U.S. Department of the Treasury Forms

Related Articles

Documents:

2369

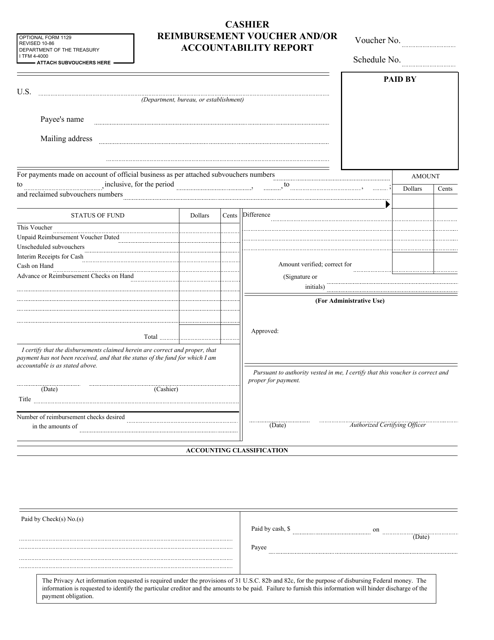

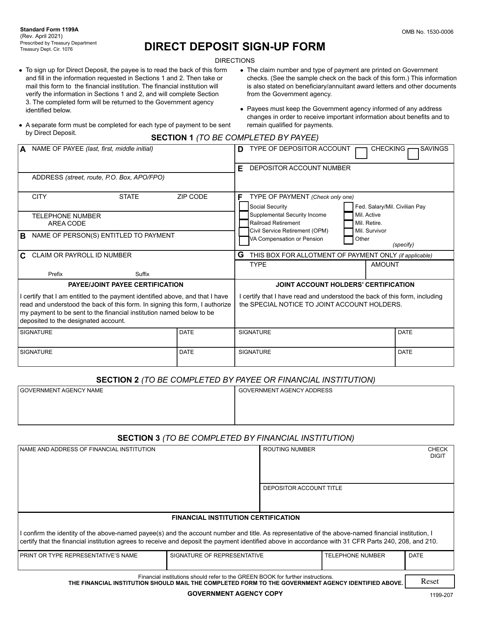

This form is used for Cashier Reimbursement Voucher and/or Accountability Report.

