U.S. Department of the Treasury Forms

Related Articles

Documents:

2369

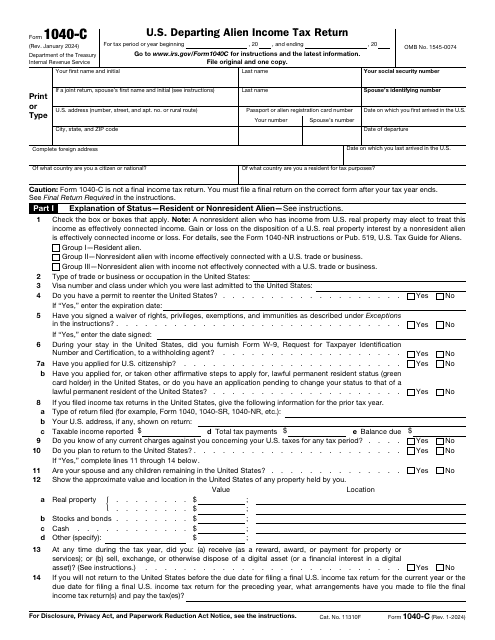

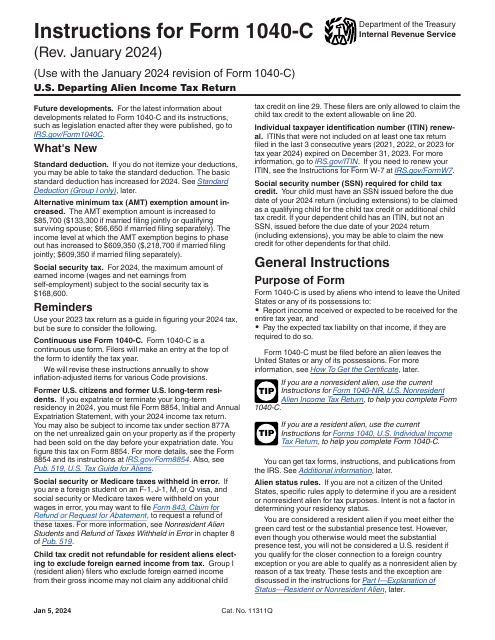

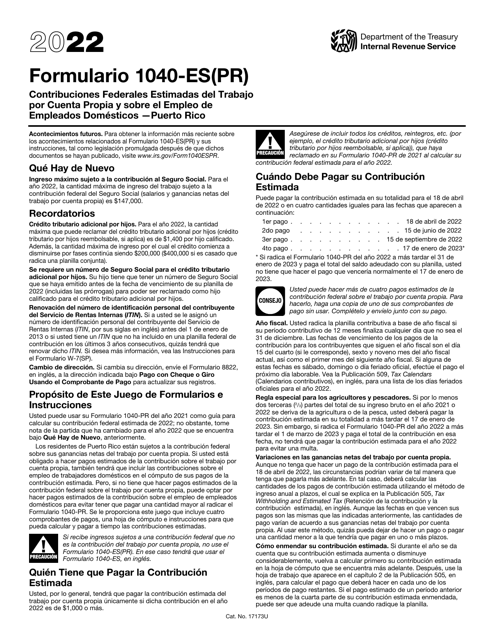

Use this form to report the income you received or expect to receive for the tax year and to pay the expected tax on that income (only if you are required to do so).

