U.S. Department of the Treasury Forms

Related Articles

Documents:

2369

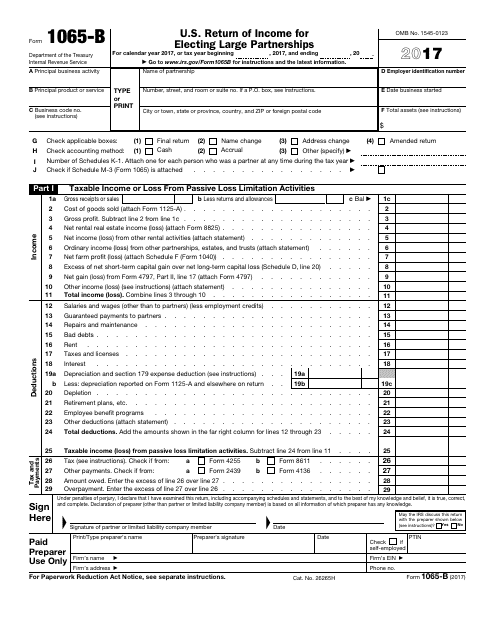

Use this form to report information on deductions, credits, and income relevant to the operation of an electing large partnership (e.g. engaged in the business of farming) to the Internal Revenue Service (IRS).

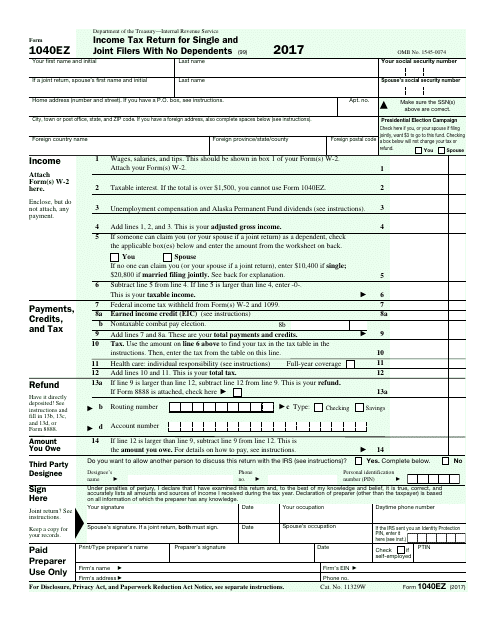

This Form is used for filing a simplified version of the U.S. Individual Income Tax Return. It is intended for taxpayers who have limited income and deductions.

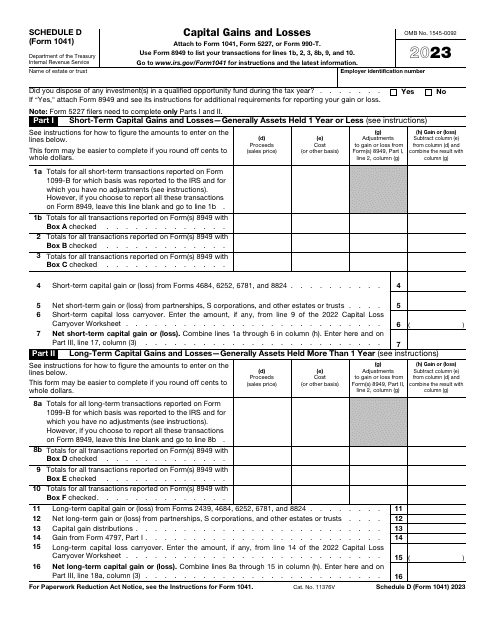

This form is also known as the IRS itemized deductions form. It belongs to the IRS 1040 series. This document is used in order to calculate the amount of your itemized deductions.

