U.S. Department of the Treasury Forms

Related Articles

Documents:

2369

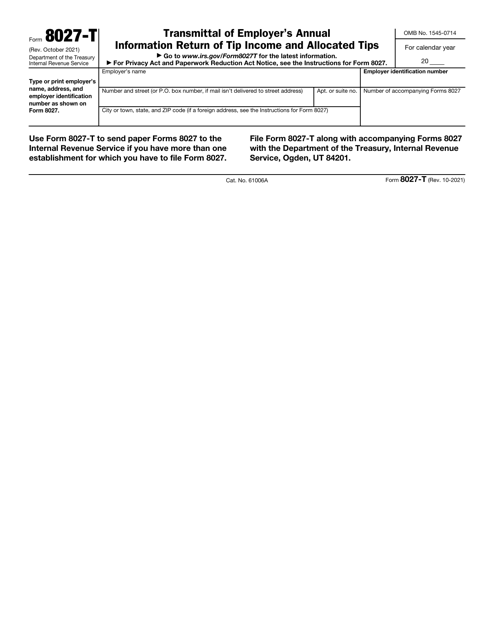

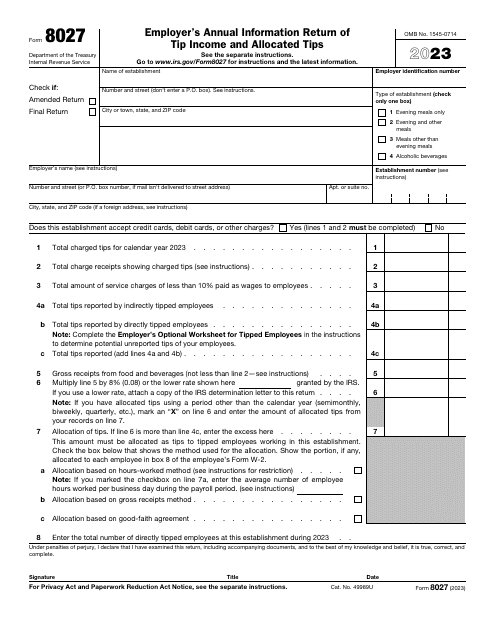

IRS Form 8027-T Transmittal of Employer's Annual Information Return of Tip Income and Allocated Tips

Download this supplemental form if you are an employer who owns one or more food or beverage establishments and wishes to submit Form 8027 in a paper format.

Every year, this form is filled out by employers wishing to report to the Internal Revenue Service (IRS) the receipts and tips their employee received, as well as to determine allocated tips.

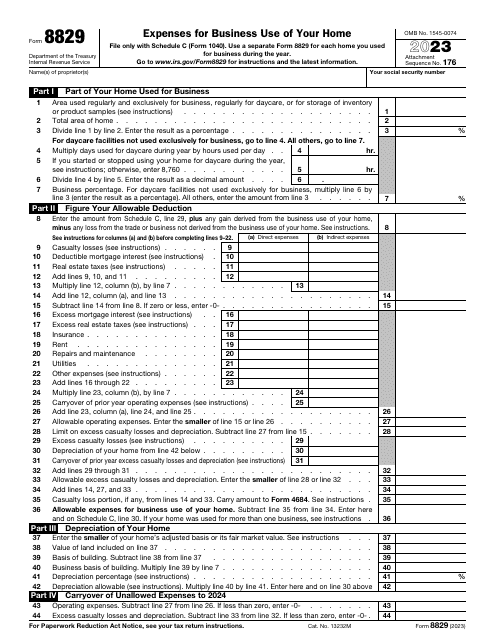

This is an IRS form used by taxpayers who work from home and want to inform tax organizations about the business expenses they wish to deduct from their taxes.

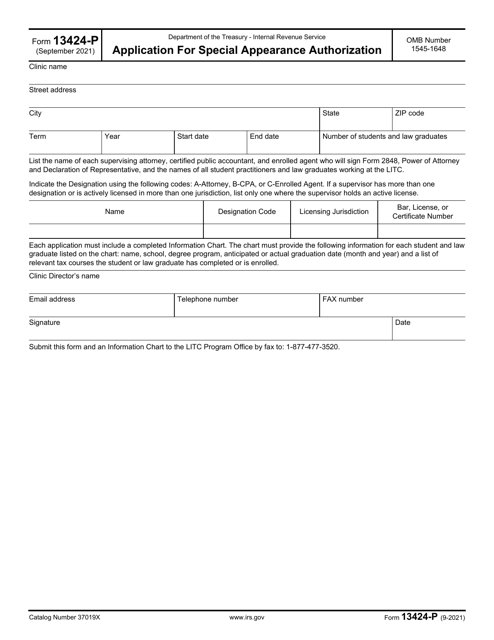

This Form is used for applying for Special Appearance Authorization with the IRS.

