U.S. Department of the Treasury Forms

Related Articles

Documents:

2369

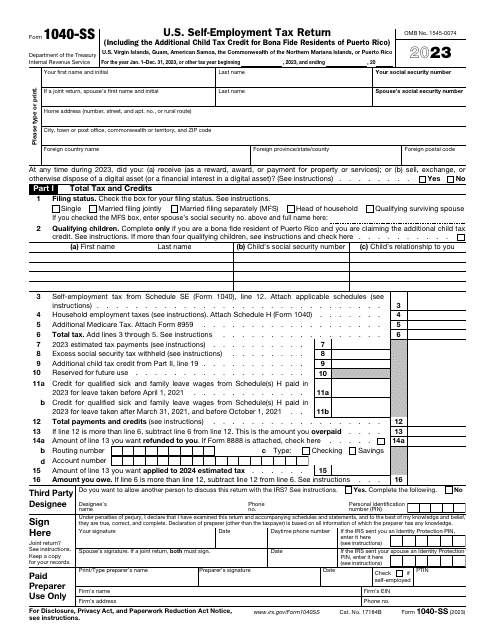

Use this document only if you are a resident of the United States Virgin Islands (USVI), Commonwealth of Puerto Rico, Commonwealth of the Northern Mariana Islands (CNMI), Guam, and American Samoa and wish to report your self-employment net earnings to the United States.

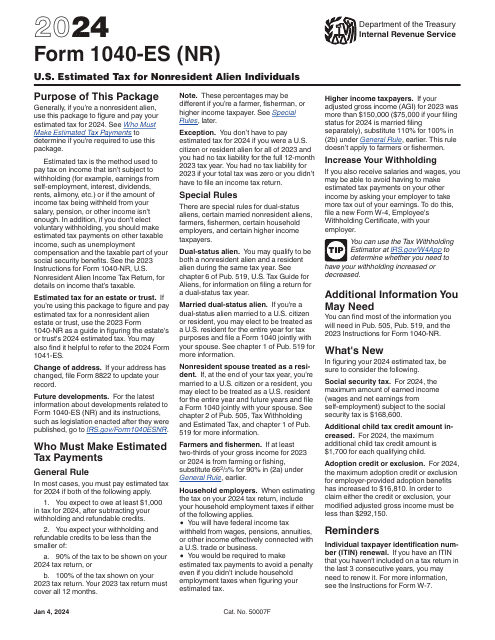

This is a form used to calculate and pay estimated tax on income by nonresident aliens that isn't subject to IRS withholding.

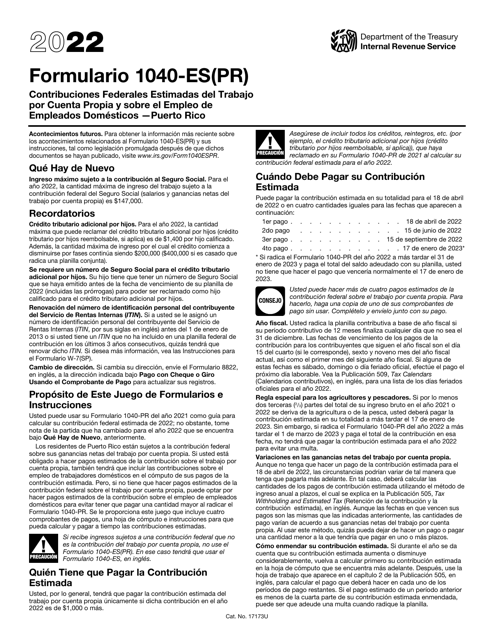

This is a fiscal form that lets individual taxpayers pay taxes based on their own calculations before the government provides them with the request to pay.

