Tax Deductions Templates

Documents:

1801

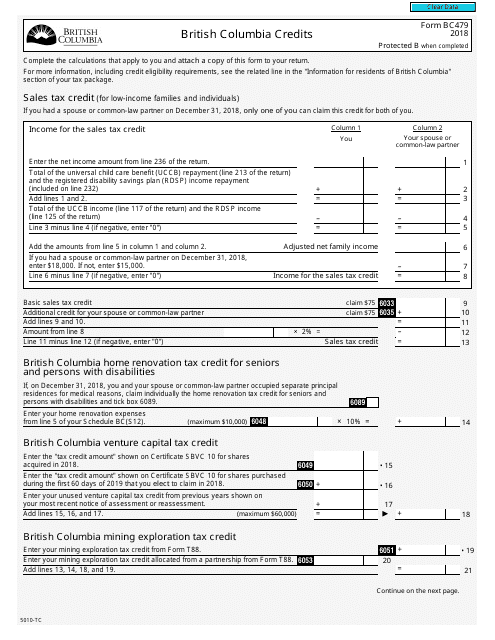

This form is used for claiming British Columbia credits in Canada.

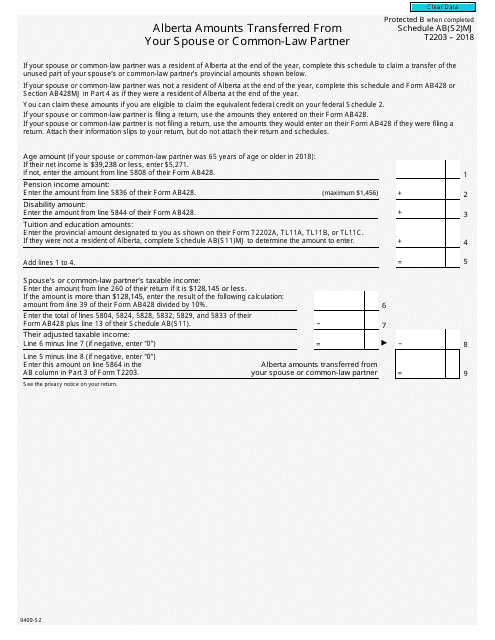

This form is used for reporting Alberta amounts transferred from your spouse or common-law partner in Canada.

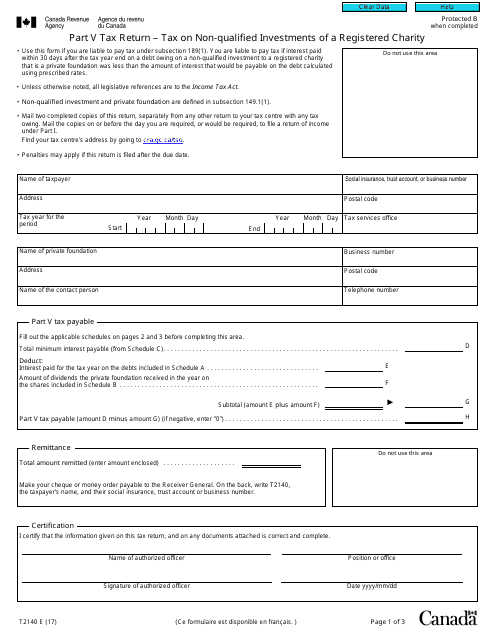

This form is used for reporting and paying taxes on non-qualified investments made by a registered charity in Canada.