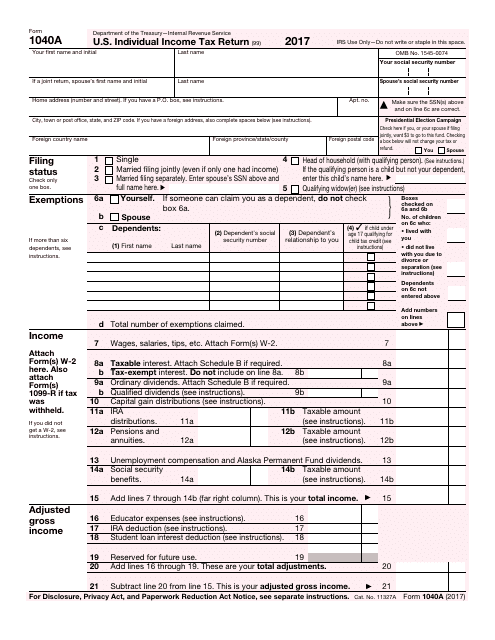

Use this basic form if you are an American taxpayer and wish to submit an annual income tax return. This form is also known as the Individual Income Tax Return Form.

This is a formal statement prepared by an employee after figuring out how much tax an employer has to deduct from their paycheck.

This is a formal document used by taxpayers to figure out the amount of deduction applied to regular payments they are entitled to receive.

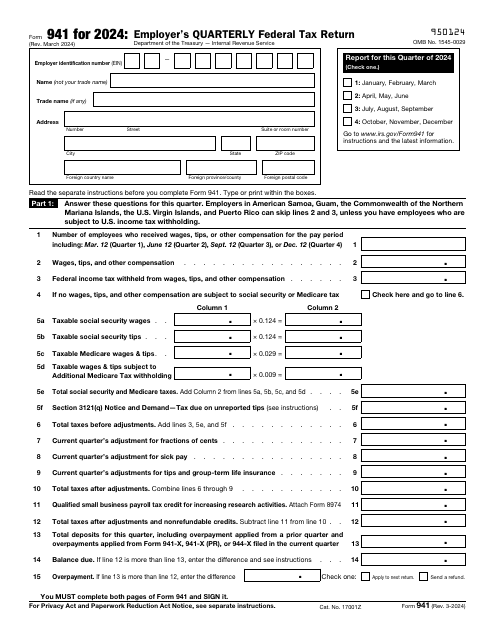

This is a formal statement used by companies to tell tax organizations about the salaries and tips their employees have received over the course of the previous quarter and the tax already subtracted from the workers' salaries.

This is a fiscal form that lets individual taxpayers pay taxes based on their own calculations before the government provides them with the request to pay.

This is a fiscal document completed by financial entities to specify the amount of supplementary income investors have generated during the year.

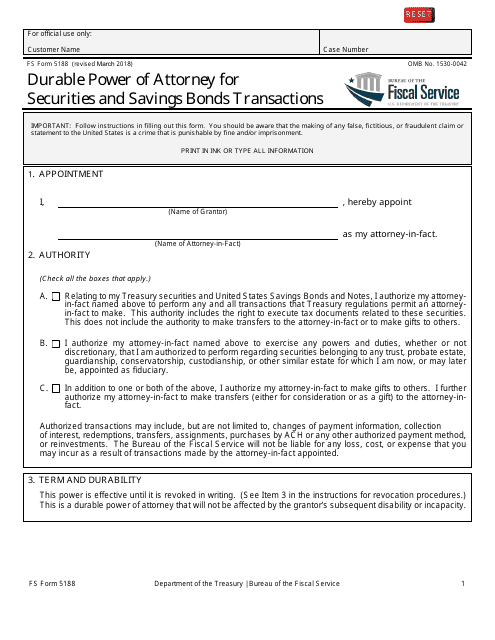

This form is used for granting someone the power to manage securities and savings bonds transactions on behalf of an individual.

