Tax Compliance Form Templates

Documents:

727

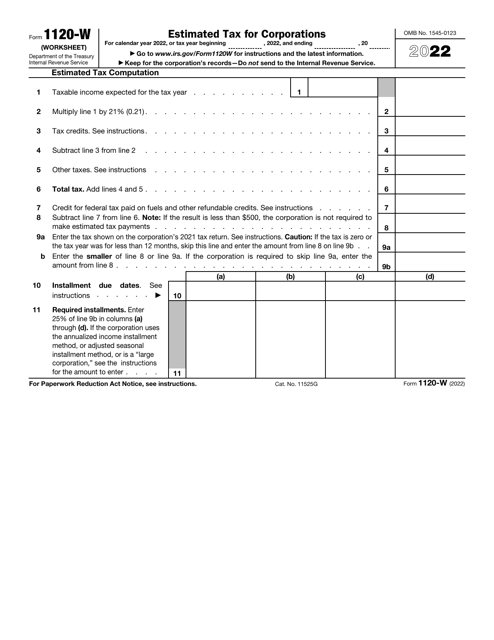

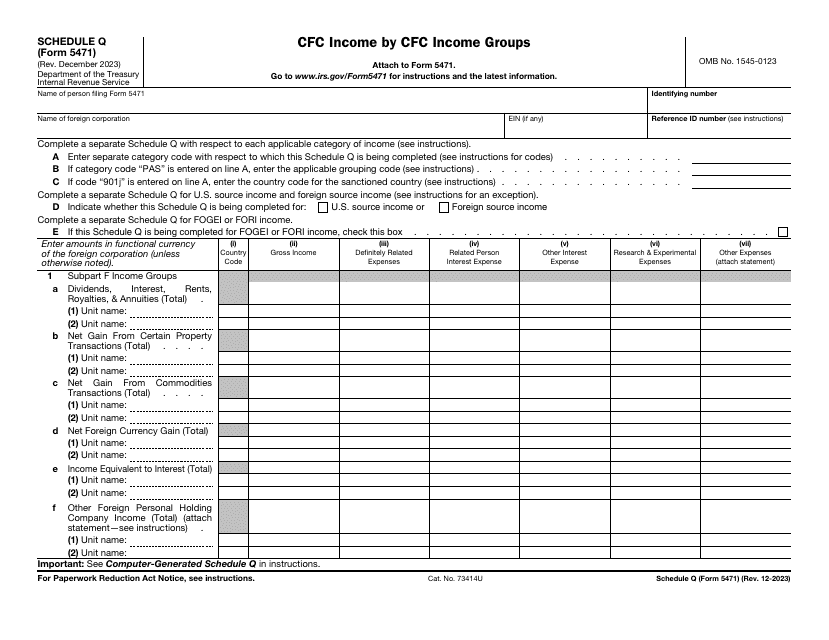

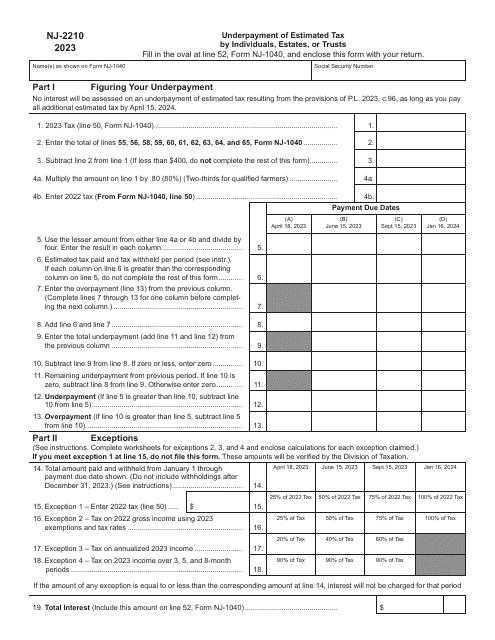

This is a supplementary form corporations were expected to fill out to compute the amount of estimated tax they owe to fiscal authorities.