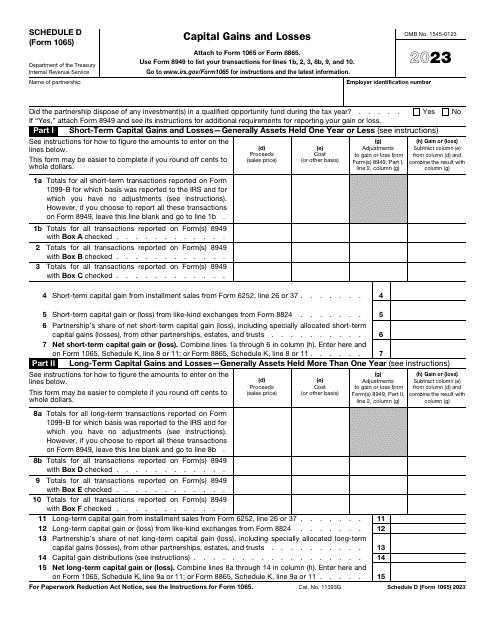

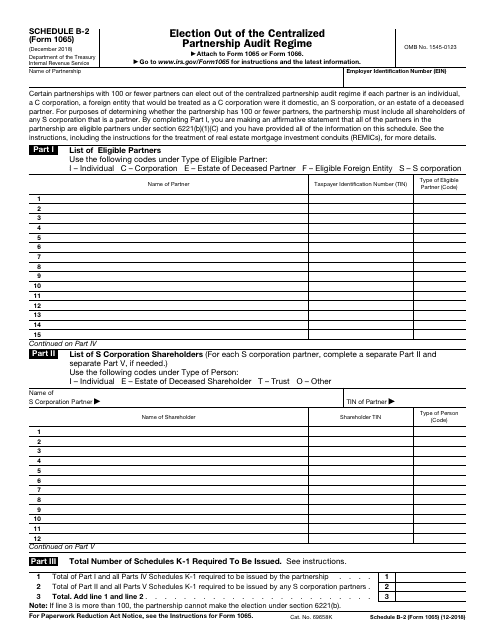

This is form is used by partnerships to inform the tax authorities they choose not to be subject to a partnership audit regime prescribed by current fiscal legislation.

This is a detailed form a partnership sends to every partner that participates in joint management of the entity to let the partner determine what to include in their personal tax returns.

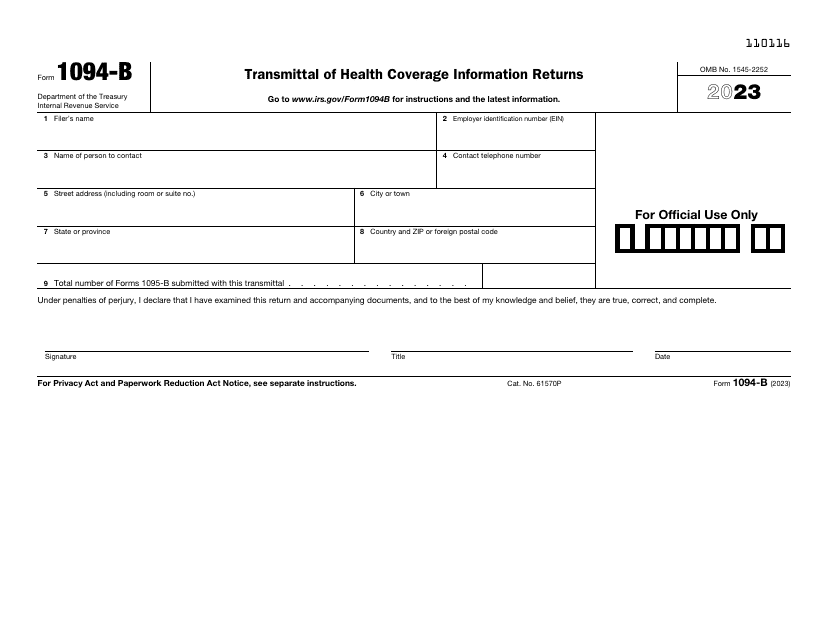

Use this form if you are an insurance provider and wish to inform the IRS about taxpayers who are eligible to receive minimum essential health coverage that meet the standards of the Affordable Care Act.

