Tax Compliance Form Templates

Documents:

727

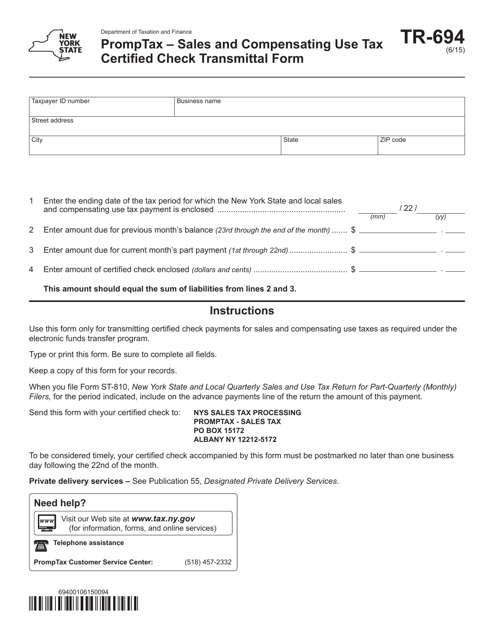

This form is used for transmitting certified checks for sales and compensating use tax in the state of New York.

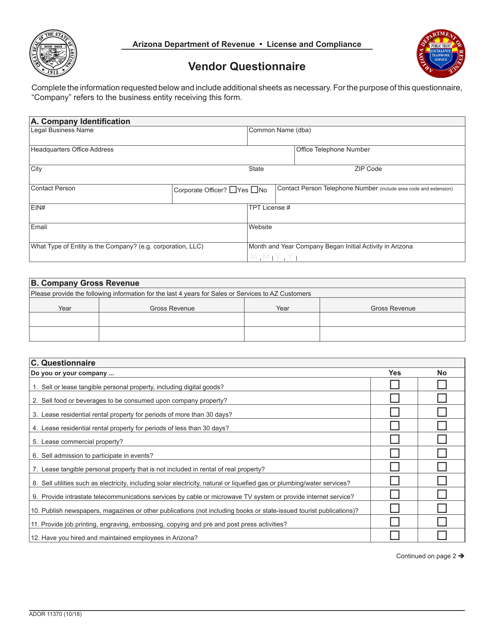

This form is used for vendors to complete a questionnaire in Arizona.

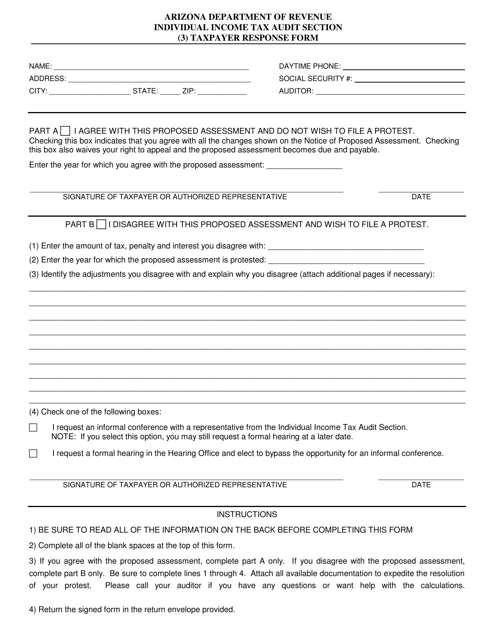

This Form is used for taxpayers in Arizona to respond to correspondence from the tax authorities.

