U.S. Department of the Treasury Forms

Related Articles

Documents:

2369

This form is used for reconciling the net income (or loss) of S Corporations with total assets of $10 million or more on Form 1120S. It provides detailed instructions for completing the Schedule M-3 section.

This Form is used for filing the U.S. Income Tax Return specifically for an S Corporation. It provides instructions on how to report income, deductions, and credits for the corporation.

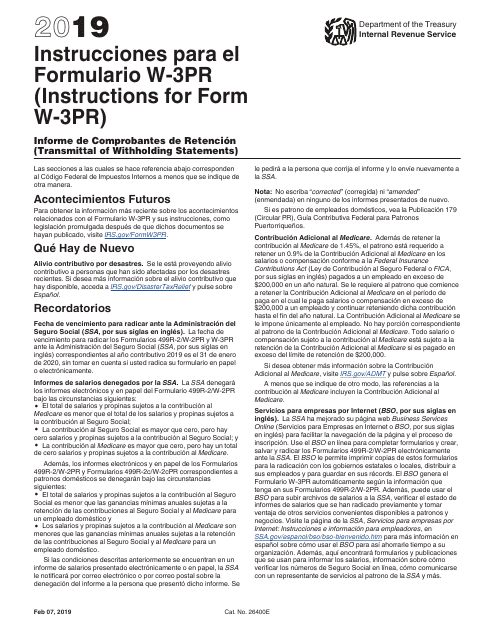

This document provides instructions for completing the IRS Form W-3PR, which is used to transmit withholding statements. The instructions are available in both English and Spanish.

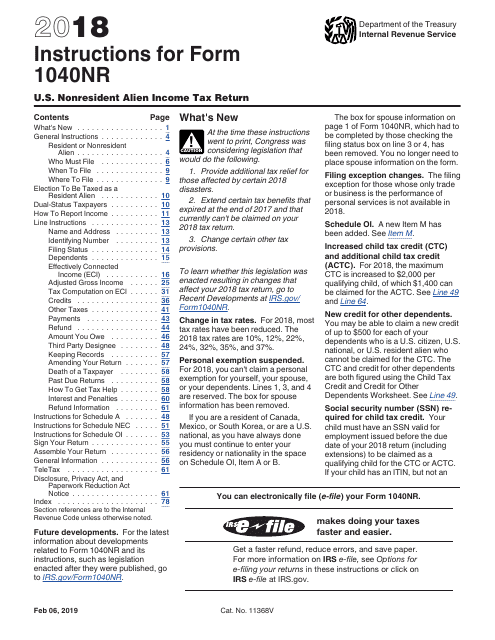

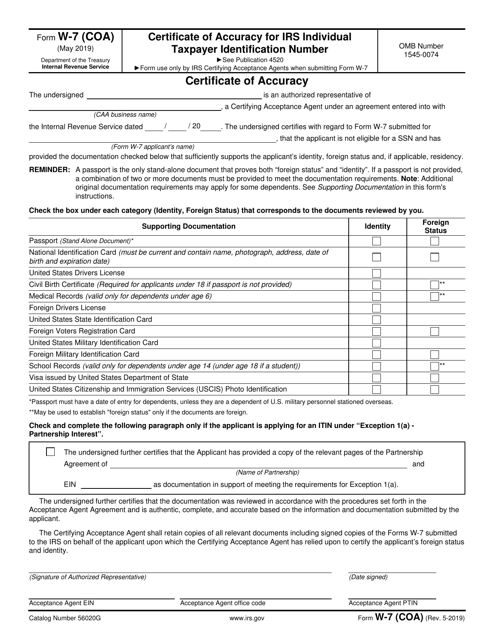

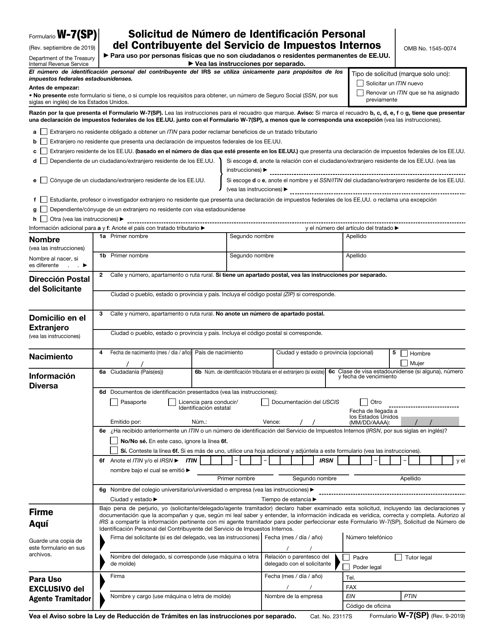

This form is used for reporting income and paying taxes for nonresident aliens in the United States.

