U.S. Department of the Treasury Forms

Related Articles

Documents:

2369

This is a detailed form a partnership sends to every partner that participates in joint management of the entity to let the partner determine what to include in their personal tax returns.

This is a formal IRS document business entities need to file with the fiscal authorities to outline the income they received during the tax year via methods that involve third parties.

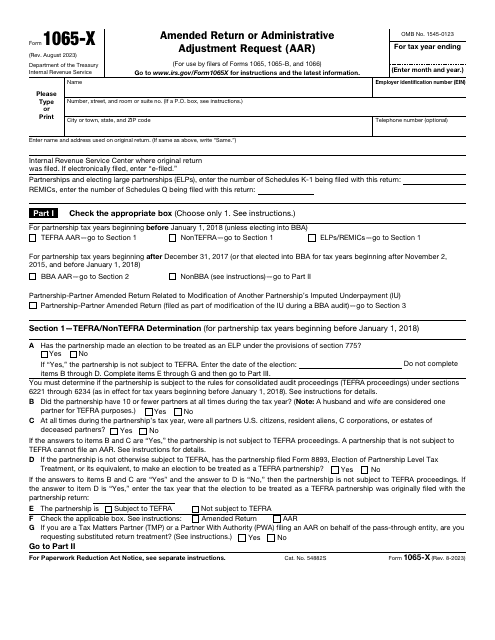

This is a fiscal statement used by partnerships and real estate mortgage investment conduits to fix the errors in previously filed IRS Form 1065, IRS Form 1065-B, IRS Form 1066.

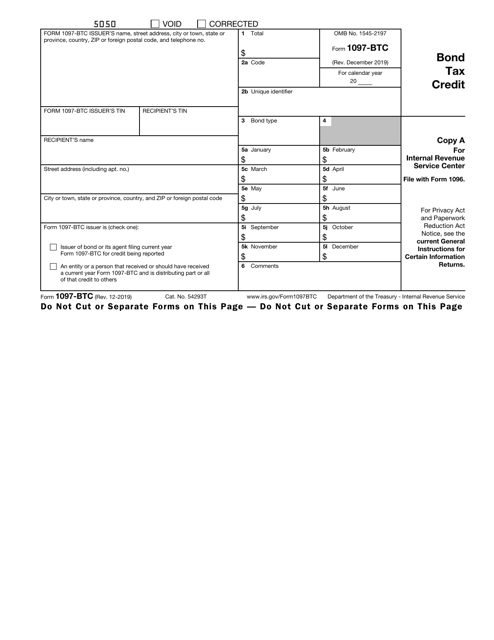

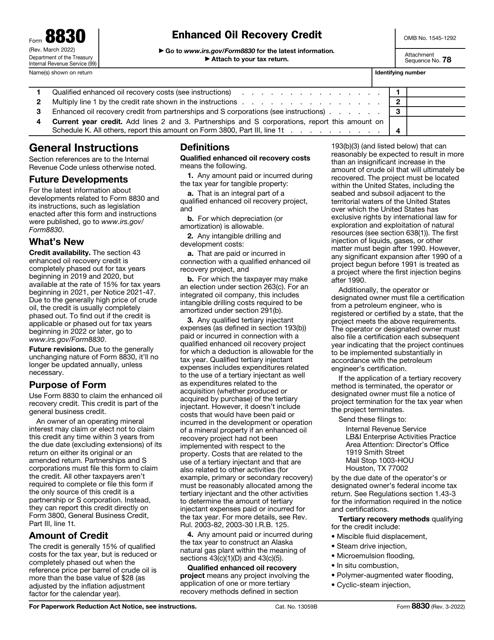

This is a formal IRS document prepared by tax credit bond issuers and taxpayers that distribute the credit in question.

Submit this form to the Internal Revenue Service (IRS) if you are a corporation that offers their employees an incentive stock option (ISO) to report to the IRS about your transfers of stock made to any transferee when that transferee exercises an ISO under Section 422(b).