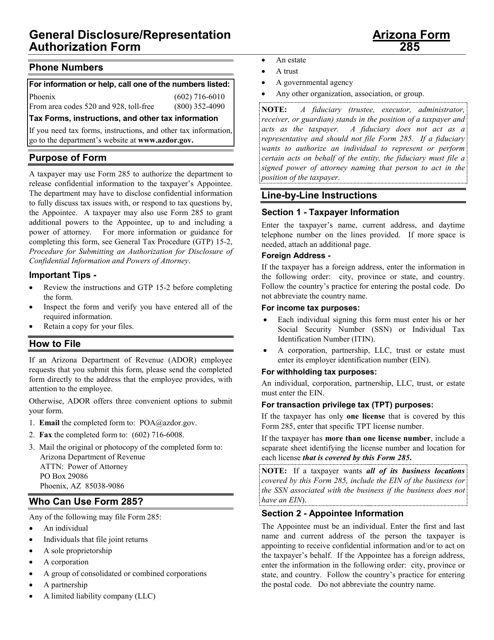

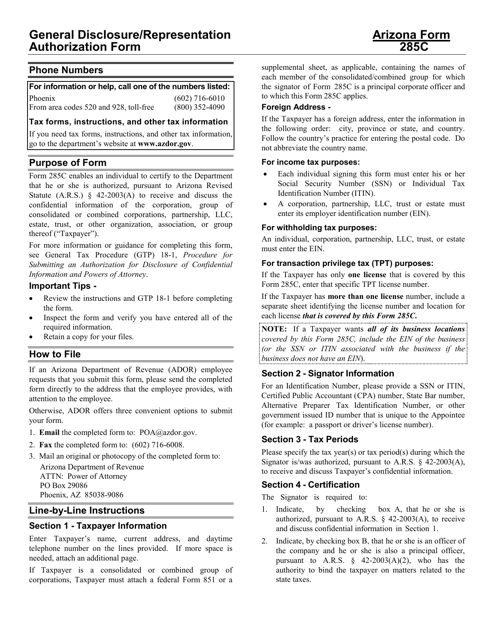

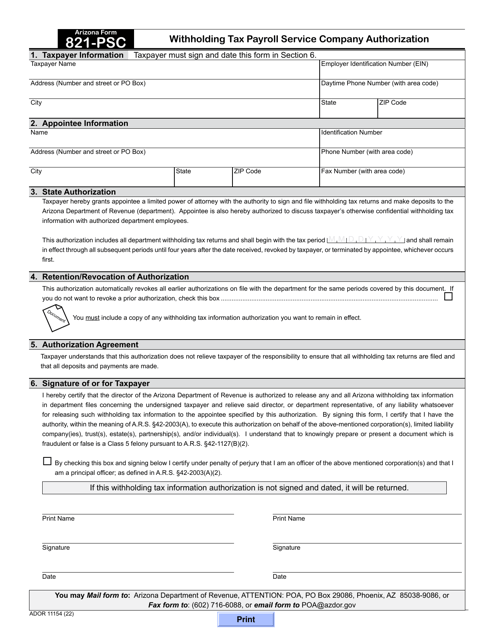

This Form is used for providing general authorization and disclosure for representing taxpayers in Arizona. It is required by the Arizona Department of Revenue.

This form is used for disclosing certification information in Arizona. It is required to provide accurate and complete information to the Arizona Department of Revenue.

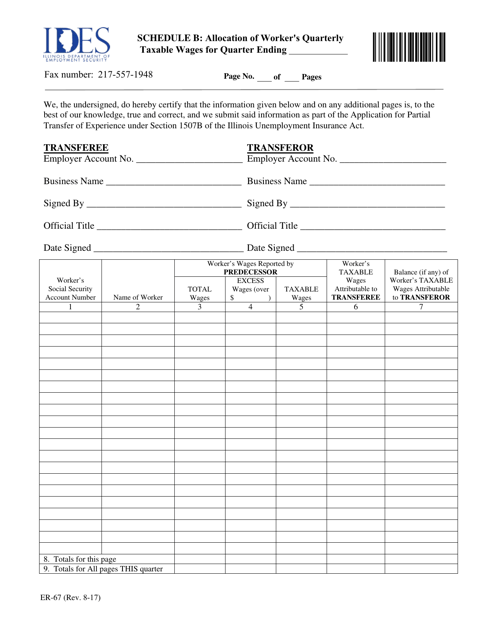

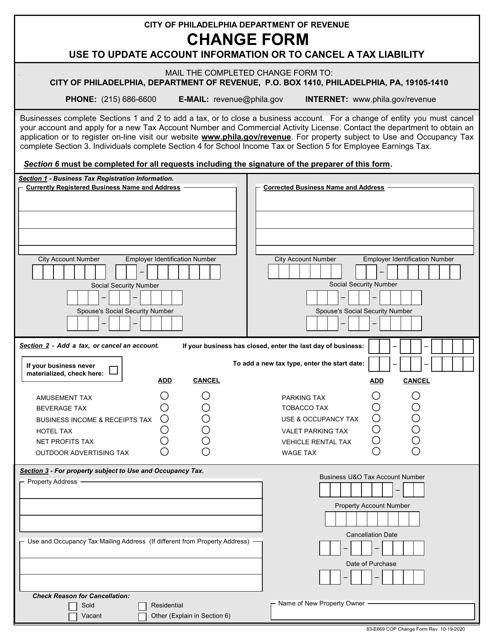

This Form is used for allocating worker's quarterly taxable wages in Illinois.