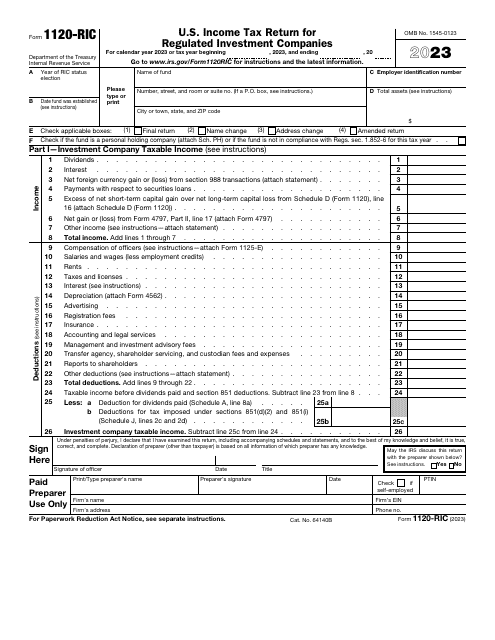

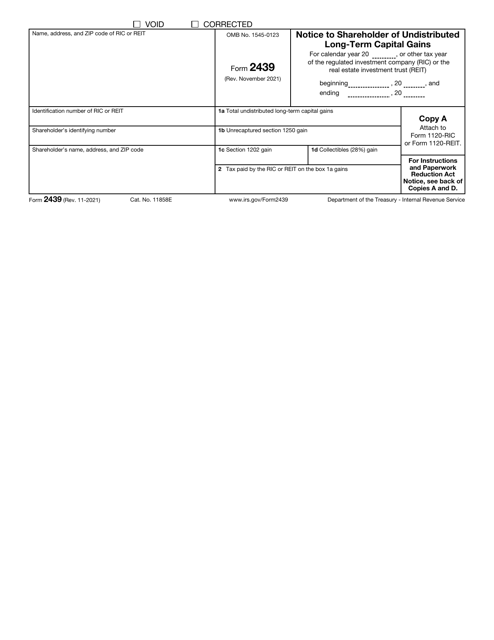

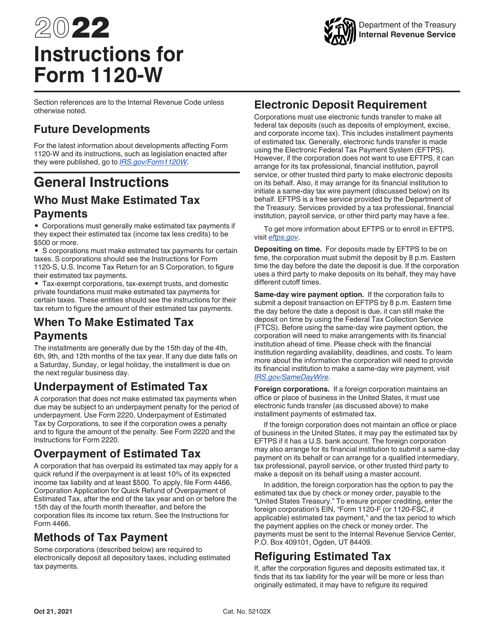

This is a fiscal form used by regulated investment companies to inform the government about their revenue over the course of the tax year, describe their losses and gains, claim tax deductions and credits, and compute their tax liability correctly.

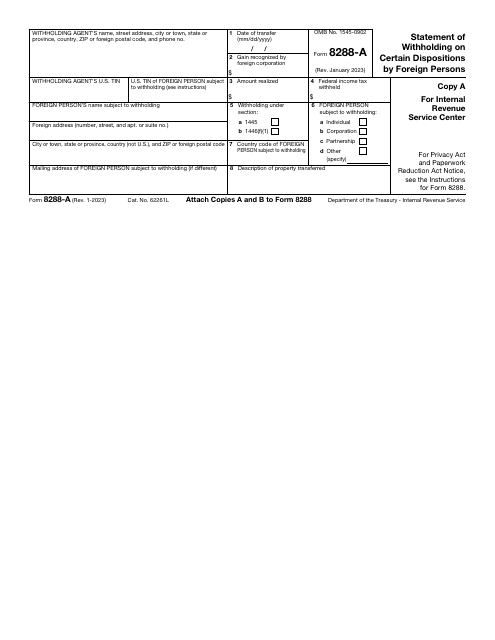

This is a supplementary document used by a withholding agent to describe the disposition of real property and report how much tax was withheld as a result of the transaction.