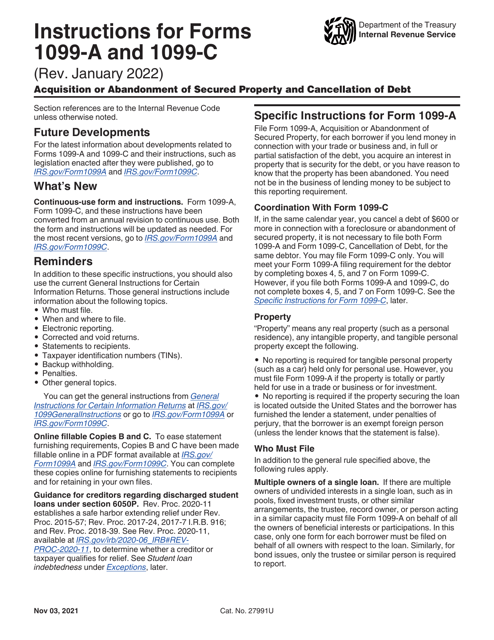

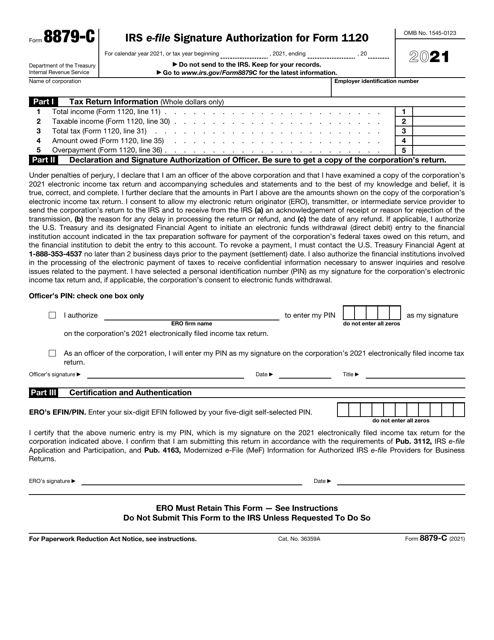

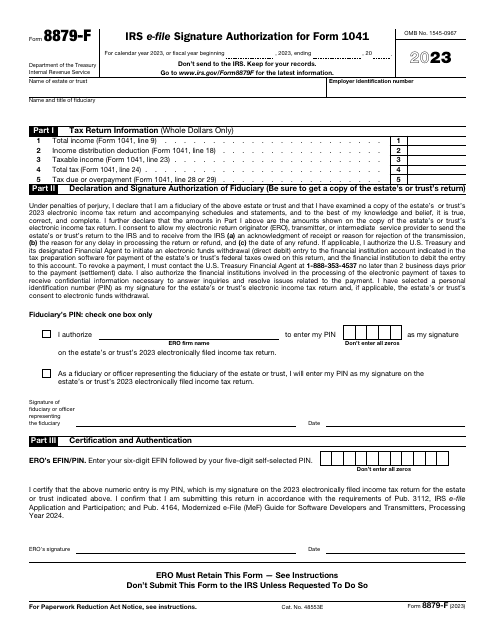

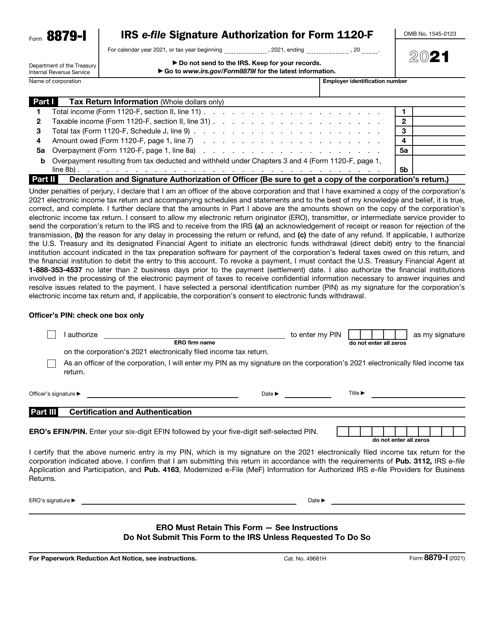

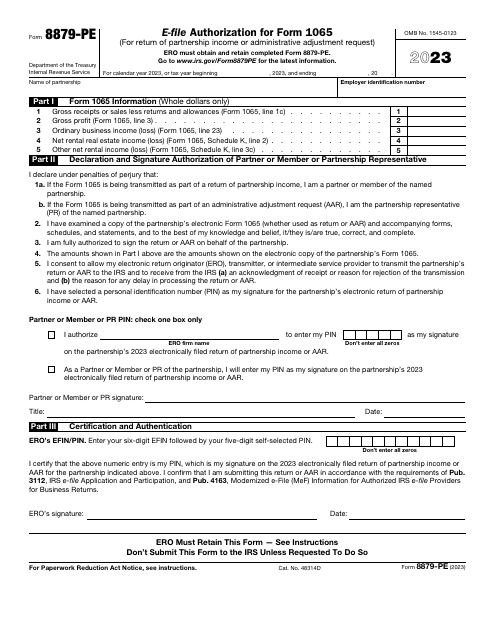

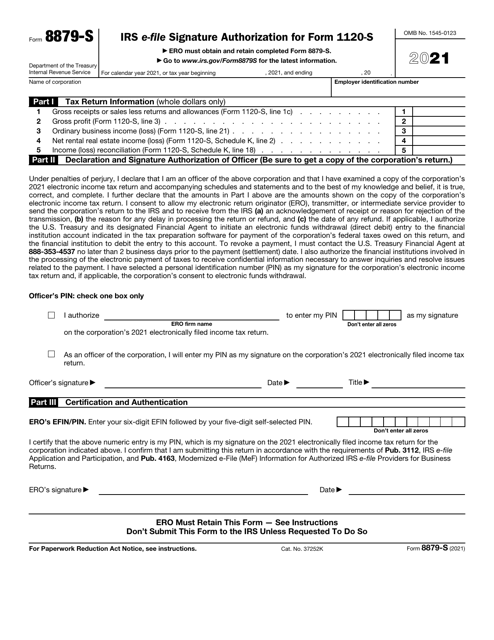

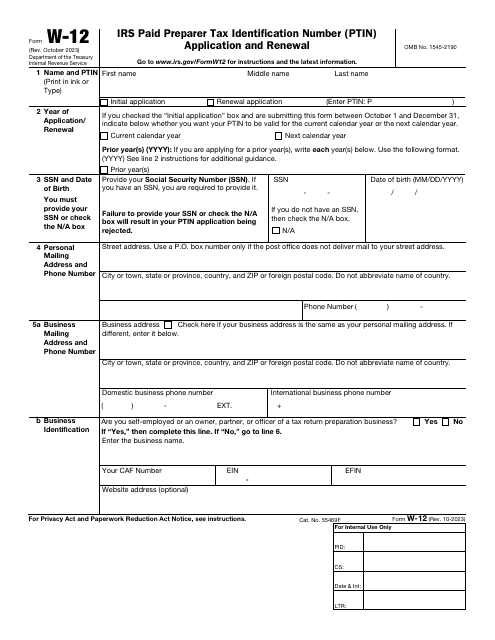