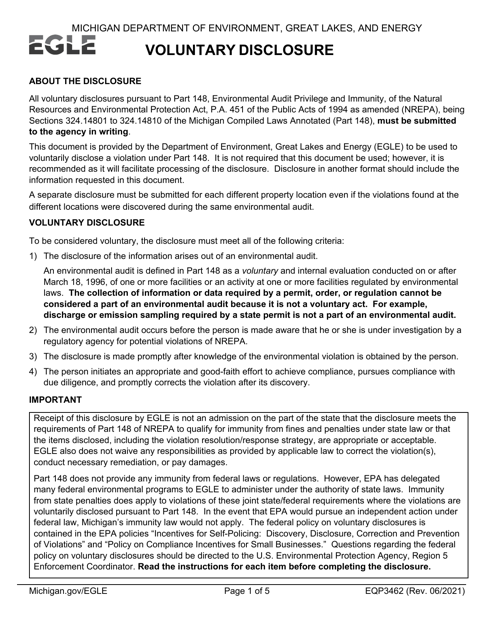

This form is used for voluntary disclosure in the state of Michigan.

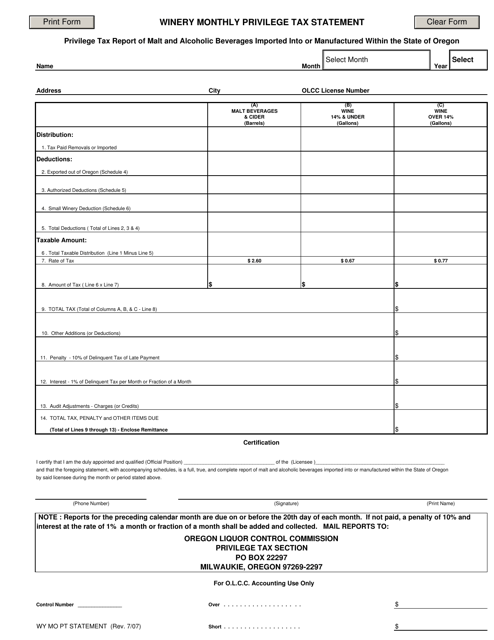

This document is used for reporting and paying monthly privilege tax for wineries in Oregon.

This form is used for tax compliance in the state of Georgia, United States. It is required to ensure that individuals and businesses are in compliance with the state's tax laws.