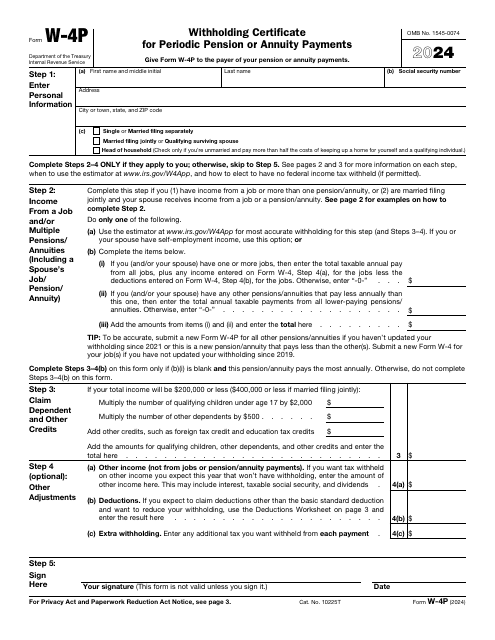

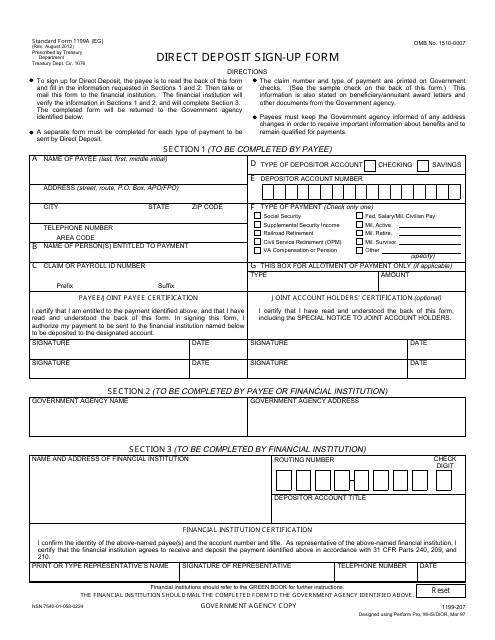

This form is a legal document released by the U.S. Department of the Treasury. This is the document for you if you are a retiree who receives Social Security benefits, a veteran receiving a pension, or an active service member receiving a salary.

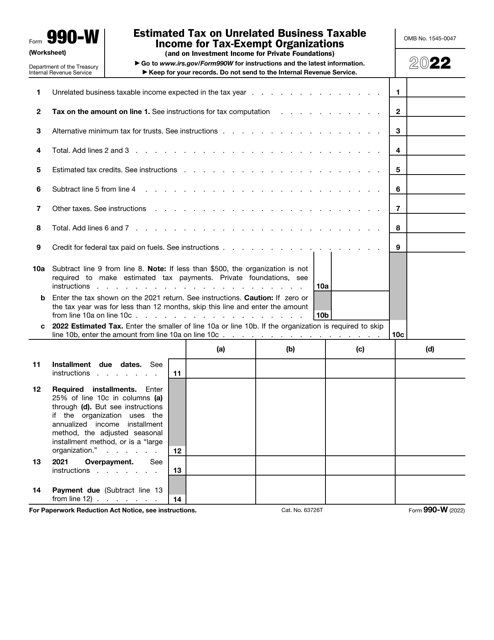

This is a supplementary form corporations were expected to fill out to compute the amount of estimated tax they owe to fiscal authorities.

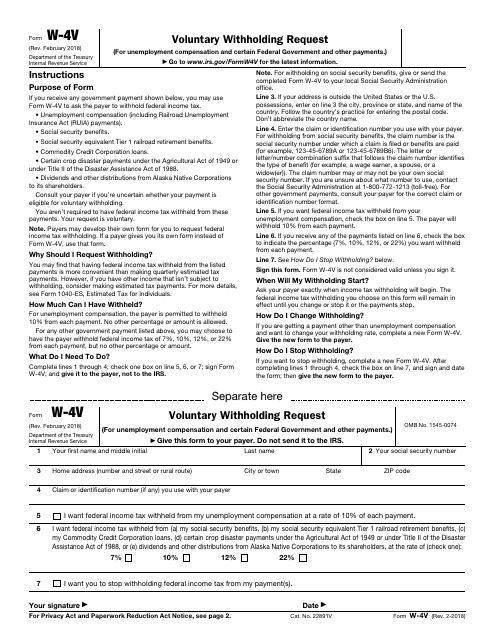

This is a fiscal document used by recipients of government payments to secure tax deductions from those amounts before the payments are sent to them.

