U.S. Department of the Treasury Forms

Related Articles

Documents:

2369

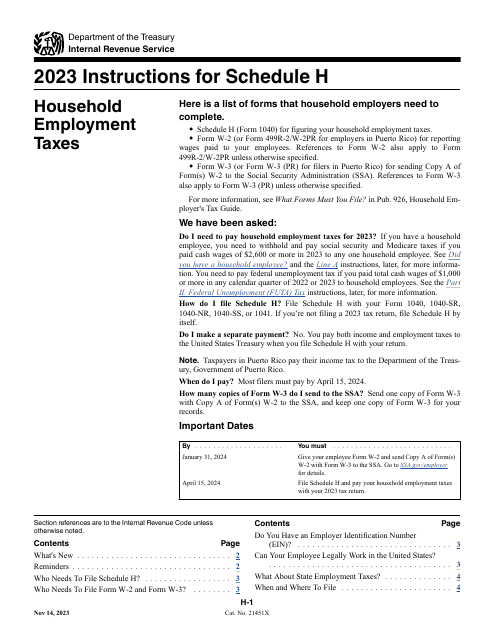

Use this document to report the amount of withheld wages and taxes to the employee and appropriate authorities. The form is also known as a W-2 and is one of the crucial annual tax documents.

If you are an employer and have to file Form W-2, Wage and Tax Statement, you need to fill out this form. This form is needed for transmitting a paper Copy A of Form W-2, to the SSA. Make sure you supply your employees with a copy of Form W-2.

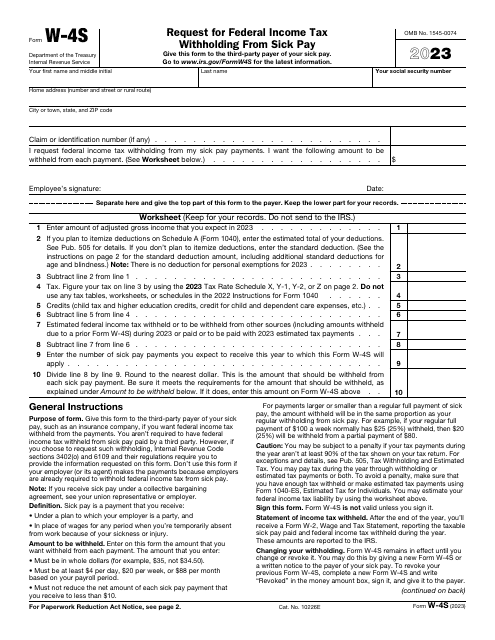

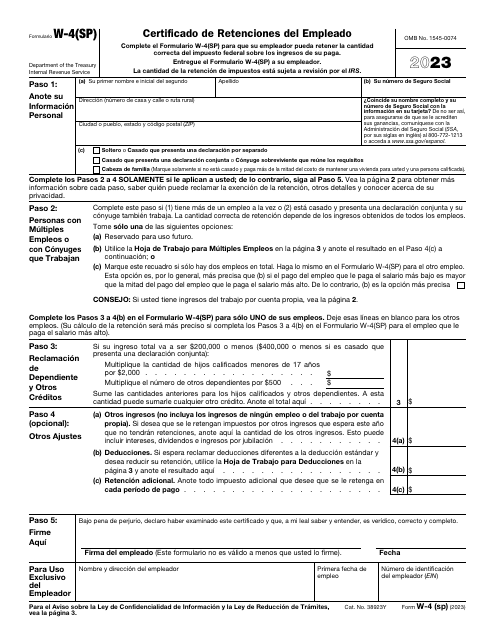

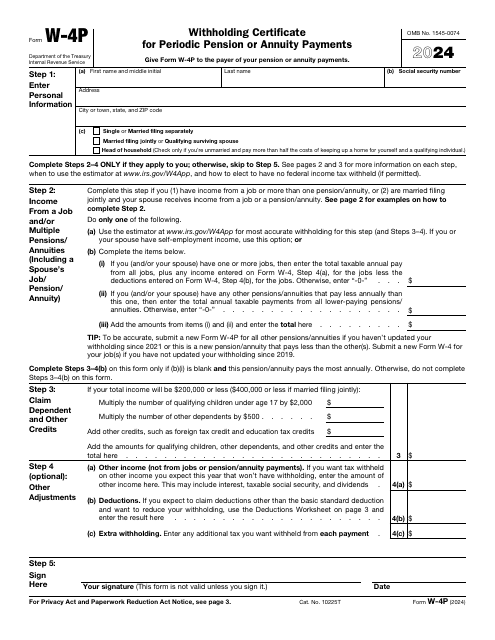

This is a formal document used by taxpayers to figure out the amount of deduction applied to regular payments they are entitled to receive.

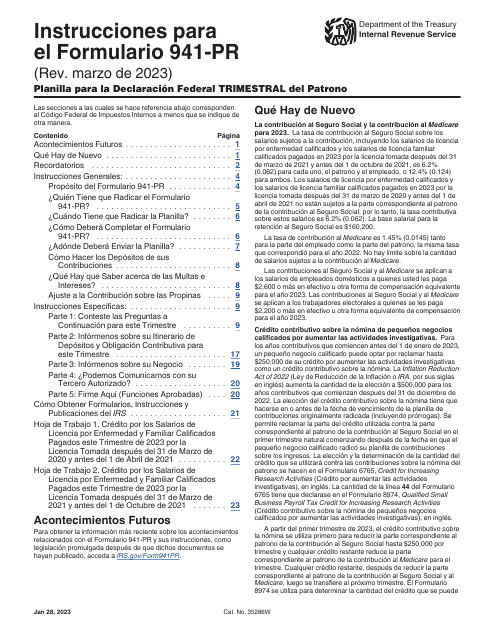

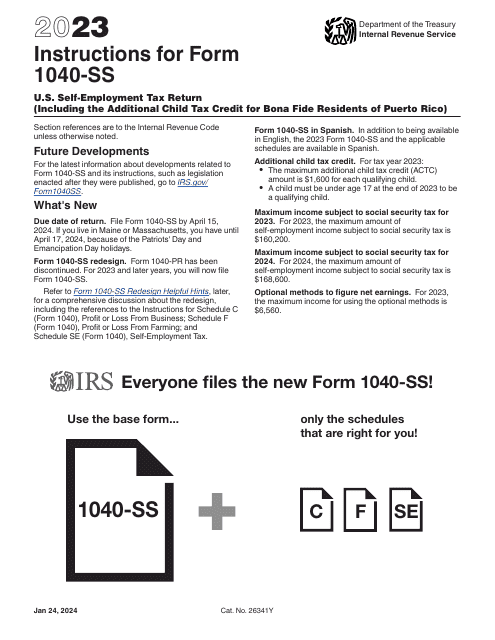

This type of document is used for filing Federal Income Tax returns for self-employed individuals in Puerto Rico. It also includes the Additional Child Tax Credit for bona fide residents of Puerto Rico.

This document provides instructions on how to complete IRS Form 1065 Schedule B-2, which is used for electing to opt out of the Centralized Partnership Audit Regime.