This is a fiscal document corporations use to create personal identification numbers in order to let electronic return originators sign tax returns on their behalf.

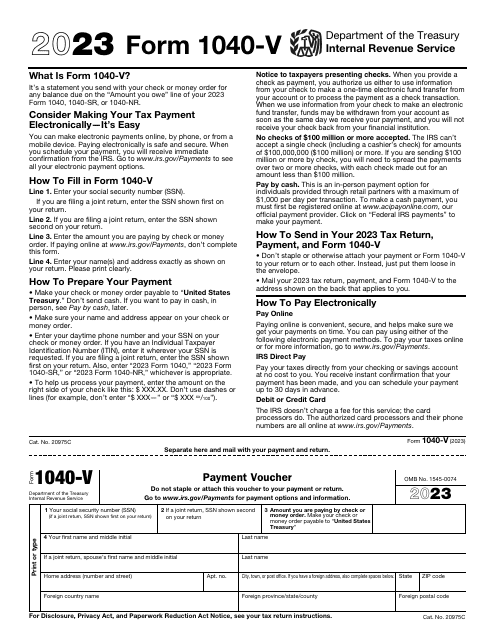

This is a supplementary document completed by taxpayers that chose to fulfill their financial obligations to fiscal organizations with the help of a check or money order.

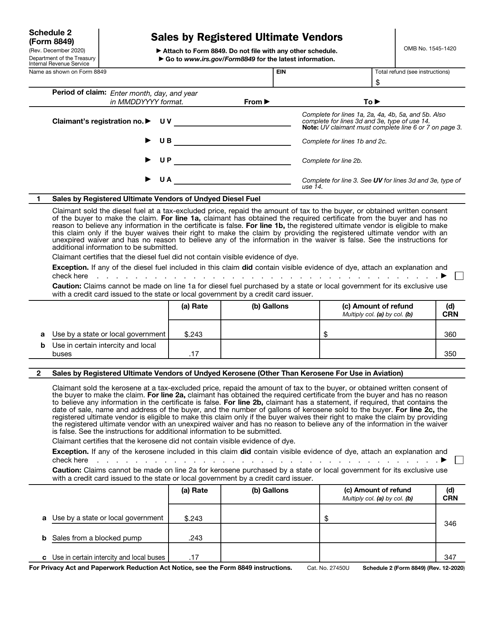

This Form is used for reporting sales made by registered ultimate vendors to claim a credit or refund.