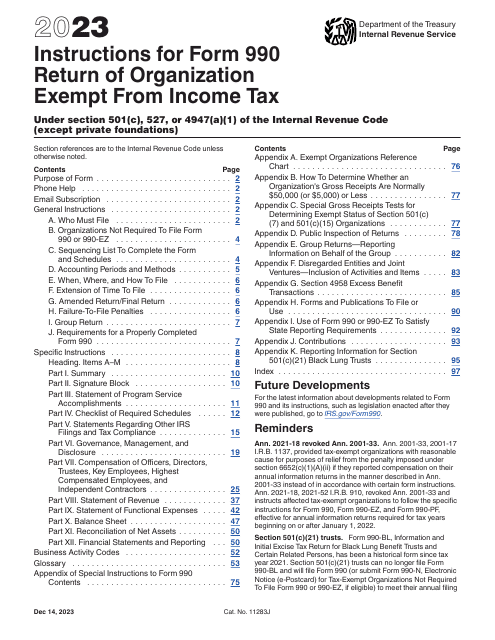

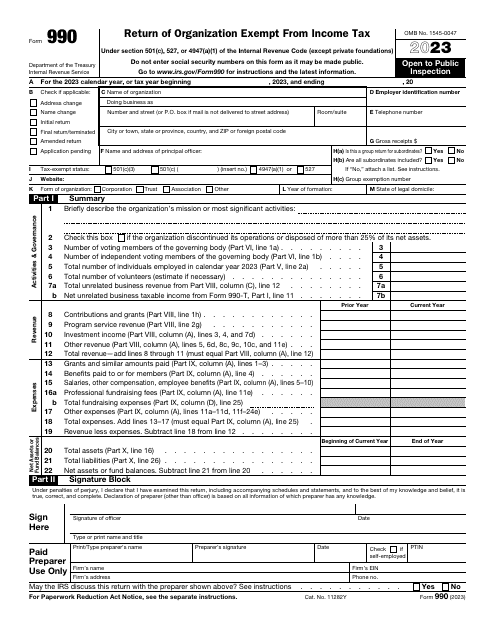

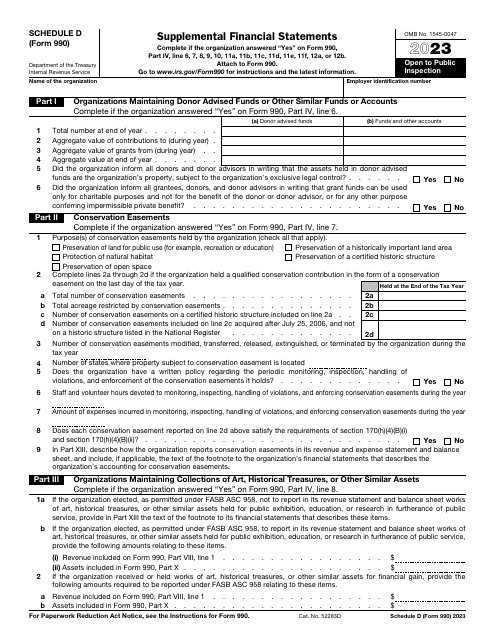

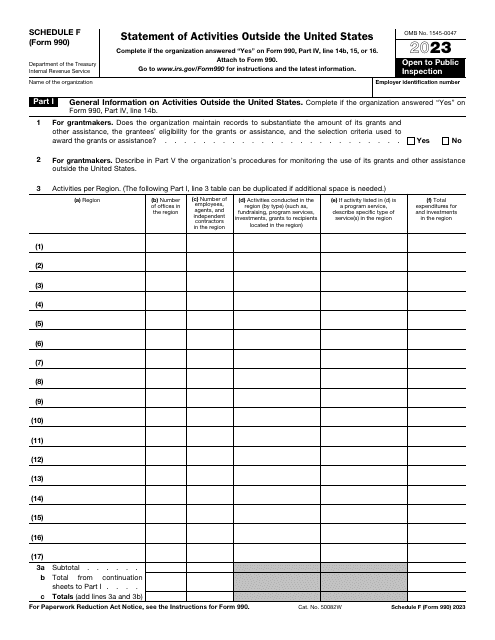

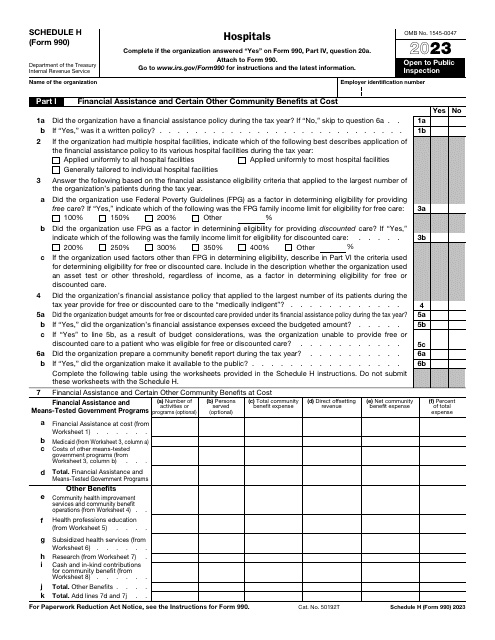

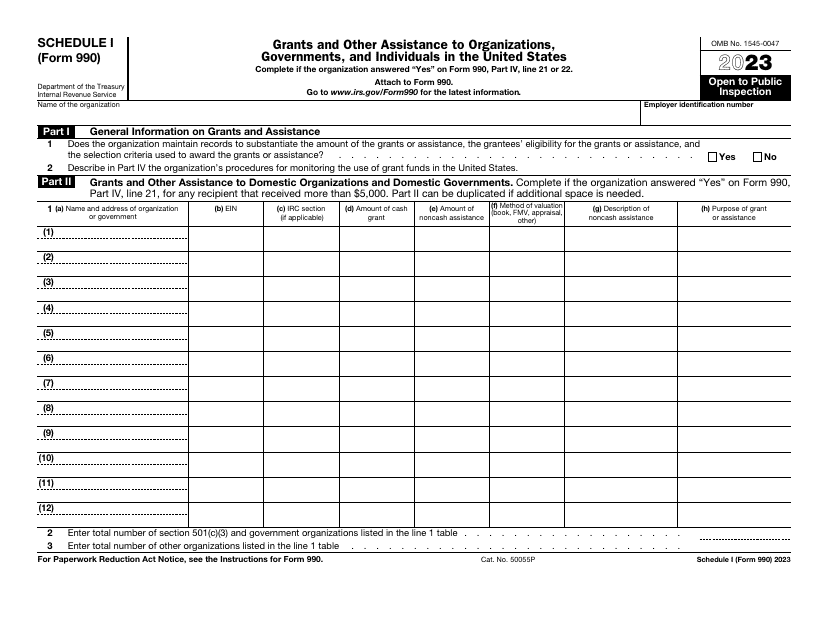

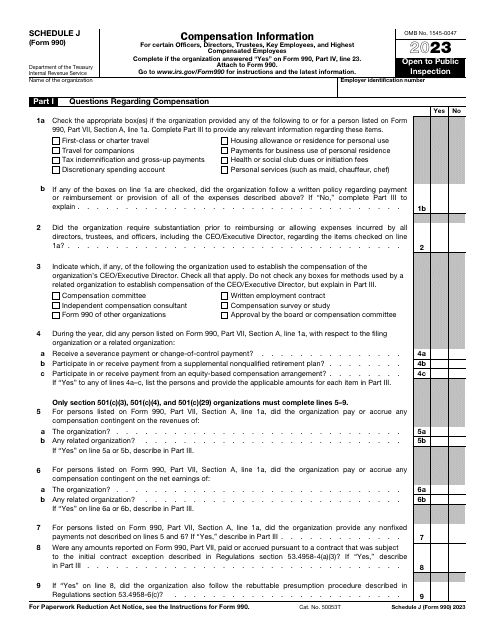