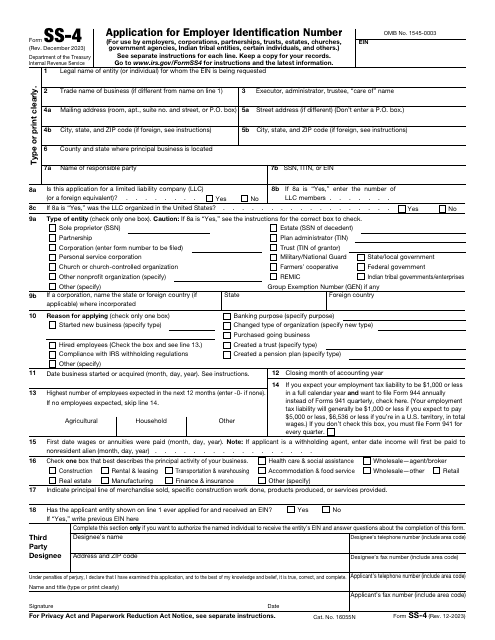

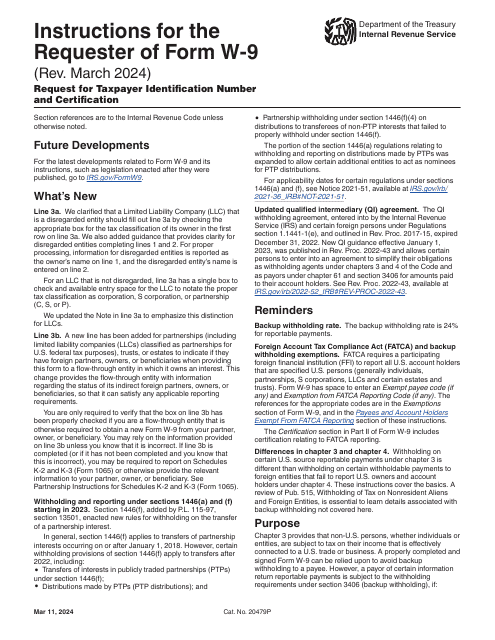

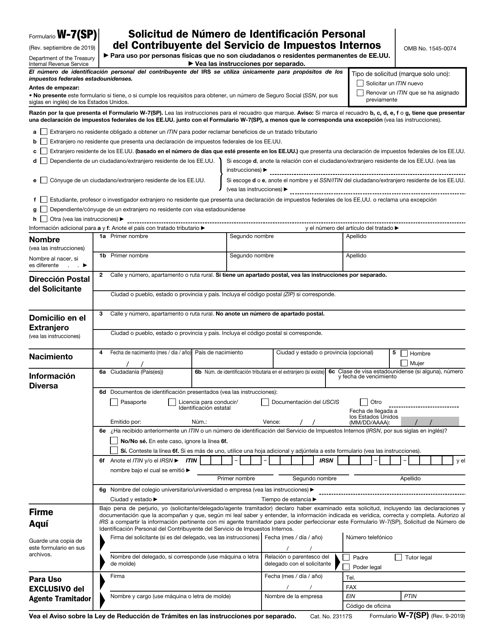

This is a fiscal document used by taxpayers - from sole proprietors to corporations - to ask tax organizations for a unique identification number.

