Tax Compliance Form Templates

Documents:

727

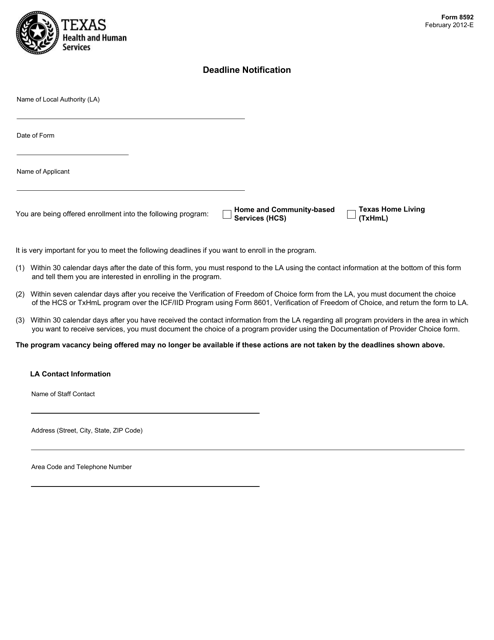

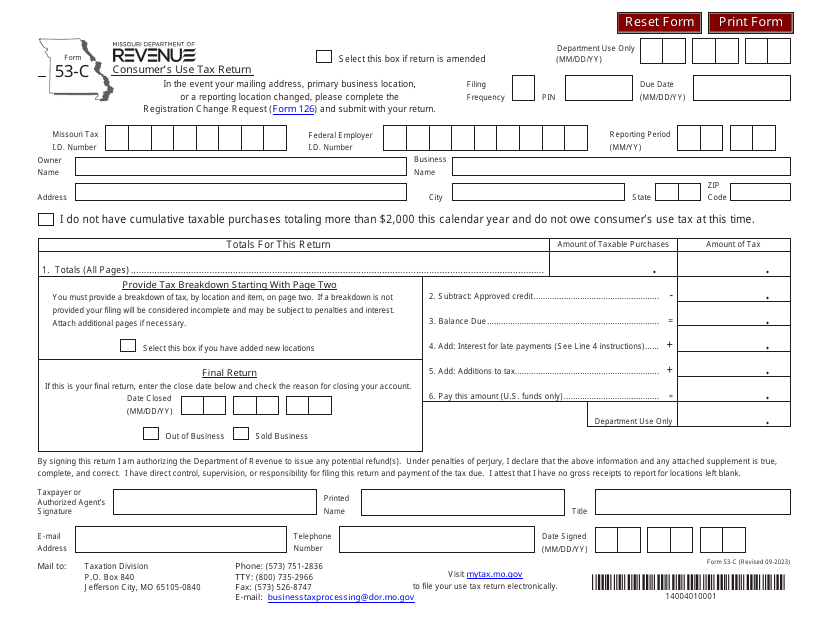

This form is used for notifying the deadline for Form 8592 in the state of Texas.

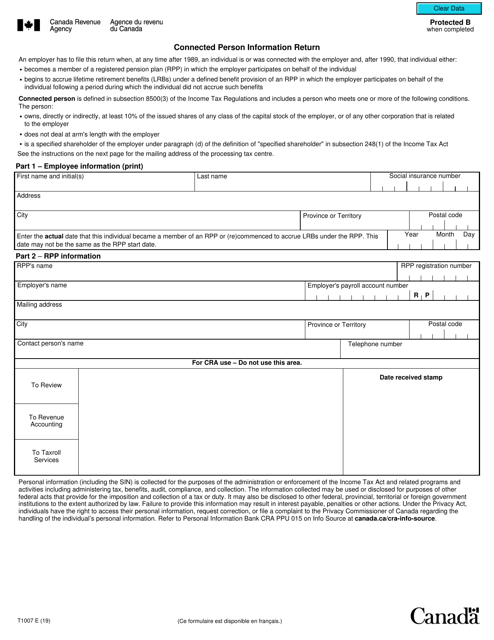

This form is used for reporting information about connected persons for tax purposes in Canada.