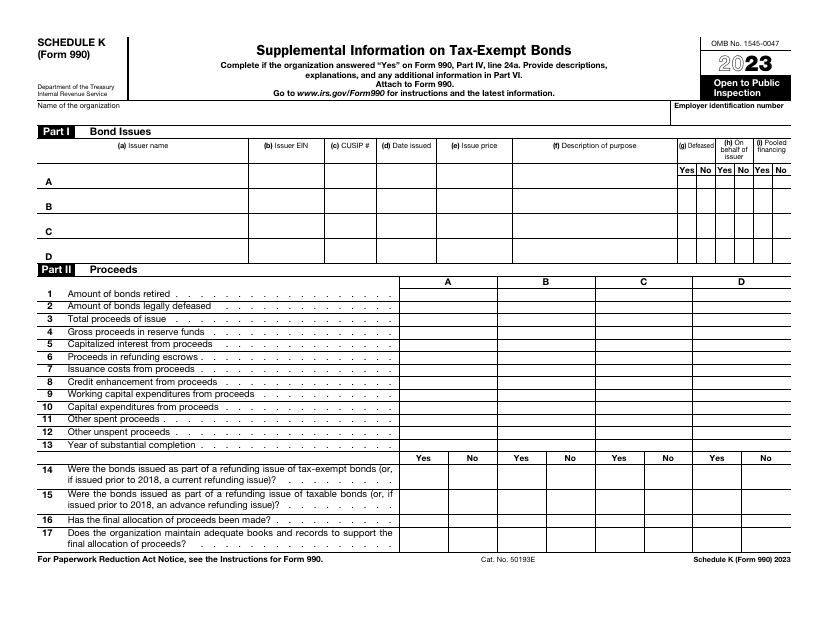

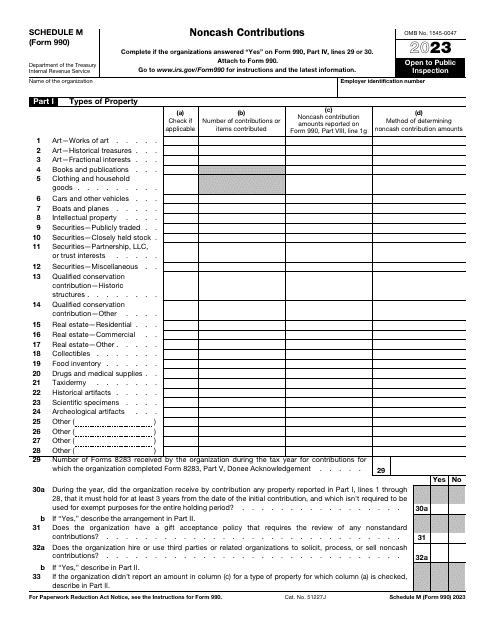

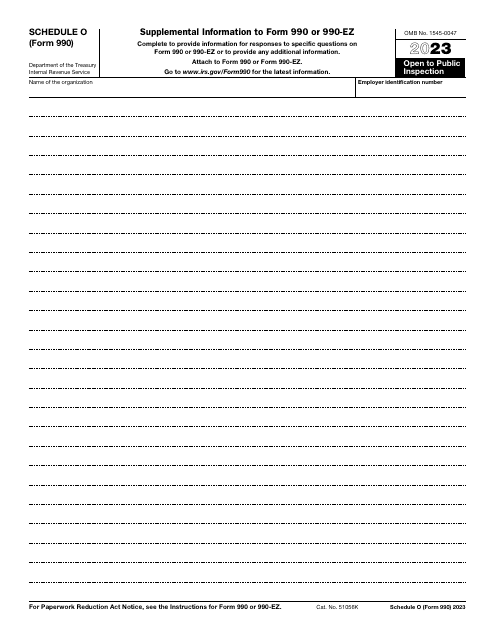

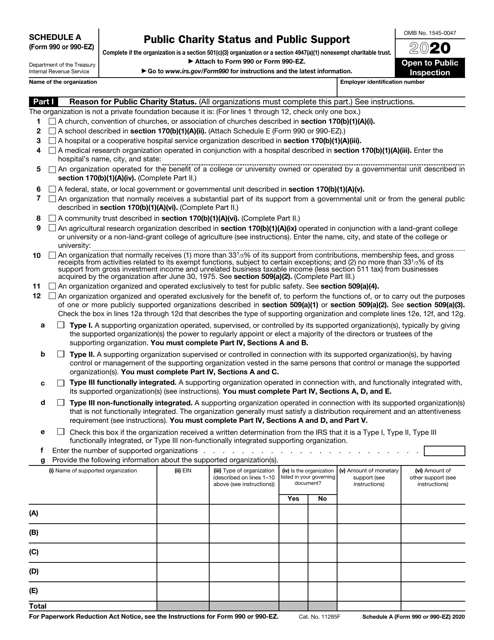

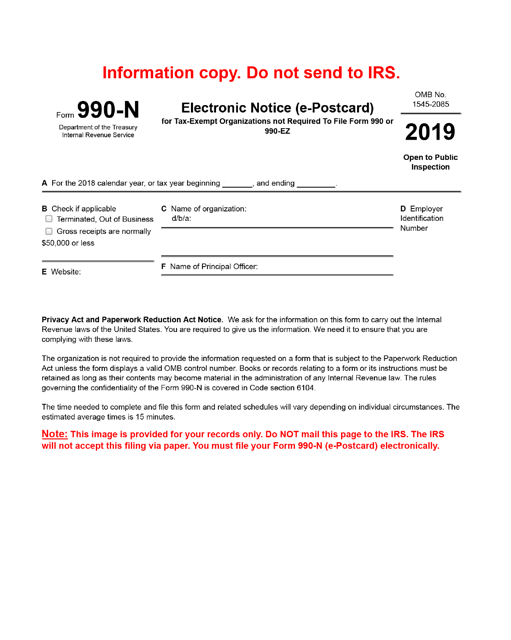

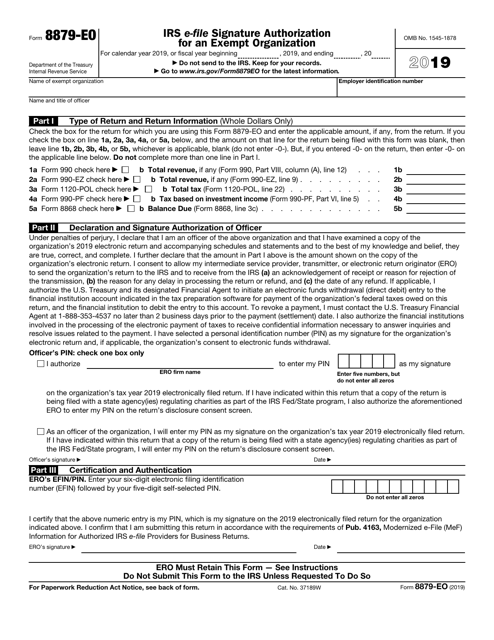