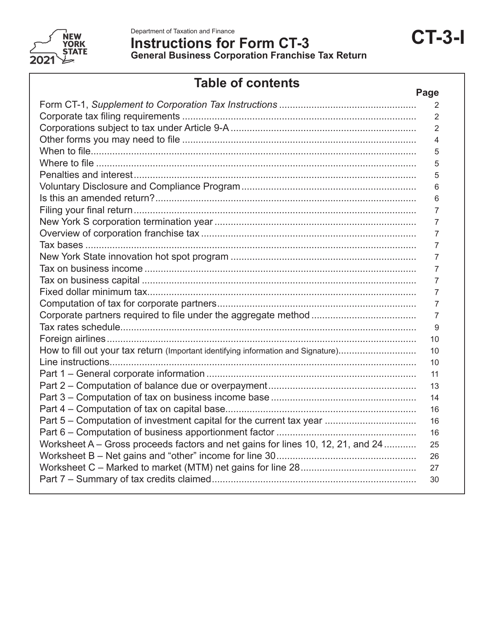

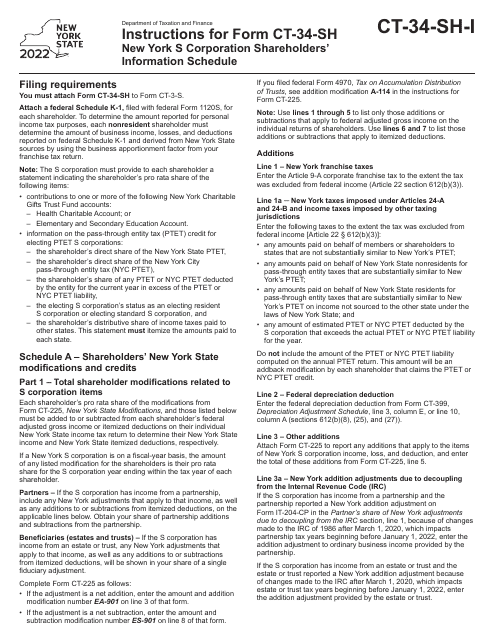

This form is used for filing the General Business Corporation Franchise Tax Return in the state of New York. It provides instructions on how to correctly complete and submit the form.

This document is used for declaring compliance with taxes, child support, fines and restitution in the state of Vermont. It ensures that individuals are in accordance with their financial obligations.

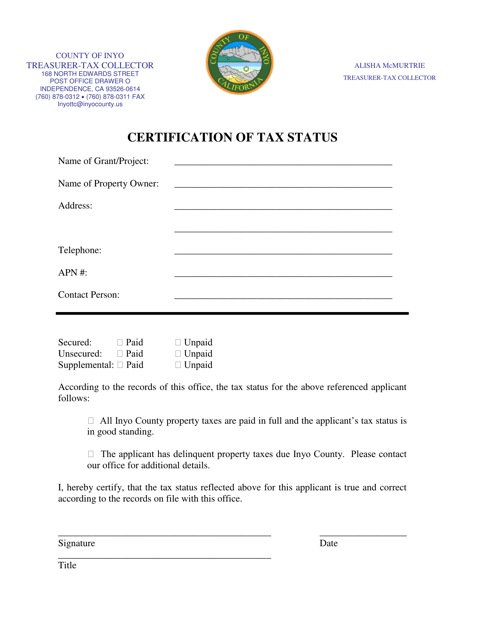

This document is used for certifying the tax status of individuals or entities in Inyo County, California. It verifies whether a person or organization is up to date with their tax obligations in the county.

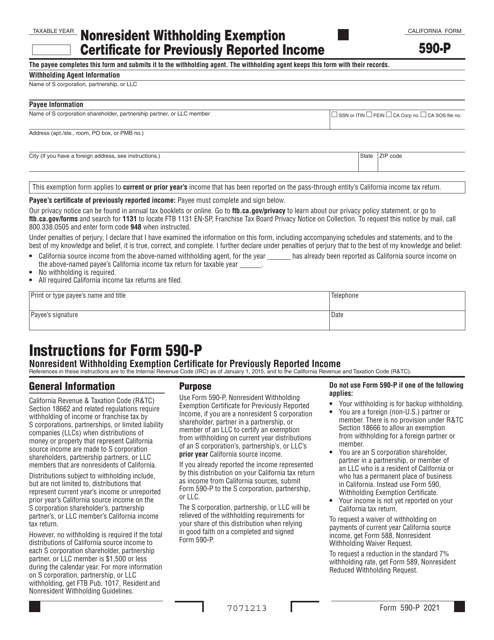

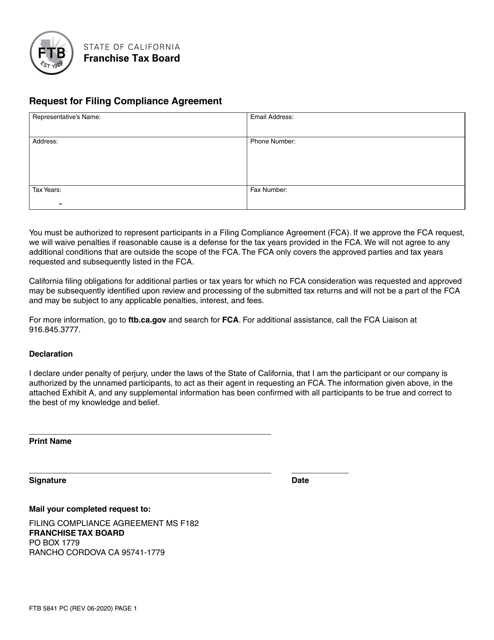

Form 590-P Nonresident Withholding Exemption Certificate for Previously Reported Income - California

This Form is used for claiming an exemption from nonresident withholding for previously reported income in California.