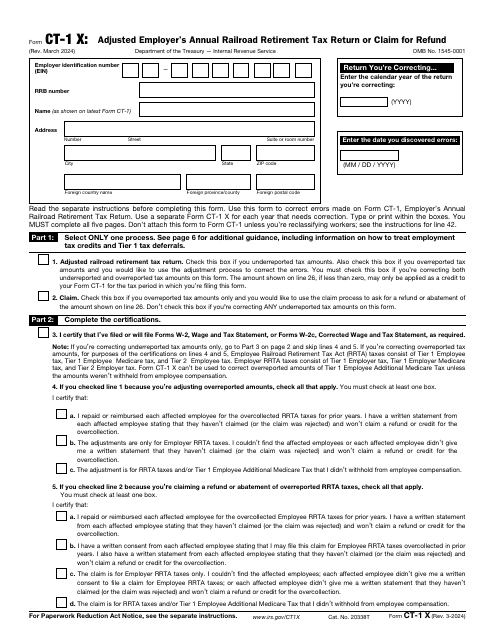

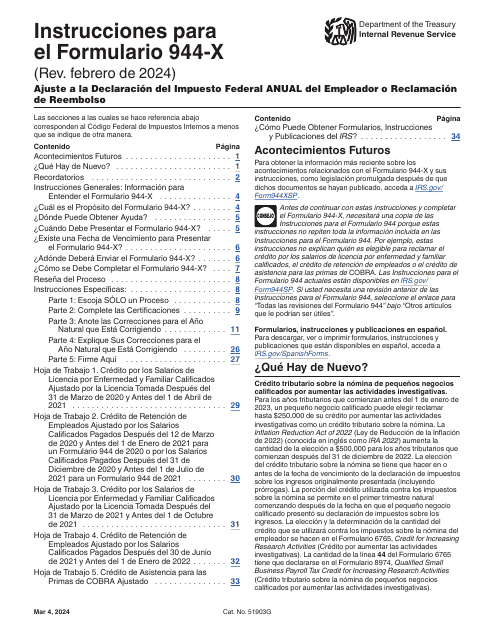

This is a formal document used by railroad industry employers to correct errors they have noticed upon filing IRS Form CT-1, Employer's Annual Railroad Retirement Tax Return.

This form is filed to report American Samoa wages and withheld taxes. It is not used for reporting income taxes in the United States. IRS Form W-2, Wage and Tax Statement is used in these cases.

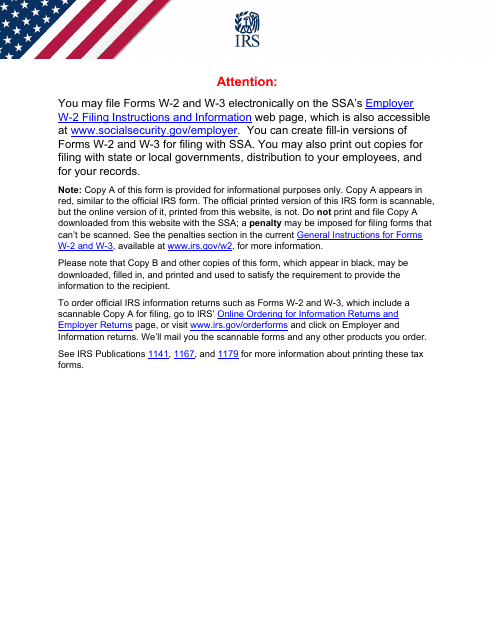

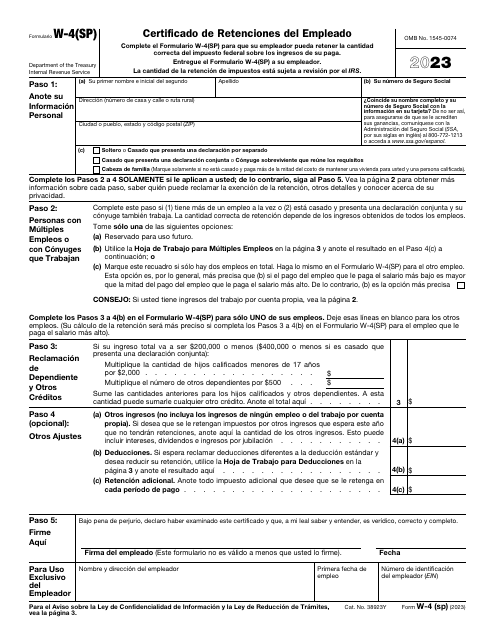

Use this document to report the amount of withheld wages and taxes to the employee and appropriate authorities. The form is also known as a W-2 and is one of the crucial annual tax documents.