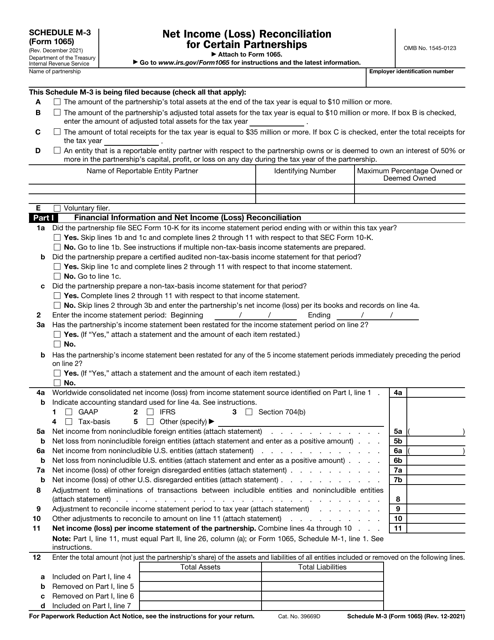

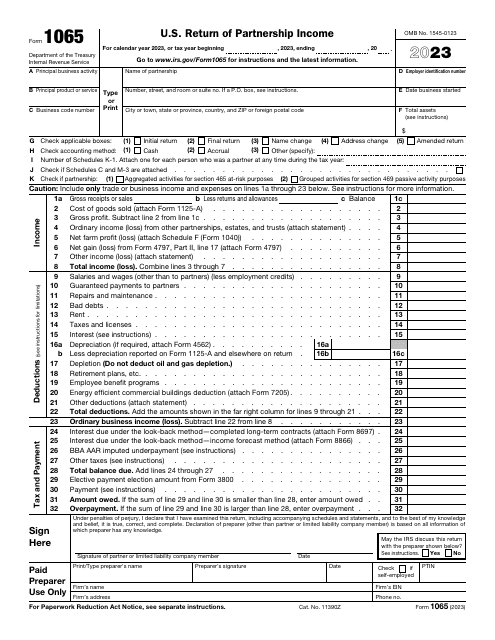

Use this form to report information on deductions, credits, and income relevant to the operation of a partnership to the Internal Revenue Service (IRS).

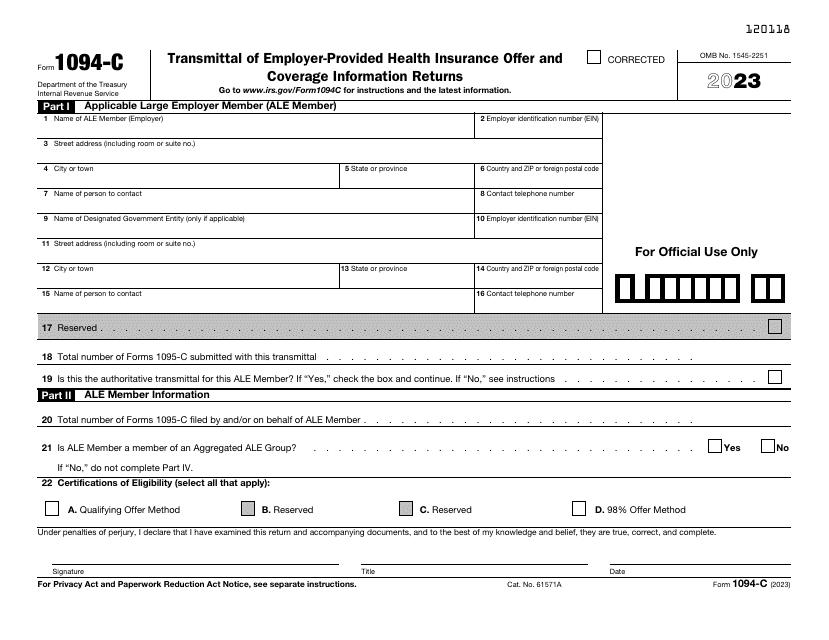

Download these cover sheets in order to report a summary about the Applicable Large Employer (ALE) and to transmit Form 1095-C, Employer-Provided Health Insurance Offer and Coverage to the Internal Revenue Service (IRS).

This form is also known as the healthcare marketplace tax form. It is used to inform the IRS about individuals and families enrolled in a health plan via the Health Insurance Marketplace.

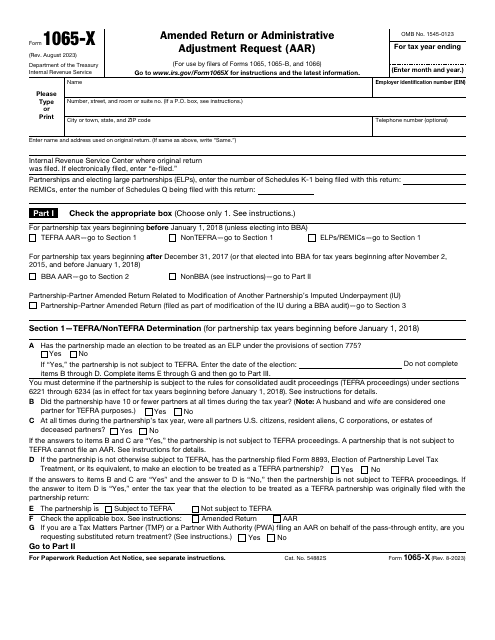

This is a fiscal statement used by partnerships and real estate mortgage investment conduits to fix the errors in previously filed IRS Form 1065, IRS Form 1065-B, IRS Form 1066.

