U.S. Department of the Treasury Forms

Related Articles

Documents:

2369

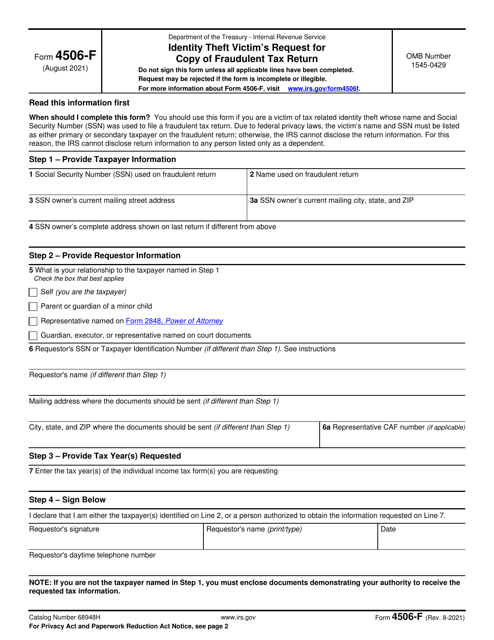

This is an IRS form designed for a victim of identity theft to allow them to get a copy of the income statement that was submitted in their name.

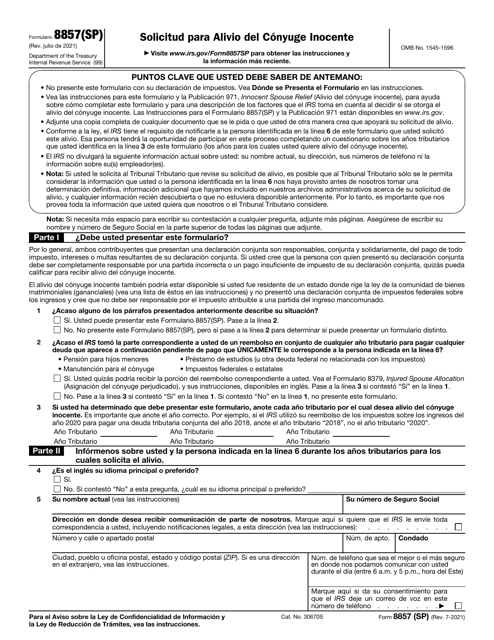

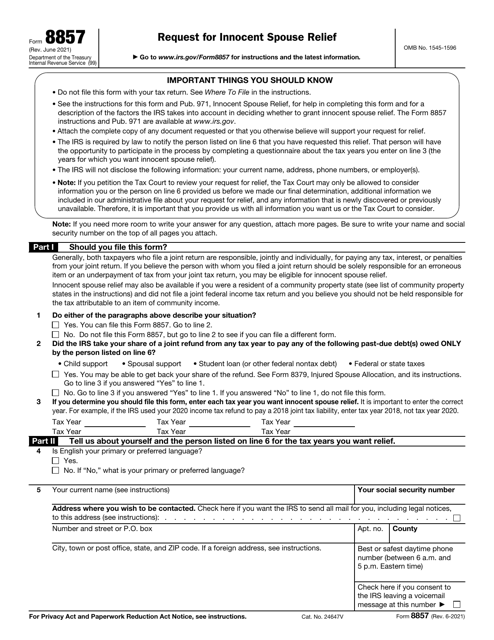

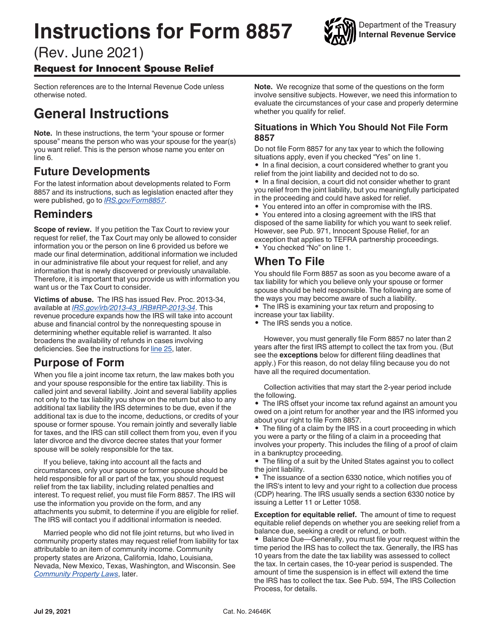

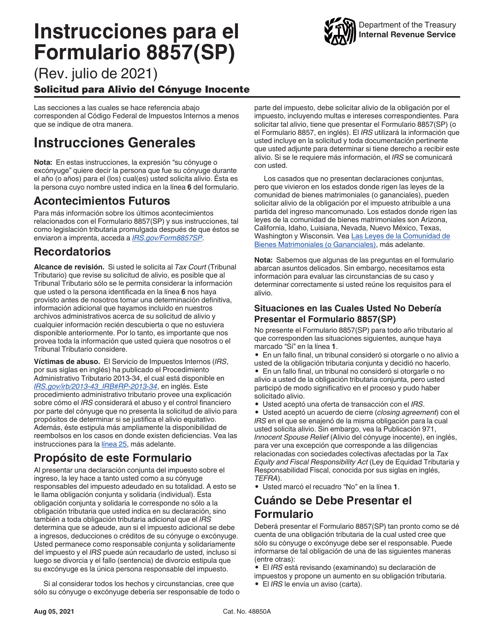