This form is used to supply the Internal Revenue Service (IRS) with information regarding receipts, gross income, disbursements, and other data used by tax-exempt organizations to summarize their work during the tax year.

This is a fiscal document used by nonprofit organizations to report the main specifics of their operations to tax authorities.

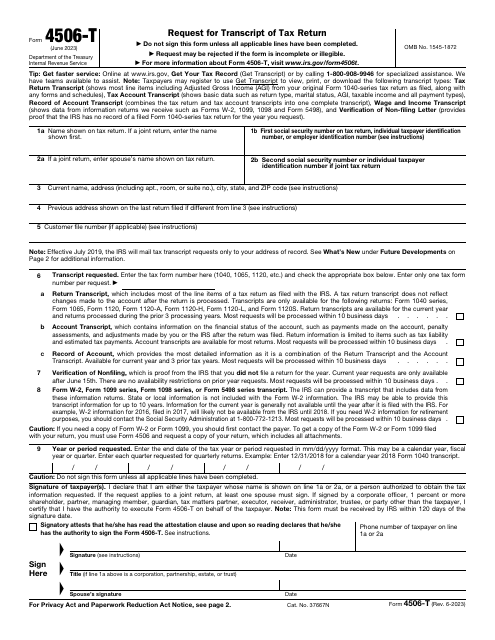

Fill in this form if you would like to request tax return information, such as different types of transcripts, a record of an account, and/or verification of nonfiling.