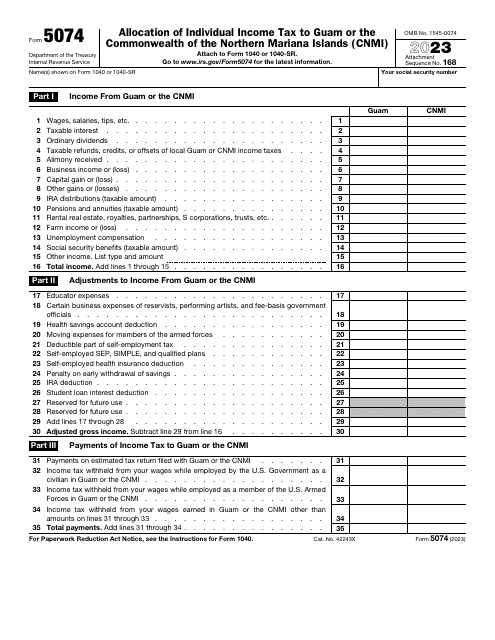

This form is filed to report Guam wages and tax deductions. The document was issued by the Internal Revenue Service (IRS), which can send you this form in a paper format, if you wish.

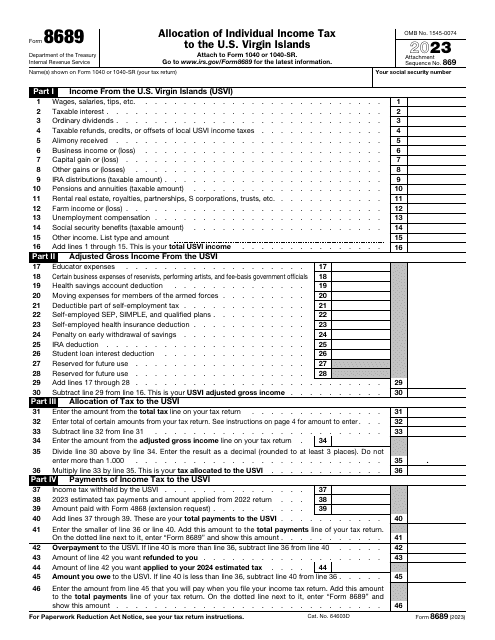

This document is designed to inform the Internal Revenue Service (IRS) about the United States Virgin Islands salaries and the amount of taxes deducted from them. This document was issued by the IRS, which can send you this form in a paper format, if you wish.

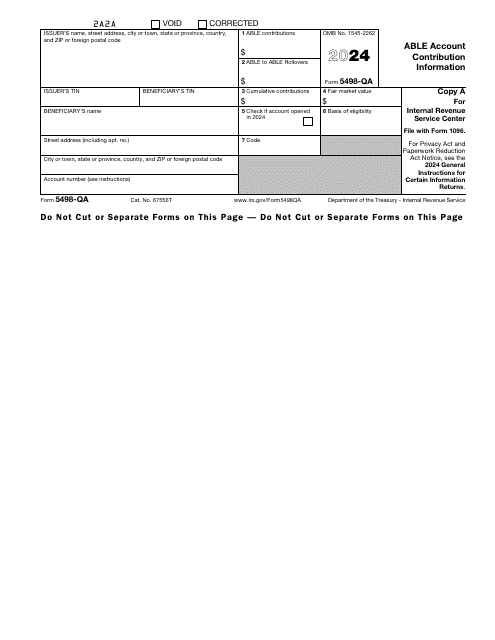

Download this form if you are an issuer of the savings account called Achieving a Better Life Experience (ABLE). This form is used to report the rollover contributions and program-to-program transfers, as well as other types of contributions made to an ABLE account.