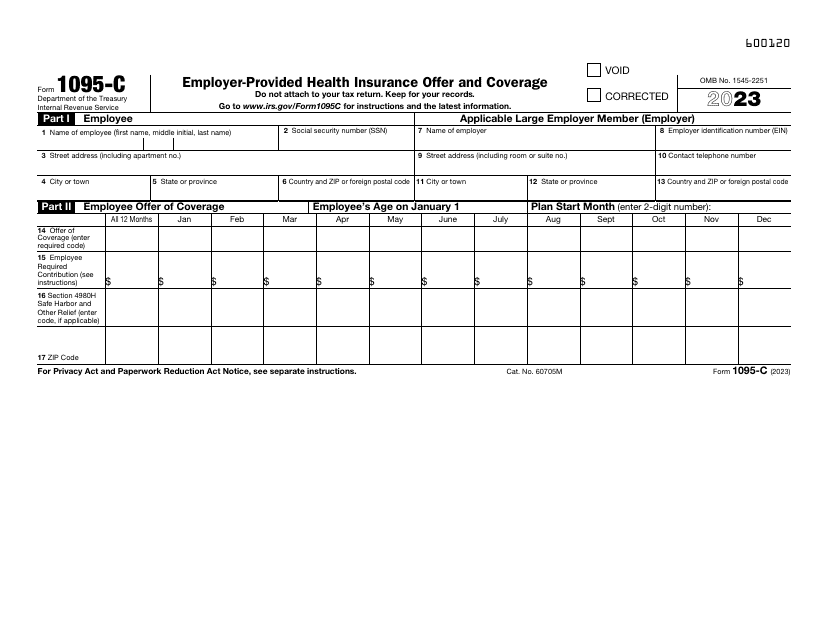

This form is filed by employers with 50 or more full-time employees in order to provide information about their enrollment in health coverage required under sections 6055 and 6056 of the Internal Revenue Code.

This form is used to report a mortgage interest paid by an individual or sole proprietor during a tax year to the government, in order to receive a mortgage interest deduction on the borrower's federal income tax return.

Download this form to report the interest amount paid on a qualified student loan during the past calendar year in cases when the amount exceeded $600.

This is an IRS form governmental entities prepare and file in order to inform the government about deductible payments like fines and penalties they have made during a particular calendar year.

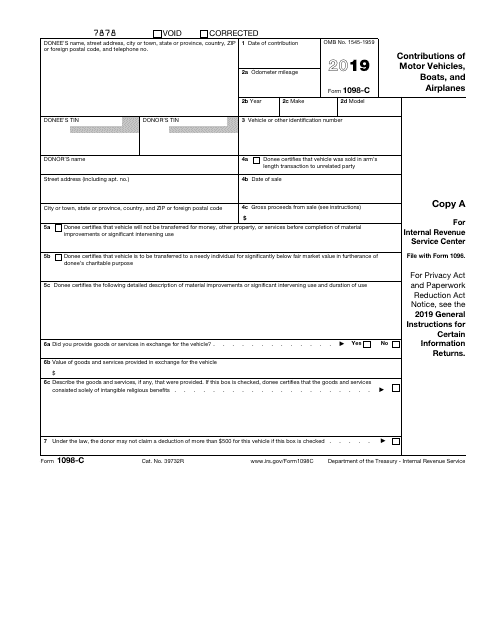

This form lists and details the donations of automobiles, boats, and airplanes made to charitable organizations. It is filed with the Internal Revenue Service (IRS) by the recipient organization.

File this form if you are in charge of a contract intended as a Qualifying Longevity Annuity Contract (QLAC), so that the annuity holder can claim deductions on their distribution taxes.

Download this form if you are an educational institution and need information about qualified tuition and related fees paid during the tax year. The information can be used by the paying student to calculate their education-related tax deductions and credits.