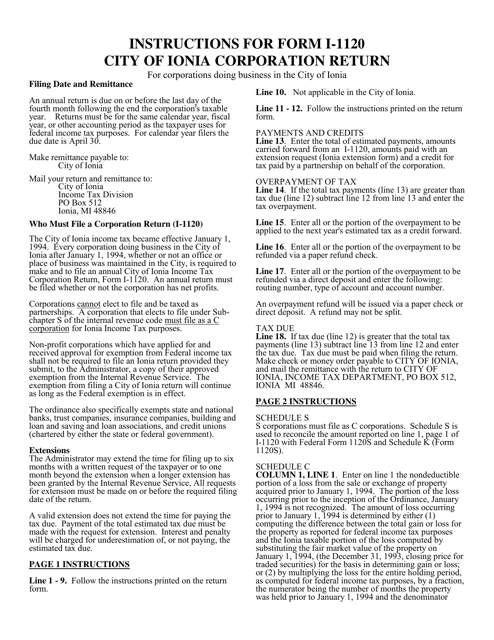

This Form is used for filing the Corporation Income Tax Return for businesses in the City of Ionia, Michigan. It includes instructions on how to accurately report income, deductions, and credits for the tax year.

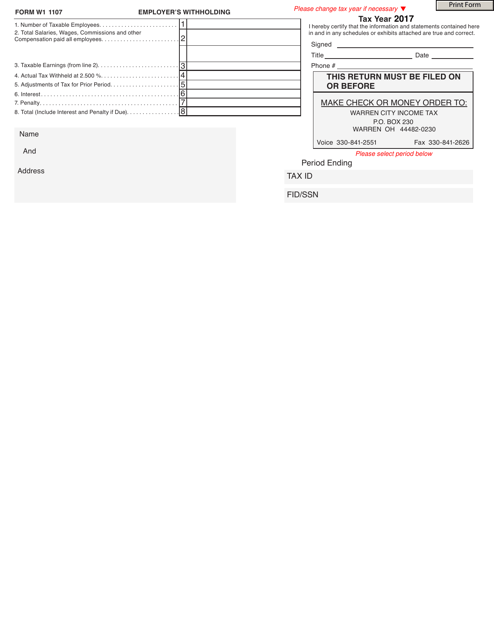

This form is used for employers in the City of Warren, Ohio to report and remit withholding taxes from their employees' wages.

This document provides instructions for filing the Corporation Income Tax Return specifically for businesses located in the City of Grand Rapids, Michigan. It explains how to report and calculate corporate income tax owed to the city.

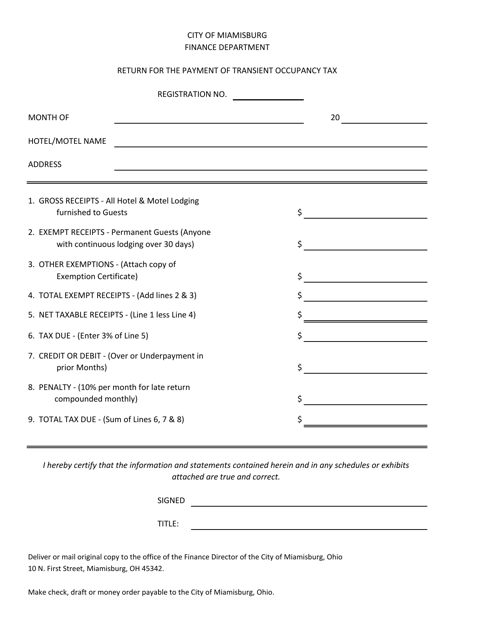

This form is used for reporting and submitting payment for the transient occupancy tax in the City of Miamisburg, Ohio.