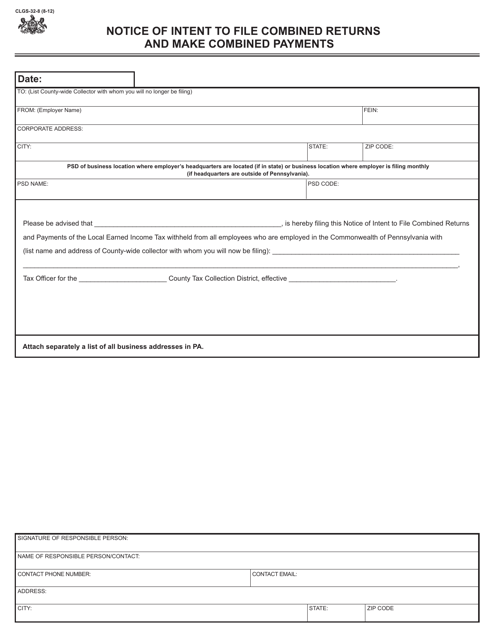

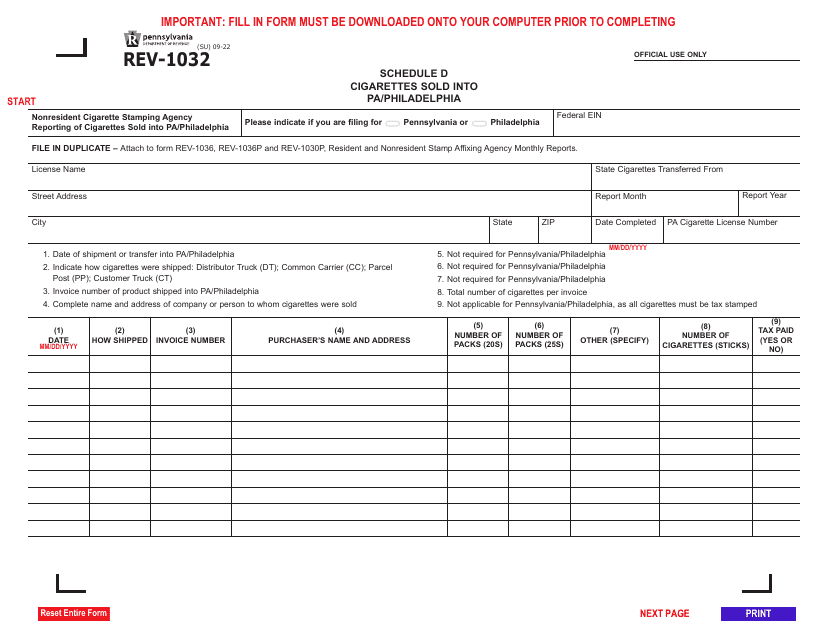

This Form is used for notifying the Pennsylvania Department of Revenue of the intent to file combined returns and make combined payments for multiple entities.

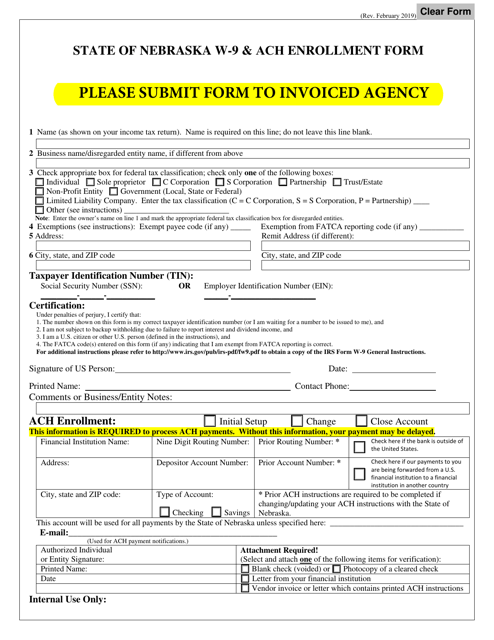

This form is used for the state of Nebraska to receive W-9 information and enroll in ACH (Automated Clearing House) payment.

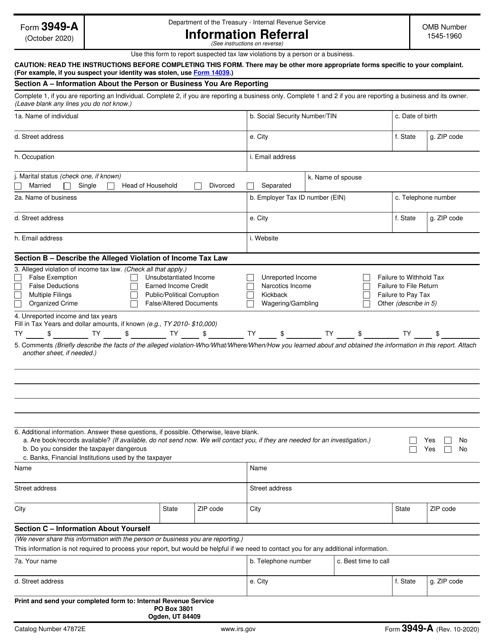

This is a fiscal IRS form any individual is free to use to report an alleged tax violation.