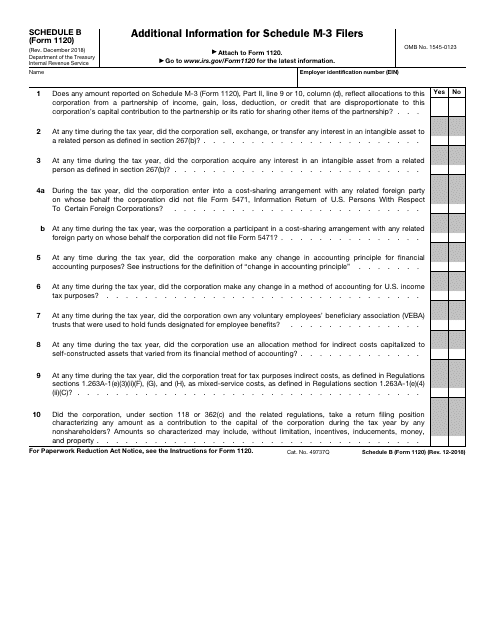

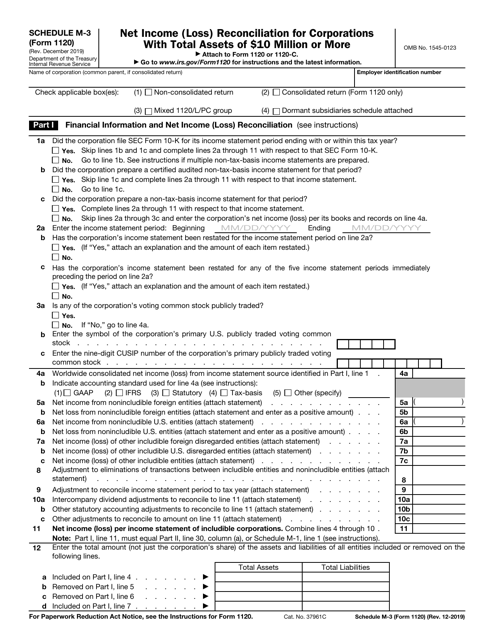

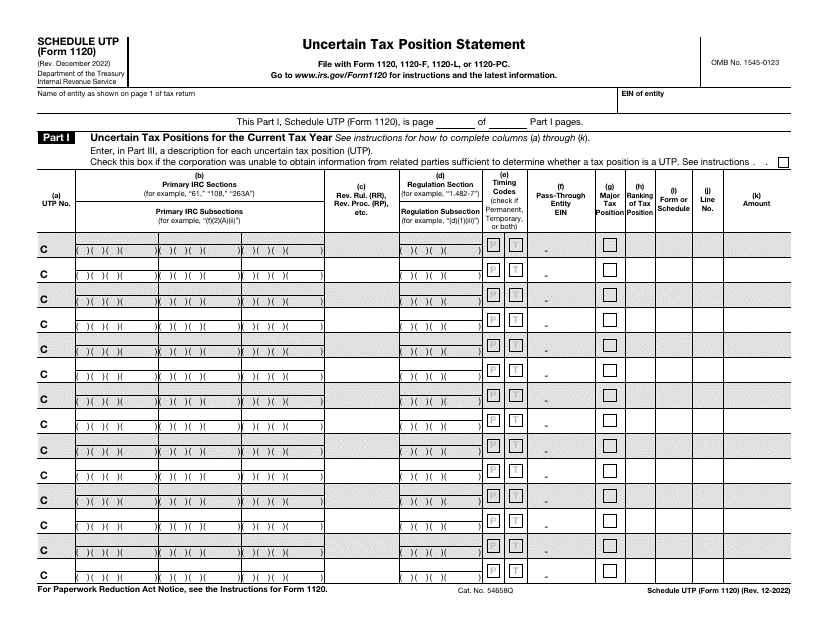

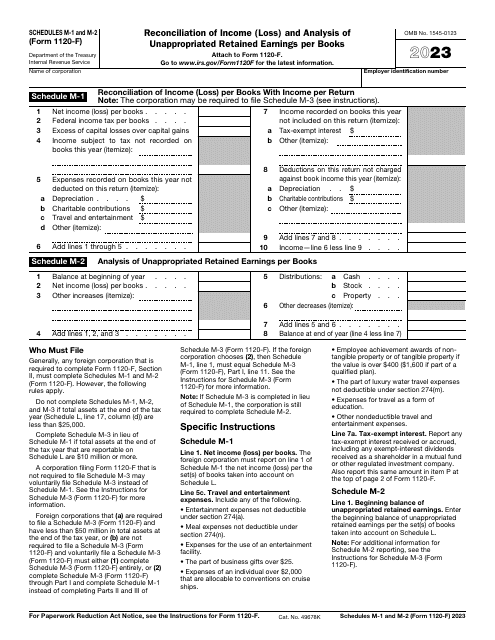

This form is used for providing additional information to Schedule M-3 filers who are filing IRS Form 1120.