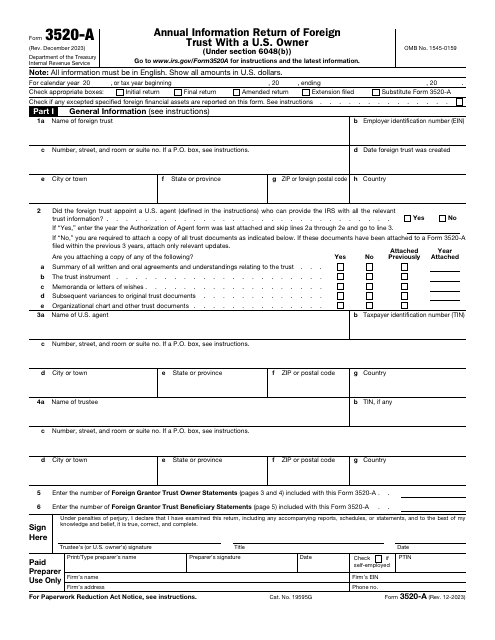

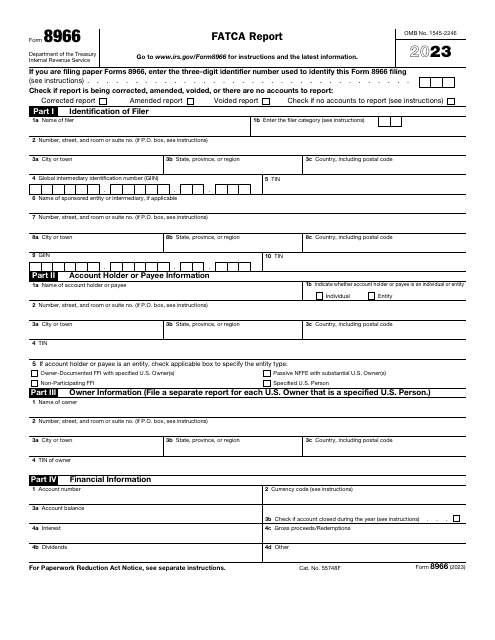

This document is submitted to the Internal Revenue Service (IRS) annually by foreign trusts with a U.S. owner to inform the IRS about the trust, its American beneficiaries, and any U.S. trust owner.

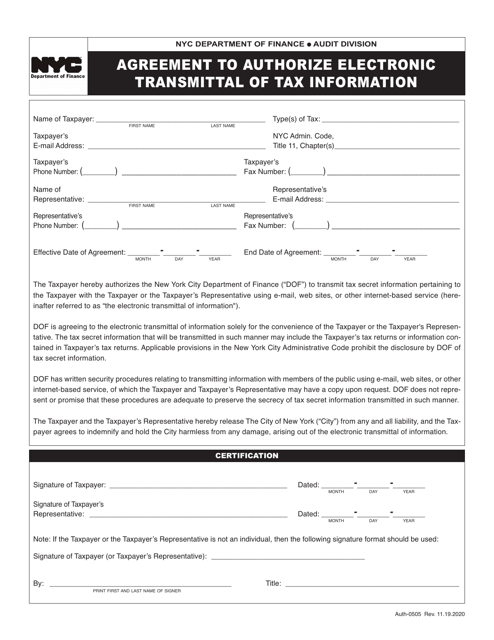

This form is used for authorizing the electronic transmittal of tax information in New York City.

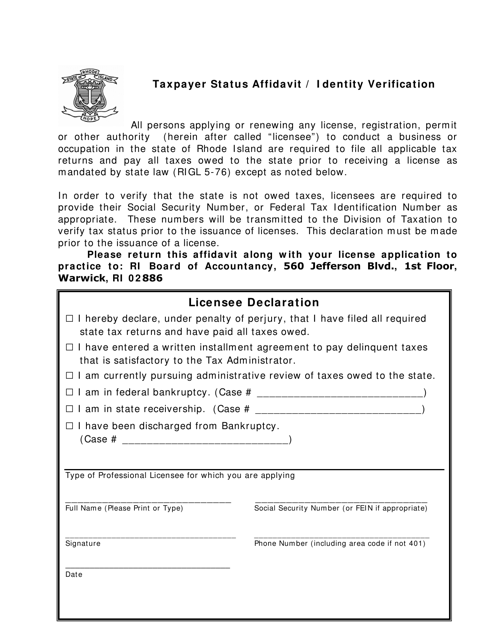

This document is used for affirming taxpayer status and verifying identity in the state of Rhode Island.