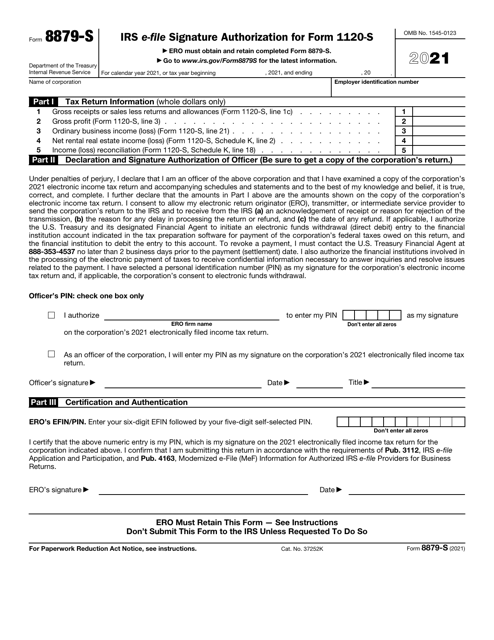

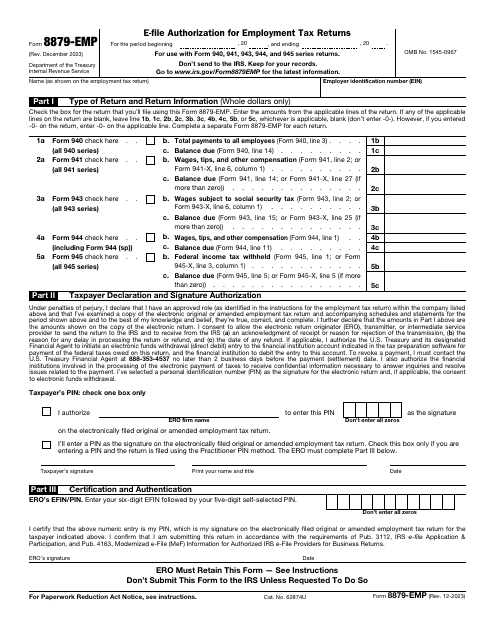

This is a supplementary form taxpayers may sign if they want to confirm their willingness to utilize a personal identification number that will allow them to provide an electronic signature when certifying employment tax returns or asking for a filing extension.

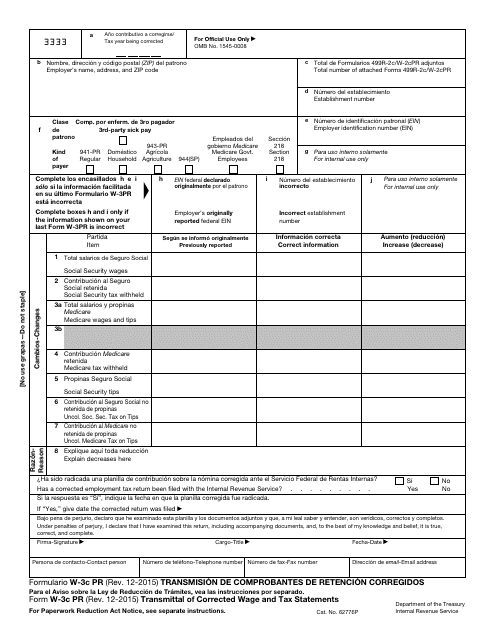

This document is used for transmitting corrected withholding statements in Puerto Rican Spanish.

This is a supplementary form used by employers to handle errors they have made upon filing IRS Form W-2, Wage and Tax Statement.