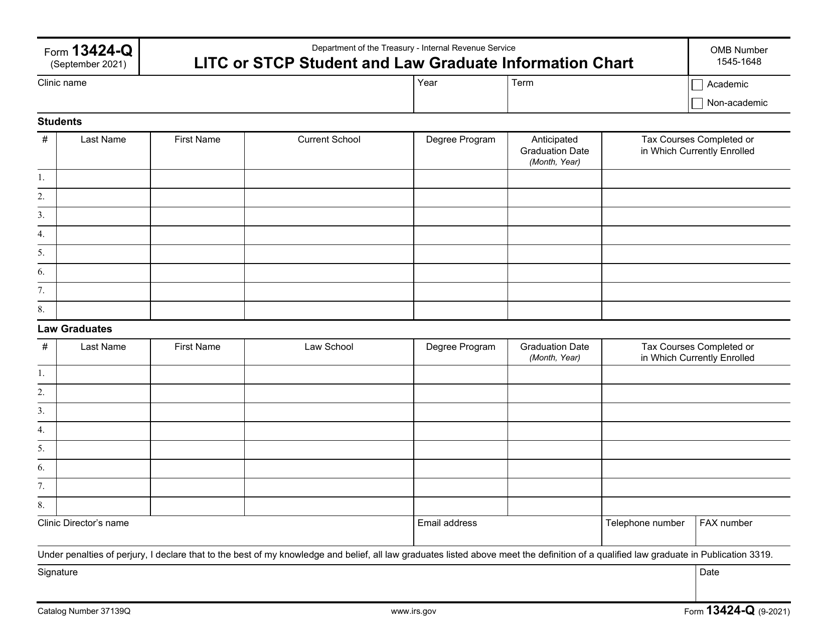

This form is used for providing student and law graduate information to the IRS.

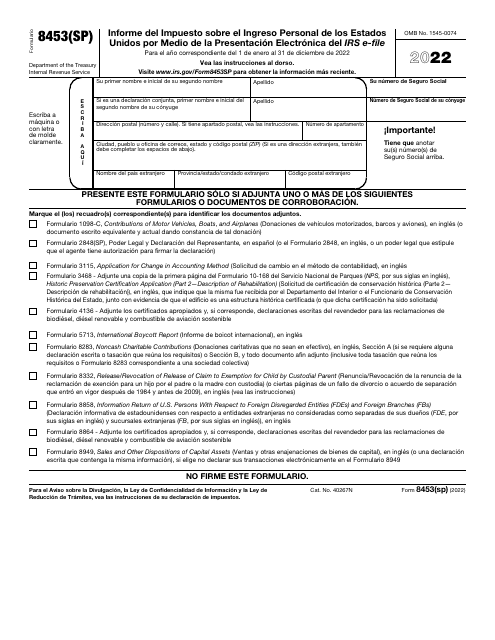

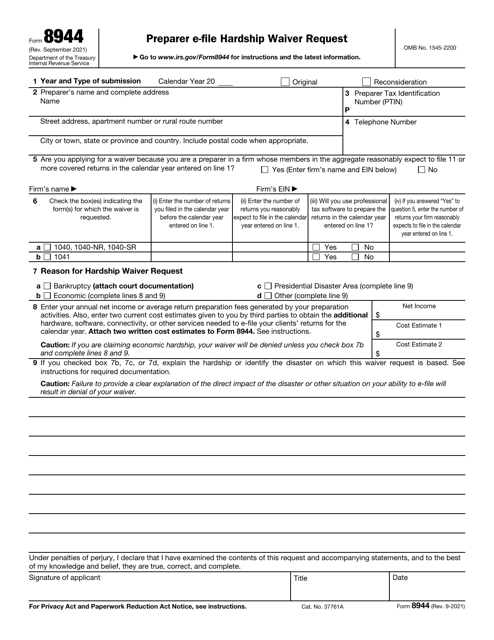

This is a formal statement completed by specified tax return preparers that cannot e-file income tax returns because of economic hardship, bankruptcy, or presidentially declared disaster.

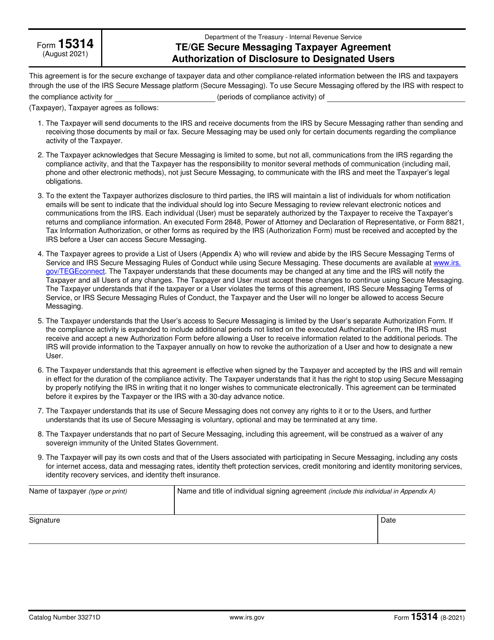

This form is used for authorizing the IRS to disclose taxpayer information to designated users through secure messaging.

Instructions for IRS Form 941-X Adjusted Employer's Quarterly Federal Tax Return or Claim for Refund