This Form is used for providing consent and creating a plan for allocation of income and deductions among companies in a controlled group. It helps with the apportionment of taxes for multiple companies.

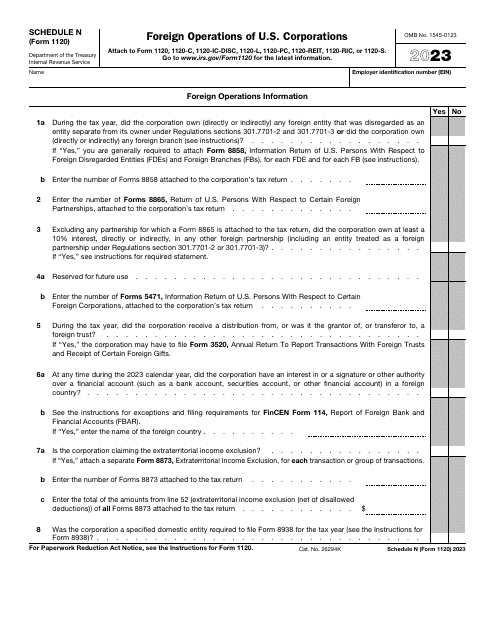

This is a formal document filed with the IRS by a domestic corporation to inform the government about their taxable income and taxes they compute annually.

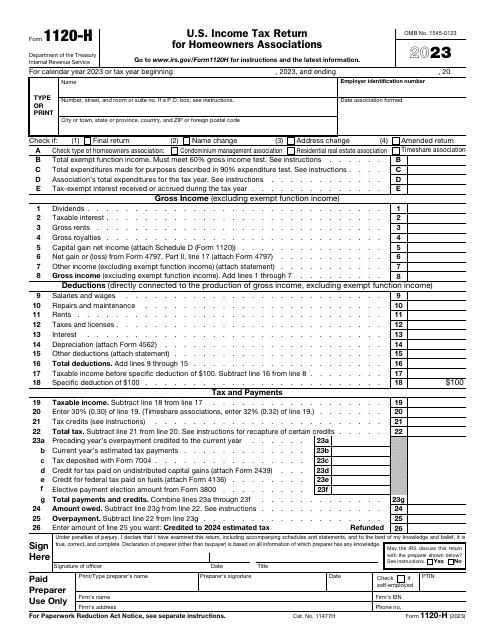

Fill out this form if you represent a homeowner's association in order to make use of certain tax benefits. That means, that the association can exclude the Exempt Function Income from its gross income.

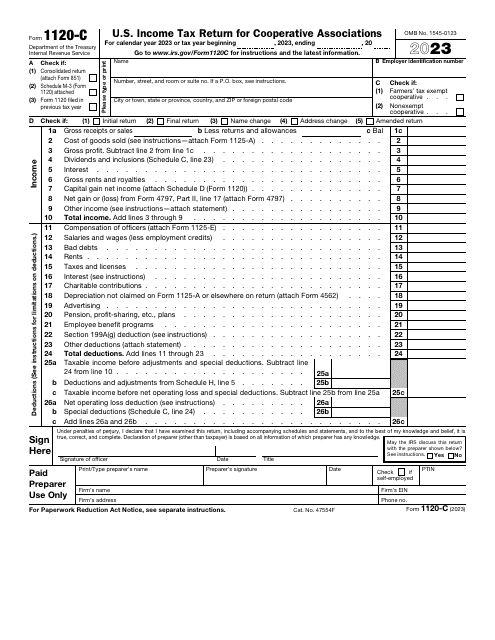

Use this form if you are a corporation that operates on a cooperative basis, to report your information (such as income, gains, losses, deductions, and credits) to the Internal Revenue Service (IRS), and to figure your income tax liability.