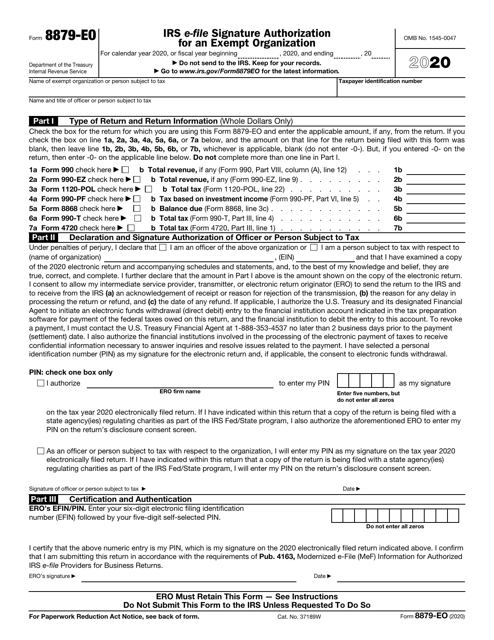

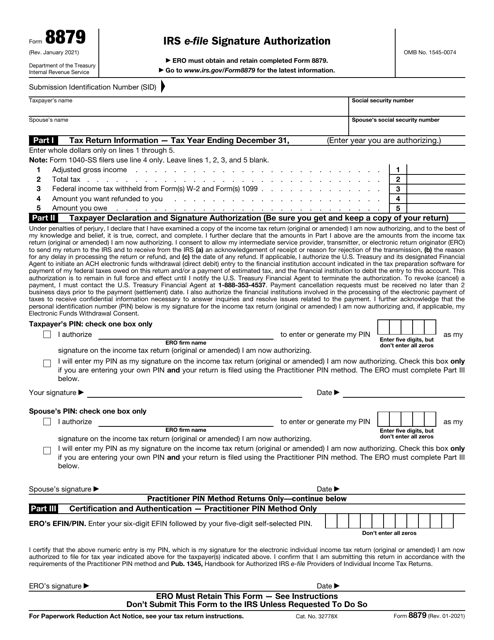

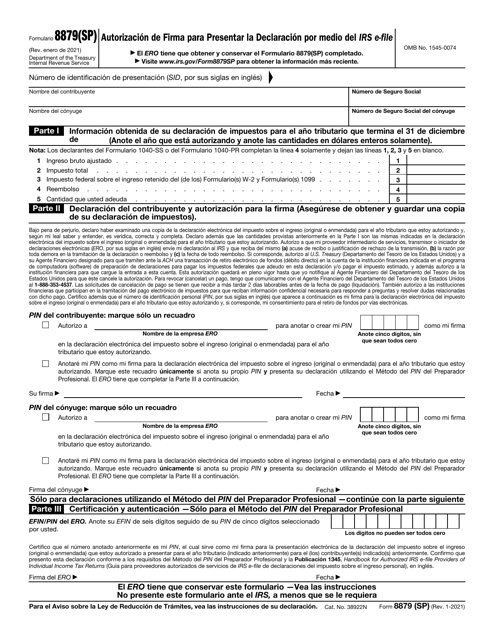

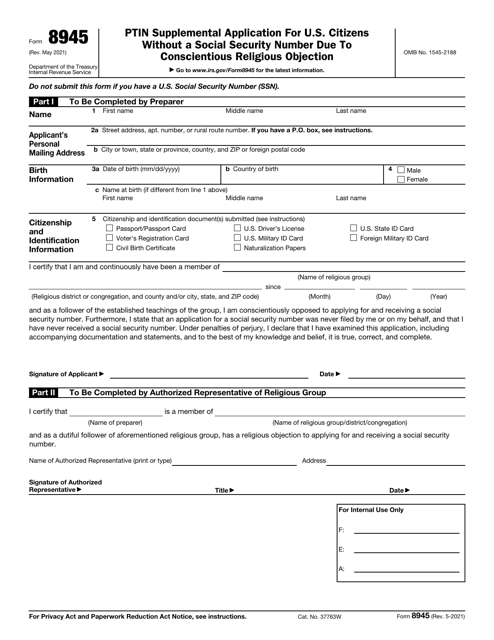

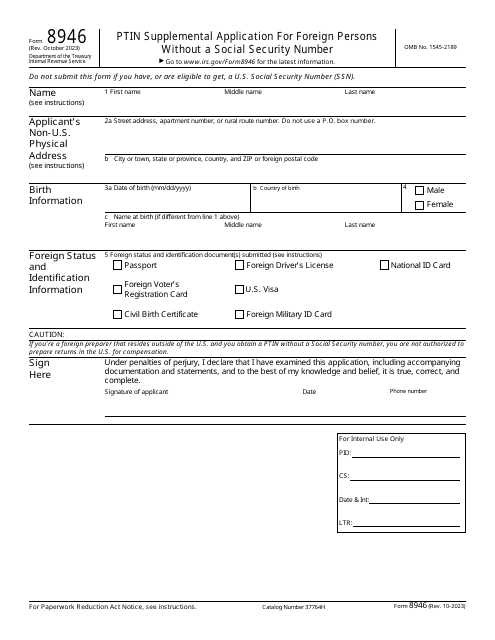

This is an IRS form that allows taxpayers to authorize an electronic return originator to use their e-signature while filing tax returns on behalf of their client.