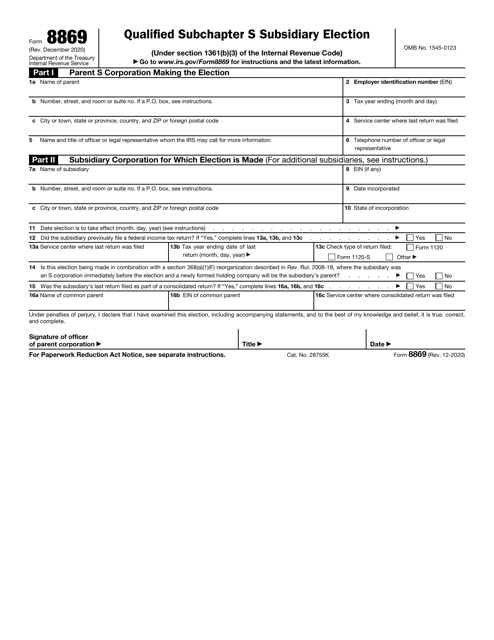

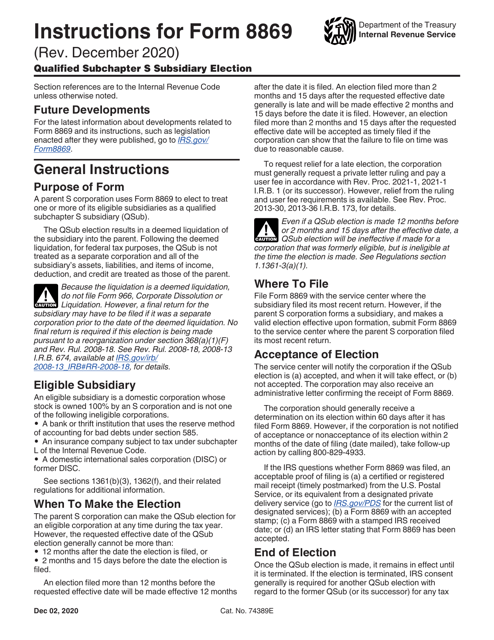

This Form is used for electing to treat a domestic corporation as a Qualified Subchapter S Subsidiary (QSub).

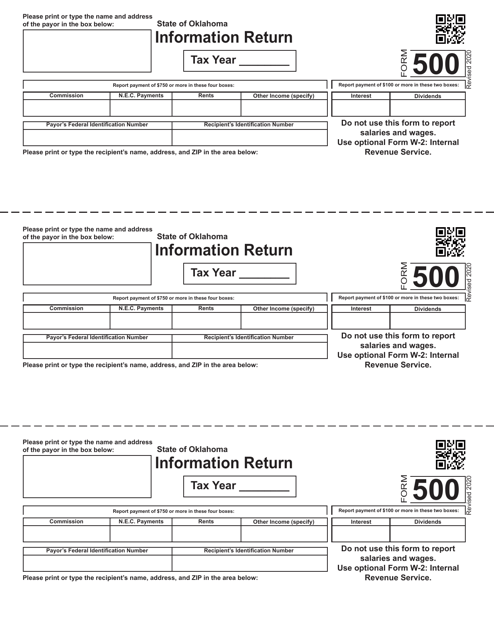

This document is used for filing an information return in the state of Oklahoma. It includes detailed information about various income sources and expenses.

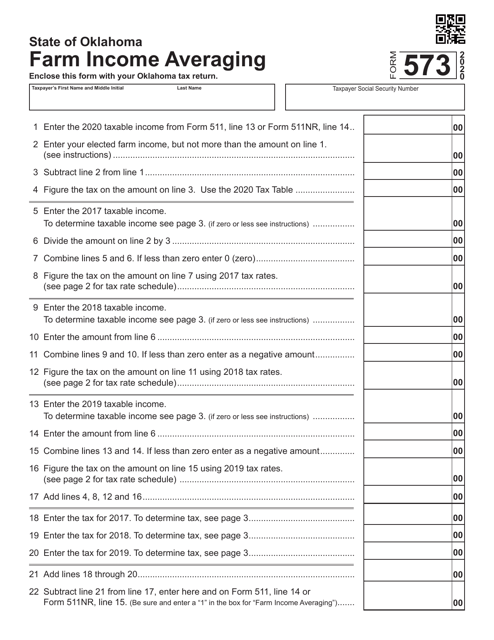

This form is used for farm income averaging in Oklahoma. It helps farmers in calculating their average income over a period of time to reduce tax liability.

