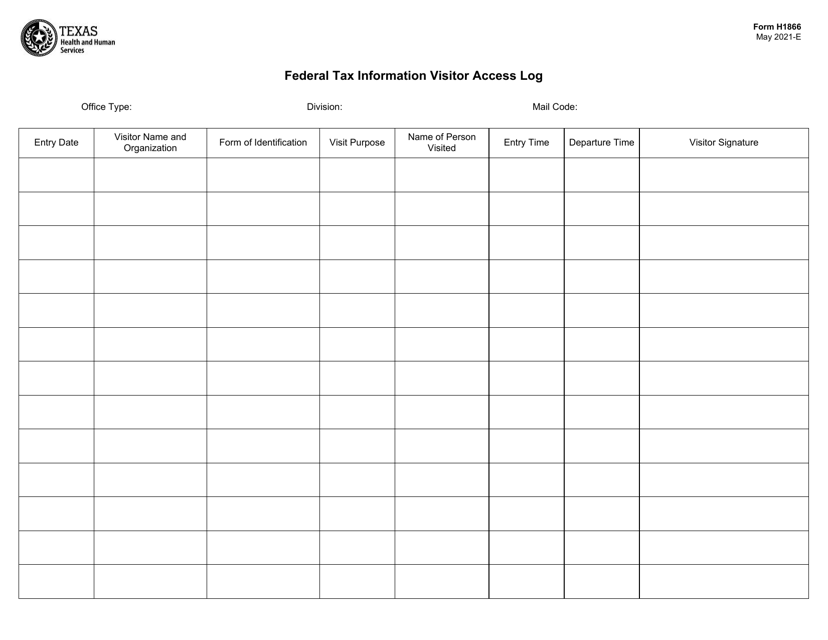

This form is used for recording visitor access to federal tax information in Texas.

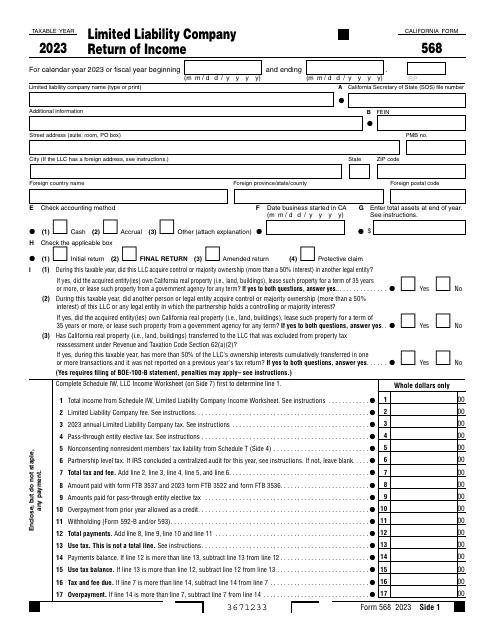

This document is supposed to be filled out only by a Limited Liability Company (LLC) classified as a Partnership. They should use this form as an income tax return that should be filed every year.

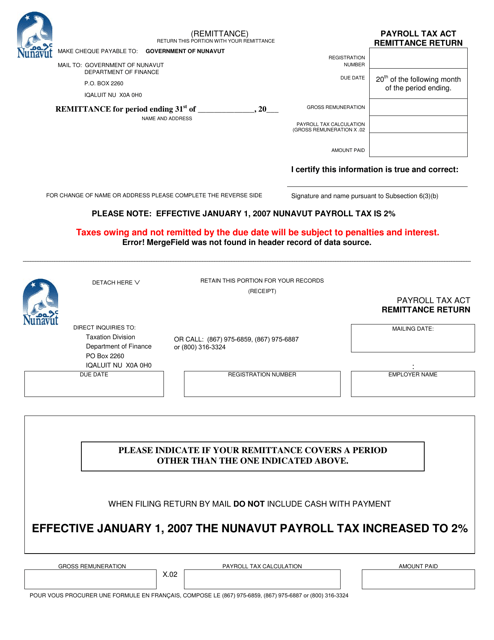

This document is for remitting payroll taxes in Nunavut, Canada. Employers use it to report and pay their payroll taxes to the government.

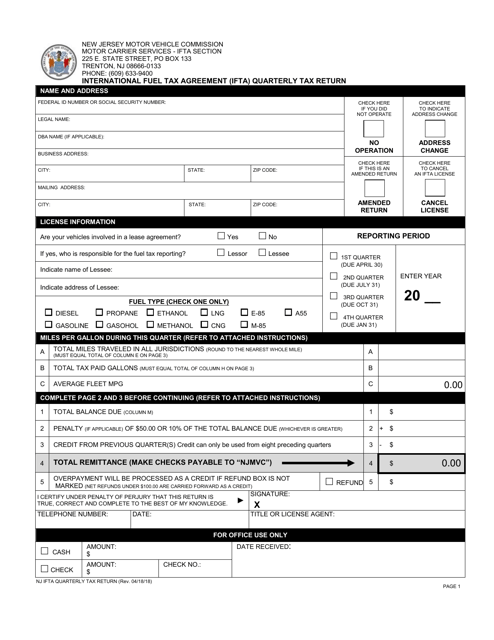

This document is used for submitting the quarterly tax return for the International Fuel Tax Agreement (IFTA) in the state of New Jersey.