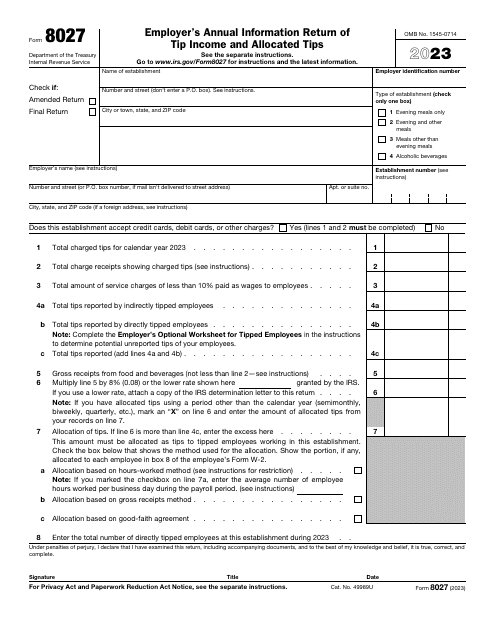

Every year, this form is filled out by employers wishing to report to the Internal Revenue Service (IRS) the receipts and tips their employee received, as well as to determine allocated tips.

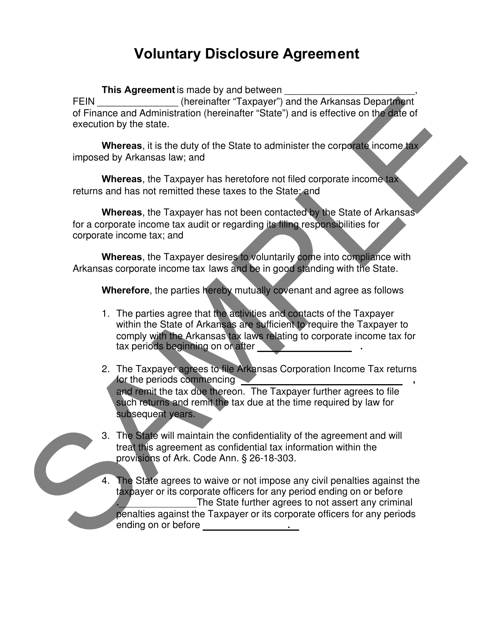

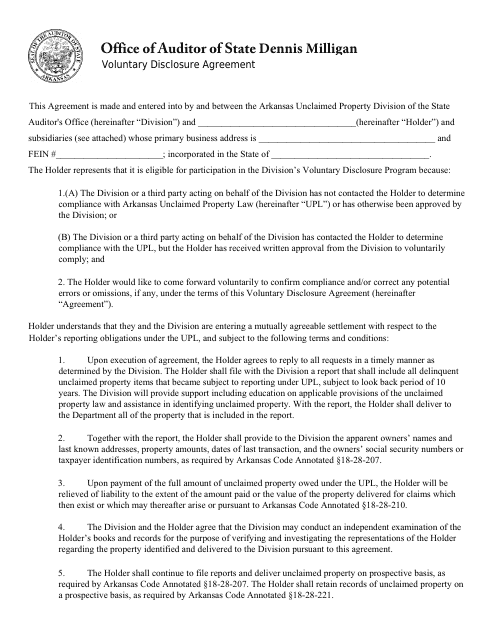

This form is used for corporate taxpayers in Arkansas to voluntarily disclose any errors or omissions in their previous corporate tax returns.

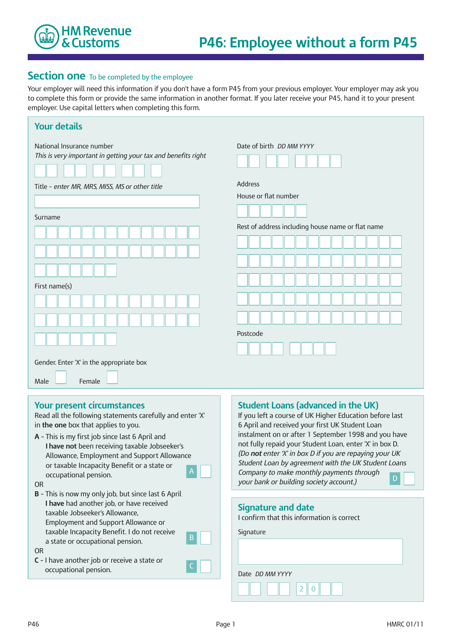

This is an outdated document that was completed for new employees to find out the correct amount of income tax to withhold.