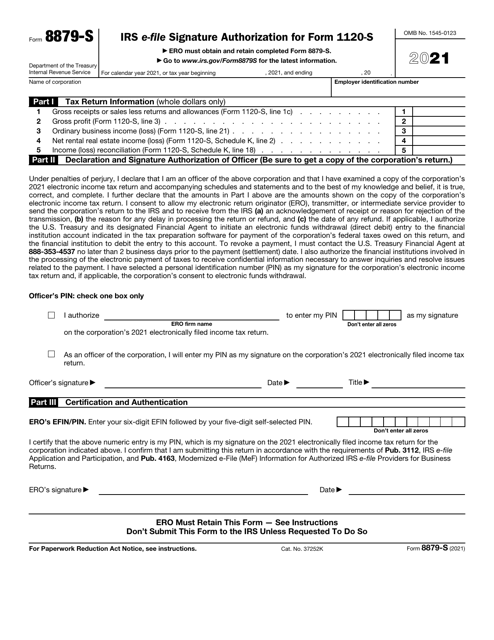

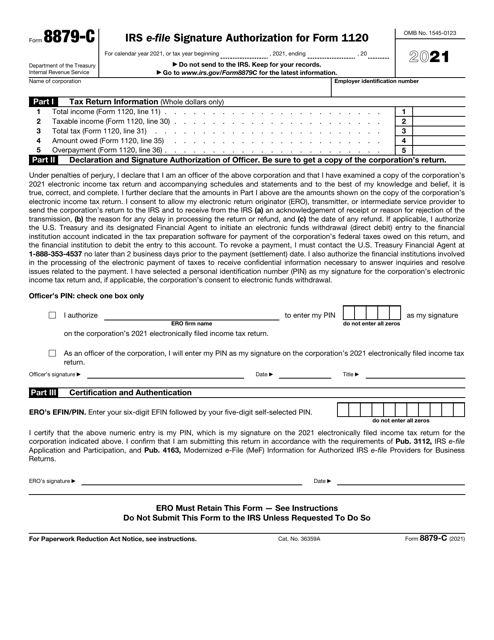

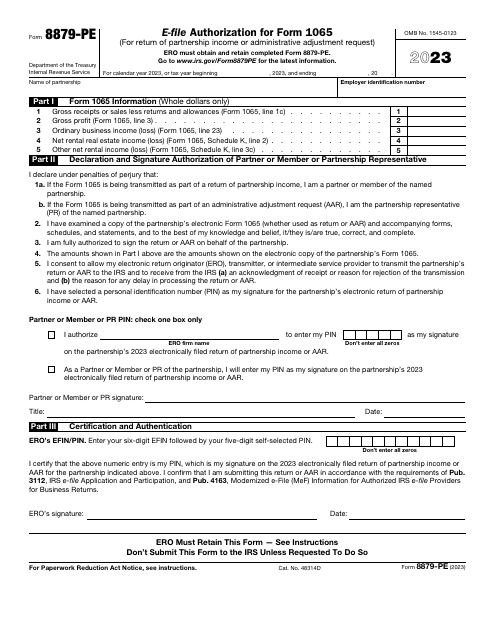

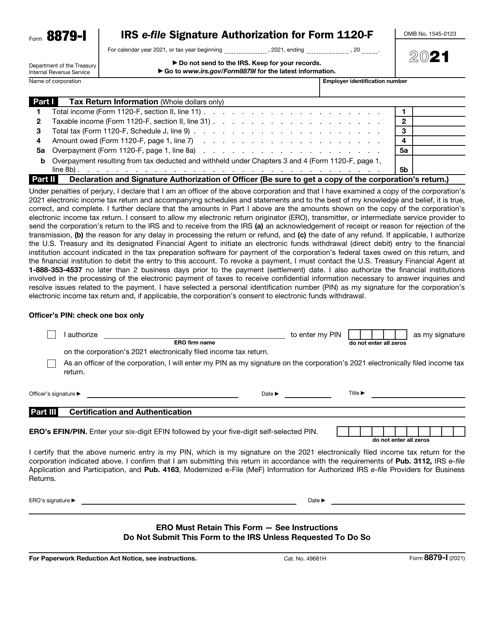

This is a fiscal document corporations use to create personal identification numbers in order to let electronic return originators sign tax returns on their behalf.