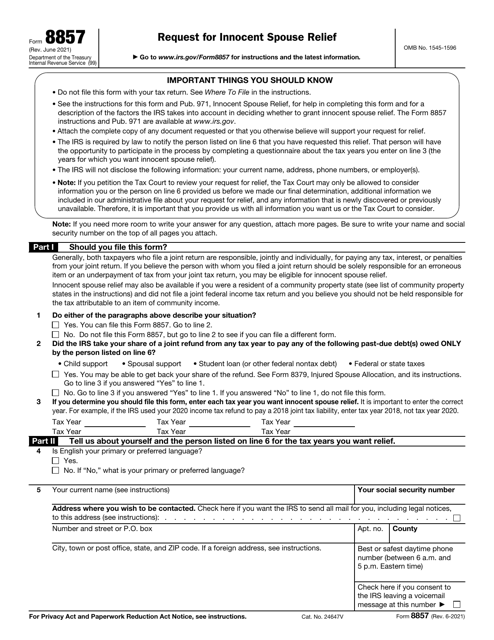

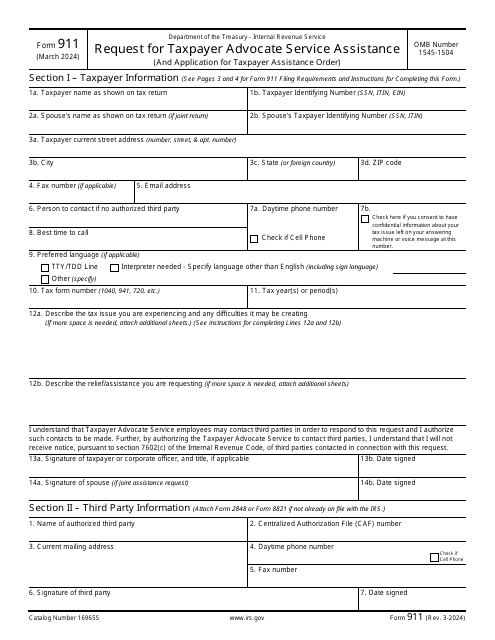

This is a fiscal form used by taxpayers that have already exhausted all other options when dealing with a tax issue.

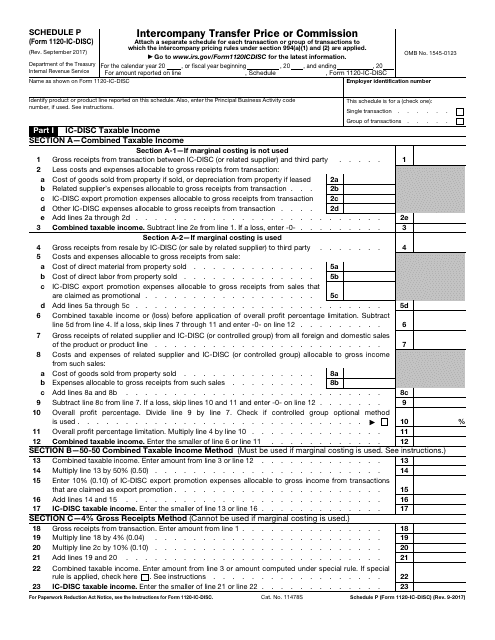

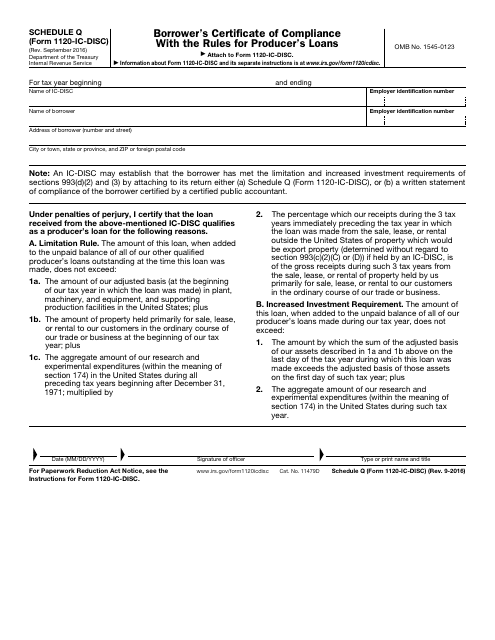

This Form is used for borrowers to certify their compliance with the rules for producer's loan related to IRS Form 1120-IC-DISC Schedule Q.

This is a formal statement filled out by the organization that manages certain retirement accounts to inform the recipient of the distribution about the income they generated and report the details to tax organizations.