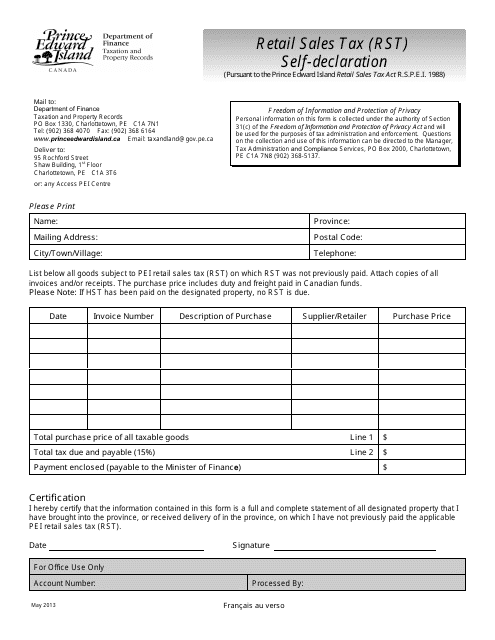

This document is used for self-declaration of Retail Sales Tax (RST) in Prince Edward Island, Canada. It pertains to businesses reporting and paying their retail sales tax obligations to the provincial government.

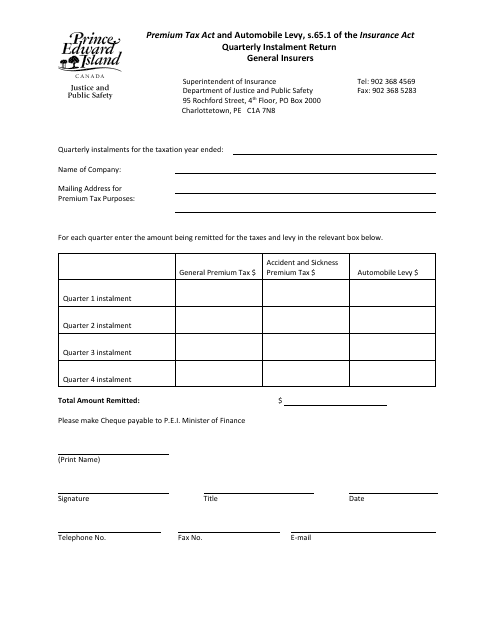

This document is used by businesses in Prince Edward Island, Canada to report their quarterly instalment payments to the government. It is a form that helps businesses calculate and remit the amount they owe for income tax or sales tax on a quarterly basis.

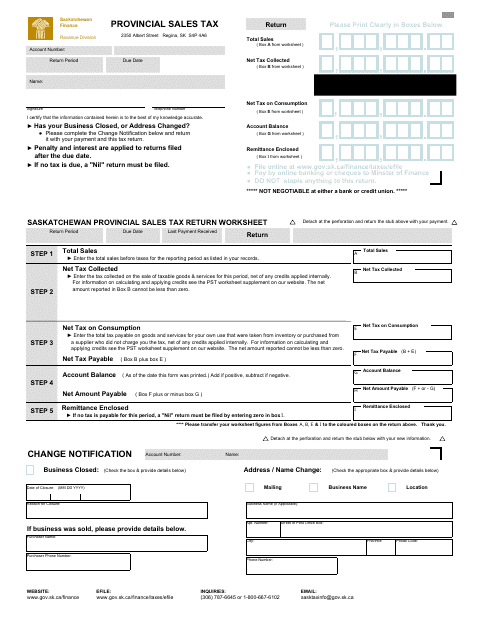

This Form is used for reporting and remitting the Provincial Sales Tax in the province of Saskatchewan, Canada.

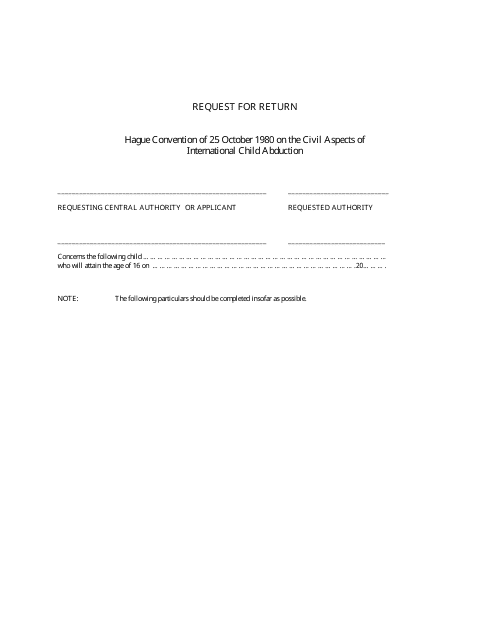

This document is used to request a return in the province of Saskatchewan, Canada.