This is a fiscal document used by issuers and trustees to report the amount of individual retirement arrangement contributions formalized during the calendar year covered in the paperwork.

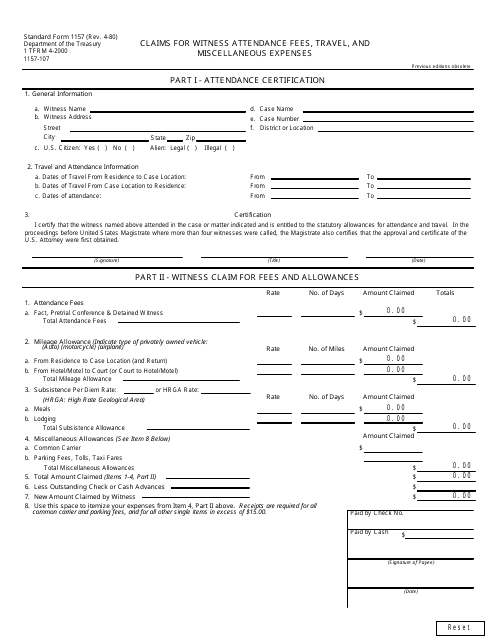

This form is used for claiming witness attendance fees, travel expenses, and miscellaneous expenses.

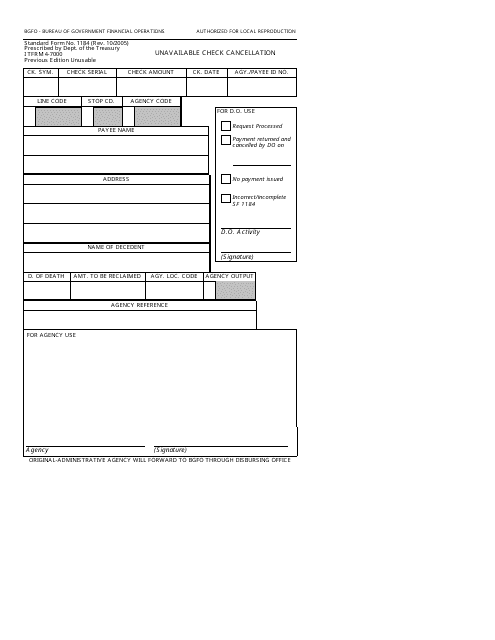

This form is used for cancelling an unavailable check.

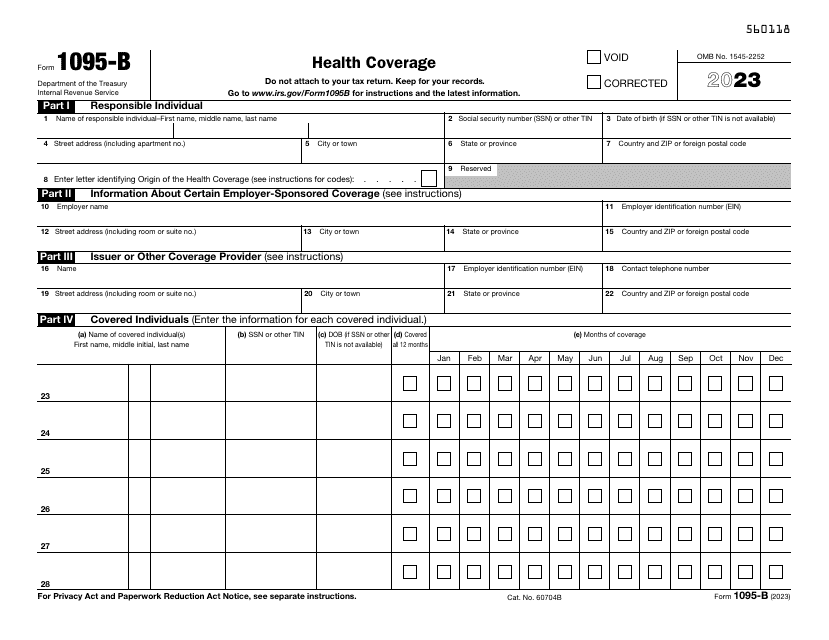

Use this document, otherwise known as the IRS Health Coverage Form, for submitting a report to the Internal Revenue Service (IRS) and to taxpayers about individuals with minimum essential coverage who are not liable for the individual shared responsibility payment.