This Form is used for requesting Innocent Spouse Relief from the Internal Revenue Service (IRS). It is intended for individuals who believe they should not be held responsible for the tax liability owed by their spouse or former spouse.

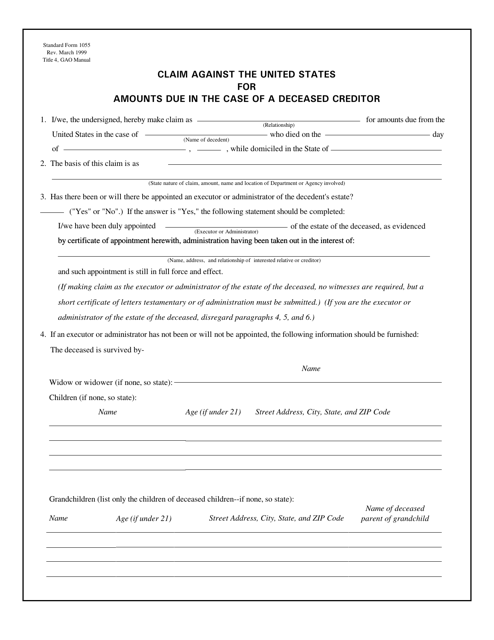

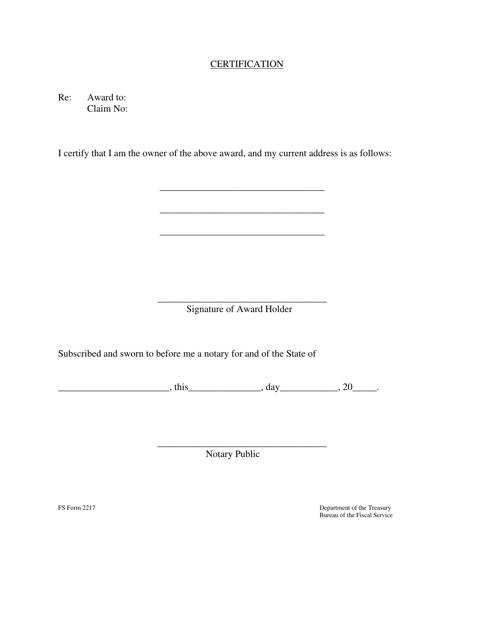

This form is used for claiming amounts due from the United States in case of a deceased creditor.