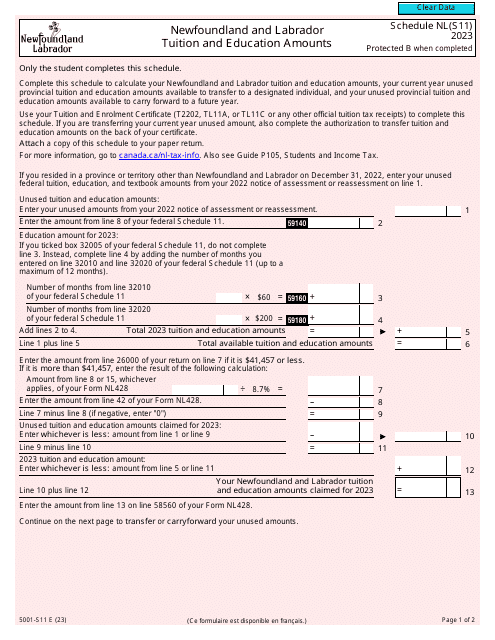

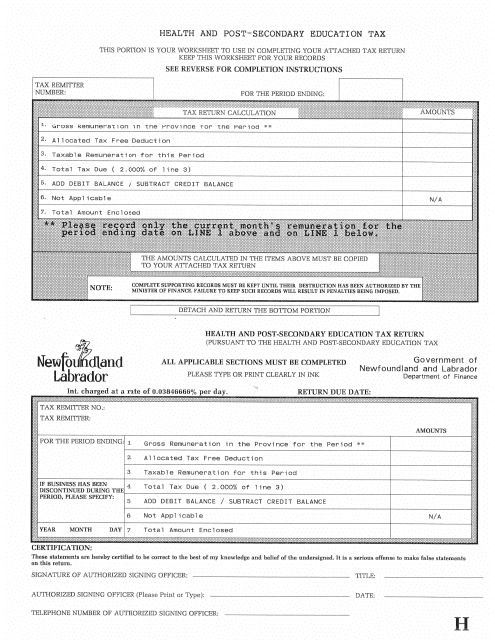

This document is for residents of Newfoundland and Labrador, Canada who want to claim health and post-secondary education tax credits.

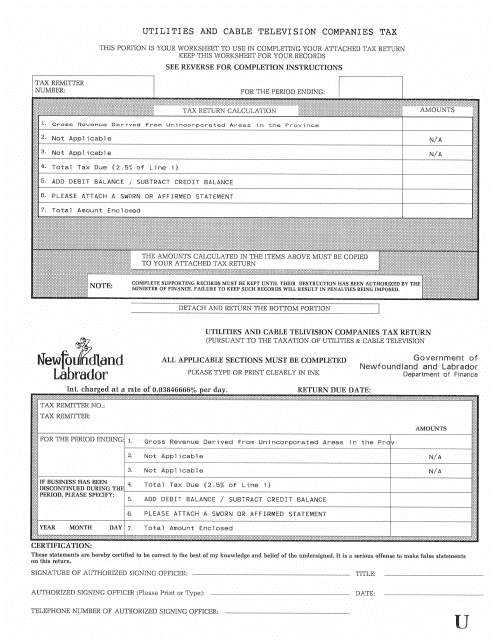

This document is for the tax regulations related to utilities and cable television companies in Newfoundland and Labrador, Canada. It provides information on the taxes applicable to these industries in the province.