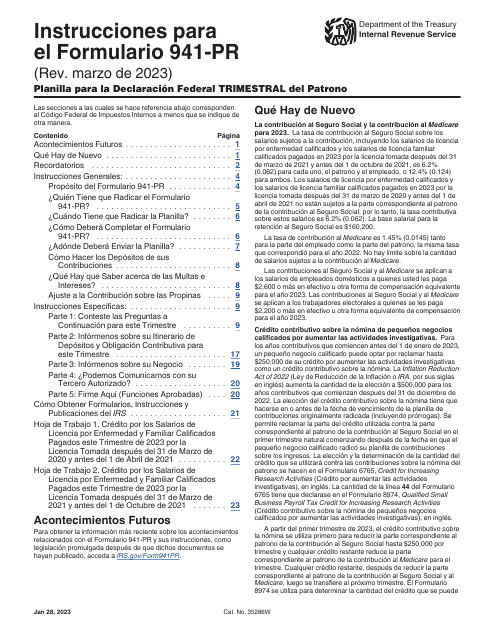

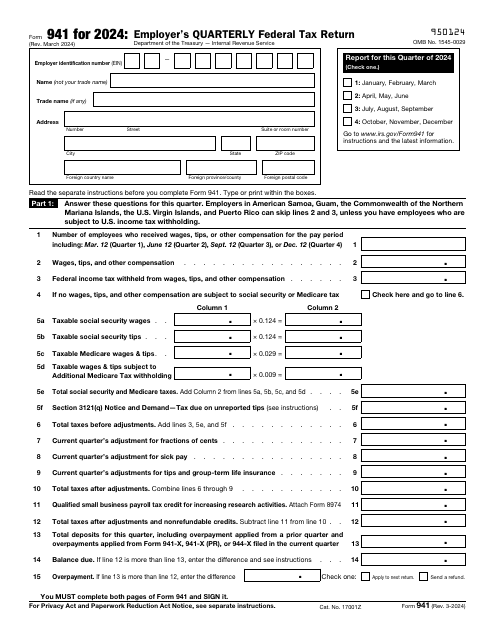

This is a formal statement used by companies to tell tax organizations about the salaries and tips their employees have received over the course of the previous quarter and the tax already subtracted from the workers' salaries.