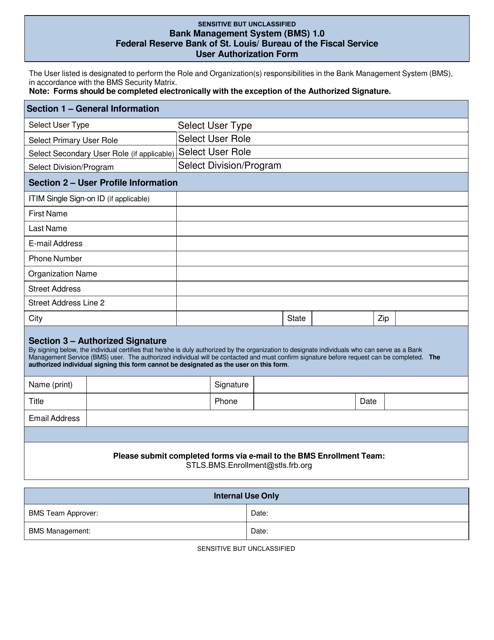

This document is for user authorization in the Bank Management System (BMS) used by the Federal Reserve Bank of St. Louis and the Bureau of the Fiscal Service. It is used to provide access to authorized individuals and ensure the security of the system.

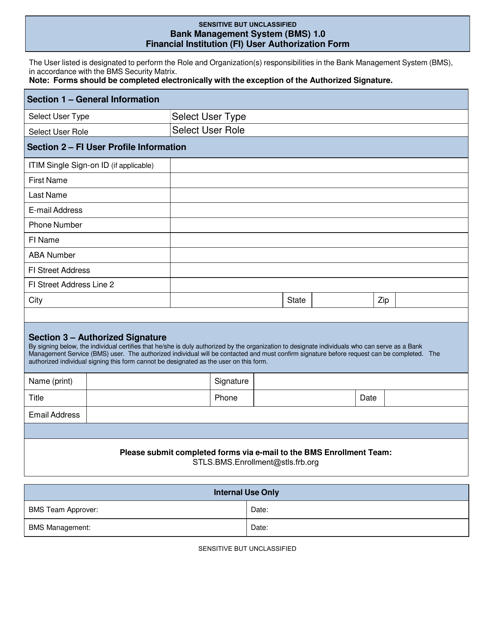

This document is used for user authorization in a Bank Management System (BMS) or Financial Institution (FI).

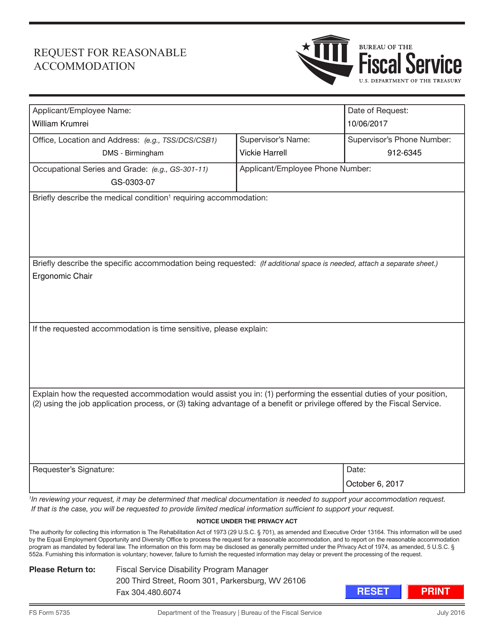

This form is used for requesting reasonable accommodation in a specific situation.

This document is used for certifying information for a federal student loan.

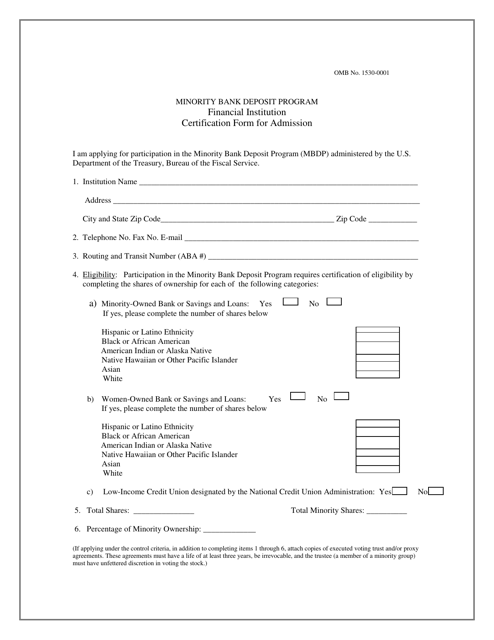

This Form is used for certification required for admission into the Minority Bank Deposit Program.