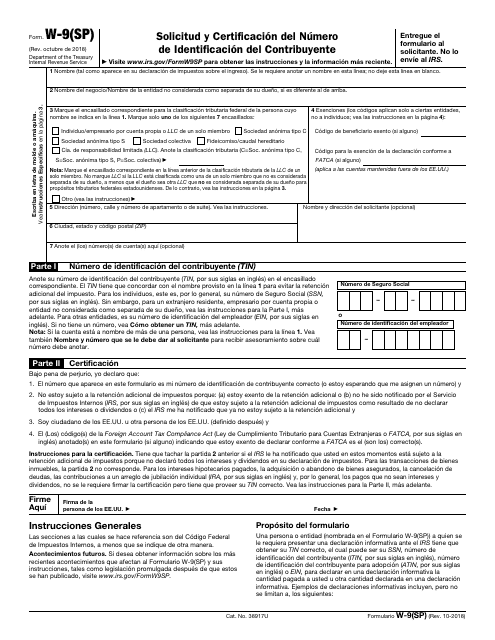

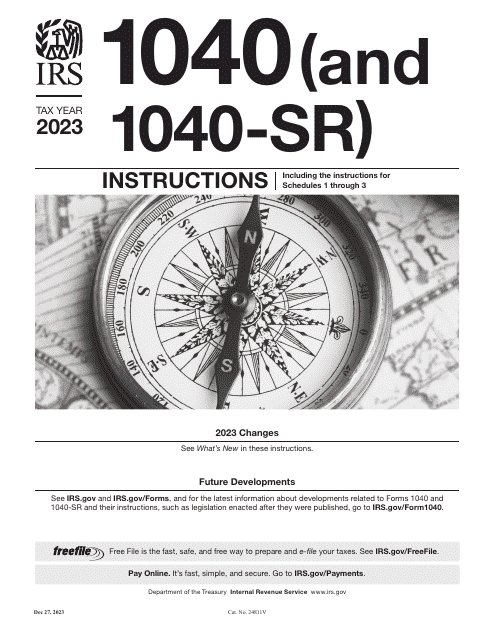

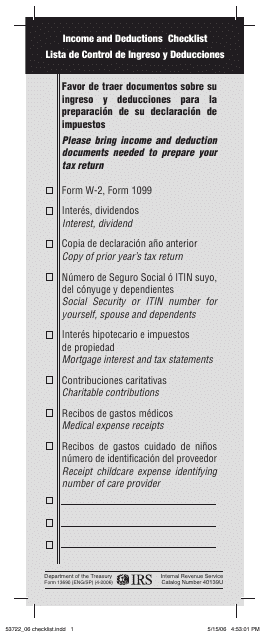

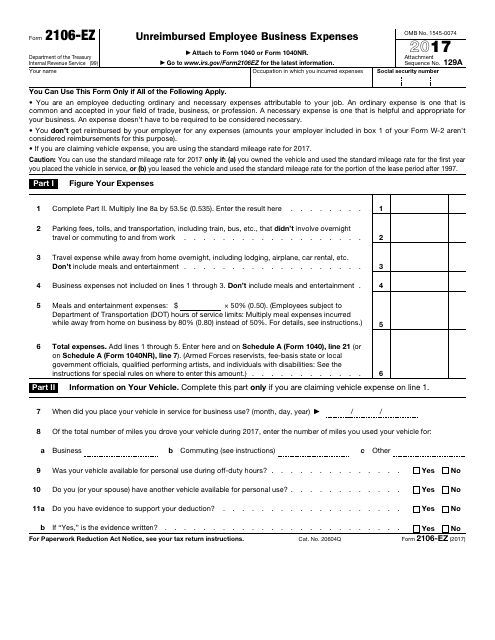

This form is used for checking income and deductions. It is available in both English and Spanish.

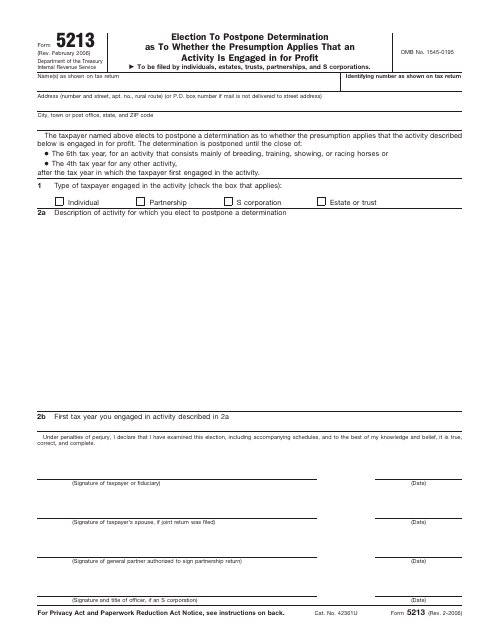

You file this form to ask for a postponement of the determination whether your business is profitable or non-profit. The document is filed by persons, estates, trusts, and S corporations.

This type of document provides instructions for completing Schedule C and providing additional information for filers of Schedule M-3 on IRS Form 1065.