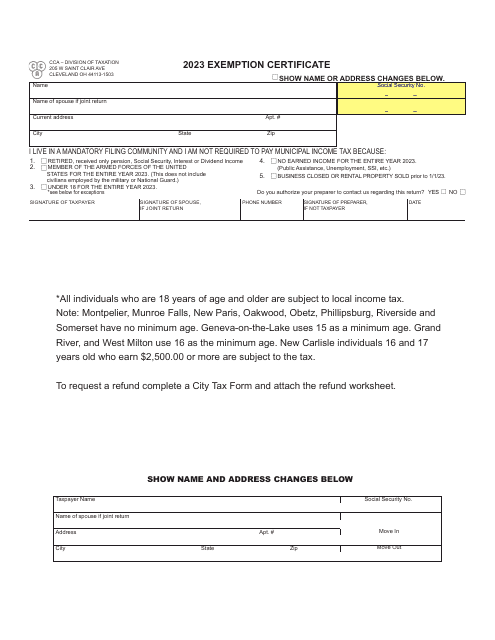

This document is a checklist for applying for a Commercial Business Tax Receipt in the City of Greenacres, Florida. It outlines the steps and requirements for obtaining a tax receipt for commercial businesses in the city.

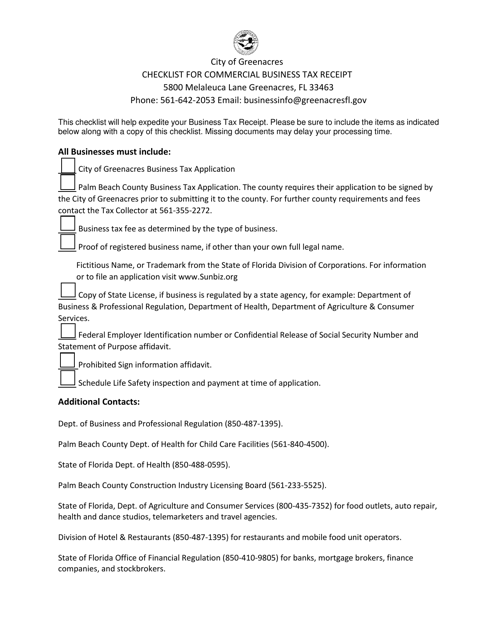

This form is used for changing your tax account information with the City of Philadelphia, Pennsylvania.

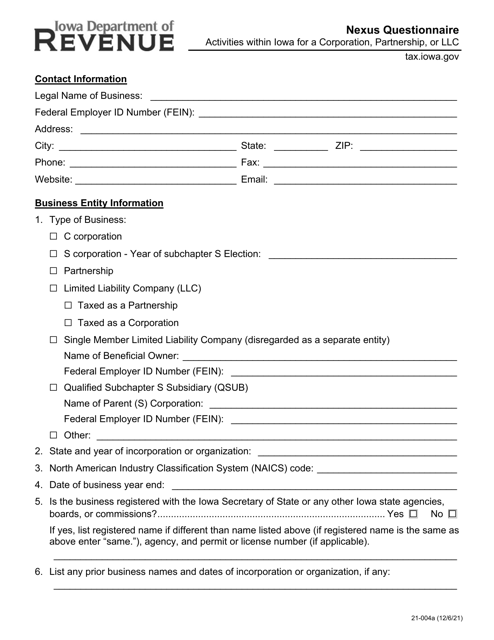

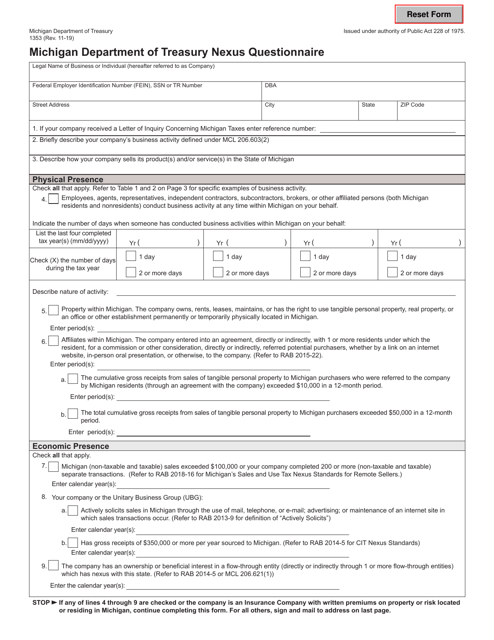

This form is used for the Nexus Questionnaire required by the Michigan Department of Treasury to determine if a business has sufficient presence in Michigan to be subject to state taxes.