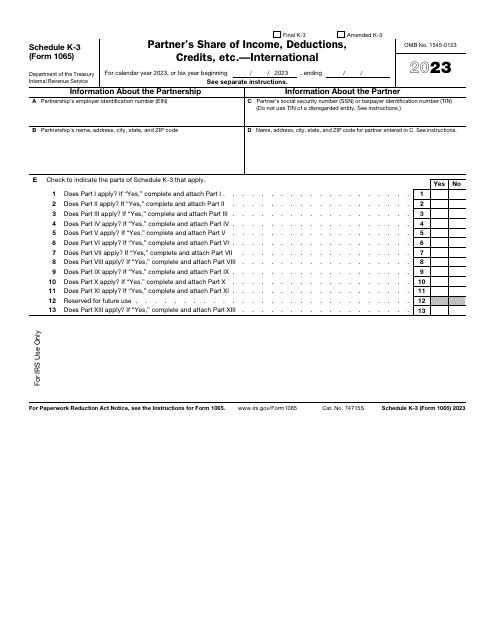

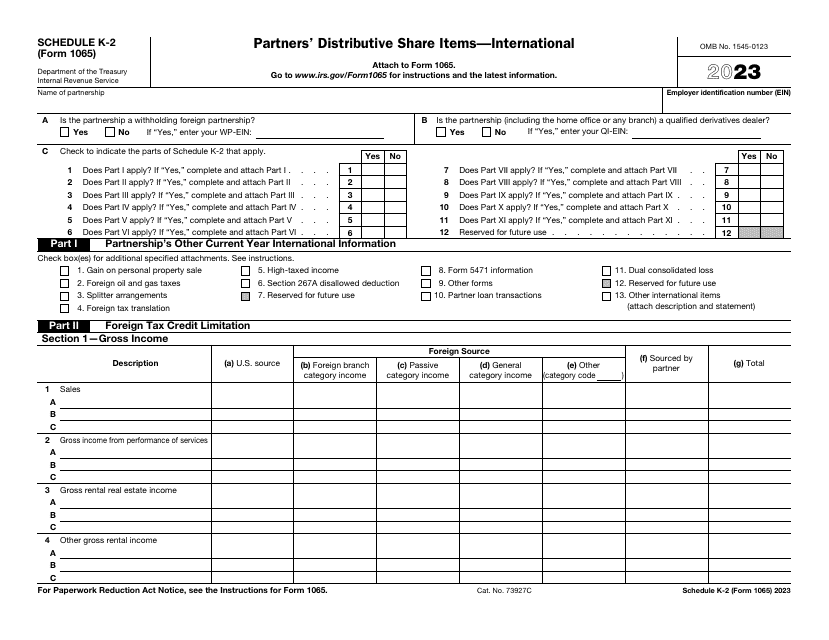

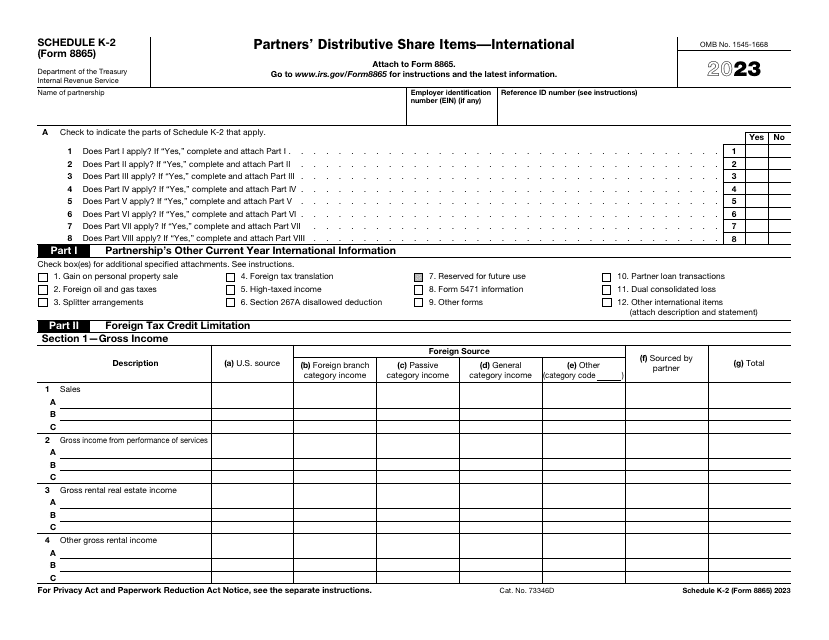

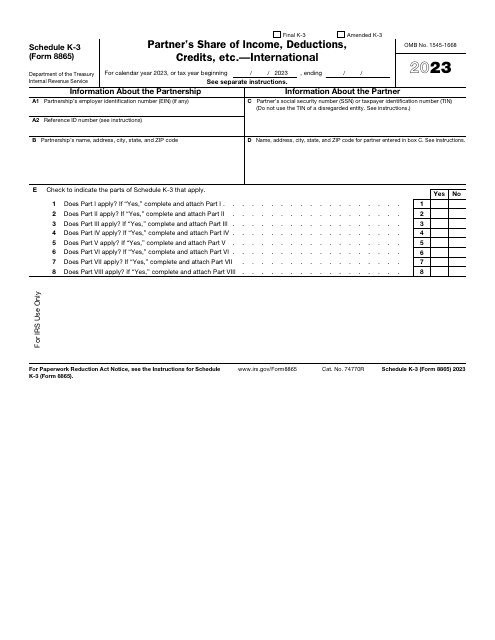

This is a fiscal IRS form designed to specify a partner's distributive share of various items that have international tax relevance.