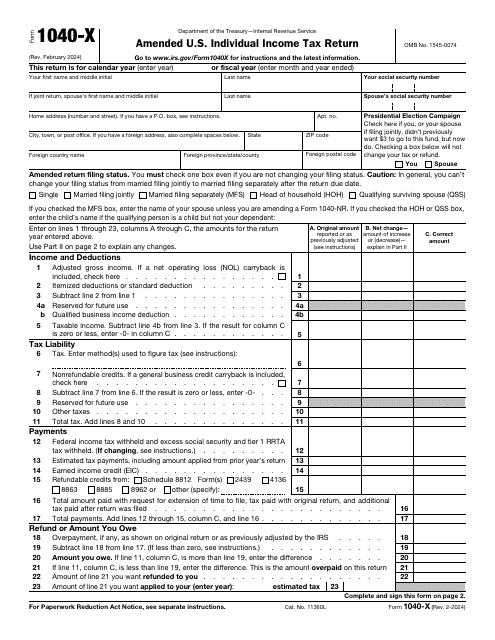

This document is used for correcting records on your tax return form. A separate form is used every year for which information is changed. Do not submit this document to request a refund of interest and penalties, or addition to the tax you have already paid.

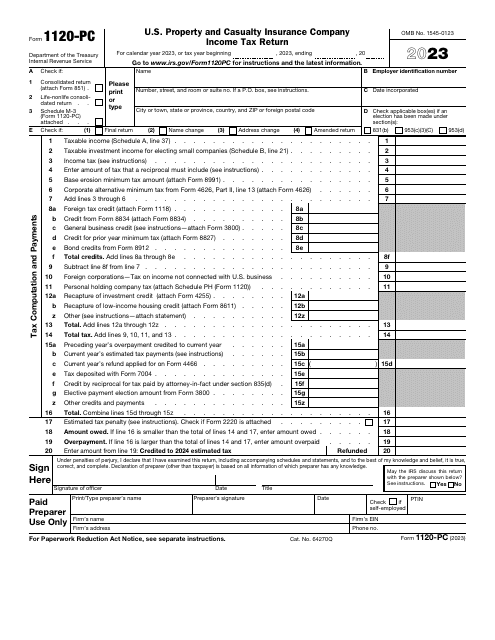

This form is filed by non-life insurance companies wishing to inform the Internal Revenue Service (IRS) of their income, deductions, and credits, as well as to figure their income tax liability.

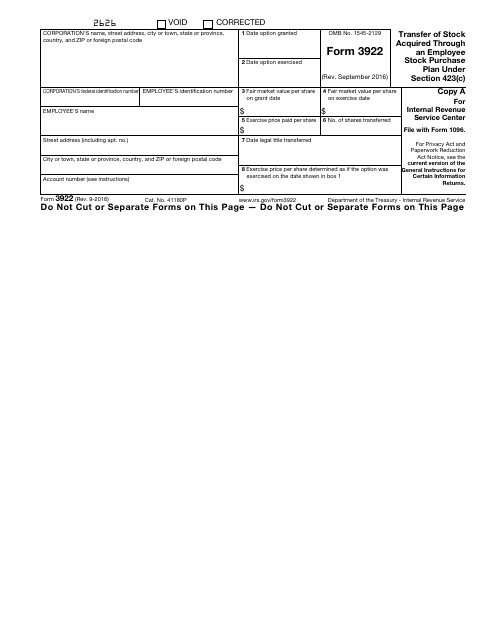

This is a formal statement used by employers to describe the details of a stock transfer if the shares were acquired by their employee.