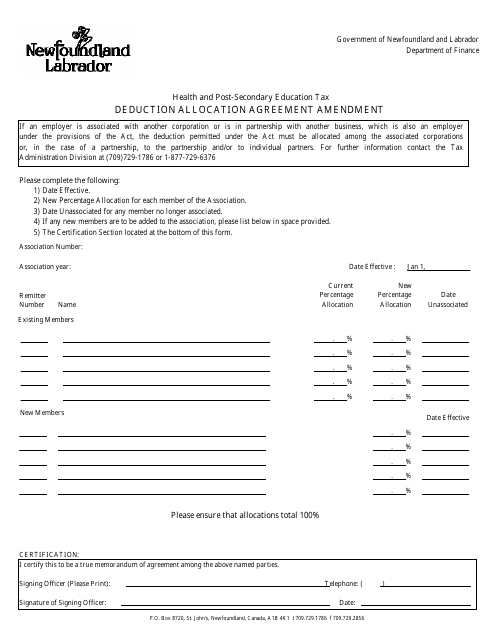

This document is used for amending the Health and Post-secondary Education Tax Deduction Allocation Agreement in Newfoundland and Labrador, Canada.

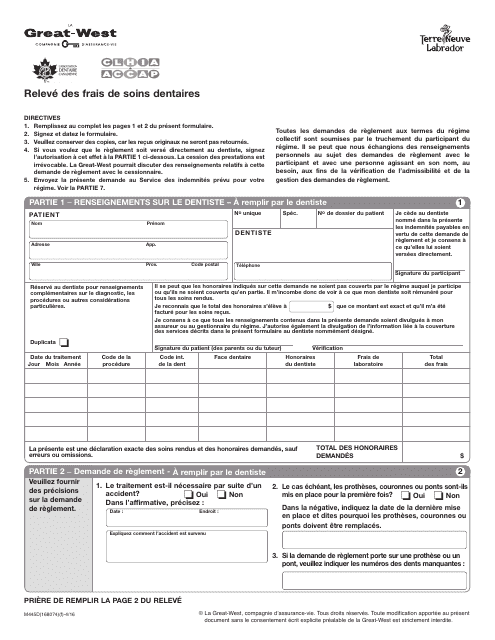

This type of document is used for reporting dental expenses in Newfoundland and Labrador, Canada. It is written in French.

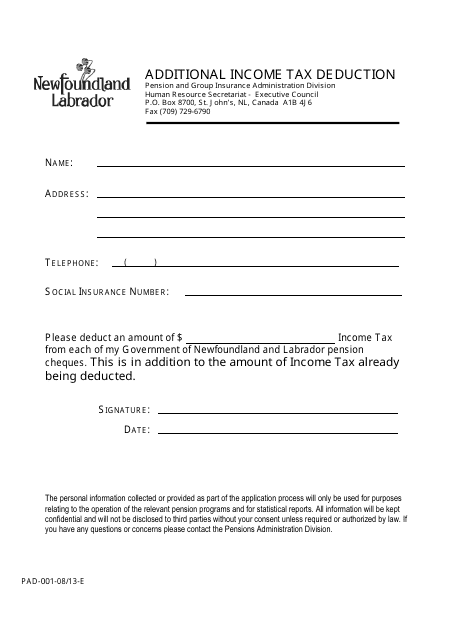

This Form is used for claiming additional income tax deductions in Newfoundland and Labrador, Canada.

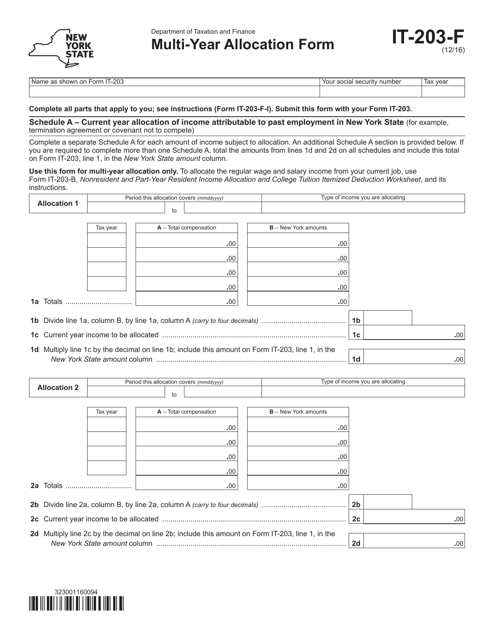

This Form is used for allocating income and deductions for multiple years in New York.