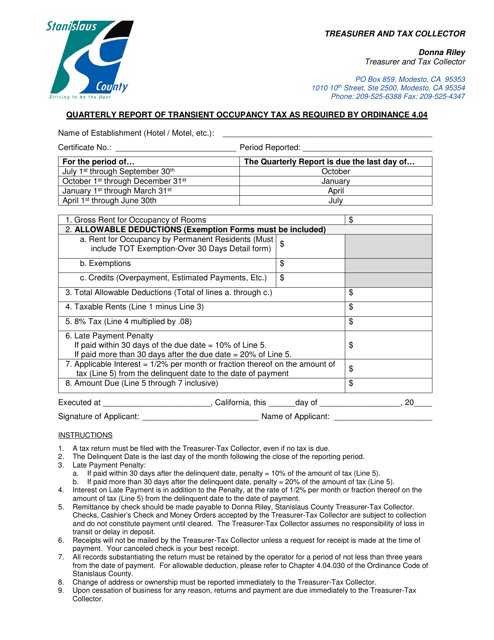

This document is used for reporting the Transient Occupancy Tax in Stanislaus County, California, as required by Ordinance 4.04. It is a quarterly report that provides information on the tax collected from temporary accommodations.

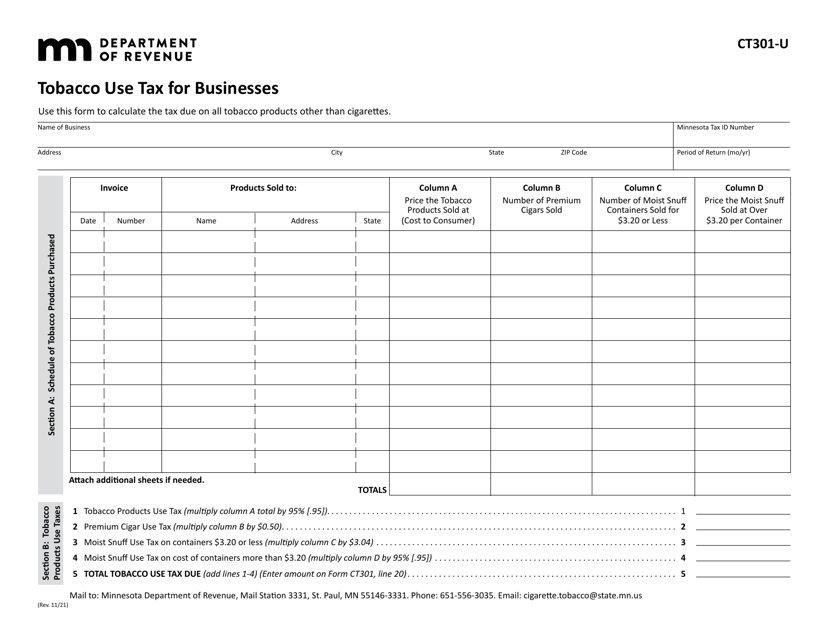

This form is used for businesses in Minnesota to report and pay tobacco use tax.

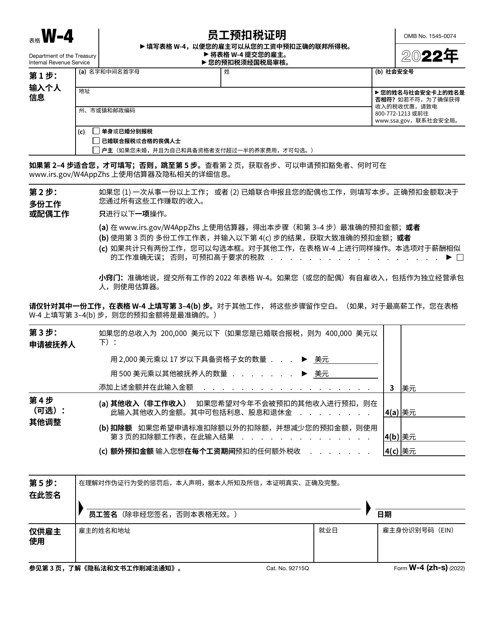

This Form is used for Chinese Simplified version of the IRS Form W-4 Employee's Withholding Certificate. It is used by employees to indicate their tax withholding preferences for income earned in the United States.

This is a formal IRS document that outlines the financial health of a business entity that owes a tax debt to the government.