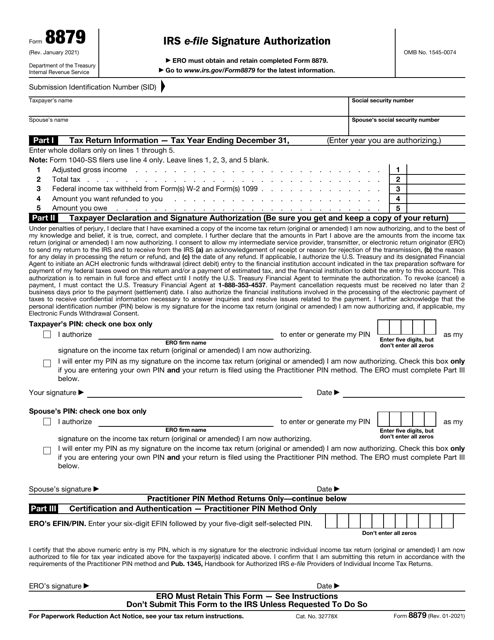

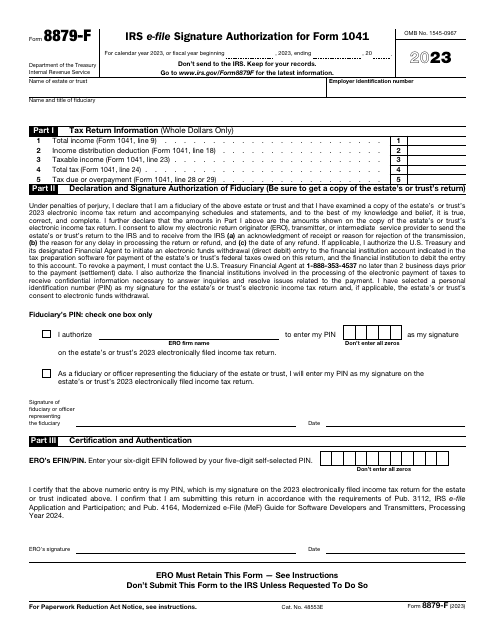

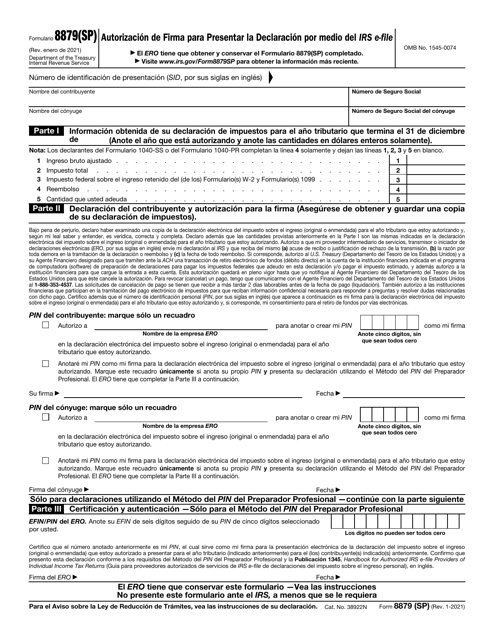

This is an IRS form that allows taxpayers to authorize an electronic return originator to use their e-signature while filing tax returns on behalf of their client.

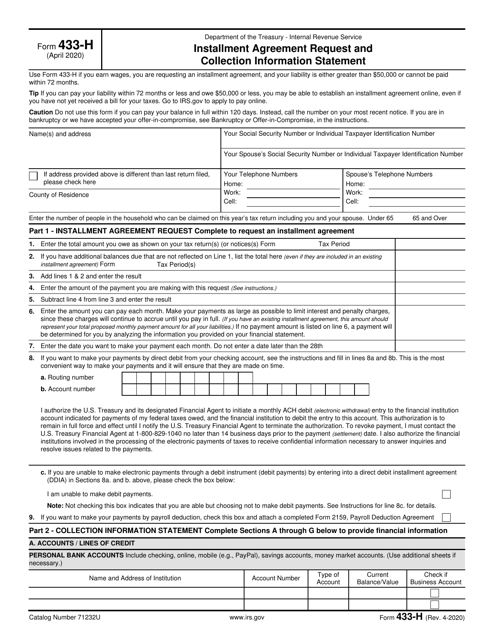

This is a formal IRS statement used by taxpayers to ask the fiscal authorities to let them pay off their tax debts in monthly payments.