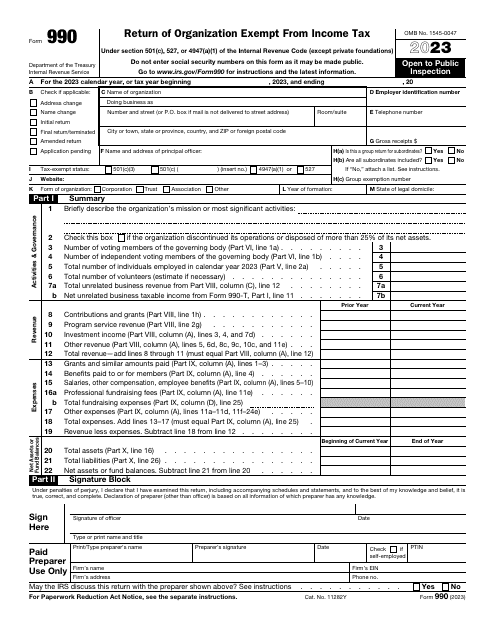

This form is used to supply the Internal Revenue Service (IRS) with information regarding receipts, gross income, disbursements, and other data used by tax-exempt organizations to summarize their work during the tax year.

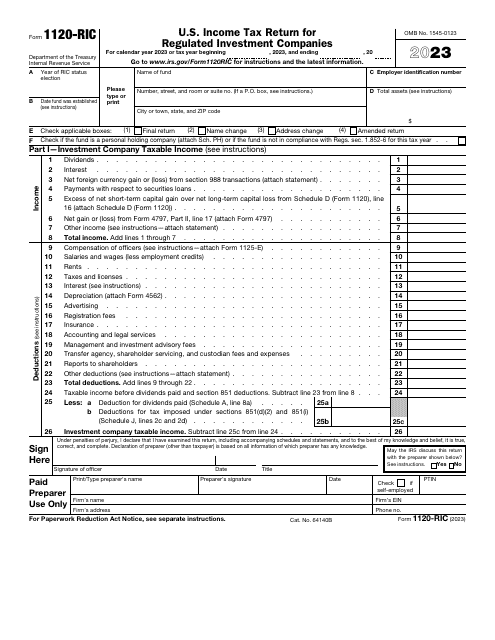

This is a fiscal form used by regulated investment companies to inform the government about their revenue over the course of the tax year, describe their losses and gains, claim tax deductions and credits, and compute their tax liability correctly.

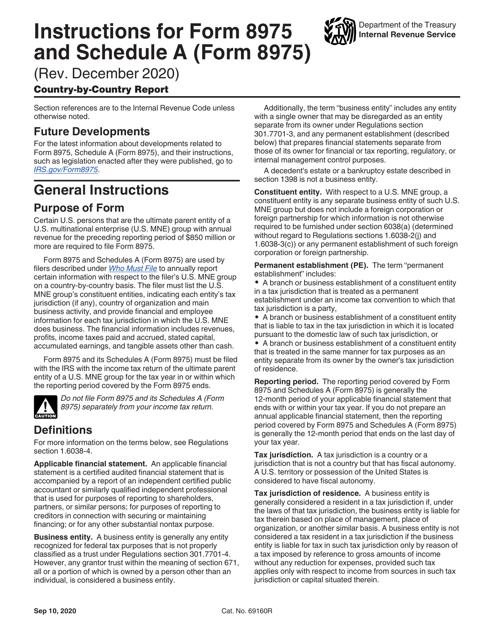

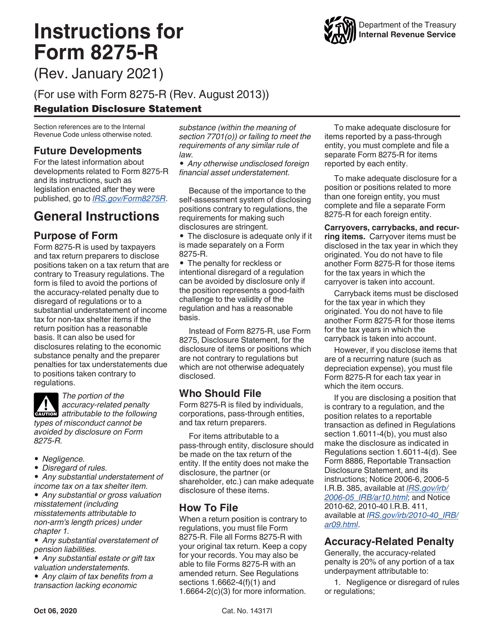

This document provides instructions for completing IRS Form 8275-R, which is used to disclose questionable tax positions to the IRS. It guides taxpayers on the required information and how to accurately complete the form.