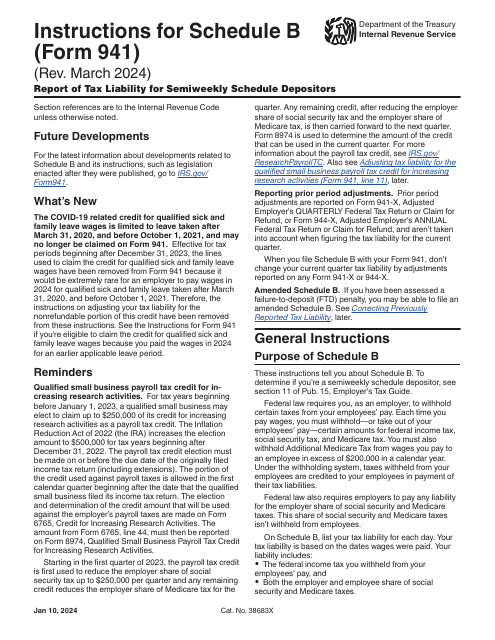

This is a formal instrument used by taxpayers that need to fix the mistakes they have discovered upon filing IRS Form 941, Employer's Quarterly Federal Tax Return.

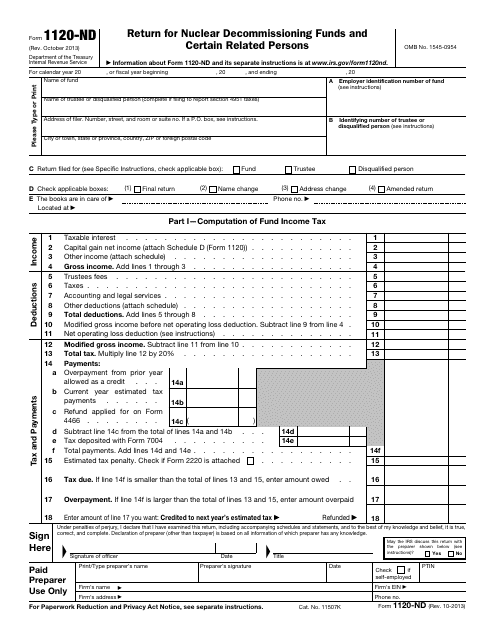

This document is used by the Nuclear Decommissioning Funds to inform the Internal Revenue Service (IRS) about their income, contributions, and administrative expenses of fund operation.

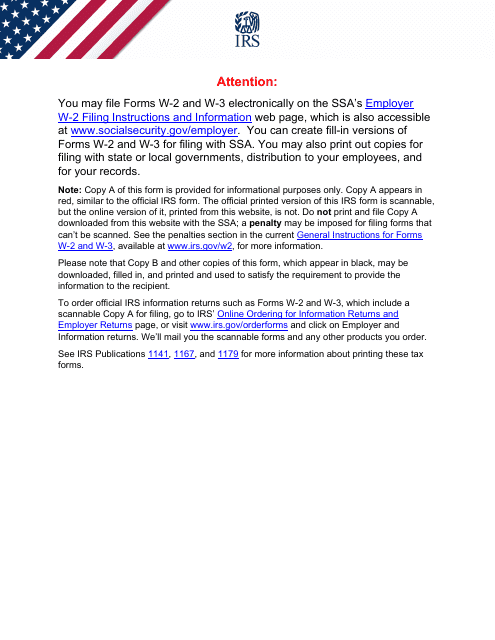

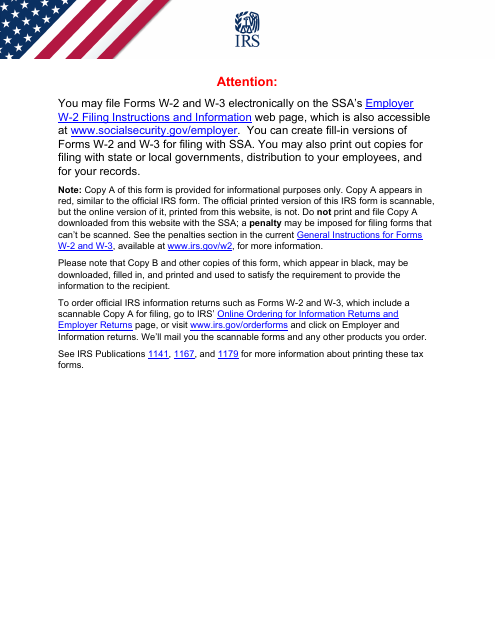

This is a supplementary document used by taxpayers to file IRS Form W-2C, Corrected Wage and Tax Statement. This form works as a summary of changes you have made to IRS Form W2, Wage and Tax Statement.