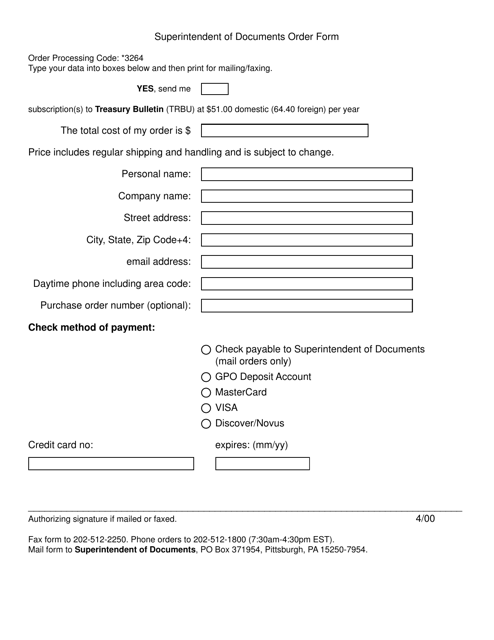

This form is used for ordering documents from the Superintendent of Documents.

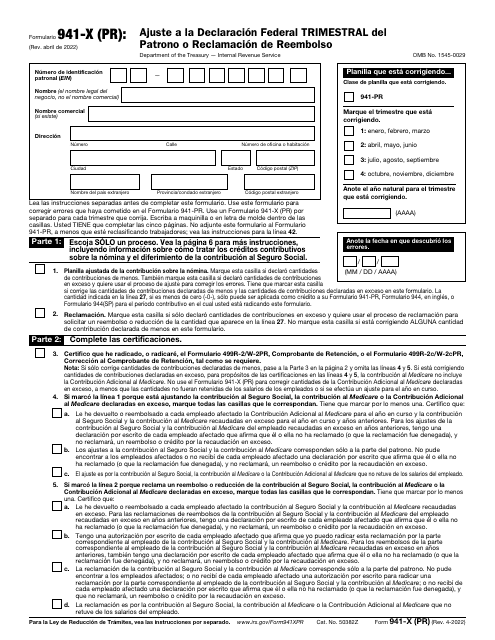

This is a formal instrument used by taxpayers that need to fix the mistakes they have discovered upon filing IRS Form 941, Employer's Quarterly Federal Tax Return.

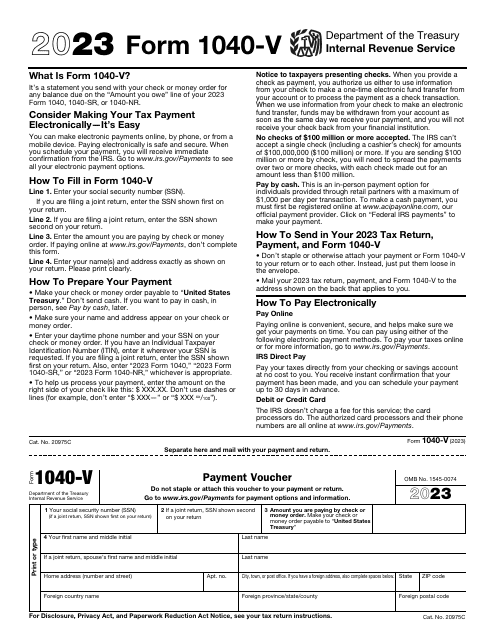

This is a supplementary document completed by taxpayers that chose to fulfill their financial obligations to fiscal organizations with the help of a check or money order.

This form is also known as the healthcare marketplace tax form. It is used to inform the IRS about individuals and families enrolled in a health plan via the Health Insurance Marketplace.