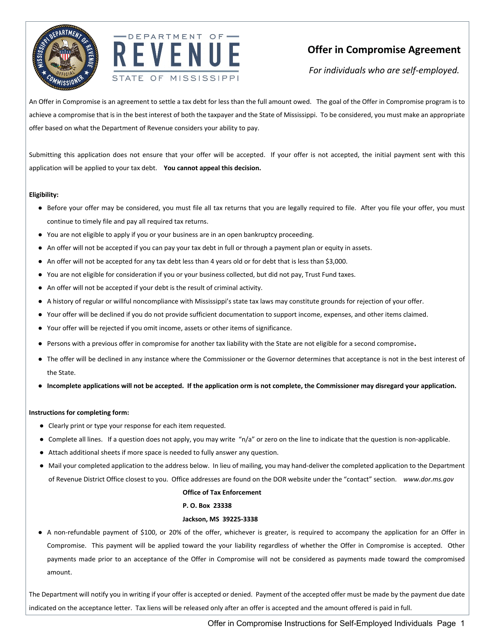

This Form is used for self-employed individuals in Mississippi who want to apply for an Offer in Compromise to settle their tax debt with the state. It provides instructions on how to complete the application process.

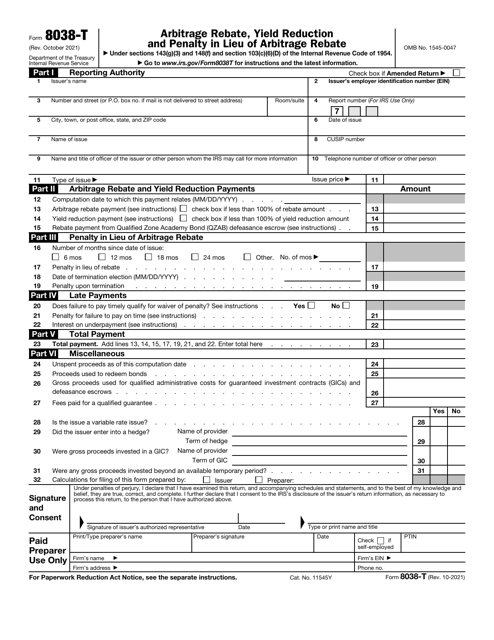

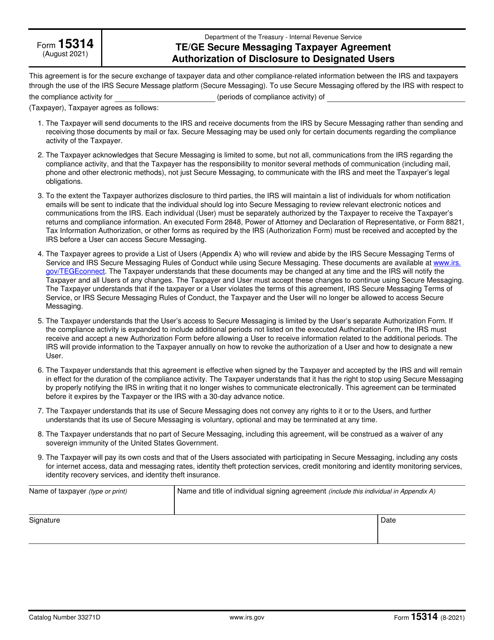

This form is used for authorizing the IRS to disclose taxpayer information to designated users through secure messaging.

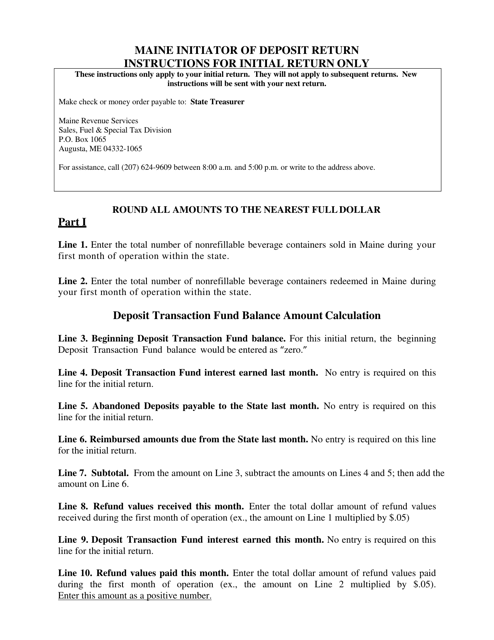

This document provides instructions for individuals in Maine who are initiating their initial deposit tax return. It outlines the requirements and steps for completing the return accurately.

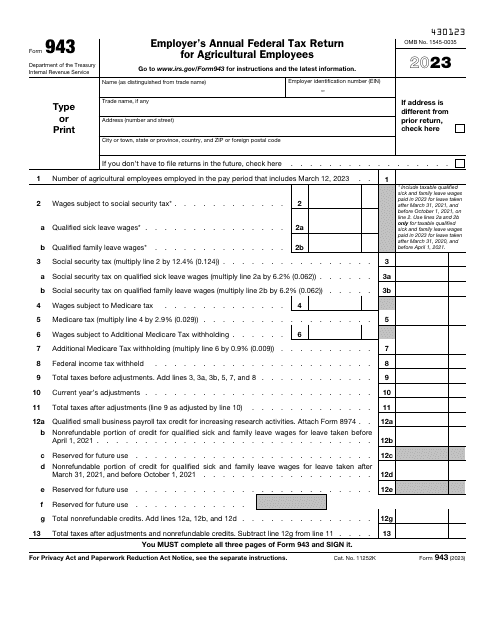

If you paid wages in the reported tax year to one or more farm workers, file this form for your annual federal tax return in case the wages you paid to your farmworkers were subject to the federal income, Medicare, or social security tax withholdings.