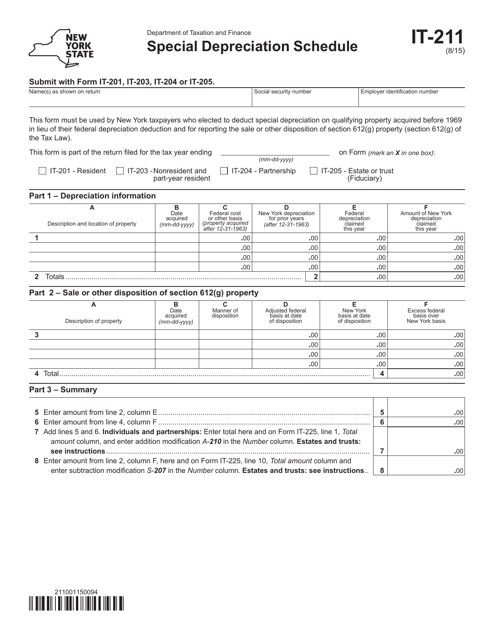

This form is used for reporting special depreciation for businesses in New York. It helps businesses calculate and claim deductions for depreciating assets.

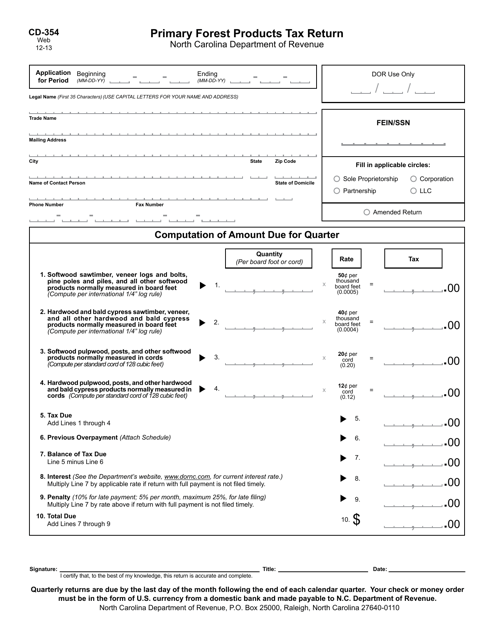

This form is used for reporting and paying taxes on primary forest products in North Carolina.

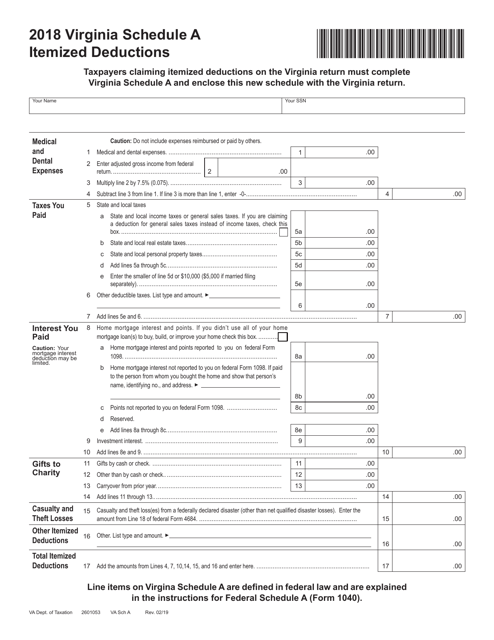

This form is used for reporting itemized deductions on your Virginia state tax return. It allows you to claim deductions such as medical expenses, mortgage interest, and charitable contributions to potentially reduce your taxable income.