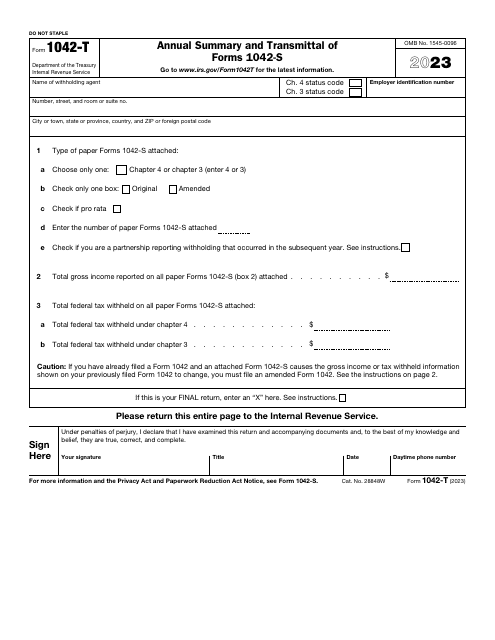

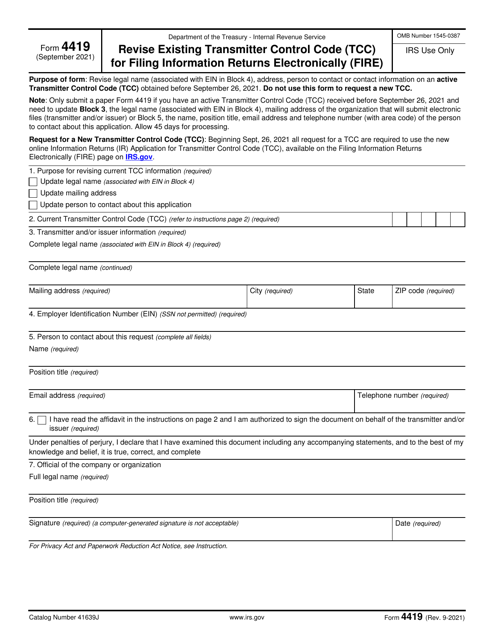

This is a formal IRS statement prepared and submitted by taxpayers that have active Transmitter Control Codes.

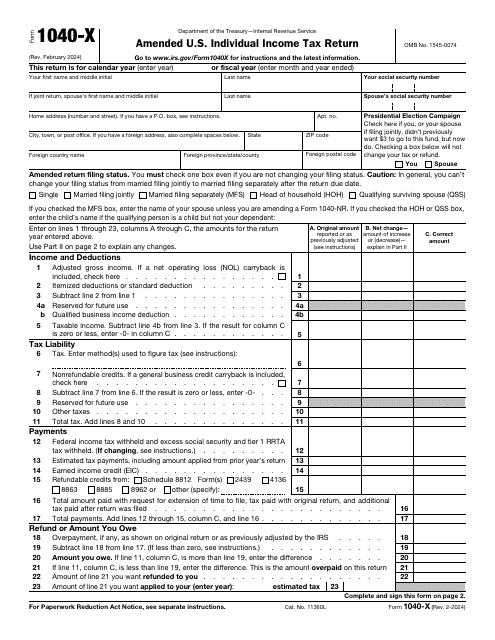

This document is used for correcting records on your tax return form. A separate form is used every year for which information is changed. Do not submit this document to request a refund of interest and penalties, or addition to the tax you have already paid.

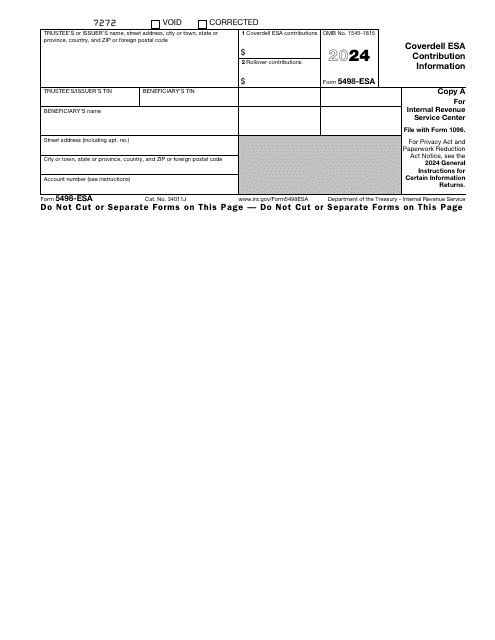

This is a fiscal document completed by a taxpayer to describe their financial contributions to the qualified education expenses of other people.