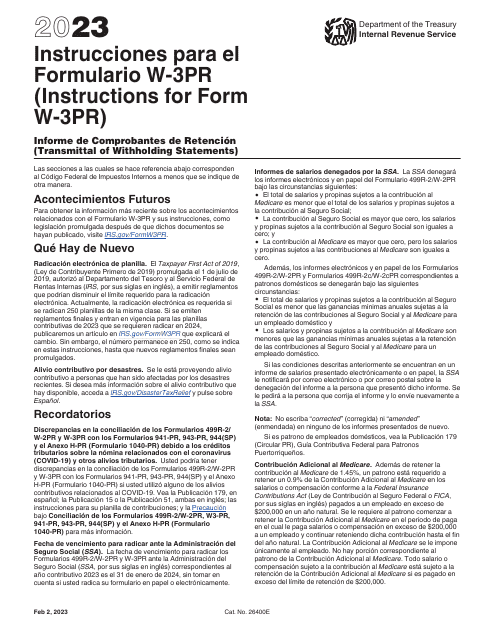

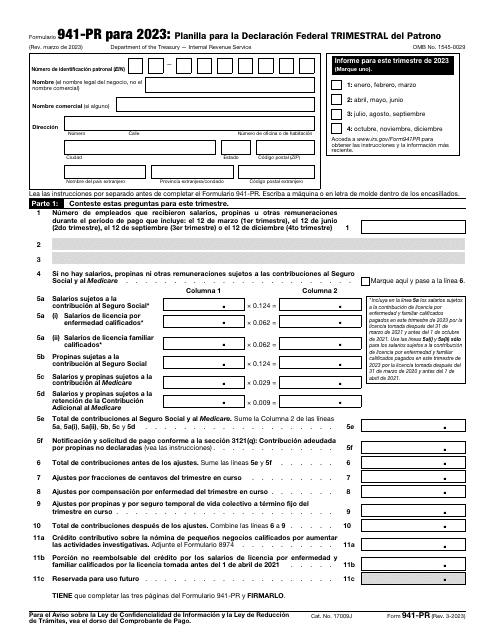

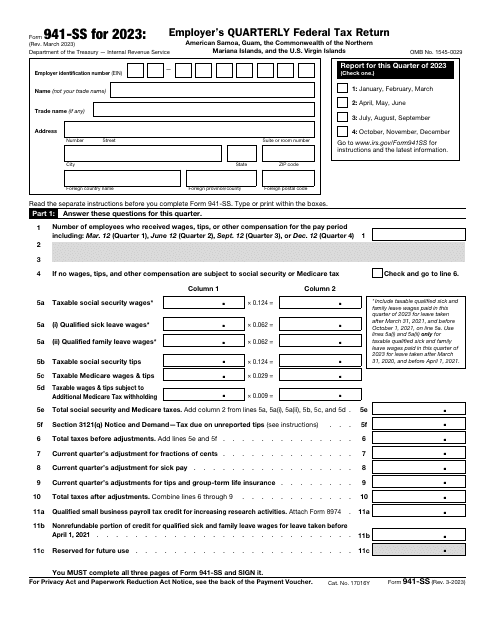

This document, otherwise known as the Employer's Quarterly Federal Tax Return, is a form downloaded to report about your social security and Medicare taxes. This form is used only if the official place of business is located within the specified territories.

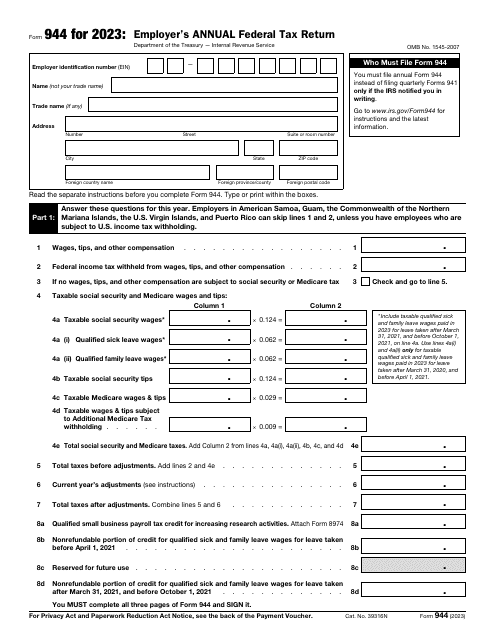

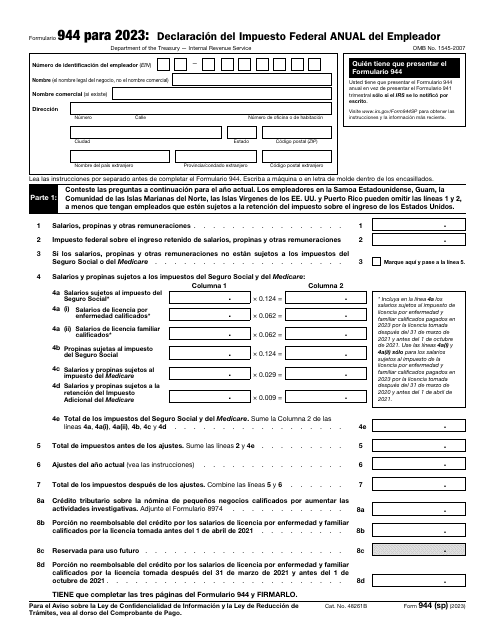

This is a fiscal document filled out by employers with a low annual tax liability to report their payroll activities to tax organizations.