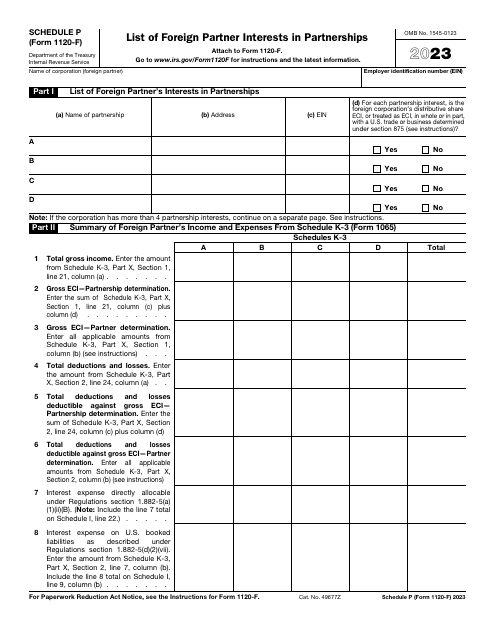

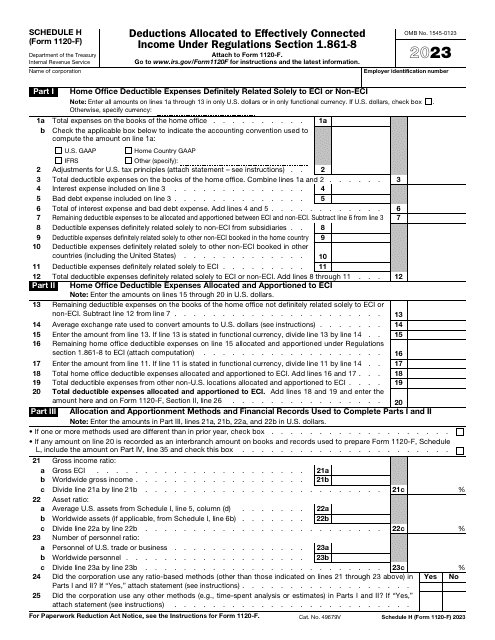

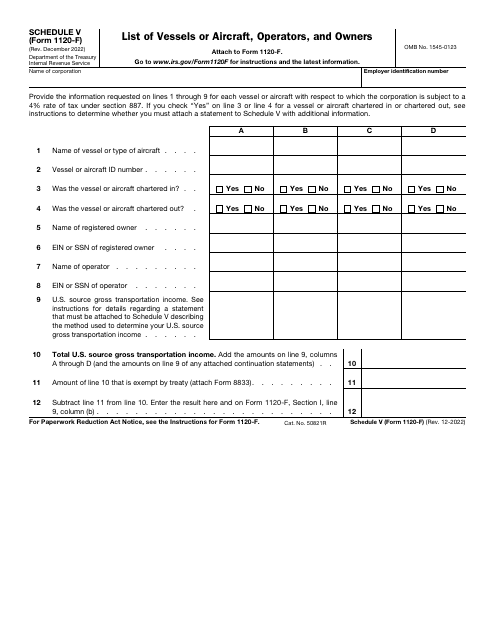

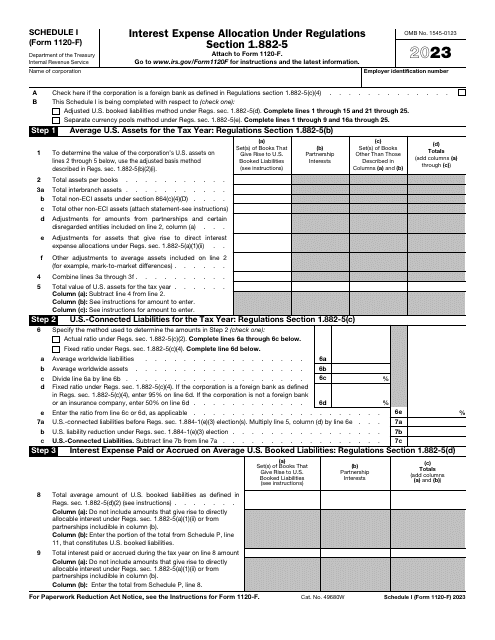

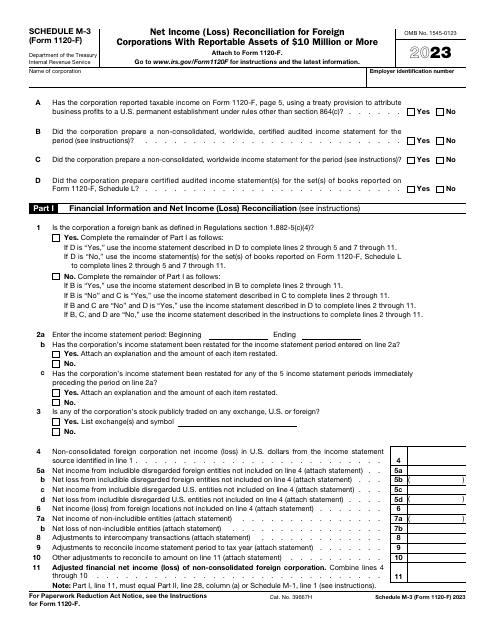

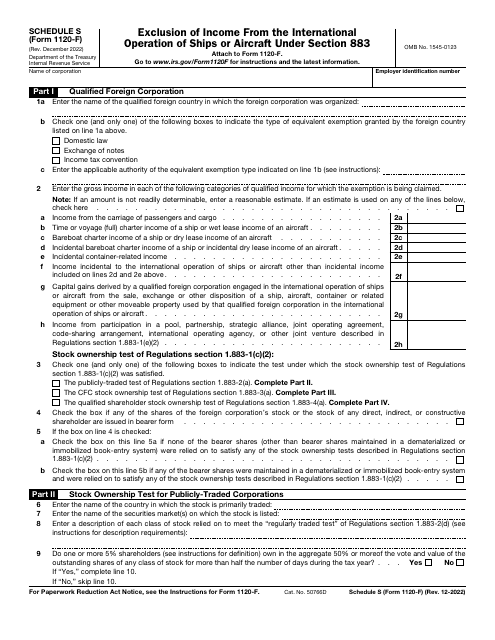

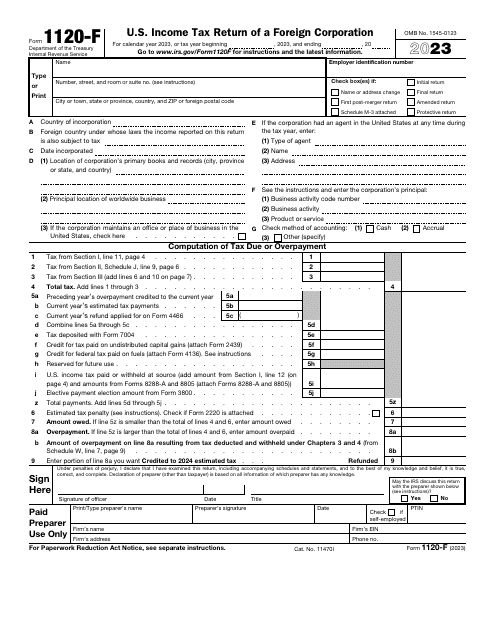

File this form if you are a foreign corporation and maintain an office within the United States in order to report your income, deductions, and credits to the Internal Revenue Service (IRS), as well as to figure your U.S. income tax liability.

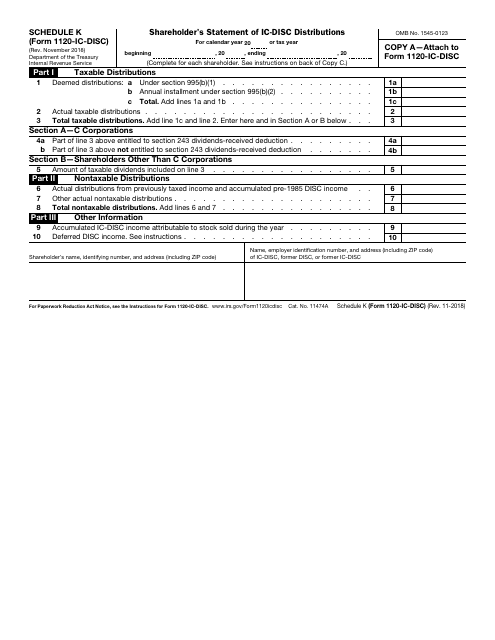

This document is used for reporting IC-DISC distributions made to shareholders.