This Form is used for reporting a partner's share of income or loss from an electing large partnership. It is specifically for the partner's use only.

This Form is used for reporting income and expenses of electing large partnerships in the United States.

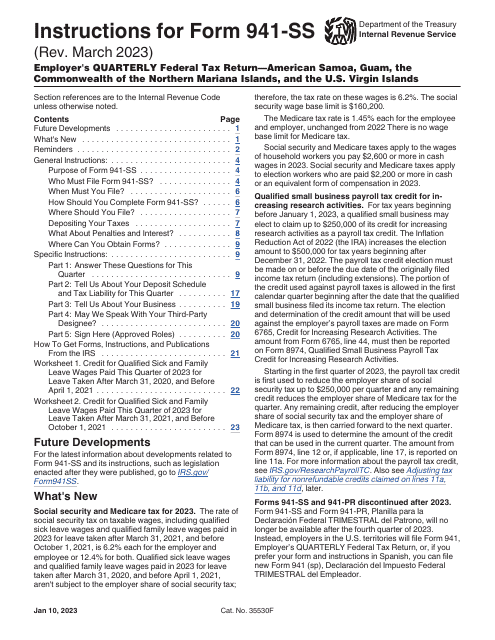

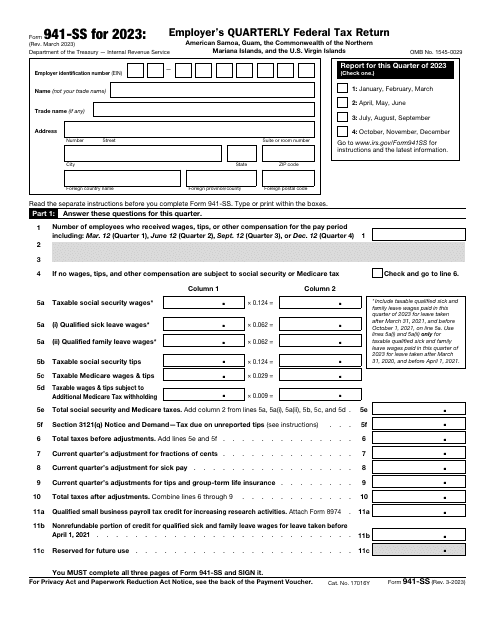

This document, otherwise known as the Employer's Quarterly Federal Tax Return, is a form downloaded to report about your social security and Medicare taxes. This form is used only if the official place of business is located within the specified territories.

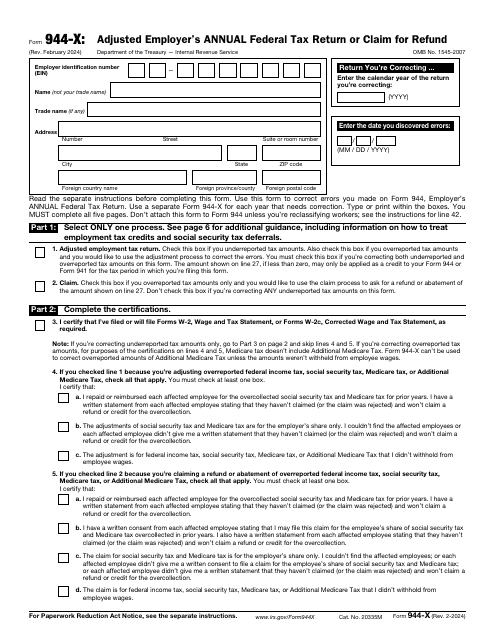

This is a fiscal form used by employers that learned about the need to correct a previously filed IRS Form 944, Employer's Annual Federal Tax Return.