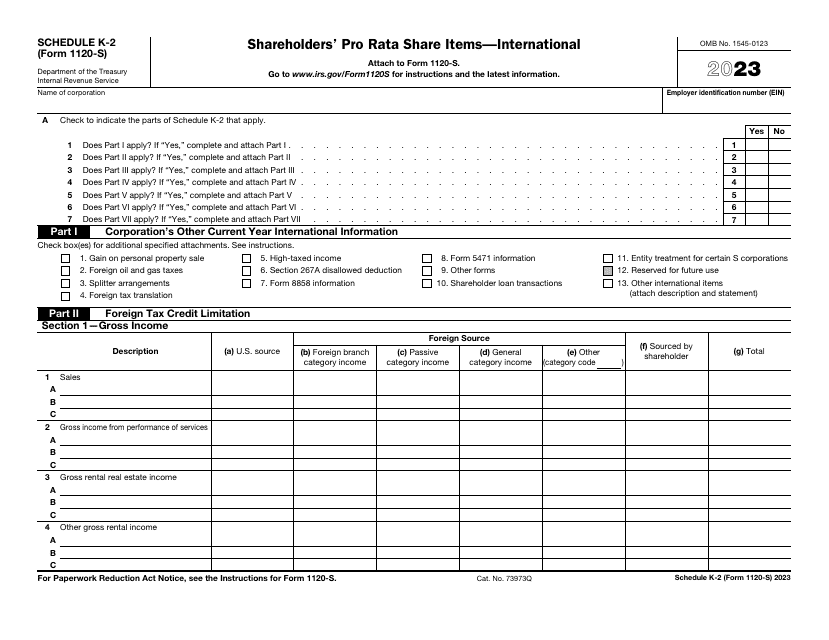

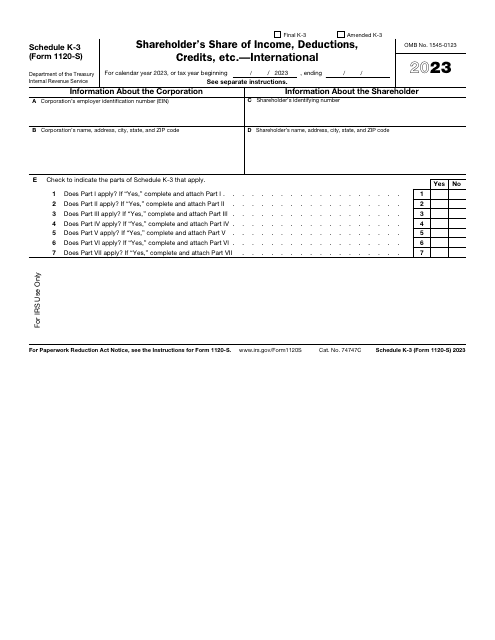

This is a fiscal form filled out by S corporations to inform the tax authorities about their international operations that are subject to tax.

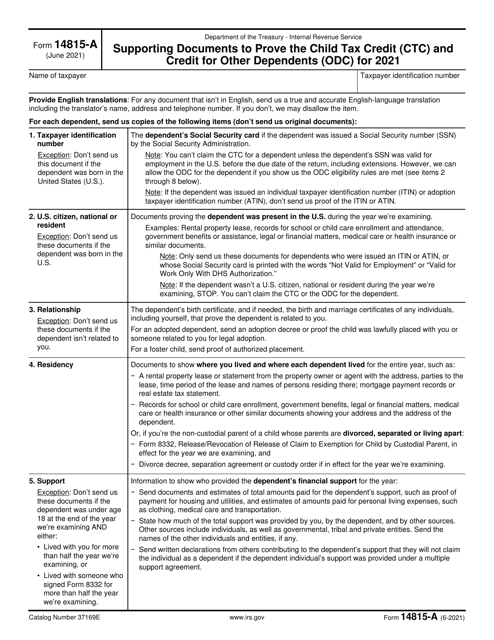

This type of document, IRS Form 14815-A, is used to provide supporting documentation to prove eligibility for the Child Tax Credit (CTC) and Credit for Other Dependents (ODC).

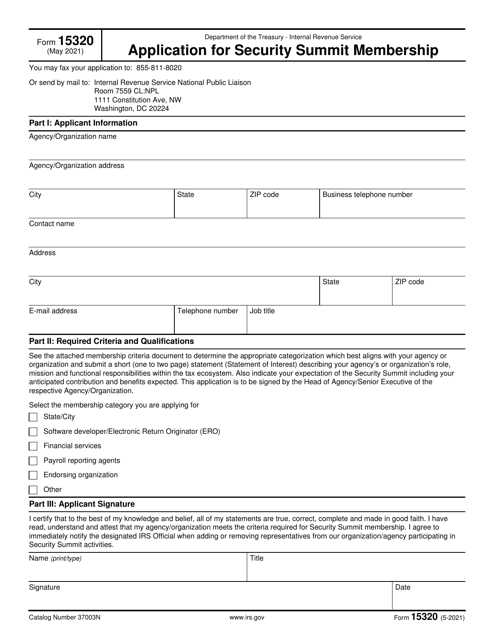

This document is for applying for membership to the IRS Security Summit.